Trader Joe XYZ Liquidity Pools on Avalache

Key Insights

- Trader Joe XYZ is a DEX on Avalanche offering liquidity pools like AVAX-USDC with high earning potential.

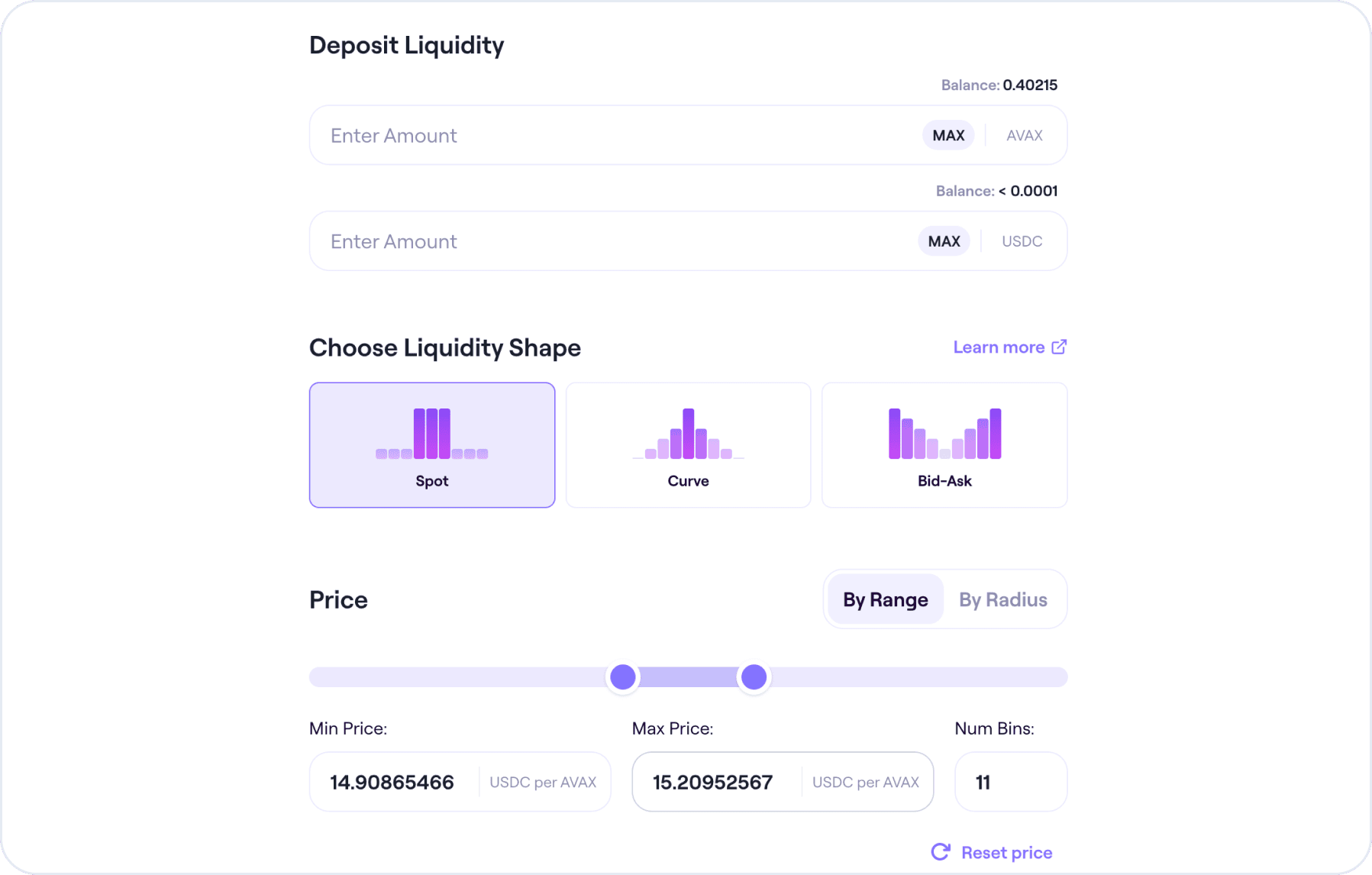

- To provide liquidity, deposit AVAX and USDC into the wallet, connect to Trader Joe XYZ, and select the AVAX-USDC pool.

