Blockchain Layers Crypto Portfolio

Key Insights

- The Blockchain Layers portfolio offers a diversified approach to the blockchain industry, addressing all blockchain layers for enhanced performance and efficiency.

- The allocation of assets across different blockchain layers demonstrates a strategic approach to risk mitigation.

- The inclusion of stable assets like USDC and DAI as a reserve component highlights the portfolio's commitment to stability and protection against market volatility.

The following Blockchain Layers portfolio is a balanced combination of leading blockchains and innovative solutions designed to optimize the performance and efficiency of networks.

What Is Crypto Portfolio

Crypto portfolio is a strategic mix of digital assets used for investment purposes. In order to invest in a balanced way, it is important to understand the concept of a crypto portfolio strategy, which enables to balance risk and reward across a variety of blockchain projects. All of these key points are necessary to make informed financial decisions.

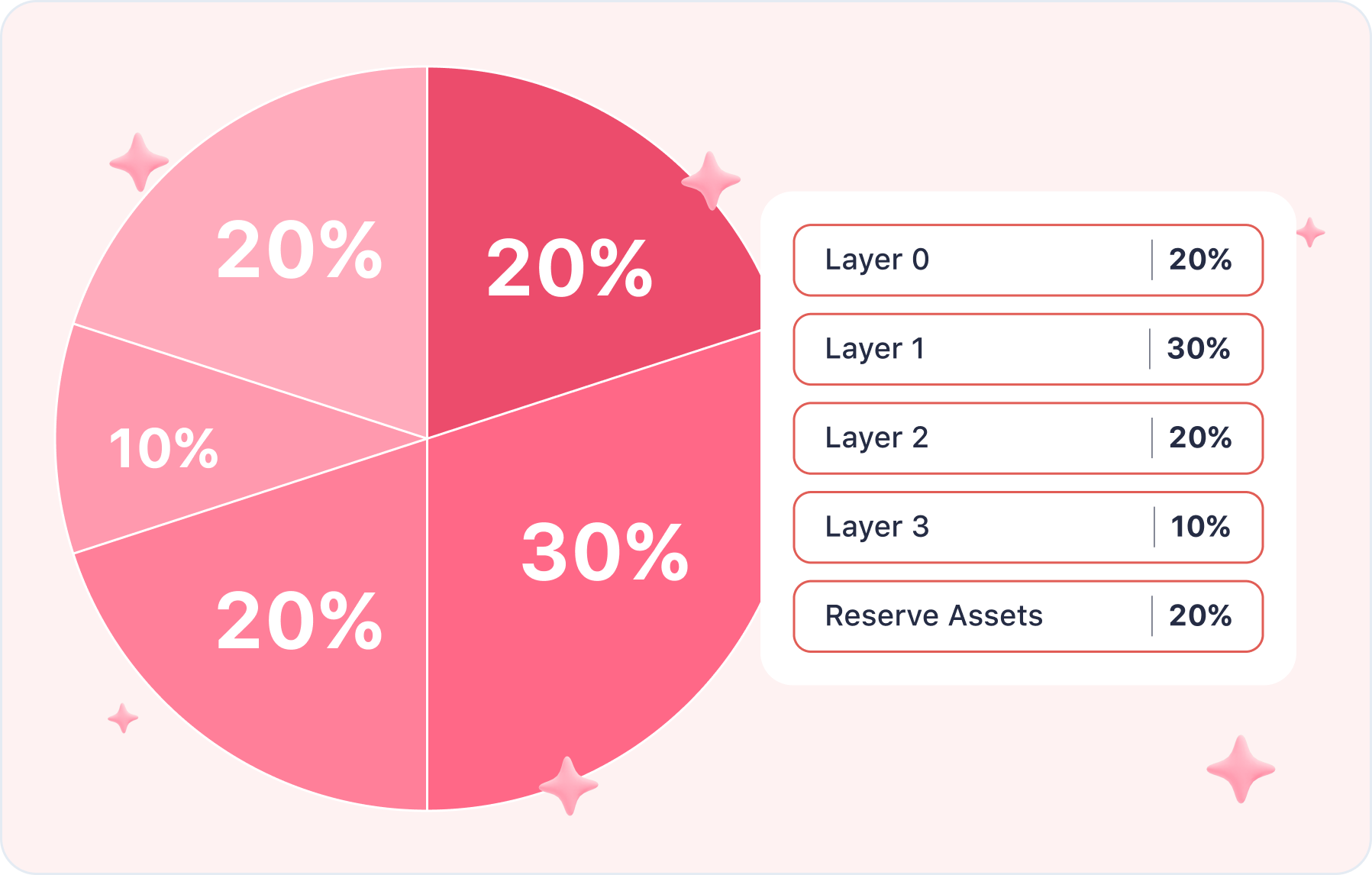

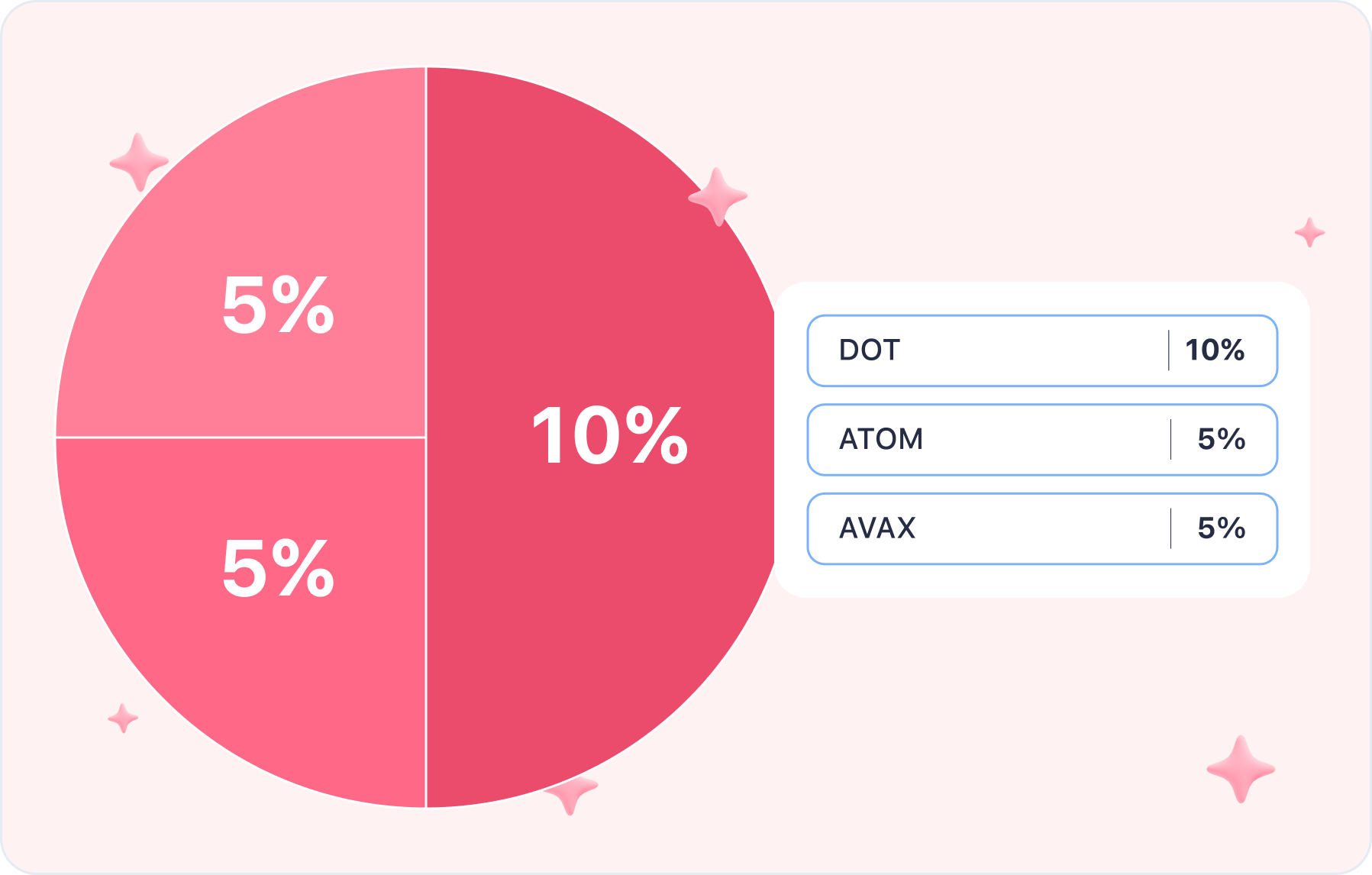

Layer 0 (L0): 20%

This level includes leading platforms that provide infrastructure for blockchain networks and enable them to interact with each other. This layer represents the blockchain itself and its fundamental infrastructure, including hardware, protocols, and other foundational elements.

