Nostra: Liquid Staking on Starknet

Key Insights

- Nostra offers users the ability to lend, borrow, and exchange crypto assets with high capital efficiency and low transaction fees, similar to centralized exchanges.

- Liquid staking on Nostra allows users to earn staking rewards while maintaining liquidity through derivative tokens, enhancing capital efficiency and investment opportunities.

- Nostra's integration with the Starknet ecosystem leverages zk-rollup technology, providing scalability, security, and reduced transaction costs, making it a robust platform for DeFi activities.

Nostra is a liquidity protocol on the Starknet platform, providing users with the ability to lend, borrow, and exchange crypto assets with the efficiency of centralized exchanges.

Similar to successful DeFi projects like Compound, Aave, and Uniswap, Nostra implements features aimed at optimizing capital efficiency and improving compatibility within the Starknet ecosystem, known for its low transaction fees. By focusing on DeFi lending and borrowing, Nostra ensures users can maximize their returns while benefiting from a highly efficient and cost-effective network.

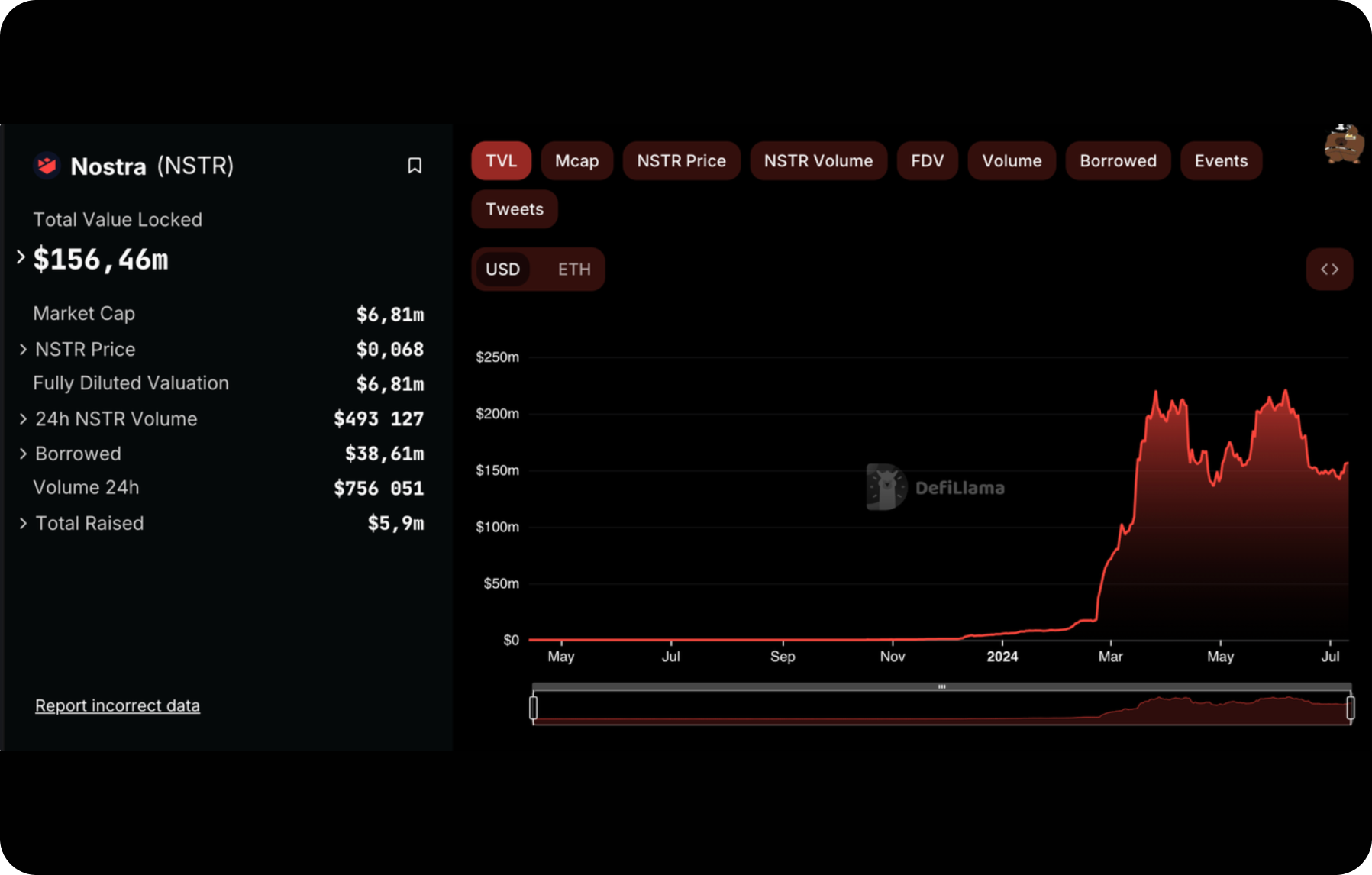

Nostra currently boasts a Total Value Locked (TVL) of $156 million, consistently maintaining this figure within the range of $140 to $200 million. This stability indicates high demand for the platform and strong user trust, positioning Nostra as one of the reliable crypto staking platforms in the market.

Benefits of Liquid Staking

- Increased Liquidity

Unlike traditional staking, where assets are locked and inaccessible, liquid staking provides users with a tradable token, enhancing liquidity in DeFi staking. Nostra leverages this to offer its users greater flexibility and capital mobility.

- Enhanced Capital Efficiency

Users can earn staking rewards while simultaneously utilizing their assets in other DeFi activities, optimizing their capital use. This is a key feature of Nostra, allowing users to maximize their returns.

- Diversified Investment Opportunities

By providing a derivative token, liquid staking enables users to diversify their investments across multiple DeFi protocols. Nostra supports this diversification, helping users spread their investments across a range of opportunities.

Stark Coin and Starknet Ecosystem

Stark Coin (STRK)

Stark Coin (STRK) is the native cryptocurrency of the Starknet platform.

