Revert Finance & Uniswap: Liquidity Pools Management

Key Insights

- Revert's liquidity analytics tools like price charts and volume flow tracking enable data-driven decision making for optimal yield generation on manage liquidity pools in AMMs.

- Automated portfolio rebalancing and gas-efficient auto-compounding maximize yields for liquidity pools through passive position management.

- Revert's modular position builder offers adjustable parameters like fee tier and price range selection for customized liquidity pools creation per user strategies.

Revert Finance is a platform providing analytics and management tools for liquidity providers on decentralized exchanges like Uniswap. It aims at helping investors understand how liquidity pools work and ways to optimize returns and manage risk, as DeFi grows in adoption.

One of the most important aspects to consider when getting started with Revert Finance is the concept of what is liquidity in crypto. Liquidity refers to the ease with which an asset can be bought or sold without a significant change in price. In DeFi, understanding liquidity is key to effective trading and investment strategies.

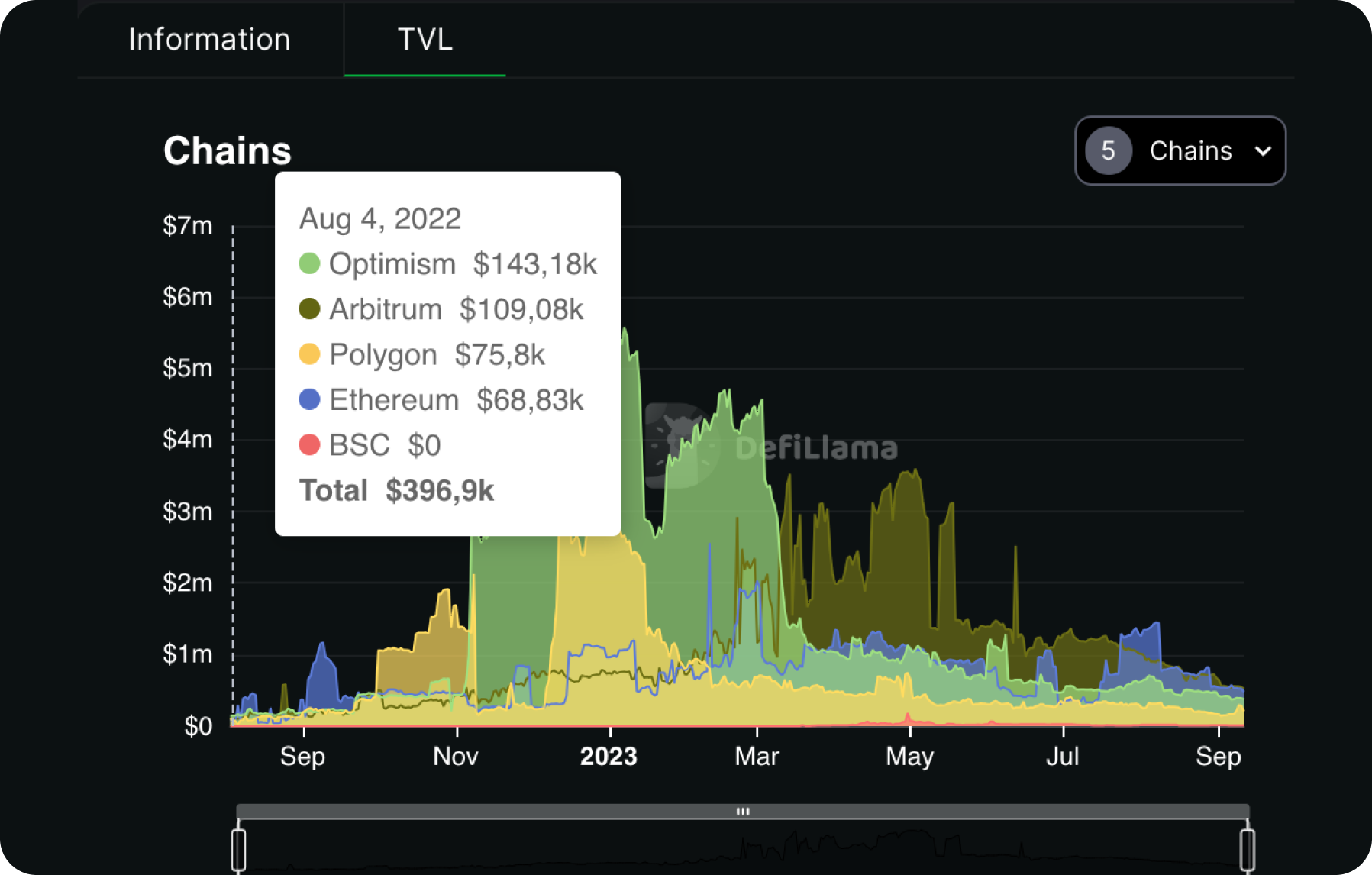

At the start of 2023, Revert's total value locked (TVL) reached $10 million. However, a hacking incident in February damaged confidence and caused TVL to drop sharply.

Revert Finance Functionality

Revert offers various features to help liquidity providers analyze and manage positions.

Analytics Tools

Revert provides analytic tools for liquidity providers in AMM protocols. Let's see how to use the service in general, and at the end of this article you will find a link to the full detailed instructions for using it specifically on Uniswap V3. These tools help users understand and optimize returns. This includes:

Coverage of the top AMM Exchanges

