Solayer: Restaking on Solana

Key Insights

- Solayer introduces asset restaking to the Solana network, enhancing economic security for decentralized applications and boosting capital efficiency within the ecosystem.

- The concept of restaking allows for the reuse of assets to validate services on Proof-of-Stake blockchains, thereby reducing security costs and increasing trust in protocols by leveraging existing network assets.

- Solayer has developed sUSD, a stablecoin on the Solana blockchain that offers a stable yield, backed by US Treasury Bonds, and can be used in restaking to generate additional returns.

What Is Solayer

Solayer is one of the pioneers of restaking in the Solana ecosystem, as well as the first protocol to develop a stablecoin with built-in yield in this network.

Solayer aims to provide crypto economic security for decentralized applications on Solana and improve capital efficiency in its ecosystem.

According to DefiLlama, Solayer has a TVL of $331M and ranks 16th among DeFi protocols in the Solana ecosystem.

So far, Solayer is not as popular as Ethereum-based restaking solutions such as EigenLayer.

However, with the development of the protocol's infrastructure and the growth of Solayer's DeFi ecosytem, Solayer could become one of the leading DeFi projects in its field in the future.

What Is Restaking

Restaking is a new concept designed for Proof-of-Stake blockchains to extend their security by reusing assets to validate the operation of services.

Some protocols such as data availability layers, oracles, bridges, cannot use the L1 virtual machine of the blockchain and have to issue their own tokens to validate operation or use permissionless systems.

However, this increases security costs and reduces trust in the protocols. Restaking solves this problem by reusing L1 network assets (e.g., ETH or SOL) at the consensus level to validate the operation of such services and ensure their security.

You can read more about the concept of restaking in our breakdown of the EigenLayer protocol.

Solayer Architecture

The Solayer architecture is built to provide a resilient, flexible and scalable environment for asset restaking on Solana. The core elements of the Solayer infrastructure include:

