Avalanche Fundamental Analysis

Key Insights

- The Avalanche blockchain stands out with its inventive consensus methods and adaptable structure, providing efficiency and versatility for various applications, setting it apart in the blockchain sphere.

- With a robust economic model, including staking and token burning, coupled with strong community support and experienced leadership, Avalanche demonstrates a solid foundation for sustained growth.

- Avalanche's proactive risk approach and consistent development efforts exhibit a commitment to stability and innovation, ensuring its competitiveness in the market.

What is Avalanche

Avalanche is a decentralized platform for creating smart contracts and deploying dApps. The Avalanche blockchain was introduced in 2020 by Emin Gün Sirer.

The history of the Avalanche project began with the team's development in response to challenges faced by existing blockchain platforms, such as scalability, performance, and security. The founders aimed to create a platform capable of high throughput, low latency, and resistance to attacks.

The initial distribution of AVAX tokens occurred through a token sale in a public ICO in 2020. This allowed the team to raise funds for further development and improvement of the platform. The current market cap of Avalanche reflects community interest and support, amounting to $13,385,913,737.

The goal of the Avalanche blockchain is to provide developers with tools for creating decentralized applications and smart contracts with outstanding performance and scalability. The platform offers flexible infrastructure supporting various cryptocurrencies and tokens.

The mission and vision of Avalanche are aimed at creating a sustainable blockchain network that contributes to the mass adoption of dApps. The primary objective is to provide developers and users with tools to operate in a decentralized environment, freeing them from the limitations of centralized structures.

Users can get AVAX on SimpleSwap.

AVAX CoinMarketCap

Users can get AVAX on SimpleSwap.

- Avax Crypto Market Cap: 9th place ($13,385,913,737)

- Avax Crypto Volume (24h): 7th place ($1,946,731,908)

- Avax Crypto Total Supply: 433,796,201 AVAX (50.8%)

- Avax Crypto Max. Supply: 720,000,000 AVAX

Avalanche Blockchain Competitive Environment Analysis

Among the main competitors of Avalanche are projects like EOS, NEO, Cardano, Tron, and Tezos.

EOS is a blockchain platform that also provides opportunities for creating dApps and smart contracts. Its main advantages include high performance and scalability. However, EOS is less decentralized compared to, for instance, Ethereum, and its developer ecosystem is less extensive.

NEO is a Chinese blockchain project with the capability to create smart contracts and dApps. It possesses high performance but has a limited developer ecosystem, which might make user attraction challenging.

Cardano is a blockchain platform using the Haskell programming language, ensuring security and error resistance. However, Cardano's developer ecosystem is not as developed as Ethereum's yet.

Tron is a blockchain platform with high speed and performance, a wide developer ecosystem, and integration with popular payment systems. Nevertheless, Tron has a low degree of decentralization, and security issues have been reported.

Tezos is a blockchain platform with the ability to update the protocol without network division. It has a built-in mechanism for self-governance and community voting, ensuring high decentralization. However, Tezos' developer ecosystem is more limited compared to Ethereum's.

Overall, Avalanche, with its outstanding performance and scalability, is competitive. Yet, as with many projects, scalability might pose a challenge. Comparatively, Avalanche promises user-friendliness and efficiency, potentially becoming key factors in attracting developers and users.

Avalanche Technology Assessment

Avalanche is a platform that applies a range of advanced technologies to achieve decentralization, scalability, and efficiency in the blockchain sphere.

Avalanche Consensus Protocol

Decentralized Proof-of-Stake (dPoS): Avalanche employs a Proof-of-Stake protocol that involves the participation of tens of thousands of validators in the decision-making process, reducing energy consumption compared to traditional mechanisms like Proof of Work.

Efficiency and Scalability: The Avalanche protocol aims to ensure high throughput and the ability to process transactions in parallel, allowing the network to efficiently scale with increasing loads.

Customization and Scalability: Avalanche provides outstanding flexibility and network customization capabilities through its structure of subnets. Each chain in the system represents a subnet, enabling the network to adapt to various requirements and efficiently scale with increasing user activity.

