Chainlink Fundamental Analysis

Key Insights

- An in-depth look into Chainlink project and its competitive analysis

- Chainlink is an innovative, constantly evolving, and financially stable blockchain platform for oracles

- Comprehensive insight into the technology and team behind Chainlink project

What Is Chainlink

Chainlink, a project that began its journey in 2017, was founded when Sergey Nazarov and Steve Ellis joined forces with the goal of creating a decentralized blockchain platform for oracles. This platform aims to enable smart contracts executed on the blockchain to access reliable and up-to-date external data in real-time.

The main goal of the Chainlink project is to develop an infrastructure capable of providing smart contracts with access to external data and information sources. This addresses a critical issue concerning the limitations of smart contracts, which by default lack access to data outside the blockchain network.

Chainlink's mission is to establish a universal standard for implementing oracles in the blockchain environment and provide trustworthy data sources for smart contracts.

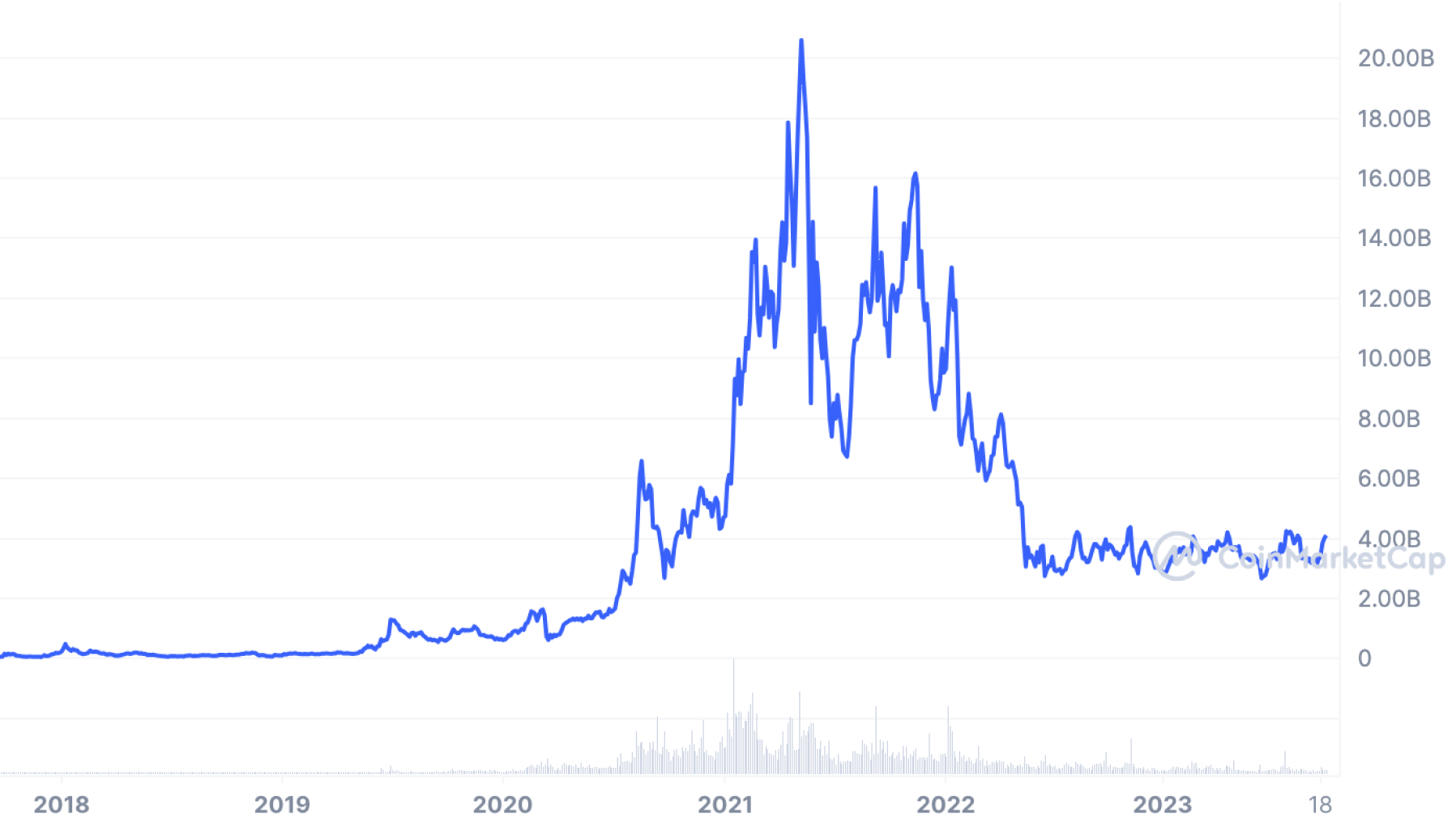

As of now, the market cap of the LINK token is $4,103,292,048 and is dependent on the demand for Chainlink services. The Chainlink project is a key player in the field of decentralized oracles and is at the center of attention for an active community of developers and users.

