Crypto, Oil & Gas, Stock Market Indices Correlation

Key Insights

- Bitcoin's weak correlation with major stock indexes allows for portfolio diversification.

- The strong correlation between BTC and the US Dollar Index underlines Bitcoin's sensitivity to macroeconomic factors and its status as a perceived safe asset.

- Traditional oil stocks have a weak correlation with crypto, but high oil prices can drive interest in Bitcoin as a hedge against inflation and a store of value.

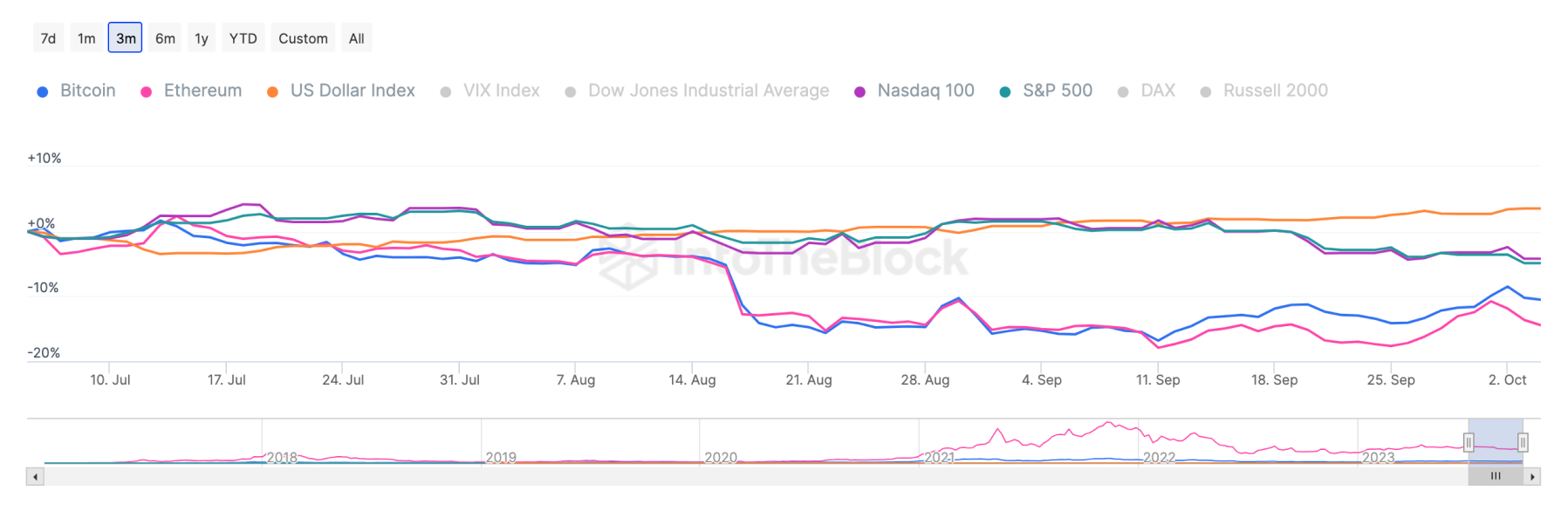

BTC & Stock Indices Correlation

The correlation graph between Bitcoin and Ethereum and leading US stock indices like Nasdaq 100 and S&P 500 shows a very low level of correlation (in most cases, even negative) over the past 30 days. This means that Bitcoin price fluctuations are only weakly correlated with the price movements of these indicators.

In this context, the low or negative correlation between Bitcoin and these indices may signal that the factors affecting the value of BTC have little dependence on events or factors affecting the Nasdaq 100 and S&P 500.

This has important implications for investors and traders. Bitcoin's weak correlation with stock indices could mean that changes in the cryptocurrency's price occur independently of traditional financial markets.

Investors looking to diversify their portfolio to include a variety of cryptocurrencies may see BTC as a potential asset that reacts to unique factors and has its own price dynamics.

