Market Uncertainty Crypto Portfolio

Key Insights

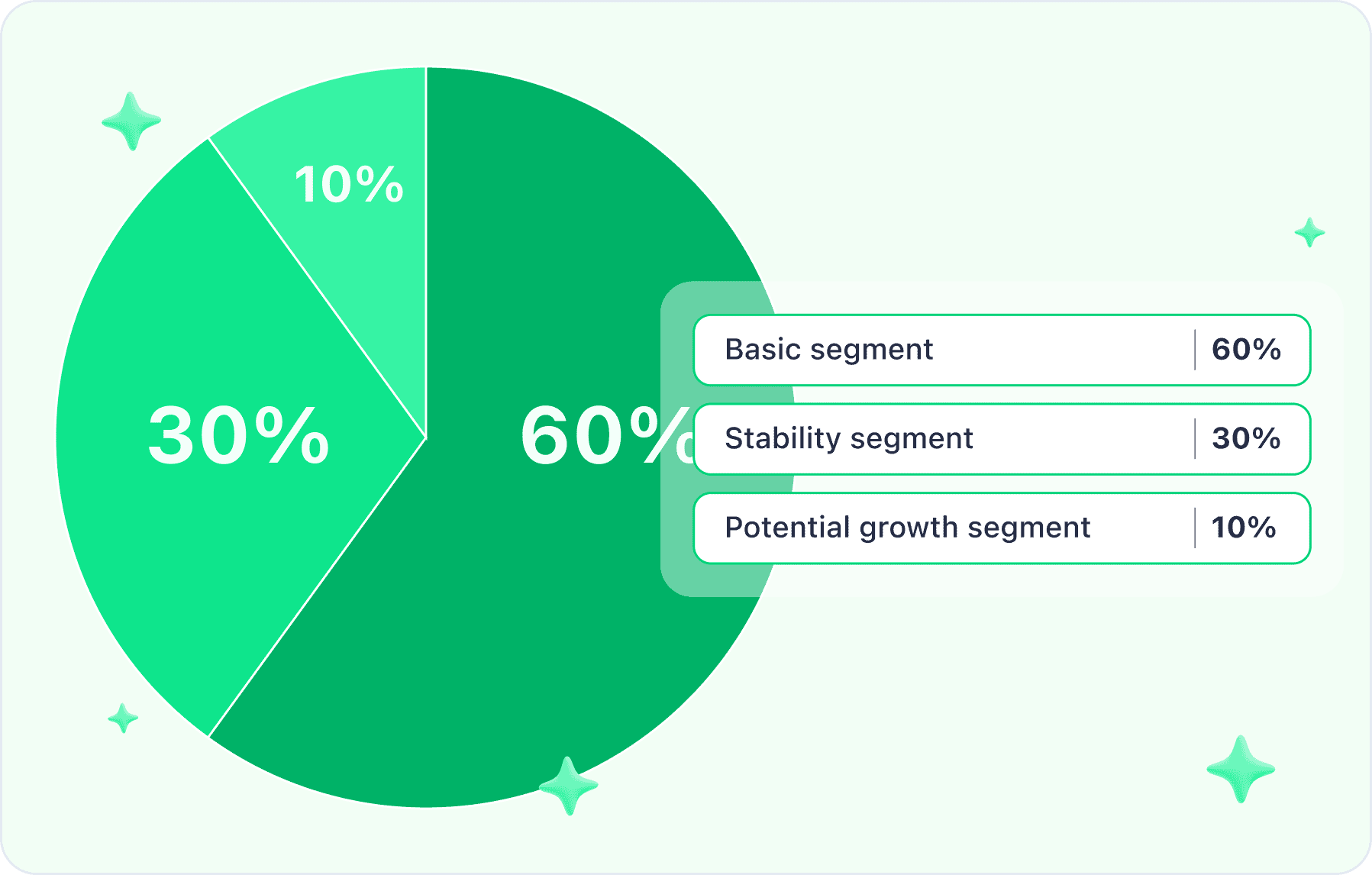

- A 60% allocation to BTC and ETH provides stability amid volatility, while LTC and BCH work for diversification.

- 30% allocated to stablecoins USDT and USDC balances the portfolio, offering liquidity and enabling easy conversions.

