Aptos Fundamental Analysis

Key Insights

- Aptos ecosystem unique technologies, including the Move programming language, Block-STM parallel execution, and AptosBFT v4 consensus, enable it to achieve high transaction throughput and low latency, positioning it as one of the fastest blockchains.

- With an eightfold increase in Total Value Locked (TVL) and rapid adoption of applications like Aries Markets and KYD Labs, Aptos foundation is building a robust ecosystem that attracts both developers and users.

- APT tokens are distributed to incentivize growth, while substantial investments from major funds support ongoing development and increase project visibility, enhancing Aptos’s potential as a long-term blockchain solution.

Aptos ecosystem is a high-performance Layer 1 blockchain designed for scalability and resilience under heavy loads. The development team behind Aptos foundation aims to create the fastest and most scalable blockchain in the industry, while enhancing security and decentralization. Their ambitious goal is to achieve 160,000 transactions per second (TPS) with latency under one second.

Distinctive technologies within the Aptos ecosystem include its parallel execution engine, Block-STM, the Quorum Store protocol for mempool, and a custom Move programming language. The blockchain prioritizes low latency and high throughput to foster rapid adoption of innovations in today’s demanding environment.

Aptos Ecosystem: The Team Behind Aptos

Aptos Labs was founded by Mohammed Shaikh and Avery Ching, both previously involved with Meta’s (Facebook) blockchain project, Diem.

Known for innovations such as the Move programming language, the Block-STM parallel execution engine, and the Narwhal and Bullshark consensus mechanisms, Aptos Labs has assembled a skilled team.

Mohammed Shaikh, CEO of Aptos, has over 10 years of experience in finance and blockchain. During his time at Meta, he worked on strategic partnerships for Novi and contributed to developing blockchain infrastructure for digital assets.

Shaikh also advised the World Economic Forum on digital currencies and co-founded Meridio, the first company to release fractional real estate shares on blockchain, backed by ConsenSys.

Avery Ching, CTO of Aptos, has over a decade of experience in distributed technology scaling. Prior to Aptos ecosystem, he led Meta’s crypto platform, working on Diem’s blockchain infrastructure and wallet. Ching also managed analytics technologies at Meta, such as Spark, Giraph, and Hive, serving billions of users.

Aptos Architecture

Aptos ecosystem operates on a Delegated Proof of Stake (DPoS) system. Like Proof of Stake (PoS), DPoS relies on token staking but selects only specific delegates, chosen by token holders, to act as validators.

This enhances network performance, as consensus is reached among a limited number of trusted nodes, resulting in faster and more scalable network operations, though with slightly less decentralization compared to PoS.

