Ethereum Blockchain Analysis May 2024

Key Insights

- There’s an indication of increased interest in withdrawing ETH from centralized cryptocurrency storage platforms and investing in decentralized financial applications.

- Positive percent changes in most of the balance ranges indicate an increase in the balance over May, with this increase appearing to be greater for large balances.

- A substantial increase in Ethereum movement from exchanges could drive increased demand for ETH and support Ethereum price growth going forward.

What Is Ethereum

The Ethereum blockchain stands as one of the most popular and widely recognized blockchain initiatives globally. It employs its proprietary programming language, Solidity, for developing smart contracts and boasts a vast ecosystem of developers and applications.

Currently, the market capitalization of Ethereum makes it as the second-largest cryptocurrency after Bitcoin.

Technically, Ethereum originally utilized the Proof-of-Work (PoW) protocol and has since transitioned to the Proof-of-Stake (PoS) protocol. This shift enhances security and decentralization, allowing Ethereum blockchain participants to earn rewards for maintaining the network and verifying transactions.

The Ethereum Foundation and its developer community are actively working on updates to improve security, scalability, and network performance. These collaborative efforts have led to a high level of technical maturity within the Ethereum blockchain.

To address scalability challenges, Ethereum is implementing solutions like sharding and Plasma. These methods will distribute the workload across multiple blockchains, significantly increasing transaction processing speeds.

However, the growing popularity of Ethereum poses a risk of centralization, as major players might begin to control a substantial portion of the network.

To conduct an Ethereum analysis for May 2024 we turn to such crucial metrics as outflow volume, historical concentration, and balance by holdings.