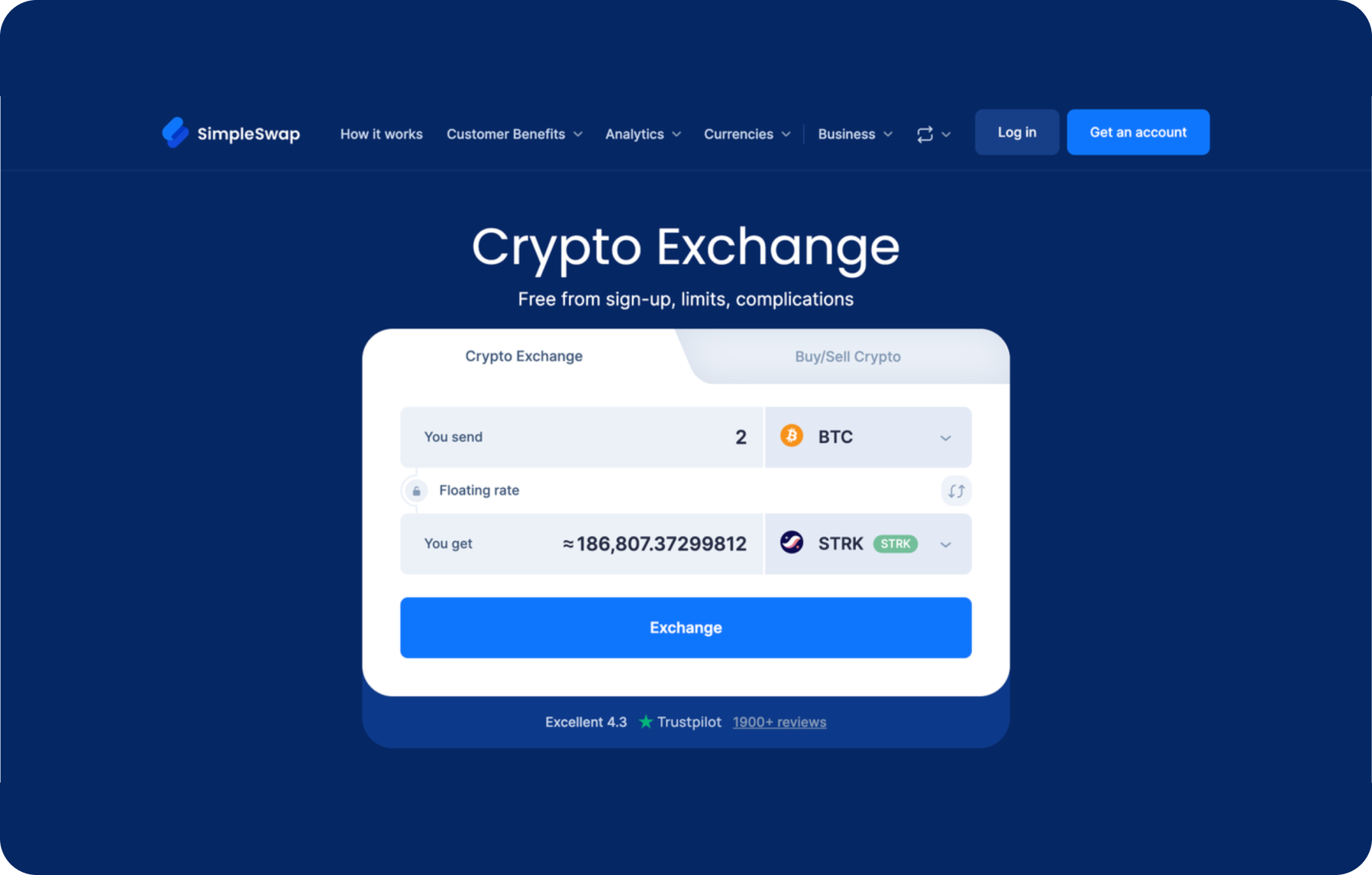

It plays a crucial role in the Starknet ecosystem by facilitating transactions, incentivizing network participants, and enabling DeFi activities on the platform. Users can get STRK on SimpleSwap.

What is Starknet

Starknet is a Layer 2 scaling solution for Ethereum, designed to enhance the network's scalability and reduce transaction fees.

Utilizing zk-rollup technology, Starknet processes transactions off-chain and bundles them into a single proof that is verified on the Ethereum mainnet. This approach significantly improves throughput and efficiency.

Key Features of Starknet

- Scalability

Starknet can process thousands of transactions per second, far exceeding the capabilities of the Ethereum mainnet.

- Low Fees

By aggregating transactions off-chain, Starknet drastically reduces transaction costs.

- Security

Starknet inherits the security of the Ethereum mainnet through zk-rollup technology, ensuring robust protection against malicious activities.

Prominent Projects in the Starknet Ecosystem

- Nostra

As discussed, Nostra is a leading liquidity protocol on Starknet, offering efficient lending and borrowing services.

- StarkEx

A scalability engine that powers various DeFi applications, enhancing their performance and reducing costs.

