Beefy Auto Compounding on Thena

Key Insights

- Thena allows creating liquidity pools with assets like USDT-USDC, while Beefy auto-compounds funds for higher yields.

- To utilize them, create a pool on Thena and transfer the LP tokens to Beefy to enable auto-compounding.

- On Beefy, deposited LP tokens will be auto-compounded for maximized returns without active management.

The Thena and Beefy projects being connected is a way investors can create and manage liquidity pools with various assets on the Binance Smart Chain.

What Is Auto Compounding

Auto-compounding presents a strategy for optimizing cryptocurrency staking.

Auto compounding method automatically reinvests earned profits into the initial investment, allowing rewards to generate additional earnings over time, resulting in significant growth.

Auto compounding also streamlines the staking process, eliminating the need for manual reinvestment to capitalize on compounding gains.

Auto compounding interest entails the automatic reinvestment of earned interest or rewards into the original investment.

This process, requiring no manual intervention, is widely utilized in different DeFi protocols and platforms to maximize investment returns and achieve optimal yields.

What Is Thena

THENA stands out as a leading decentralized exchange (DEX) boasting an extensive array of popular digital currencies.

With numerous markets available, THENA users have ample opportunities to explore and engage in trading activities with their preferred assets. Its support for a wide variety of trading pairs caters to both novice traders and seasoned professionals.

Drawing inspiration from Curve's vote-escrow model and Olympus's anti-dilution mechanism, veTHE holders exercise full control over THENA emissions allocated to gauges. They also benefit from weekly rebases, effectively mitigating dilution resulting from emissions over time.

This model incentivizes long-term THENA supporters and fosters alignment of stakeholders' interests by promoting fee generation.

Positioning itself as a DEX and liquidity protocol, THENA strives to establish itself as the primary liquidity layer on the BNB Chain. It offers enhanced liquidity solutions that are more efficient and cost-effective for traders, liquidity providers, and token holders alike.

By introducing a gauge voting system, THENA transcends the conventional DEX model, providing a mechanism to realign incentives with the interests of token holders and liquidity providers.

What Is Beefy

Beefy stands as a decentralized, cross-chain yield optimizer designed to enable users to accrue auto compounding interest on their cryptocurrency holdings. Prioritizing safety and efficiency, Beefy crypto platform offers competitive APYs to its users.

Employing a series of investment strategies enforced by smart contracts, Beefy automatically maximizes user rewards from various liquidity pools, automated market making (AMM) projects, and other yield farming opportunities within the DeFi ecosystem.

At the core of Beefy's offerings are its Vaults, which implement investment strategies to auto compounding arbitrary farm reward tokens from a decentralized exchange back into users' initially deposited assets. Funds are never locked in any Beefy contract, ensuring users have the freedom to withdraw at any time.

One of the distinguishing features of DeFi applications is their permissionless and trustless nature, enabling anyone with a supported wallet to interact with them without relying on a trusted intermediary. While funds are staked in a THENA vault, users retain complete control over their cryptocurrency.

The BIFI Token serves as the governance token. It serves as the central asset, connecting all stakeholders across the Beefy project to perpetuate the cycle of value creation that was the inspiration for the Beefy project.

By adding their tokens to the pools, users enjoy liquidity rewards. Beefy Finance specializes in auto compounding and optimizing yield from liquidity pools, has forged connections with a range of DeFi platforms, including THENA.

