AAVE Depositing & Lending Instruction

Key Insights

- AAVE enables earning interest on crypto deposits and borrowing against collateral unlocking liquidity.

- To use AAVE, connect a crypto wallet, select the desired network, and deposit assets to earn interest or borrow against collateral.

- Control over deposits, loans, and transactions is maintained through the user's wallet and the AAVE dashboard.

An overview of AAVE and an instruction on how to earn interest on your crypto deposits and take out loans against the deposits.

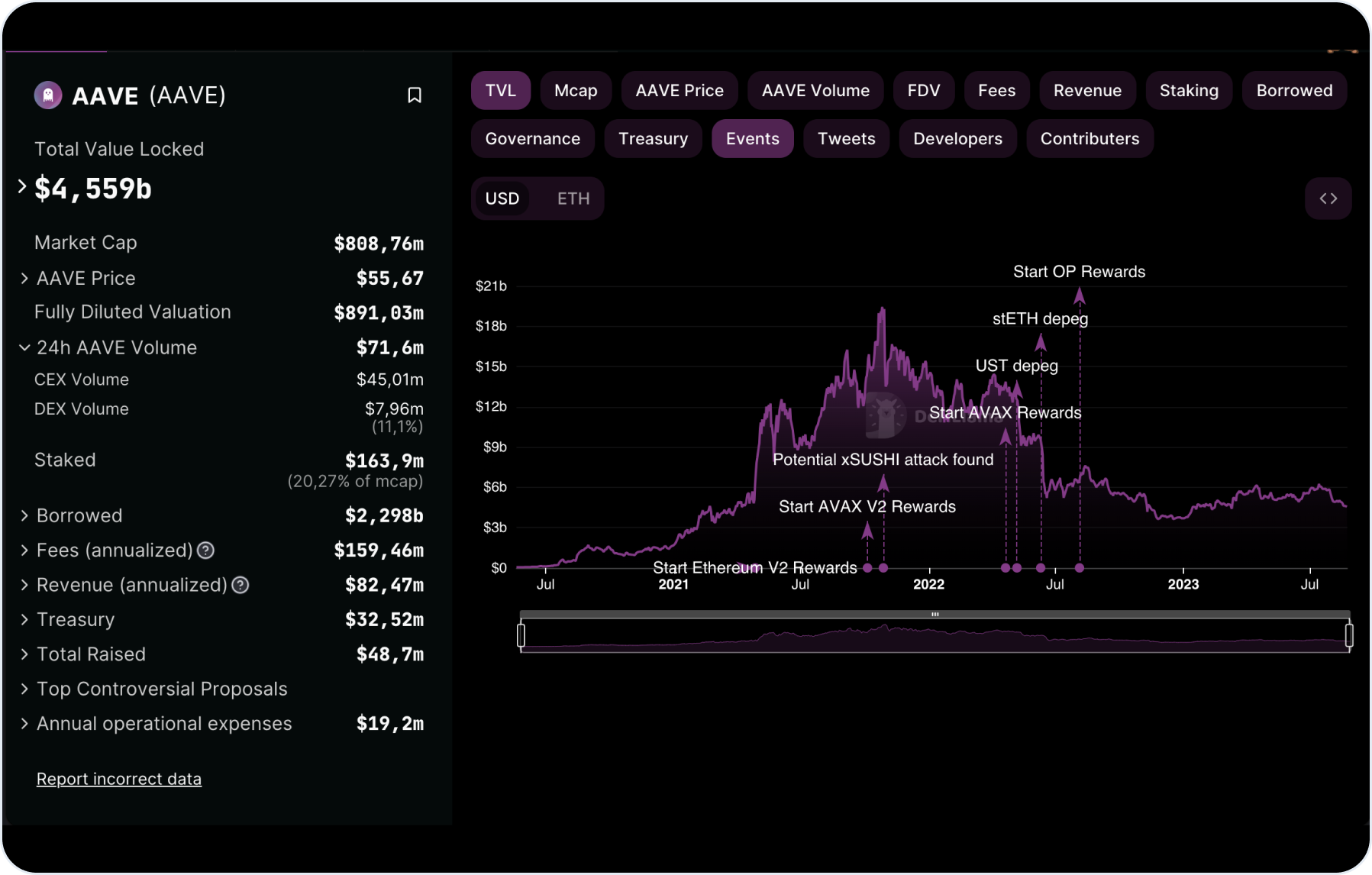

What Is AAVE

AAVE crypto is a decentralized, non-custodial liquidity market protocol that enables users to participate by either supplying or borrowing.