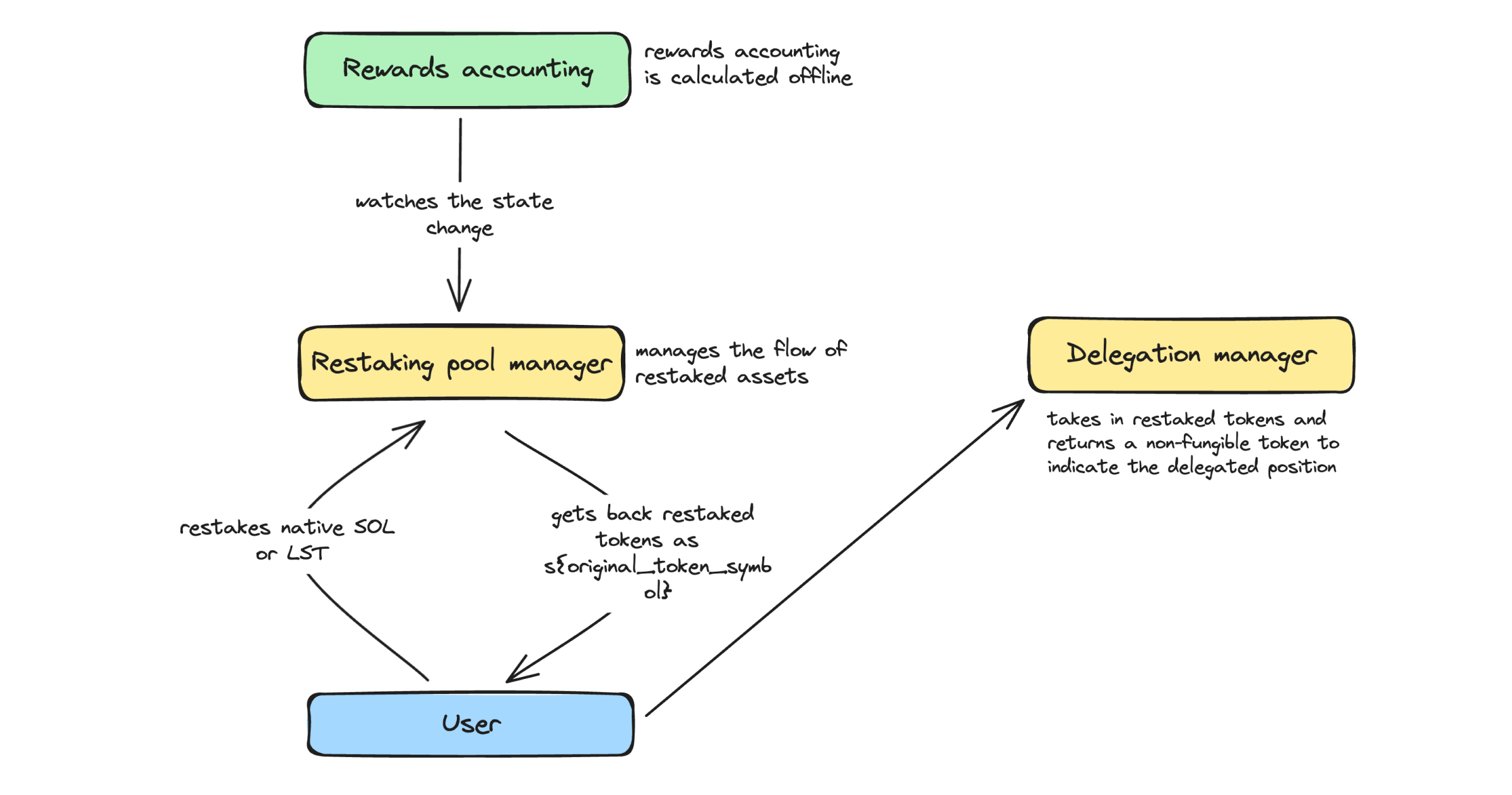

Restaking Pool Manager

A key component of Solayer responsible for the inflow and distribution of assets in the protocol. In particular, the Restaking Pool Manager provides the process for users to deposit funds into the protocol, convert native SOL to sSOL, and issue transferable tokens that serve as proof of user's deposit into Solayer (Solayer assets)

Unbonding and Delegation

At the main level, Solayer assets do not have lockups for unbonding. Unbonding from AVS services is performed separately and managed by a special delegation manager. AVS (actively validated services) can set their own unbonding periods, the maximum duration can be 2 days. In case of problems AVS protocol provides for urgent withdrawal of assets without lockups.

Thus, in order to participate in asset restaking on Solayer, a user must lock their native SOL or other assets (e.g. LST tokens) in Solayer pools and receive in return the equivalent of an unstaked token from Solayer (e.g. sSOL).

Restaking Pool Manager is responsible for allocating and managing users' assets in AVS. Once allocated, users receive a return on the use of their funds in restaking, and can also use Solayer assets in other DeFi protocols toincrease returns.