- A 10% segment in high-potential assets like ADA and MATIC allows for measured exposure to growth opportunities.

Over the last few years, the cryptocurrency market has experienced significant growth. Cryptocurrencies display higher volatility, risk, and returns than more traditional assets.

Crypto Market Uncertainty

The cryptocurrency market itself is known for its unpredictability, with prices that can drastically rise or decline based on such factors as supply and demand, regulatory developments, and technological innovations.

The cryptocurrency industry, despite its decentralized nature and global reach, is linked to the global economic landscape, although Investors are increasingly turning to crypto market in search of diversification and hedging options.

The interdependence and correlation between traditional market with the cryptocurrency market demonstrates the necessity for adaptability. Businesses, platforms, and individual investors acknowledge the significance of scenario planning.

By anticipating potential external economic shifts and preparing for multiple outcomes, investors can ensure resilience in the face of unexpected downturns. By diversifying portfolios and crypto strategies and being able to move quickly, investors can navigate the uncertain crypto economy more effectively.

Crypto Portfolio

Below is a diversified portfolio with a wait-and-see approach in time of market instability. Each part of the portfolio consists of carefully selected cryptos based on their characteristics and potential.

Users can get all coins from this portfolio on SimpleSwap.

Each part of the portfolio consists of carefully selected cryptos based on their characteristics and potential.