Suppliers provide AAVE liquidity with the objective of generating passive income, while borrowers have the option of borrowing in either an over-collateralized (perpetual) or under-collateralized (one-block liquidity) manner.

AAVE operates across a number of networks, including Ethereum, Arbitrum, Avalanche, Fantom, Harmony, Optimism, and Polygon. It facilitates the utilization of multiple coins from these networks as collateral.

The Aave crypto protocol facilitates decentralized lending and borrowing through the use of pooled collateral assets andtokenized credit. Its smart contracts ensure transparent connections between lenders and borrowers, eliminating the need for intermediaries.

How to Use AAVE: An Instruction

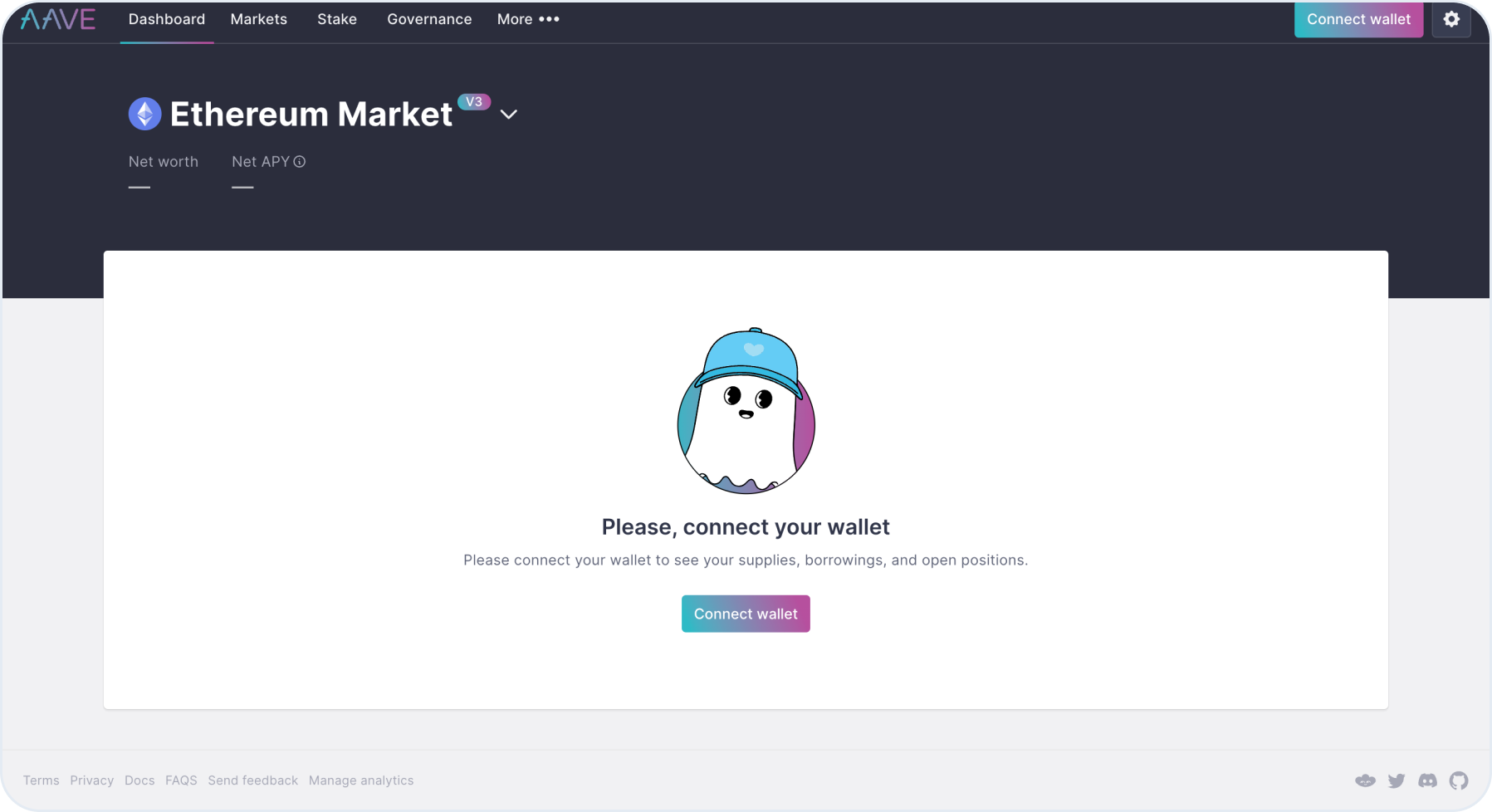

- Go to AAVE

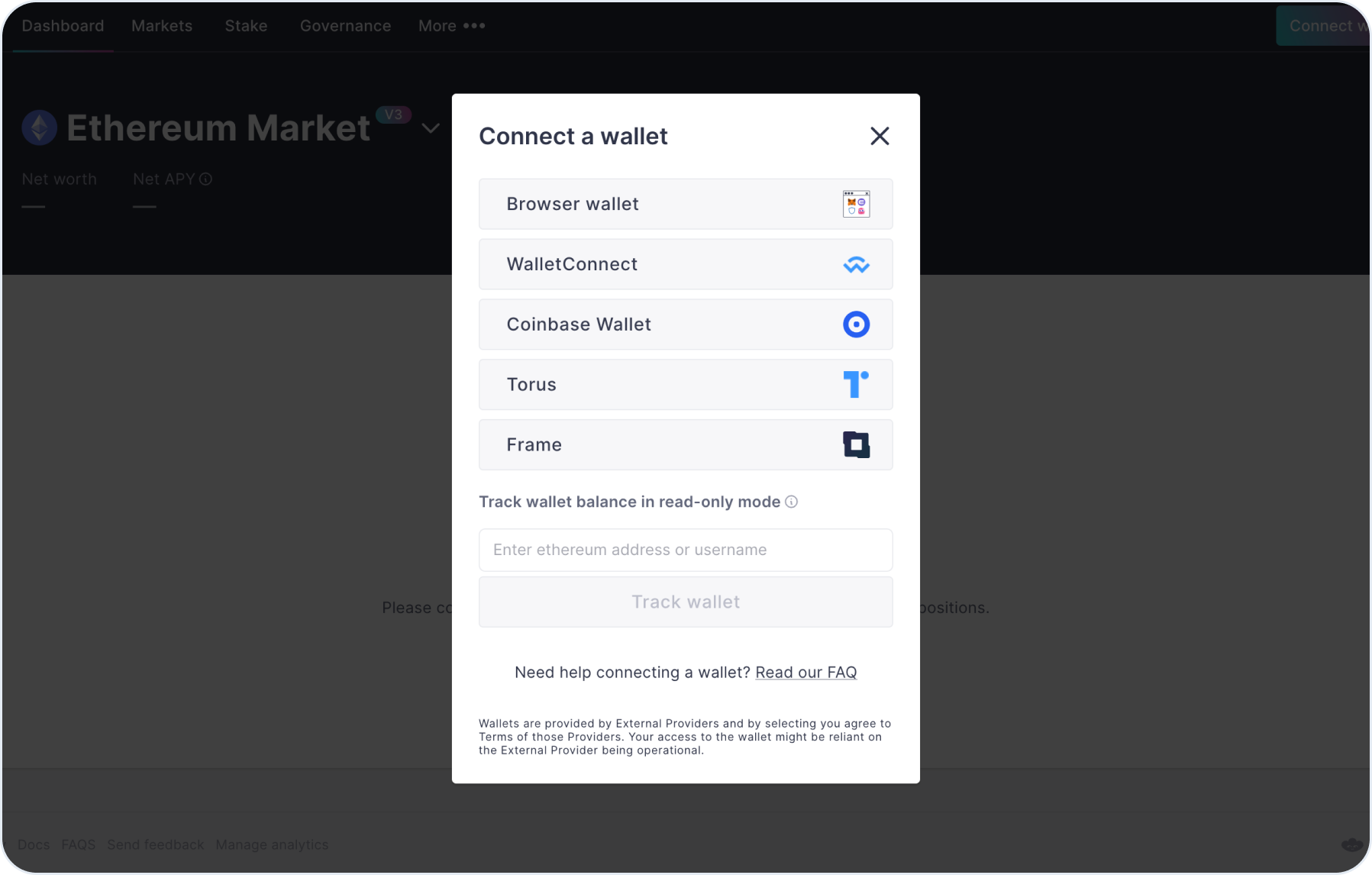

Connect your wallet

Click Connect Wallet

Select your existing wallet from the list of supported wallets. Grant AAVE access to it.

