BTC Accumulation Strategy on AAVE

Key Insights

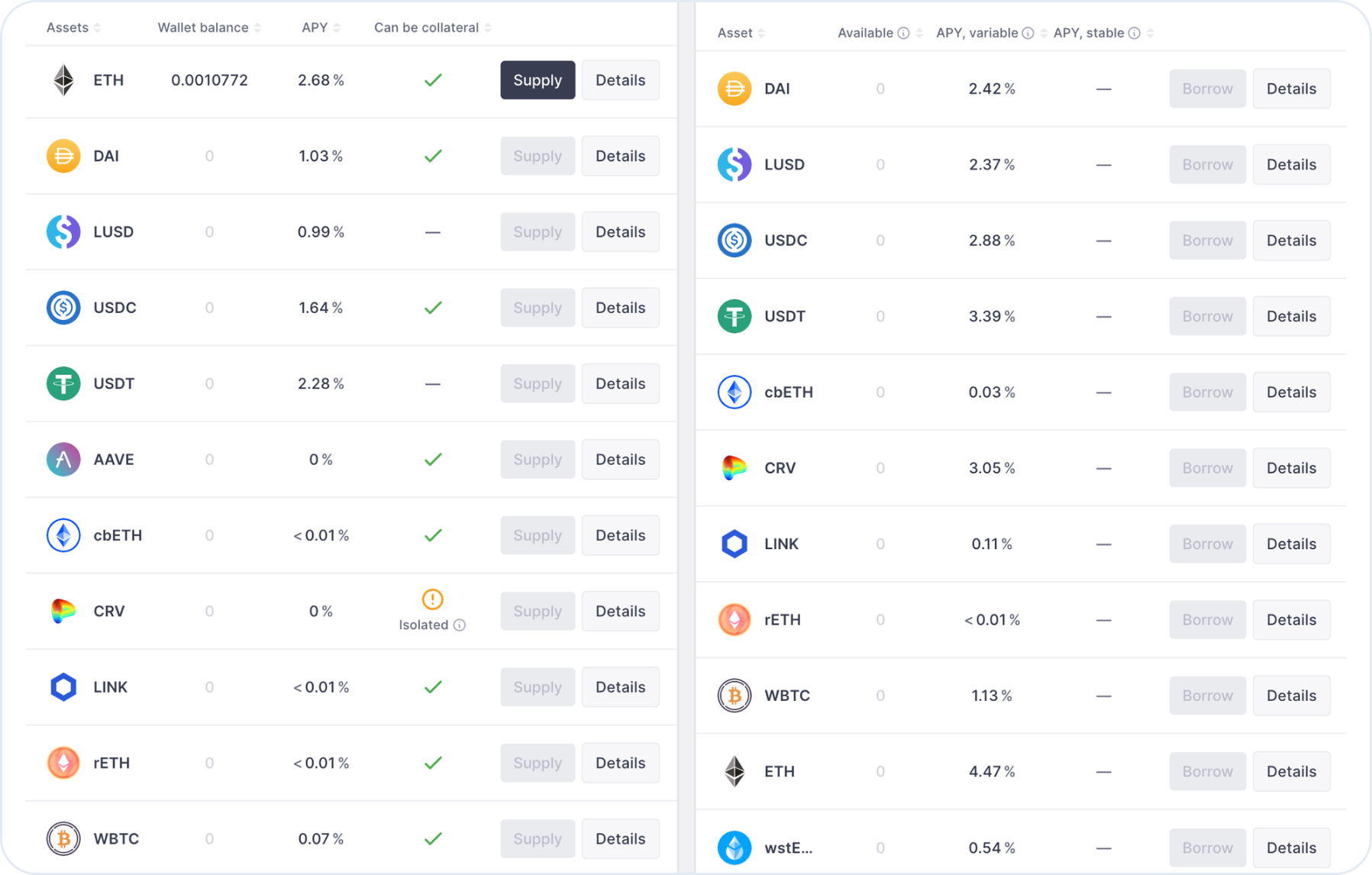

- AAVE allows using BTC as collateral to take loans or engage in other operations by first converting it to WBTC.

