ETH Fundamental Analysis

Key Insights

- An in-depth overview of Ethereum history, team, economic model, risks and more

- As for Ethereum technical maturity, its turn from Proof-of-Work to Proof-of-Stake protocols must be noted

- Based on its upsides and advantages compared to its competitors, Ethereum shows great development perspectives

What Is Ethereum

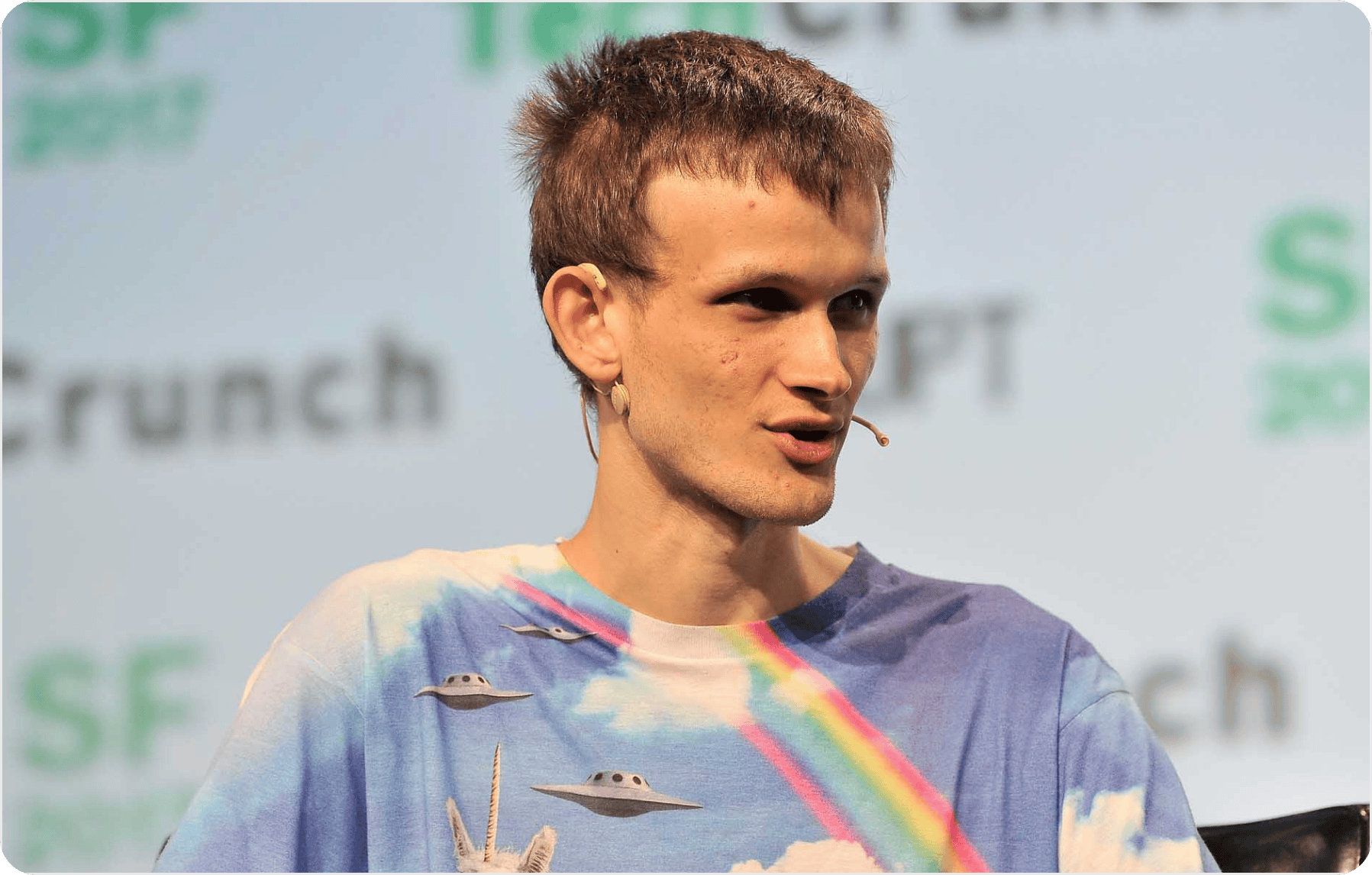

Ethereum is a decentralized platform for creating smart contracts and dApps. The project was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer who had previously worked on Bitcoin's development.