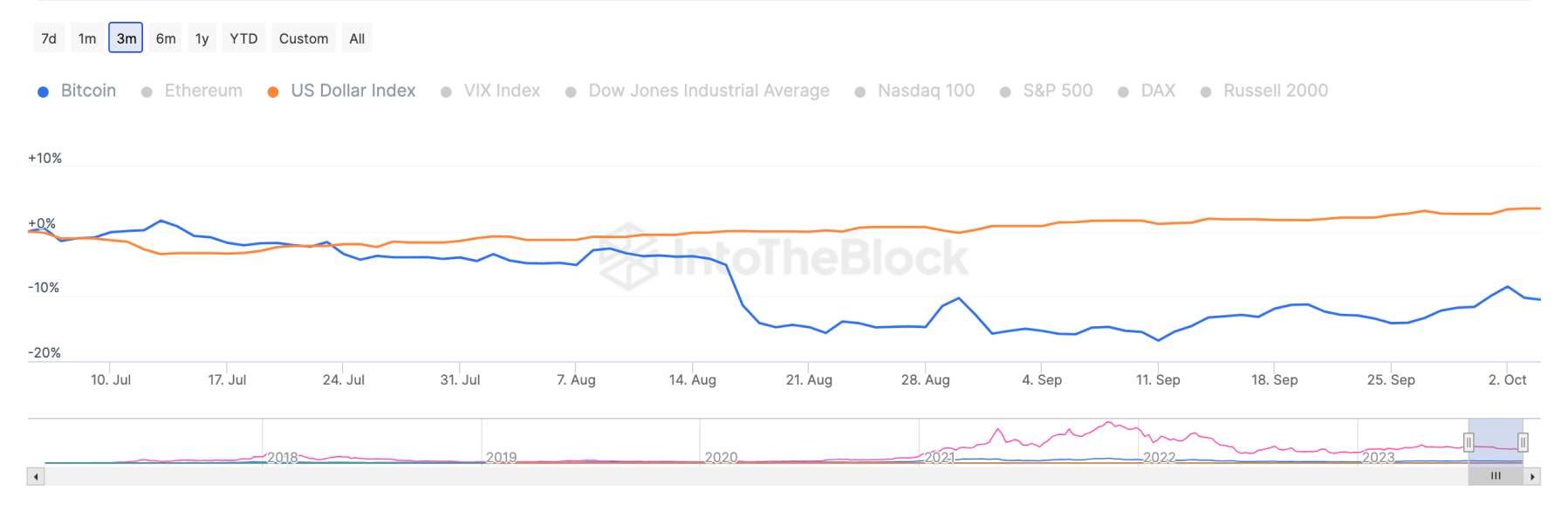

BTC & US Dollar Indices Correlation

Unlike the major stock indices, there has been a fairly high degree of correlation between Bitcoin Index and the US Dollar Index over the past 30 days.