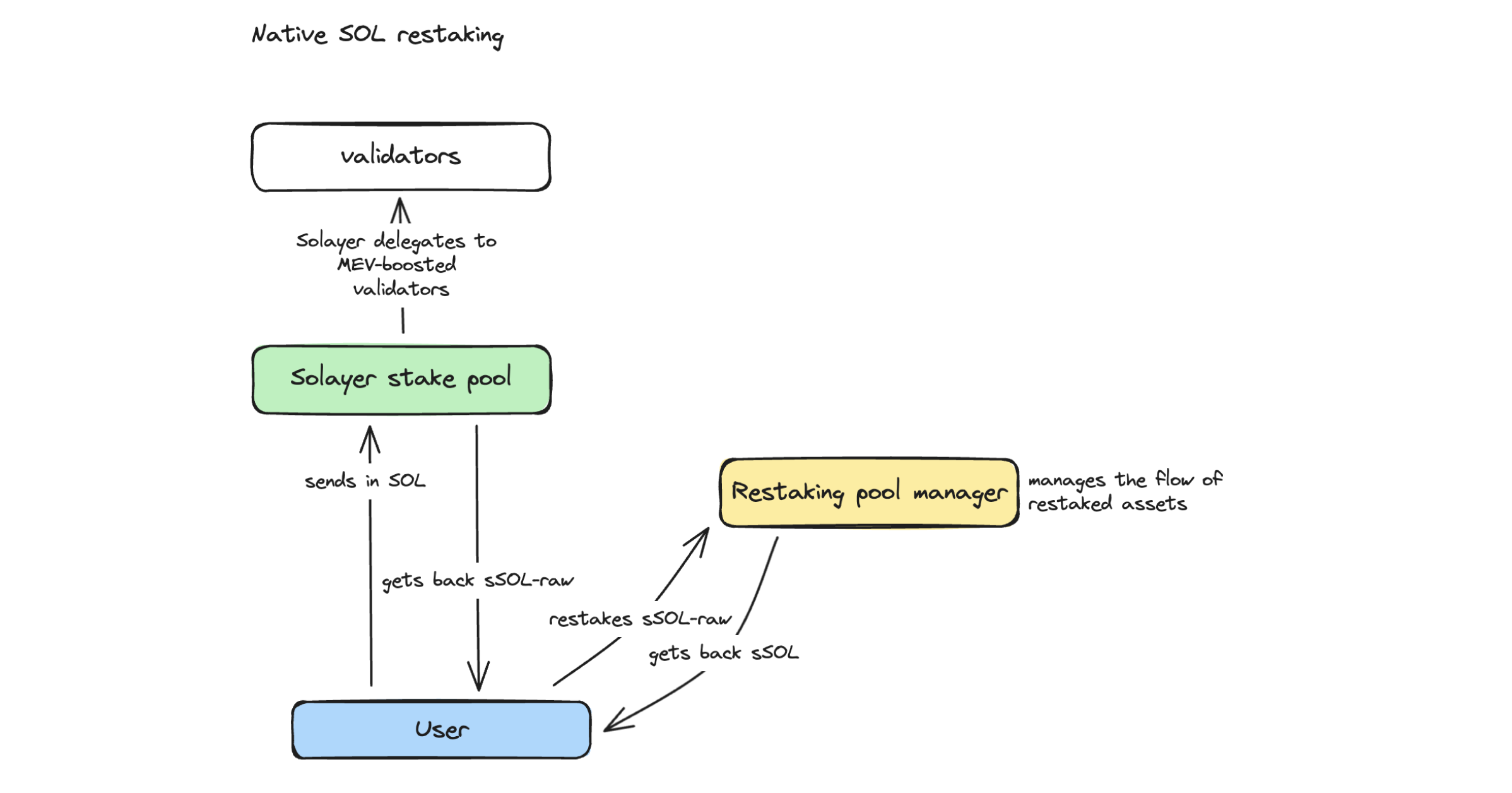

Native SOL Restaking

Restaking allows SOL or Liquid Staked SOL holders to participate in delegated consensus. They restake their holdings in a Solayer vault and delegate them to a group of operators, who then choose different protocols and networks to validate their work and receive rewards.

For native SOL restaking, Solayer converts the SOL into an “intermediate” form called sSOL-raw, which is a liquid staking token (LST) issued by the staking pool manager.

This process is non-custodial, ensuring that the staked SOL is delegated to validators who receive MEV-boosted revenue. The sSOL-raw is then converted to sSOL through an interaction with the Restaking Pool Manager.

To maximize the efficiency of the protocol, all SOL -> sSOL conversion interactions are performed in a single transaction.

In addition to native SOL staking, it is also possible to participate in the Solayer ecosystem using various Solana LST tokens such as mSOL, BNSOL, JitoSOL, JupSOL, and others.