The history of the Ethereum project began in 2013 when Buterin presented his concept at the Bitcoin conference. He wanted to create a platform with smart contracts - programs that automatically execute when certain conditions are met.

In 2014, Vitalik Buterin and his team launched a crowdfunding campaign, raising over 31,000 bitcoins (approximately $18 million at the time) to finance the project's development. Ethereum was launched in 2015.

Ethereum enables developers to create apps that are not dependent on centralized servers, providing users with greater freedom and privacy.

The initial distribution of Ethereum tokens took place in 2014 through a month-long crowdfunding campaign. A total of 60 million ETH tokens were sold, equivalent to 31,500 bitcoins at the time of the sale.

Currently, Ethereum market cap exceeds $220 billion, making it the second-largest crypto after Bitcoin. Users can get ETH on SimpleSwap.

Competitive Environment Analysis

EOS

- Capabilities for dApps and smart contracts

- High performance and scalability

- Less decentralized than Ethereum

- Limited developer ecosystem

NEO

- Capabilities for smart contracts and dApps

- Has its own cryptocurrency

- High performance (up to 10,000 transactions per second)

- Limited developer ecosystem

Cardano

- Capabilities for smart contracts and dApps

- Uses Haskell programming language for security

- High performance and scalability

- Less developed developer ecosystem compared to Ethereum

Tron

- Capabilities for smart contracts and dApps

- High speed and performance

- Wide ecosystem of developers

- Less decentralized than Ethereum, occasional security issues

Tezos

- Capabilities for smart contracts and dApps

- Ability to upgrade protocol without network splits

- Built-in mechanism for community self-governance and voting

- More limited developer ecosystem compared to Ethereum

Ethereum

- Broad ecosystem of developers

- High degree of decentralization

- User-friendly with multiple programming languages available

- Potential scalability issues compared to competitors

- Competitors may offer higher performance and integration capabilities

Ethereum blockchain project has strengths in its developer ecosystem, decentralization, and user-friendliness. However, it may face scalability challenges. Competitors may excel in performance and integration capabilities.

Ethereum Technology analysis

In this section, we will examine the project's level of technical maturity by analyzing technological solutions and innovations, the development process, and future plans.

Ethereum Technical Maturity

Ethereum project is currently one of the most popular and well-known blockchain projects worldwide. It uses its own programming language, Solidity, for writing smart contracts and has a wide ecosystem of developers and apps.

