EigenLayer Analysis: Liquid Restaking on Ethereum

Key Insights

- Restacking allows ETH to be re-utilized at the consensus level to secure various applications and services.

- Stakers of ETH and Liquid Staking Tokens (LSTs) can stake them in EigenLayer smart contracts for additional rewards, enhancing the security of the Ethereum blockchain.

- In addition to the protocol infrastructure itself, the EigenLayer ecosystem includes operators, AVSs, and liquid restaking protocols built on top of EigenLayer.

What Is Restaking

As we know, after the transition to Proof-of-Stake consensus, the security and validation of the Ethereum blockchain is ensured by validators who have staked their ETH and are rewarded if they behave in good faith (otherwise they may be deprived of some or all of their ETH in the slashing process).

However, services that cannot be run and validated on the Ethereum Virtual Machine (EVM) cannot take advantage of Ethereum's shared security.

Such services include sidechains, data availability layers, new virtual machines (VMs), oracles, and bridges.

Typically, these services are validated with their own tokens or operate within permissioned systems. This increases security costs and does not improve the overall security of Ethereum.

Restaking solves this problem by reusing ETH to provide security for similar services. The restaking mechanism provides polled security for different protocols simultaneously, reducing costs and increasing trust in individual services.

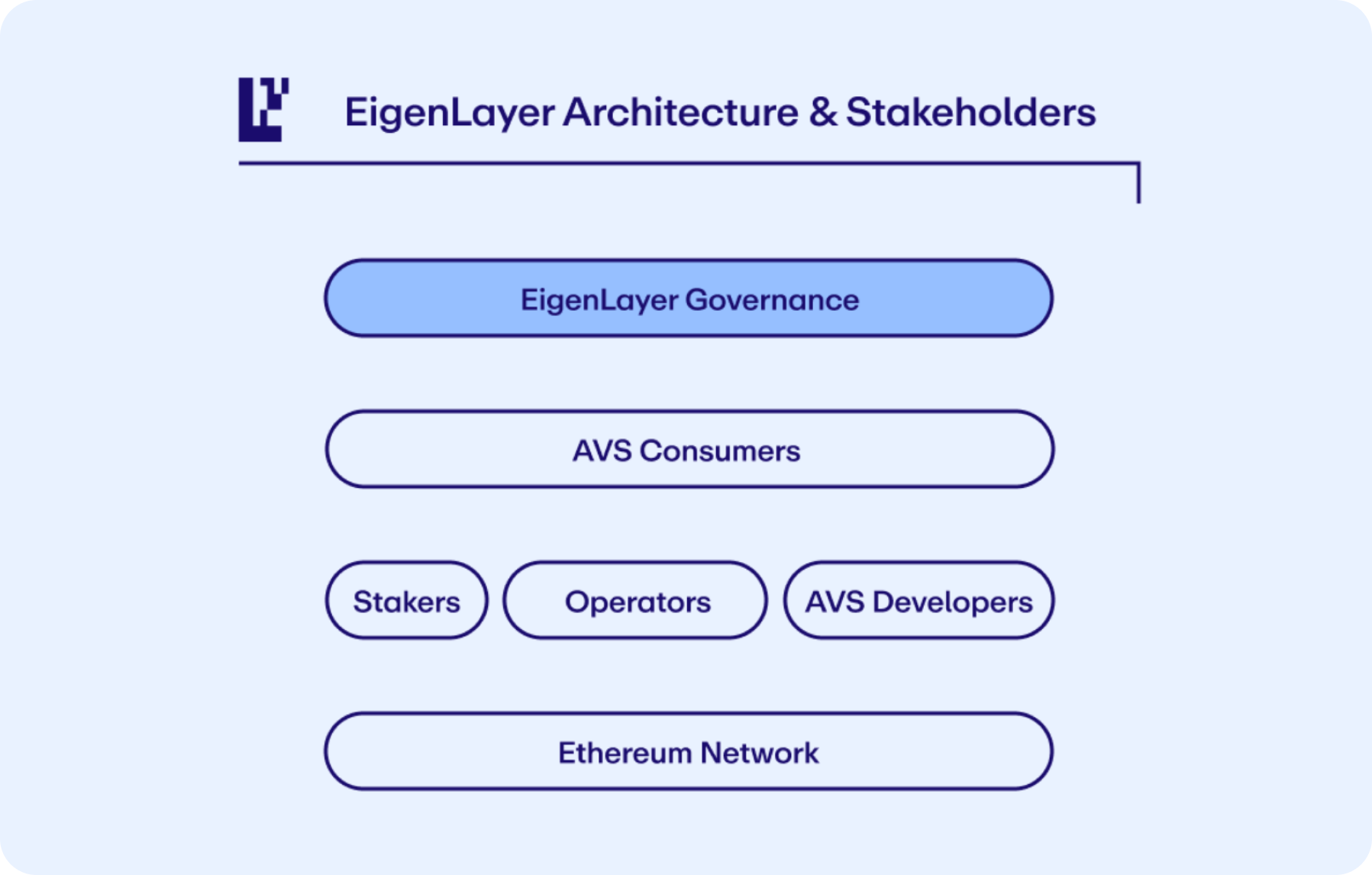

EigenLayer: Key Restaking Actors and Stakeholders

- Stakers

Holders of native ETH or liquid staking tokens (LSTs) can stake their assets in EigenLayer, allowing their assets to be used for further restaking and securing AVS. Stakers can run their own nodes or delegate assets to operators.

- Operators

Individuals or organizations that run the AVS software on the EigenLayer, receiving rewards in return. Operators execute smart contracts and ensure that AVSs run correctly, following predefined rules and conditions to avoid slashing.

- Active Validated Services (AVS)

Decentralized applications and protocols (bridges, oracles, new PoS networks) deployed using the EigenLayer infrastructure and validated by operators.

AVSs are the beneficiaries of restaking as they improve their own security through a pooled security mechanism. AVSs set their own rules that operators must follow to avoid slashing.

AVS Examples. Source: EigenLayer (@eigenlayer) on X

- AVS users

Users who use the services provided by AVS.