Users can get LINK on SimpleSwap.

Chainlink Competitive Environment Analysis

Some well-known competitors of Chainlink in this space include:

- Band Protocol (BAND)

BAND is also providing oracle services and aiming to make access to external blockchain data more accessible and reliable. The project focuses on providing diverse data and oracles that can be used in smart contracts.

Market cap: $140,152,936

- API3 (API3)

API3 is focused on providing trusted data sources for smart contracts using traditional APIs. The project aims to provide reliable and secure data sources on the blockchain.

Market cap: $96,823,778

- Tellor (TRB)

Tellor provides oracle services, specializing in providing price data for smart contracts. It emphasizes data decentralization and security.

Market cap: $76,844,788

- DIA (DIA)

This project aims to provide access to a variety of financial data, including asset prices, valuations, and other informational resources. It also focuses on decentralization and a wide range of data.

Market cap: $27,785,226

- Augur (REP)

Augur is a project focused on predictions and forecast markets. It allows for the creation and participation in prediction-based markets and can serve as a data source for smart contracts.

Market cap: $7,526,990

Each of the mentioned competitors has its unique features and approaches to providing oracle services and data for smart contracts.

Chainlink, on the other hand, remains a leader in this space due to its extensive network of oracles, active community, and collaborations with various blockchain platforms and projects.

However, as with any project, competition and innovation in this space continue to shape the competitive environment, and Chainlink must continue to evolve and improve its services to remain a leader.

Chainlink Technology Assessment

Chainlink is a project that has brought a range of technological solutions and innovations to the world of blockchain and smart contracts.