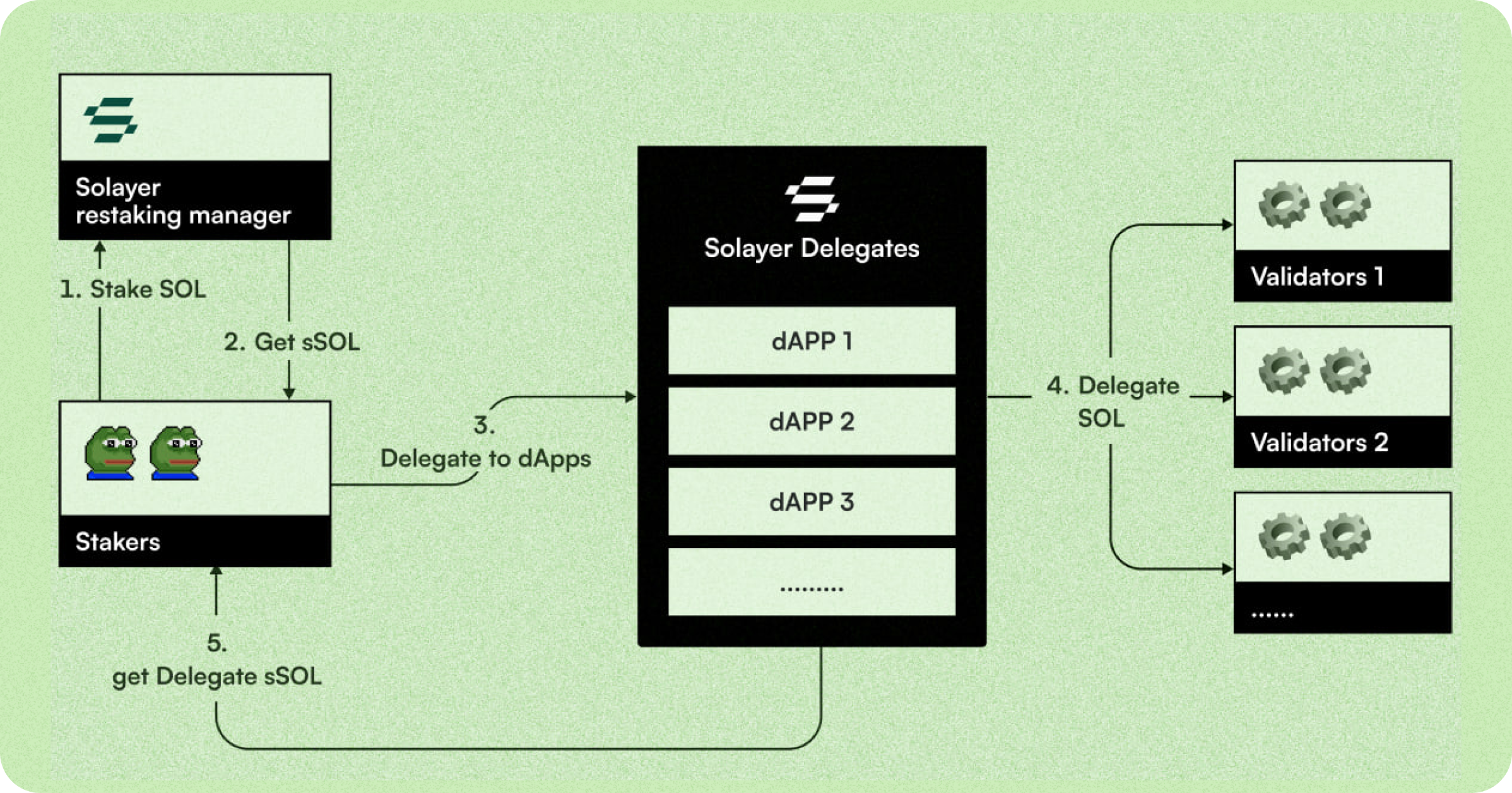

Delegation to validators

In addition to using the Solayer infrastructure for direct asset restaking, users can become delegators, i.e. delegate their assets to selected Solayer validators, who then distribute the assets in the Delegate App (endogenous AVS), converting sSOL to the delegated form. The user then receives a validator token that validates their staked assets 1:1.