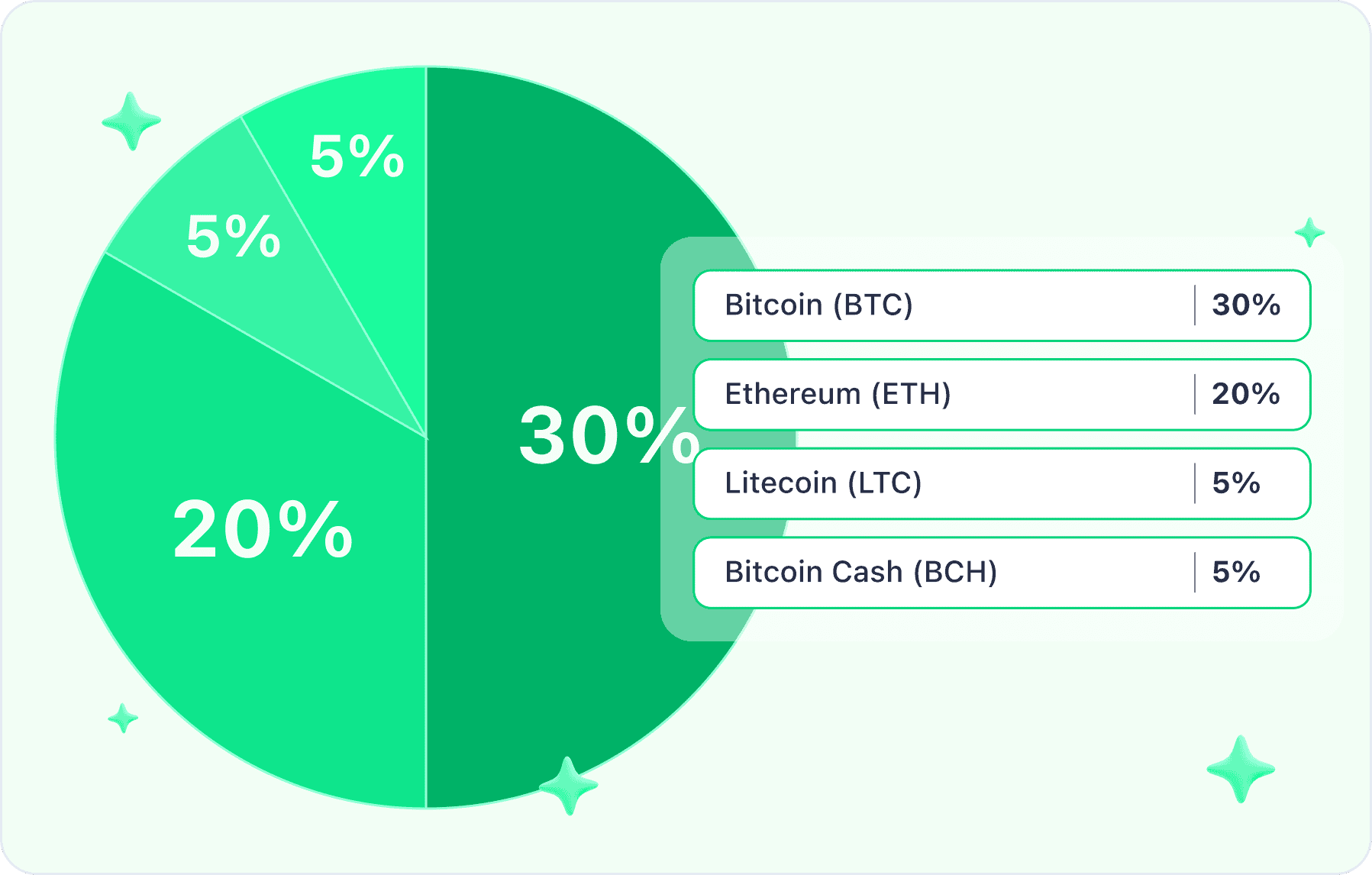

Basic Segment of Crypto Portfolio (60%)

The basic segment constitutes the majority of the allocation and aims to provide stability and participation in the potential growth of the crypto market.

- Bitcoin (BTC) - 30%

Bitcoin is the most popular and widely recognized crypto with high liquidity. Including BTC in the portfolio allows for maintaining stability. Bitcoin is comparable to gold in its limited issuance. Over the entire history of its existence, globally, Bitcoin has shown exceptional growth, which is associated with the development of the crypto industry and the influx of funds in it.

- Ethereum (ETH) - 20%

Ethereum is the second-largest crypto by market cap after Bitcoin. It serves as a platform for developing smart contracts and dApps. Ethereum allows developers to build decentralized apps, freeing users from reliance on centralized servers and enhancing their privacy and autonomy. Including ETH in the portfolio provides exposure to the dApps ecosystem and potential for growth.

- Litecoin (LTC) - 5%

Litecoin is one of the oldest and most established cryptos known for its fast transaction confirmation and low fees. Including LTC in the portfolio allows for risk diversification and access to this stable asset.

- Bitcoin Cash (BCH) - 5%

Bitcoin Cash was created as a result of a Bitcoin hard fork and offers higher block capacity and lower fees. Including BCH in the portfolio provides access to an alternative version of Bitcoin.

