Asset Recovery Strategy

Key Insights

- Leveraging lending platforms like Venus enables using assets as collateral to borrow crypto for purchases.

- Maintaining adequate collateral ratios safeguards against liquidations in a further price drop while still freeing capital.

- Purchasing new assets in the bear market with borrowed funds allows for asset price averaging and portfolio growth.

This strategy explains how to launch assets that are currently at a loss and then hold them until they reach their desired price.

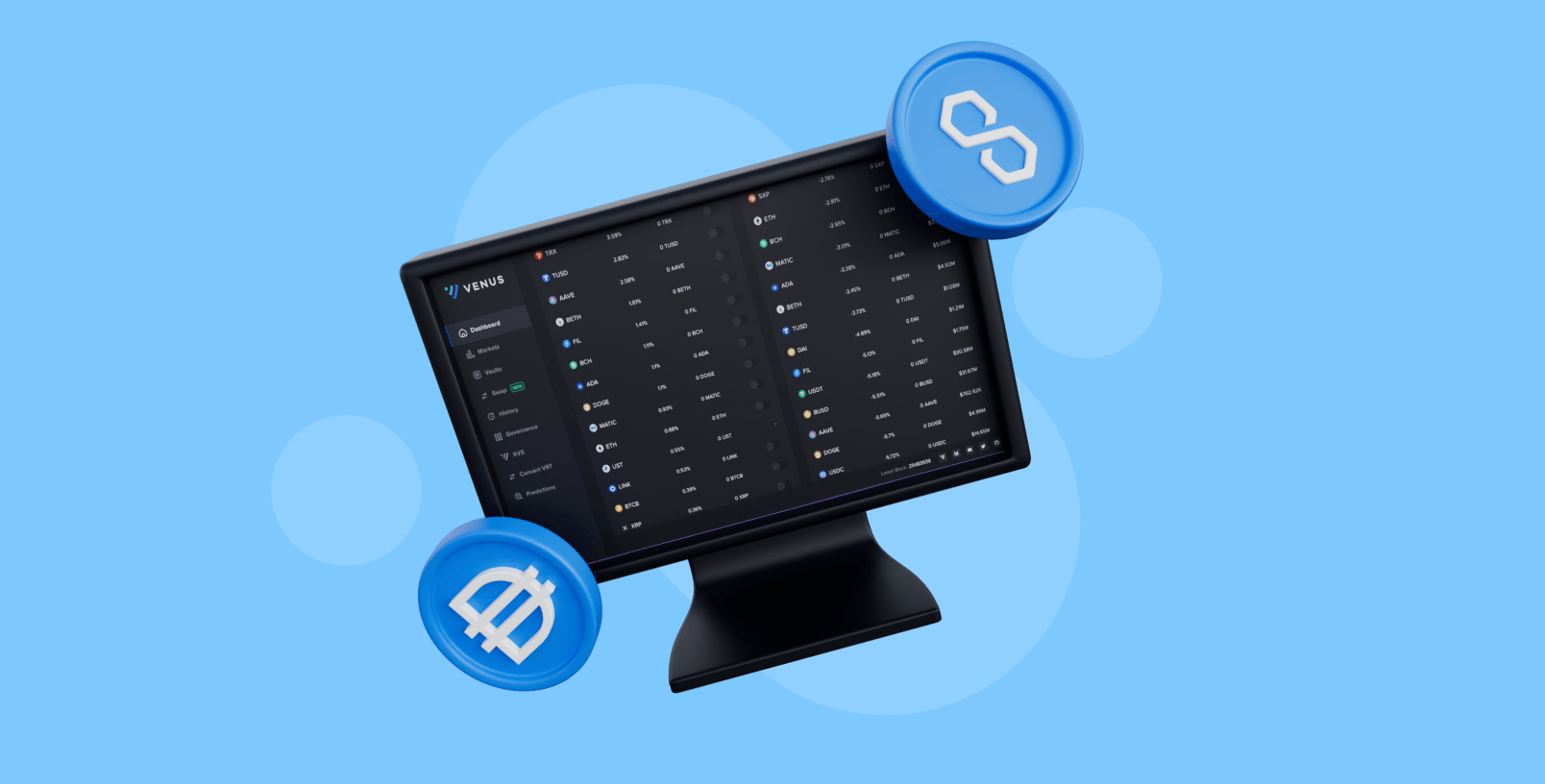

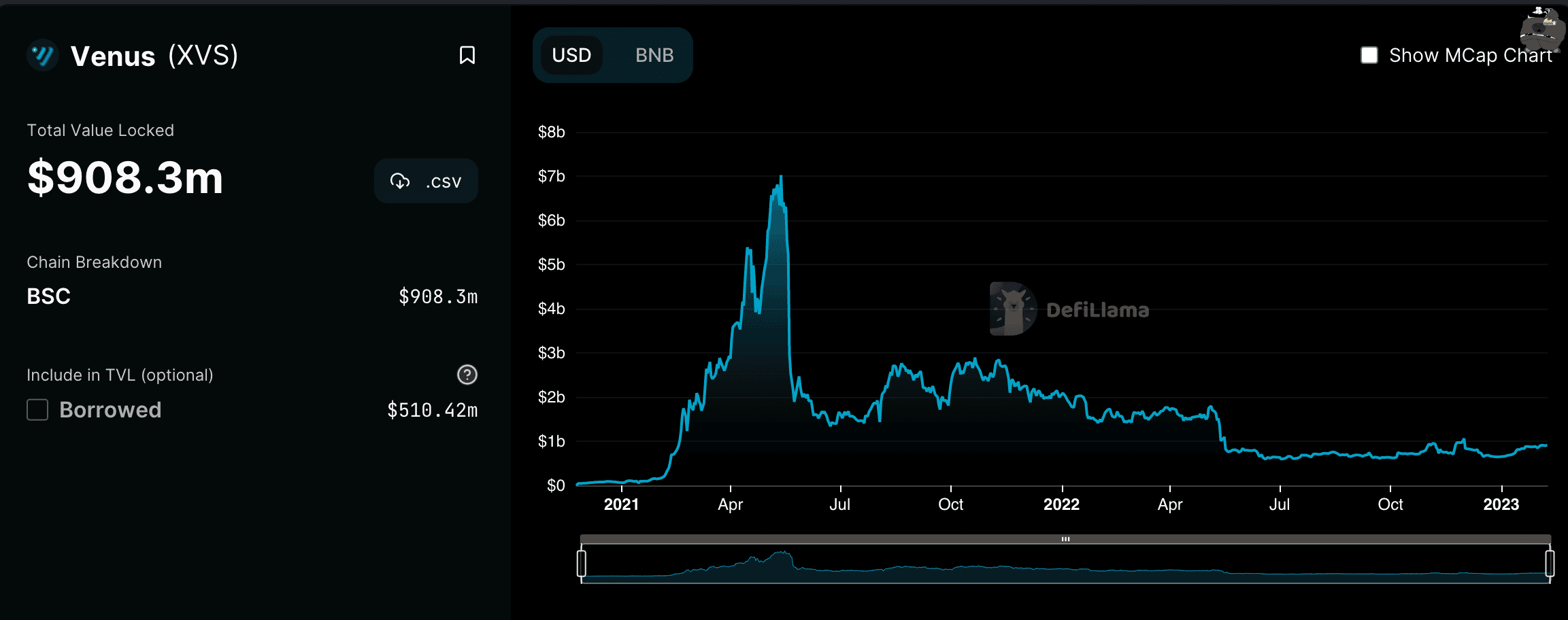

Venus Protocol is a decentralized lending platform powered by Binance Smart Chain.

This protocol allows us to use many BSC network coins as collateral. The BSC network guarantees a low transaction fee, but we need a small amount of BNB to pay for it.

Say we exchanged Matic coins for $1,000 at the peak of a bullish trend at around $3 each. At the moment, MATIC is in the red zone.

