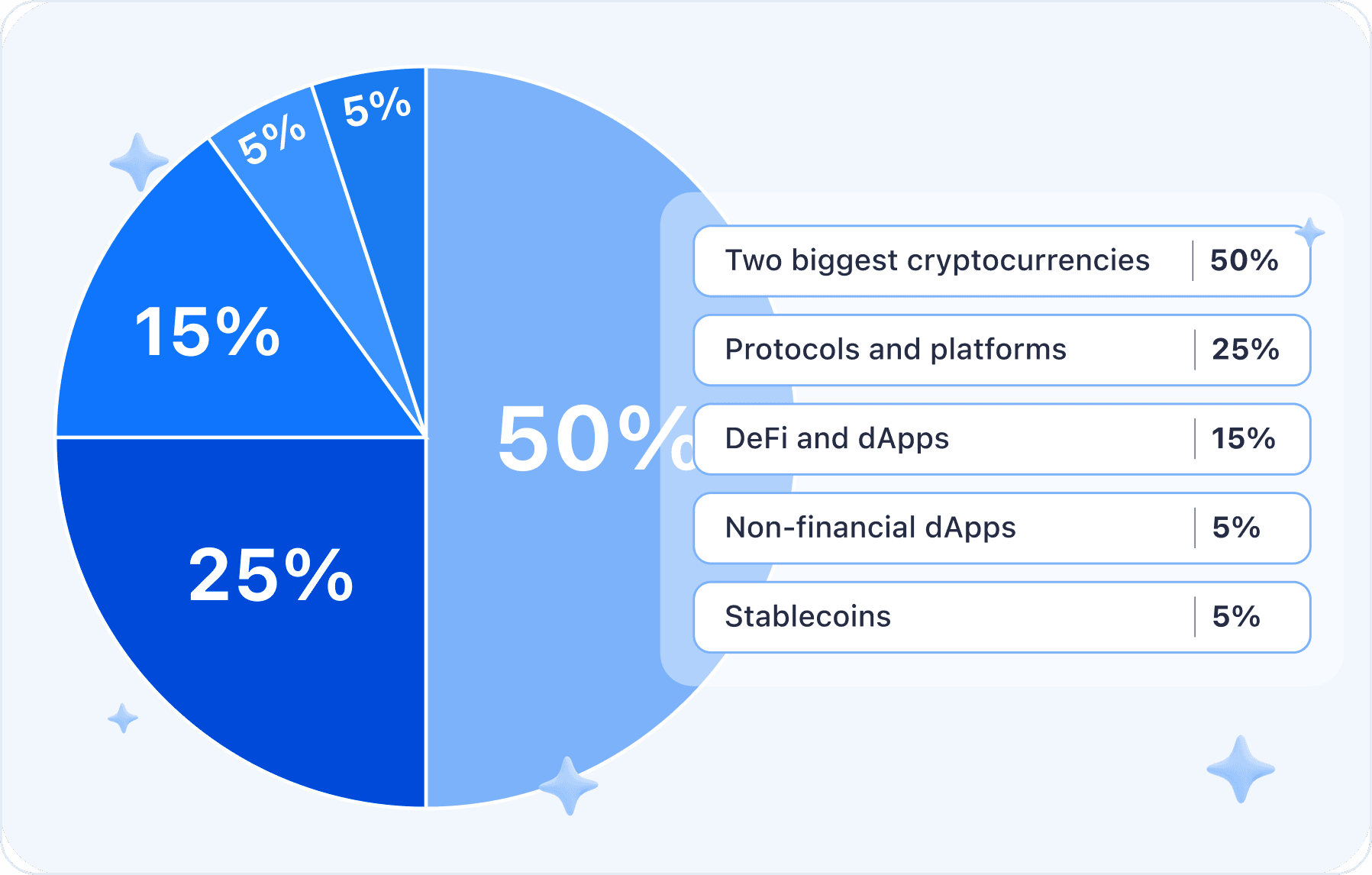

Grand Crypto Portfolio

Key Insights

- Inclusion of USDC, USDT, and DAI, as well as 2 biggest cryptos allows portfolio stabilization during volatility.