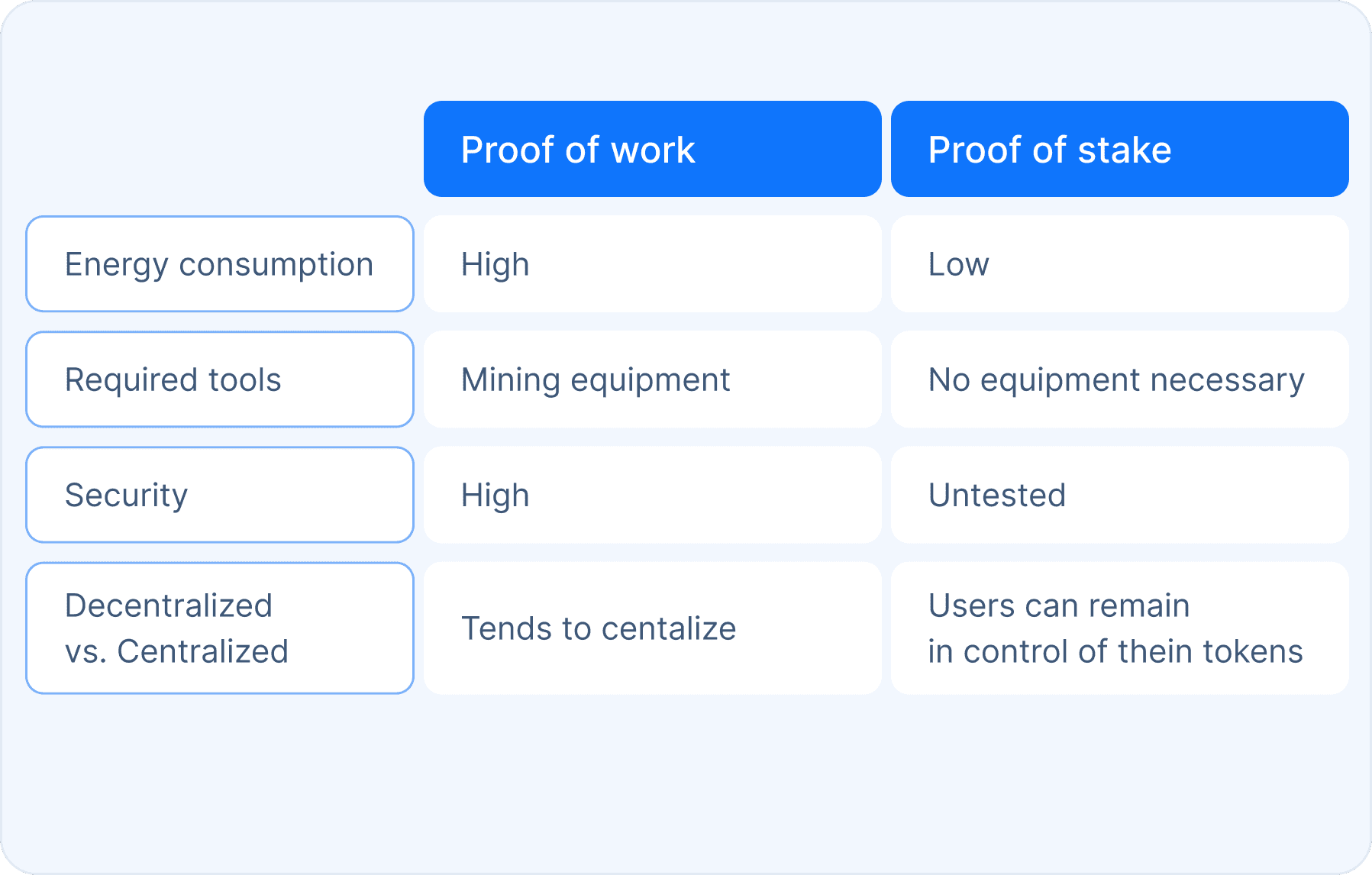

From a technical perspective, Ethereum initially used the Proof-of-Work (PoW) protocol and has transitioned to the Proof-of-Stake (PoS) protocol, ensuring high security, and decentralization. These protocols allow miners or network participants to receive rewards for maintaining the network and verifying transactions. It also employs a gas system to ensure fair transaction fee payment.

There is a risk, though, that Ethereum popularity could lead to centralization when major players begin to control a significant portion of the network.

Ethereum Development Process and Future Plans

Ethereum continually works on enhancing its technology and development processes. The Ethereum Foundation team and the developer community actively collaborate on updates that include security improvements, scalability enhancements, and network performance.

One major Ethereum upgrade involved, as stated above, transitioning from PoW to PoS and increasing transaction processing speed to 100,000 transactions per second.

Additionally, Ethereum is actively addressing scalability challenges through the implementation of solutions such as sharding and Plasma. These solutions will distribute the workload across multiple blockchains and, as stated, increase transaction processing speed.

Ethereum also supports the development of its ecosystem by providing tools and resources for developers and startups interested in building applications on Ethereum.

Ethereum demonstrates a high level of technical maturity and continues to improve and evolve. It has its unique advantages and disadvantages compared to competitors but remains one of the most popular and influential blockchain projects globally.

