BSC Fundamental Analysis

Key Insights

- A look into Binance Smart Chain’s history and vision as a reliable platform for creating and interacting with dApps

- Primary competitors of these popular and stable platform are Ethereum, Polkadot, Solana, Avalanche, and TRON

- Despite its upsides, for instance high market cap, BSC still poses some questions and challenges, namely risks of centralization and need for scalability support

Binance Smart Chain (BSC) is a blockchain platform created by the Binance team, one of the world's largest cryptocurrency exchanges.

Introduced in March 2020, BSC serves as a parallel chain to the Binance Chain, focusing on the development and deployment of decentralized applications (DApps) and smart contracts.

What Is BSC

BSC Project History and Founders

Binance Smart Chain was developed and launched by the Binance team, led by Changpeng Zhao, widely known as CZ. Building upon the success of Binance Chain, which was launched in 2019, BSC emerged in response to the growing interest in decentralized finance (DeFi) applications.

BSC Project’s Goals and Objectives

BSC aims to provide developers and users with a user-friendly and efficient platform for creating and interacting with DApps. Its primary focus is on achieving high throughput and low transaction fees, making it an attractive choice for users and developers, particularly within the DeFi space.

Mission and Vision

The mission of Binance Smart Chain is to foster accessibility to a decentralized financial ecosystem that is easily accessible and widely adopted by millions of users worldwide.

The project envisions creating an ecosystem where individuals can freely exchange assets and engage in financial services.