How to Create a Liquidity Pool on Thena

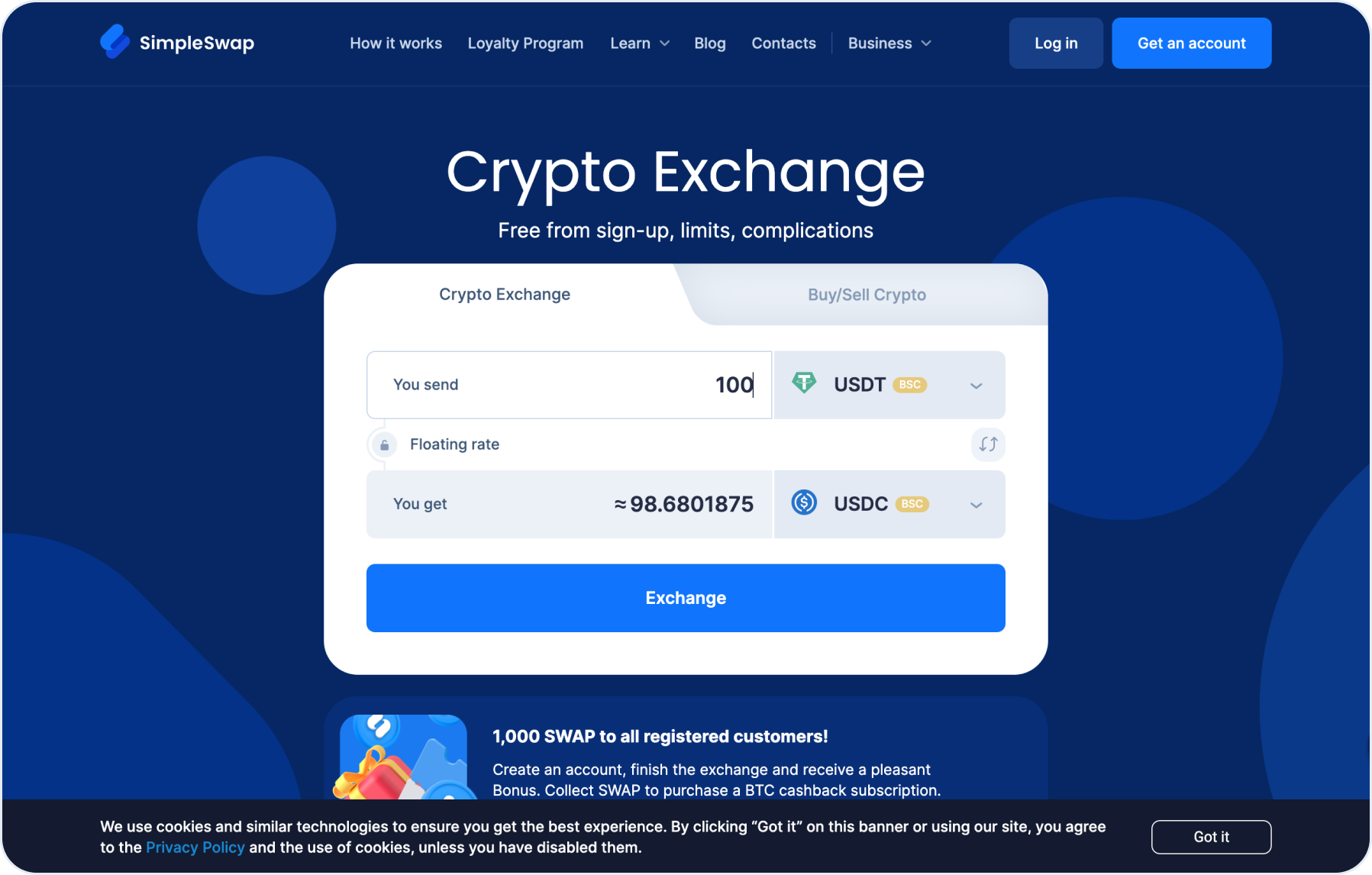

Fund your stablecoin wallet

To do so, you can use the SimpleSwap exchange.