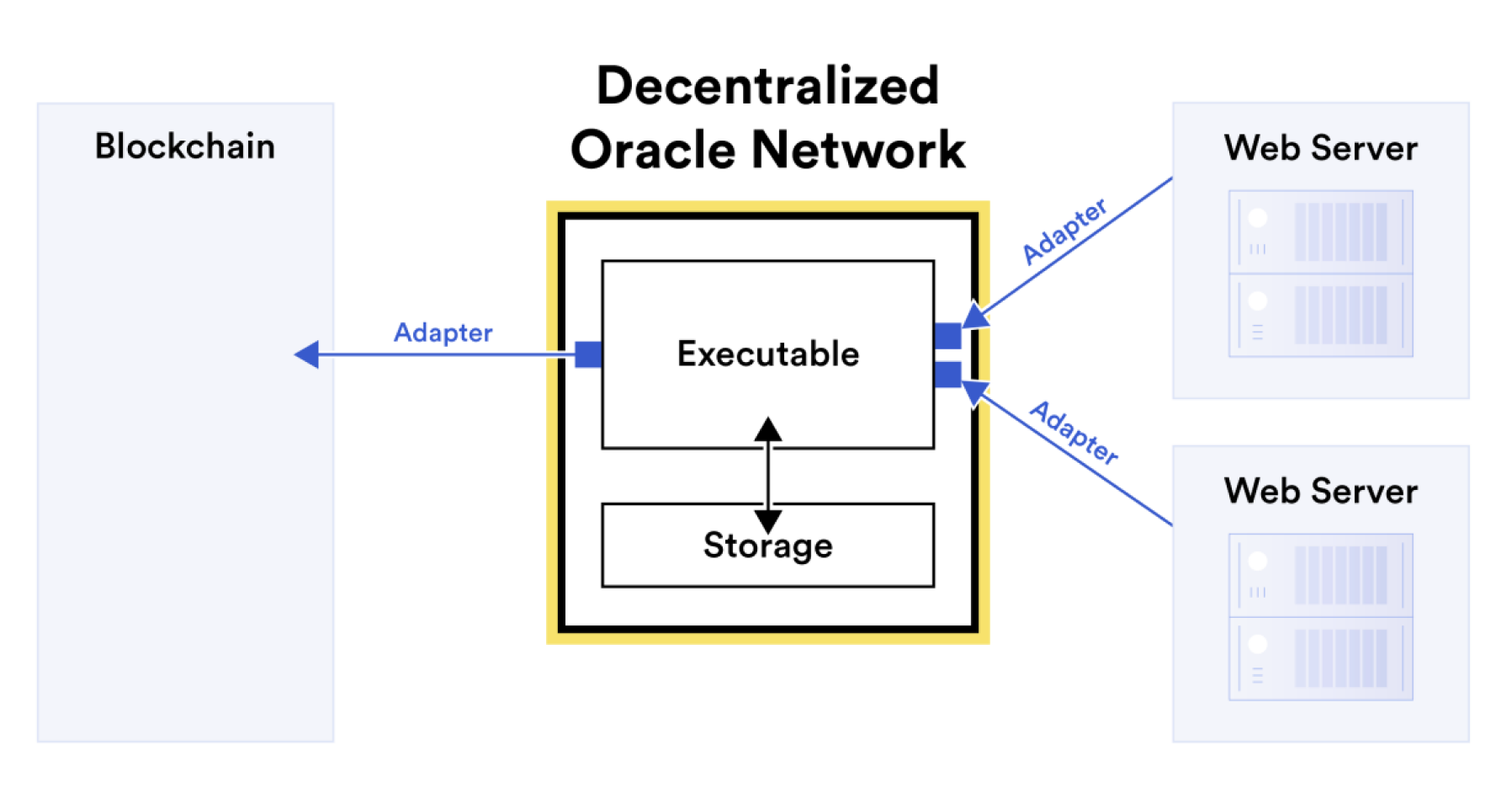

Conceptual figure showing as an example how a Decentralized Oracle Network can realize basic oracle functionality, i.e., relay off-chain data to a contract. An executable uses adapters to fetch off-chain data, which it computes on, sending output over another adapter to a target blockchain.

Technological Solutions and Innovations

- Decentralized Oracles

One of Chainlink's key innovations is the creation of decentralized oracles. These oracles are network nodes that provide smart contracts with access to data from external sources. This allows smart contracts to obtain real-time information about asset prices, weather, financial data, and other parameters.

The key advantage of Chainlink, though, is its decentralized approach to oracles, making the data more reliable and resistant to manipulation.

- Own Consensus Protocol

Chainlink has developed its own consensus protocol known as the "Chainlink Consensus Protocol," which ensures data consistency between oracles and smart contracts.

This protocol guarantees that the data provided by oracles meets the expectations of smart contracts and prevents manipulations.

- Data Provider Incentive Mechanisms

Chainlink utilizes a system of rewards and penalties to motivate data providers to supply accurate and reliable data. These incentive mechanisms contribute to ensuring the honesty and reliability of oracles.

- Flexibility and Customizability

Chainlink provides tools for creating customizable oracles and adapters, enabling smart contracts to easily integrate Chainlink to obtain data that meets their specific requirements.

- Interoperability

Chainlink is developing solutions to ensure compatibility with various blockchain networks. This makes it a universal tool for smart contracts on different platforms.

Future Plans

Chainlink is actively working on advancing its technology, aiming to improve scalability, security, and performance.

The project also considers integration with various blockchain networks and providing a broader range of data for smart contracts, expanding its capabilities and applications across different domains. These plans underscore Chainlink's ambitious strategies for the future, focused on long-term development and growth.

Chainlink Project’s Team and Management

The founders of the Chainlink project, Sergey Nazarov and Steve Ellis, possess impressive experience in blockchain technology and smart contracts. Sergey Nazarov has a background in software development and has had successful startups in the past.

Steve Ellis, on the other hand, also had experience in developing blockchain projects. The Chainlink development team includes highly qualified specialists in blockchain technology, cryptography, and oracles.

- Quality of Project Management

The management of the Chainlink project is characterized by a high degree of professionalism and organization. The team has clear strategic goals and a development plan, contributing to efficient resource management and the achievement of set objectives.

The founders and key team members actively interact with the community, taking into account the opinions and needs of users and partners.

- Effectiveness of Teamwork

The Chainlink project has a developed and active community of developers, users, and partners. Collaboration and idea exchange within this community contribute to continuous development and improvement of Chainlink technology.

The Chainlink team also collaborates with various blockchain platforms and oracles to expand its ecosystem and provide broader access to data for smart contracts.

Overall, the Chainlink project team has extensive experience, effectively manages the project and collaboration with the community and partners. Their teamwork enables Chainlink to successfully evolve and maintain a leading position in the field of decentralized oracles and smart contracts.

Economic Incentive Models and Inflation

Researching the economic model of Chainlink provides important insights into the mechanisms that enable its functioning and incentivize participation in the network. Here is an analysis of the key aspects of Chainlink's economic model.