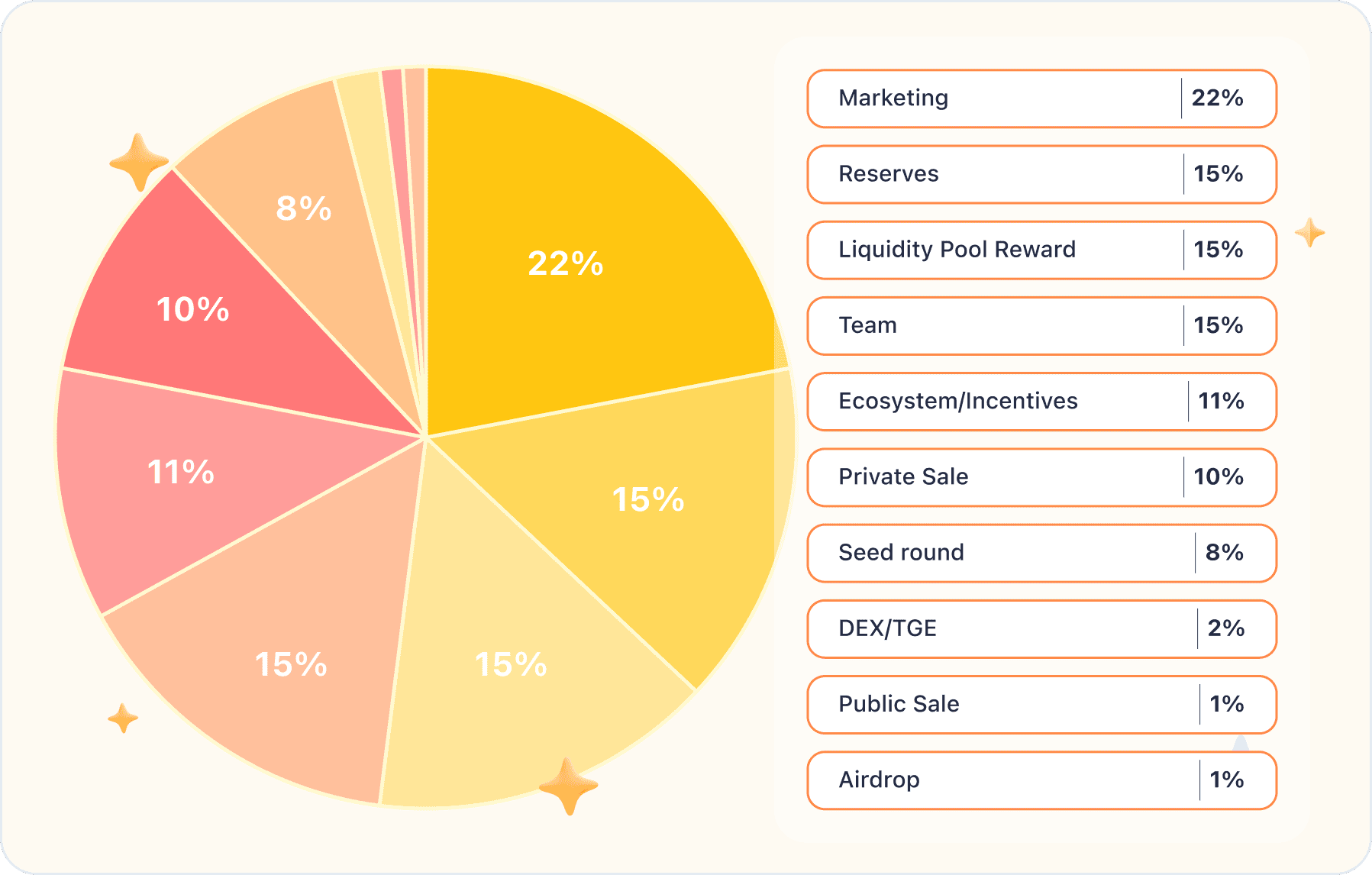

Initial Token Distribution and Market Cap

Binance Smart Chain's native token is called Binance Coin (BNB). Initially launched as an ERC-20 token on the Ethereum blockchain in 2017, BNB crypto token was later migrated to the Binance Chain and BSC. Currently, BNB boasts a market capitalization of $37,840,732,403.

BSC's compatibility extends beyond its native BNB token. It also supports other tokens initially issued on various blockchains, including Ethereum. This cross-chain compatibility enables users to seamlessly transfer their assets across different blockchains.

Users can get BNB on SimpleSwap.

The overall project history, goals, objectives, mission, and vision have contributed to the widespread popularity and active utilization of Binance Smart Chain as a platform for developing and interacting with DApps within the decentralized finance ecosystem.

Competitive Environment Analysis

Assessing project competitors, evaluating advantages and disadvantages compared to rival projects.

Among the prominent competitors of Binance Smart Chain are Ethereum, Polkadot, Solana, Avalanche, and TRON.

Ethereum

Ethereum, as a leading blockchain platform, offers extensive smart contract capabilities and dApps. It boasts a wide-ranging developer ecosystem and a decentralized network. However, Ethereum has encountered scalability issues resulting in high fees and transaction delays.

Polkadot

Polkadot is a multi-chain platform that aims to unify diverse blockchains into a single ecosystem. It provides high scalability and facilitates interoperability between different blockchains. Polkadot's developer ecosystem, though, is currently smaller compared to BSC, which may pose challenges in attracting users.

Solana

Solana stands out as a high-performance blockchain platform with fast transaction processing and low fees. It enjoys a broad developer ecosystem and actively garners attention within the decentralized finance (DeFi) realm. Nonetheless, BSC also exhibits high performance and appealing features for developers.

Avalanche

Avalanche is a blockchain platform that combines the strengths of public and private blockchains. It excels in high performance, scalability, and low fees. The issue is, the Avalanche's developer ecosystem is not as developed as BSC's at present.

TRON

TRON is another blockchain platform that offers capabilities for creating dApps and smart contracts. With high performance and a wide developer ecosystem, TRON presents itself as a strong competitor, but TRON doesn't possess the same degree of decentralization as BSC and may encounter security concerns.

These prominent competitors provide both strengths and weaknesses in relation to Binance Smart Chain, contributing to a dynamic and evolving landscape within the blockchain industry.

Analysis of the competitive landscape reveals the following insights about BSC platform:

BSC analysis shows its advantages, such as high performance, low fees, and a wide developer ecosystem. These factors make BSC attractive to users and foster the development of diverse dApps.

Ethereum stands as a primary competitor to BSC, with its extensive developer ecosystem and decentralized network. However, Ethereum's scalability issues, including high fees and transaction delays, may incentivize users and developers to explore alternative platforms, including BSC.

Polkadot, Solana, Avalanche, and TRON also compete with BSC, offering unique advantages such as multi-chain architecture, high performance, or the integration of public and private blockchains. Nevertheless, some of these platforms, including Polkadot and Avalanche, have yet to achieve the same level of developer ecosystem as BSC.

Drawbacks of BSC include relative centralization and security risks when integrating with other blockchains. These factors may raise concerns among users and developers, especially those who prioritize decentralization and security.

Overall, Binance Smart Chain continues to garner attention and remain competitive as a blockchain platform due to its performance advantages, low fees, and a variety of decentralized applications. BSC's challenges are improving decentralization and ensuring security, which may require further development and innovation.

BSC Technology Assessment

In this section, we will examine the level of technical maturity of the BSC platform by analyzing technological solutions and innovations, the development process, and future plans.