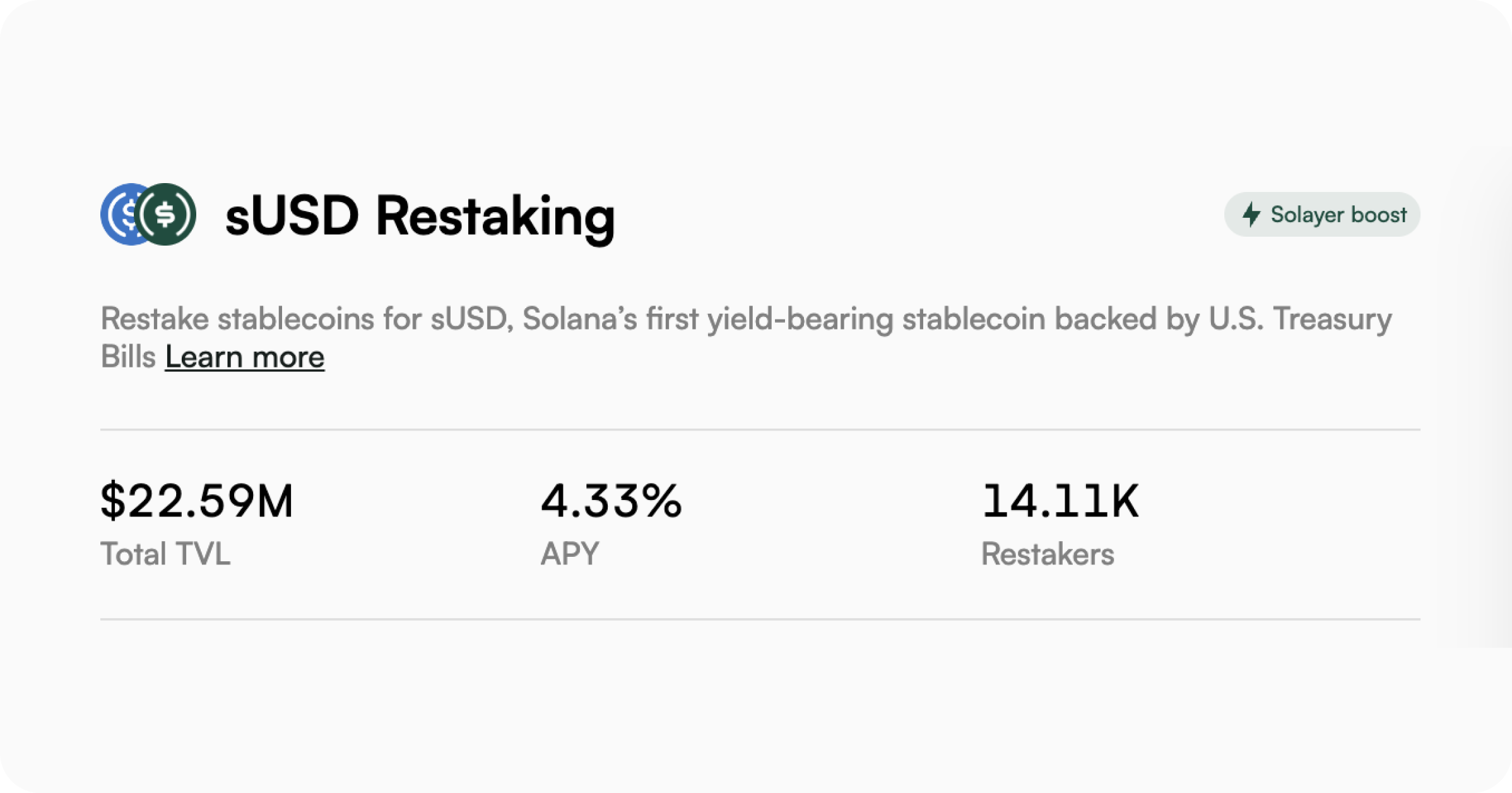

Solayer Native Stablecoin: sUSD

sUSD is a Solayer-developed yield-bearing restaking stablecoin. This stablecoin was developed in response to the rapid development of the Solana ecosystem and the influx of stablecoins into its DeFi ecosystem.

The sUSD is the first stablecoin with an embedded yield bearing on the Solana blockchain. It is pegged 1:1 to the US dollar and backed by US Treasury Bonds (T-Bills). The mechanisms of sUSD ensure its permanent peg to the dollar and a stable yield of 4-5% per annum thanks to T-Bills.

Holders of sUSD will earn yield simply by holding the stablecoin in their wallet. The balance of sUSD will gradually increase similar to the increase in the size of a bank deposit.

Key features of sUSD:

The first T-Bills backed stablecoin with yield on Solana

The first stablecoin backed by restaking

Ability to be used in restaking in the Solana ecosystem.

The use of sUSD in restaking, in particular delegation for validation of exogenous AVSs (exoAVSs, modular protocols that work in parallel with Solana) allows to get additional yield from this asset besides the stable 4-5% APR.

Currently, sUSD APY is 4.33%, the total value of funds blocked in sUSD staking is $22.6M.