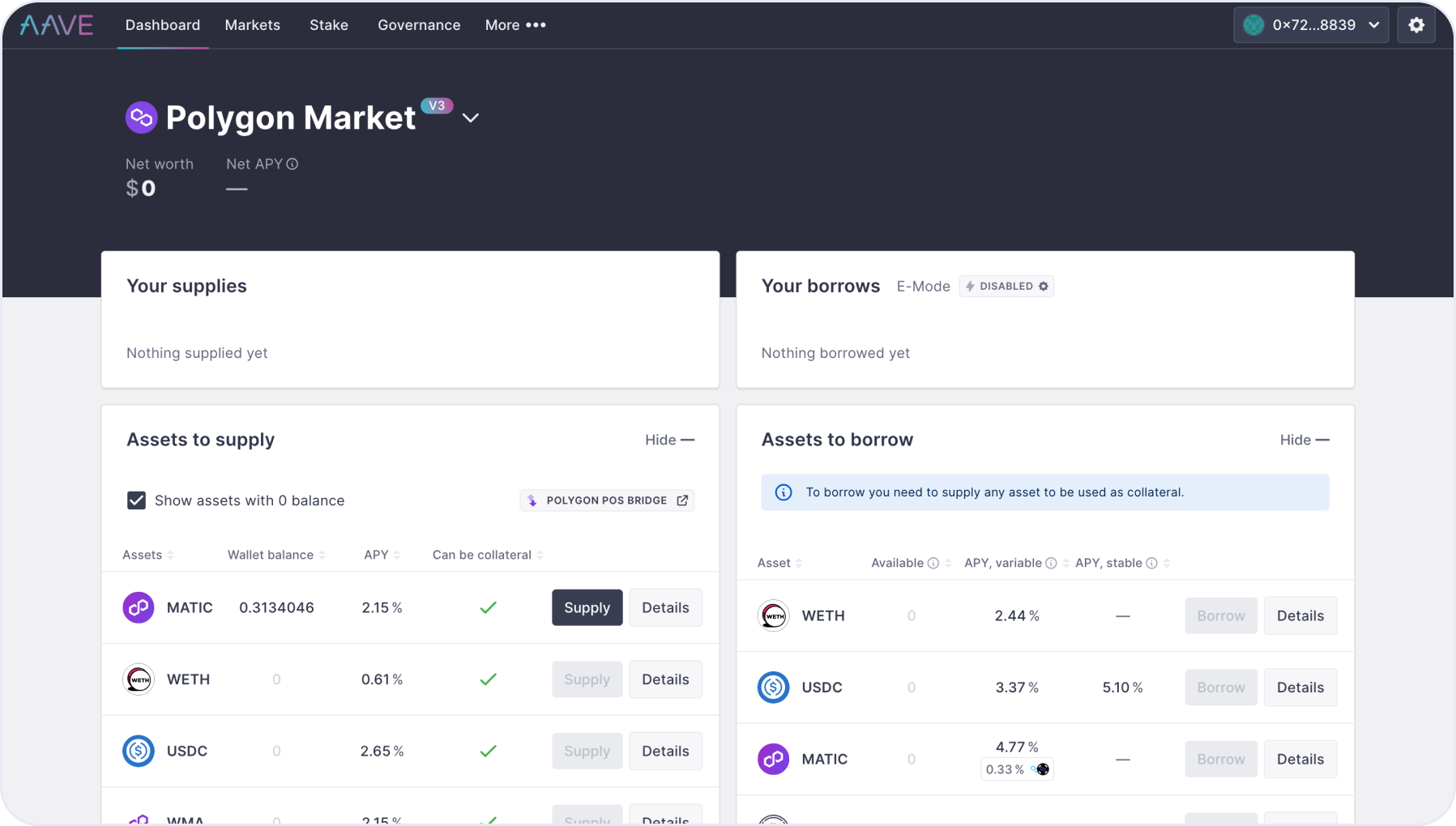

- Switch to the desired network

In our case, it’s Avalanche. Ensure that your AAVE wallet is configured to work with the Avalanche network. If you have multiple networks, switch to the Avalanche network.

- Deposit or borrow on Aave

Now you are connected to Aave on the Avalanche network and ready to get started.

