Unipilot Automated Liquidity Management

Key Insights

- Unipilot's capital allocation algorithms enable dynamic rebalancing of liquidity ranges based on price fluctuations, ensuring funds remain in active bands.

- The platform's automated compounding of earned fees back into liquidity pools boosts capital efficiency and maximizes liquidity providers' revenue.

- Unipilot makes liquidity management easy by minimizing impermanent loss and reinvesting accumulated fees, abstracting complexity for liquidity providers.

What Is Unipilot

Unipilot is a protocol designed to automate and optimize liquidity management on decentralized exchanges, in particular Uniswap V3. Its goal is to allocate capital among the different Uniswap liquidity pools to maximize commission revenues for liquidity providers.

The Unipilot system is designed to optimize the liquidity of the Uniswap v3 protocol by maintaining the price at or near the current trading value. This approach is intended to maximize revenue and minimize the cost of gas. In return for their investment in the Unipilot token (PILOT), holders receive a share of the protocol's revenue, amounting to 40% of the total.

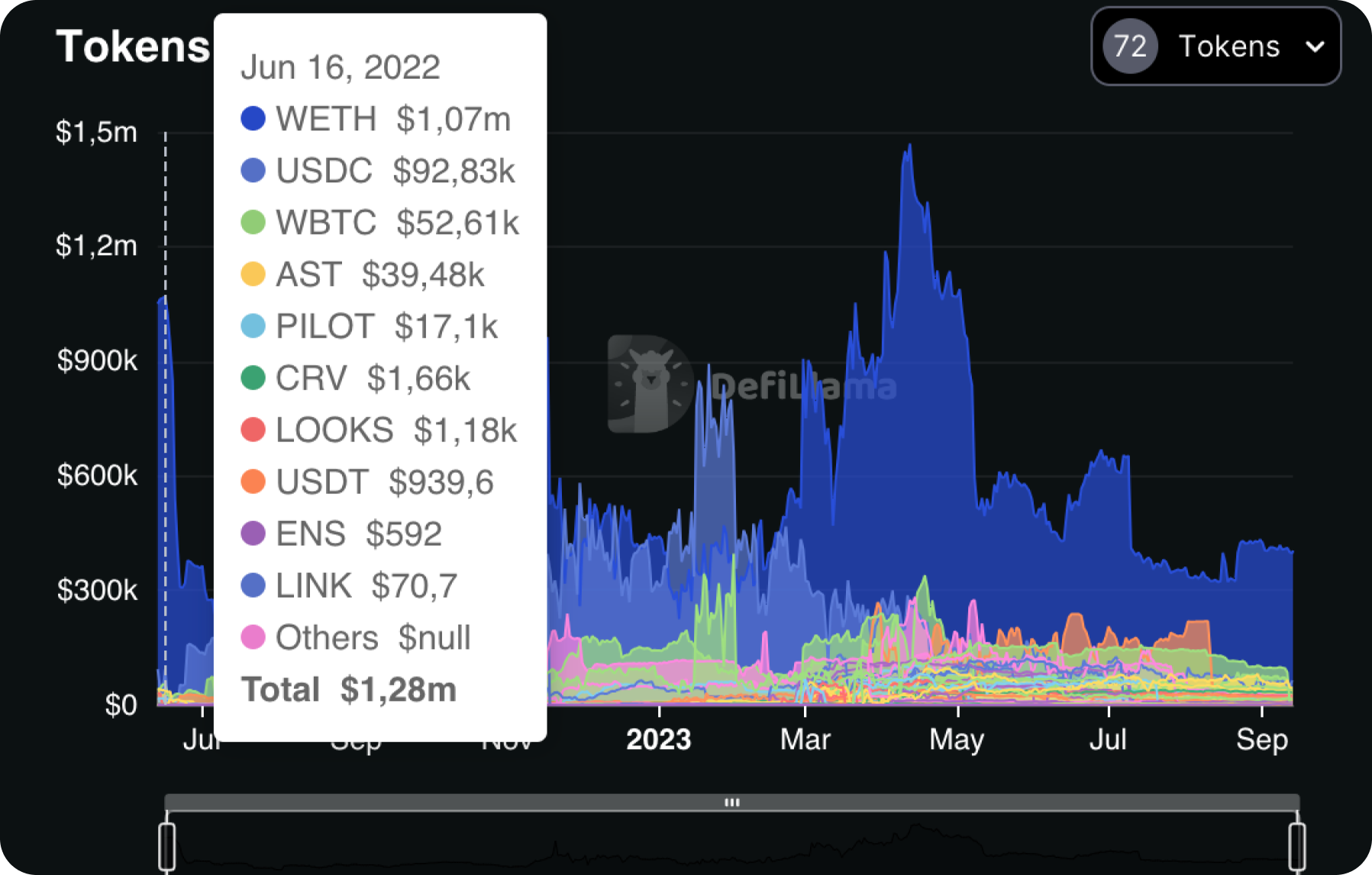

From the beginning of January to April, amid the general growth of the crypto market, interest in the Unipilot crypto protocol was also growing. The maximum amount of blocked funds (TVL) reached more than $3.6 million.

However, based on the general market correction, interest in the protocol decreased.

Unipilot Functionality

The protocol solves the liquidity concentration problem by ensuring continuous capital participation in active price bands, and automatically balances liquidity in line with changes in market prices. Unipilot also covers the transaction costs associated with liquidity adjustment operations.

The Unipilot crypto protocol charges a fee of 10% of the revenue generated on Unipilot. This revenue is used to pay staking fees and to cover the protocol's transaction costs.

The platform is backed by Web3 R&D Company Xord and audited by A Unified Front for Web3.0 Security BlockApex.

Unipilot’s roadmap for Q2 2023 includes deploying on BNB Chain, expanding to QuickSwap V3 DEX, launching on Dogechain, building partnerships, and improving marketing schemes.

In Q3 2023, the platform aims to expand to more DEXs and launch on additional chains.