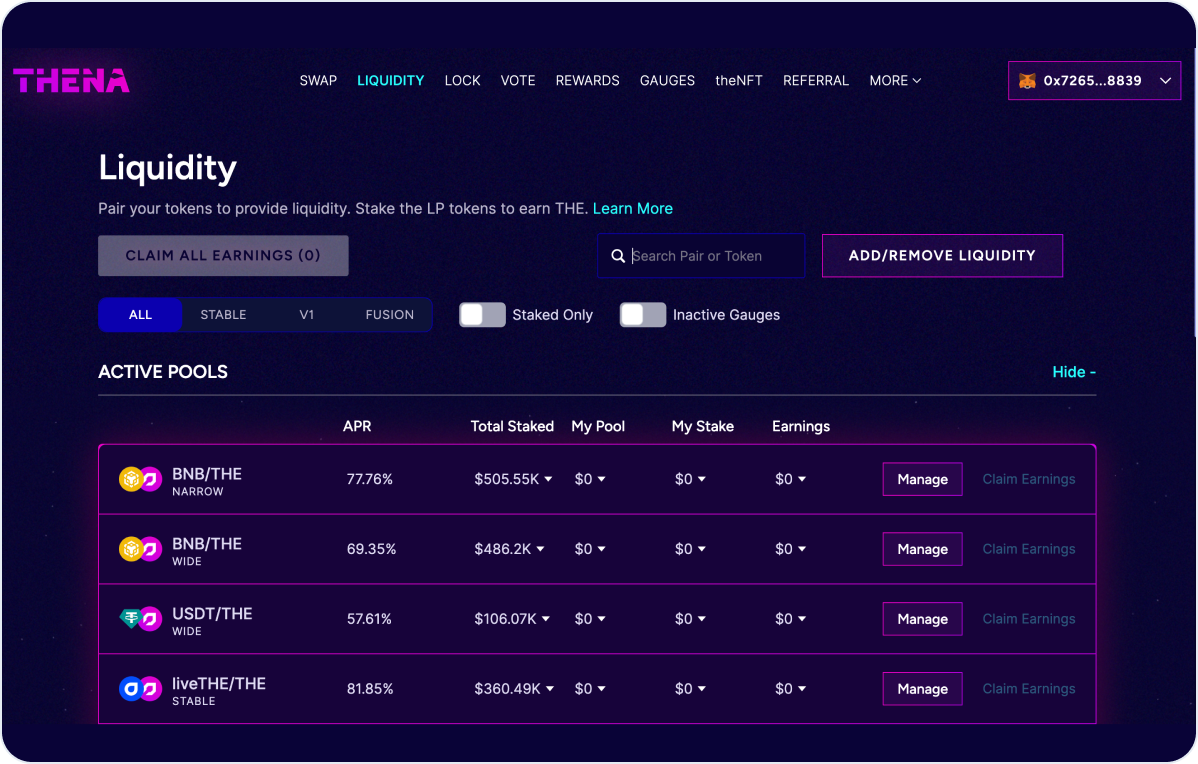

- Head to Thena

Connect to your wallet with sufficient USDT and USDC for creating a liquidity pool and go to the Liquidity tab

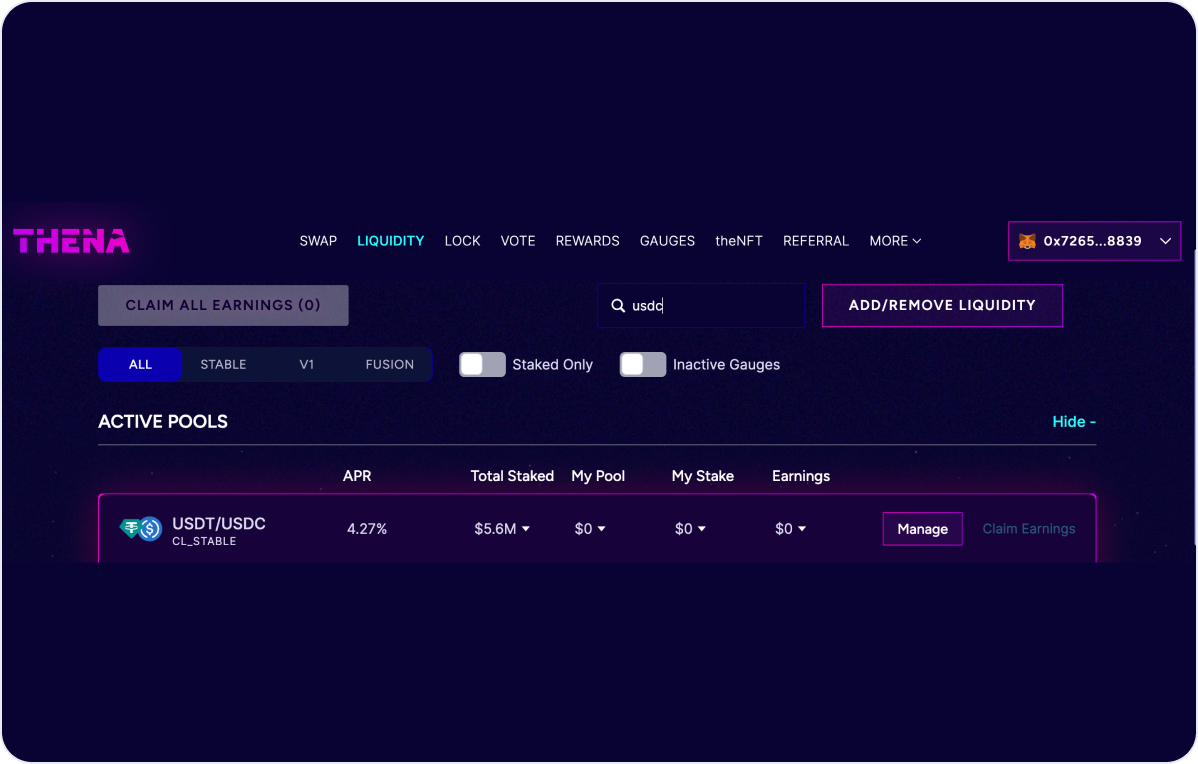

On the Liquidity tab, locate the USDT-USDC trading pair

Then click the Add/Remove Liquidity button.