- Polkadot (DOT): 10%

Polkadot is a blockchain platform that provides infrastructure for creating and managing parallel blockchains and facilitating their interaction. Polkadot is a protocol aimed at connecting blockchains, enabling the transfer of value and data across previously incompatible networks such as Bitcoin and Ethereum. The DOT token is utilized for staking and governance.

For DOT Technical Analysis see here.

- Cosmos (ATOM): 5%

Cosmos provides the means to create and interact with independent blockchains, ensuring secure interactions. Cosmos' history is closely tied to the increasing interest in blockchain scalability and addressing the issue of isolation between different blockchains. The platform provides a solution for constructing scalable, secure, and interoperableblockchains and decentralized applications.

You can read more on Cosmos here.

- Avalanche (AVAX): 5%

Avalanche provides high scalability and security for blockchain networks. Avalanche is a platform that enables the creation of smart contracts and deployment of dApps in a decentralized manner. Avalanche's mission and vision are focused on creating a sustainable blockchain network that promotes the mass adoption of dApps. The main goal is to offer developers and users the necessary tools to operate in a decentralized environment, freeing them from the constraints of centralized structures.

You can familiarize yourself with AVAX here.

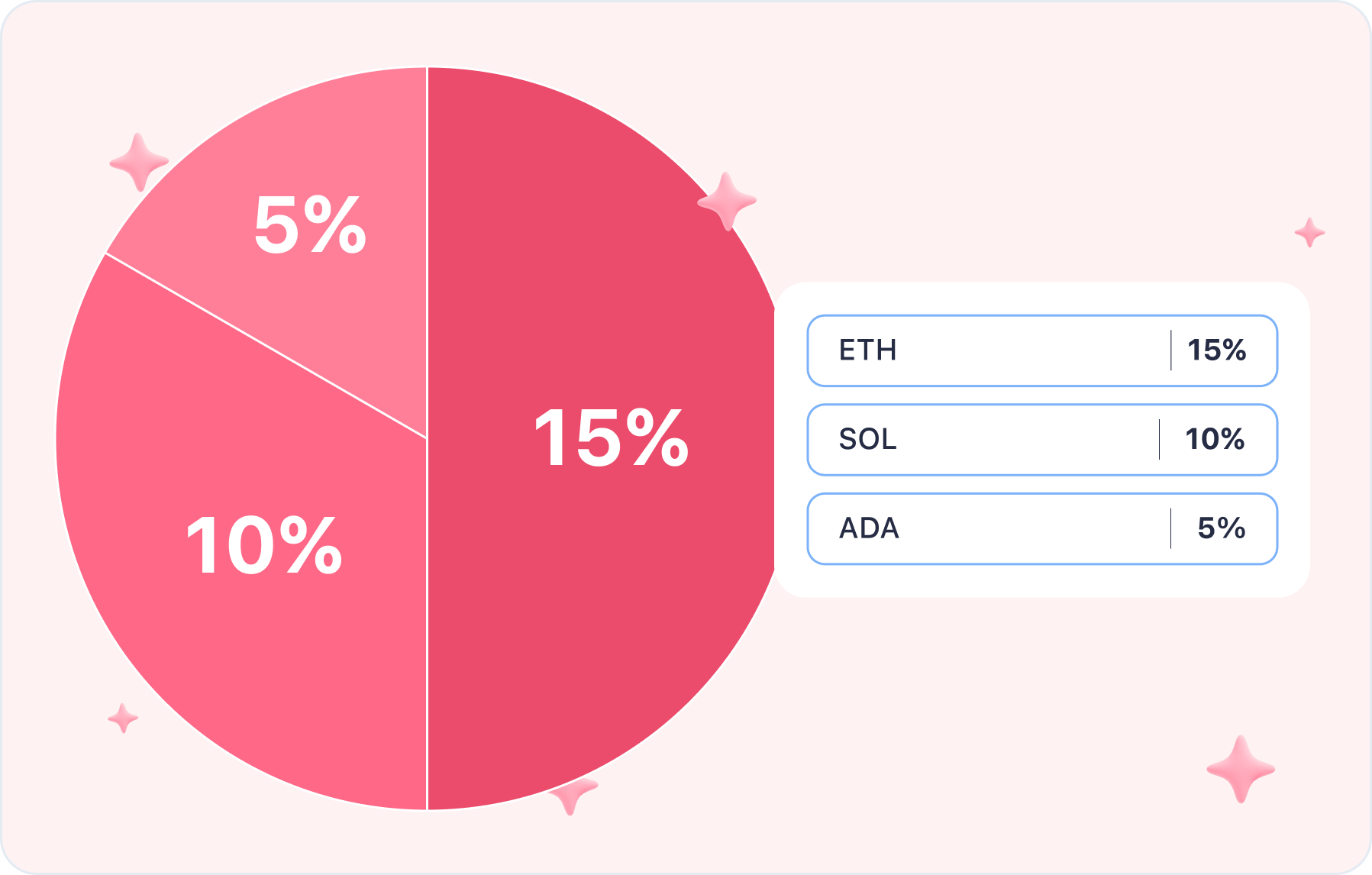

Layer 1 (L1): 30%

This level includes major blockchain platforms that offer capabilities for creating smart contracts and decentralized applications.

- Ethereum (ETH): 15%

Ethereum is the leading blockchain for smart contracts and dApps. Ethereum allows developers to build decentralized apps, freeing users from reliance on centralized servers and enhancing their privacy and autonomy. Currently, the market cap of Ethereum exceeds $220 billion, making it the second-largest cryptocurrency after Bitcoin.

Get to know more about Ethereum here.

- Solana (SOL): 10%

Solana ensures high scalability and performance for blockchain networks. The Solana Blockchain is a distributed ledger that utilizes innovative technological solutions to achieve high performance and low fees. Its infrastructure is capable of processing thousands of transactions per second, making it an attractive option for various dApps and projects seeking to enhance the efficiency and accessibility of decentralized systems.

Discover more about Solana here.

- Cardano (ADA): 5%

Cardano is a research-oriented platform aiming to provide secure smart contracts and a stable ecosystem. It is a blockchain platform that prioritizes security and scalability, with a focus on simplicity in developing dApps.

You can read our ADA Technical Analysis.