- Users can choose between Spot, Curve, or Bid-Ask liquidity shapes based on their strategy before splitting and deploying the deposit to start earning fees on trades.

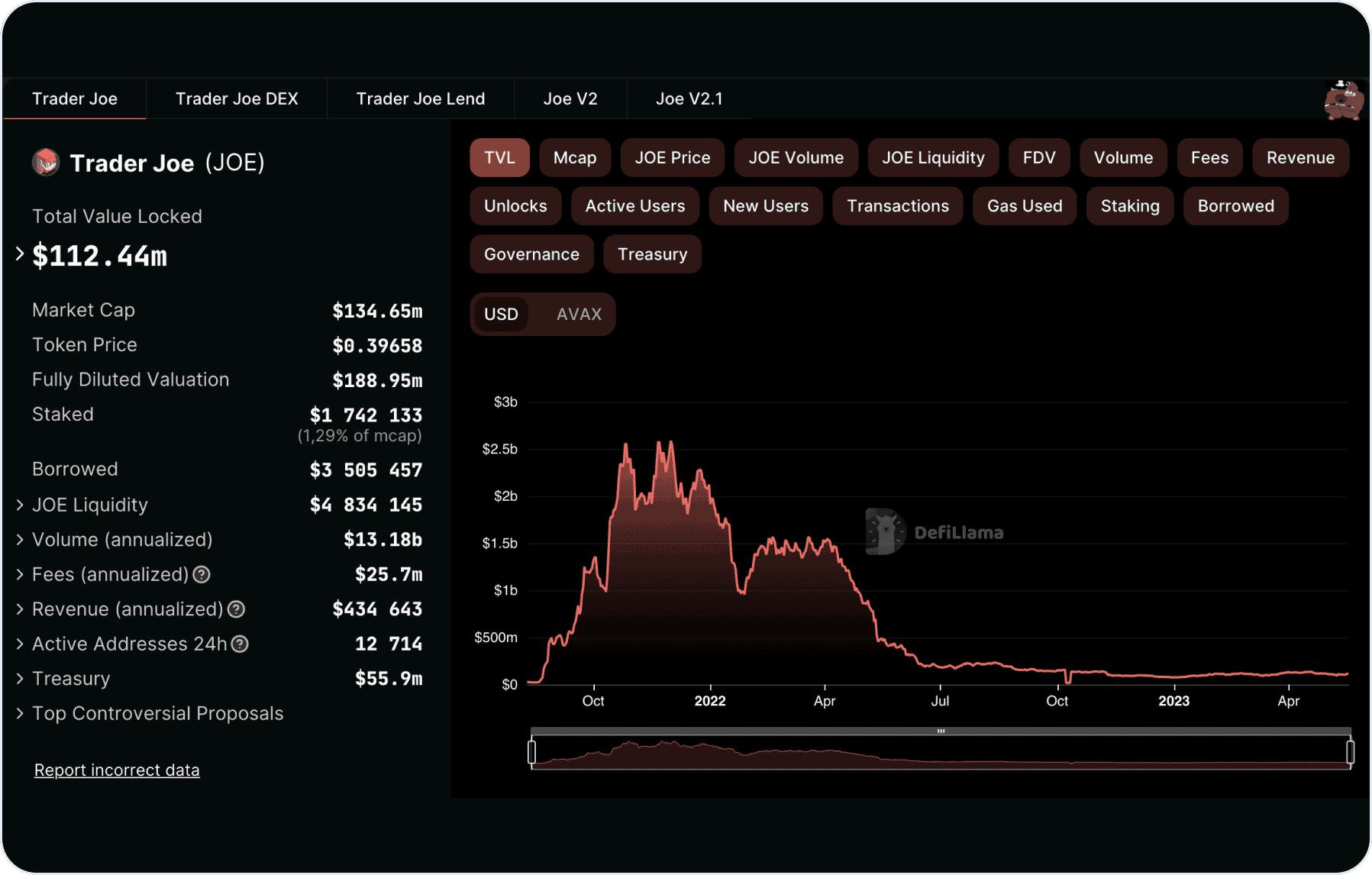

Trader Joe XYZ

Trader Joe XYZ is an innovative decentralized exchange (DEX) that operates on the Avalanche blockchain network. Since its launch in June 2021, it has rapidly gained popularity in the crypto community.