Revert provides detailed analytics on major DeFi pools including Uniswap, Sushiswap, Curve, and Balancer across networks like Ethereum, Polygon, Arbitrum, and Optimism.

Yield charts

Visualize liquidity pools yields over time to identify trends.

Price change charts

Analyze price shifts of pool assets to detect significant swings.

Volume change charts

Track liquidity pools volume changes to find rising/falling activity.

These tools allow informed decisions by providing key liquidity pools crypto data. Users can identify high-yield pools and adjust accordingly.

Automation Tools

Revert also automates liquidity management.

Auto rebalancing

Automatically rebalances assets in a pool based on market fluctuations. This maintains optimal ratios.

Auto yield optimization

Reinvests earned fees at optimal times based on gas costs. Maximizes compounding returns.

Automation lets users passively manage positions without constant oversight and create an effective liquidity management strategy.

Liquidity Management

In addition to analytics and automation, Revert has tools for hands-on liquidity administration:

Volume management

Manually adjust liquidity based on trading volume and liquidity pool crypto activity.

Yield management

Fine tune yield farming by collecting fees, compounding, and withdrawing liquidity.

These features allow precision control over liquidity pools. Users can tailor management to their individual needs and strategies.

Auto-Compounding

Revert's auto-compounder reinvests earned fees for a percentage of the yield. This incentivizes maximizing compounding at optimal times to reduce gas costs. The auto-compounder is an important part of Revert's overall liquidity management process, allowing them to optimize returns while maintaining sufficient liquidity to handle user withdrawals.