Lend & Borrow on Nostra

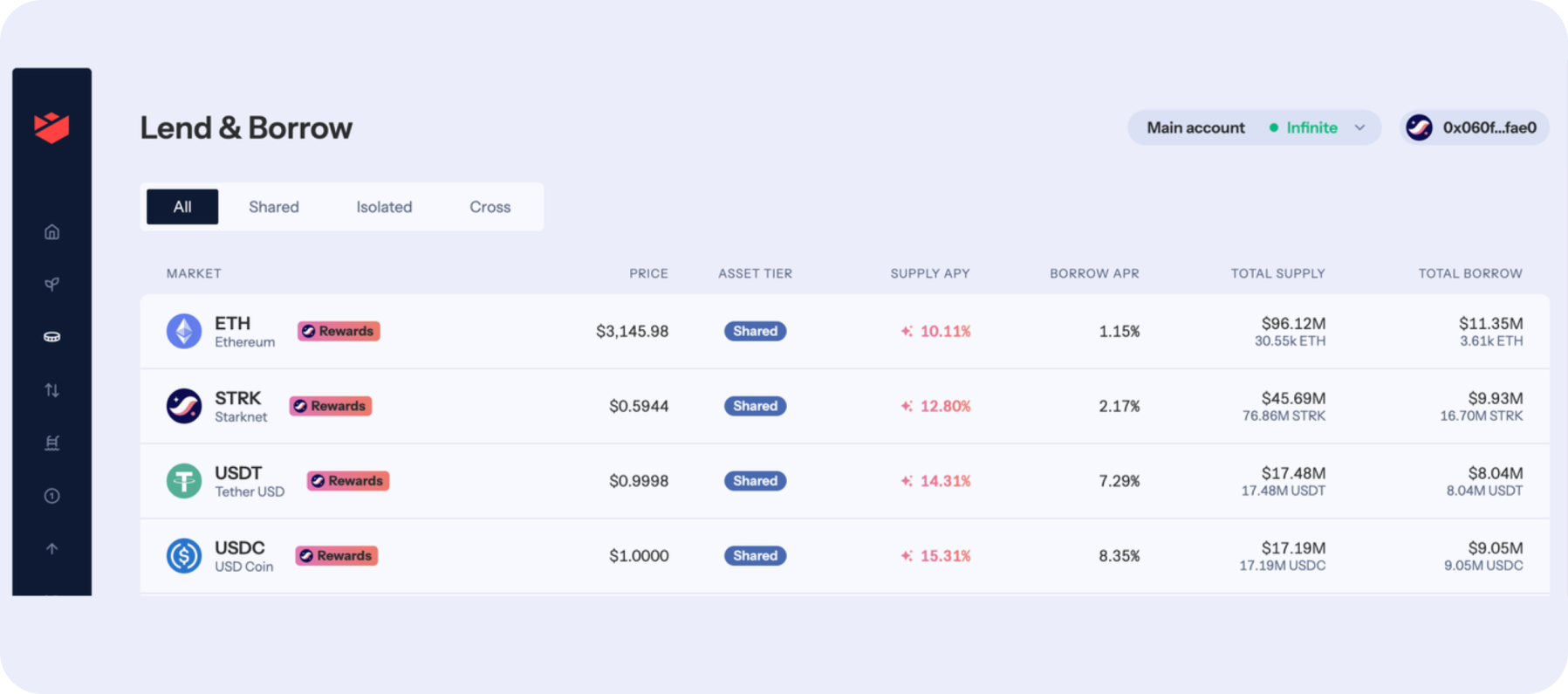

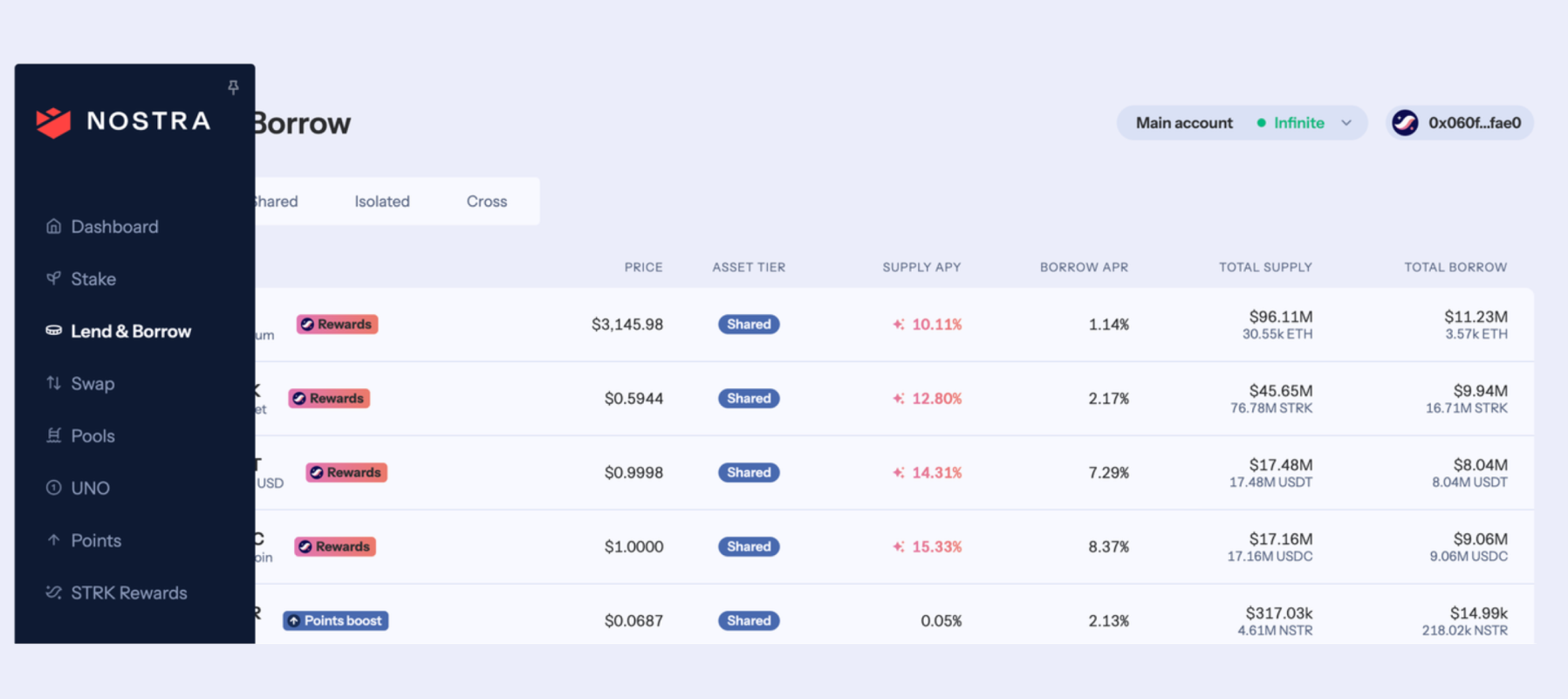

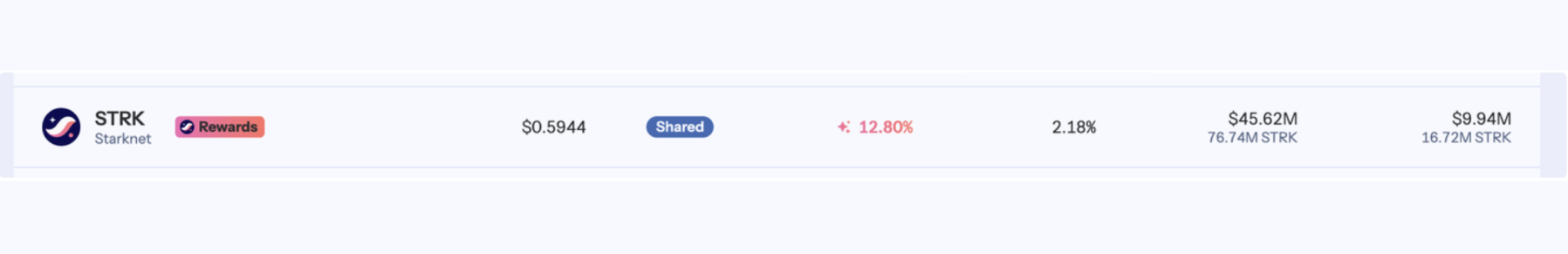

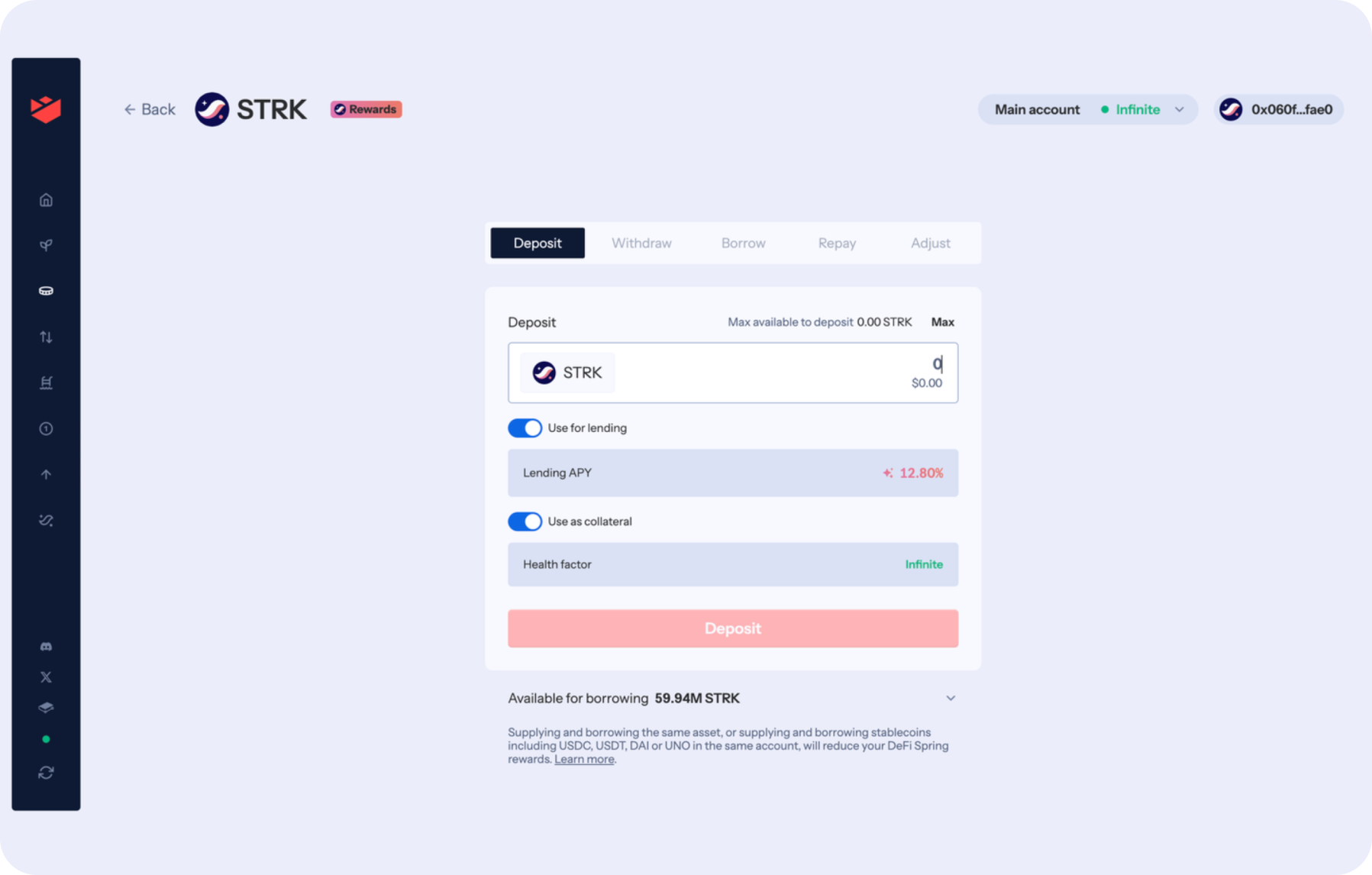

At present, Nostra offers users an attractive annual yield of 12.8% on deposits in the Stark asset. Below is a step-by-step guide to help you get started with lending on Nostra.

- Prepare Your Wallet and Connect to Starknet

If you don't already have a wallet that supports Starknet, create one. An example of a compatible wallet is the Braavos Wallet.

- Fund Your Wallet with Stark Coins

You can fund your wallet with Stark coins using a cross-chain exchange like SimpleSwap, which allows you to easily swap various cryptocurrencies.

- Access the Nostra Platform

Visit the Nostra website and click Launch App.