Primary Blockchains in Avalanche Network

The Avalanche main network comprises three key blockchains, each performing unique functions.

Platform Chain (P-Chain): The P-Chain is responsible for managing the network as a whole. Strategic decisions related to consensus parameters, subnet configurations, and other aspects influencing the entire ecosystem's operations are made here.

Contract Chain (C-Chain): The C-Chain executes smart contracts. All dApps utilizing smart contracts operate on the C-Chain. This ensures a high level of security and decentralization for smart contracts.

Exchange Chain (X-Chain): The X-Chain focuses on asset exchange. The X-Chain provides an efficient and secure means of exchanging digital assets within the Avalanche ecosystem. It plays a pivotal role in maintaining liquidity and enabling the exchange of various tokens.

The combination of these three blockchains ensures the coherence and efficient functioning of the entire Avalanche platform, making it adaptable and flexible across diverse use cases in decentralized finance and enterprises.

Causally Ordered DAGs Principle & Snowman Protocol

Linear Order through Causally Ordered DAGs: Avalanche implements a unique principle of Causally Ordered Directed Acyclic Graphs (DAGs), different from the chronological order in traditional blockchains. Here, emphasis is placed on the causal relationships between transactions. Instead of solely considering the time order, the system prioritizes how one transaction triggers another. This allows for a more flexible and rapid transaction processing environment.

Snowman Protocol: To ensure linear transaction order within Causally Ordered DAGs, Avalanche employs the Snowman protocol. This progressive consensus protocol structures transactions in a sequential order, ensuring clarity and sequence during consensus.

The Snowman protocol operates through several stages, starting with Slush, where nodes vote between red and blue, and culminating in the Avalanche protocol where transactions merge into a DAG structure. This enables the system to efficiently achieve consensus, even under conditions of high decentralization and intense network activity.

Avalanche Network & Ecosystem Management

Subnet Platform: Everything within Avalanche constitutes a subnet, providing flexibility and modularity in configuring various network aspects.

Primary Network: By managing the Primary Network comprising the Platform Chain, Contract Chain, and Exchange Chain, Avalanche supports essential functions and ensures the coherence of the entire ecosystem.

Slush Consensus: The consensus process in the Avalanche network commences with the Slush stage. Nodes in the network choose between two colors, red and blue, in a voting process. This choice initiates the decision-making process but represents only the initial stage of consensus.

Snowflake & Snowball Technologies

The subsequent stages of consensus involve so-called Snowflake and Snowball technologies. These stages introduce memory and confidence into the consensus process.

Snowflake: This stage integrates memory into the consensus process. Nodes retain information about previous votes, enabling them to make more informed decisions based on the network's past experiences.

Snowball: This stage adds an element of confidence to voting. Nodes become more confident in their decisions when they observe other nodes in the network making similar choices. This strengthens consensus within the system.

Avalanche Consensus: The final stage of consensus in the Avalanche network is the Avalanche protocol. At this stage, transactions are merged into a Directed Acyclic Graph structure, ensuring a linear order of events and transaction confirmation within the network. This delivers high efficiency, scalability, and increased decentralization in the system.

Thus, the sequence of these progressive consensus stages ensures efficient and secure operation within the Avalanche network, endowing it with outstanding characteristics.

Avalanche represents an exceptional blockchain platform designed for the advancement of decentralized financial applications and enterprises. Its technological stack integrates advanced consensus methods, DAG data structures, and a flexible approach to network management. Supported by high throughput, efficiency, and decentralization, Avalanche is a key player in the modern era of blockchain technologies.

Avalanche Teams

Ava Labs is a company founded by Emin Gün Sirer, Kevin Sekniqi, and Maofan Ted Yin in 2018. Each of the founders possesses significant expertise in blockchain and information technologies.

Emin Gün Sirer is a computer science professor who gained wide recognition for his contributions to the blockchain and cryptography field. His academic background and research experience make him a crucial figure in the world of blockchain technologies. He's also known for his work on the Ghost concept and involvement in creating Ethereum.