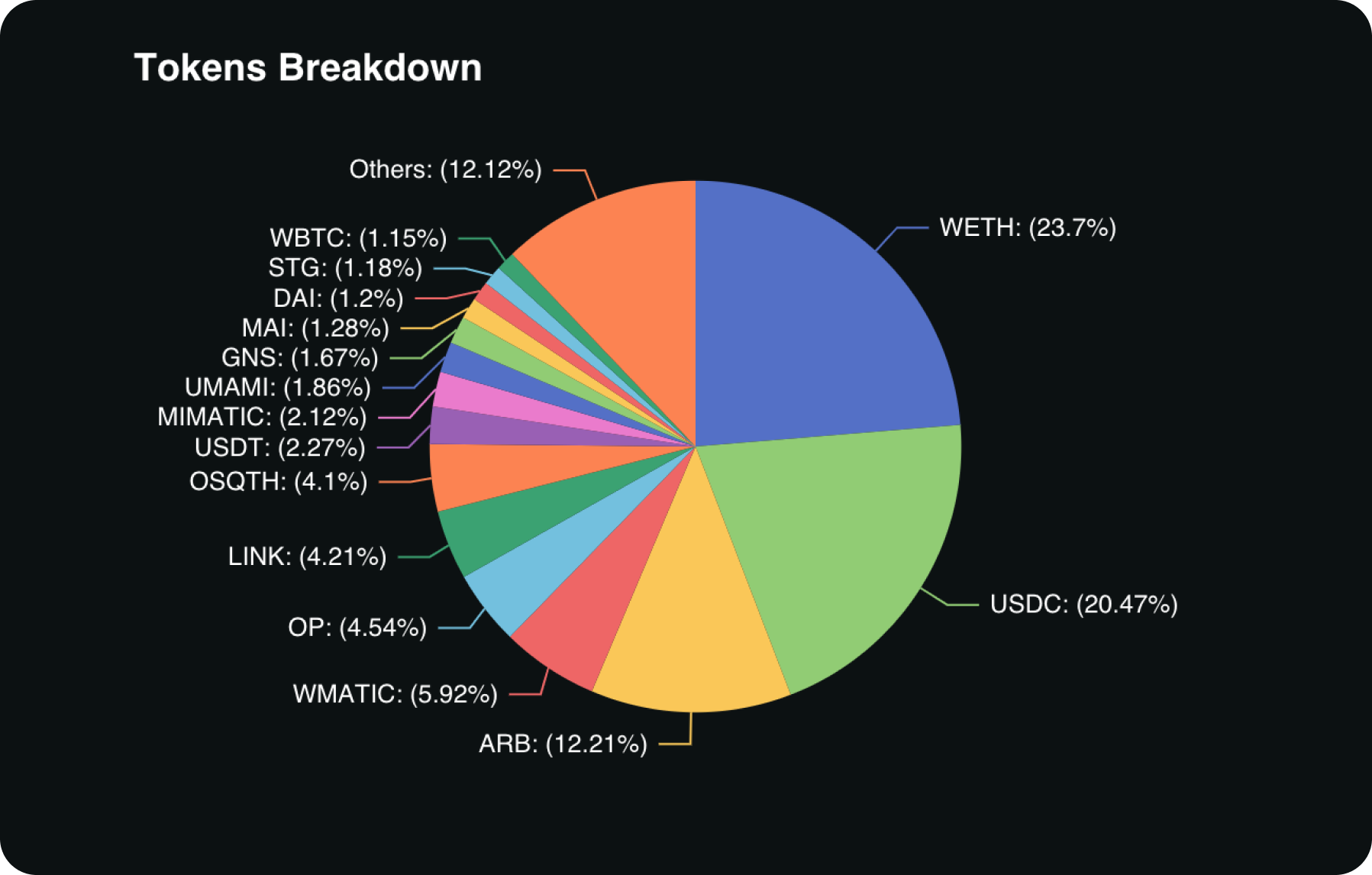

The piechart below shows the distribution of tokens used as liquidity on decentralized exchanges and connected to auto-compounding through Revert.

Optimism, Arbitrum, and Polygon are currently the most used chains on Revert. As scaling solutions for Ethereum, they offer users faster and cheaper transactions.

How to use Revert Finance

Revert Finance offers a straightforward process for liquidity providers to analyze and create positions. Here are the key steps:

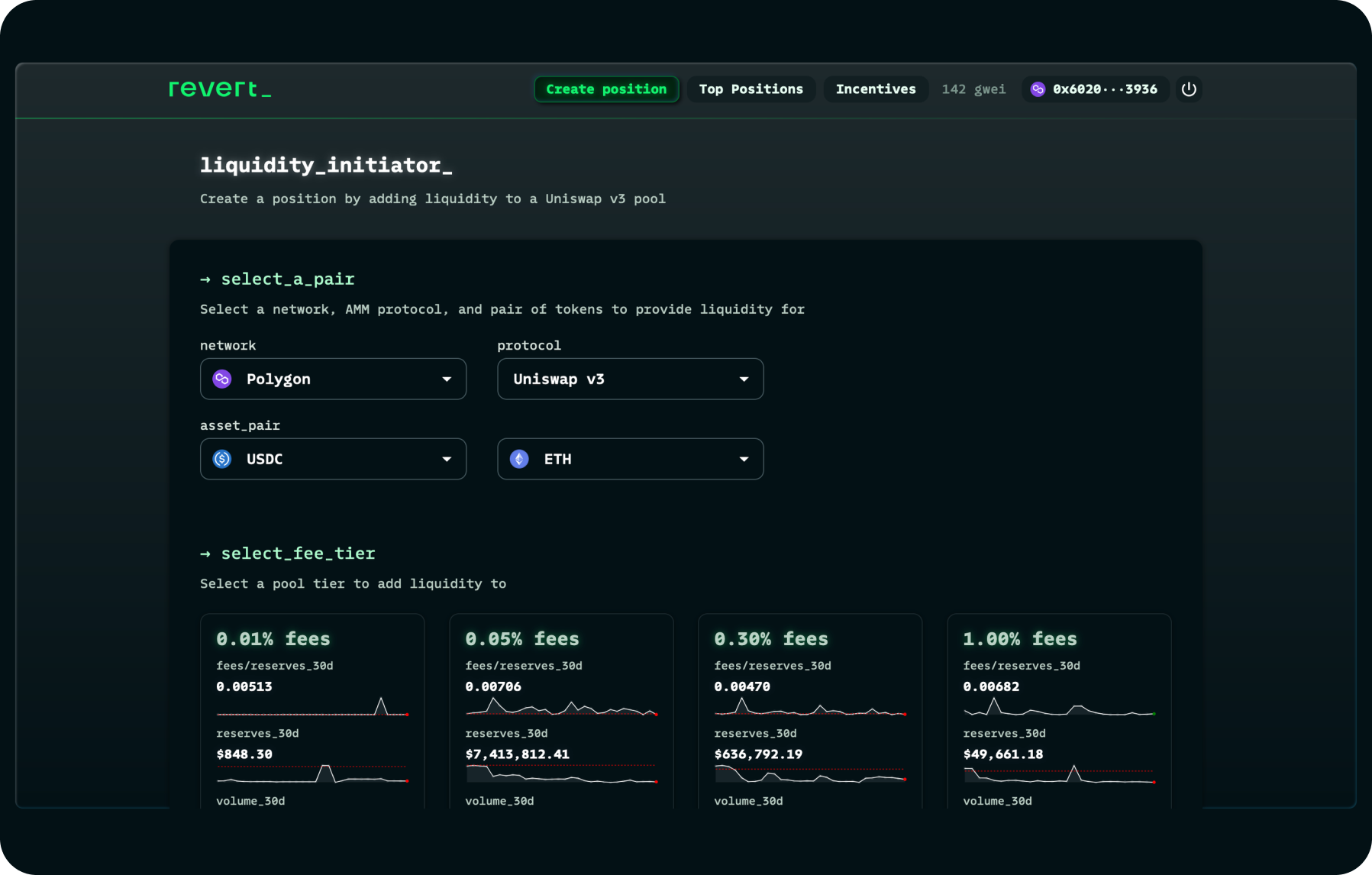

Visit Revert Finance and click Create Position to begin

This will open the position builder.

Select the desired blockchain network and liquidity protocol

For example, Ethereum and Uniswap V3. Next, choose the two liquidity coins for the pair along with the fee tier; we chose USDC and ETH.

- Select the price range

Revert shows the current optimal range for maximum liquidity. Users can adjust the range higher or lower.