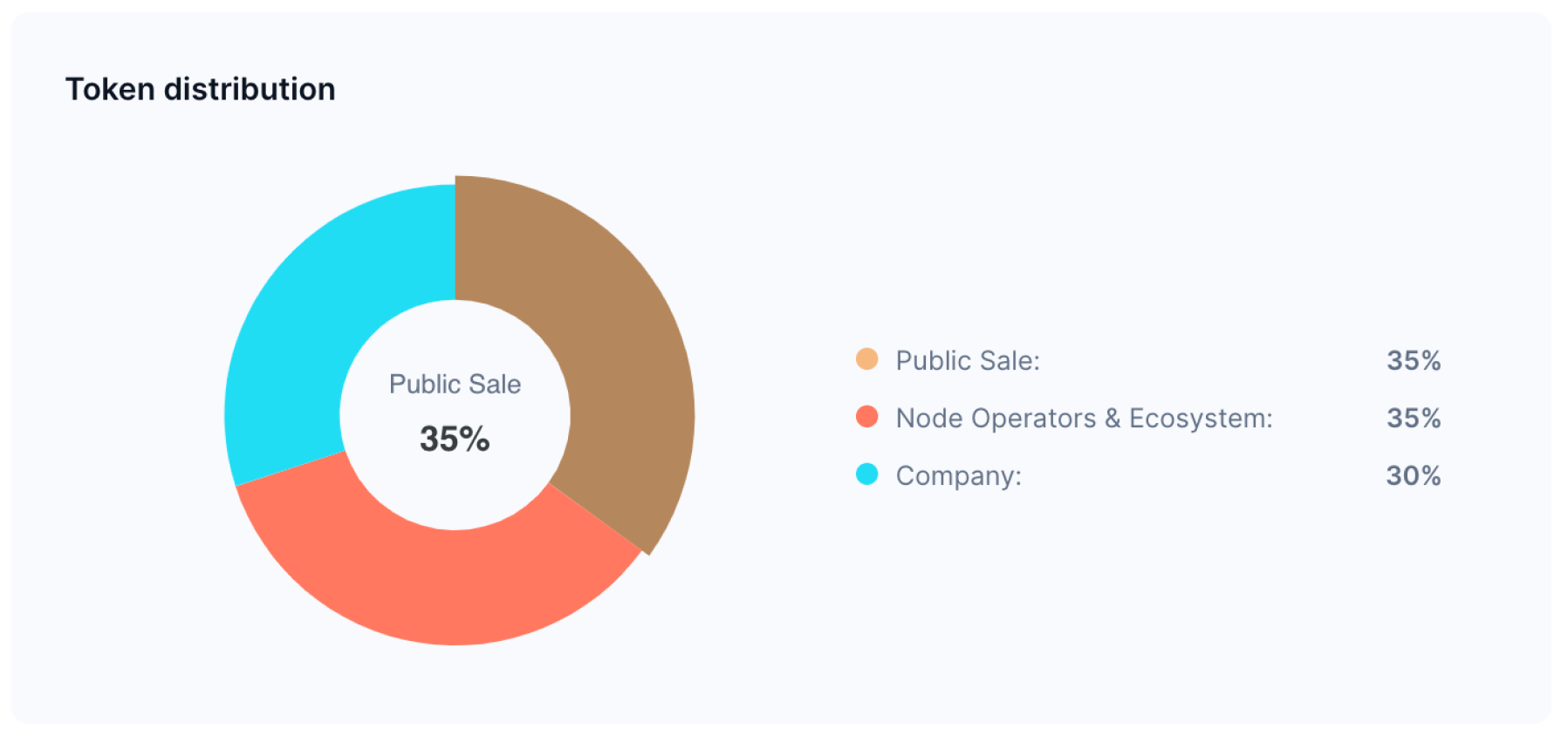

Token Distribution Mechanism

The initial distribution of LINK tokens was carried out through an Initial Coin Offering (ICO) in 2017, which allowed for the necessary funding to support the project's development. The majority of the tokens were distributed to investorsand the founders of Chainlink.

LINK began its journey with a crowdsale. During the crowdsale, funds were raised for the development of the project, and investors received LINK tokens in exchange for their contributions. Thus, a portion of the tokens was distributed among the investors.