Technical Maturity

Binance Smart Chain was launched in 2020 and quickly gained popularity due to its compatibility with the Ethereum Virtual Machine (EVM) and low transaction fees. BSC enables the creation of smart contracts and dApps similar to Ethereum.

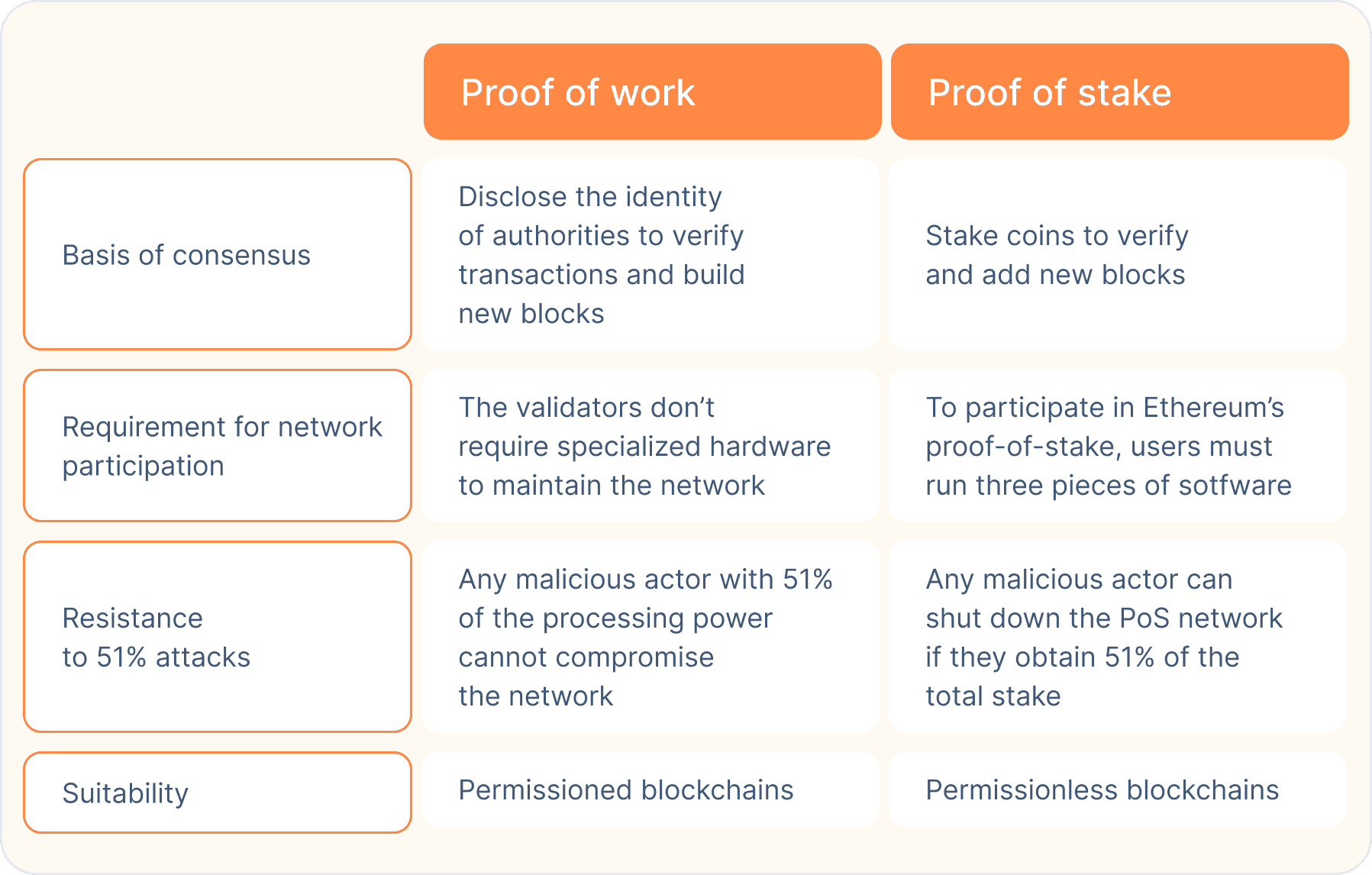

From a technical standpoint, BSC utilizes its own consensus algorithm called Proof-of-Staked-Authority (PoSA), which combines the advantages of Proof-of-Stake (PoS) and Proof-of-Authority (PoA). This allows for high network performance but also requires greater centralization, as consensus nodes are selected by a centralized group. Please see the pros and cons of both algorythms below.