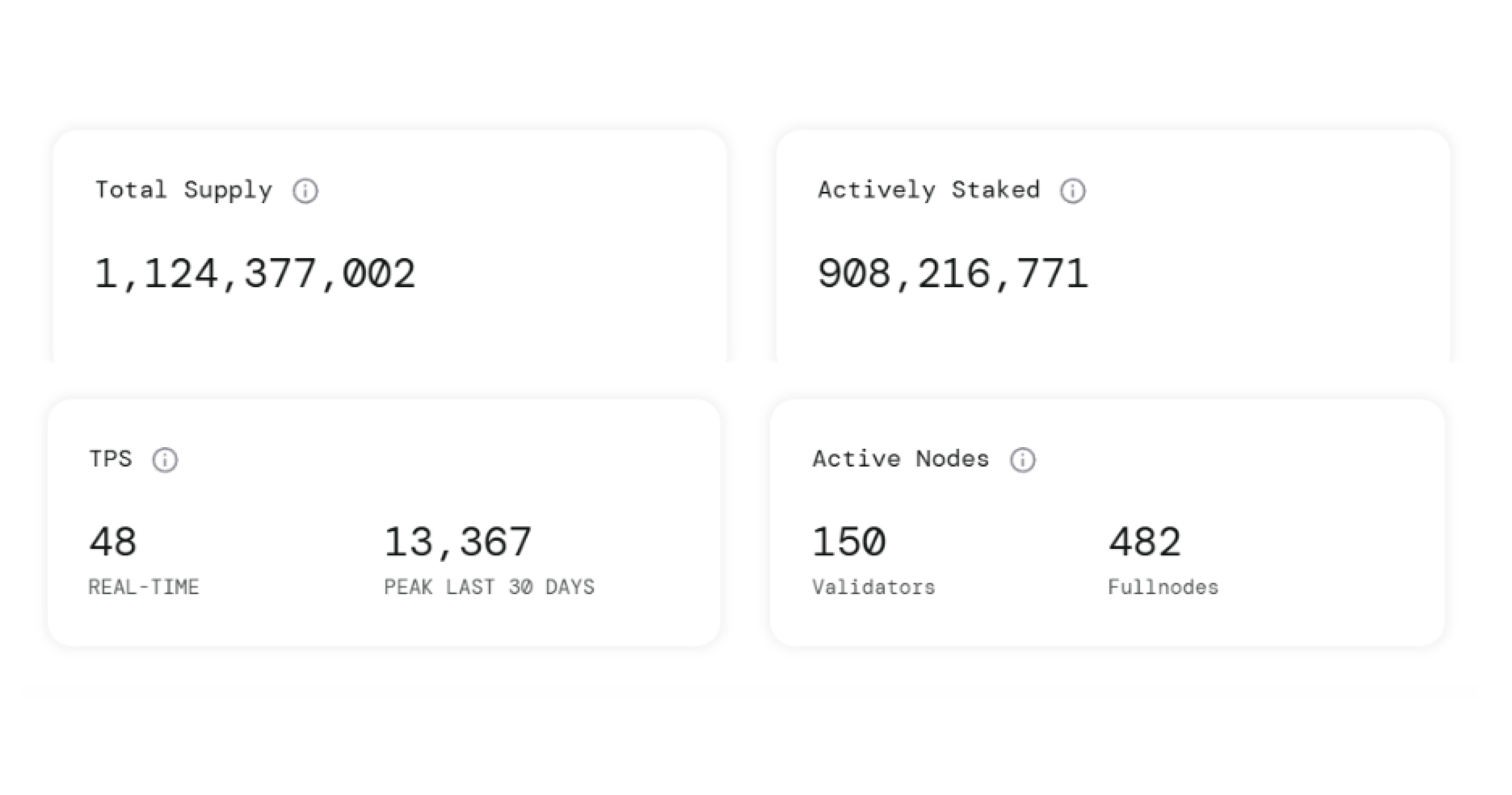

Currently, over 80% of the circulating supply in the Aptos ecosystem is distributed among approximately 150 validators.

Key Components of the Aptos Ecosystem Architecture

- AptosBFT v4 Consensus Protocol

The AptosBFT v4 protocol is an improved version of the Jolteon protocol designed to reduce latency. It incorporates a reputation-based leader selection, considering both stake proportion and performance.

Validators interact directly through a peer-to-peer approach, which reduces dependence on leaders and increases network throughput in the Aptos ecosystem. The pipeline-like design enables one node to participate in various consensus stages, maximizing resource use at every step.

- Quorum Store Module

The Quorum Store enhances Aptos consensus by separating data distribution and transaction ordering. Transactions are bundled and shared across validators in parallel. Once confirmed by at least two-thirds of the validators, Quorum Store generates a proof of readiness for consensus.

This lightens the load on leaders, allowing block creation from certified packages and optimizing resource allocation. Quorum Store’s main advantage is horizontal scalability, enabling additional nodes to join as load increases to improve data transfer and throughput.

- Block-STM Parallel Execution Mechanism

The Block-STM parallel execution mechanism ensures high performance in the Aptos ecosystem through parallel transaction processing. Unlike pessimistic parallelism, Block-STM operates optimistically, assuming transactions are non-conflicting. In the event of a conflict, transactions can be rolled back and retried, simplifying code and minimizing latency.

Together, AptosBFT v4, Quorum Store, and Block-STM enable Aptos to handle up to 30,000 TPS, with a stable throughput of 25,000 TPS. These figures were achieved a year ago in the Previewnet, a mainnet-like environment. By comparison, Solana processes about 3,000 TPS on average, including voting transactions.

Move Programming Language: Advantages for Aptos Ecosystem

Aptos leverages its own Move language, developed initially for Meta. Move programming language emphasizes security, minimalism, and efficient resource management.

Key distinctions of Move language from more established languages like Solidity and Rust include:

- Formal verification, allowing developers to mathematically validate code accuracy.

- Modularity, supporting code reuse.

- Parallel execution, enabling multiple transactions to be processed simultaneously.

- Mitigations against replay and double-spend attacks.

Popularity of the Move language is attributed to its ability to support parallel execution. Imagine if each chef in a kitchen prepared dishes sequentially - it would be slow. With Move programming language , however, validators act like chefs working in parallel, each handling tasks efficiently.

The Block-STM mechanism allows validators to work on assigned tasks concurrently, aligning validator actions in real-time and maximizing available resources.

This parallel approach allows validators to process many records simultaneously without delays or compromises in accuracy, making Move language an attractive option for developers and projects within the Aptos ecosystem.

