DeFi APY on Nanoly

Key Insights

- Nanoly simplifies yield optimization in DeFi by aggregating opportunities and insights across fragmented protocols and chains.

- Customizable filters empower informed decision making amidst shifting market dynamics affecting DeFi yields.

- By compiling data, Nanoly enables both novice and experienced users to navigate the complex DeFi landscape effectively.

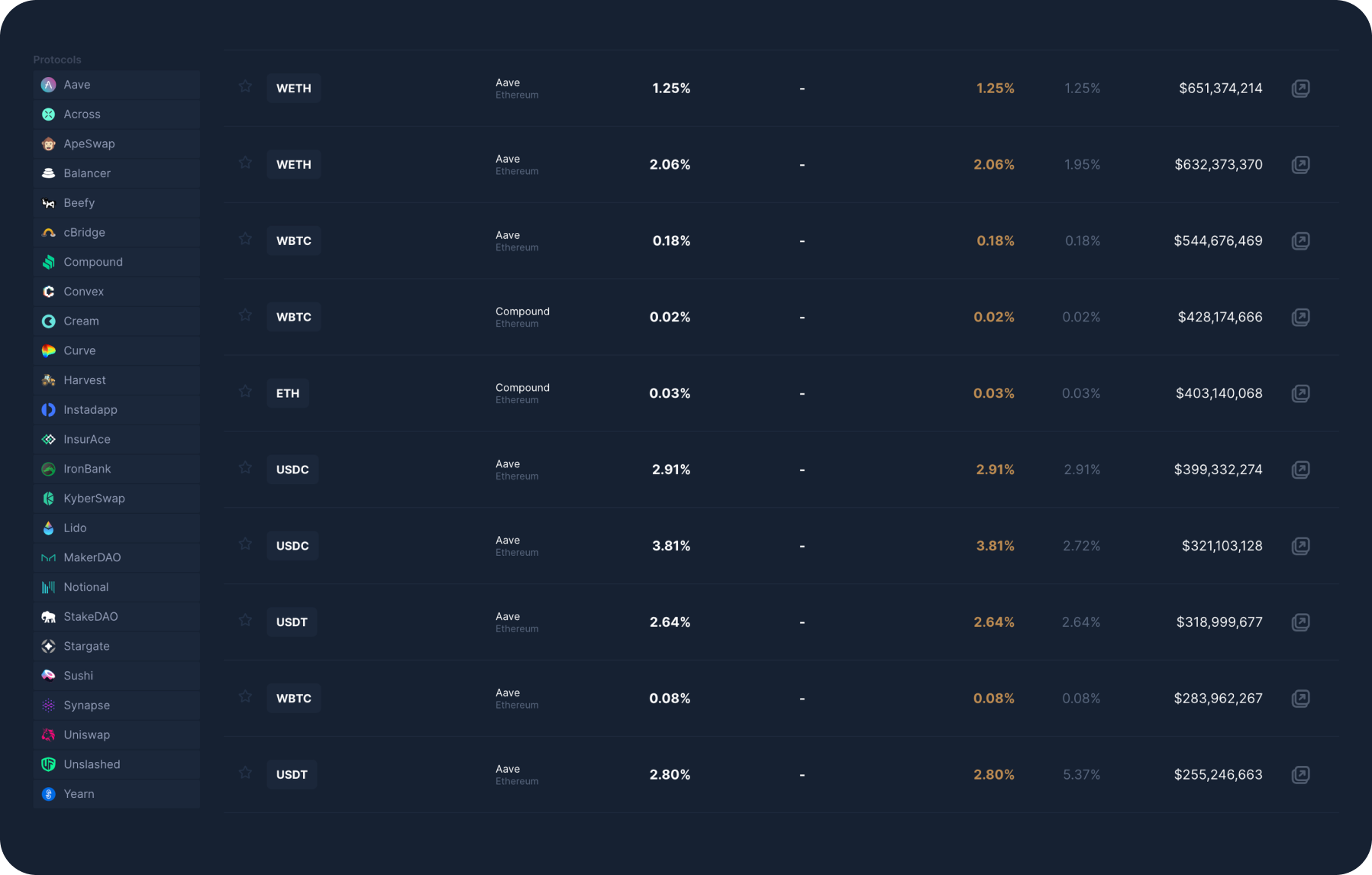

Nanoly is a platform that gathers pieces of the DeFi ecosystem and gives information about the highest yields and interest rates. This platform provides a simple and intuitive interface for navigation and helps you quickly find the best crypto APY.