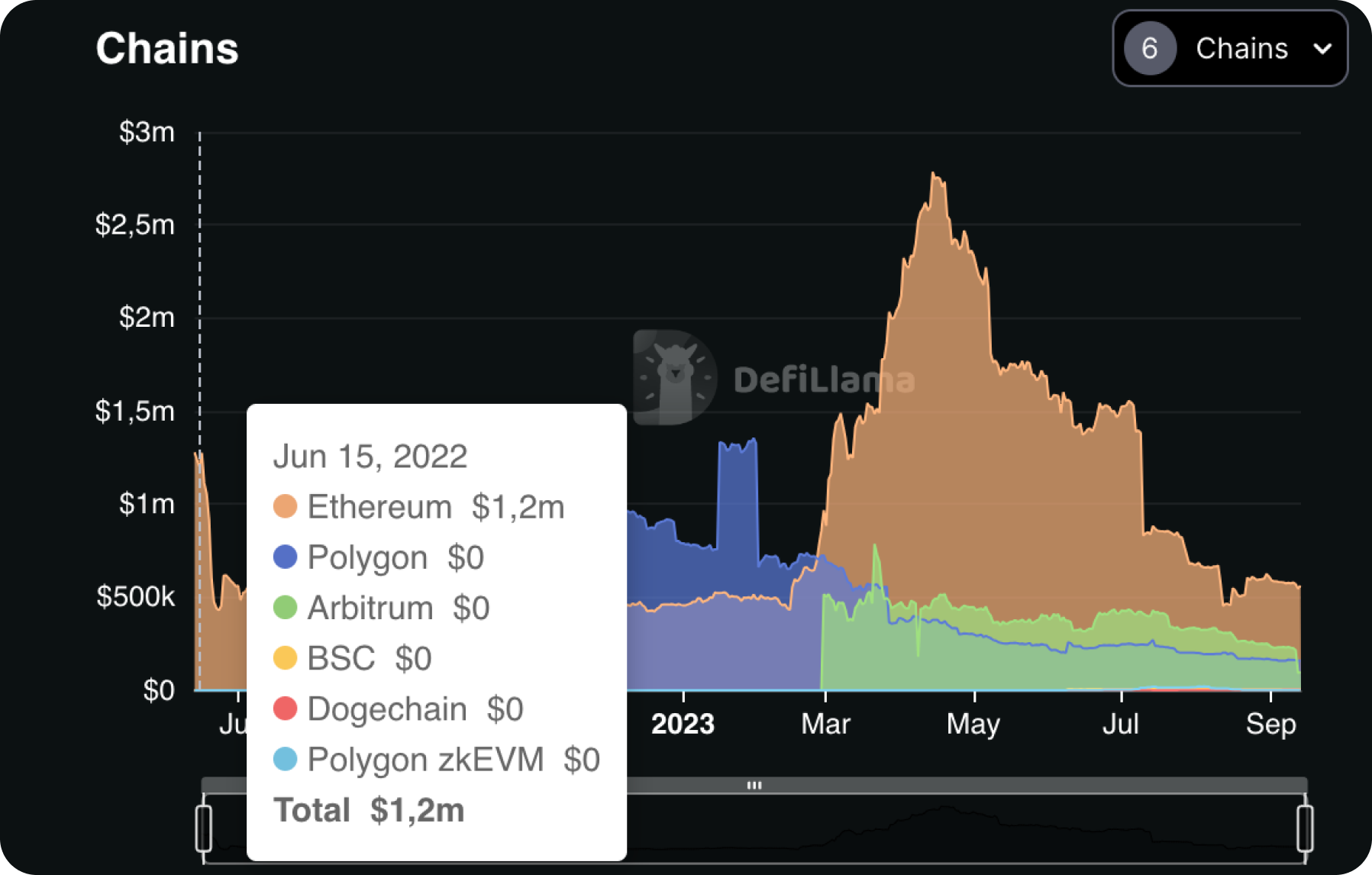

Unipilot Chains

Unipilot supports several networks including Ethereum, Polygon, Polygon zkEVM, Arbitrum, BNB Chain, and Dogechain. It also supports exchanges such as Uniswap V3 and QuickSwap V3.

The most popular network used by users is Ethereum, as Unipilot takes care of transaction fees when changing the range, as well as collecting and reinvesting accumulated commissions into the pool. Based on this, the popularity of Ethereum in this context has a logical explanation.

