BTC Analysis September

Key Insights

- The decline in new Bitcoin addresses hints at waning interest from new users, but the stability of active addresses suggests existing BTC holders are still engaged with the network.

- A significant decrease in Bitcoin transactions during September underscores reduced network activity, possibly due to decreased user interest amidst a prolonged consolidation phase.

- The steady rise in Bitcoin's hash rate and its position near the undervaluation zone on the MVRV Z-Score suggest miners' confidence and potential attractiveness to investors seeking undervalued assets for future growth.

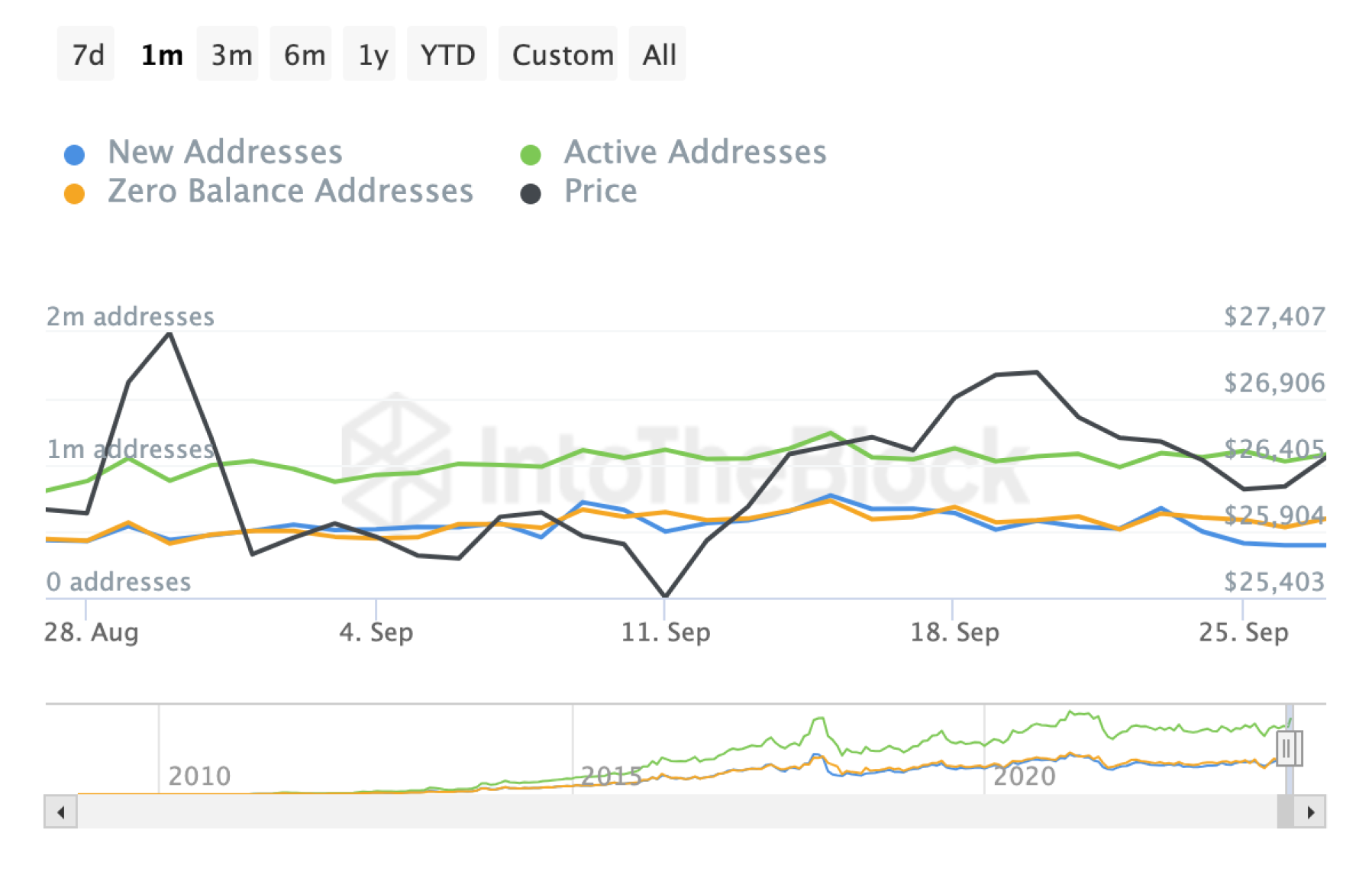

Daily Active Addresses

There has been a decline in the number of newly created addresses during September, and this has increased to over 32% in the last seven days. At the same time, the number of active addresses and zero-balance addresses remain stable, with a slight increase of less than two per cent over the last week.

The decrease in the number of new addresses in September may indicate a decline in new users' interest in BTC

This could be due to the overall low activity in the market amid the prolonged consolidation of the BTC value.