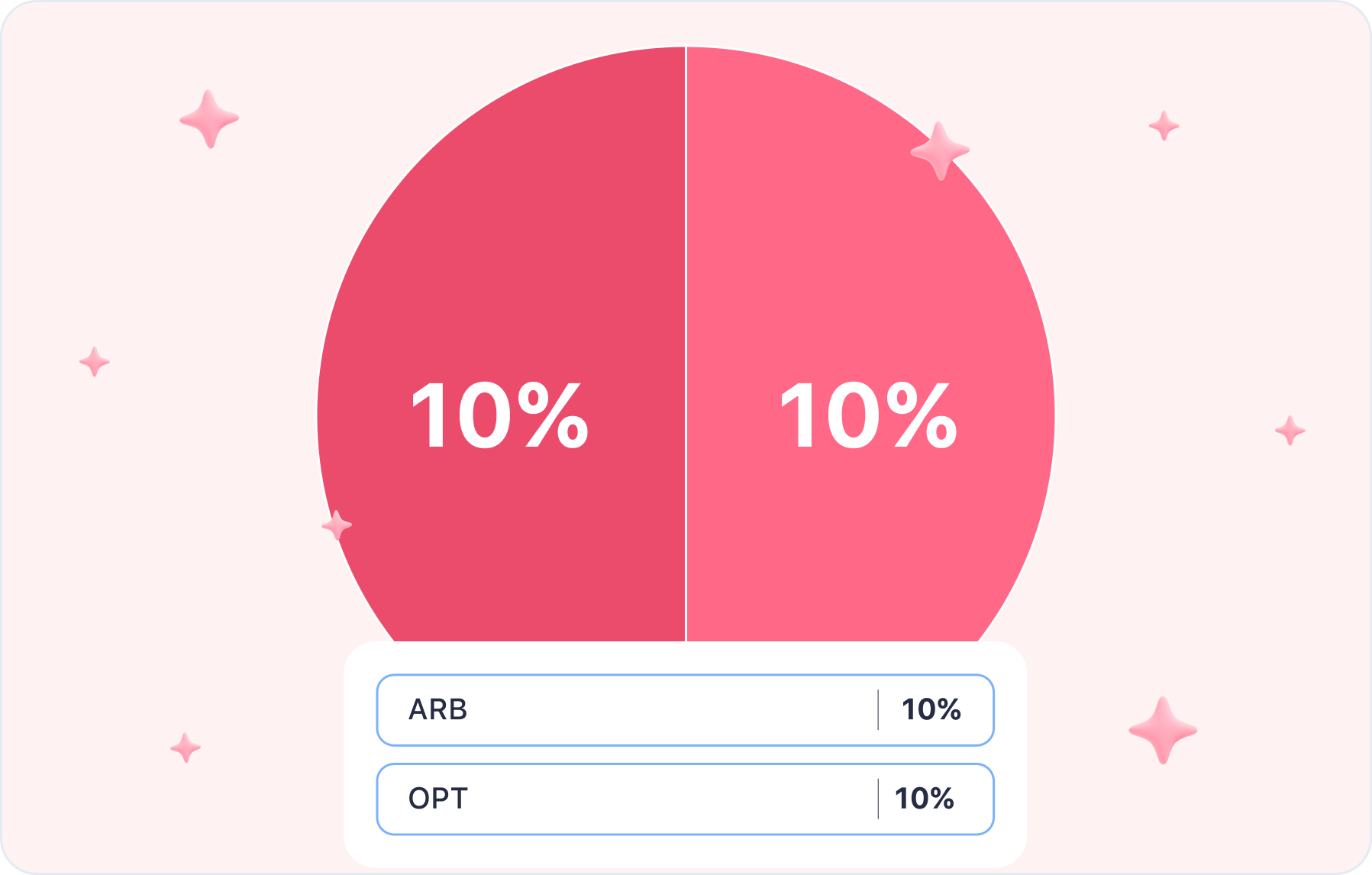

Layer 2 (L2): 20%

These L2 solutions significantly improve performance and reduce transaction costs on the Ethereum blockchain.

- Arbitrum (ARB): 10%

Arbitrum provides a Layer 2 (L2) solution to enhance performance and reduce transaction costs on the Ethereum network by alleviating congestion and speeding up processing. Arbitrum is an ecosystem developed by Offchain Labs to address scalability and performance issues on the Ethereum blockchain. Its core technology, Arbitrum Rollup, processes transactions off-chain and aggregates results onto the Ethereum chain, increasing throughput and improving execution for the network.

Get more information about Arbitrum here.

- Optimism (OP): 10%

Optimism also increases throughput and reduces Ethereum transaction costs, making them more accessible. Optimism enables low-cost and near-instantaneous Ethereum transactions. The OPT cryptocurrency fuels the Token House, which is a division of the Optimism Collective together with the Citizens' House. The Collective governs network parameters, treasury disbursements, and protocol upgrades.

You can learn more about OPT usage here.