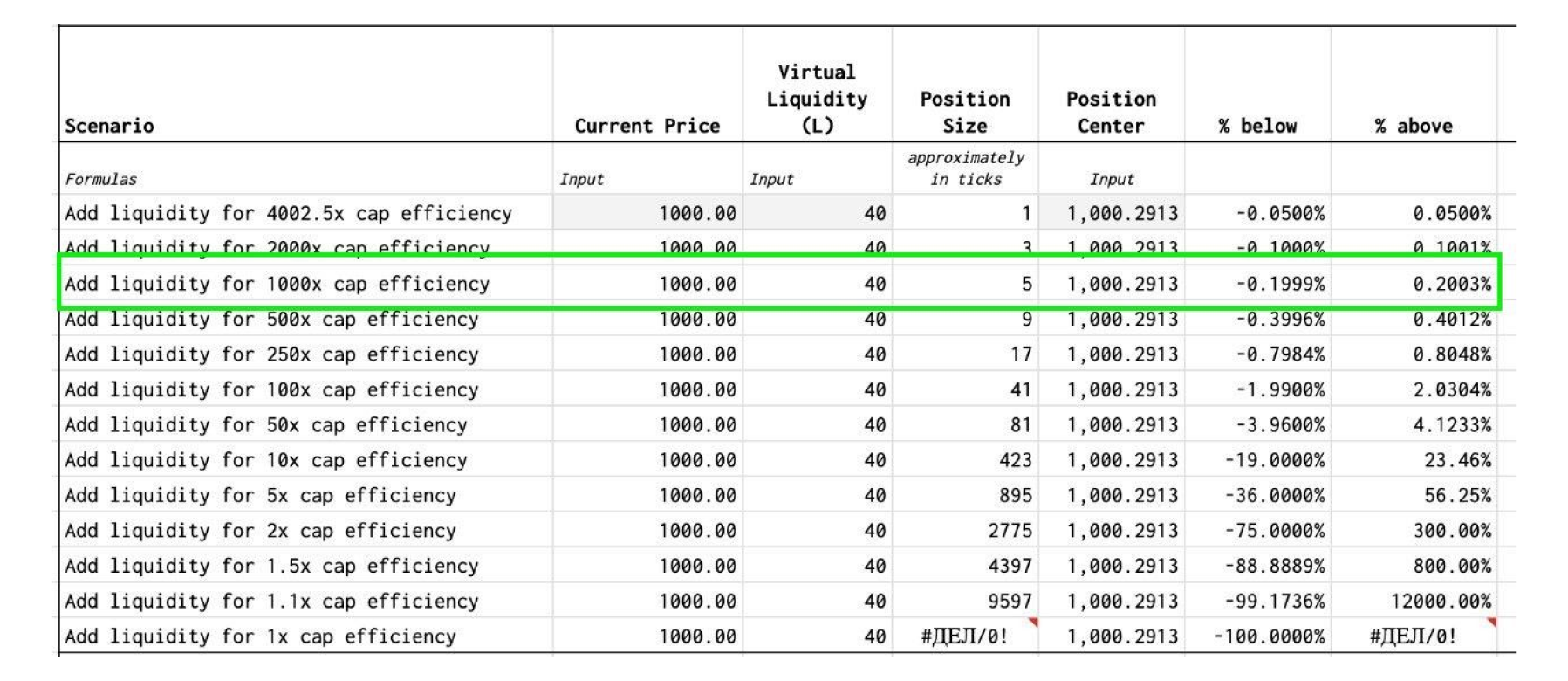

Using a 4% range comes with x1000 cryptocurrency liquidity efficiency, as seen in the table below.

- Recalculate the quantity of each asset needed to provide liquidity within the set range

Revert automatically determines the amounts.