The fact that the decrease in the number of newly created addresses increased to more than 32% over the last week may indicate that this trend is intensifying

This could be a warning of a possible further decline in interest in BTC.

Despite the decline in new user interest, the number of active addresses remains stable

This may indicate that current BTC holders are still actively interacting with the network and not leaving it.

An increase in zero-balance addresses by less than two per cent may indicate some increase in new users

Or that current participants have resumed active use of their addresses.

In general, a decrease in the number of new addresses requires attention, as it may indicate a change in interest in BTC. A stable number of active addresses indicates that current users remain active, while a slight increase in zero-balance addresses may indicate some activation in the market.

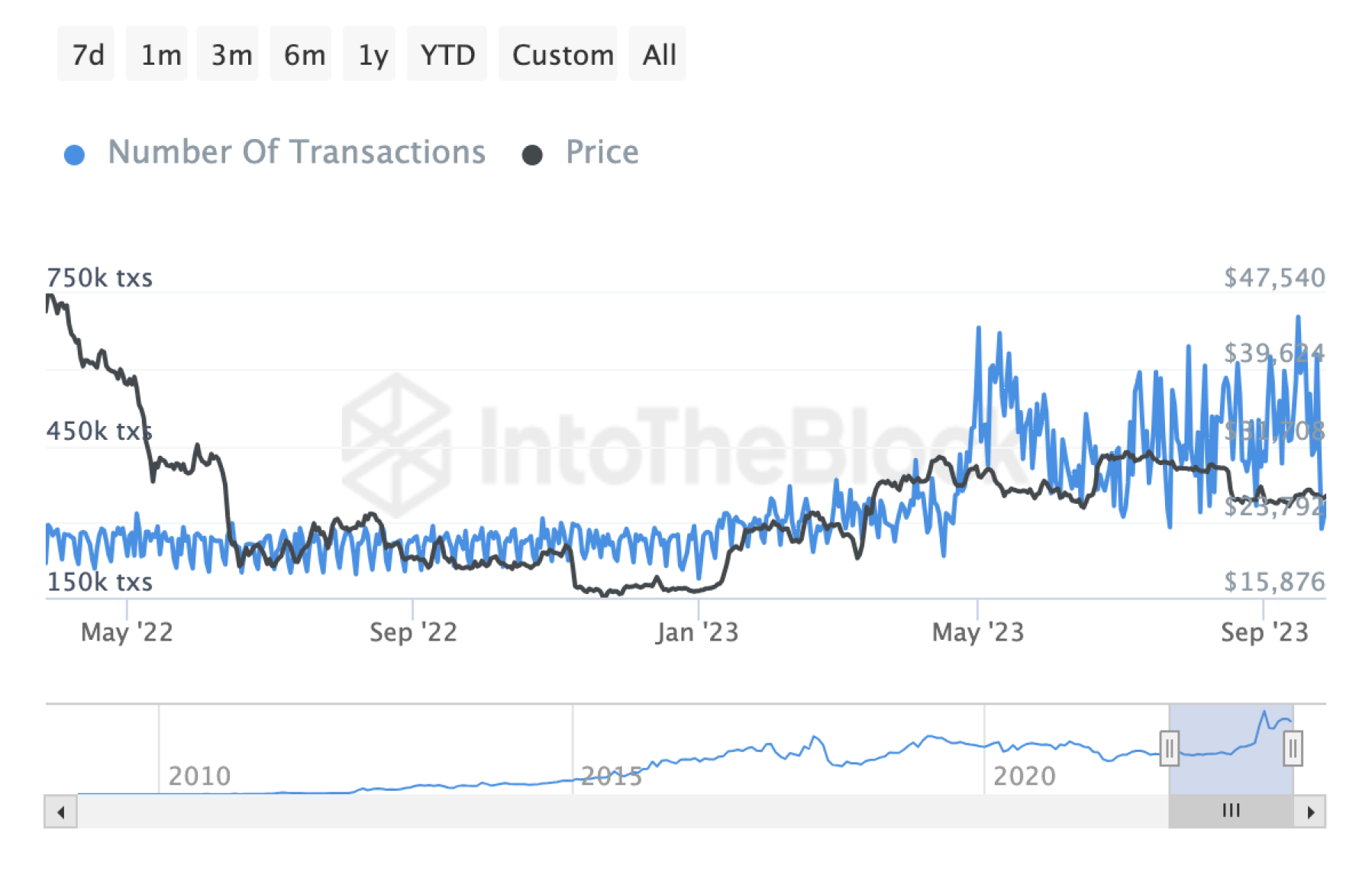

Number of Transactions

Also in September, there was a decrease in the number of transactions from 703.69K to 285.75K txs.