Led by talented and anonymous developers known as Cryptofish and 0xMurloc, Trader Joe XYZ offers a unique trading experience, ensuring security, transparency, and speed through innovative blockchain technologies.

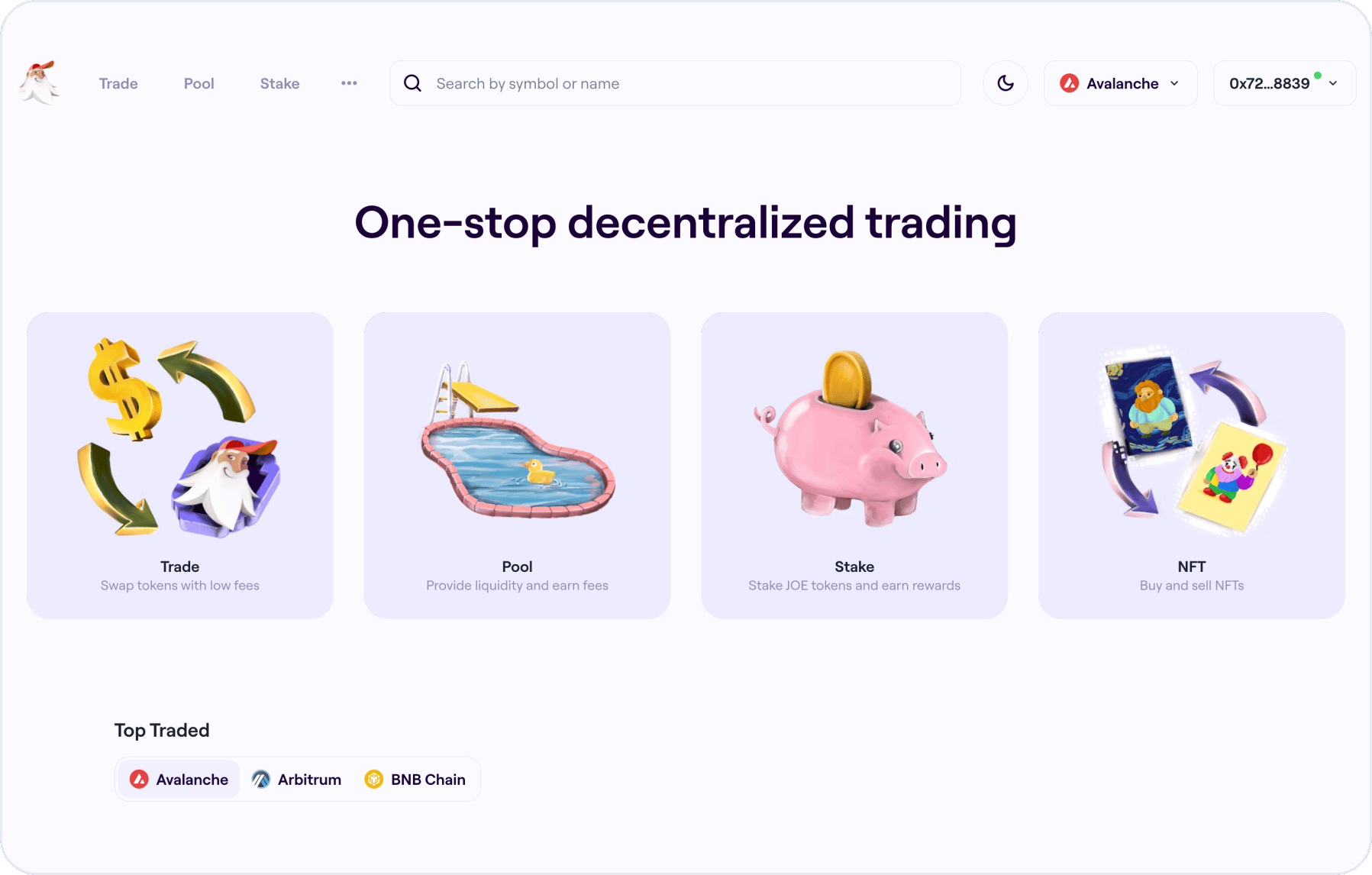

How to Create Liquidity Pools on Avalanche