Solayer: Asset Restaking on Solana

If you want to participate in asset restaking on Solana with Solayer and get extra yield, you only need to follow a few simple steps:

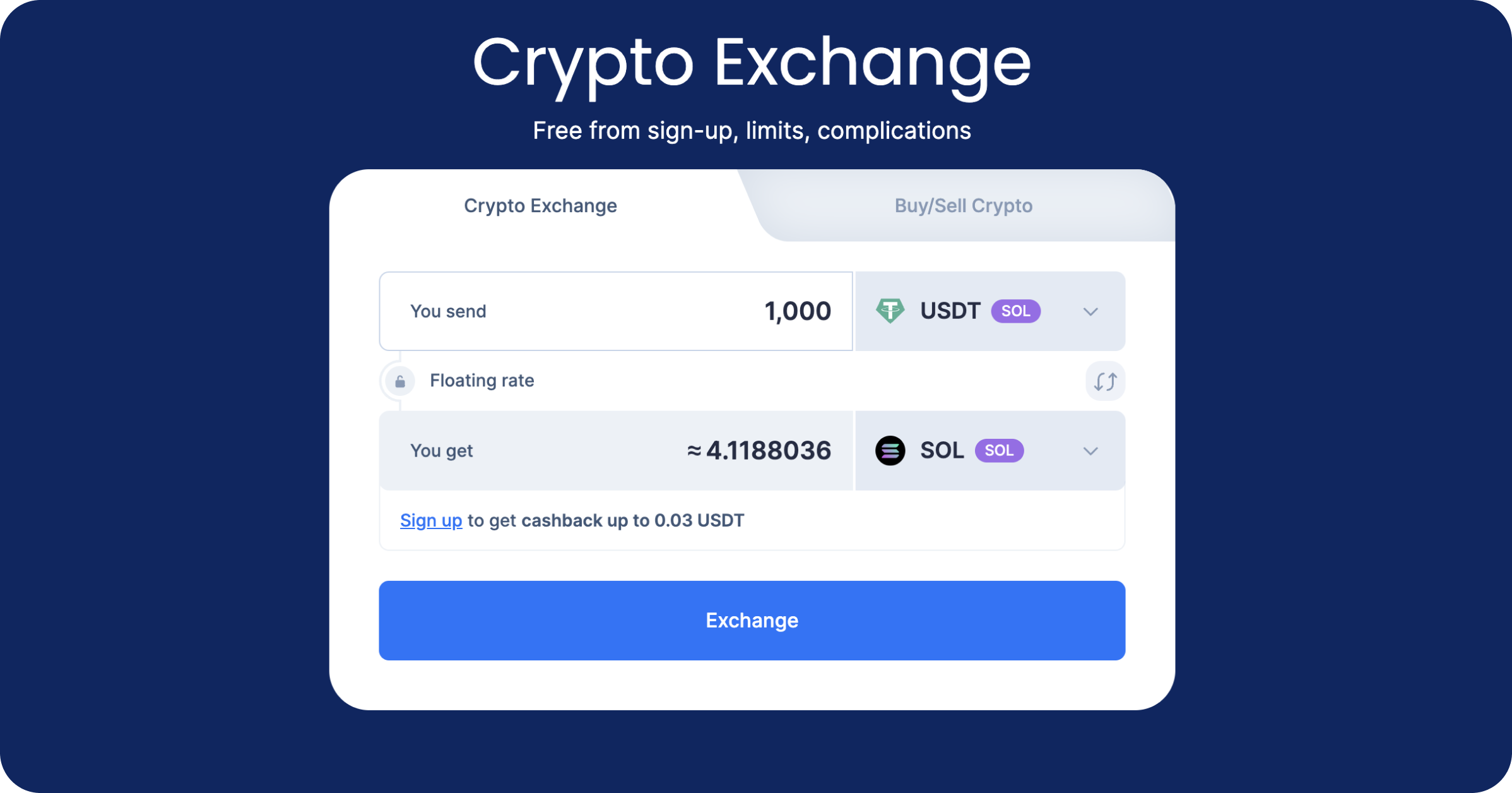