- Navigate to Lend & Borrow

On the Nostra homepage, select the Lend & Borrow tab.

- Select the STRK Asset

From the list of available assets, choose STRK and click on it.

- Enter the Deposit Amount

Enter the amount of STRK token you wish to deposit. Ensure that you have sufficient funds in your wallet to complete the transaction.

- Confirm the Deposit

Click the Deposit button and confirm the transaction in your wallet. Once the transaction is confirmed, the asset will be transferred to the Nostra platform and will start earning an annual yield of 12.8%.

Additionally, you can use your deposited STRK token as collateral to take out a loan in the Borrow section.

Summary

Nostra is revolutionizing the DeFi landscape on Starknet by offering a robust liquidity protocol for lending, borrowing, and exchanging crypto assets. Its integration with the Starknet ecosystem ensures low transaction fees and high efficiency, making it an attractive platform for users.

The introduction of liquid staking on Nostra further enhances capital efficiency, allowing users to earn staking rewards while maintaining liquidity. The Starknet ecosystem, with its advanced zk-rollup technology, provides a scalable and secure environment for Nostra and other DeFi projects.

As the DeFi space continues to evolve, Nostra and the Starknet ecosystem are well-positioned to drive innovation and provide users with cutting-edge financial services. However, it's crucial for users to engage responsibly, adhering to legal and ethical standards to ensure sustainable growth and development in the cryptocurrency industry.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.