Retirement Crypto Portfolio

Key Insights

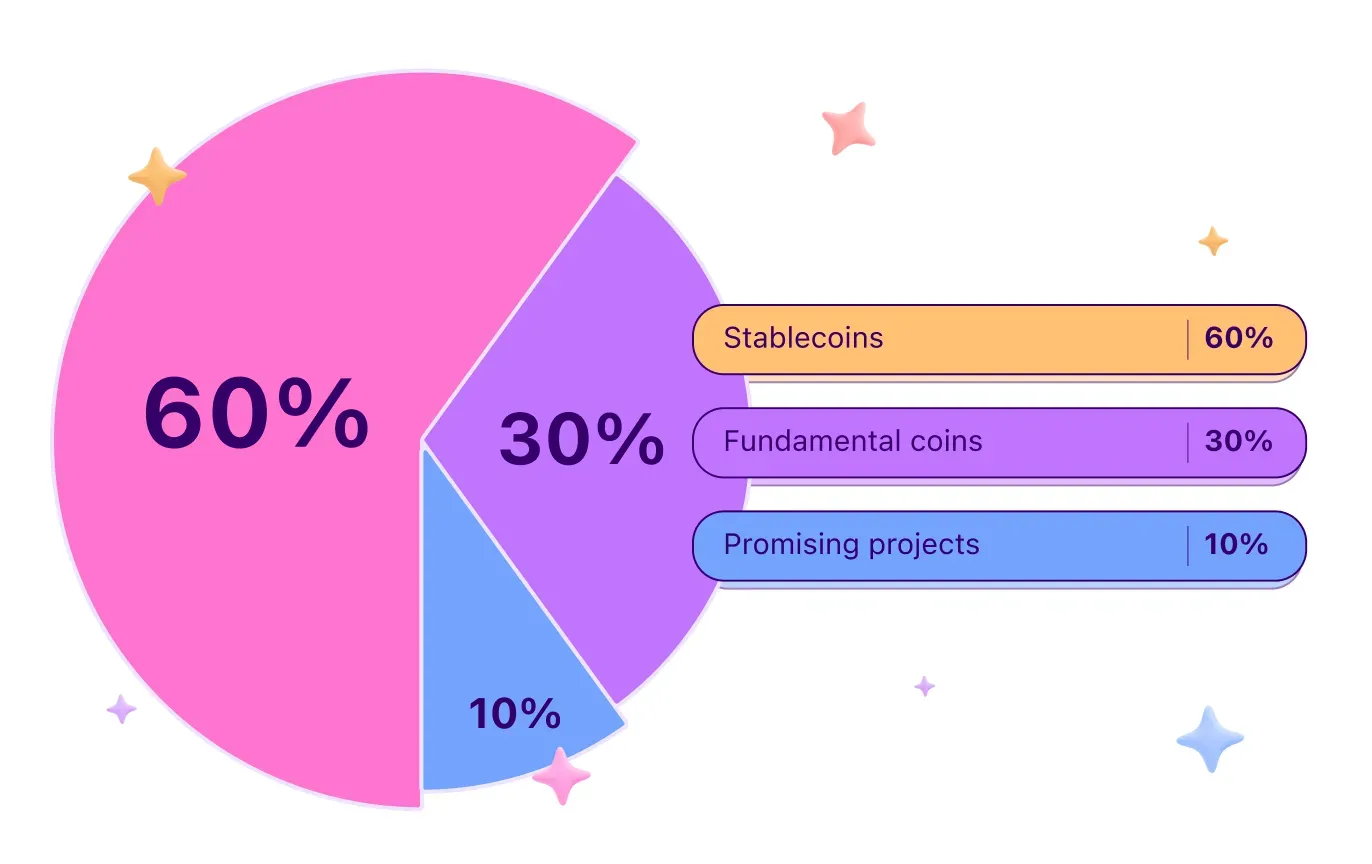

- Allocating 60% to stablecoins like USDT, USDC, and DAI reduces volatility risk and maintains liquidity for purchases.

- Including BTC provides exposure to crypto's largest asset for long-term value storage and growth potential.

- Small allocations to emerging projects with promising fundamentals but lower market caps allows higher risk/reward plays.

What Is a Retirement Crypto Portfolio

Retirement portfolio implies that you have enough funds to live by after you retire. This allows for having a more financially stable life spending what you’ve worked so hard for prior to retirement. Here we delve into how to manage retirement portfolio and how to do retirement asset allocation.