Purchase SOL or USDC on the Solana network on SimpleSwap

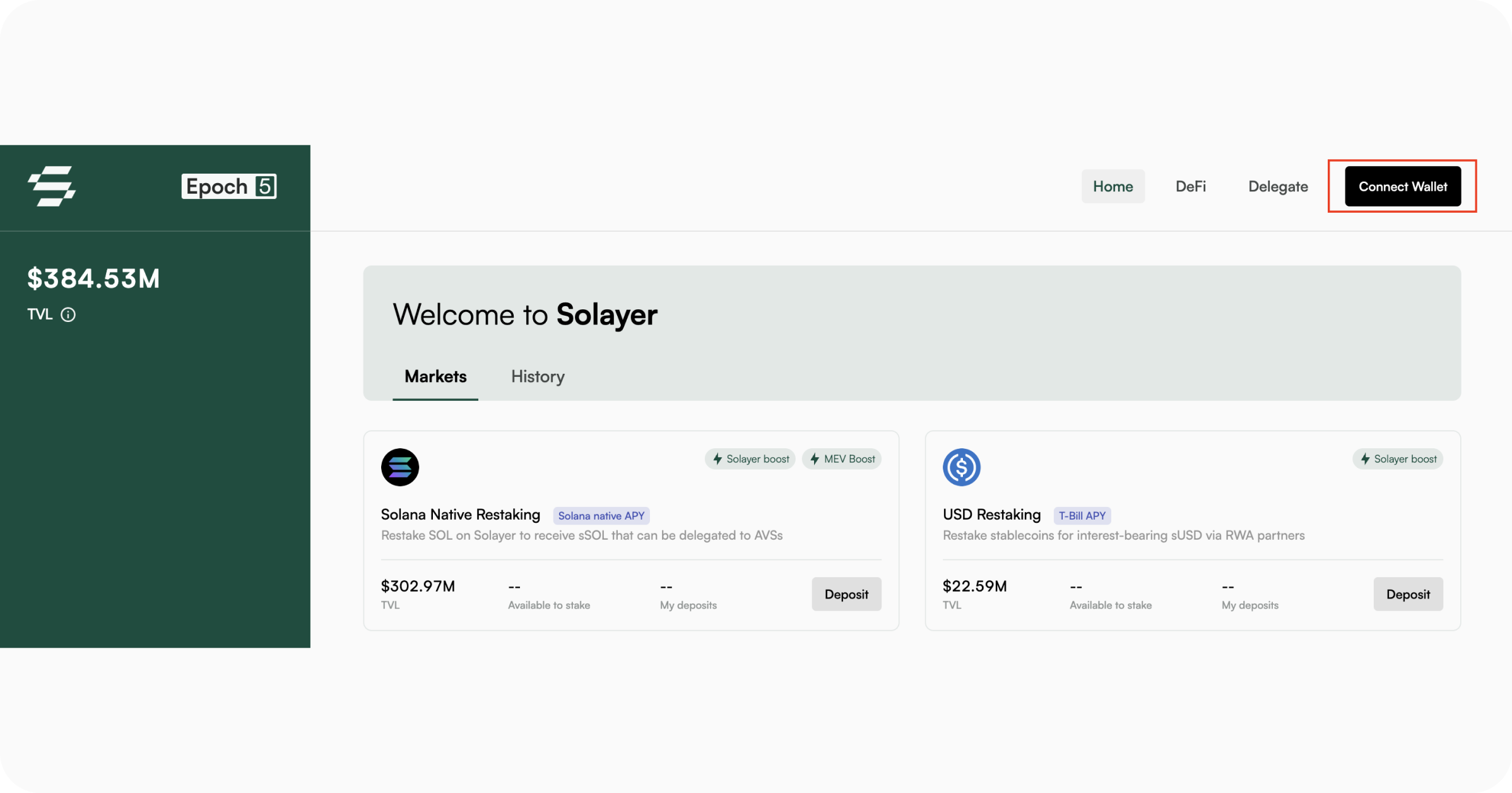

Go to the Solayer website

Click on Deposit now, go to the dApp interface and connect your Solana wallet.