Kevin Sekniqi is an experienced developer and engineer in the blockchain space. Prior to co-founding Ava Labs, he worked in several technology companies, providing him with experience in developing complex systems. His professional skills are crucial for the technical aspects of the project.

Maofan Ted Yin, or just Ted is a key member of the Ava Labs team. His technical expertise and involvement in creating Avalanche make him one of the most important contributors to the platform's development.

John Wu, the President of Ava Labs, manages the company's operational aspects. His experience and leadership skills are pivotal for the strategic development of the Avalanche blockchain.

Below are some notable angel investors who supported Ava Labs by Avalanche.

Balaji Srinivasan is a former Coinbase CTO and proponent of the network state ideology. His experience in the crypto and blockchain industry brings valuable strategic vision to Ava Labs' development.

Naval Ravikant is a founder of AngelList, early investor in Uber, Twitter, StackOverflow, and other successful projects. His investments and experience contribute to strengthening the company's financial and strategic position.

Ava Labs Developers

The development team at Ava Labs comprises experienced specialists in various areas of blockchain technologies. Each of them contributes to the development of the Avalanche platform.

- Software Development

The software developers on the team have expertise in creating highly efficient blockchain protocols. They actively participate in the development of the Avalanche core, ensuring its efficiency and functionality.

- Cryptography

Cryptography experts are responsible for the security and confidentiality of the protocols used in the Avalanche network. Their work is aimed at ensuring the reliability and protection of data within the network.

- Business Development

The business development team focuses on expanding the Avalanche ecosystem. They devise strategies for implementing the technology across various industries and attracting new participants.

This team of specialists combines efforts to efficiently develop and enhance the Avalanche platform, ensuring its functionality, security, and readiness for widespread adoption in various sectors.

Founded in 2018, Ava Labs is a startup operating in the blockchain technology space and compliant with US regulations. The company's headquarters are located in Brooklyn, New York.

AVAX Crypto Economic Model

Avalanche crypto AVAX started its journey with a token sale in 2020, providing investors with the opportunity to acquire AVAX tokens in exchange for their investments.

This approach led to a wide distribution of tokens among participants and sparked interest from investors.

Models of economic incentives

- Staking

Users can stake their AVAX tokens to participate in the Proof-of-Stake consensus mechanism and receive rewards in the form of additional AVAX tokens. This mechanism incentivizes participants to hold and actively utilize their tokens to ensure the network's security.

- Block Rewards

Participants validating transactions and supporting the network's operations receive rewards in AVAX crypto. This encourages involvement in maintaining the blockchain's functionality and creates motivation for active participation.

- Token Burning Mechanism

Within network operations like transactions or executing smart contracts, AVAX tokens can be burned. This process aims to reduce the total token supply, which can impact the token's value and create a deflationary effect.

AVAX Network Inflation

Inflation within the AVAX network is dynamically adjusted based on the its needs and incentivizing participation. The inflation rate can be adapted to maintain a balance between attracting new participants and controlling inflation. Such a flexible approach creates an ecosystem that responds to current conditions and community needs.

It's important to note that these mechanisms are aimed at creating a stable and resilient ecosystem where participants efficiently interact, drive network development, and receive rewards for their efforts. Decentralized decisions regarding changes to the economic model parameters can be made using management mechanisms provided by the Avalanche network.

Avalanche Risk Assessment

- Technical Risks

Avalanche implements innovative consensus concepts, which might come with technical complexities during development and operation. Errors in code and unforeseen technical challenges are possible.

Securing the Avalanche network from potential security threats is a critical aspect. Possible attacks and vulnerabilities could impact user trust.

- Competition Risks

Competition in the blockchain technology sphere is always intense. Avalanche competes with other blockchain platforms for developer and user attention. Changes in competitors' strategies may influence Avalanche's market position.

- Regulatory Risks

Changes in cryptocurrency and blockchain-related legislation may affect Avalanche's operations. Risks associated with regulation across different jurisdictions might impact the platform's usage.

- Security Risks

Avalanche faces challenges in ensuring data confidentiality and transaction security. Security incidents could undermine the project's reputation and trust.