Move Language for Security and Performance

The Aptos foundation is continuously enhancing Move language, adding tools for testing and reliability. In May 2024, tools like move-mutator and move-spec-test were introduced to help identify vulnerabilities in smart contract specifications.

These tools expose deficiencies through controlled code changes, while the built-in Move Prover further verifies code accuracy, adding an extra layer of security.

To improve performance, Aptos ecosystem also launched Move Compiler v2, which accelerates compilation and improves error messaging, making Move language a convenient tool for Aptos’s long-term growth.

Aptos Ecosystem Key Performance Indicators

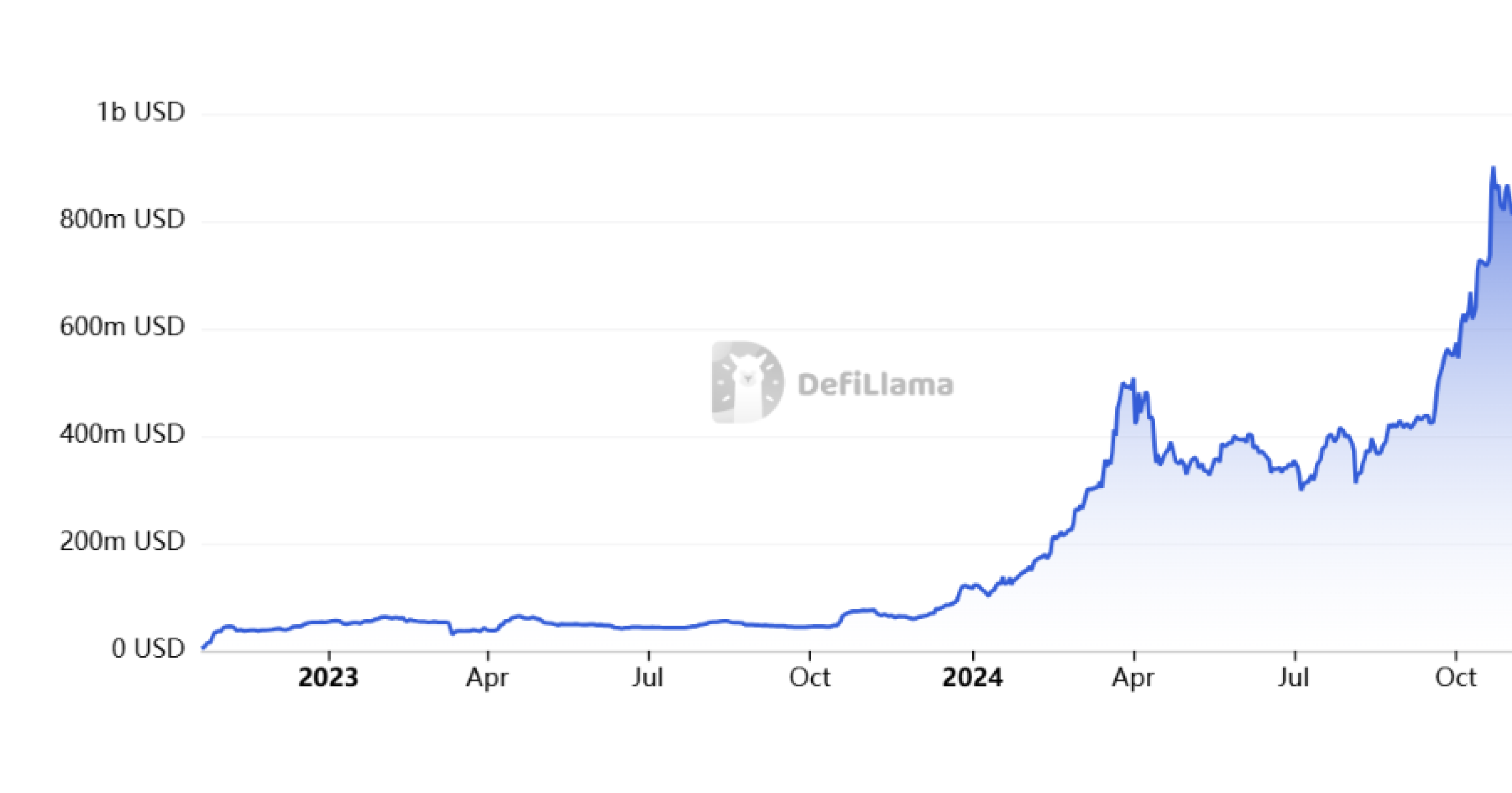

The Aptos ecosystem has shown strong growth in 2024, with Total Value Locked (TVL) increasing almost eightfold- from $116 million at the start of the year to over $800 million today. This growth underscores the network’s positive trajectory and increasing user trust.