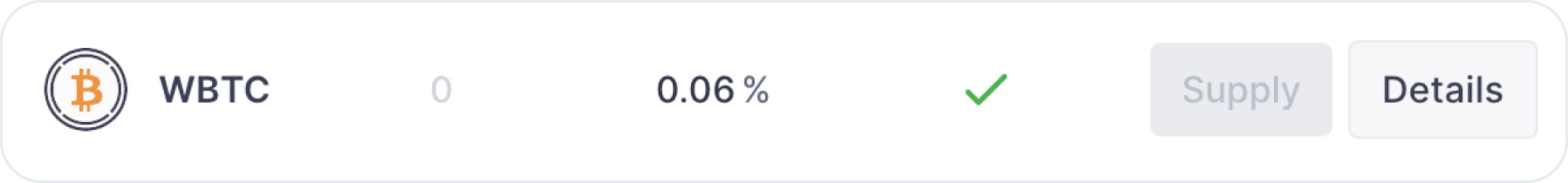

- Once WBTC is transferred to AAVE, it can be used as collateral with a current yield of 0.06%, leveraging 50% of its value.

- As BTC rises over time, the collateral value increases, offsetting the cost of the initial purchase and enabling accumulation.

This strategy shows how to accumulate crypto assets with BTC, employing the AAVE lending protocol.

What Is AAVE

AAVE is a decentralized, non-custodial liquidity market protocol, which users can participate in by either supplying or borrowing. Suppliers provide AAVE liquidity to earn a passive income, while borrowers can borrow in an over-collateralised (perpetual) or under-collateralised (one-block liquidity) manner.

AAVE stands as a decentralized lending platform that operates across networks such as Ethereum, Arbitrum, Avalanche, Fantom, Harmony, Optimism, and Polygon, and facilitates the utilization of multiple coins from these networks as collateral.

WBTC on Ethereum Chain Strategy Illustration

Let's delve into the strategy using WBTC on the Ethereum chain as an example.