- Partnership Risks

Avalanche's success partly relies on partnerships with projects utilizing its technology. Changes in partners' strategies or departures may affect the project's development.

- Market Risks

The AVAX coin is subject to cryptocurrency market volatility. This may affect investors and users associated with the project.

- Technology Adoption Risks

Avalanche's success depends on how quickly the platform attracts developers and users. Insufficient market attention could slow its growth.

The Avalanche team actively works on addressing these risks, implementing improvements, and focusing on community security and trust. However, given the dynamism of the blockchain space, there remains a level of uncertainty regarding risks and challenges.

Avalanche Community Analysis

Community Activity and Engagement

The Avalanche community is dynamic and diverse, encompassing a wide range of participants, including developers, token holders, investors, and users. Key communication channels, such as Telegram, serve as platforms for active discussions and information exchange.

The increase in the number of participants in official communication channels and discussions on thematic topics in forums indicates the liveliness and interest in the project.

The Avalanche community demonstrates a high level of support for the project. This is evident through active discussions about news, updates, and the platform's development prospects. A significant number of developers aiming to integrate Avalanche technology into their projects and smart contracts signify the attractiveness and trust the project garners. The Avalanche community actively participates in proposing and discussing ideas for ecosystem improvements.

The analysis of the community not only underscores Avalanche's technical maturity but also speaks to the strong support and engagement of its participants. This factor could be pivotal in ensuring the project's long-term success, strengthening its position within the blockchain community.