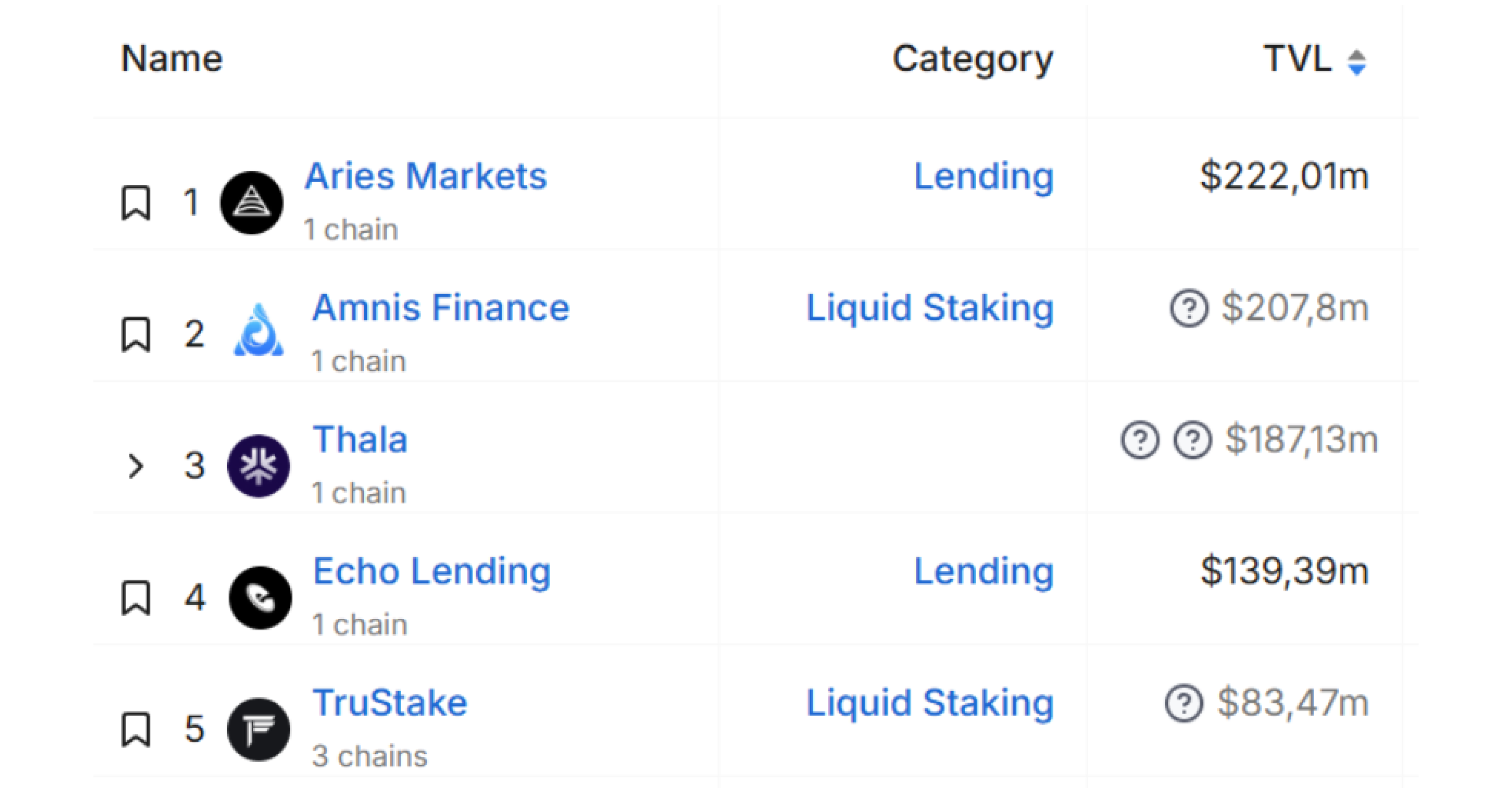

The leading project in the Aptos ecosystem by TVL is Aries Markets. Aries Markets is a decentralized margin trading protocol on Aptos, allowing users to borrow, lend, swap, and trade with margin through an on-chain order book at lightning speed.