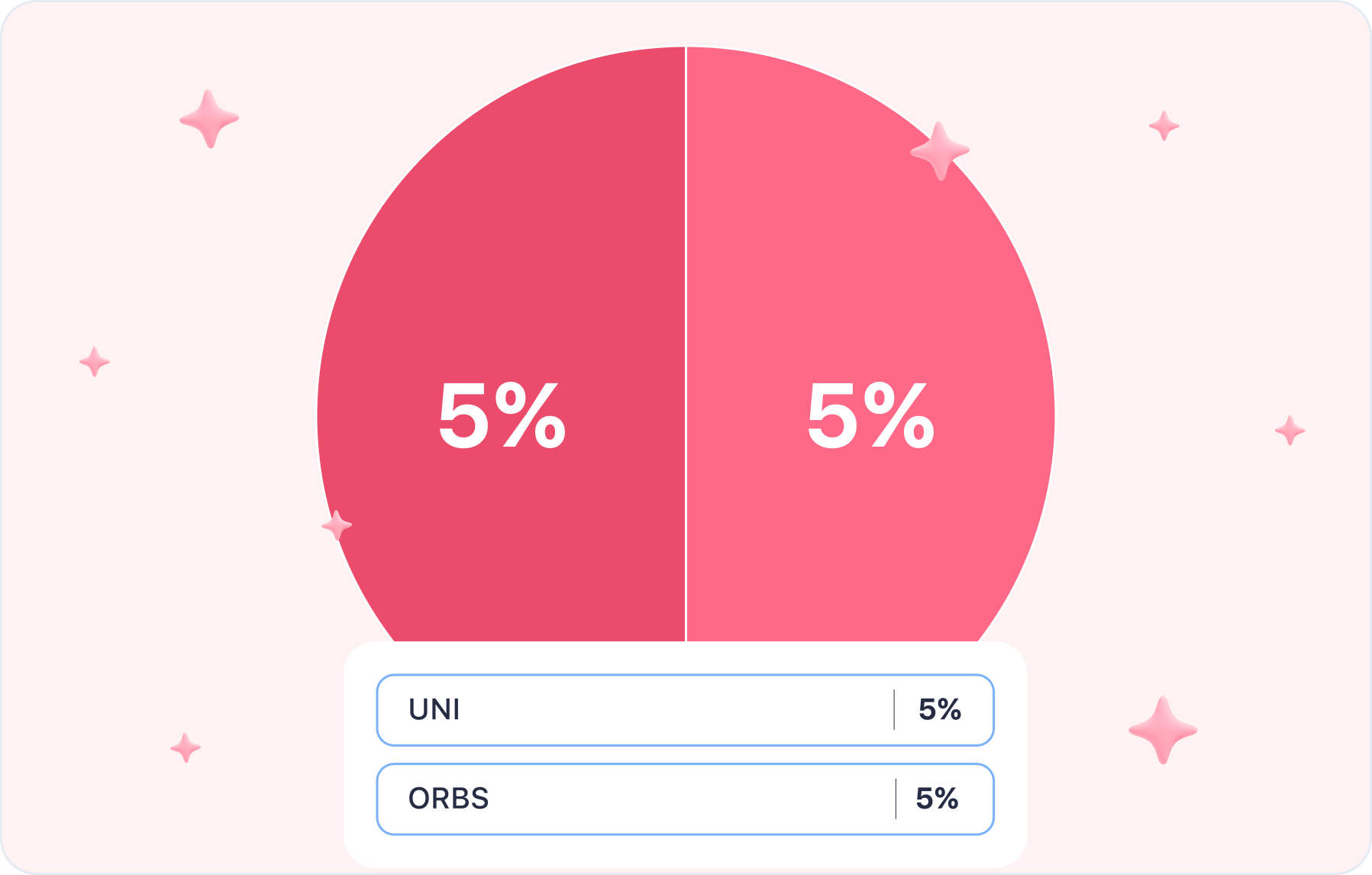

Layer 3 (L3): 10%

L3, or the application layer, includes decentralized applications and protocols that enable their operation.

- Uniswap (UNI): 5%

Uniswap provides decentralized financial services and token exchange. Uniswap is a decentralized cryptocurrency exchange that utilizes an automated market-making (AMM) model to facilitate trades without intermediaries. It operates on the Ethereum blockchain and was among the earliest DEXs to achieve widespread adoption.

You can read Uniswap-related articles here and here.

- Orbs (ORBS): 5%

Orbs offers solutions for scalability and blockchain security, promoting innovation. Orbs is a public, decentralized blockchain infrastructure that is executed by a secure network of permissionless validators using Proof-of-Stake (PoS) consensus. It aims at enhancing the capabilities of existing EVM (Ethereum Virtual Machine) and non-EVM smart contracts.

