Storm Trade: Passive Yield Strategy for Ton Aficionados

Key Insights

- Storm Trade allows users to trade a variety of assets (such as TON, USDT, NOT) with real-time quote updates, and the platform's integration with Telegram makes it /b>highly accessible and enhances user engagement.

- Storm Trade integrates SocialFi elements, allowing users to interact with the platform through Telegram, participate in copy-trading, trading tournaments, and earn NFTs.

- Liquidity providers contribute assets to one-way vaults, earning returns from trade commissions and penalties.

What Is Storm Trade

Storm Trade is one of the first platforms offering decentralized derivatives trading on the Ton blockchain with integration into the Telegram app.

Storm Trade allows users to trade with leverage up to 50X through the web version of the platform or with the help of a Telegram bot.

Key features of Storm Trade:

- Advanced trading capabilities

Instant quote updates, leverage trading opportunities up to 50X, ability to use multiple assets (TON, USDT, NOT) as collateral.

- Integration of SocialFi mechanics

Integration with Telegram allows users to use the platform via Telegram, participate in trading tournaments, connect copy-trading, collect NFTs and much more.

- Passive income opportunities

Pools to get additional yield from your assets on Ton without the need for farming and active position management.

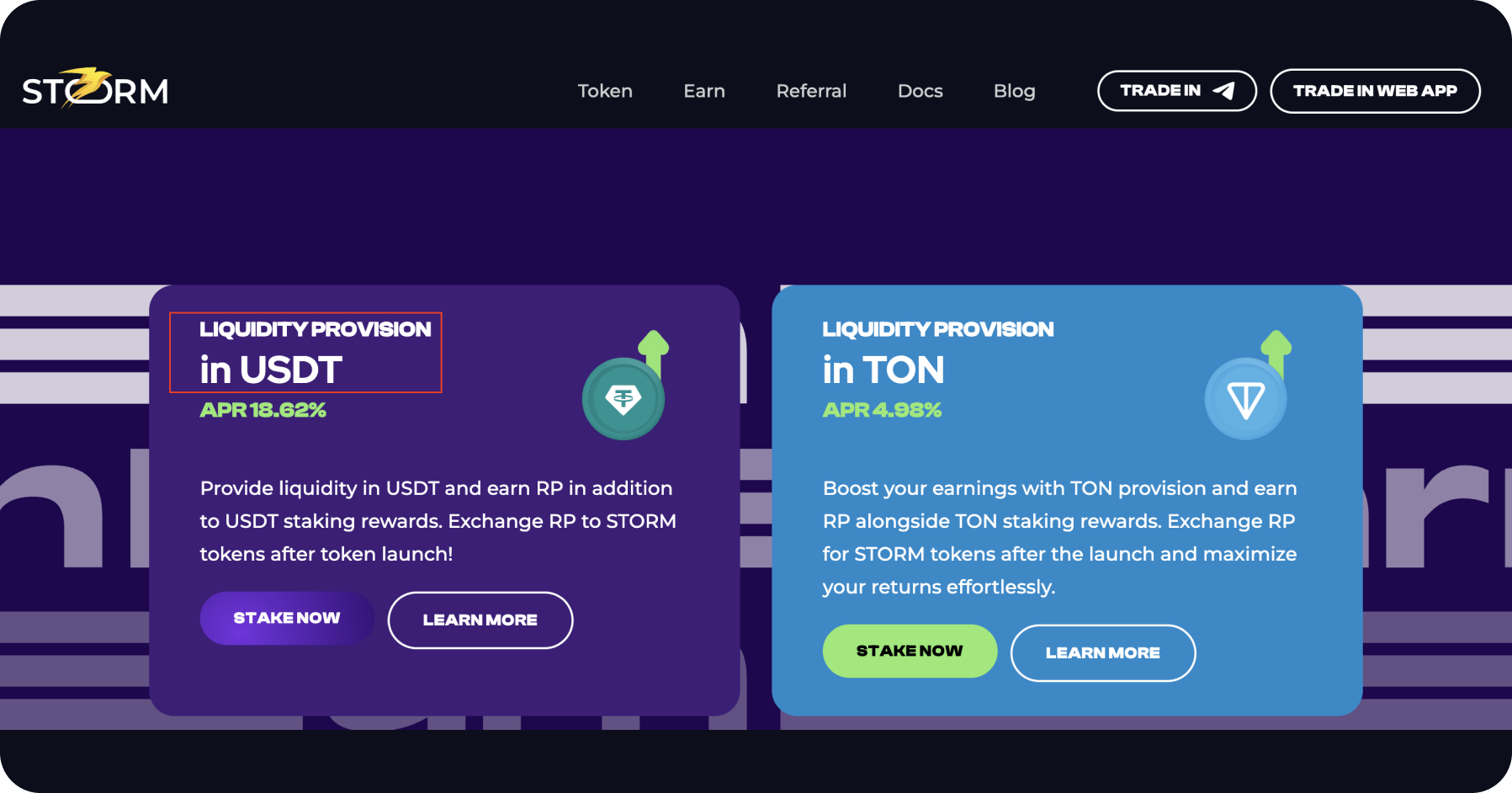

In addition to trading options, Storm Trade offers users the opportunity to become liquidity providers to generate additional returns on their assets such as TON, USDT, NOT.

Storm Trade Liquidity Provision

A key feature of Storm Trade is that liquidity provision takes place in a one-way pool or vault. This means that a liquidity provider does not need to provide two tokens to a liquidity pool.

Liquidity providers in Storm Trade receive different commissions from the protocol.