On Nanoly, users can easily find information about the different ways to make money in DeFi farming, including deposits, staking, and liquidity provision. The platform also shows the importance of security by providing access to audited projects and educational resources.

Nanoly is becoming an important tool for those looking for optimal opportunities in the world of cryptocurrencies, regardless of experience level. It provides easier access to this exciting ecosystem and helps users make informed investment decisions.

Influencing Factors of DeFi Yields

DeFi yields can vary significantly and are affected by many factors. Some of the key factors affecting returns include:

Market volatility

Crypto markets are very volatile and asset prices can change in short order. This affects the returns of those strategies that depend on price movements.

Liquidity condition

DeFi yields in liquid pools can fluctuate depending on the amount of funds made available in the pools and the demand for trading.

You can also check out our guide, which provides an overview of the practice of putting crypto assets into debt and explains what is yield farming and how to generate profitability by providing liquidity to automated market makers such as Uniswap V3.

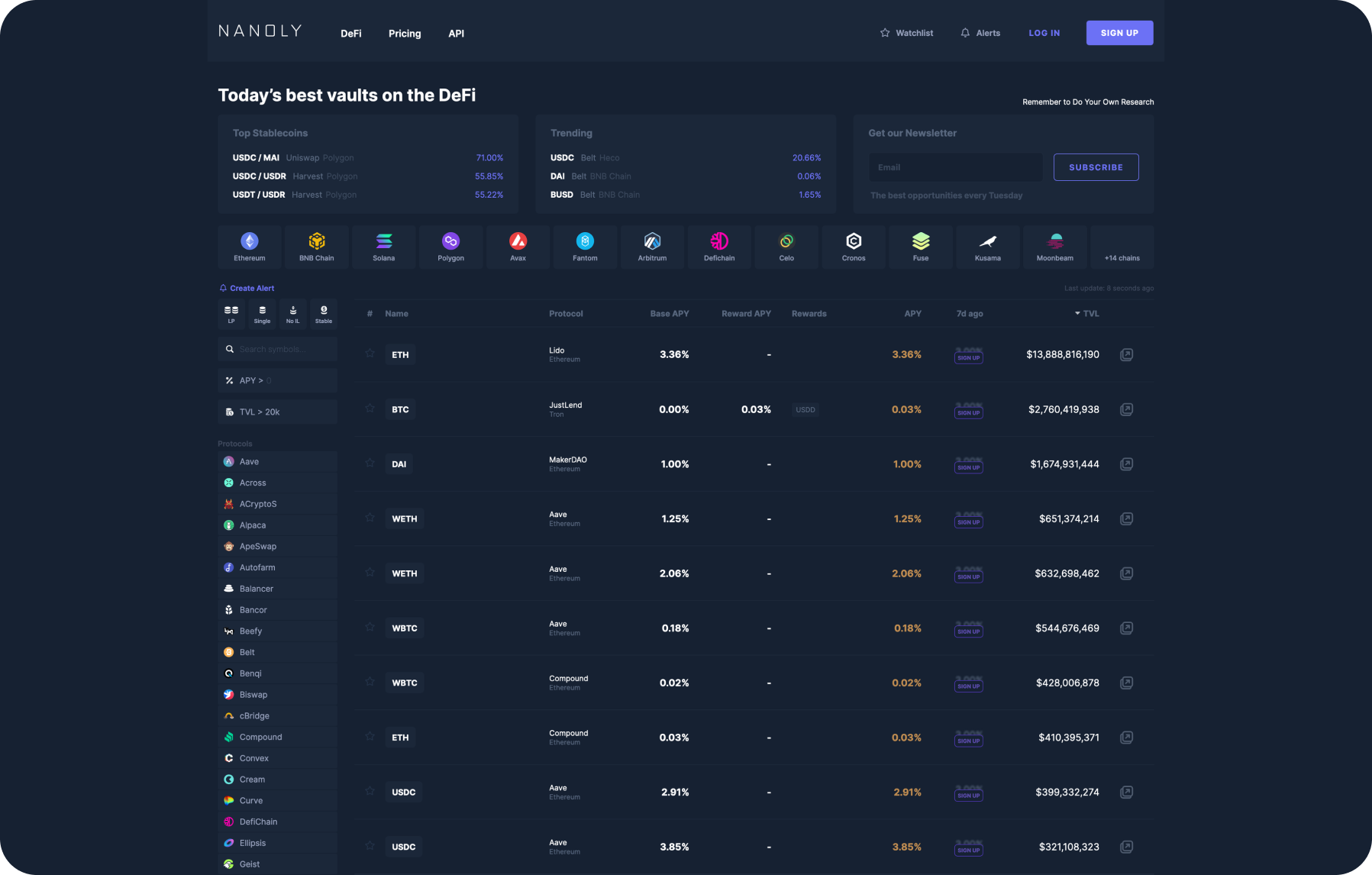

How to Use Nanoly

- Go to the Today's best vaults on the DeFi section

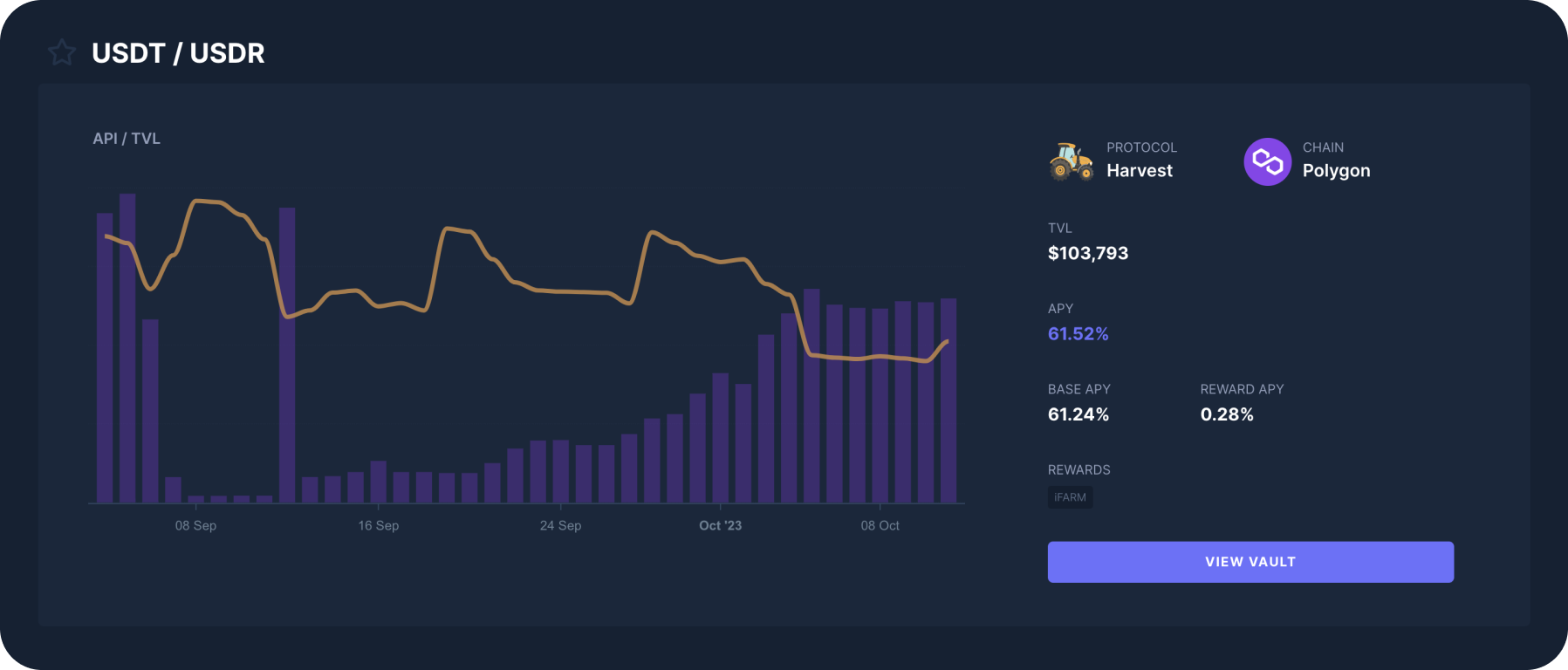

It shows the maximum DeFi yields available today for the stablecoins on a particular blockchain network and project. This section also gives you the option to jump to a brief overview of a pair of stablecoins.

Here you can quickly assess which options currently offer the best vaults opportunity to maximize your yield in stablecoins. Users can get stablecoins for crypto or fiat on SimpleSwap.