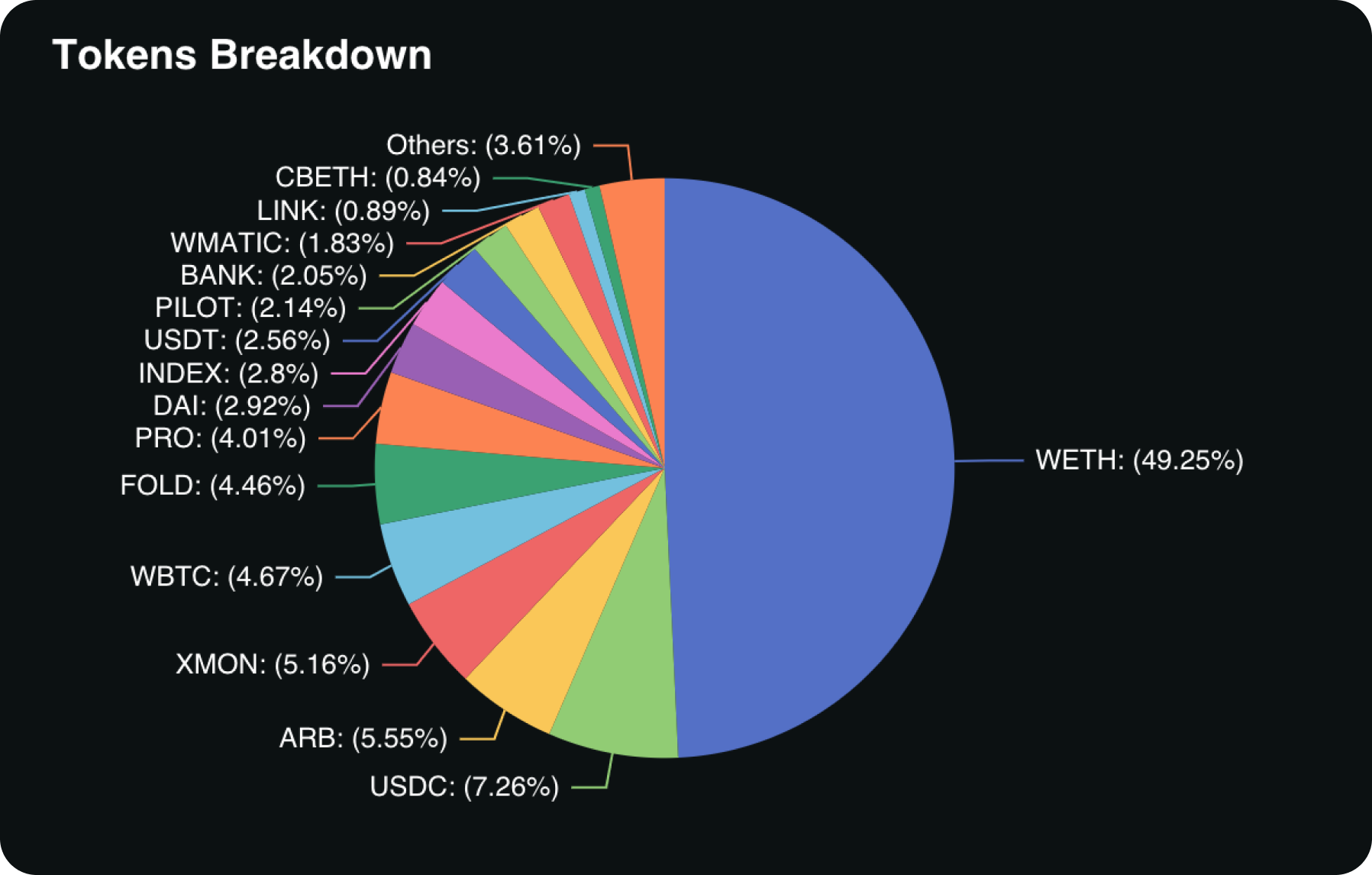

Unipilot Token Breakdown

Below is the distribution of assets used as liquidity on decentralized exchanges connected to Unipilot.

The most popular paired coin is the wrapped Ethereum (WETH), the second most popular is the USDC stablecoin.

WETH has been a leader among the assets used in the protocol for a long time.

How to Use Unipilot

Below is an instruction on how to interact with the Unipilot platform using the example of the USDC/WETH pool on the Polygon network.

- Install a wallet

If you don't have a wallet for the Polygon network, install MetaMask and create a wallet.