- Targeting leading smart contract platforms like Cardano, Solana, and Polkadot provides infrastructure for participating in the growing dApps ecosystem.

- Capping DeFi exposure at 15% balances yield opportunities with risk management.

This diversified portfolio highlights a range of cryptos and dApps across different sectors, aiming to strike a balance between stability and growth potential.

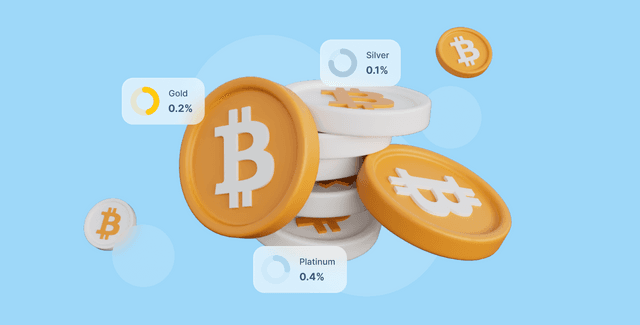

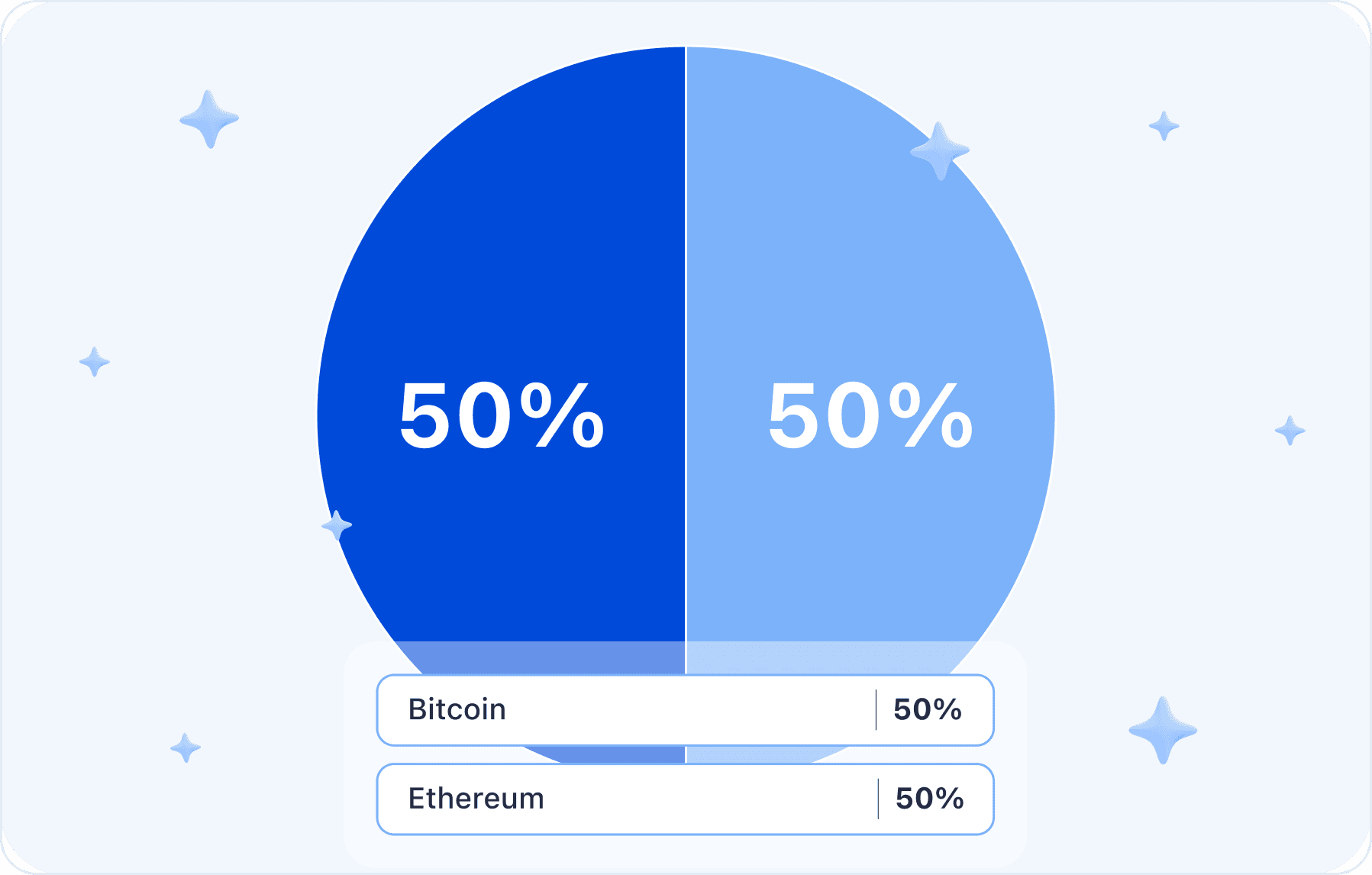

Biggest Cryptos (50%)

- Bitcoin (BTC) - 30%

Bitcoin is the most popular and widely recognized cryptocurrency. Including BTC in the portfolio ensures stability and long-term growth potential.

- Ethereum (ETH) - 20%

Ethereum is the second-largest cryptocurrency by market capitalization after Bitcoin. It serves as a platform for developing smart contracts and decentralized applications. Including ETH in the portfolio allows participation in the decentralized application ecosystem.