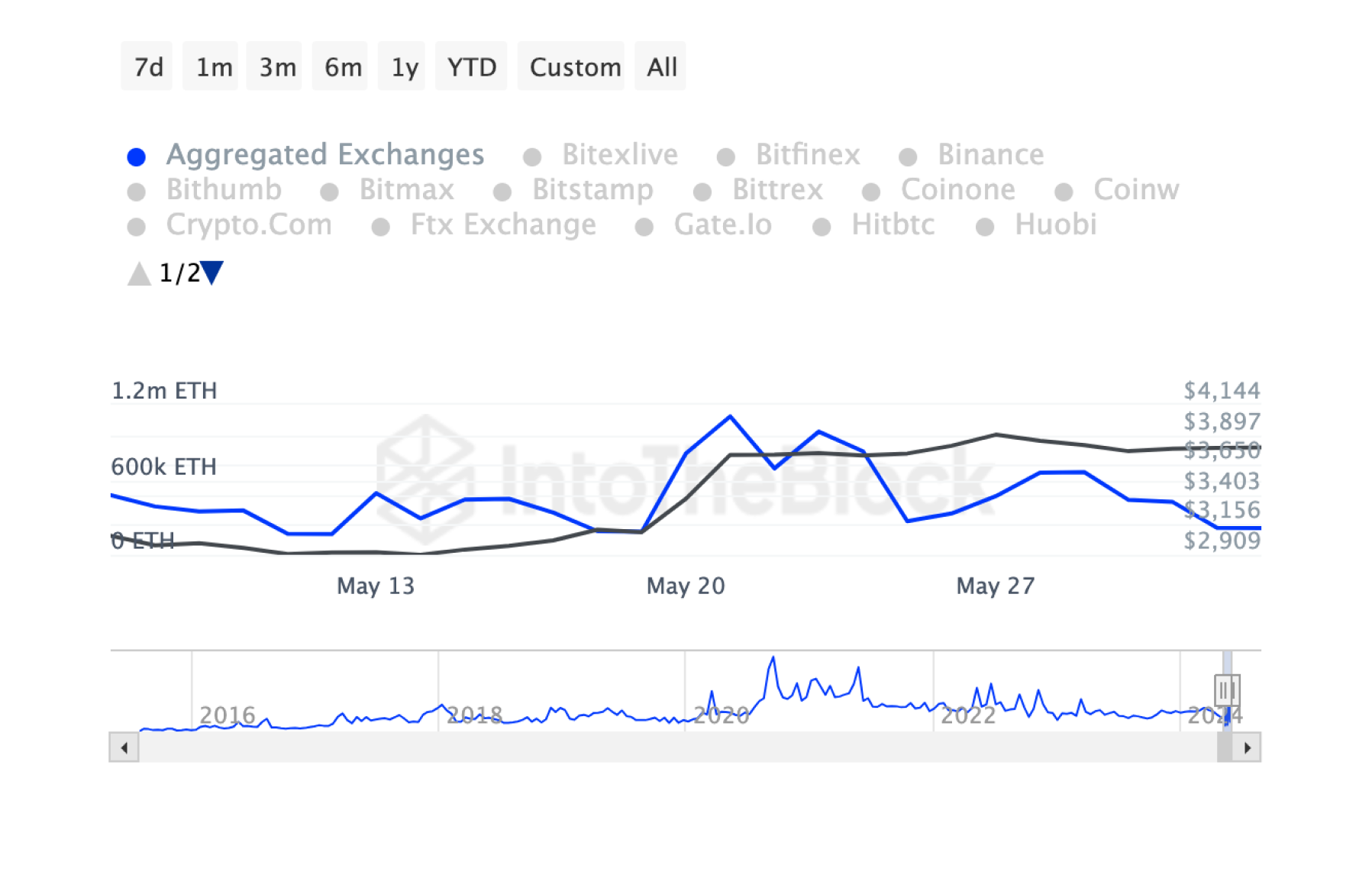

ETH Outflow Volume

The 117.16% increase in the Outflow Volume ETH metric over the past 30 days could indicate a significant movement of Ethereum off exchanges.

The potential upside prospects for the ETH price as a result of this increase may be related to the shortages created by the reduced supply of ETH on exchanges.

When users withdraw ETH from exchanges, this could lead to a decrease in liquidity in the market, especially if demand for this cryptocurrency remains high or increases.

A scarcity scenario could trigger an increase in demand for Ethereum, which in turn could support an increase in ETH price. This is especially likely if market conditions remain favorable for cryptocurrencies in general and if DeFi continues to attract new participants and capital.