- Deposit AVAX crypto and USDC

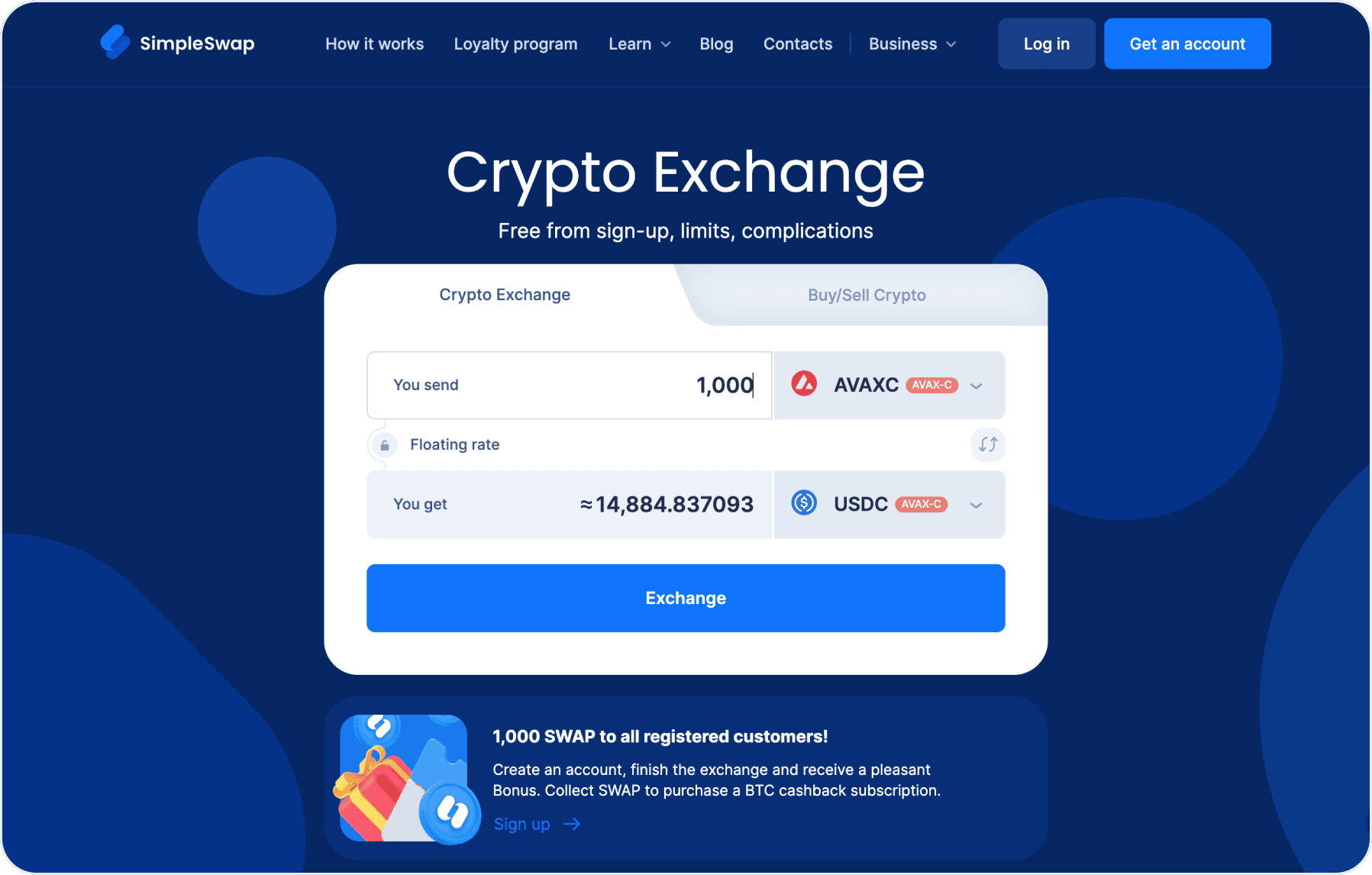

Deposit a sufficient amount of AVAX (Avalanche crypto) and USDC into your wallet to add to the liquidity pool. You can purchase or exchange assets using SimpleSwap.

- Visit traderjoexyz

Connect your wallet that supports the Avalanche blockchain.