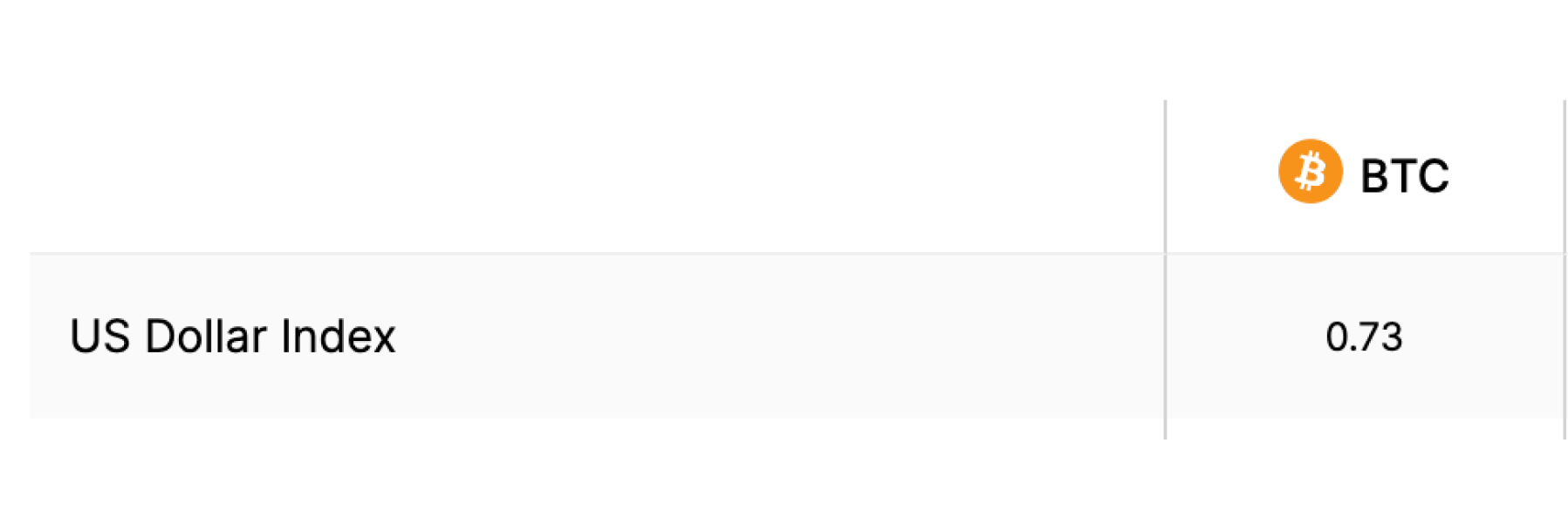

The correlation coefficient between the US Dollar Index and BTC is 0.73, with a value of 1 indicating a perfect correlation.

The decision of the US Federal Reserve System (Fed) to maintain its key interest rate can affect the relationship between the BTC Index and US Dollar Index markets over the past 30 days. Let's look at the mechanism of this impact.

When the Fed decides not to change the interest rate, it is often perceived as the central bank's desire to maintain the current stability in the economy and financial markets. This is an important signal that can bolster investor confidence in the U.S. dollar and the BTC cryptocurrency. As a result, investors can react with certainty that both of these currencies will remain stable and reliable stores of value.

This increased confidence, in turn, may be a contributing factor to similar stock market movements for the U.S. dollar and BTC. Investors may view both of these assets as safe and secure investments, which could lead to a sustained and growing correlation between their prices.

Thus, the Fed's decision to leave the interest rate unchanged may influence investors' perception of the U.S. dollar and BTC as stable assets, which, in turn, may contribute to similar market trends.