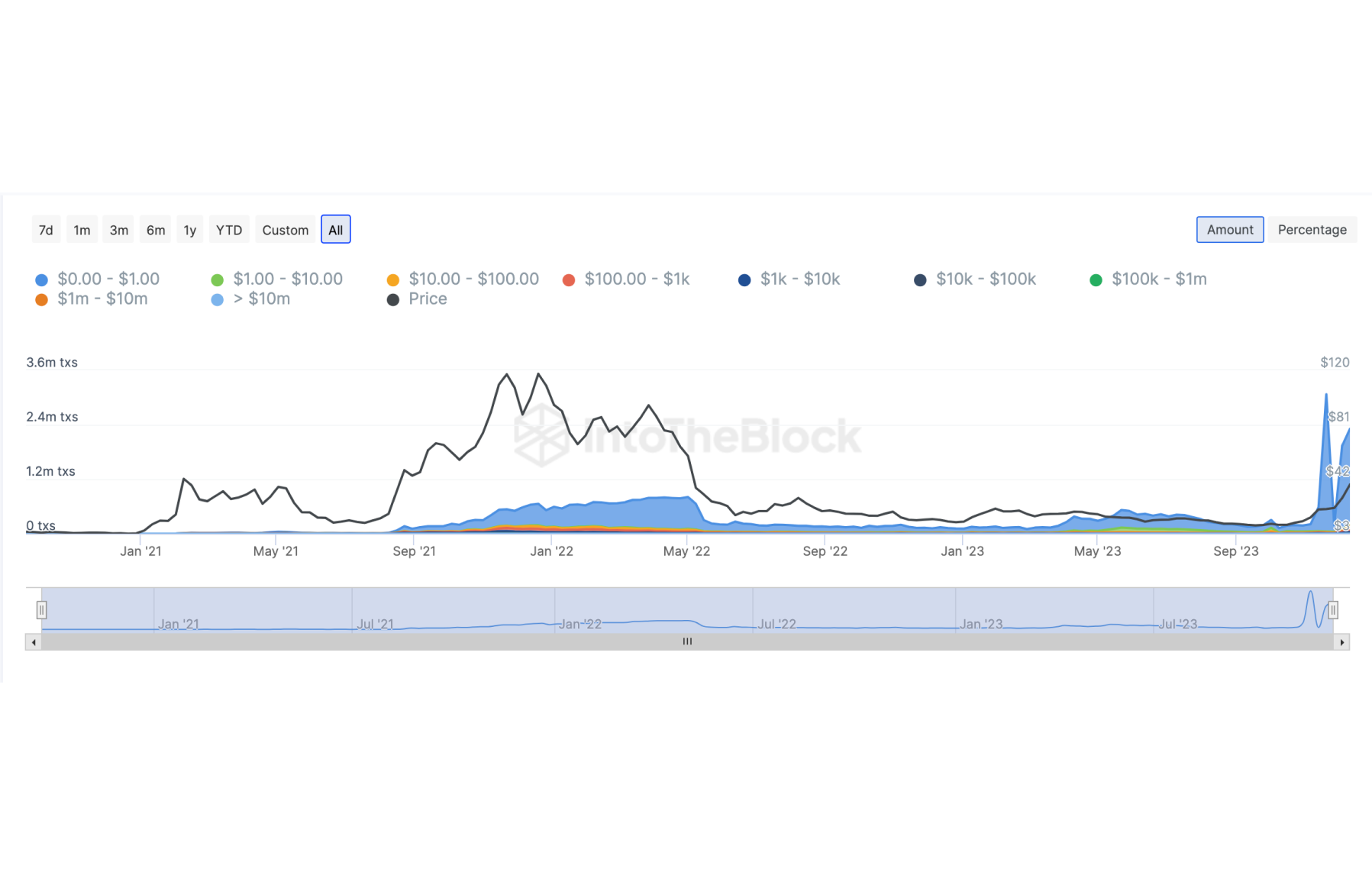

Avalanche AVAX Financial Stability Assessment

The AVAX market cap reflects the total value of all available Avalanche tokens in the market. A high market cap indicates the project's financial stability. Trading liquidity across various exchanges and active markets for AVAX tokens provide participants with the ability to freely trade.

AVAX's market cap ranks 9th ($13,385,913,737), signaling the project's significant financial weight in the crypto market.

The 24-hour trading volume is also substantial (ranking 7th, $1,946,731,908), indicating high liquidity and active trading.

There's observed stable growth in market cap and high market activity, contributing to long-term stability.

Investment Interest

Attractiveness to investors and partners also plays a crucial role in the financial stability of Avalanche. Successful partnerships, active investments, and support from institutions can strengthen the project's financial position.