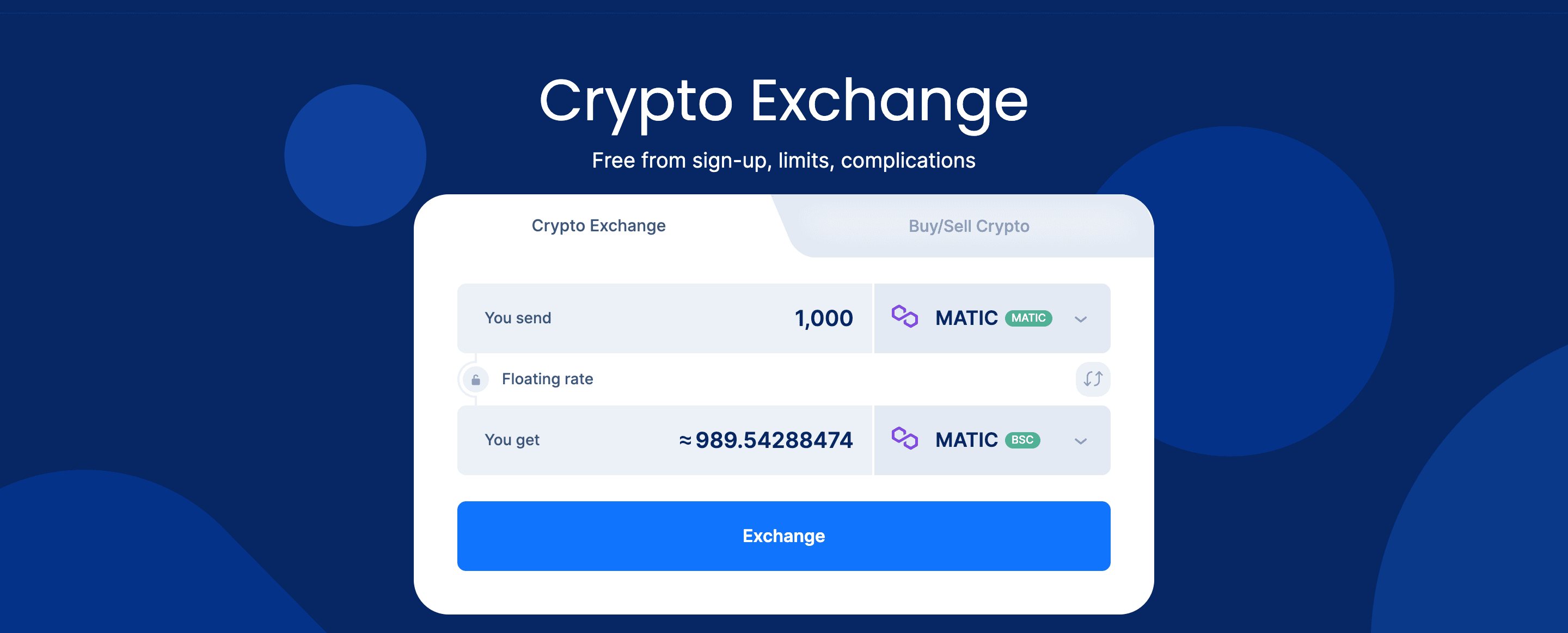

We transfer our MATIC from the Polygon network to BSC with SimpleSwap.