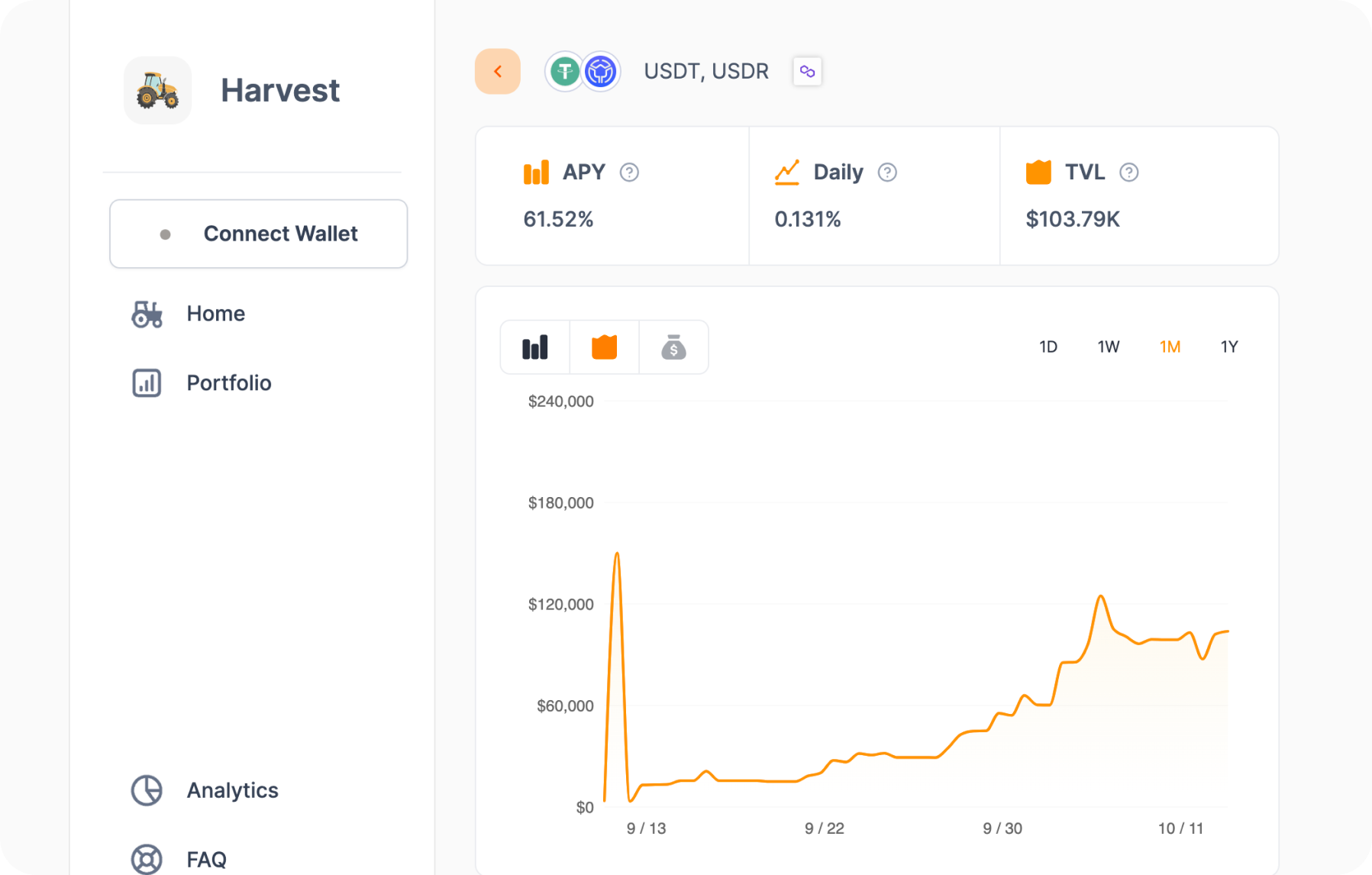

- Click View Vaulet

This button will take us to the project website and pool page. In this case, it will be the Harvest protocol on the Polygon network. Certain projects in this space facilitate DeFi farming through liquidity provision.

Nanoly Filters

On the main page of the Nanoly project, you can filter information by various parameters:

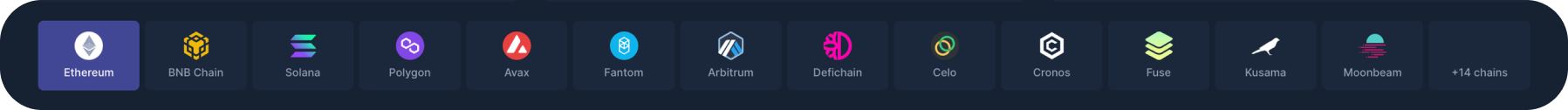

Chains (blockchains)

You can select specific blockchain networks to see information about the DeFi yields available on those networks.