Core stakeholders of EigenLayer. Source: Intro to EigenLayer | EigenLayer

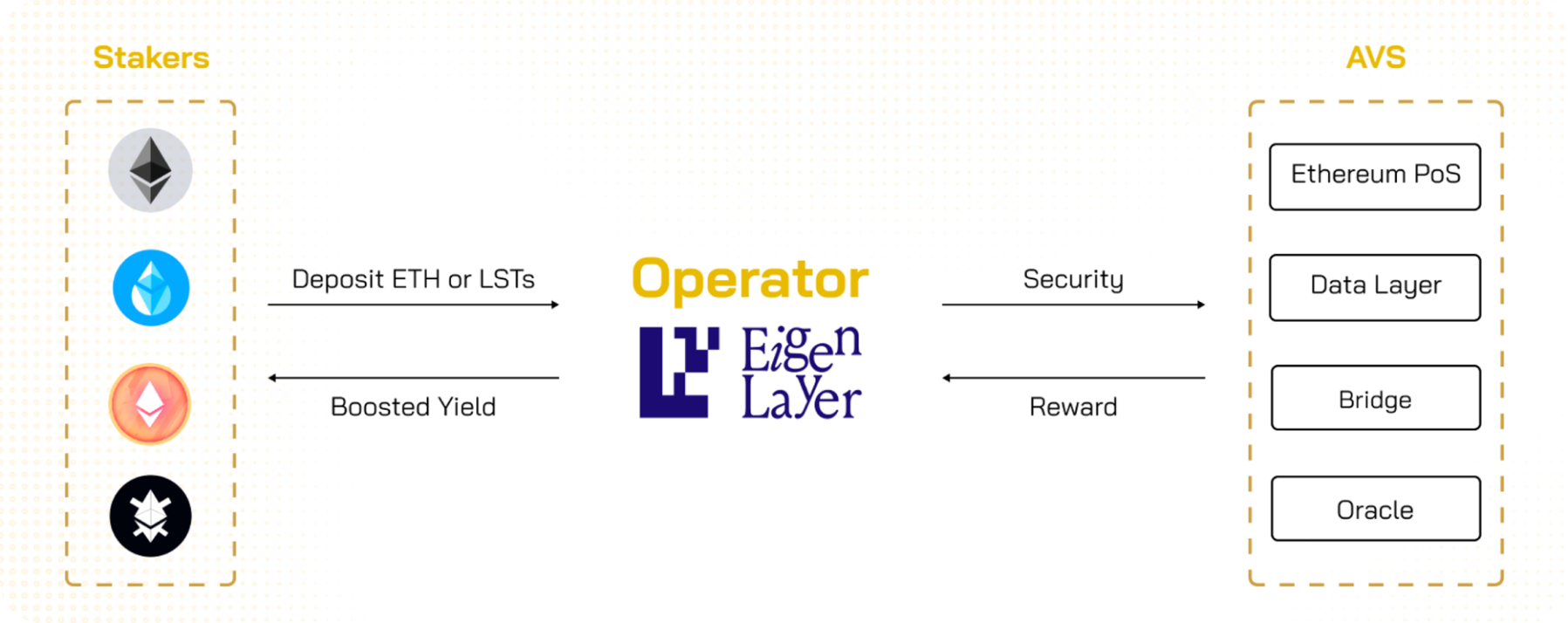

EigenLayer Restaking Process

Users wishing to participate in the restaking process can stake their tokens and then delegate them to operators (if the user is not an operator).

If you decide to participate in the restaking process, you can purchase ETH or LST tokens with minimal commissions on SimpleSwap.

EigenLayer restaking participants can decide which AVSs they choose to validate. Operators receive delegated tokens and perform validation work on the selected AVSs, contributing to network security and receiving rewards for their work in return.

AVSs in turn provide their services to users. Restakers can initiate the withdrawal of their assets from the restaking. Prior to withdrawal, the operator's status will be checked for irregularities and the need for slashing.