Economic Incentive Models

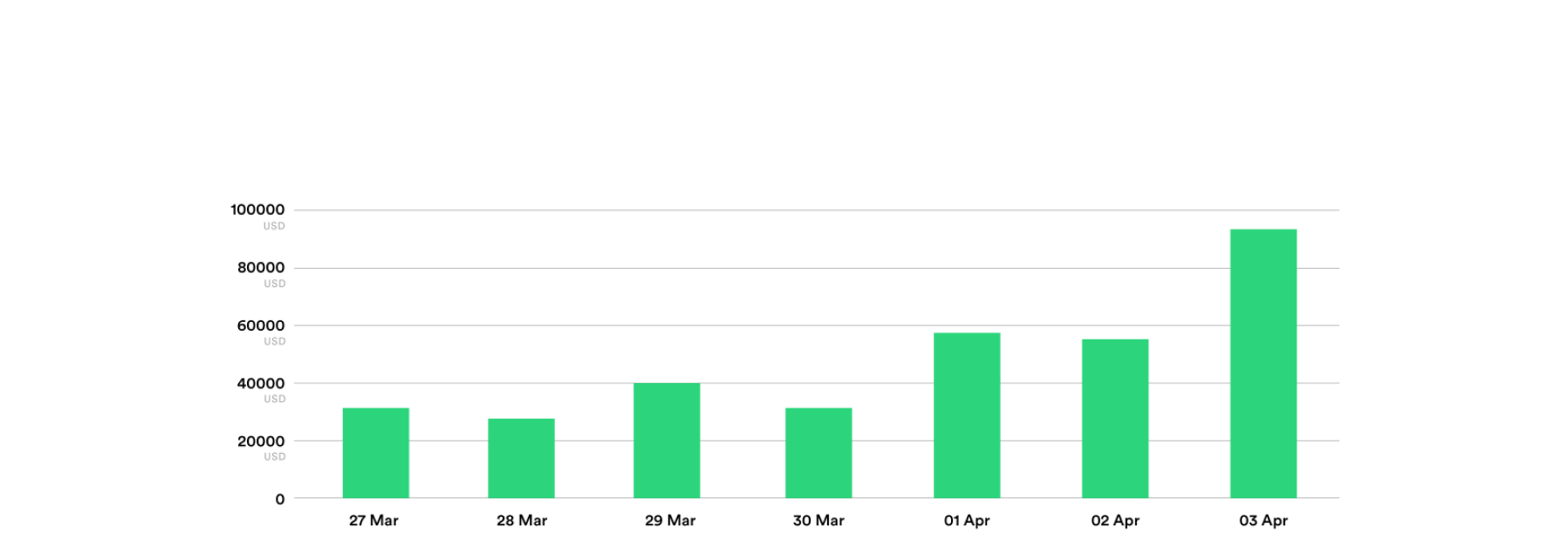

Below is a graph representing the revenue earned by Chainlink nodes on a single data feed (ETH-USD) during a representative week in March 2021.

Chainlink utilizes an incentive model to attract participants and ensure network security. Key points in this model include the following.

- Gas Cost

Users sending requests to obtain data from Chainlink oracles must pay gas in the form of LINK tokens. This provides an economic incentive for data providers (oracles) to service requests.

- Staking

Data providers can stake LINK tokens as collateral to participate in oracle operations. Staking increases trust in providers and enhances network security.

- Rewards

Data providers and participants ensuring network security can receive rewards in LINK tokens for their work. This incentivizes active participation and network support.

Inflation

The issuance of new LINK tokens in the Chainlink network doesn't follow a fixed inflationary model. Instead, it depends on the activity of network participants and can vary over time based on the needs and decisions of the community.

This allows for the adaptation of inflationary mechanisms to current conditions and network requirements, providing flexibility and manageability to the project's monetary policy.

Governance and Decision Making Process

Chainlink employs a decentralized approach to network governance. Participants have the ability to propose protocol improvements and participate in voting.

This democratic process allows the community to actively influence the project's development direction and make key decisions, ensuring greater transparency and participation in governance.

The economic model of Chainlink is focused on incentivizing activity and ensuring the reliability of oracles, making it a vital component of the blockchain ecosystem for providing external data with a high degree of security and dependability.

Risk Assessment

When assessing the risks faced by the Chainlink project, the following key factors that could influence its future success are identified:

- Technical Risks

Like most projects in the blockchain space, Chainlink is susceptible to technical risks. This includes potential vulnerabilities in the code, attacks from hackers, and network operational issues. Such problems can affect the stability and reliability of oracles.

- Competition Risks

The decentralized oracle space is constantly evolving, and Chainlink competes with other projects striving to provide similar services. Competitors may offer innovative solutions or attractive conditions for data providers and smart contract users.

- Regulatory Risks

Similar to other crypto projects, Chainlink crypto project is subject to the risk of changes in the regulatory environment. Legislative changes and rules can impact the ability to use Chainlink and smart contracts relying on its oracles.

- Security Risks

Data protection and ensuring the confidentiality of information transmitted through oracles are priorities for Chainlink. Possible security incidents can damage the project's reputation and lead to a loss of trust among users.

- Partnership Risks

The success of Chainlink partly depends on collaboration with partners and blockchain projects utilizing its oracles. Changes in partner strategies or their exit from the ecosystem can impact the project.

- Market Volatility Risks

Like many other cryptocurrencies, the LINK token is subject to high volatilityin the market. This can create risks for investors and users associated with price fluctuations of LINK.

It is important to note that the Chainlink team actively works to address these risks, focusing on security, improving partnerships, and enhancing the reliability of data provision to smart contracts. However, there’s always a degree of uncertainty and risk in the blockchain space.

