Marinade Finance: Solana Liquid Staking & mSOL

Key Insights

- Marinade Finance provides accessible avenues for users to efficiently participate in Solana's staking ecosystem, augmenting earning potential without complex validator node management.

- The Solana protocol rewards those who lock up their SOL tokens to help secure the network, but this process can be technically complex to set up and maintain.

- The process of staking Solana coin to receive mSOL allows retaining ownership of the staked assets while earning rewards, providing both accessibility and return potential.

As the Solana ecosystem grows, new opportunities arise for users to maximize returns on their holdings. This article will discuss one such option, namely the Marinade Finance platform, its liquid token, and the pros and cons of holding mSOL vs SOL.

What is Marinade Finance

Marinade Finance is a decentralized protocol built on the Solana blockchain that aims to make staking cryptocurrencies easier. Users can stake their SOL tokens, through the platform to earn rewards while maintaining liquidity.

Its core focus lies in optimizing Marinade staked SOL to generate attractive yields. Marinade Finance provides avenues for investors to stake their SOL holdings, allowing them to participate in liquidity provision and yield farming protocols.

Users can stake their Solana coin on the platform and receive liquid Marinade tokens in return that represent their staked position. The tokens can then be used on other DeFi platforms and applications without having to unstake the original SOL holdings. At the same time, the SOL remains staked on Marinade Finance and continues earning staking rewards that accrue to the users' positions.

Overall, Marinade Finance provides an intuitive way for crypto holders to earn passive income from their portfolio in a secure, non-custodial manner directly through their existing wallets.

Solana Staking Validator

A staking validator contributes to the security and growth of the Solana protocol by validating transactions on the blockchain. Validators package transactions into new blocks and confirm the order and validity of transactions. In return, validators receive rewards from a portion of transaction fees.

To become a validator, one must delegate or stake a minimum of 1 SOL. This amount is locked in order to confirm the validator has "skin in the game" and incentive to behave honestly. Validators that misbehave by signing invalid blocks can have their stakes slashed as punishment.

Many investors opt for Solana liquid staking instead of running a validator node themselves. With liquid rates, the funds remain available and in demand while continuing to generate returns on rates for investors.

Running a validator node requires technical skills and ongoing maintenance of hardware. However, it allows controlling a share of the network and earning inflation rewards directly from block production. The best Solana staking validators produce blocks frequently and have uptime over 99%, ensuring maximum rewards.

Marinade Finance stands as a notable entity within the DeFi Solana landscape, offering accessible avenues to staking benefits. Through this platform's solutions, users can efficiently participate in Solana's staking ecosystem, augmenting their earning potential without the complexities inherent in managing a validator node.

Marinade Token (mSOL)

The Marinade token (mSOL) is an integral component within the Marinade Finance ecosystem, designed to provide added functionalities and opportunities for holders compared to the standard SOL token.

Pros of owning mSOL

Enhanced yield potential

Holding mSOL allows participants to engage in yield farming and liquidity provision, potentially garnering higher returns compared to simply holding SOL.

Protocol incentives

Marinade Finance often introduces unique incentives and rewards for mSOL holders, encouraging greater participation and engagement within the ecosystem.

Risk diversification

For investors seeking diversified exposure within the Marinade crypto landscape, mSOL offers an alternative investment avenue beyond traditional SOL holdings.

Cons of owning mSOL

Risk

Engaging with mSOL involves additional potential smart contract risks, which may not be suitable for all investors.

Volatility and market conditions

The value of mSOL can be subject to increased volatility compared to SOL due to its derivative nature.

Weighing these pros and cons allows an informed decision when evaluating mSOL.

How to Use Marinde Finance

Below you will find a detailed guide on how to utilize the basic functionality of Marinade Finance.

Refill Solana wallet with SOL tokens

To begin, add SOL tokens to your Solana wallet. Using the SimpleSwap cross-chain exchange, you can easily exchange nearly any asset across various networks for SOL coin. Alternatively, Solana tokens can also be purchased directly with cash.

- Visit Marinade Finance project website

Navigate to the Marinade Finance project website from your browser and click the Optimize your staking button to start the staking process.