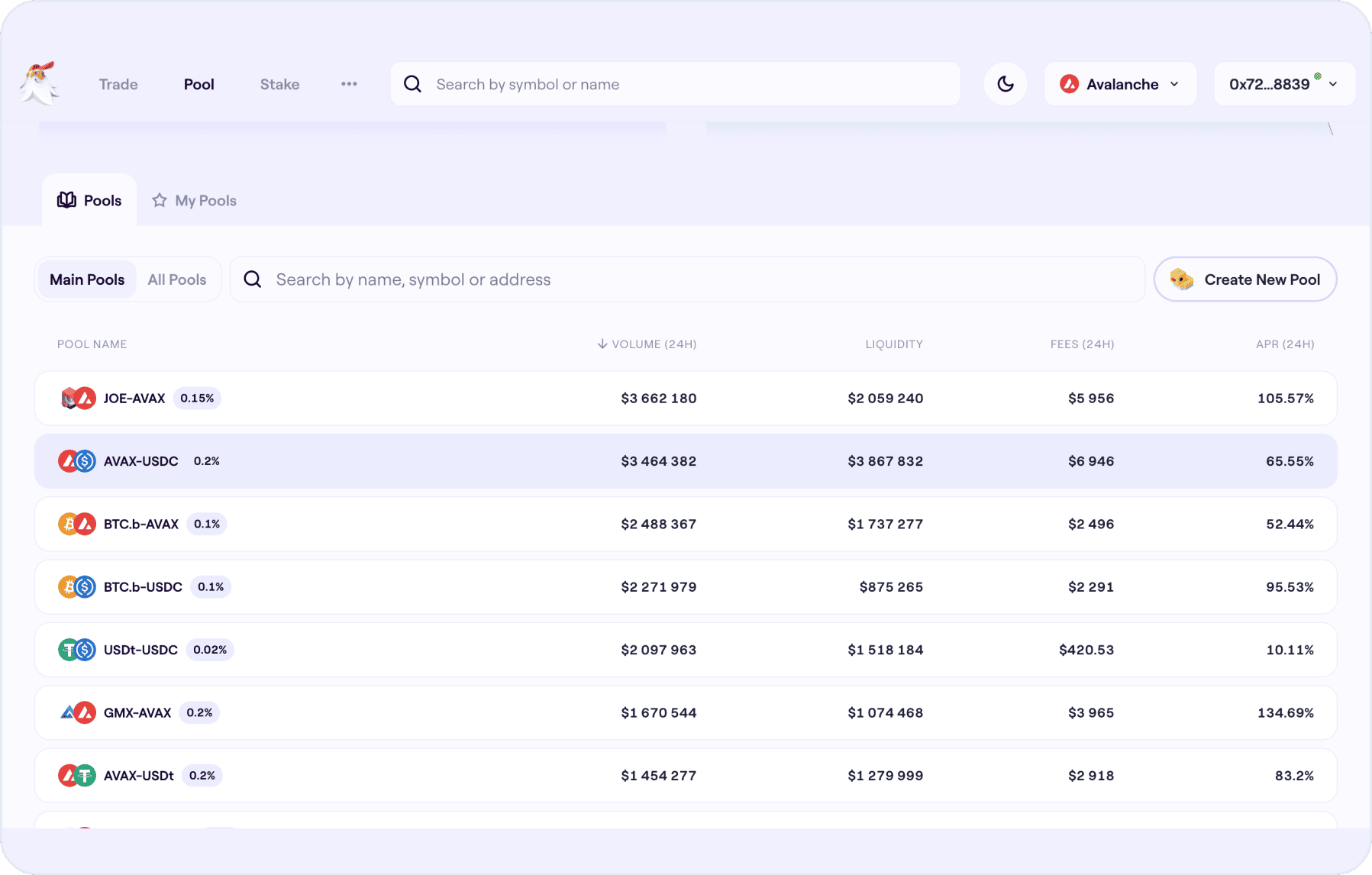

- Click on Pool

Select AVAX-USDC pair.

- Choose the Spot liquidity shape

Spot

This mechanism provides uniform liquidity distribution, creating a versatile and well-managed structure applicable to any market and conditions, while considering risks. It is ideal for trading pairs involving stablecoins and optimizes capital utilization.

Curve

This mechanism distributes liquidity in the form of a concentrated curve, allowing for fee generation from both price growth and decline. Liquidity is concentrated around a specific price, making it suitable for pairs consisting of low-volatility stablecoins.

Bid-Ask

This liquidity distribution utilizes a reverse curve, which is particularly effective for averaging strategies and capturing market volatility.

