Uniswap Liquidity Pools Instruction

Key Insights

- Liquidity providers require ETH for gas fees and 2 tokens to supply the liquidity pool in desired quantities.

- Token quantities input determine the provider's share of the liquidity pool and set the exchange rate between the assets.

- After approving transactions in the wallet, providers must wait for confirmation before earning trading fees from their pooled liquidity.

As a decentralized exchange (DEX), Uniswap simplifies the process of providing liquidity for users.

The liquidity pool is a service for crypto investors that offers a share of the commission when two tokens are exchanged in it with minimal risk. The process is outlined below using Uniswap as an example.

What Is Uniswap

Uniswap is a DEX built on the Ethereum blockchain, with Uniswap V3 representing its third iteration.

The key advancement in Uniswap V3 over its predecessor, Uniswap V2, and other earlier versions, is the introduction of more flexible pricing mechanisms within liquidity pools.

When two tokens are exchanged within a Uniswap pool, liquidity providers earn a portion of the transaction fee. The share of the fee each provider receives is proportional to the amount of liquidity they have contributed relative to the total pool.

Uniswap V2 allows the exchange of any ERC-20 tokens, making it a popular choice for those seeking decentralized trading options. UNI, native token of Uniswap, plays a crucial role in this growing sector.

Uniswap operates without traditional order books, using automated liquidity pools to facilitate direct token swaps. The UNI token is central to the Uniswap ecosystem, enabling seamless token swaps while enhancing liquidity for less popular ERC-20 tokens.

Additionally, UNI holders can participate in network governance and earn rewards, further integrating them into the Uniswap community.

To create liquidity pools on Uniswap you will need a crypto, e.g. Ethereum (ETH), and a pair of tokens you wish to add to the exchange pool. Below is a detailed step-by-step guide.

When starting, make sure you have the chosen crypto in your wallet with enough balance to cover gas fees, and tokens you want to add to the liquidity pool.