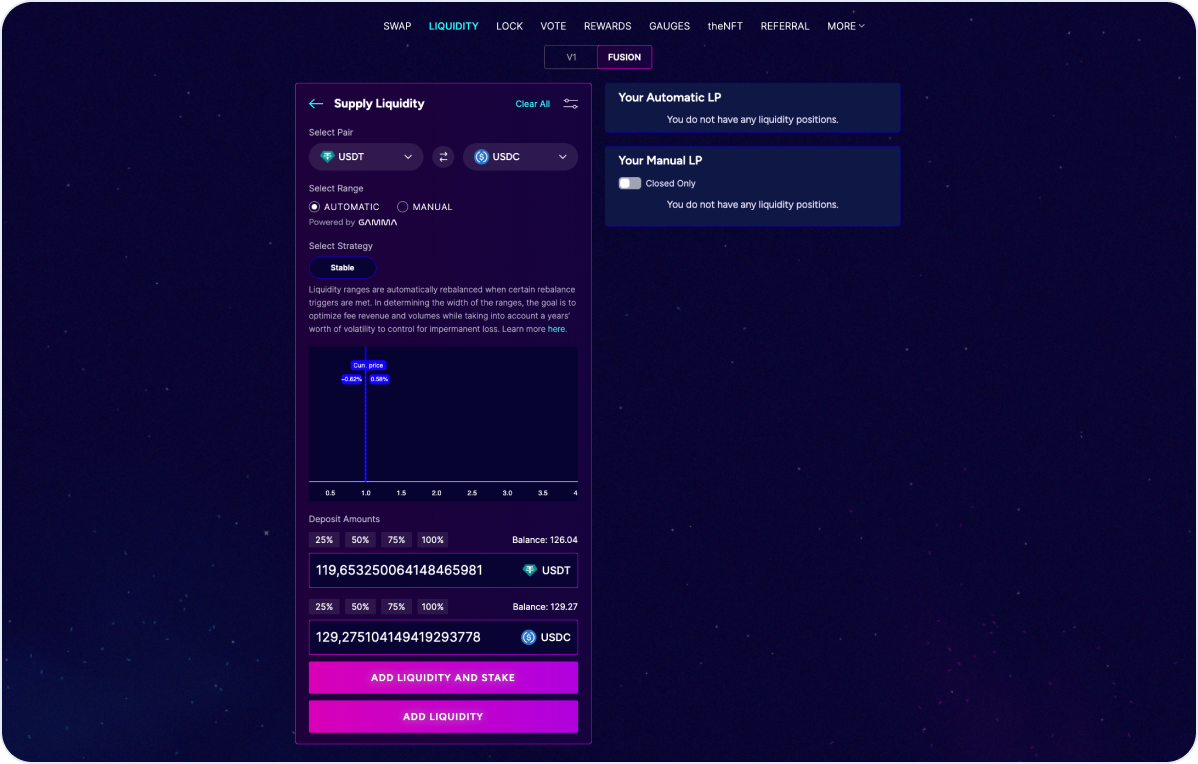

Specify the amounts of USDT and USDC to add to the liquidity pool

Keep the Select Range at Automatic for a well-balanced pool. Click Add Liquidity.

Confirm the transaction in your wallet

Voilà! Your funds are now part of the liquidity pool.

How to Transfer the Pool to Beefy for Automated Compounding

Visit Beefy

Connect to your wallet, where you have the liquidity pool you created earlier.