- Get the required crypto

To interact with the platform, make sure you have enough Ethereum (ETH) and USDC or other tokens you may need.

- Get connected to the platform

Open your MetaMask wallet and switch to the Polygon network. To do this, select the Polygon Mainnet network in MetaMask or add it if it hasn't been added yet.

- Switch to Unipilot

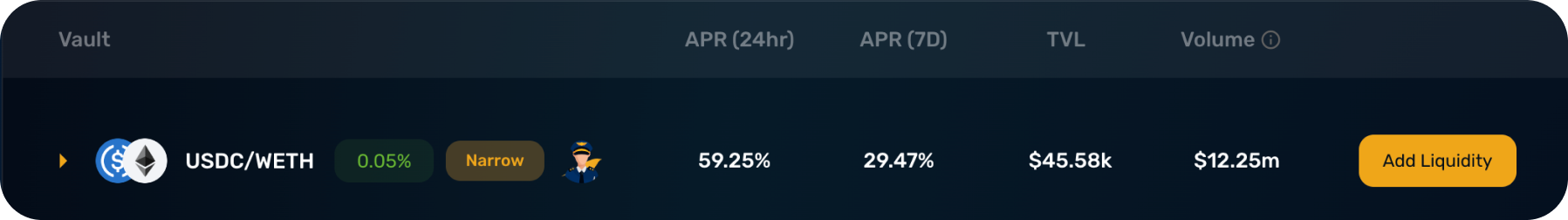

Select the USDC/WETH pool as the most profitable one for you. Add liquidity clicking Add Liqudity.

Next, specify the amount of USDC and WETH you want to add to the pool and follow the instructions on the platform to complete this operation.