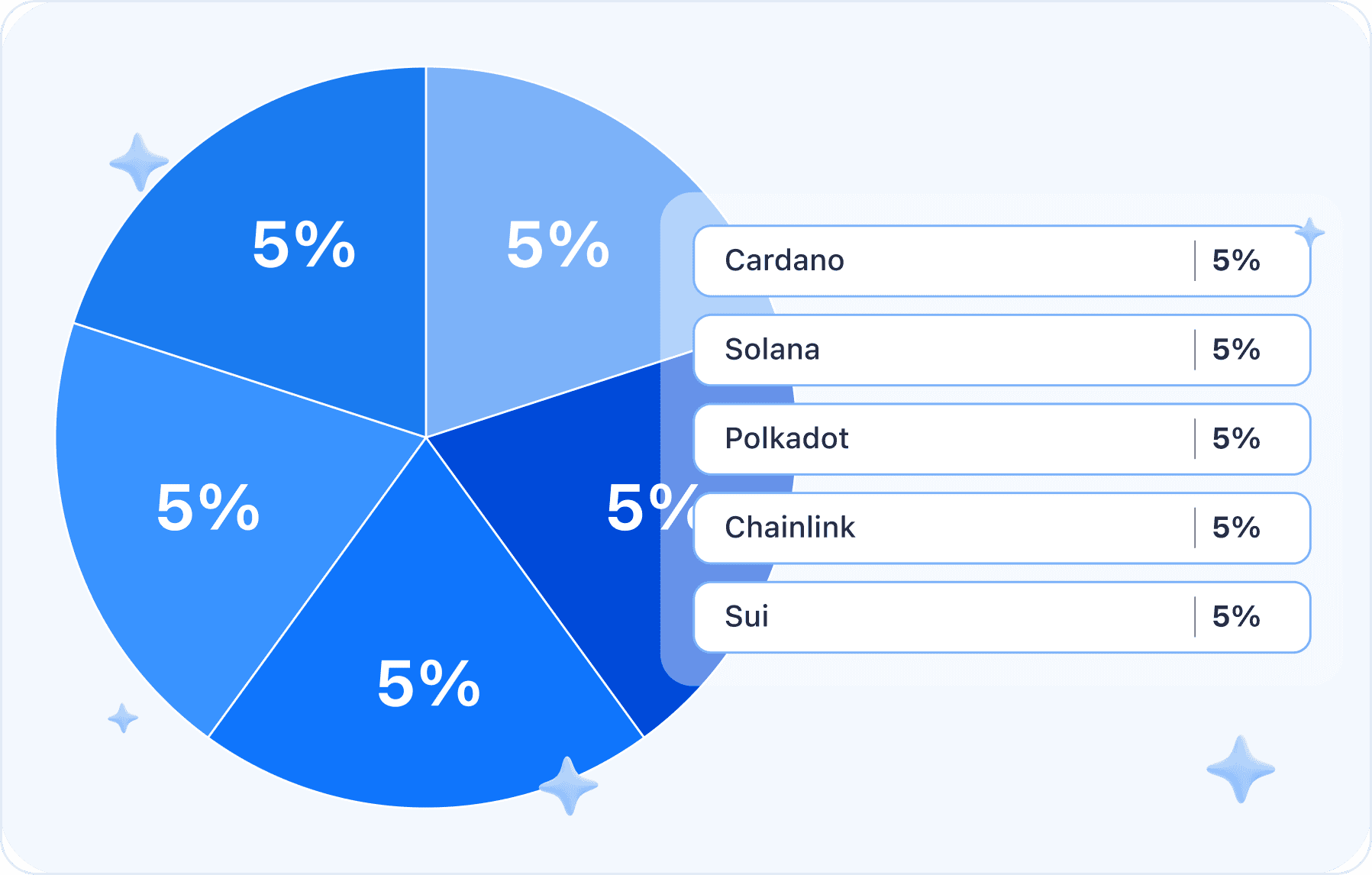

Protocols & Platforms (25%)

- Cardano (ADA) - 5%

Cardano is a blockchain platform focused on security and scalability. It aims to provide simplicity in developing decentralized applications.

- Solana (SOL) - 5%

Solana is a high-performance blockchain platform that offers scalability and low fees. It provides fast transactions and supports various decentralized applications.

- Polkadot (DOT) - 5%

Polkadot is a multi-chain platform that enables different blockchains to interact and exchange data. It provides infrastructure for creating interoperable decentralized applications.

- Chainlink (LINK) - 5%

Chainlink is an oracle protocol that connects blockchains with external data. It allows the use of real-world data in decentralized applications.

- Sui (Sui) - 5%

Sui is a blockchain platform that offers tools for creating and deploying decentralized applications. It emphasizes usability and scalability.