Chainlink Community Analysis

Community analysis is an important part of assessing the success and sustainability of a project in the future. Let's conduct an analysis of the Chainlink community.

- Activity and Engagement within the Community

The Chainlink community is actively evolving and encompasses a broad spectrum of participants, ranging from smart contract and oracle developers to investors and users.

One of the key indicators of activity is the number of participants in official communication channels, such as Telegram and Twitter. Chainlink also maintains a forum where community members can discuss technical aspects of the project and propose improvements.

Below are Twitter and Telegram sentiment graphs respectively.

- Community Support Assessment

The Chainlink community demonstrates a high level of support for the project. This is evident in the number of participants actively discussing project news and updates, as well as the number of developers and data providers integrating Chainlink into their applications and smart contracts.

Furthermore, the Chainlink community regularly expresses its willingness to participate in improving the protocol and suggests new ideas for project development.

The community analysis confirms that Chainlink not only possesses technical maturity but also enjoys strong support from an engaged community. This can be a key factor in its long-term success.

Project’s Financial Stability

Financial Stability Assessment of the Chainlink Project encompasses several crucial factors that impact its long-term stability.

- Market Cap and LINK Liquidity

Market capitalization reflects the total value of all available LINK tokens in the market. A high market cap can indicate the financial stability of the project.

Additionally, active trading on various crypto exchanges and the presence of liquid markets for LINK provide participants with the ability to easily buy and sell tokens.

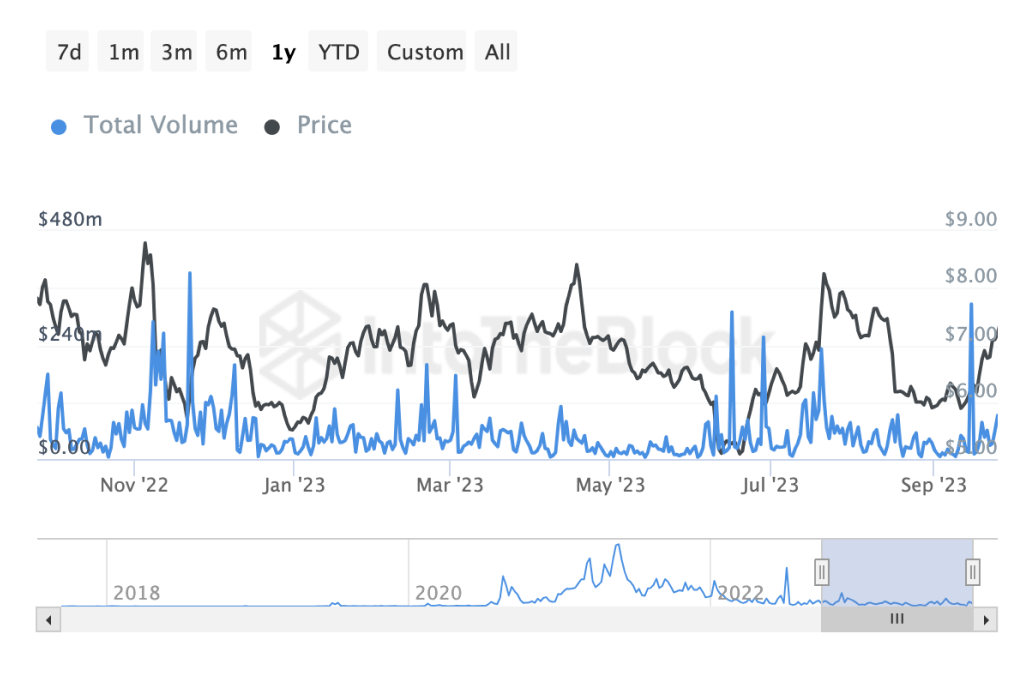

Above is the aggregated daily volume, measured in USD from onchain transactions where each transaction was greater than $100,000. The adjusted view subtracts the change in UTXO based transactions.

- Investment Interest

The appeal of the project to investors and partners is crucial for its financial stability. Successful partnerships and active fundraising efforts can contribute to the financial stability of the Chainlink project.