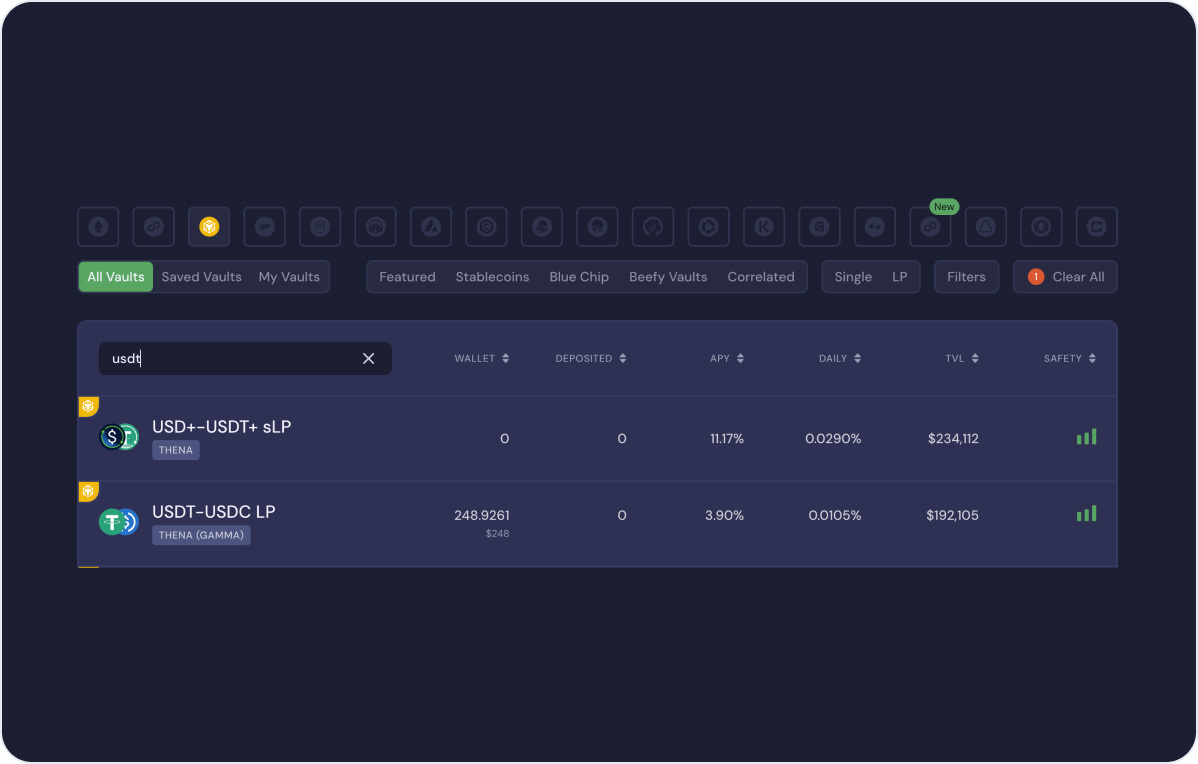

On the Vaults page, locate the USDT-USDC asset pair

To do so, find the corresponding liquidity pool linked to Thena.