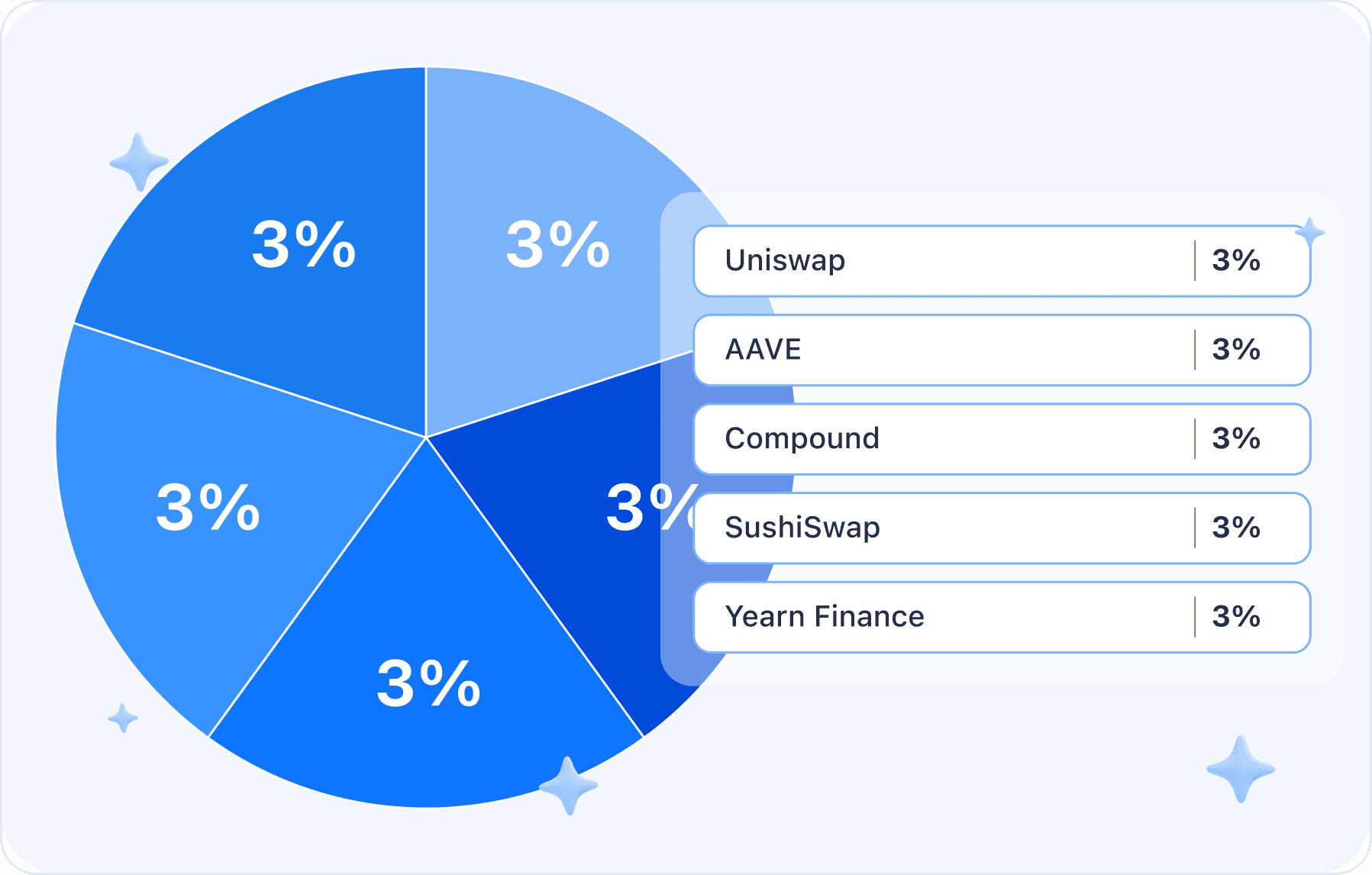

DeFi (15%)

- Uniswap (UNI) - 3%

Uniswap is a decentralized exchange based on an automated market-making protocol. It allows users to exchange various tokens without intermediaries.

- Aave (AAVE) - 3%

Aave is a protocol for decentralized lending and borrowing. It provides users with the opportunity to borrow and lend cryptocurrencies.

- Compound (COMP) - 3%

Compound is a protocol for borrowing and lending funds that allows users to earn interest on their deposits and take out loans.

- SushiSwap (SUSHI) - 3%

SushiSwap is a decentralized exchange and liquidity protocol. It offers tools for earning through liquidity provision and token swapping.

- Yearn Finance (YFI) - 3%

Yearn Finance is a platform for automated asset management in DeFi. It provides tools for optimizing yield across various protocols and exchanges.