- Click Run backtester

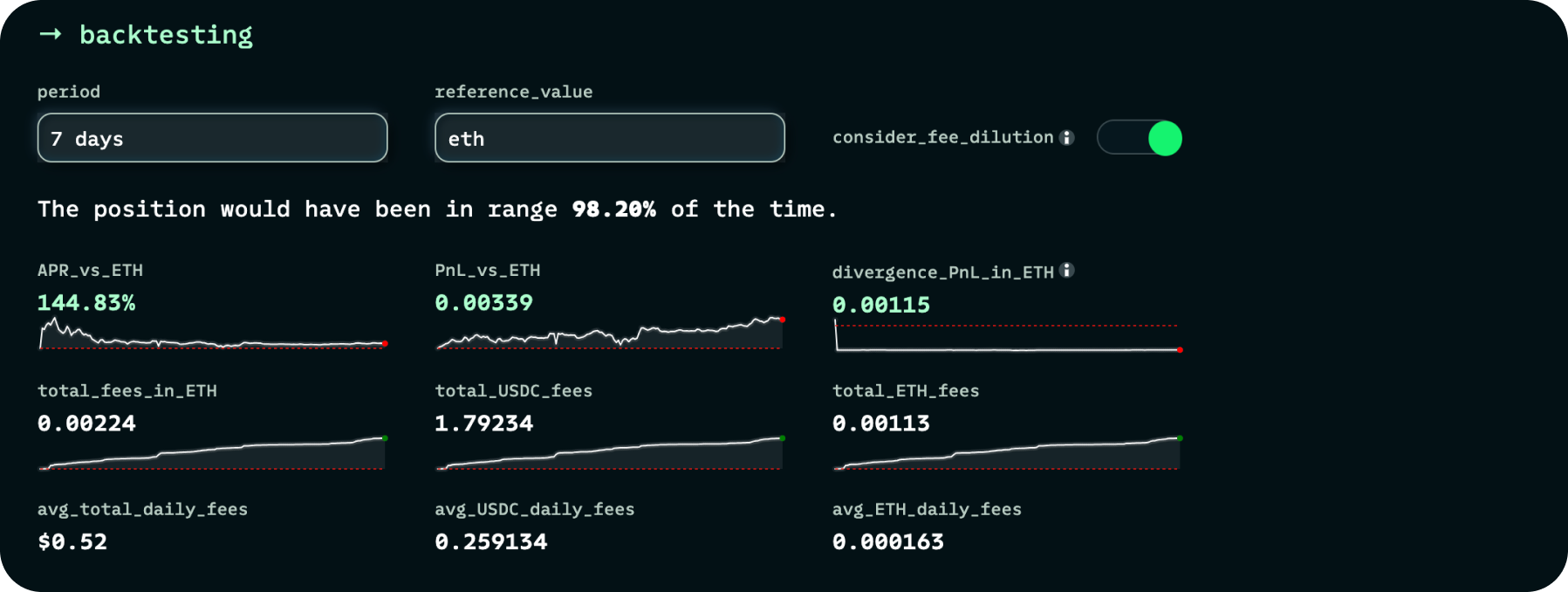

The range test results for the last 7 days show the return on assets in the pool compared to simply holding ETH in the wallet.

Navigate to Uniswap and create the liquidity pool crypto with the calculated asset amounts and range. The position will now be actively managed on Revert Finance. Using this service, users effectively use Uniswap, the leading decentralized protocol. Revert provides detailed information about liquidity pools positions and allows management of them through a single console – maximum automation.

Also being an open source protocol, Uniswap V3 makes its code base available to all interested parties on GitHub. This transparency allows traders and liquidity providers to analyze the smart contracts that power the platform.

This repository provides a deep understanding of Uniswap's inner workings, as well as in-depth analysis of optimization strategies. As a useful resource, the Uniswap GitHub facilitates informed decision-making and strategic planning.

We provide a universal step-by-step instruction on how to create liquidity pools on Uniswap V3.

Uniswap is a decentralized exchange protocol that allows users to trade cryptocurrencies without an intermediary. This platform because it has high mobility and a simple interface for creating liquidity pools. Traders and liquidity providers often utilize tools like the Uniswap v3 calculator to estimate gas costs and projected returns for various positions.

Platforms like Revert Finance seek to empower DeFi users with analytics and automation. Despite security incidents that damaged trust, Revert provides useful tools to select the best liquidity pool and manage it effectively.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.