- Protocols

You can also filter information on different DeFi protocols to find details about specific protocols and their capabilities.

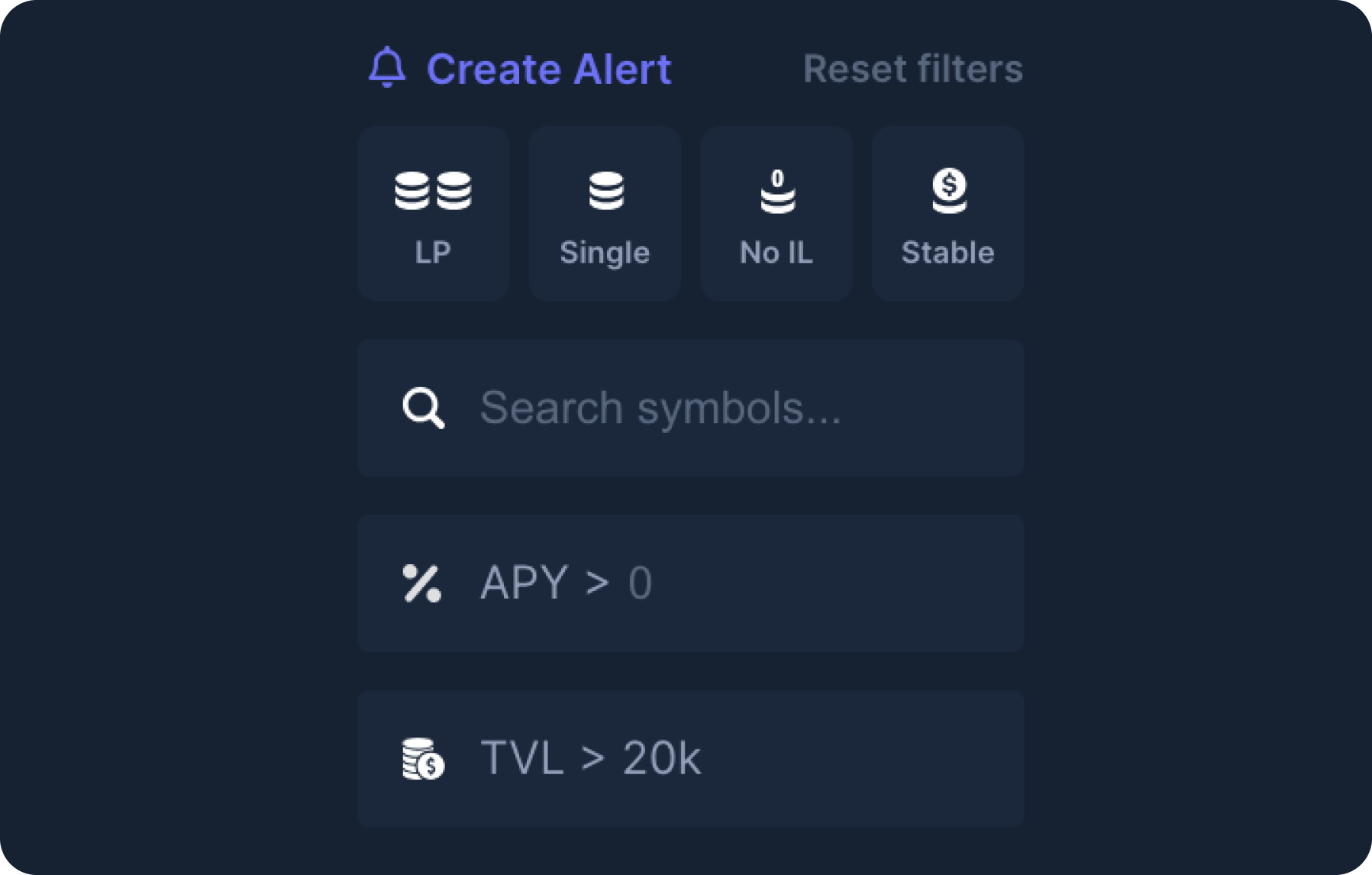

This section also allows you to apply filters to more accurately search for information. You can filter results by specific coin, DeFI APY interest rate, total blocked funds TVL and specific earning methods such as liquidity pools, staking, no impermanent loss and stablecoins. This makes finding the top opportunities and the best crypto APY more convenient and accurate.

The guide above elucidates leveraging Nanoly's platform advantages and functionalities within financial strategies and APY vision, empowering users with tools and data for informed DeFi engagement.

Users can get all coins mentioned in this article on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.