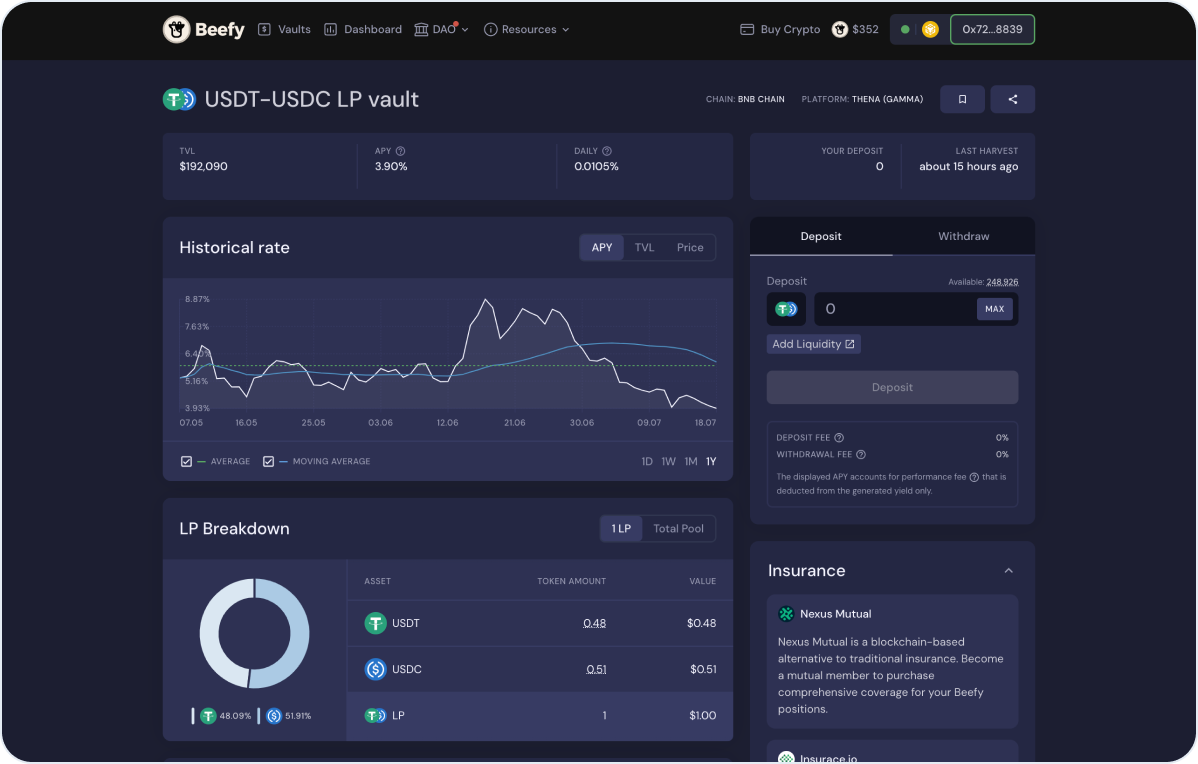

Click on this pool

Make sure to check the current percentage rate, rewards, and risks.

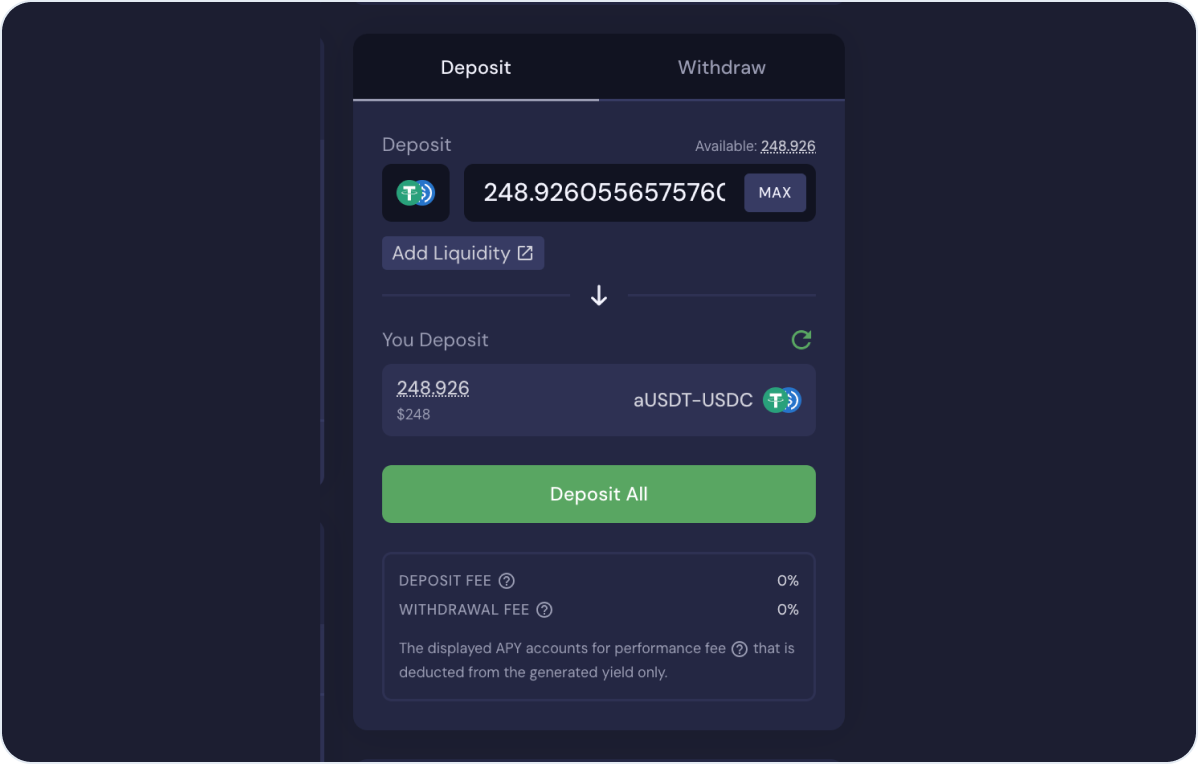

Click on the Deposit tab

Indicate the amount of LP tokens you want to transfer to Beefy.