Liquidity providers contribute their assets to special vaults in Storm Trade, receiving liquidity provider tokens (SLPs) in return. SLPs represent the user's share of the total liquidity of the vault. Vaults act as a participant in all trading operations on Storm Trade.

In case of positive PnL (Profit and Loss) of traders, their profits are paid out of the Vaults' funds. In case of negative PnL, traders' losses are directed to the Vault. In addition, the vaults receive commissions:

- Up to 70% of all trade commission minutes

- 35% of liquidation penalties

- 70% of fundings paid by traders.

Thus, the profitability of vaults is a function of the amount of commissions received and the size of positive/negative PnL of traders. In case of consistently high positive PnL, liquidity providers in the vaults may incur losses, while in case of consistently high negative PnL their profit increases.

Practice shows that in the long run, liquidity providers make profits rather than losses. For example, the profit made by liquidity providers in the USDT vault over the last year is 20.4% with a current APR of 18.3%.

Despite the fact that liquidity is provided by only one token, there is a risk of non-permanent losses here as well as in other liquidity pools.

As already mentioned, these arise when the traders' PnL (Profit and Loss) becomes consistently positive and exceeds the amount of commissions they pay to the vault.

In the long run, non-permanent losses can be recovered and user’s position will become profitable, but if the user decides to withdraw funds from the liquidity pool while having non-permanent losses, they will take a loss.

In addition, users must also consider the risks associated with the use of DeFi protocols: vulnerabilities in smart contracts, the possibility of hacking and withdrawal of funds from the vaults by attackers.

Storm Trade Crypto Strategy: How To Become a Liquidity Provider

In order to become a liquidity provider in Storm Trade, you need to follow the crypto strategy steps below:

- Purchase the asset you want to use in Storm Trade's vaults

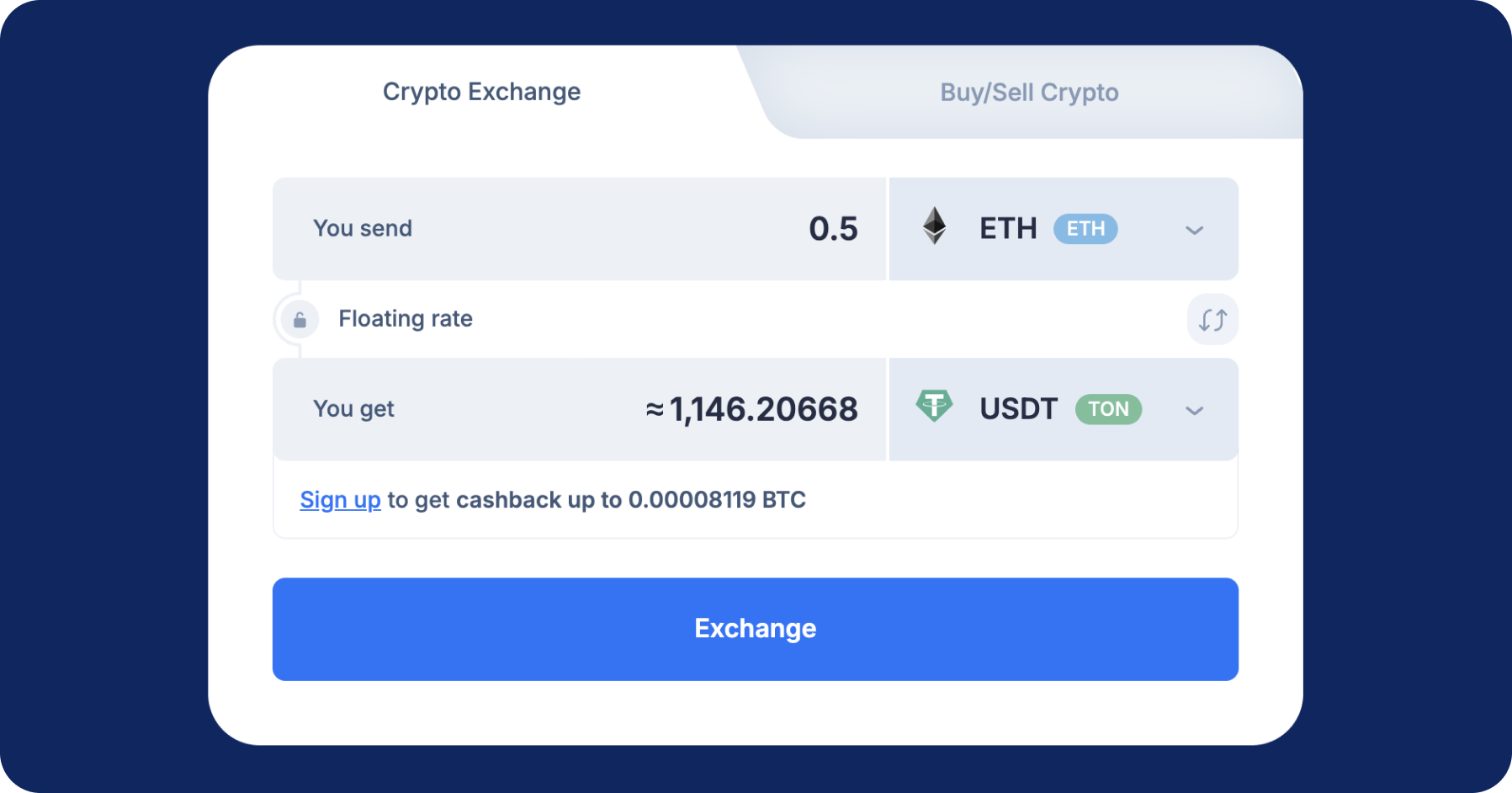

For example, exchange your ETH on the Ethereum network for USDT on the Ton network on SimpleSwap without having to use bridges.

