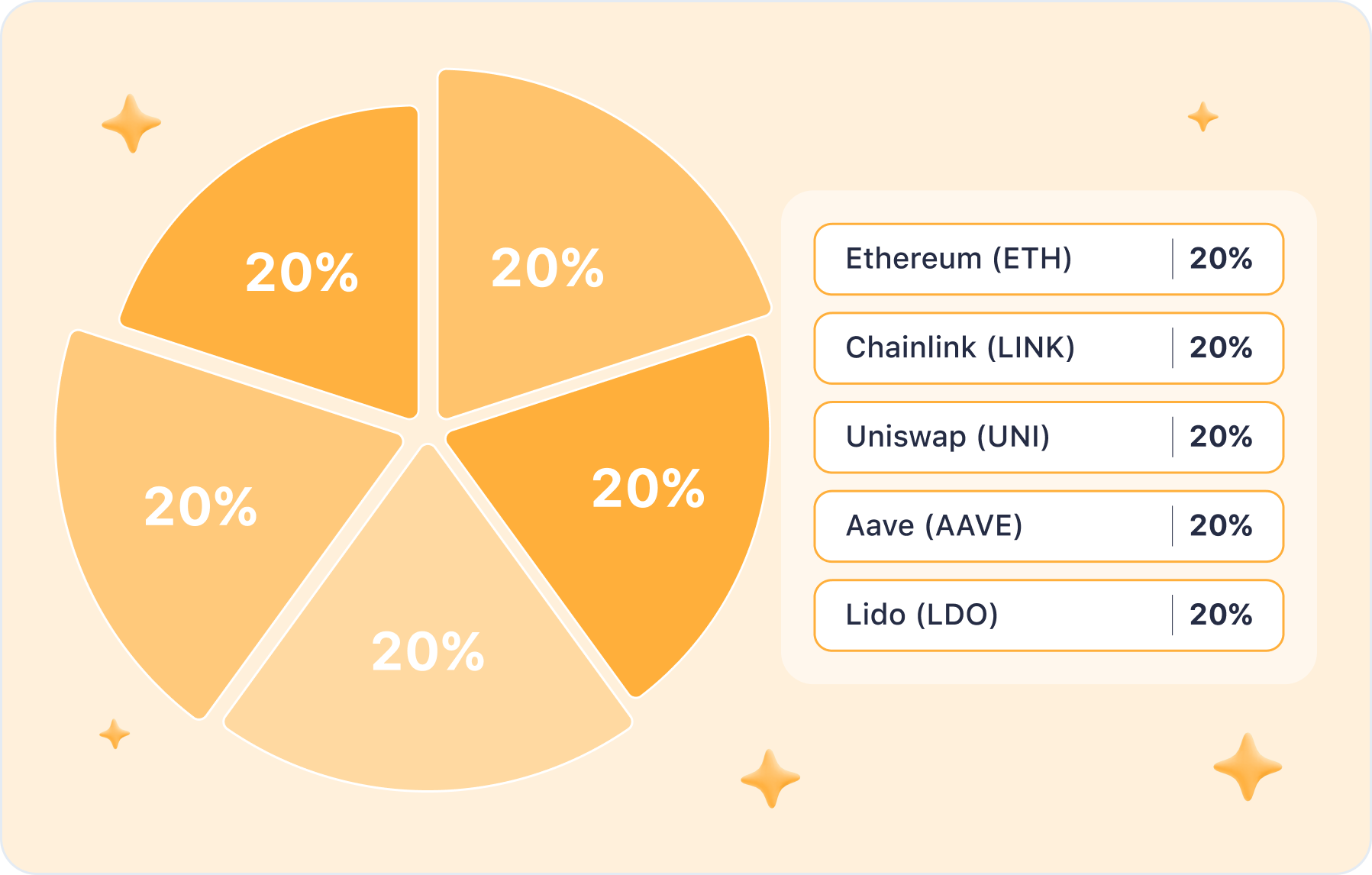

Leading DeFi Coins Portfolio

Key Insights

- The portfolio balances DeFi sector exposure across 5 major tokens covering key subsectors like DEXs, oracles, lending, and staking platforms.

- Allocating 20% each to ETH, LINK, UNI, LDO, and AAVE diversifies risk while capturing upside from growth across DeFi.

- The diverse functionality of the selected tokens provides participation in critical DeFi sectors likely to see increased adoption.

What Is DeFi Coin

A DeFi coin is a cryptocurrency coin or token utilized to participate in the DeFi economy. In particular, a DeFi coin is a cryptocurrency employed in decentralized exchanges, liquidity pools, income farming, lending, asset management, digital wallets, and NFT.

Given the multitude of DeFi services currently available, there is an equivalent number of DeFi coins and tokens.

A DeFi coin is a native asset that runs on its own blockchain.

The market for DeFi coins and tokens is expanding, and the value of many DeFi projects is also on the rise. For investors seeking to gain exposure to DeFi, many of the projects listed below can serve as a valuable starting point for research.

Following you can see a list of crypto projects suitable for a diversified portfolio.

Ethereum

Ethereum (ETH) — 20%

Ethereum is a platform for creating smart contracts and dApps perfect to be utilized as means of portfolio diversification. With the favorable transition to PoS in Ethereum 2.0, efficiency and scalability are expected to improve, which could contribute to the development of the DeFi ecosystem.

This crypto asset is also included in the portfolios of a wide range of investors and is a rather conservative investment aimed at expecting stable, albeit not explosive growth.

Chainlink

Chainlink (LINK) — 20%

Chainlink is an oracle service (a provider of data from external sources that allows smart contracts to fulfill their functions) that provides connectivity between blockchains and external data. Chainlink has the potential to become an indispensable component of the DeFi ecosystem with a need for trusted information.

Chainlink performs a critical function by enabling cross-chain data exchange between blockchains and decentralized applications.

Uniswap

Uniswap (UNI) — 20%

Uniswap is a DEX that simplifies the provision of liquidity, and Uniswap v2 allows users to exchange any ERC-20 tokens among themselves. The increasing need for decentralized trading platforms makes UNI a key asset to participate in the growth of this sector.

The Uniswap exchange is a decentralized platform that uses automated liquidity pools instead of order books to facilitate direct token swapping.

The UNI token is essential to Uniswap's ecosystem, enabling trustless swapping and bootstrapping liquidity for long-tail ERC-20 tokens. Users also participate in governance and receive rewards within the network with the UNI coin.

Lido

Lido (LDO) — 20%

Lido provides members with the opportunity to participate in the Ethereum 2.0 staking. With the growing interest in staking and increasing network security, LDO has the potential to attract community attention and support.

Lido Finance is an online platform that enables users to earn rewards from staking their crypto assets without locking them up. Lido tokens represent the users' stake in the Ethereum network and can be traded freely at any time while still earning the users Lido staking rewards.

Aave

Aave (AAVE) — 20%

Aave is an Ethereum-based protocol in decentralized lending and borrowing. As DeFi evolves, AAVE can remain at the center of innovation by providing new financial options to the user.

AAVE is the leading DeFi lending protocol in terms of total volume. AAVE enables users to borrow and lend cryptocurrencies through smart contract technology, eliminating the need for third parties. AAVE is a pioneer in decentralized finance, developing lending solutions based on smart contracts and data exchange.

Summary

This portfolio gathers actual projects in the DeFi world and provides an possibility to participate in innovations that support the expansion of decentralized financial solutions. The perspective of these coins is reinforced by their functions. Each one provides users with unique functionality: from the exchange of all ERC-20 coins to staking and increased security.

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.