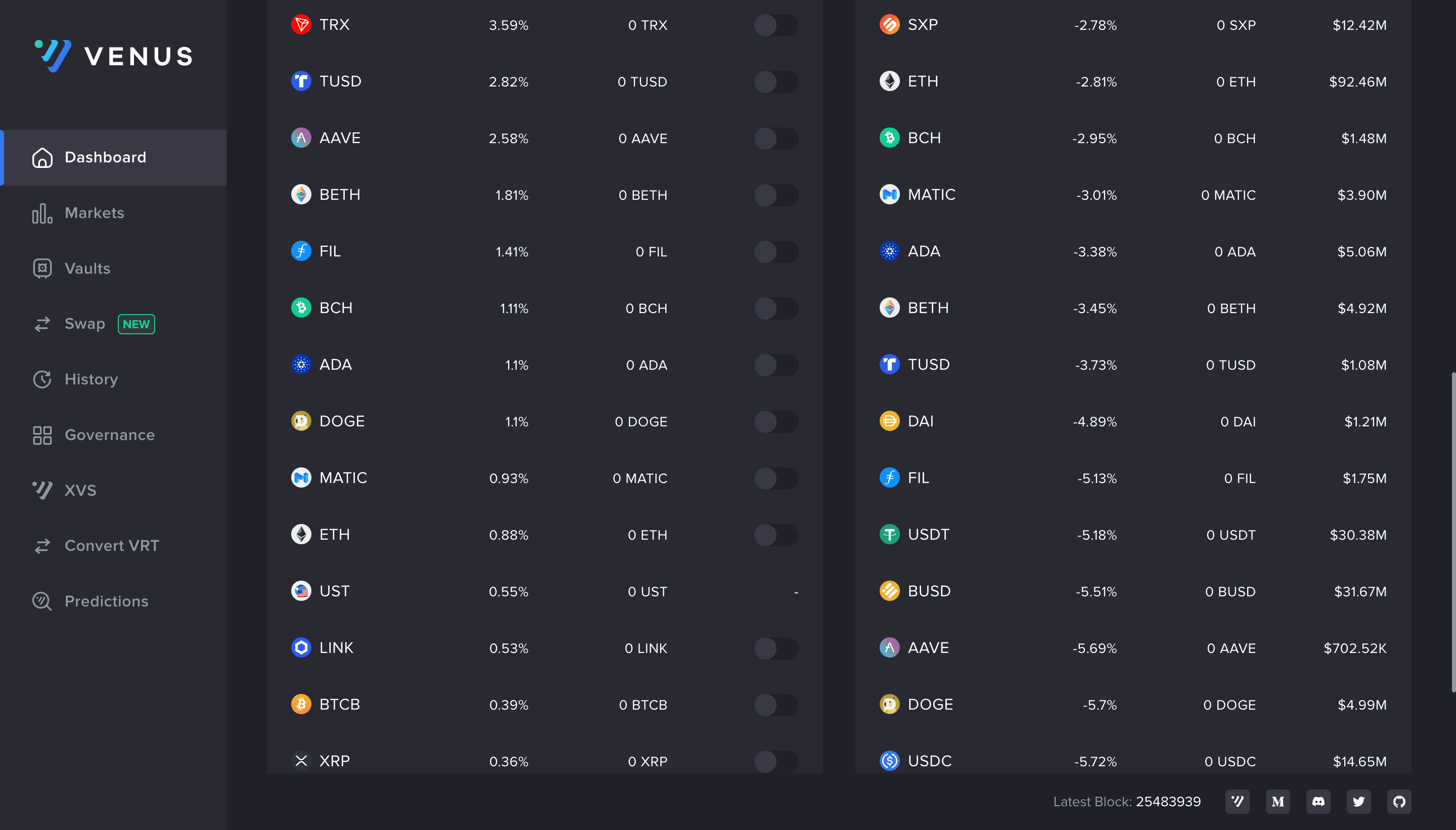

We then deposit MATIC in the BSC network on the Venus platform and receive an annual interest rate of 0.93%. The rate may change depending on the growth in demand for the coin.

Then we take out a loan at 4.89% per annum in DAI for 50-60% of the collateral. We do this to avoid the liquidation of the collateral position in case of a massive drop in the MATIC value.

We send a third of the received DAI to a collateral position at 4.15% per annum. By doing this, the collateral position can be strengthened, and the interest rate on the borrowed funds can be covered.