Ethereum Project Team Analysis

Assessing the Ethereum project team involves evaluating the qualifications and experience of founders and the project team, the quality of project management, and team efficiency.

The Ethereum founders, including Vitalik Buterin, Gavin Wood, Joseph Lubin, and others, possess high qualificationsand experience in blockchain technology, cryptography, and programming. They work on improving the Ethereum protocol and creating new tools and applications based on Ethereum.

They have a good reputation in the community and are considered experts in their field.

The Ethereum project management team has a solid structure and transparent development processes, ensuring a high-quality product and meeting the community's needs.

The team's efficiency in working together is also high. Ethereum developers and community members actively collaborate and exchange ideas, contributing to the project's development and strengthening the Ethereum ecosystem as a whole.

Thus, the Ethereum project team exhibits a high level of qualification and experience, effectively manages the project, and ensures high team efficiency.

Ethereum Economic Model Analysis

Evaluation of ETH Token Distribution Mechanisms

Ethereum PoS system utilizes an economic incentive model that rewards participants for participating in block validation and network maintenance. Participants, known as validators, stake a minimum of 32 ETH to have the right to validate blocks.

Validators receive rewards for validating blocks, which depend on the number of tokens staked. Validators can also earn rewards for referring other participants to become validators, creating additional incentives to attract new validators.

The more tokens a validator stakes, the higher their chances of receiving rewards. If a validator violates the rules, their stake can be confiscated.

Additionally, Ethereum employs mechanisms for token distribution to support network development and finance various projects. For instance, the Ethereum Foundation finances the development of Ethereum, and the Ethereum Community Fund supports application development on the Ethereum platform.