BSC also integrates with the main Binance network, enabling users to easily move between the two networks and perform asset exchanges.

Technological Solutions and Innovations

BSC provides a similar development experience to Ethereum, utilizing the Solidity programming language and supporting existing tools and libraries for smart contract development. Unlike Ethereum, BSC offers lower transaction fees and faster transaction processing speeds.

BSC has also implemented a range of innovations, such as the support for MetaMask for convenient interaction with dApps and integration with other blockchain platforms to expand the network's functionality.

Development Process and Future Plans

Binance Smart Chain is actively evolving and expanding its ecosystem. The Binance team and developer community are working on improving the network's performance, security, and scalability. Future plans include enhancing consensus algorithms to increase network decentralization and introducing new features and innovations to attract more developers and users.

BSC also aims to foster closer collaboration with other blockchain projects and develop interchain solutions to provide broader opportunities for users and apps.

By and large, Binance Smart Chain possesses significant potential and offers an alternative to Ethereum. It is still important to note that the level of decentralization in BSC may be lower compared to Ethereum due to its centralized consensus algorithm.

BSC Project’s Team

The analysis of the project team requires evaluating the qualifications and experience of the founders and team members, assessing the project management quality, and evaluating the effectiveness of teamwork.

The founders of Binance Smart Chain, including Changpeng Zhao, have extensive experience in blockchain technology and the crypto industry. Changpeng Zhao, the founder and CEO of Binance, is an influential figure in the crypto community and is known for his previous successes in developing and launching blockchain projects.

The BSC development team also possesses significant experience and expertise in blockchain technology and smart contracts. They are working on improving the BSC crypto protocol, ensuring its security and scalability, and developing tools and solutions that contribute to the growth of the BSC ecosystem.

The project management of Binance Smart Chain is carried out professionally and efficiently. The team adopts a structured approach to project development and management, ensuring transparency and openness in their relationship with the community. Binance actively supports and promotes the development of the BSC ecosystem by providing tools and resources for developers and users.

The teamwork within the BSC project is effective. Developers and community participants actively interact, exchange ideas, and collaborate to drive the project's development and expand its ecosystem. The welcoming nature of the community allow active participants to contribute to the improvement of BSC and the creation of new applications on its platform.

Overall, the Binance Smart Chain project team possesses high qualifications and experience in blockchain technology, effectively manages the project, and contributes to the development of the BSC ecosystem.

BSC Economic Model Analysis

Token Distribution Mechanisms

In BSC, token distribution mechanisms have their own characteristics. The process of distributing new tokens is linked to block validation and network maintenance.

Validators can stake BNB tokens to gain the right to validate blocks and receive rewards. Unlike Ethereum, BSC doesn't have a fixed requirement for the amount of tokens staked to become a validator. However, the more tokens staked, the higher the probability of obtaining the right to validate a block and receive a reward.

BSC also has mechanisms for token distribution to support network development and project funding. Binance Smart Chain actively develops the ecosystem by providing financial support through various initiatives.

For example, Binance Launchpad is a platform for launching new projects where users can participate in token sales and receive new tokens. Additionally, Binance Smart Chain supports various funds and programs aimed at funding development and stimulating innovation in the BSC ecosystem.

Economic Incentive Models and Inflation

BSC employs an economic incentive model and inflation that reward participants for their involvement in the network and maintaining its stability.

The economic incentive model is based on participation in block validation and receiving rewards for it. Validators, as well as participants who delegate their tokens for staking, have the opportunity to receive rewards in the form of BSC tokens. The rewards depend on the amount of tokens participating in staking or delegation and the duration of participation. This creates an incentive for participating in validation and maintaining the security of the BSC crypto network.

Regarding inflation, BSC also regulates a dynamic inflation mechanism based on the network's state. If the BSC network is actively used and fully utilized, inflation may be increased to encourage greater participation and network stability. If the network is less congested, inflation may be decreased to control excessive token supply. The goal of these mechanisms is to ensure a sustainable balance between the supply and demand of BSC tokens.

In addition to the economic incentive model and inflation, BSC employs a token burning mechanism. The BSC token burning mechanism allows for reducing the overall token supply, which can lead to an increase in their market value. Specifically, transaction fees and smart contract execution fees can be directed towards token burning. This process reduces the total number of tokens in circulation and can contribute to a deflationary effect.

The BSC token burning mechanism is one of the tools to control excessive token supply and maintain price stability. It is important to note that the BSC project team can adjust and adapt these mechanisms over time to meet the requirements and needs of the BSC ecosystem and its participants.