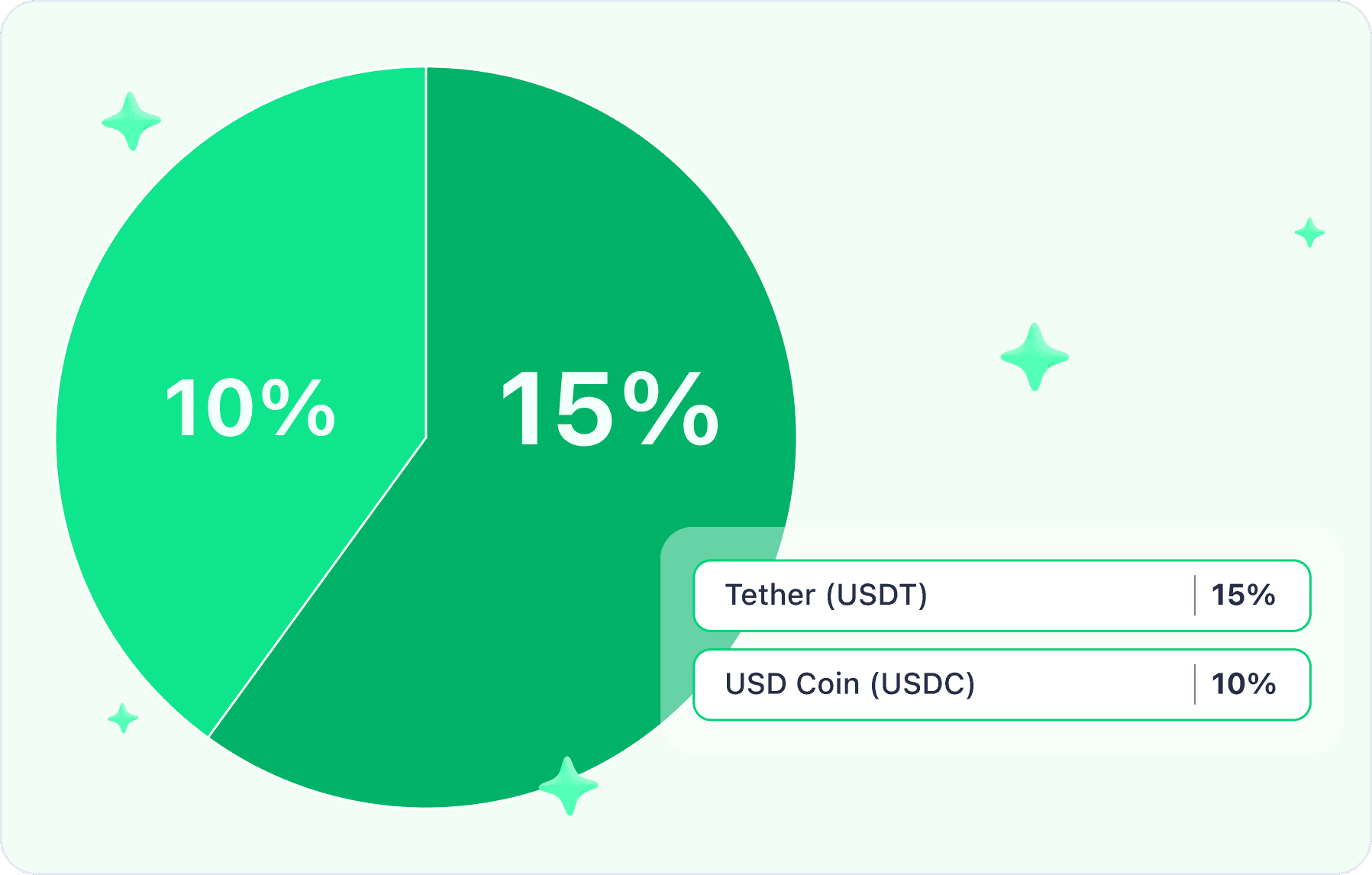

Stability Segment of Crypto Portfolio (30%)

The stability segment aims to provide stability and balance to the portfolio, particularly during periods of high volatility.

- Tether (USDT) - 15%

Tether is a stablecoin pegged to the value of the US dollar, providing stability in the portfolio amidst the volatility of cryptos. USDT is widely used in crypto trading and can be easily converted into other assets. USDT is the third cryptocurrency in terms of market capitalization (after Bitcoin and Ethereum respectively), and is the largest stablecoin.

- USD Coin (USDC) - 15%

USD Coin is also a stablecoin pegged to the US dollar, ensuring stability and liquidity in the portfolio. USDC is backed 1:1 by U.S. dollar. It is a tokenized U.S. dollar, with the value of one USDC coin being as close to the value of one U.S. dollar as possible. USDC has broad application in the DeFi sector and can be easily converted into other assets, too.