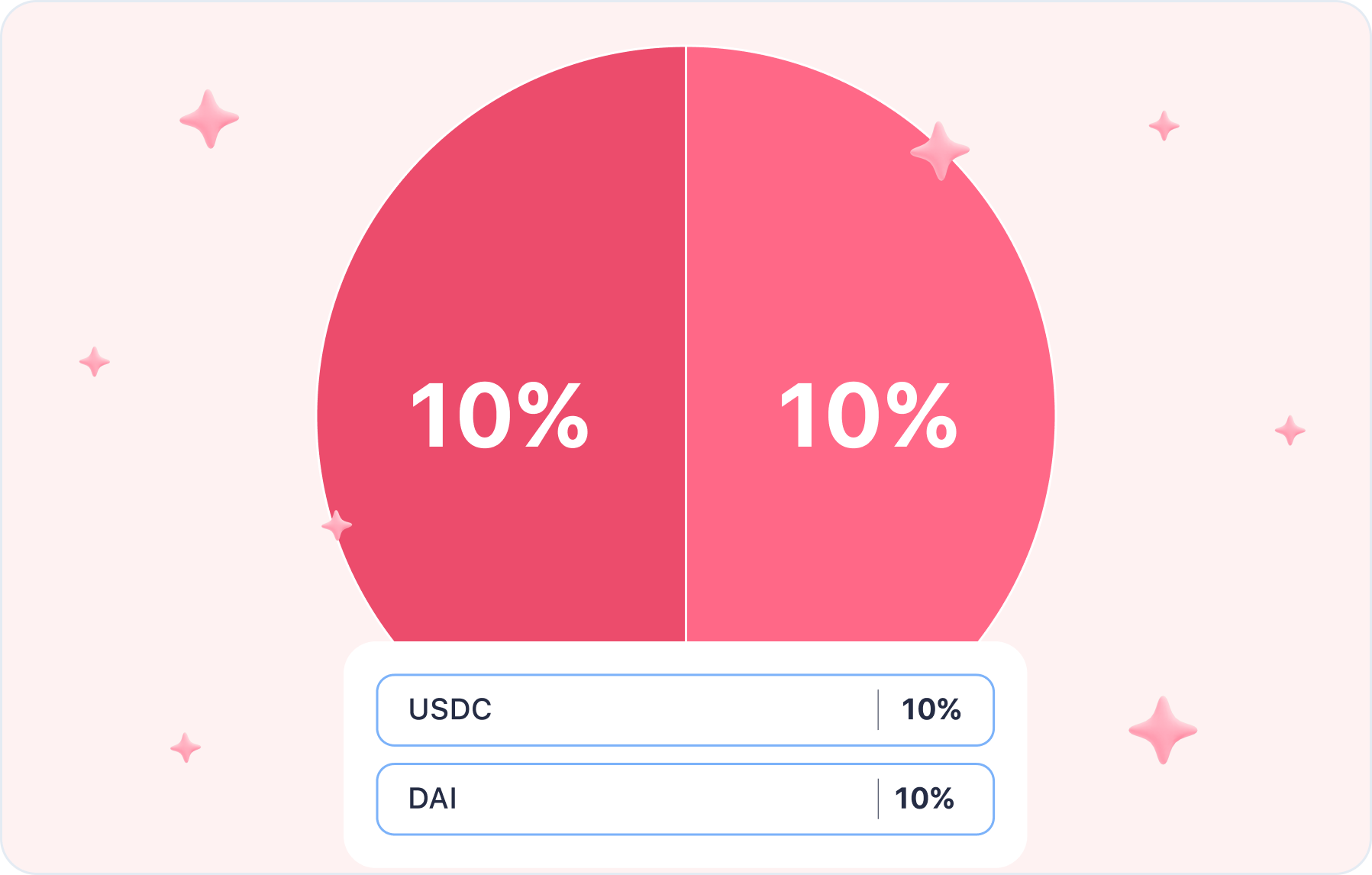

Reserve Assets: 20%

The stablecoins serve as reserves and can be exchanged for other assets if needed, providing reliable protection against market fluctuations.

- USDC - 10%

USD Coin (USDC) is a digital currency that is backed 1:1 by the U.S. dollar. It is a tokenized version of the U.S. dollar, with the value of one USDC coin being as close to the value of one U.S. dollar as possible. USDC is a stablecoin, designed to maintain a stable value.

- DAI - 10%

The price of DAI is fixed in relation to the value of the US dollar. As a stablecoin, this crypto asset can serve as a reliable means of storing funds and facilitating interuser payments. The stability of DAI is guaranteed not only by its peg to the dollar but also by its use of collateralized debt positions (CDPs) and smart contract technology.

DAI offers a stable alternative in an otherwise volatile market. It is a cryptocurrency that is designed to automatically respond to changing market conditions in order to maintain a stable value against major world currencies.

Summary

In this article we took a detailed look into layered crypto portfolio. Layer 0 includes DOT, ATOM and AVAX. Layer 1includes ETH, SOL, ADA. Layer 2 consists of ARB and OPT, while Layer 3 has UNI and ORBS in it. USDC & DAI serve as the reserve assets.

This portfolio is designed for risk diversification and performance optimization across various levels of blockchain technology, including core blockchains, scalability layers, and stable assets.

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.