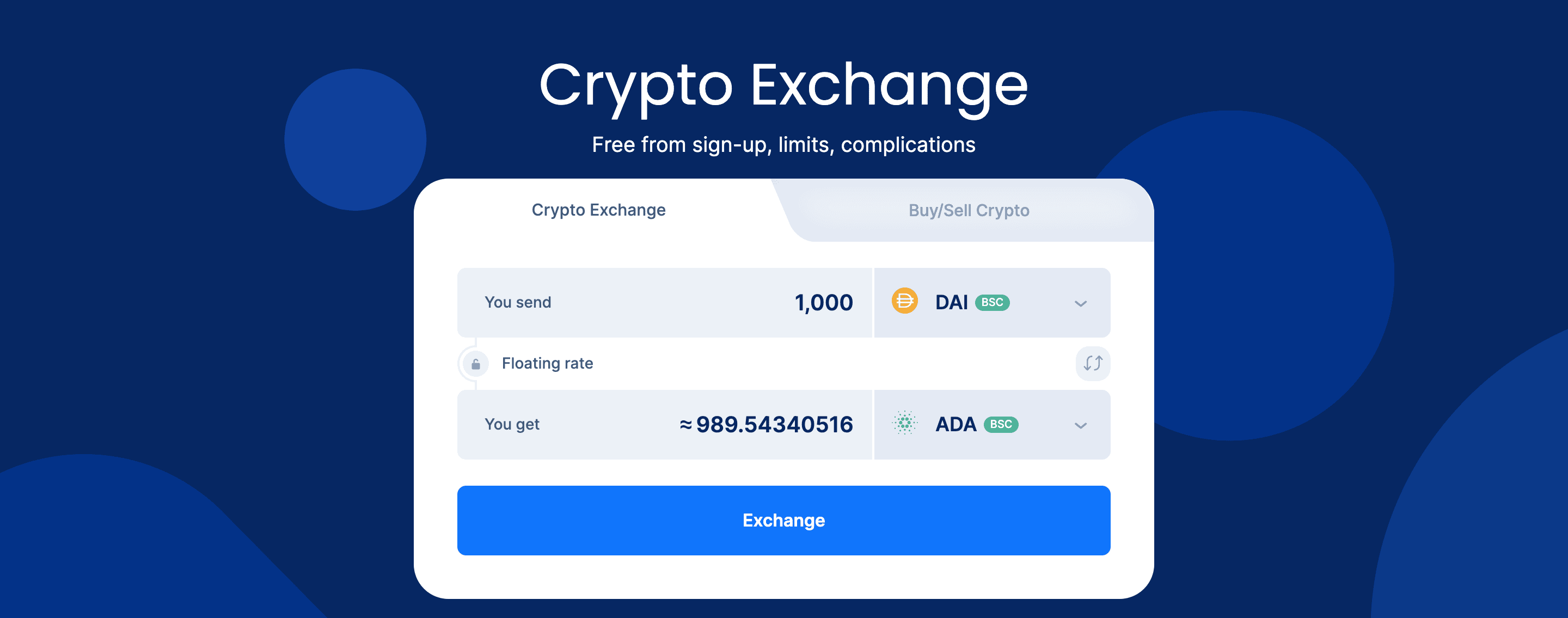

With the remaining DAI, we purchase any coin on the selected network using SimpleSwap. In this case, we chose to buy ADA on the BSC network.

Using the borrowing platform, we leveraged the current MATIC value and purchased ADA into our portfolio at over 80% below ATH. We also managed to keep MATIC anticipating the price we needed.

Users can get all above mentioned coins on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.