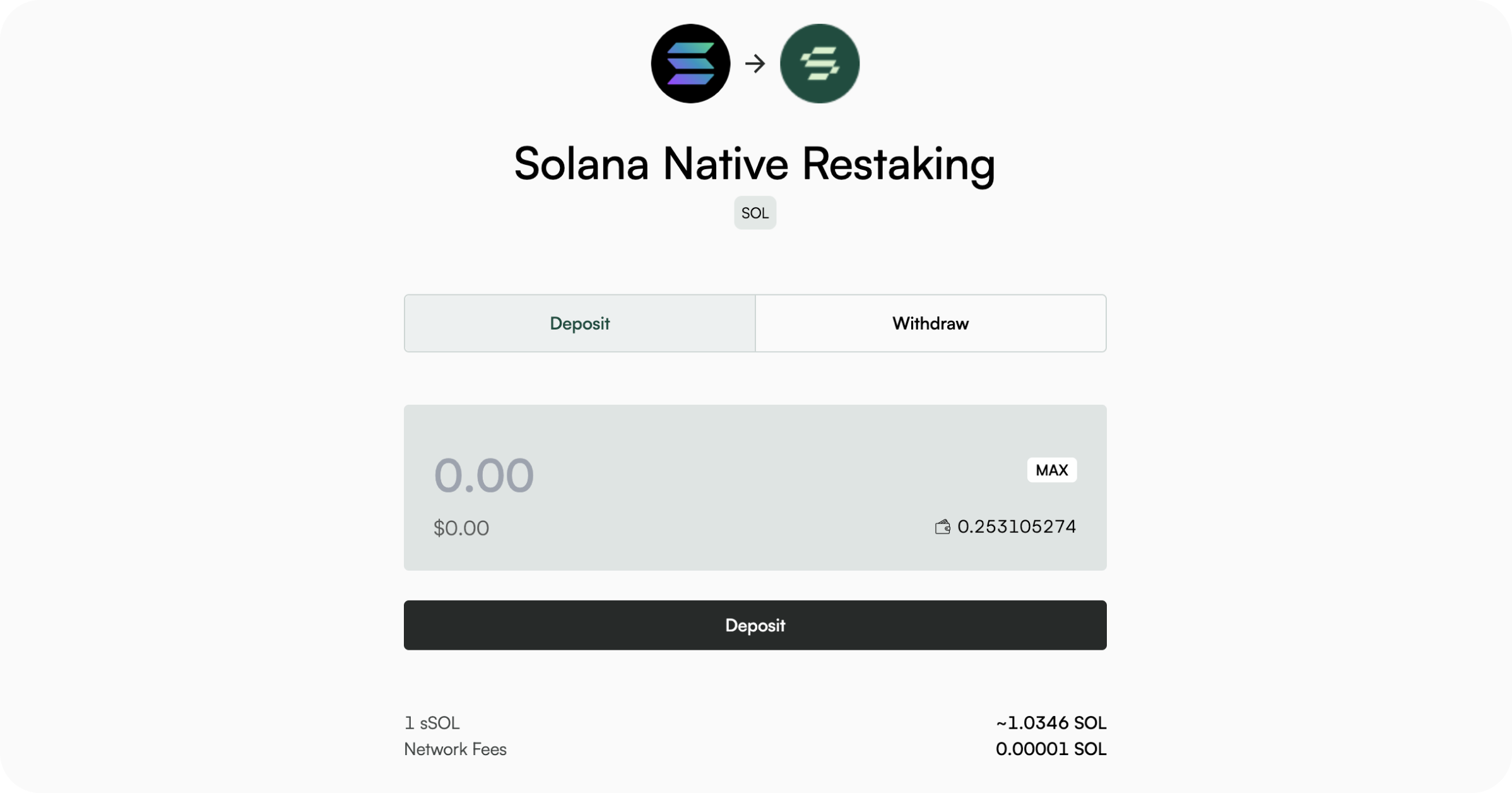

Once the wallet is connected, you will be able to select the asset you wish to stake, in our example SOL or USDC. Select the appropriate vault, click Deposit, select the desired amount to be staked and confirm the transaction.

Done! You've staked your assets in Solayer and will receive the yield from the restaking.

Summary

Solayer is a pioneering DeFi protocol on the Solana network, focusing on asset restaking to enhance security and capital efficiency.

By reusing network assets for service validation, Solayer reduces security costs and increases protocol trust.

Additionally, its innovative stablecoin, sUSD, provides stable yields and can be utilized in restaking for further benefits, positioning Solayer as a significant player in the DeFi landscape.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.