Confirm the transaction in your wallet

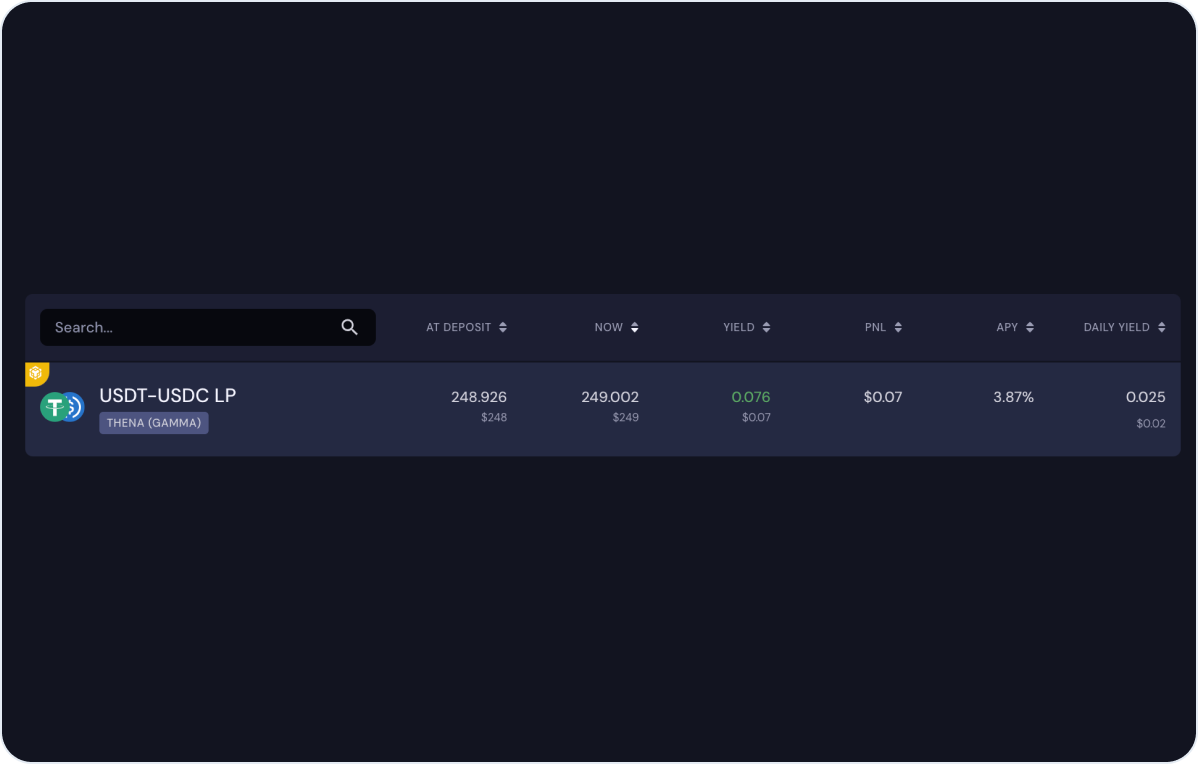

And there you have it! Your funds are now transferred to Beefy for automated compounding. Here's what we've already earned.

Congratulations! You've successfully created a liquidity pool on Thena and effortlessly migrated it to Beefy, where your USDT-USDC pair investment will thrive through automatic compounding on the BSC network.

Users can get all coins mentioned in this article on SimpleSwap.

Summary

The integration between Thena and Beefy presents investors with a seamless opportunity to establish and manage liquidity pools comprising various assets on the Binance Smart Chain.

Auto compounding emerges as a strategic tool for optimizing cryptocurrency staking, automatically reinvesting profits into the initial investment to generate additional earnings over time.

With Beefy's decentralized, cross-chain yield optimization platform, users can capitalize on competitive APYs while ensuring safety and efficiency. Additionally, Thena's role as a leading decentralized exchange provides users with an extensive selection of digital currencies and liquidity solutions, further enhanced by its governance model and commitment to aligning stakeholders' interests.

By leveraging the respective strengths of Thena and Beefy, investors can maximize their yields and participate in the DeFi ecosystem with confidence.

Through a straightforward process, users can create liquidity pools on Thena and seamlessly transfer them to Beefy for auto compounding, ensuring their investments thrive on the BSC network.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.