How to Create Liquidity Pools on Uniswap

- Go to Uniswap

- Connect your crypto wallet

Click Connect and choose your wallet from the list

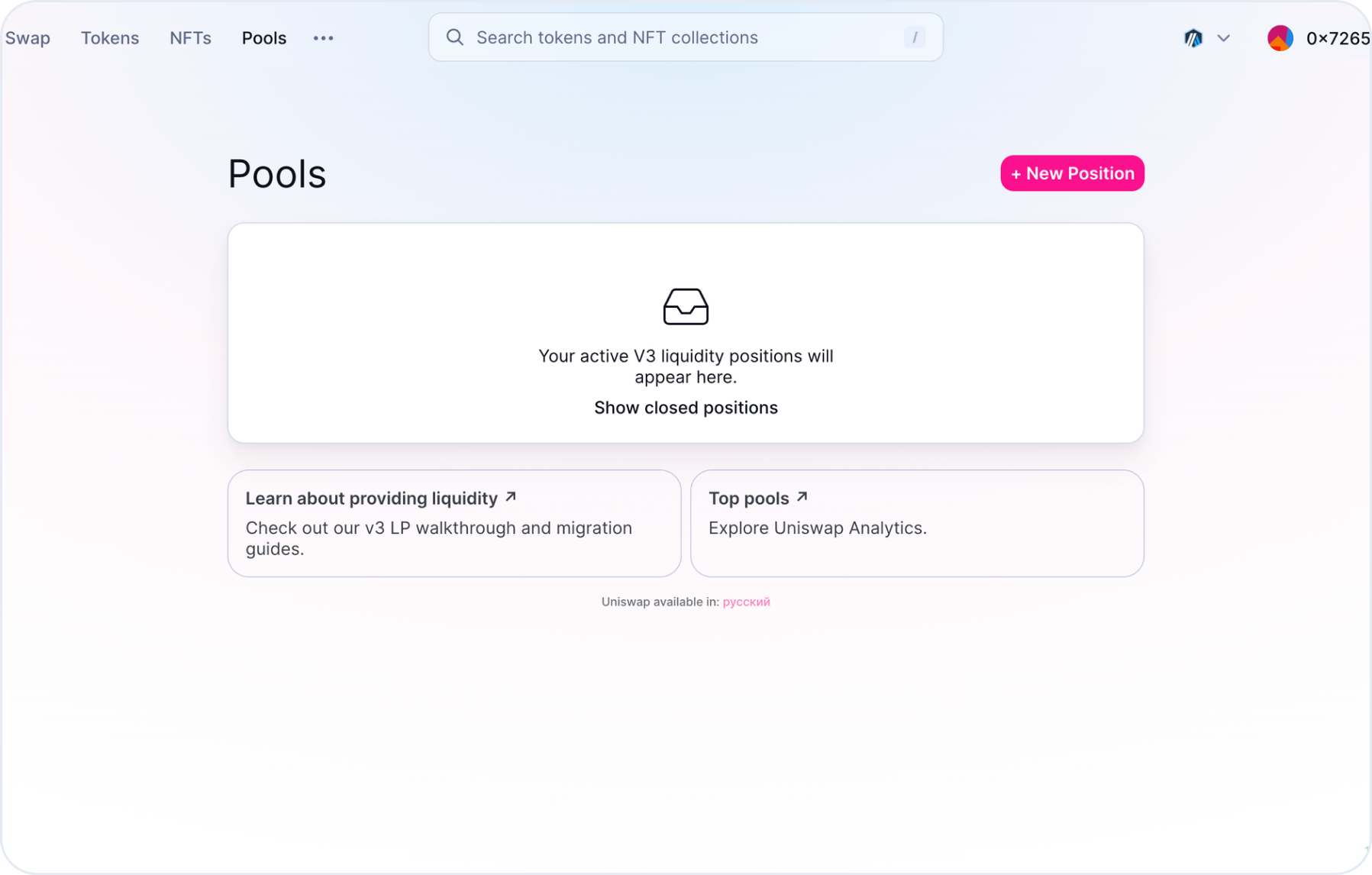

Go to Pools

In the Pools section in the top navigation, click New Position

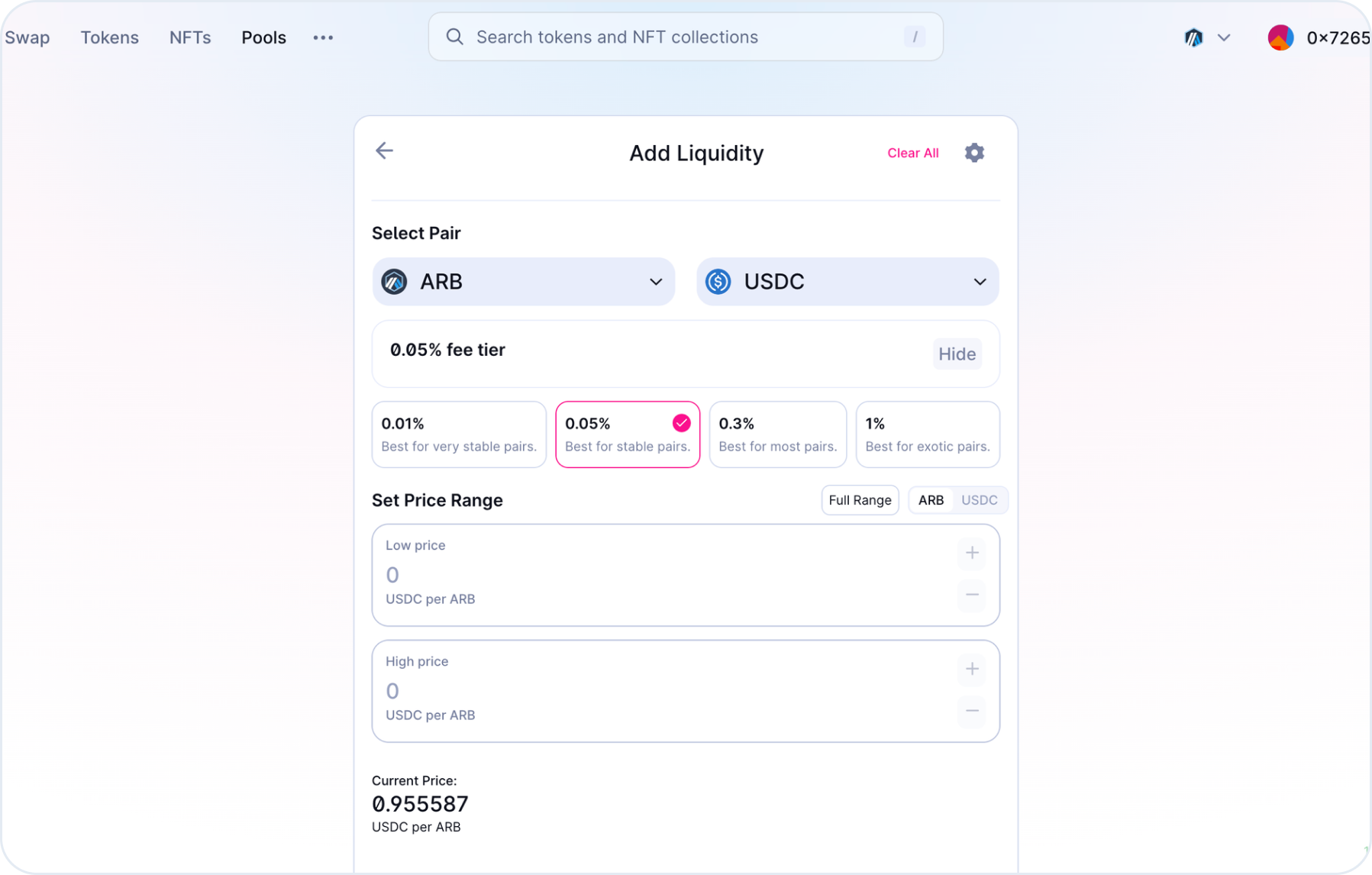

- Select the token pair

Choose two tokens you want to add to the liquidity pool. Enter the token names or choose them from the list

- Specify the quantity

Enter the quantity of each token you want to add to the liquidity pool. Uniswap will automatically calculate the corresponding amount of the other token based on the current exchange rate

- After entering the token quantities, click Approve for each token

This grants Uniswap permission to manage your tokens

- Click Enter an amount

After the toke is approved, you'll see detailed pool information, including your share and the exchange rate.

- Click Confirm Supply

After reviewing the information and making sure everything is set correctly, confirm your transactions. At this point, you'll need to do so in your wallet and pay the gas fees.

After submitting the transaction, wait for it to be processed by the network. The confirmation might take a few minutes depending on network congestion.

Once the transaction is confirmed, you'll become a participant in the Uniswap exchange pool. Your tokens will be used for trading on the exchange, and you'll earn fees from these trades.

Summary

Uniswap is a decentralized cryptocurrency exchange built on the Ethereum blockchain. Uniswap V3 enhancements significantly increase liquidity efficiency while minimizing losses during token exchanges.

In this article we provided a detailed step-by-step instruction on how to create liquidity pools on Uniswap.

Users can get all coins mentioned in this article on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.