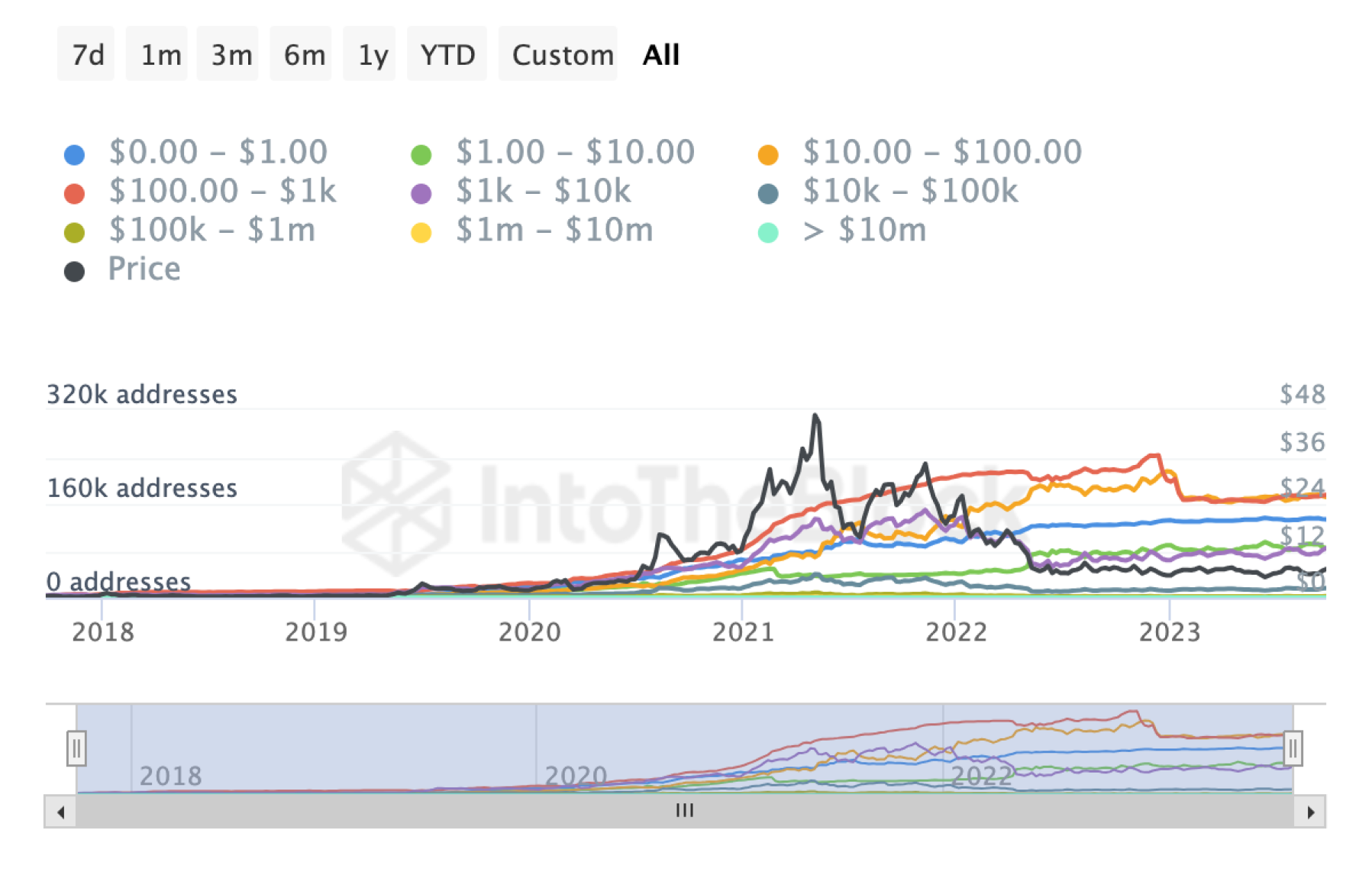

Above is the number of addresses holding the selected dollar amount. This can be displayed in terms of the aggregate count of addresses or the percentage they make out of all.

- Development and Updates

The number and quality of developers working on the Chainlink project and implementing improvements also impact its financial stability. Regular updates and the development of the Chainlink platform help it remain competitive in the decentralized oracle market.

