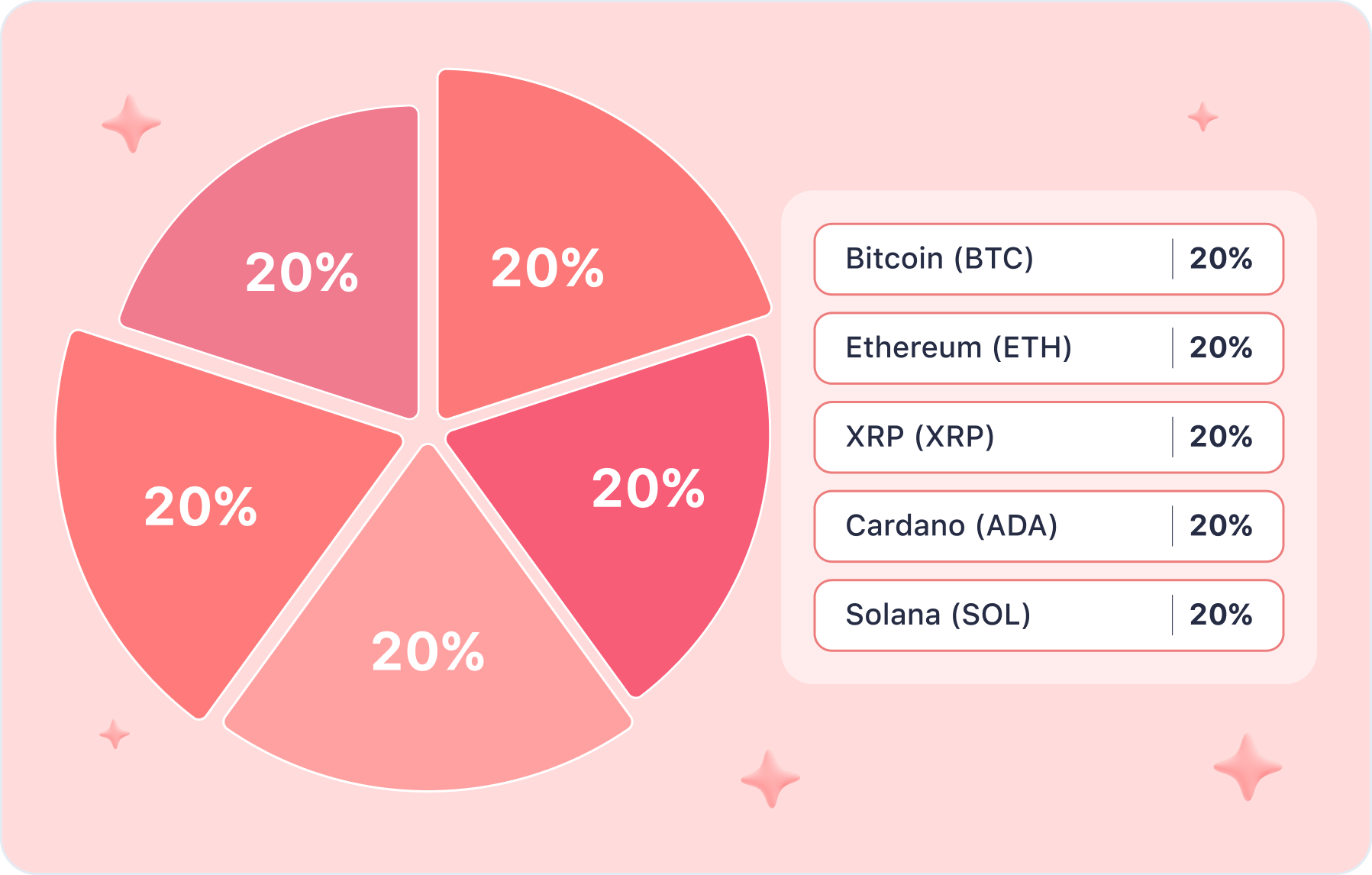

Top-5 Crypto Indexes Portfolio

Key Insights

- A diversified portfolio of top cryptos captures the full innovation scope of the ecosystem beyond the major currencies.

- Including smart contract platforms like Ethereum in the portfolio provides exposure to the exponential growth potential in DeFi.

- Optimal allocations balance upside from higher-risk assets like SOL with the stability of blue-chip cryptos like BTC.

What Is Crypto Portfolio

A crypto portfolio is a strategic mix of digital assets utilized for investment purposes. In order to invest in a balanced manner, it is essential to comprehend the concept of a crypto portfolio strategy, which enables the balancing of risk and reward across a multitude of blockchain projects. All of these key points are necessary to make informed financial decisions.

In this article, readers will learn how they can diversify their crypto portfolios with leading digital currencies that span the entire cryptosphere.

Bitcoin (BTC)

Bitcoin (BTC) — 20%

Bitcoin is the inaugural and most significant cryptocurrency. Bitcoin serves as a global standard of digital value and a symbol of resilience in the investment world.

Bitcoin represents the pinnacle of the token portfolio, serving as an unshakable foundation that provides stability and reliability to the investment journey of market participants.

As the pioneering decentralized digital currency, Bitcoin provides a robust store of value and liquidity benchmark. Its longevity and proven security instill institutional confidence, and the trading volume of BTC USDT indicates high interest from individual users. Additionally, those with limited experience in cryptocurrency may wish to consider diversifying their Bitcoin portfolio in order to mitigate risk.

Ethereum

Ethereum (ETH) — 20%

Ethereum is a platform for the creation of smart contracts and decentralized applications (DApps) that can be utilized as a means of portfolio diversification. The transition to Proof of Stake (PoS) in Ethereum 2.0 is expected to enhance efficiency and scalability, which could facilitate the growth of the DeFi ecosystem.

This cryptocurrency is also included in the portfolios of a diverse range of investors, with the objective of achieving stable, albeit not explosive, growth.

Ethereum plays a pivotal role in the advancement of DeFi and innovative technologies.

XRP

XRP (XRP) — 20%

XRP is a digital asset designed to facilitate rapid and cost-effective global payments. The utilization of XRP in this context serves to enhance the diversification of the portfolio. It has the potential to transform the landscape of international financial transactions.

The Ripple company offers real-time gross settlement, currency exchange, and remittance through its permissioned but public network, with the objective of complementing legacy systems. The XRP coin serves as an efficient bridge currency for cross-border payments and settlements between different fiat currencies and cryptocurrencies.

Cardano

Cardano (ADA) — 20%

Cardano is a blockchain platform that prioritizes security and scalability. The platform's objective is to provide the necessary tools for the creation of decentralized applications (DApps) and contracts, which makes it an excellent option for portfolio diversification.

Cardano represents a blockchain platform with a distinctive architectural design and an active development process. The native currency of Cardano, ADA, has the potential for growth, particularly in light of planned upgrades and the implementation of new features.

Solana

Solana (SOL) — 20%

Solana is a high-performance blockchain platform that provides rapid and scalable solutions for decentralized applications (DApps) and financial products. The cryptocurrency's leading speed and low transaction costs have the potential to open up new use cases for blockchain and accelerate the growth of innovative DeFi products.

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

Summary

The presented portfolio encompasses five of the most influential digital currencies, showcasing the entirety of the crypto ecosystem. It offers investors the chance to effectively participate in market growth and diversify their investment portfolios.

Taking this portfolio diversification option under consideration can allow for a diversification of investment portfolio and provide means to making informed investment decisions.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.