The decrease in the number of transactions in September, from 703.69K to 285.75K transactions (txs), confirms the trend of reduced activity in the Bitcoin network during this period.

The decrease in the number of transactions is due to a decrease in users' interest in making financial transactions with BTC.

This may be due to a prolonged consolidation after a sharp decline in the value of the asset. Investors can expect news, events or factors that may affect the direction of Bitcoin price in the future.

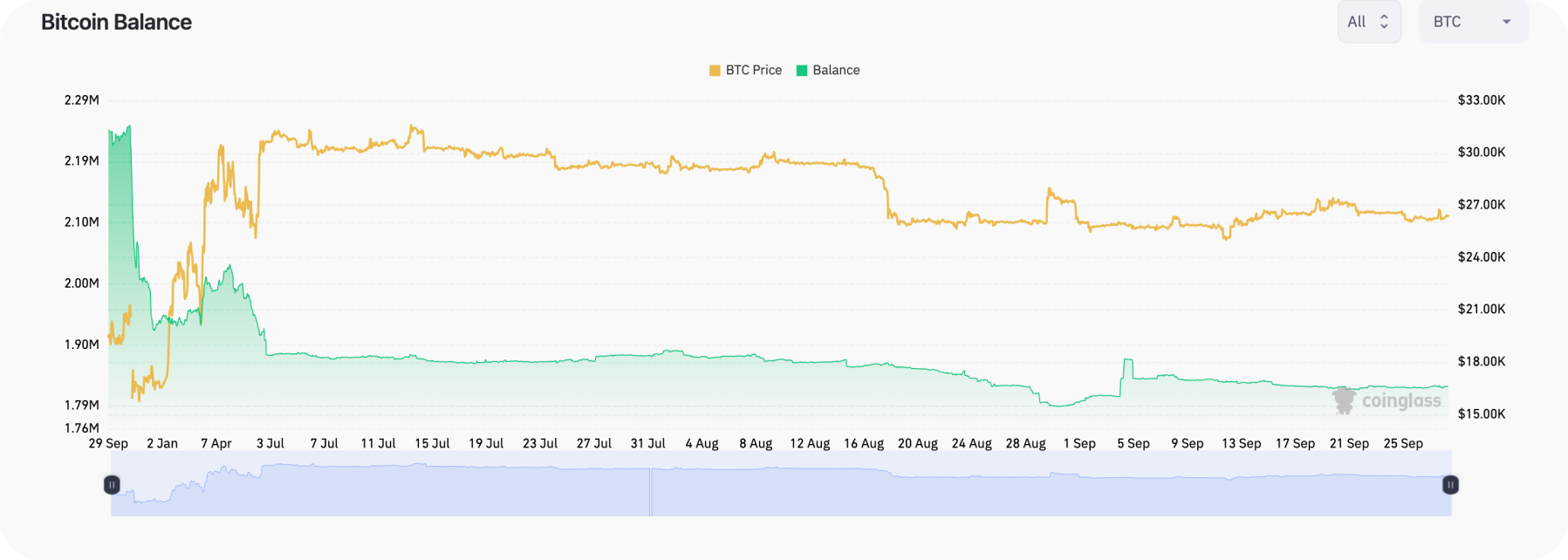

Balances on Exchanges

The amount of BTC on centralized exchanges continues to decrease gradually.

Investors may reduce their balance on exchanges for strategic reasons, such as engaging in long-term investing (HODLing) or waiting for certain market conditions that they consider more suitable for selling an asset.

Also, a reduction in the balance on exchanges may also be an indicator of reduced trading activity.

Hash Rate

The Bitcoin hashrate continues to grow steadily with no hint of slowdown despite the long consolidation of the price after a drop to the $26,000 area.

The hashrate growth may indicate that miners are still interested in mining BTC, even at the current price. This can be interpreted as a positive signal that indicates miners' faith in future price growth.

An increase in hash rate also means an increase in the processing power of the Bitcoin network, which makes the network more secure against potential attacks. This can be an important aspect for users and investors interested in network security.

Overall, the rise in bitcoin's hashrate during a long price consolidation could represent an interesting dynamic in the market. It may indicate the persistence of miners and their confidence in the future of BTC. Users can get BTC on SimpleSwap.