- Split your deposit

Divide your AVAX and USDC deposit into equal portions based on the chosen price step.

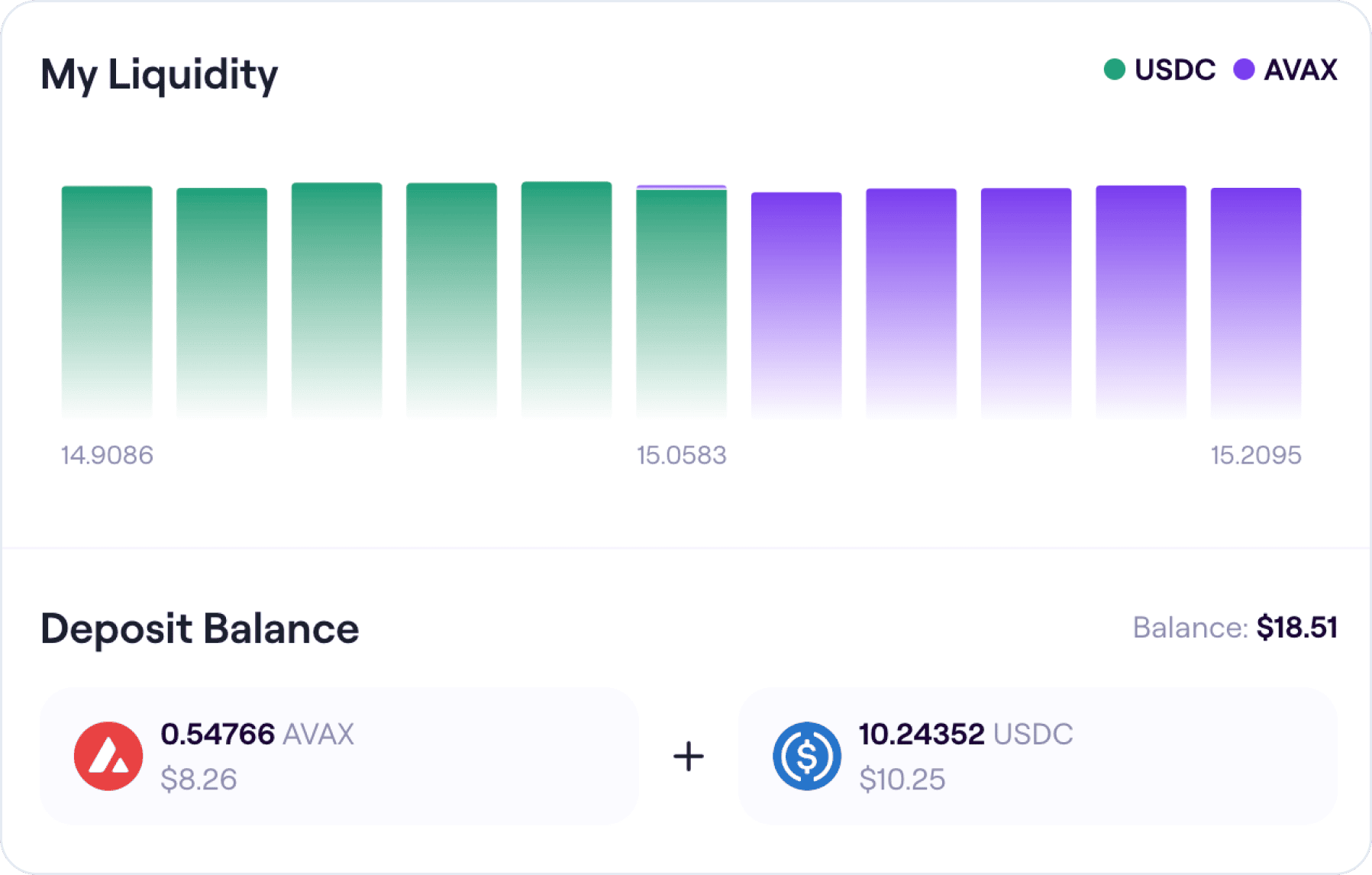

- Deploy the liquidity

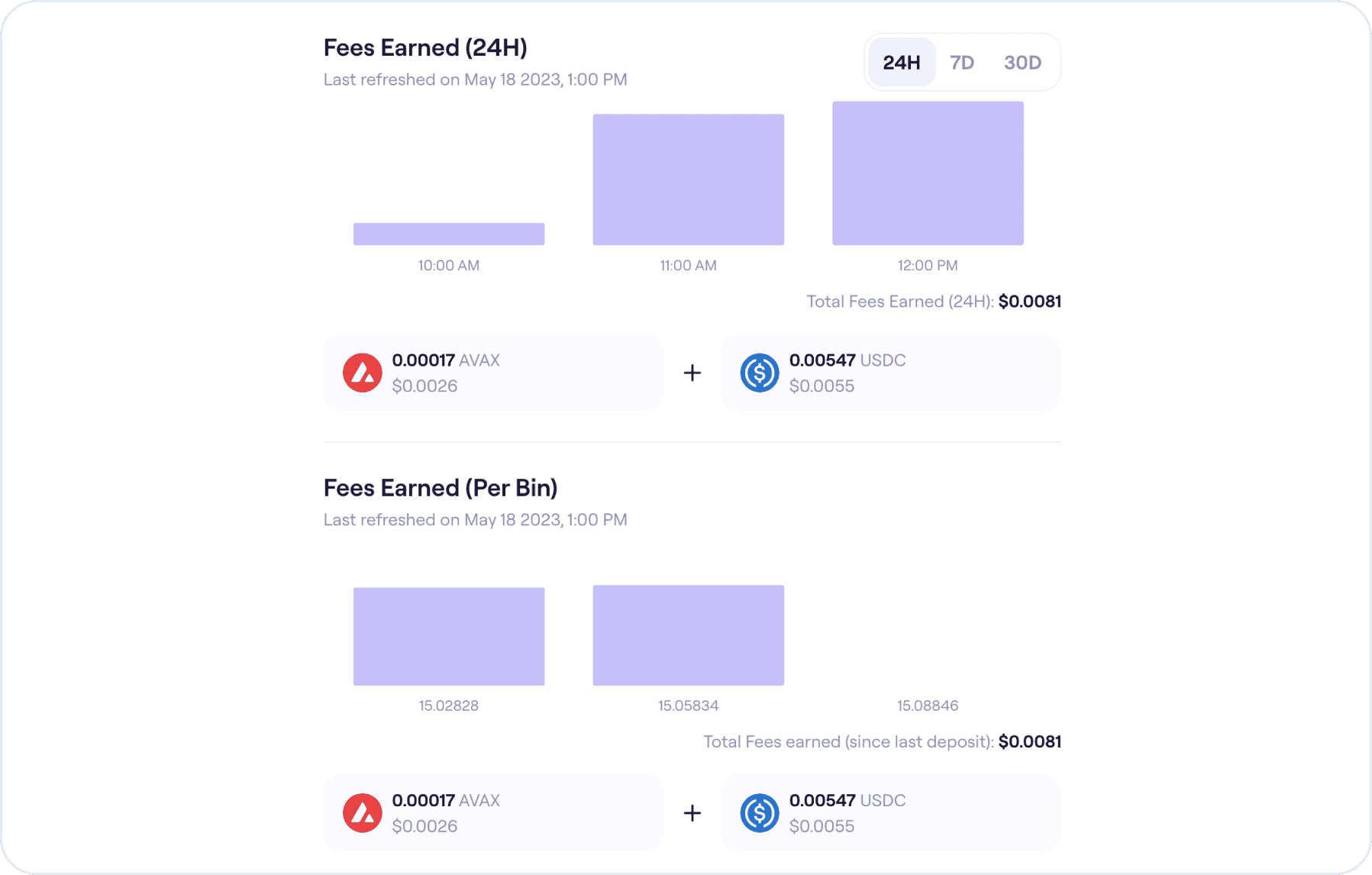

Place the liquidity into the Trader Joe XYZ pool. Earned fees will automatically accumulate in the designated baskets.

Once an exchange occurs within the selected pair at the specified price range, you will receive a reward in both AVAX and USDC. Users earn rewards through fee accumulation upon exchange within the specified price range every time someone performs an exchange.

The strategy above provides an overview of liquidity pools on Avalanche with the use of Trader Joe XYZ, specifically focusing on the AVAX-USDC pool with a current APR (annual percentage rate) of 65.55%.

Users can get all coins mentioned in this article on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.