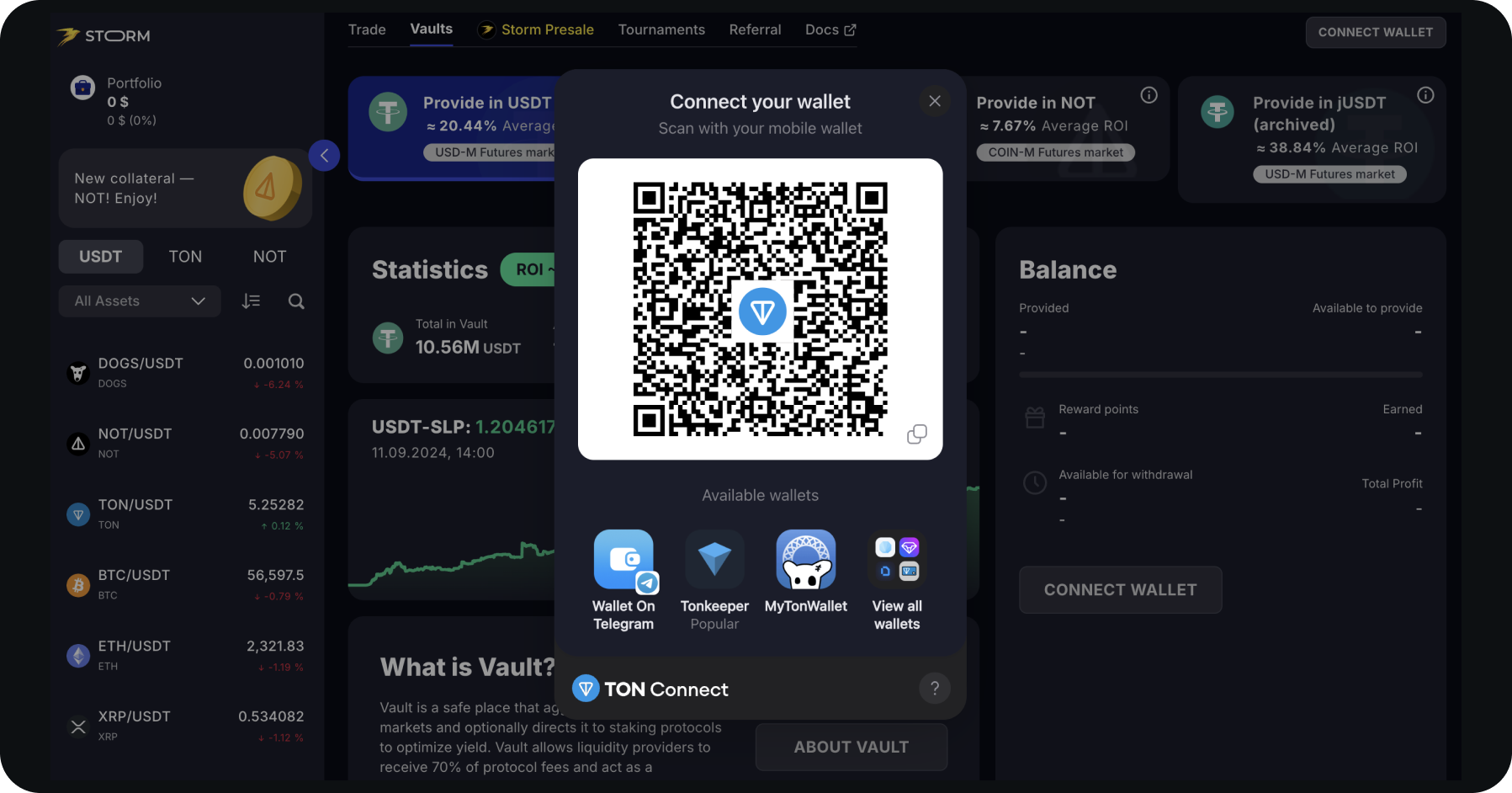

Go to the official Storm Trade website, select the earn section and the asset you want to submit (e.g. USDT).

Connect your Ton wallet

- Select the amount you want to invest and make a transaction in your wallet.

- During the deposit process, you will receive liquidity provider (SLP) tokens that represent your liquidity in the vault.

- Now you have become a liquidity provider in Storm Trade and started receiving returns from the assets represented in the vault.

- To withdraw from the vault, you need to specify the number of SLP tokens to withdraw. The SLP tokens will be burned and you will receive the tokens you contributed to the vault according to the current exchange rate.

If you are a Ton asset holder such as USDT, TON or NOT, you can consider Storm Trade Vaults as a passive strategy to generate returns on your assets. However, you should always consider the risks associated with using DeFi protocols and investing in DeFi strategies.

Summary

Storm Trade, launched on the Ton blockchain with integration into Telegram, offers decentralized derivatives trading with up to 50X leverage. Its advanced features include real-time quote updates, SocialFi mechanics, and passive income opportunities for liquidity providers.

Users can engage with the platform via Telegram or the web version to participate in trading tournaments, copy-trading, and earn from liquidity pools.

Liquidity provision on Storm Trade involves contributing to single-token vaults, and liquidity providers earn returns through trade commissions and liquidation penalties.

Although risks like impermanent losses and DeFi vulnerabilities exist, long-term profitability is likely, as demonstrated by the consistent returns of over 20% in USDT vaults.

By leveraging Ton-based assets such as USDT, TON, and NOT, Storm Trade allows users to passively generate income while engaging in the growing DeFi ecosystem.

However, it’s important to carefully assess the risks before committing to liquidity provision strategies.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.