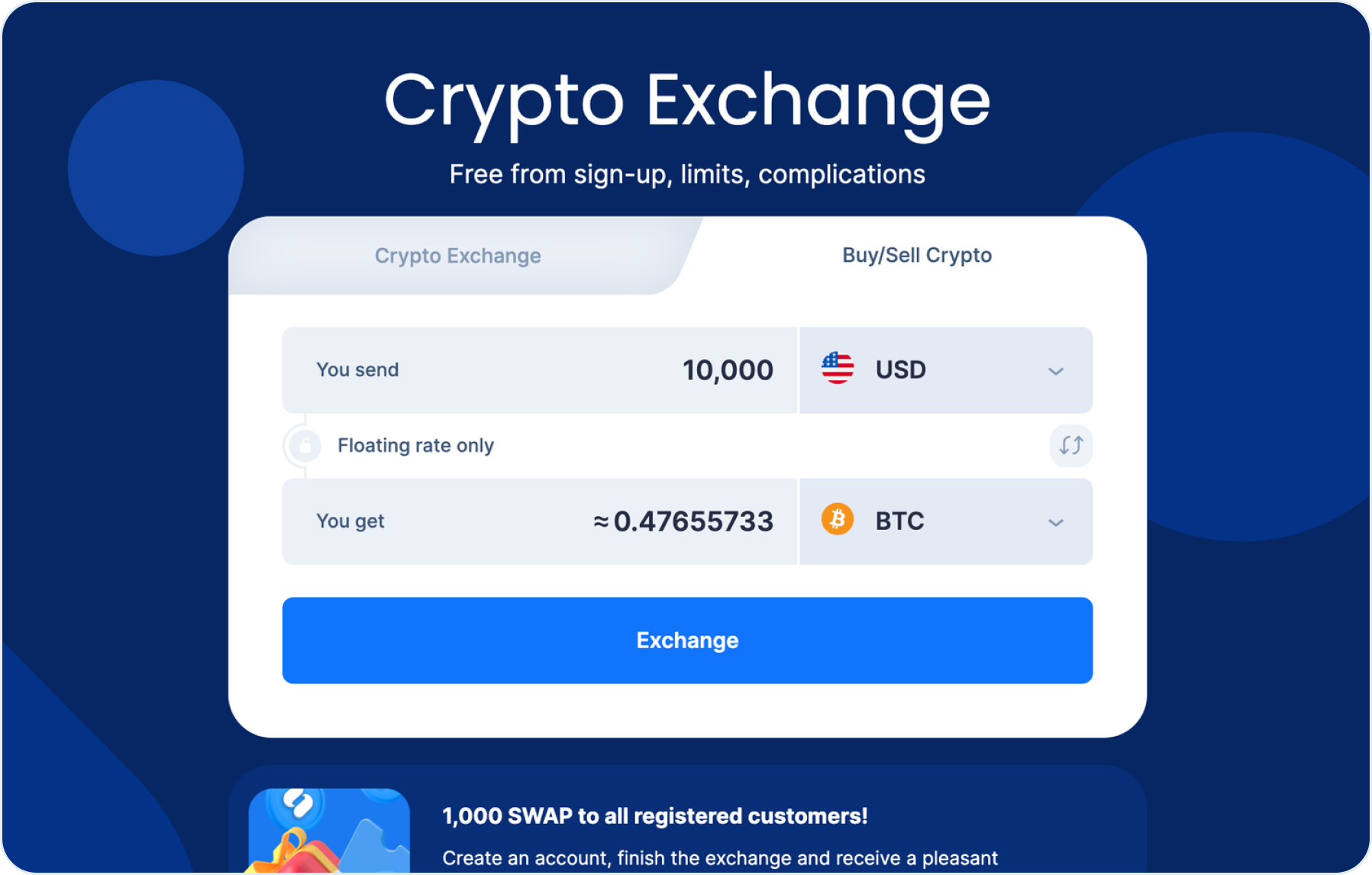

- Purchase Bitcoin

Use SimpleSwap to get BTC for crypto or fiat currencies.