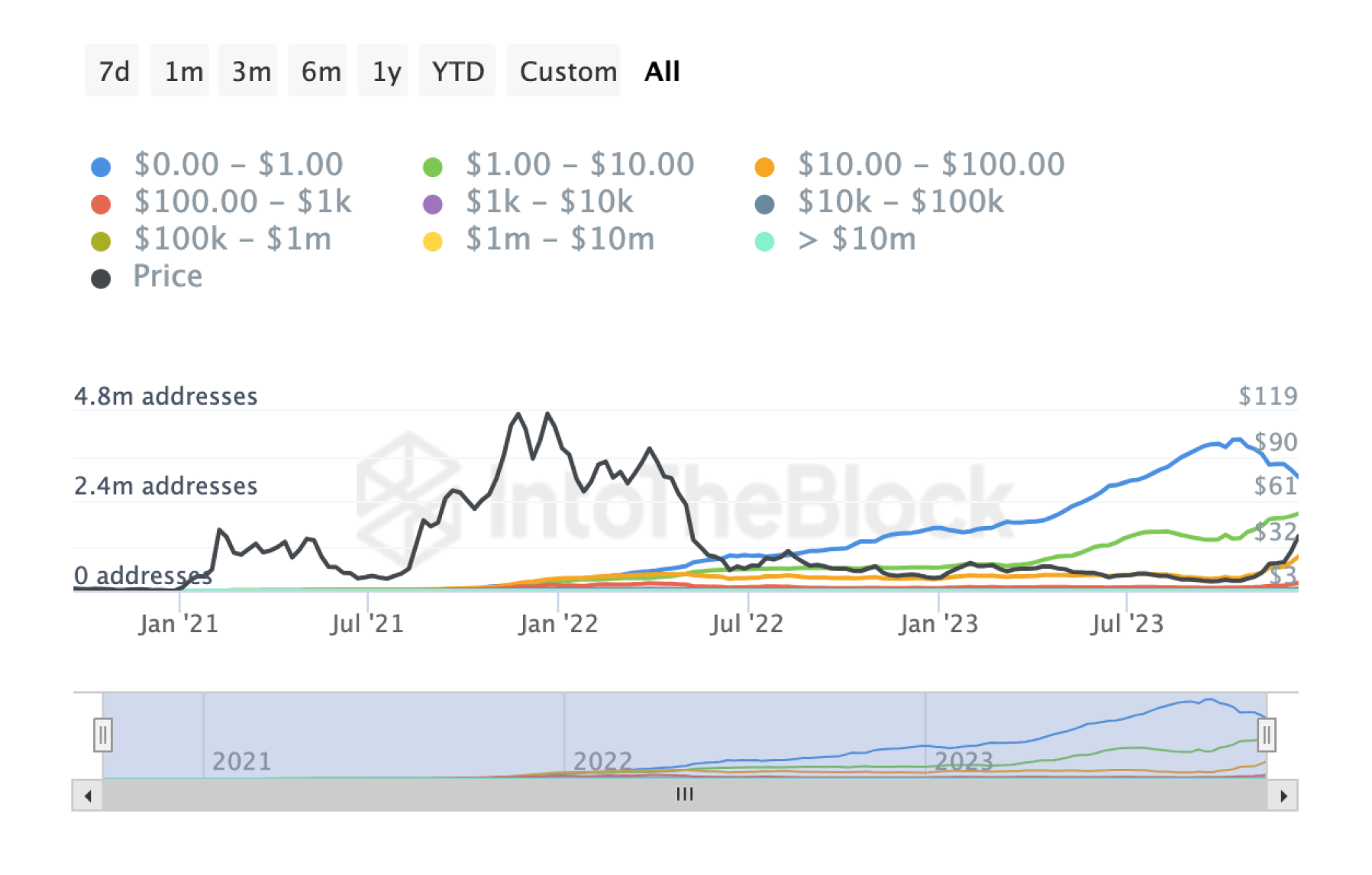

The attractiveness to investors is demonstrated by the growth in AVAX crypto holders. Successful partnerships and active investments confirm the interest from institutions and private investors.

The growth in the number of holders and active engagement of investors underline the project's long-term attractiveness.