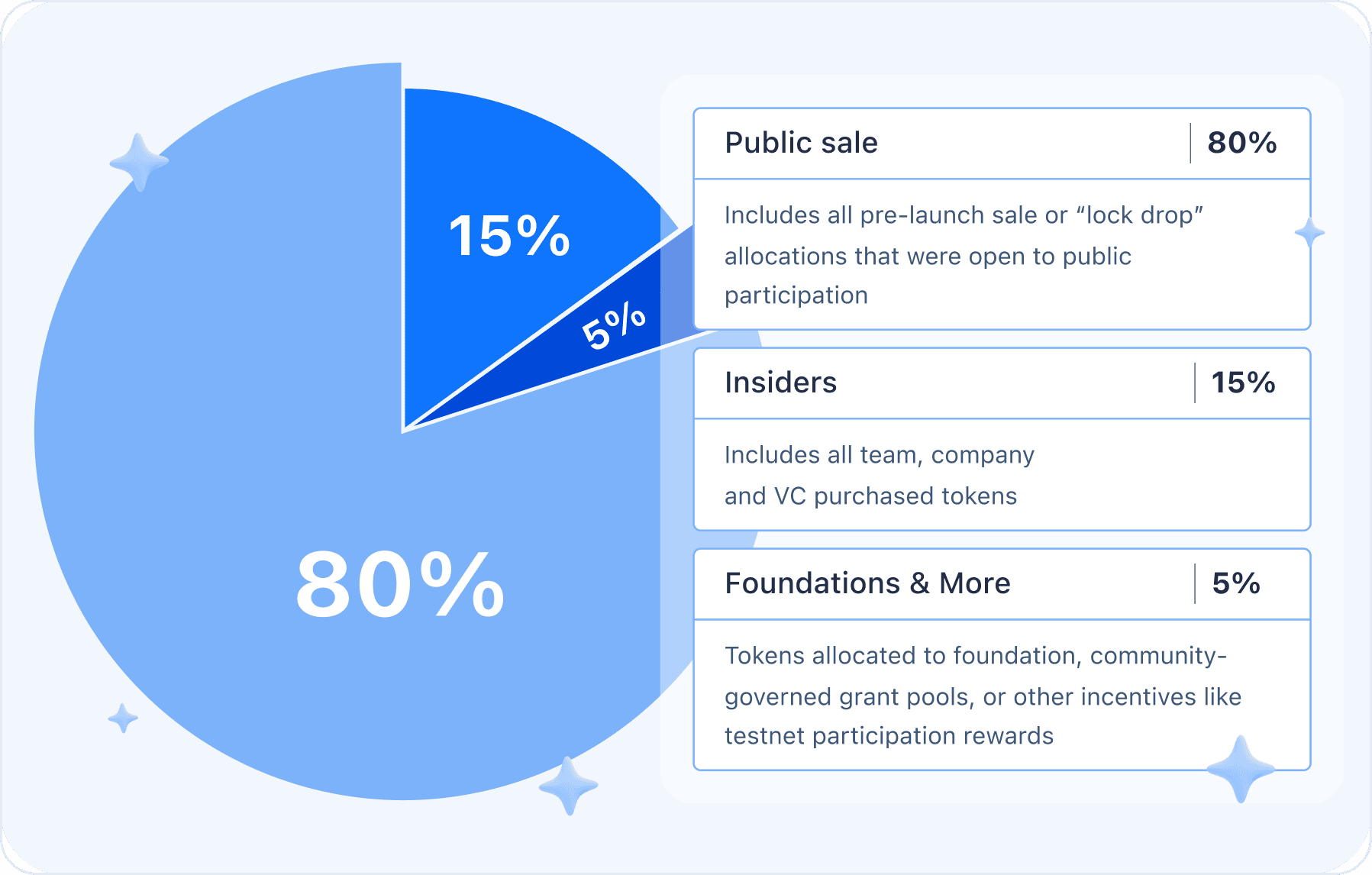

Ethereum initial token allocation is an example of a solid community influence. Approximately 80% of all tokens are open to public participation. It means that the management team or other insiders won’t be able to manipulate the token’s price or major decisions.

Models of Economic Incentives and Inflation

Inflation in Ethereum on PoS is dynamically regulated. The inflation rate can vary depending on the network's capacity. If the network is fully occupied by validators, the inflation rate is decreased.

Conversely, if there is a shortage of validators, the inflation rate is increased to attract more participants. Thus, the inflation mechanisms in Ethereum on PoS aim to maintain a healthy balance between rewards for validators and the total supply of tokens.

Ethereum Token Burning Mechanism

The token burning mechanism is introduced in Ethereum to control inflation and maintain ETH price stability. As part of this mechanism, a portion of transaction fees and smart contract execution fees are burned by sending tokens to an address from which they cannot be retrieved. Consequently, the circulating supply of ETH is reduced, leading to a deflationary effect.

The purpose of burning ETH tokens is to decrease overall issuance and control inflation. Additionally, it can contribute to increasing the value of the ETH token in the market since burning reduces its available supply.

It's important to note that the ETH token burning mechanism is part of Ethereum economic policy and may be subject to change or adaptation over time based on the needs and consensus within the Ethereum community.

Analysis of Governance Process

In Ethereum PoS system, the governance and decision-making process is based on the concept of Ethereum Improvement Proposals (EIPs). Any community participant can propose an EIP, describing changes or new functionalities, and the community has the opportunity to discuss and adopt these proposals.

The decision-making process in Ethereum also involves the Ethereum Foundation and other key stakeholders. The Ethereum Foundation plays a vital role in the development and management of the Ethereum protocol, and their contributions and opinions are considered in decision-making. Additionally, there are developer, user, and validator communities actively involved in discussing and making decisions that impact the development of the Ethereum ecosystem.

Ethereum has various forums and resources, such as Ethereum Research and the Ethereum Community Forum, where the community can exchange ideas and discuss different proposals. Various conferences and events are also held to discuss governance and decision-making matters.

Overall, Ethereum strives to ensure decentralized governance and decision-making, taking into account the opinions and contributions of various community participants to maintain an effective protocol that meets the needs of its users.