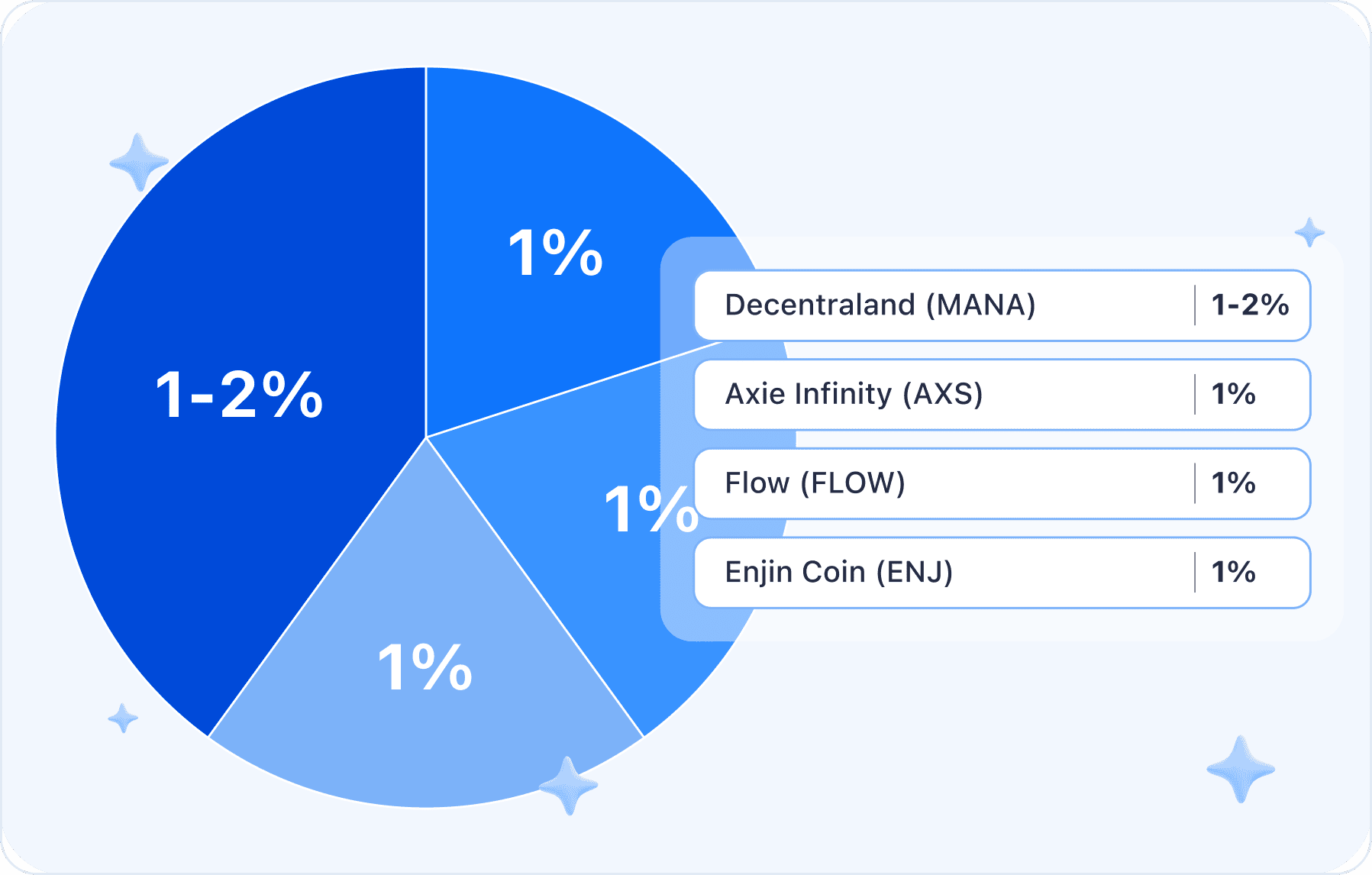

Non-Financial dApps (5%)

- Decentraland (MANA) - 2%

Decentraland is a blockchain-based virtual world where users can create and sell virtual assets and real estate.

- Axie Infinity (AXS) - 1%

Axie Infinity is a gaming platform that allows users to play, collect, and trade virtual creatures known as Axies.

- Flow (FLOW) - 1%

Flow is a blockchain platform designed for creating and launching decentralized applications and games.

- Enjin Coin (ENJ) - 1%

Enjin Coin is a token associated with a platform for creating and managing digital assets in games and virtual worlds.