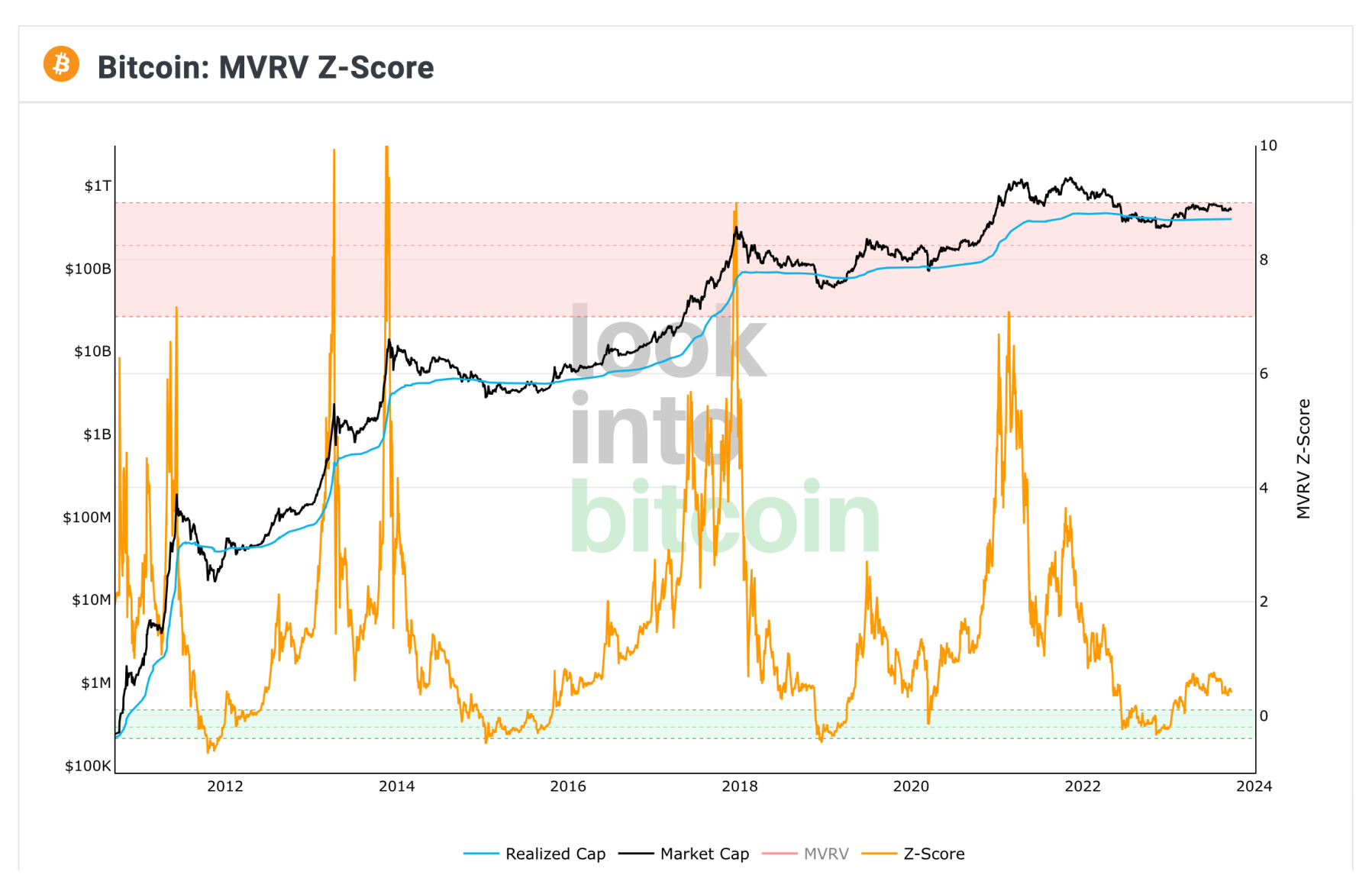

MVRV Z-Score

Keeping the realized value of BTC near the green zone, which has historically been considered a good time to buy, may indicate that the asset is considered undervalued.

The undervaluation of the asset may attract investors who are looking to buy at a lower price with the hope of future growth.

Summary

Data analysis on Bitcoin reveals several interesting observations about the current state of the market and the crypto's prospects:

- Number of Active Addresses

The number of new BTC addresses dropped in September indicating declining interest from new users amid low market activity, although active addresses remained stable.

- Number of Transactions

BTC transactions decreased significantly from 703K to 285K in September, confirming lowered network usage and transactional interest during the price consolidation.

- Balances on Exchanges

BTC balances on exchanges kept decreasing potentially due to investors holding strategically or waiting for favorable conditions to sell, also signaling reduced trading volumes.

- Bitcoin: Hash Rate

Despite sideways BTC prices, the Bitcoin hash rate grew steadily in September suggesting miners remain confident mining BTC even at current prices.

- MVRV Z-Score

BTC's realized value stayed near the buy zone implying possible undervaluation that could attract investors expecting future growth.

Overall, the data points to the relative stability of the Bitcoin market after temporary fluctuations and supports long-term confidence in the prospects of this cryptocurrency.

The decline in new addresses needs attention, but the stability of active addresses and other factors indicate that current users remain active. At the same time, the growth of BTC hashrate and the undervaluation of the asset add positive aspects for investors.

Users can get BTC for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.