Risk Assessment

Technical Risks

Ethereum, like any other project, faces the risk of technical issues such as code vulnerabilities, hacker attacks, and scalability challenges in the network.

Competition Risks

Ethereum faces competition from other platforms like Cardano, Solana, Binance Smart Chain, and others. These platforms may offer faster and more scalable technology, potentially reducing interest in Ethereum.

Regulatory Risks

Cryptocurrencies and blockchain technology face regulatory risks from government authorities. This could lead to the prohibition of cryptocurrencies in some countries, potentially reducing demand for Ethereum.

Legal Risks

Ethereum and other crypto projects face legal risks related to insufficient market regulation, unclear legal status of tokens, and other legal issues.

Social Risks

Ethereum and other cryptocurrencies are still perceived as means for quick profits and investments. This may lead to market bubbles that can burst at any time, resulting in significant losses for investors.

Community Analysis

Community analysis is an important aspect of assessing Ethereum project potential. The Ethereum community is one of the largest and most active communities in the cryptocurrency industry. Developers, users, and investors actively communicate in various forums, messengers, and social networks.

Key advantages of the Ethereum community

- A large number of developers and users actively working on the project and utilizing its technology to create new products and applications.

- High level of community engagement expressed through active exchange of opinions, ideas, and feedback.

- Stable project funding from community resources such as the Ethereum Foundation and Ethereum Community Fund.

The Ethereum community's challenges

- High transaction costs on the Ethereum network, making it inaccessible for users with limited resources.

- The need to address scalability issues due to the growing number of users and transactions on the Ethereum network.

- Divergent opinions within the community regarding various technical and economic issues, which can slow down the project's development process.

The Ethereum community remains active and committed to the long-term success of the project. Developers and the community are working on solving problems and creating new applications based on Ethereum technology.

Ethereum Financial Stability Assessment

Assessing the financial stability of the Ethereum project is crucial for evaluating its potential profitability and stability. While Ethereum is not a corporation and does not have a traditional business model, its financial indicators can be evaluated based on various factors.

Ethereum Market cap

Ethereum market cap reflects the current value of all available ETH tokens multiplied by the token's current market price. The higher the market capitalization, the more financially stable the project can be considered. As of the time of writing this text, Ethereum market cap exceeds 220 billion US dollars.

Profitability of Ethereum validators

Higher validator profitability indicates a more stable project as it means validators have sufficient incentive to continue adding new blocks.

Number of active users and apps on Ethereum

The more active users and applications, the more stable the project can be considered, as it indicates that the Ethereum platform is popular and has growth potential.

Number of developers working on the platform and creating new apps and improvements

The more developers involved, the more stable the project can be considered, as it indicates that the Ethereum platform has a wide base of talented and experienced developers who can contribute to its improvement and future development.

All in all, the financial stability of the Ethereum project can be considered high, thanks to its significant market capand successful history of fundraising. However, like in any investment project, there are risks and a need for constant monitoring of financial indicators, like the Ethereum price, to make informed decisions.

Decision making

We need to draw conclusions and make a decision on whether or not to invest in the project and determine an acceptable investment level.

Overall, investing in the Ethereum project can be a profitable and promising decision. It is nonetheless recommended to invest in Ethereum at a moderate level, taking into account the risks and potential crypto market volatility.

Summary

Here we took a detailed look inside Ethereum, one of the most renowned blockchain projects. We delved into its team, competitors, economic model, risks, and more.

Based on an in-depth fundamental analysis of Ethereum, it can be concluded that the project has high potential for further development. The technical solutions underlying Ethereum enable the creation of decentralized apps and smart contracts, opening up new opportunities for businesses and the financial sector.

However, the project carries certain risks, such as intense competition in the blockchain space, regulatory risks, and project management shortcomings. Additionally, it is important to consider Ethereum's technical limitations, such as high transaction fees and network performance constraints.

The Ethereum community is active and interested in the project's development, which is a positive factor. The project's financial stability should be noted, too, indicating that Ethereum has sufficient financial resources to implement its future plans.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.