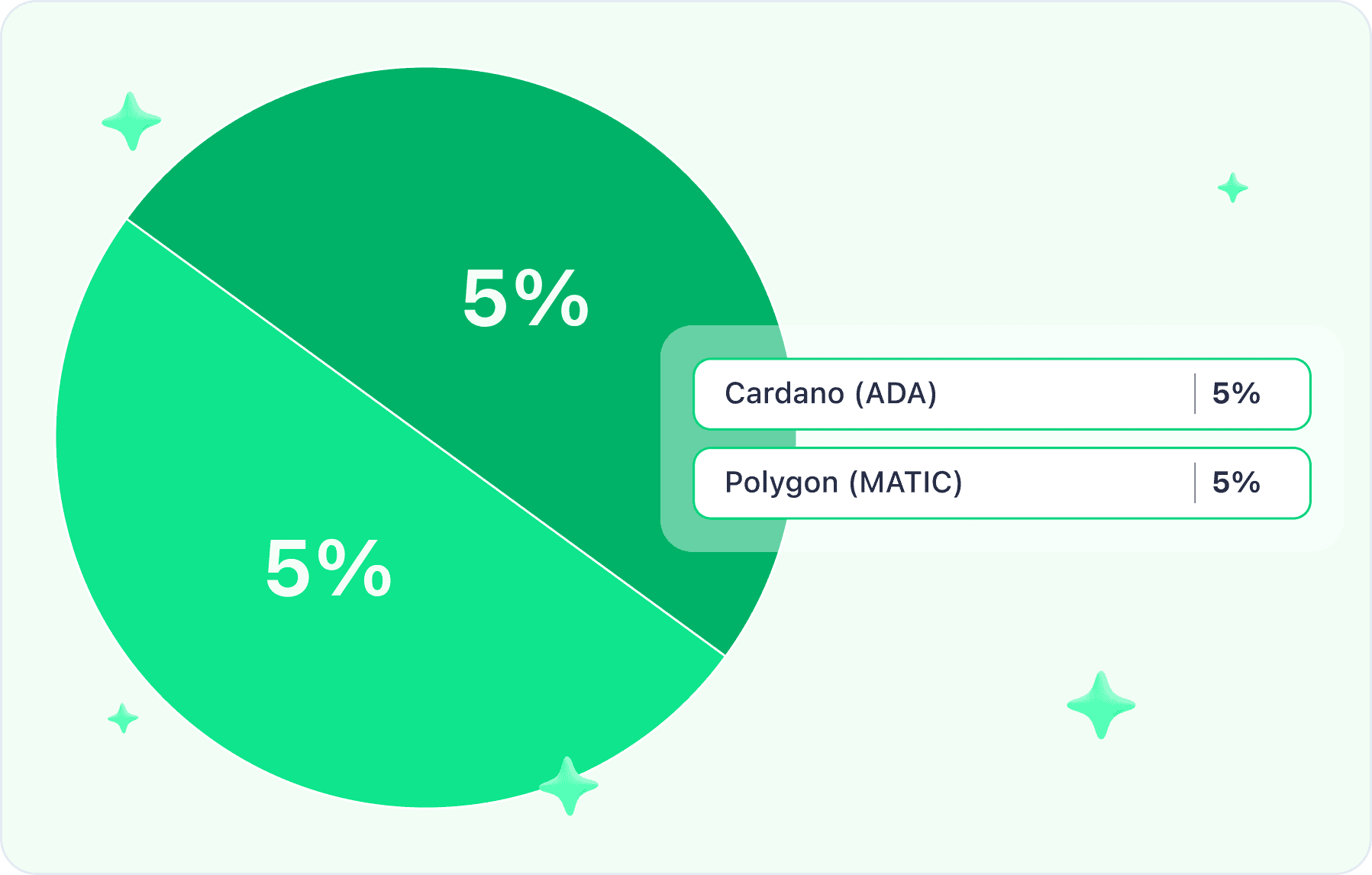

Potential Growth Segment (10%)

The potential growth segment focuses on cryptos with potential for growth, taking into consideration their unique features and anticipated developments.

- Cardano (ADA) - 5%

Cardano represents a blockchain platform with a unique architecture and active development. ADA, the native currency of Cardano, has growth potential, especially considering planned upgrades and the implementation of new features.

Cardano is a research-oriented platform aiming to provide secure smart contracts and a stable ecosystem. It is a blockchain platform that prioritizes security and scalability, with a focus on simplicity in developing dApps.

- Polygon (MATIC) - 5%

Polygon offers a scalable multi-chain platform for creating and interacting with dApp. MATIC has growth potential, particularly in the context of increased interest in blockchain scalability solutions.

Polygon provides compatability with Ethereum. It also uses PoS consensus mechanism, and its token (MATIC) is compatible with Ethereum.

Thus, the basic segment provides stability and exposure to the leading cryptocurrencies, while the stability segment safeguards against volatility. The potential growth segment offers opportunities for capitalizing on emerging trends and developments in the crypto market.

Summary

Crypto market is a subject to risks, volatility, and uncertainty. In order to properly navigate the investment world of cryptocurrency investors might consider having a diversified crypto portfolio.

In this article, we provide such a portfolio for the investors. It includes several types of stablecoins, and coins showing great potential.

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.