Restaking process on EigenLayer. Source: Coin98

EigenLayer Ecosystem

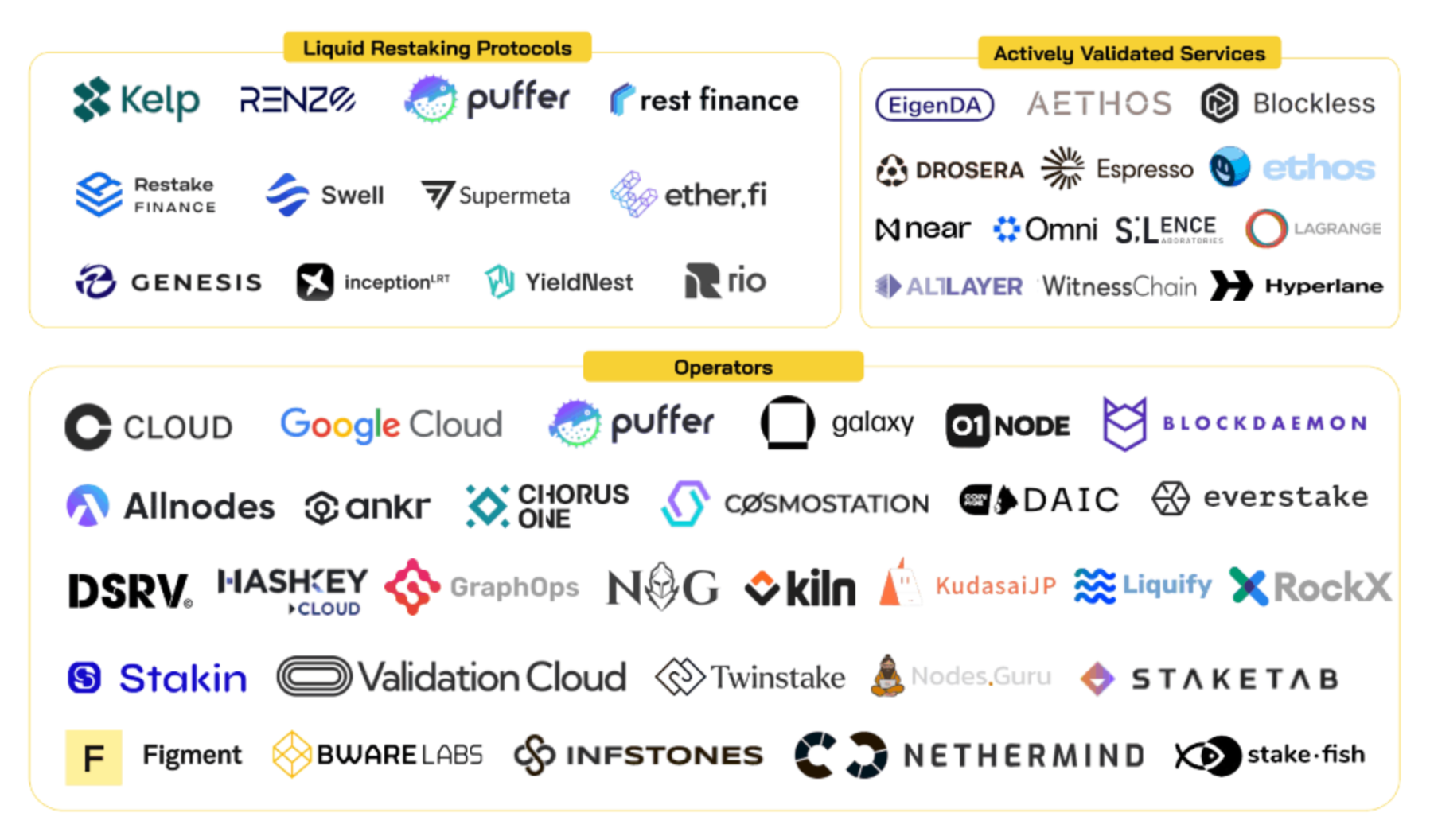

EigenLayer ecosystem includes operators, AVSs, and liquid restaking protocols.

Operators can be individuals or organizations. To participate in EigenLayer, they must be registered as an operator on EigenLayer and meet the technical requirements.

EigenLayer ecosystem. Source: Coin98

Among the AVSs validated on EigenLayer are major projects such as Hyperlane, EigenDA, AltLayer and others.

Another important part of the ecosystem is the liquid restaking protocols that provide liquidity for ETH staked on EigenLayer.

Liquid Staking Protocols allow users to stake ETH or LST on EigenLayer and in return receive Liquid Restaking Tokens (LRT) - tokens issued by these protocols that represent ETH staked by users.

LRT tokens can further be used in the DeFi ecosystem to provide liquidity on DEX, in lending protocols and to increase yields in various DeFi strategies.