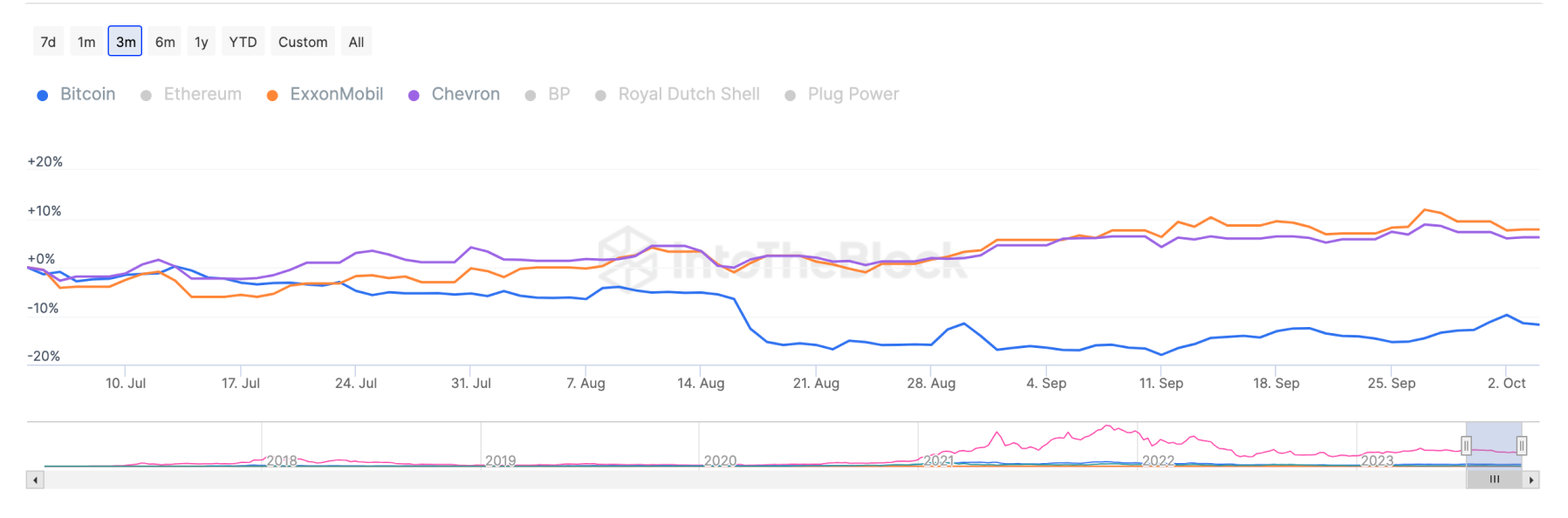

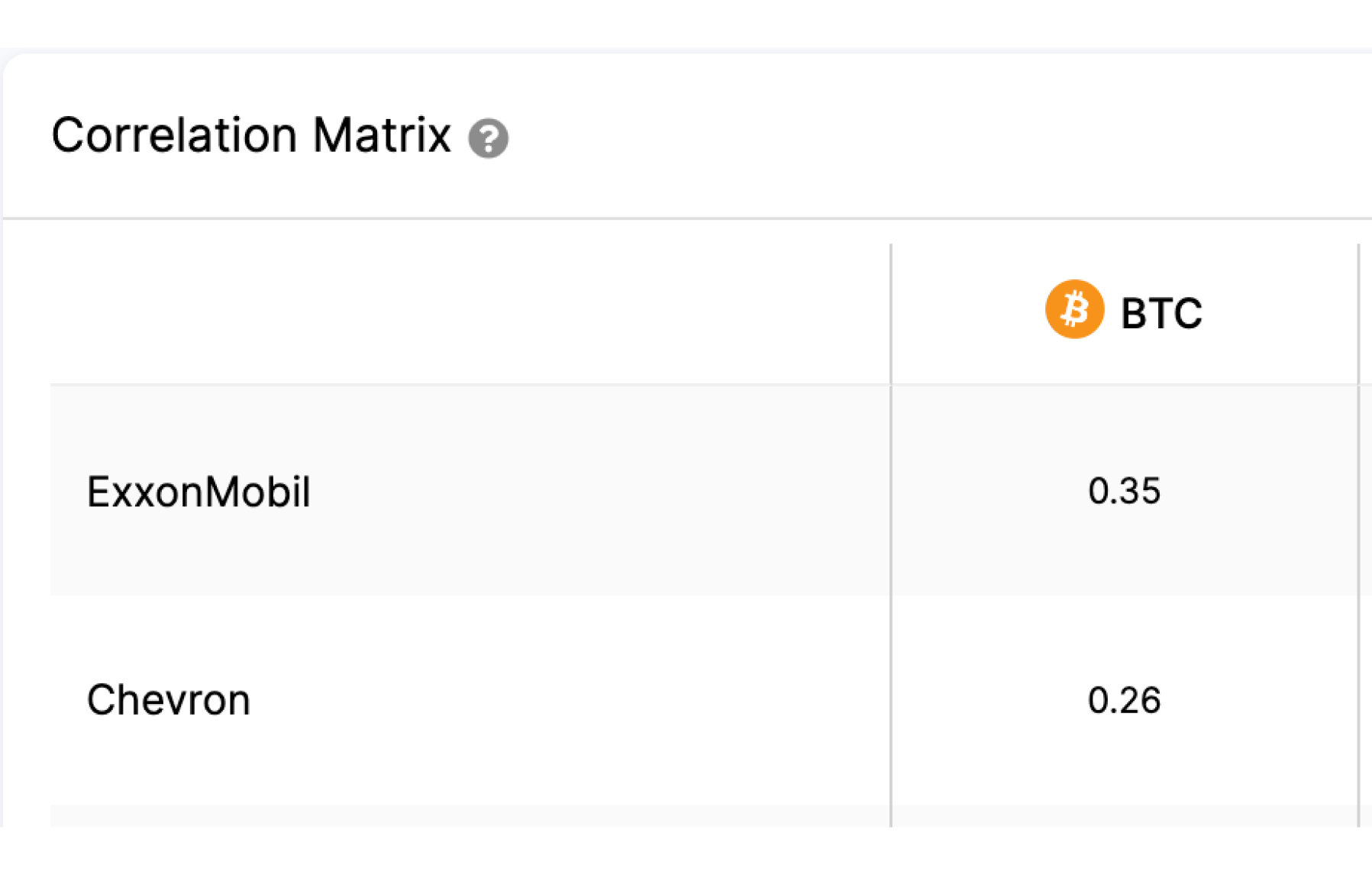

Crypto and Oil & Gas Indices Correlation

A graph of the relationship between Bitcoin (BTC) and major American oil and gas corporations Exxon Mobil and Chevron, over the past 30 days, shows a small degree of correlation.

Companies specializing in oil production and refining, such as ExxonMobil and Chevron, can achieve significant profitability during periods of high oil prices. This attracts the attention of investors who see the potential for these companies' stock values to rise.

High oil prices can also signal a possible increase in inflation. In such a situation, investors may view cryptocurrencies, including Bitcoin, as a means to preserve value and protect against long-term depreciation in the purchasing power of the dollar and other traditional currencies.

This is because assets such as BTC, unlike national money, typically have a limited supply and can serve as an alternative way to preserve value during periods of economic instability.

Thus, high oil prices can have a multifaceted impact on the investment market, attracting attention to oil company stocks while increasing interest in cryptocurrencies as an inflation-protective asset.