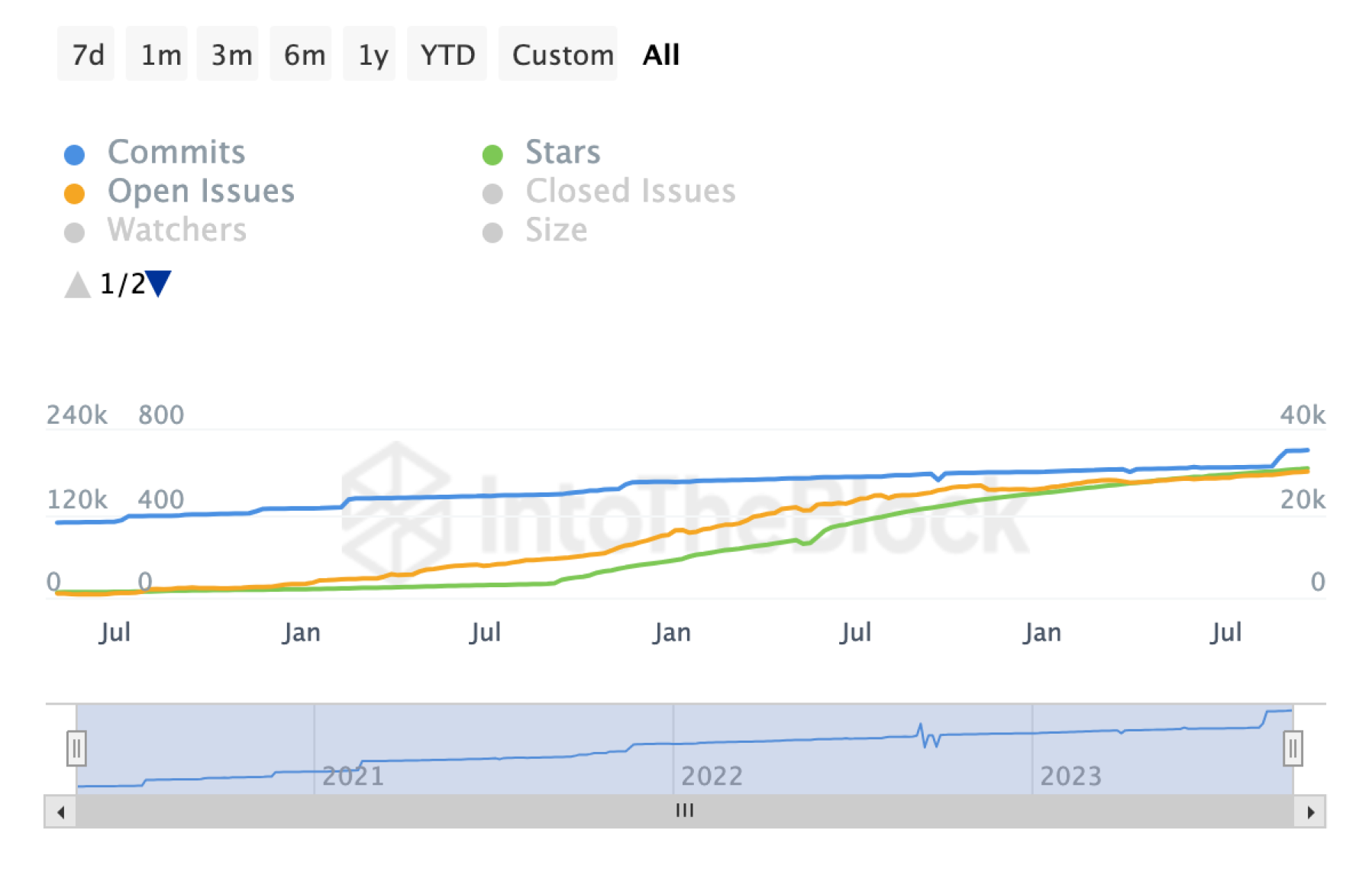

Github indicators provide insights regarding development activity for a crypto asset based on commits (changes made to the code of the asset ecosystem by developers), stars and issues (interest and engagement shown by the community) and pull requests (changes and network improvements submitted and approved over time)

- Community Activity

An active and devoted community of developers, users, and investors who actively engage and support the project's development contributes to the stability and successful growth of Chainlink.

- Partnerships and Clients

Partnerships with financial institutions, blockchain projects, and other companies utilizing Chainlink for obtaining external data can contribute to the financial stability of the project by increasing demand for Chainlink oracle services.

- Economic Model

The staking system and rewards for data providers in the Chainlink ecosystem influence the profitability and financial stability of network participants.

Overall, the financial stability of the Chainlink project can be assessed as high, based on its market capitalization, liquidity, community activity, and partnerships. However, like any crypto project, there are risks and variables that could affect its financial stability in the future.

Summary

Analyzing the Chainlink project from a fundamental perspective, it is important to note several strengths:

- Technological innovation

Chainlink provides solutions in the field of decentralized oracles, making it a key player in the smart contract ecosystem. Innovative consensus and data provider incentive mechanisms make the project competitive.

- Development and updates

The project is actively evolving thanks to the support of the developer community, ensuring regular updates and improvements.

- Partnerships

Chainlink has strategic partnerships with leading blockchain platforms and companies, facilitating its integration and use in various domains.

Nevetheless, potential risks should be considered, such as technical issues, competition in the oracle space, regulatory changes, and cryptocurrency market volatility.

By and large, the Chainlink project appears promising due to its innovative solutions and community support. The decision to invest in Chainlink should be made considering one's own financial capabilities and risks, and keeping track of updates and changes in the decentralized oracle space.

Users can exchange all cryptocurrencies mentioned in this article for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.