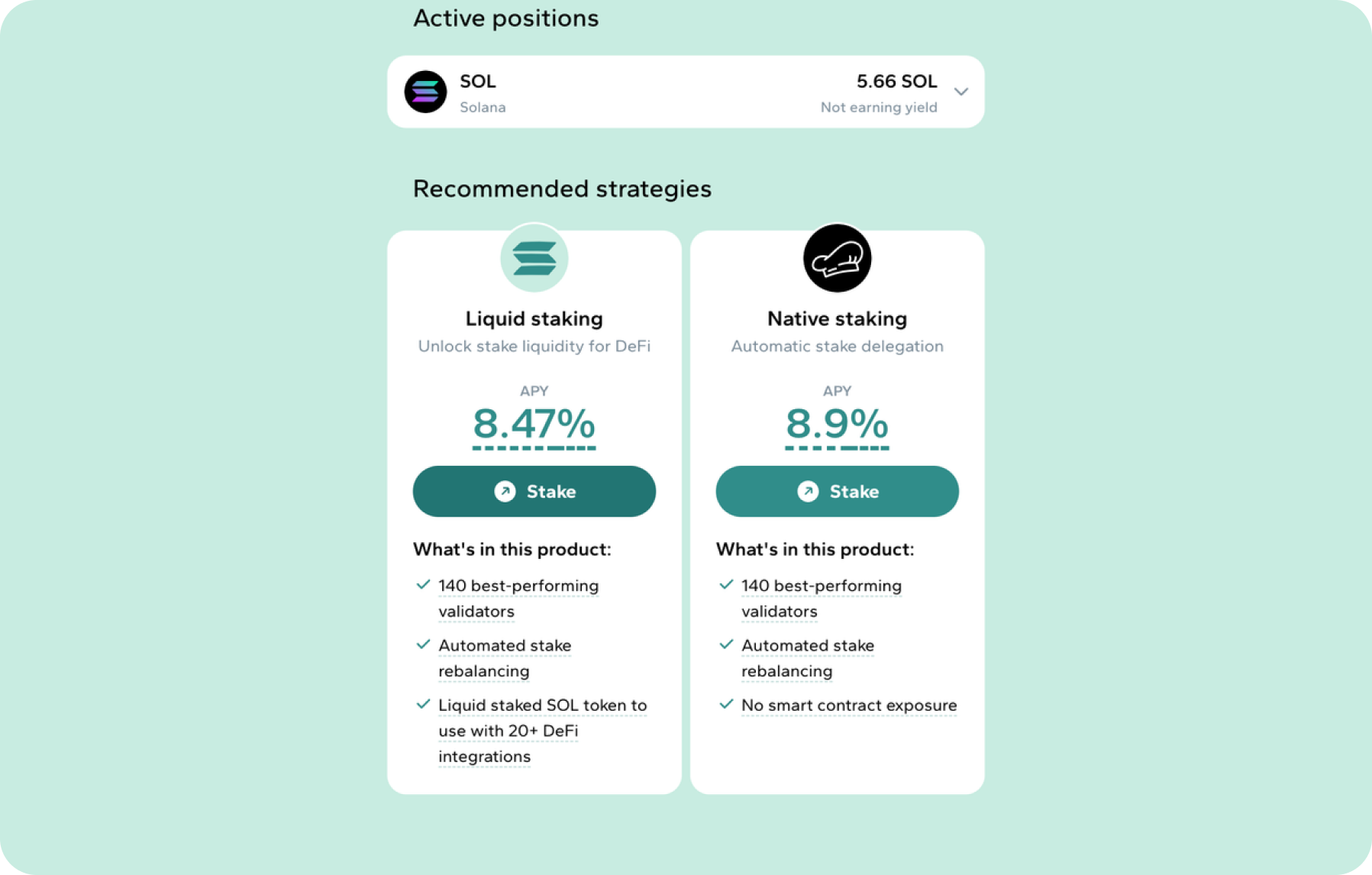

- Select liquid staking and confirm

Scroll down the webpage until you find Liquid Staking. Proceed by selecting this option and subsequently clicking the Stake button to confirm your choice.

- Stake your SOL coin

Initiate the staking process for your SOL coins following the selection of Liquid Staking. This step involves committing your tokens to the staking mechanism.

- Confirm staked amount

After staking, we can see we are now earning 8.47% APR yield on our staked SOL coins.

- Check your Solana wallet

Using a Solana wallet such as Phantom, check for the replenishment of mSOL tokens. These tokens represent a smaller amount than the originally staked SOL coin but hold an equivalent dollar value.

Note that the ratio of mSOL to SOL isn't 1:1 due to the premium value of mSOL, which reflects staked SOL generating rewards. This ratio ensures the protocol's liquid staking functionality.

Below is a graph of the mSOL price, which clearly demonstrates that the value of the asset has risen steadily over the period indicated.

Utilize mSOL for additional income

The mSOL coin can be used in other projects of Defi ecosystem of Solana network and bring additional income.

As an easy to use liquid staking protocol, Marinade Finance aims to expand participation in Solana's staking activities while maintaining flexibility for users. Through mSOL, the platform facilitates yield generation and access to broader DeFi opportunities directly from investors' existing wallets.

Similar to any DeFi protocol, users should assess the risks before investing. For investors seeking passive income or diversified Solana exposure, Marinade Finance provides an option through the mechanics of its mSOL token and approach to liquid staking.

Users can get all coins mentioned in this article on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.