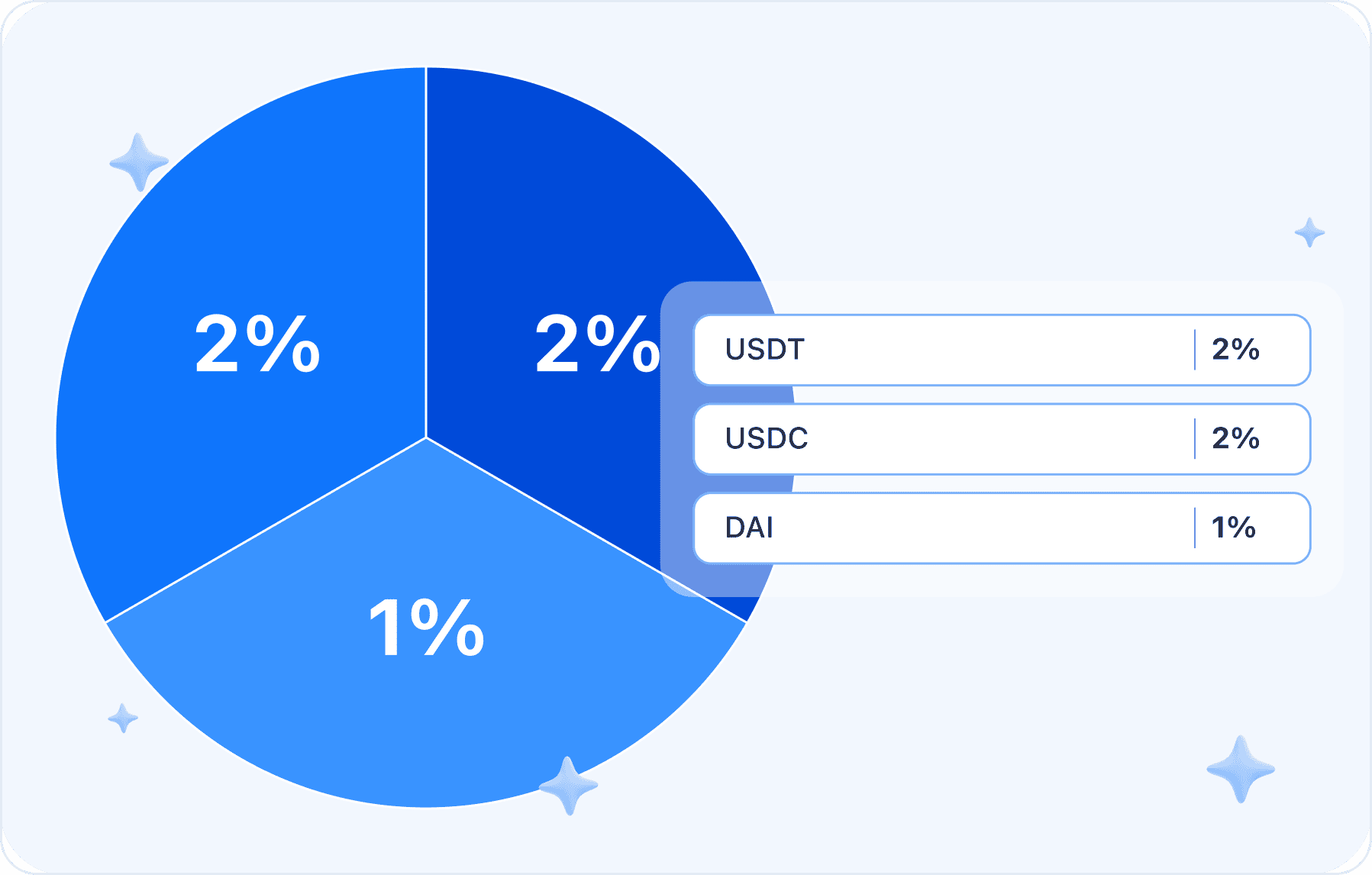

Stablecoins (5%)

- USD Coin (USDC) - 2%

USD Coin is a stablecoin pegged to the US dollar. It provides price stability and is used for exchanging other cryptocurrencies.

- Tether (USDT) - 2%

Tether is a stablecoin pegged to the US dollar. It is widely used in cryptocurrency trading and exchanges.

- DAI - 1%

DAI is a stablecoin that utilizes a collateralization mechanism to maintain price stability. It operates on the Ethereum blockchain.

The expected profitability of this portfolio depends on the market dynamics of each crypto individually. Diversifying risks and allocating assets among different crypto categories helps mitigate risks and increases the likelihood of overall portfolio profitability.

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.