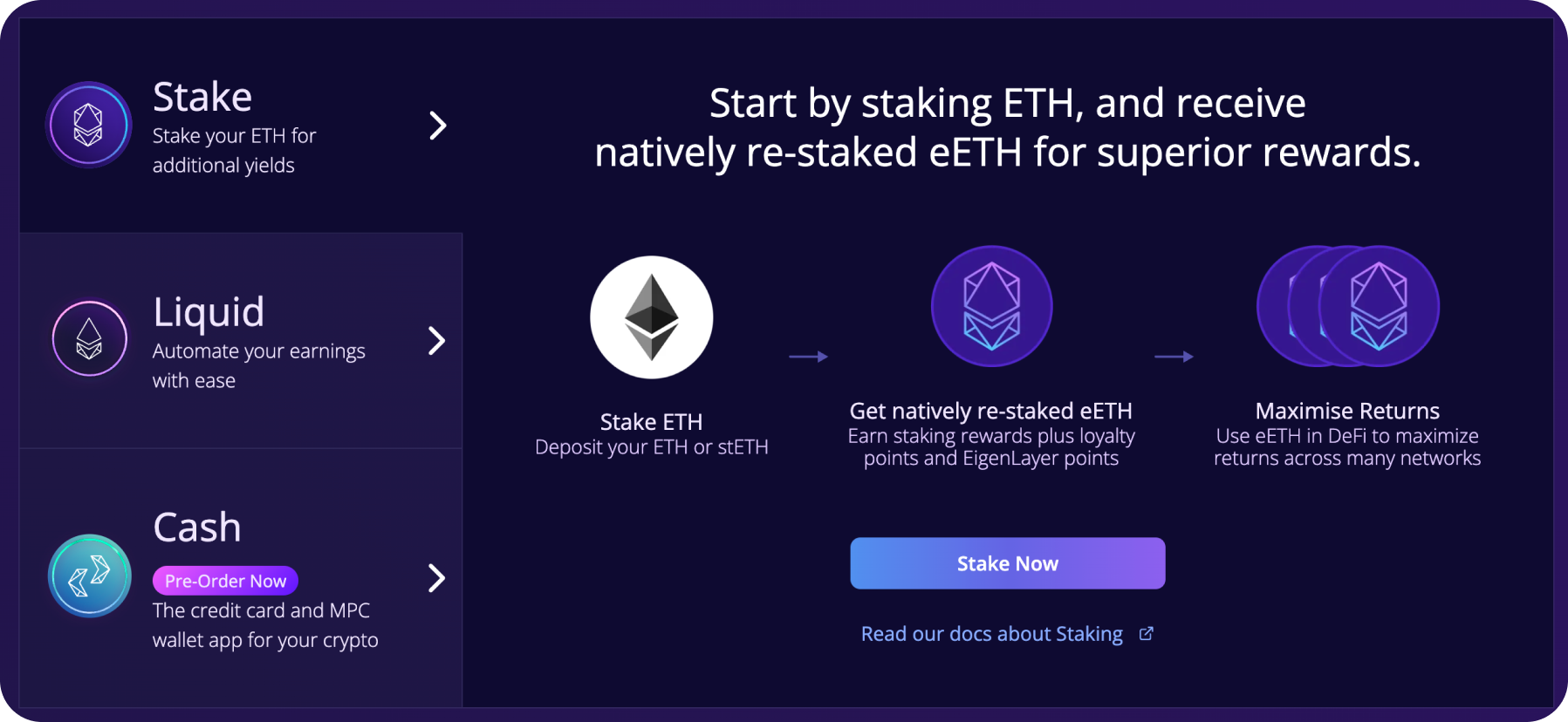

Etherfi (ETHFI)

A decentralized delegated staking protocol with the LRT token eETH. Etherfi provides an ETH restaking service in EigenLayer (and other protocols) to generate yield from ETH staking and restaking, as well as loyalty points from Etherfi and EigenLayer.

In addition, Etherfi offers out-of-the-box strategies to increase yields from ETH, eETH or stablecoin staking in automated vaults.

Renzo (REZ)

Provider of the LRT token ezETH and manager for ETH restaking. Renzo simplifies the restaking process by allowing deposits to be made in various Ethereum Rollups and automatically rewarded for staking and restaking.

ezETH can be used in a wide range of DeFi protocols to generate additional yield. Moreover, the option of staking the native token $REZ is available to boost Renzo farming points (ezPoints) for staking.

KelpDAO

Another solution with LRT token rsETH for EigenLayer. KelpDAO gives the opportunity to participate in ETH restaking by making a deposit on Ethereum or popular L2 networks. rsETH has integrations with a large number of protocols for further use in the DeFi ecosystem.

KelpDAO also offers automated yield strategies such as Airdrop Gain Vault, giving exposure to farm points from several popular projects such as Linea, Scroll, Karak, EigenLayer and others.

If you decide to participate in ETH restaking in the protocols described above, buy ETH for stablecoins or other assets on SimpleSwap quickly and with minimal fees.

Summary

EigenLayer is a revolutionary protocol that introduces the concept of ETH restaking to improve blockchain security and provide shared security for various services commonly referred to as AVS.

Restaking improves the crypto-economic security of Ethereum and allows ETH stakers to generate additional returnson their assets.

The main participants on EigenLayer are stakers delegating their assets for restaking, operators performing AVS validation, and AVSs providing their services to end-users.

An important element of the EigenLayer ecosystem are liquid restaking protocols that offer LRT tokens to replace ETH staked in EigenLayer, ensuring its liquidity and further use in DeFi protocols and strategies.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.