Here this retirement investment portfolio will consist of such crypto assets as stablecoins by 60%, fundamental coins by 30%, and promising projects that have not yet reached the peak of their market cap, by 10%. A retirement crypto portfolio is intended to build up a stable basis for your future whenever you start working on such. The returns can possibly prevent you from having to live on a fixed income.

Stablecoins (60%)

What Is Stablecoin

A stablecoin is a type of cryptocurrency that is backed by reserve assets, such as the U.S. dollar or gold, to provide price stability. This backing makes it less susceptible to market fluctuations.

Stablecoins offer a solution for the public to use a stable currency, especially in countries with high inflation rates. The fact that stablecoins are backed by something makes them more attractive as an exchange medium and, more importantly, as a store of value. These characteristics make it more realistic for stablecoins to become a substitute for fiat money.

We save the majority of our fiat dollars in digital ones. This allows us to always be ready for buying other coins at decent prices. Besides, stablecoins always show less volatility compared to other coins.

This part of the portfolio includes the following stablecoins:

- USDT

Tether (USDT) is the third cryptocurrency in terms of market capitalization (after Bitcoin and Ethereum respectively), and is the largest stablecoin. USDT is a coin that is pegged to the U.S. dollar and backed by Tether company’s dollar reserves.

- USDC

USD Coin (USDC) is a digital currency that is backed 1:1 by U.S. dollar. It is a tokenized U.S. dollar, with the value of one USDC coin being as close to the value of one U.S. dollar as possible. USDC is a stablecoin, designed to maintain a stable value.

- DAI

DAI’s price is pegged to the US dollar rate. As a stablecoin, this crypto asset can serve as a dependable means of storing funds and making interuser payments. Stability of DAI is guaranteed not only by its peg to the dollar, but also by its use of Collaterilized Debt Positions (CDPs) and smart contract technology.

DAI provides stability in the face of volatility. It is a cryptocurrency that automatically responds to changing market conditions to maintain a stable value against major world currencies.

Fundamental Crypto Projects (30%)

Here we use one of the most famous and reliable cryptocurrencies, Bitcoin. It has enough features and characteristics to have great inherent worth as a digital crypto asset.

- BTC

Bitcoin is the first cryptocurrency, operating through peer-to-peer technology without the need for central authority or banks. The Bitcoin network collectively manages transactions and the issuance of BTC. It remains the most popular and stable cryptocurrency in the market's volatility.

We buy BTC into a portfolio to store the value of funds. Bitcoin is comparable to gold in its limited issuance, but has a higher degree of mobility.

Over the entire history of its existence, globally, Bitcoin has shown exceptional growth, which is associated with the development of the crypto industry and the influx of funds in it.

Promising Crypto Projects (15%)

These projects didn’t have time yet to realise their potential to the fullest and show their price records. This section contains crypto assets with an interesting fundamentals and strong community support.

Below are some coins with a low market cap due to the ongoing bearish trend:

- GLMR

Glimmer (GLMR) is the native utility token of Moonbeam Network, which is a smart contract parachain on the Polkadot blockchain. GLMR is the utility token of Moonbeam Network. It is designed to be developer-friendly and is compatible with Ethereum. Moonbeam, being a decentralized smart contract platform, relies on the Glimmer token for its essential functionality.

- ASTR

ASTR, in turn, is the native cryptocurrency of Astar Network, a smart contracts platform built on a parachain in the Polkadot ecosystem, connected to blockchains such as Ethereum and Cosmos. To achieve high scalability, Astar uses Layer 2 optimistic rollup solutions, and it also includes a Build2Earn model where developers are paid through dApp staking.

- MOVR

Moonriver (MOVR) is a smart contract parachain on Kusama, compatible with Ethereum. It is intended to be a companion network to Moonbeam, where it provides a permanently incentivized canary network. The parachain serves as a testing ground for smart contracts before their implementation on Moonbeam.

- KAR

Karura (KAR) is It is a scalable layer-1 blockchain platform and a DeFi hub on Kusama, designed to enable developers to create dApps. KAR enables users to swap, borrow, lend, earn, and more with minimal transaction fees.

Summary

Whenever you retire it’s vital to have a retirement crypto portfolio to live by. Here we delved into a possible type of said portfolio. It includes stablecoins (USDT,USDC, DAI), fundamental (BTC) and promising projects (GLMR, ASTR, MOVR, KAR).

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.