- Deposit funds

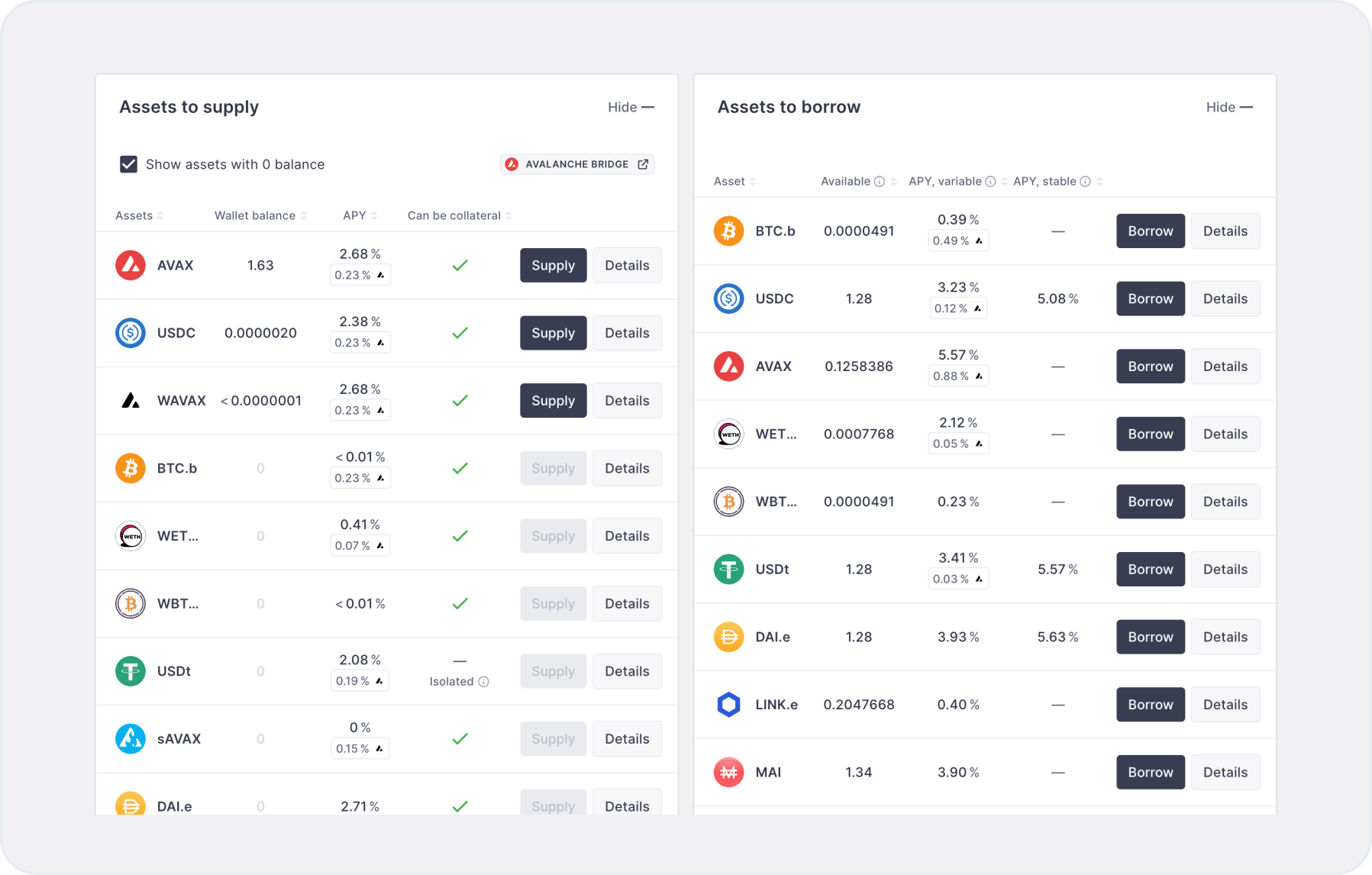

To earn interest on your funds, select the Assets to supply section and choose the asset you want to deposit. Specify the amount and click Supply.

Follow your wallet's instructions to complete the transaction.

- Request a loan

If you want to take out a loan against your crypto collateral, choose Assets to borrow. Select the asset you want to use as collateral and specify the loan amount. Click Borrow and follow your wallet's instructions to complete the transaction.

- Track your transactions

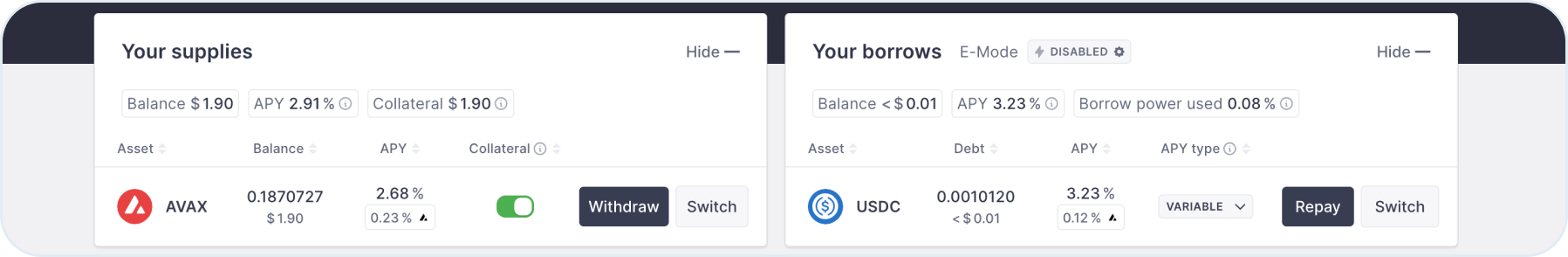

After completing a deposit or loan request, you can track your transactions on AAVE. Information about your deposits and loans will be available on the platform under the Dashboard section.

- Withdraw funds

When you decide to withdraw your funds or repay the loan, return to AAVE and select the corresponding operation. Follow your wallet's instructions to complete the transaction.

Save this instruction for later or try it out with the BTC accumulation strategy or AVAX yield farming.

Users can get all coins mentioned in this article on SimpleSwap.

Summary

AAVE is a decentralized and non-custodial liquidity market protocol that lets users supply or borrow, providing uninterrupted connection between lenders and borrowers.

The instruction in this article can help you implement any specific strategy on AAVE.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.