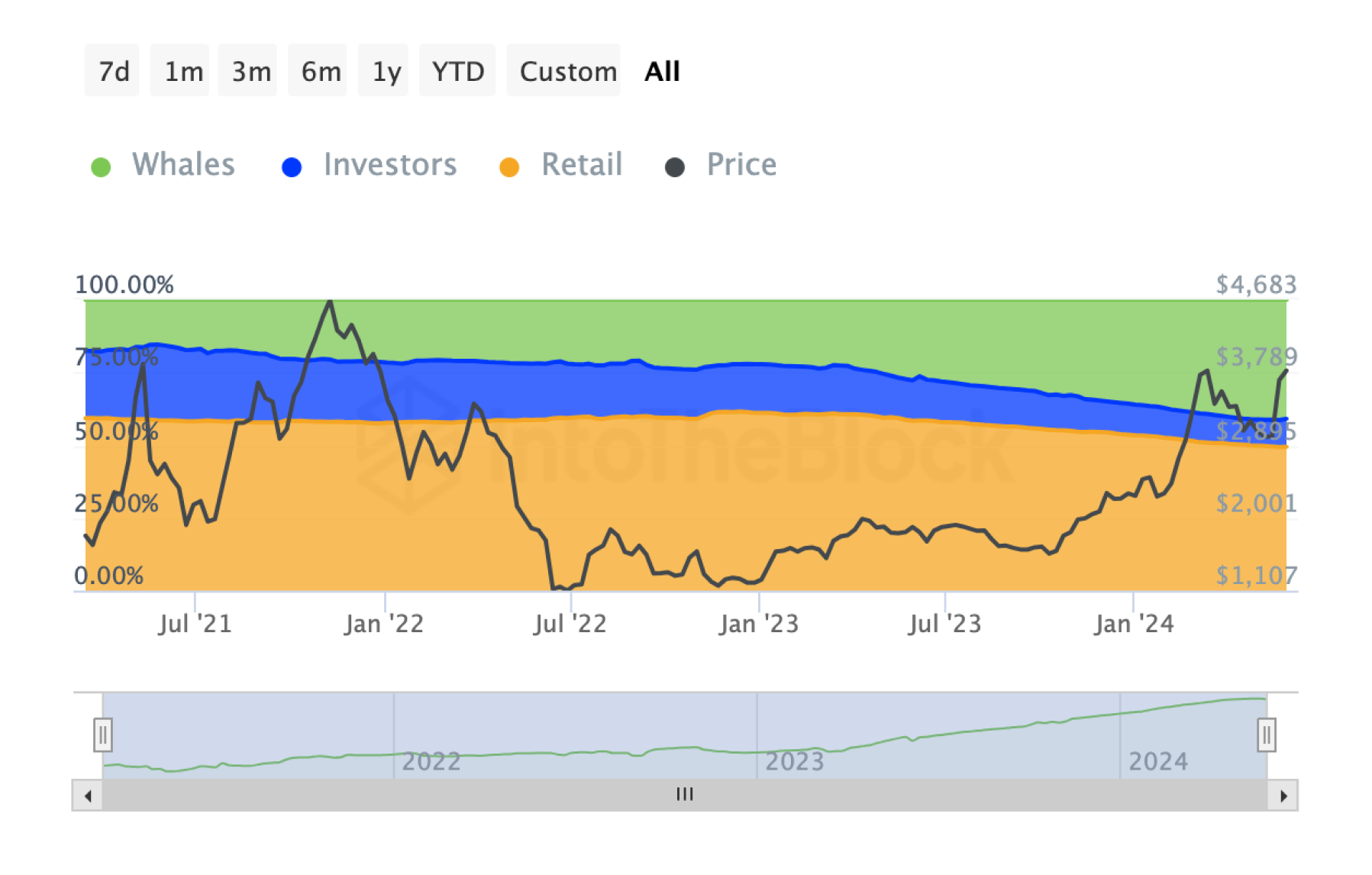

Ethereum Historical Concentration

An increase in concentration may indicate an increase in interest in Ethereum blockchain among large investors who see the potential in the development of this platform and are planning long-term investments.

Changes in historical concentration may also serve as an indicator of the overall activity in the Ethereum blockchain and the sentiment of major players towards this cryptocurrency on the market.

ETH Balance By Holdings (in USD)

This dataset is a metric that estimates the change in balance in ETH over the last 30 days in dollar terms based on the value of that balance. It is divided into different ranges of ETH balance values, ranging from very small amounts to amounts exceeding $10 million.

For example, balances in the $10 thousand to $10 million range had positive percent changes ranging from 7.41% to 17.86%, which may indicate a significant increase in Ethereum investment volume in this range.

This can be interpreted as a positive sign for market sentiment, indicating that large holders of ETH continue to hold or increase their positions.

Increased balances in larger ranges could also indicate increased confidence in ETH's long-term prospects or an expectation of Ethereum price appreciation.

Overall, analysis of this metric suggests that there is moderate optimism in the Ethereum crypto market, especially among large holders.

Users can get ETH for fiat or crypto on SimpleSwap.

Summary

The analysis of Outflow Volume, Historical Concentration and Balance By Holdings in USD metrics over the last 30 days has provided important insights into the current situation on the Ethereum blockchain.

The 117.16% increase in the Outflow Volume ETH metric indicates significant Ethereum movements off exchanges, which may indicate increased interest in removing ETH from centralized platforms for long-term storage.

Interest in Ethereum among large investors, as reflected in Historical Concentration, is also growing, indicating their confidence in the long-term prospects of this cryptocurrency.

Analysis of Balance By Holdings in USD shows an increase in Ethereum balances, especially in large ranges, which may indicate the increased confidence of large holders in Ethereum's prospects.

Overall, these metrics confirm moderate optimism in the Ethereum blockchain and point to the potential for further growth in the price of this cryptocurrency in the future.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.