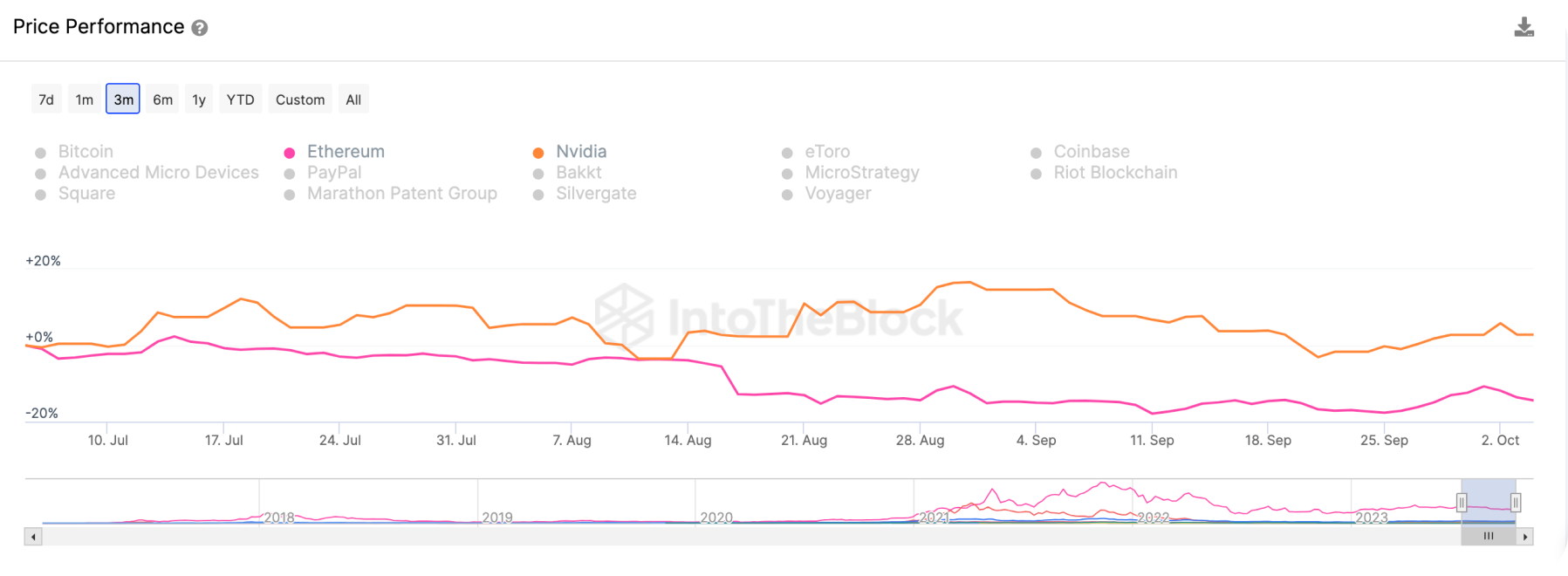

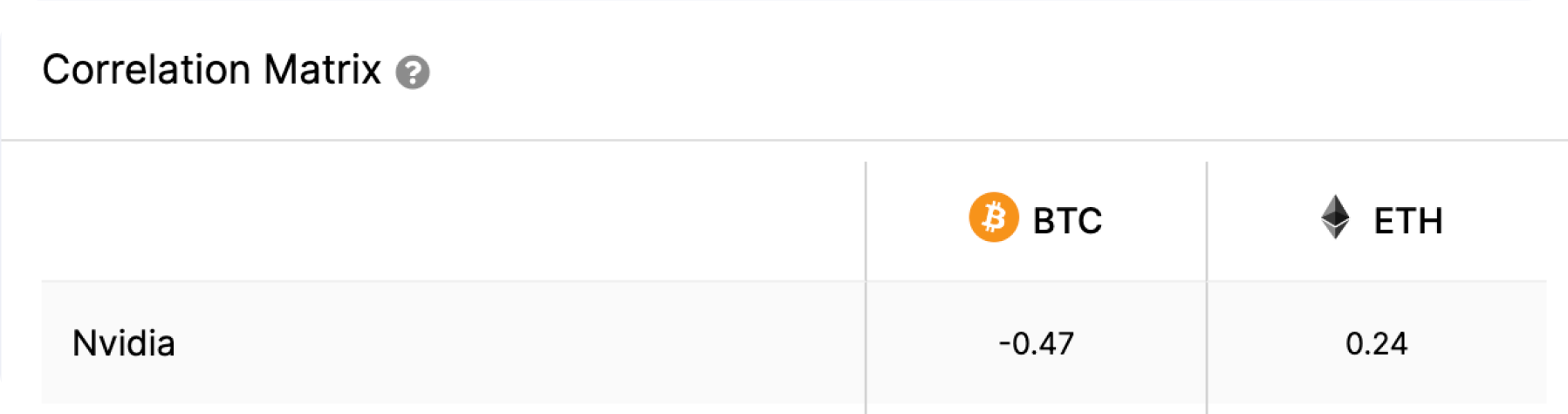

Ethereum & Nvidia Indices Correlation

Nvidia is one of the leaders in the production of graphics processing units(GPUs). GPUs are used not only for gaming and computer graphics, but also for cryptocurrency mining.

Investors with an active interest in the world of digital currencies may view Nvidia as a company with a direct connection to the blockchain and mining industry, which contributes to the correlation.

BTC, ETH and other cryptocurrencies can be purchased for crypto or fiat on SimpleSwap.

Summary

Analyzing the correlation between Bitcoin (BTC) and Ethereum (ETH) and the leading US stock indices, as well as between BTC and other assets, reveals interesting remarks about financial market correlations.

- BTC & Stock Market Indices

The correlation between BTC and the Nasdaq 100 and S&P 500 stock indices over the past 30 days is low or even negative in most cases. This suggests that changes in the price of Bitcoin are not necessarily related to the dynamics of the stock prices reflected in these indicators. This may give investors an opportunity to diversify their portfolio and include cryptocurrency as an independent asset.

- BTC & US Dollar Index

The correlation coefficient between BTC and the US Dollar Index for the month is 0.73, indicating a strong connection between the price of Bitcoin and the movement of the US Dollar. This could be due to the US Federal Reserve's (Fed) decision to leave the key interest rate unchanged. Such a decision is often seen as a desire to maintain stability in the economy and financial markets, which increases confidence in the US dollar and BTC as safe assets.

- Crypto and Oil & Gas Indices

Although typically stocks of companies such as Exxon Mobil and Chevron have a weak correlation with cryptocurrencies, high oil prices may create additional interest in BTC as a means of preserving value and protecting against inflation.

- ETH & Nvidia Indices

The correlation between Ethereum and Nvidia may be due to the technological link between GPUs and cryptocurrency mining, as well as general investor interest in the blockchain industry.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.