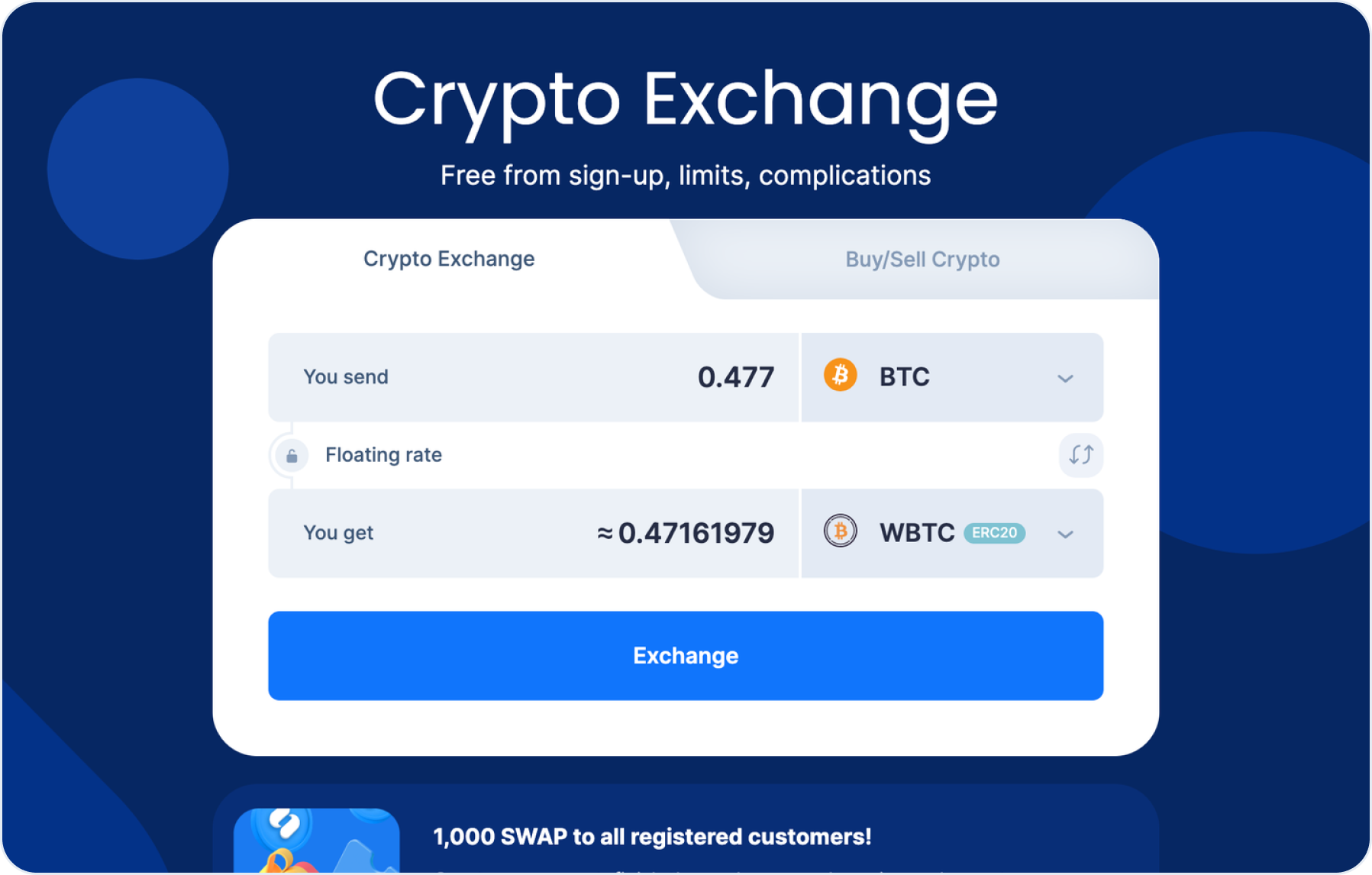

- Convert BTC to WBTC

Given that AAVE doesn't directly support BTC, you'll need to exchange BTC for Wrapped Bitcoin, or WBTC. WBTC is a token pegged to BTC's value at a 1:1 ratio, serving as collateral within the AAVE protocol. To convert Bitcoin to WBTC (an ERC-20 token), you can use SimpleSwap.

- Transfer WBTC to your Ethereum wallet

You can utilize any Ethereum wallet compatible with ERC-20 tokens for this purpose.

- Transfer WBTC from the Ethereum wallet to AAVE

Proceed to transfer it to the AAVE protocol’s website.

- Leverage the collateral

Upon successfully transferring WBTC to the AAVE protocol, you can employ it as collateral to secure loans or engage in various operations within the AAVE ecosystem. The current yield on the collateral position stands at 0.06%, subject to adjustments based on market dynamics.

BTC-AAVE Crypto Strategy Implementation

Reflecting on the past decade, Bitcoin has exhibited an annual yield of 52.09%.

Say you’ve been saving money for a serious purchase. This allocation can be directed towards purchasing BTC, subsequently transferring it to the AAVE protocol, and utilizing the acquired BTC as collateral to secure a loan denominated in USDT at an interest rate of 3.11%.

This loan leverages 50% of the collateral value. Concurrently, as your primary asset, BTC, continues rising in value, it progressively amplifies the collateral amount. This mitigates the financial impact of your initial purchase over time.

Summary

We looked into how goes the crypto assets' accumulation and growth. As an example, we provided a detailed strategy that uses WBTC on Ethereum chain. In this article we showed how it is possible to accumulate funds on DeFi. Crypto strategies can be used to diversify investment plans on top of investments in traditional financial markets.

Users can get all coins mentioned in this article on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.