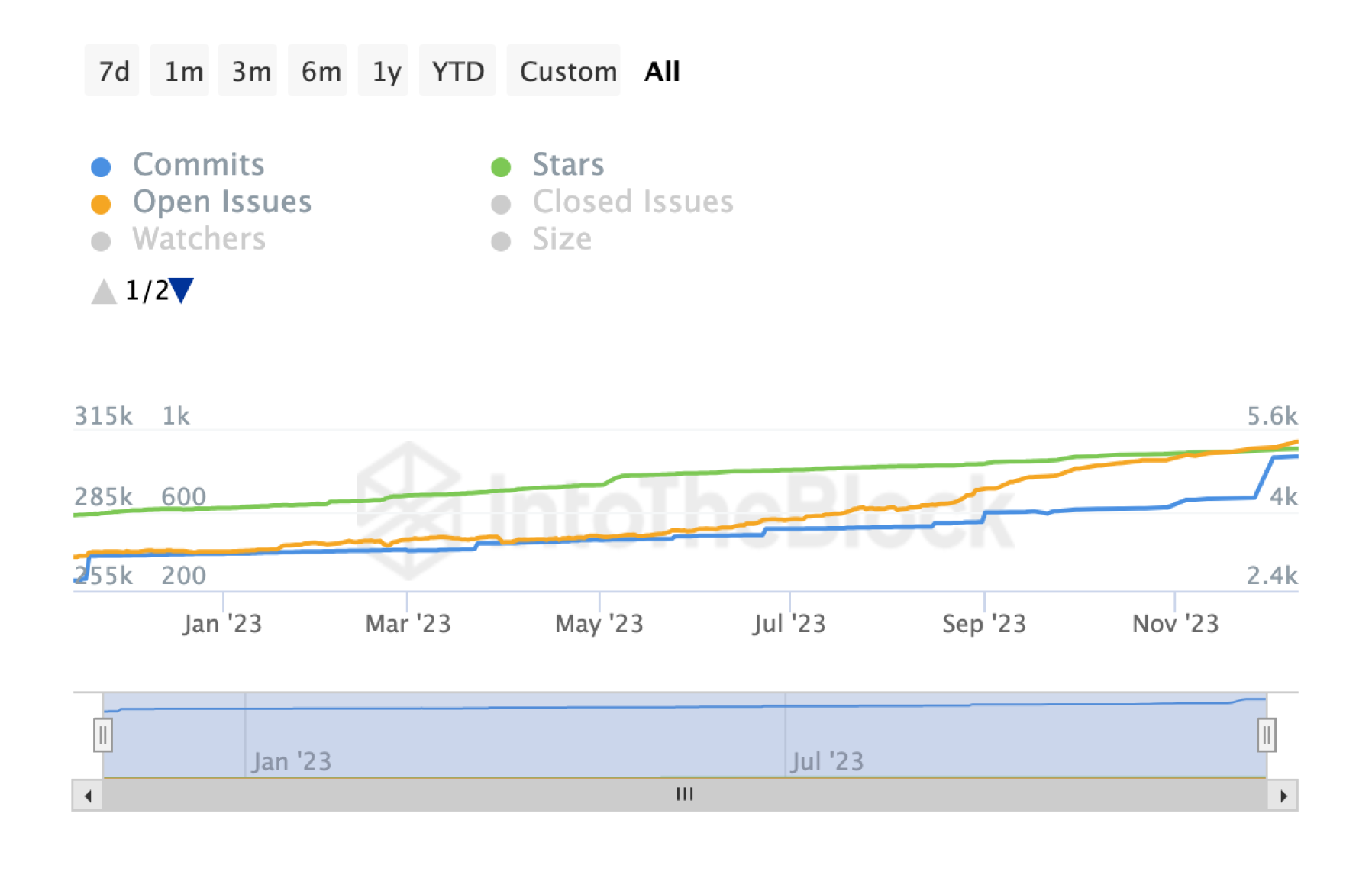

Besides, the activity and quality of development, regular updates, and improvements to the Avalanche blockchain also impact its financial stability. Regular updates allow Avalanche to remain competitive in the blockchain market.The activity and development quality of Avalanche are consistently growing.

The steady growth in development activity indicates a continual focus on improvements and innovations within the project.

Avalanche AVAX demonstrates promising financial indicators, reflecting its stability and prospects for future development. Sustained growth in market capitalization, investor activity, and high development levels make Avalanche a significant player in the crypto space.

Summary

Avalanche (AVAX) is a blockchain platform that successfully combines technical innovation, economic stability, and a strong community. Through in-depth research, key components defining the project's prospects and resilience have been identified.

- Technological Innovations and Structure

Avalanche implements innovative consensus mechanisms, making it outstanding in the blockchain field. Its flexible subnet and chain structure ensure efficiency and adaptability to various needs, maintaining the full functionality of the ecosystem.

- Economic Model and Financial Stability

The incentive model, including staking and token burning mechanisms, emphasizes the pursuit of a balance between growth and inflation control. AVAX's market capitalization and liquidity signal the project's financial significance. Investment interest and stable growth in the number of holders support its financial stability.

- Team and Community

The professionalism of the team, including experienced founders and support from renowned investors, underscores the project's seriousness. An active and diverse community, expressed through discussions and participation, confirms strong support.

- Development Activity and Updates

Steady growth in development activity, regular updates, and improvements signify a focus on innovation and a commitment to remaining competitive.

- Risk Assessment

Conscious management of technical, competitive, regulatory, and security risks highlights the team's proactive approach to ensuring stability.

Avalanche is a comprehensive project in the blockchain world. Its successful implementation of technical innovations, stable economic model, strong team, and community support make it a significant player in the crypto ecosystem.

However, despite its achievements, attention to risks and the dynamic nature of the blockchain space remains important for investors and participants. Overall, Avalanche represents a project with extensive prospects and strengthening fundamental foundations.

Users can exchange all cryptocurrencies mentioned in this article for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.