BSC Governance

The governance and decision-making process is based on decentralization and active community participation. Let's explore the key aspects of this process.

BSC has its own proposal and improvement system called Binance Improvement Proposal (BIP). Any member of the BSC community can propose a BIP to make changes to the protocol or suggest new functionalities. These proposals are subject to discussion and consideration by the BSC community.

Binance plays an important role in governance and decision-making. They provide support and coordination to projects related to BSC, and their opinion is taken into account when making strategic decisions. Decisions made by Binance are also subject to community discussion and evaluation.

The BSC community actively participates in discussions and decision-making through various forums such as the Binance Community Forum and social networks. Here, participants can express their opinions, ask questions, and discuss proposals related to the development and improvement of the BSC ecosystem.

An important aspect of governance and decision-making in BSC is the role of validators. Validators have the ability to vote and express their preferences on specific issues or protocol changes. Their votes carry weight and influence the final decisions.

BSC strives for decentralized governance and decision-making, where the opinions and contributions of the community hold significant value. Various participants, including Binance organization, developers, validators, and users, actively engage in the decision-making process to ensure the effective development and improvement of the BSC ecosystem.

Binance Smart Chain Community Analysis

The analysis of the BSC community shows that it is also quite active and engaged. The BSC community includes developers, users, investors, and other stakeholders.

Key characteristics

Growing number of developers and users actively utilizing BSC for developing and launching DApps, financial products, and other innovations.

Active communication and exchange of opinions on various forums, social media platforms, and channels such as Reddit, Telegram, Discord, and others. This allows community members to discuss and share their ideas, issues, and proposals.

Support from Binance is an important factor in the development and support of the community. Binance provides funding, resources, and an ecosystem for project development on BSC.

Challenges and issues

Centralization risk

As Binance crypto exchange plays a significant role in the management of BSC, questions arise regarding the degree of decentralization and network governance.

Need for scalability support

With the increasing number of users and transactions on BSC, it is necessary to develop and maintain network scalability to ensure its efficient operation.

Security risks

With the growing popularity of BSC, there is a threat of new types of fraud, attacks, and vulnerabilities that require continuous attention to network security.

The BSC community aims at overcoming these challenges and attract more developers, users, and investors. The development of new tools, educational resources, and events, as well as active community participation, enable BSC to continue its growth and appeal to various participants in the blockchain community.

Project's Financial Stability

The evaluation of the the financial indicators of the project, including profitability, liquidity, and market cap of the BSC project is also an important factor in assessing its potential and stability. While BSC is not a corporation, several financial indicators can be considered to evaluate its financial stability.

Liquidity and Market Cap

Liquidity

BNB liquidity can be assessed through trading volumes on crypto exchanges. Higher trading volume indicates sufficient market demand and supply, enhancing BNB liquidity.

Market Cap

Market cap reflects the current value of all existing BNB tokens multiplied by the current token price in the market. A higher market cap implies a more financially stable project. At the time of writing, the market cap of BNB is $37,815,359,852.

Profitability for Ecosystem Participants

Ecosystem participants such as validators and token holders can experience profitability within the BSC ecosystem. High profitability indicates attractiveness for participants and contributes to the financial stability of BSC.

Popularity within the Crypto Industry

The level of activity and popularity of BSC within the crypto industry is a crucial factor. The higher the number of active users, developers, and applications on BSC, the more stable the project can be considered. High activity levels indicate growth potential and attractiveness for various participants.

Financial Support and Resources from Binance

Being one of the largest crypto exchanges, Binance's involvement contributes to the financial stability of BSC greatly and influences its development.

To sum up, the financial stability of the Binance Smart Chain project is evaluated as high due to its significant market cap, active participation of stakeholders, and support from Binance.

Summary

Drawing conclusions and making a decision on whether to invest in the project and determining an acceptable level of investment is one of the main goals of this analysis.

BSC has several advantages that should be considered. First off, the platform exhibits high performance and low transaction fees, making it attractive to users with limited resources.

Secondly, BSC receives support and financial backing from Binance, a major crypto exchange, which contributes to its financial stability.

Last but not least, BSC has an active community of developers and users who actively work on creating new apps and products on the platform.

However, it is also important to consider certain risks and challenges. Competition in the blockchain space is significant, and the success of BSC depends on its ability to attract and retain developers and users. Besides, regulatory factors in the crypto industry may pose risks and uncertainties.

Users can exchange all cryptocurrencies mentioned in this article for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.