- Liquidity Management

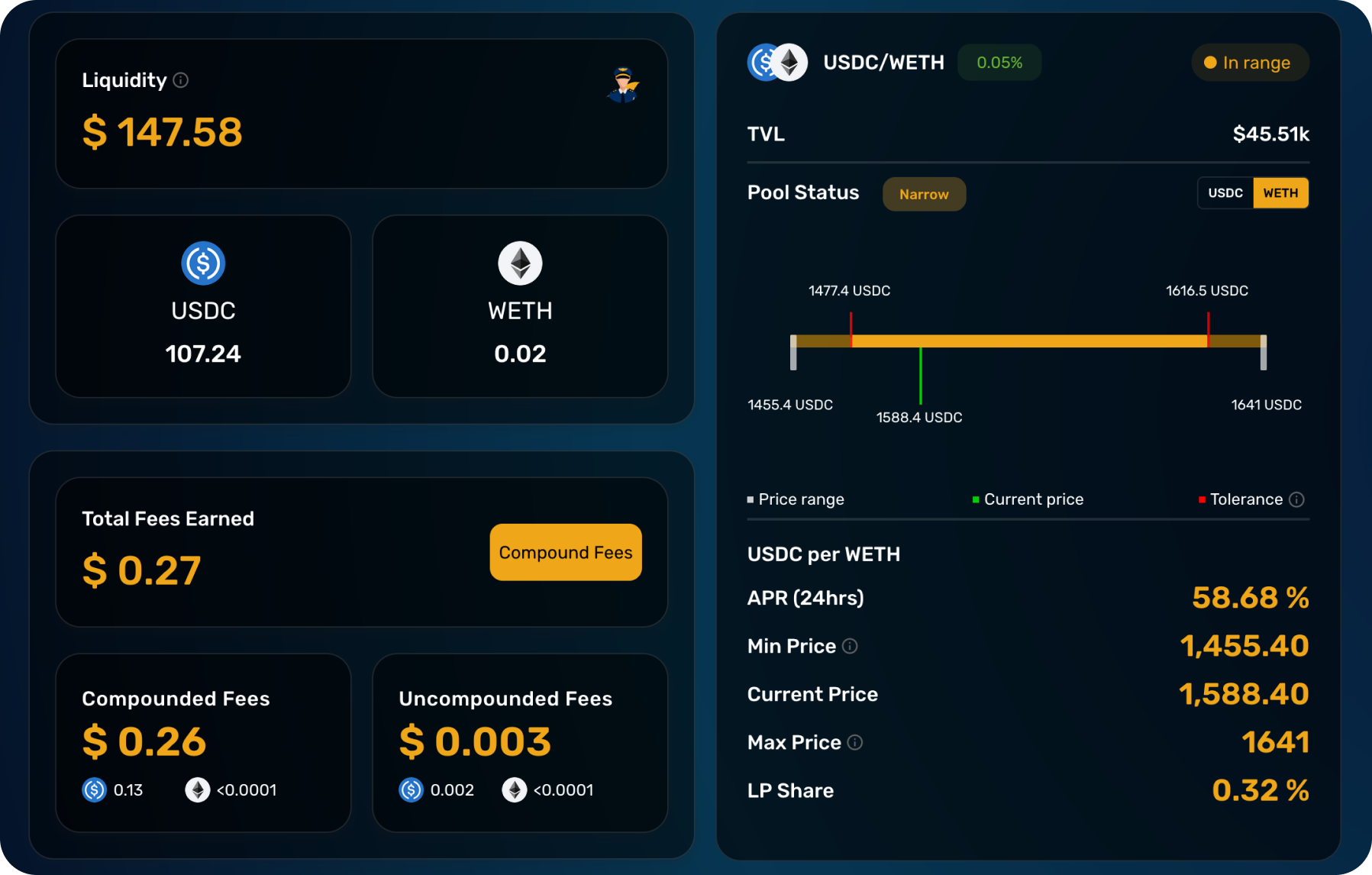

On the liquidity pool page, you can see the right table representing the liquidity allocation range, which is about 13%. The red lines indicate the boundaries for moving your position into the new range. The range between the transfer lines is 8%. This range helps to reduce the impermanent loss.

When you move your position to a new range, the accumulated commissions are automatically collected and reinvested into the liquidity pool.

If you accumulate a large amount of commissions, you can manually reinvest them by clicking Compound Fees.

Users can get all coins mentioned in this article on SimpleSwap.

Summary

Unipilot offers a straightforward way for liquidity providers to maximize returns on decentralized exchanges.

By automating optimal capital allocation and minimizing impermanent loss, the platform makes liquidity management easy and accessible.

With its expanding chain and exchange support, transparent fees model, and focus on usability, Unipilot removes the complexity from liquidity provision.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.