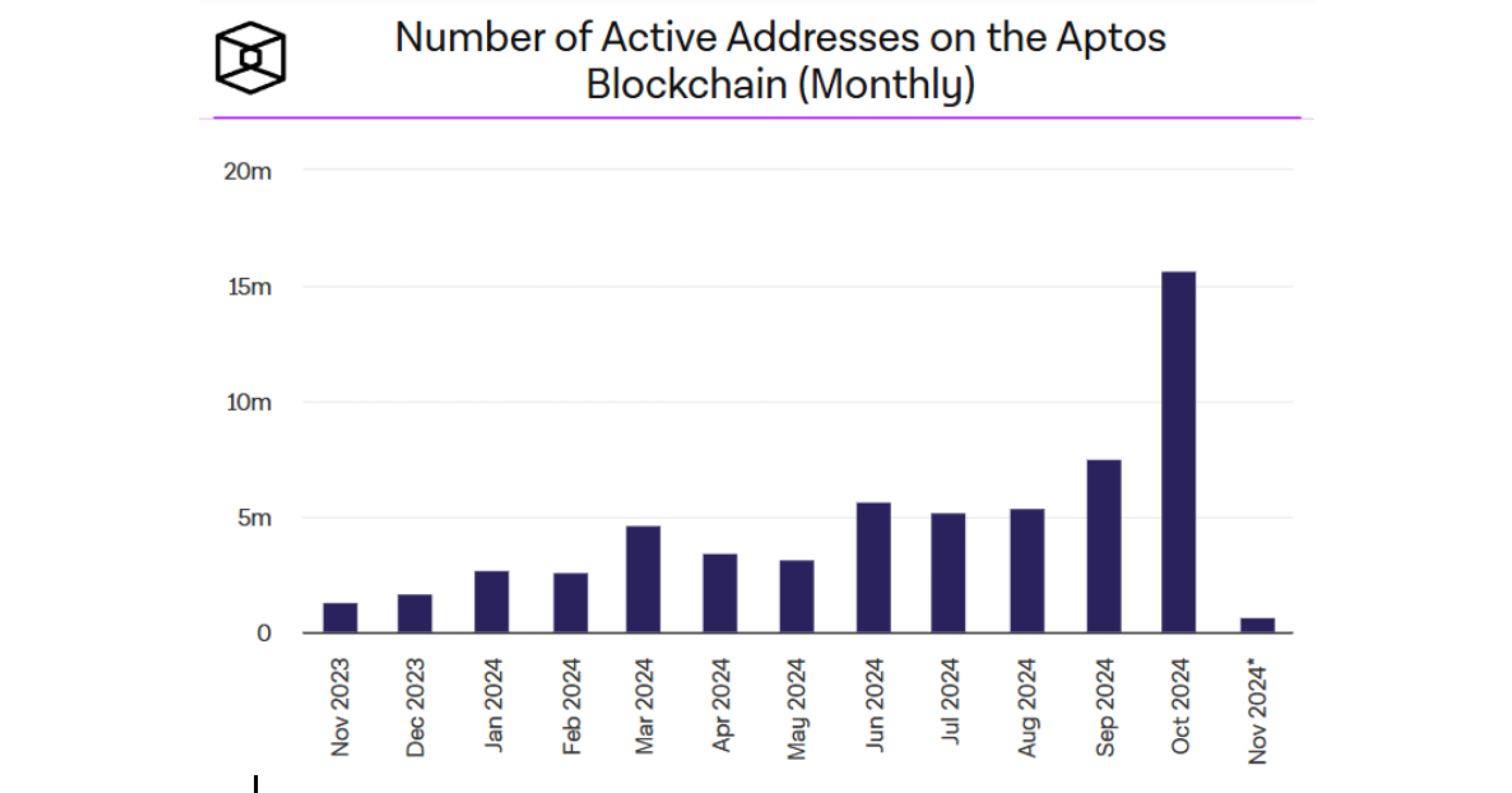

The number of active addresses within the network is also increasing rapidly, indicating growing interest and activedevelopment. Over the past year, active addresses have increased more than tenfold, from 1.3 million to 15.6 million, confirming Aptos ecosystem expanding presence in the market.

User Adoption and Consumer Applications

Aptos ecosystem actively attracts users by integrating Web2 and Web3 solutions, enabling easy blockchain transitionswith familiar accounts.

Through Aptos Keyless, users can create Aptos wallets by logging in with their Google ID, simplifying access to the platform. Aptos Connect allows users to sign into Web3 applications with a familiar interface.

Several consumer applications are already active on the Aptos ecosystem, including KYD Labs, Overlai, and Supervillain Labs. The ticketing blockchain platform KYD Labs has attracted over 50,000 users and processed more than one million sales, recently partnering with NYC’s Le Poisson Rouge to reach a new audience.

Supervillain Labs’ game Wanted, launched on Aptos ecosystem, enables in-game item management via Aptos accounts, with low fees and high transaction speeds fueling ecosystem engagement and new applications.

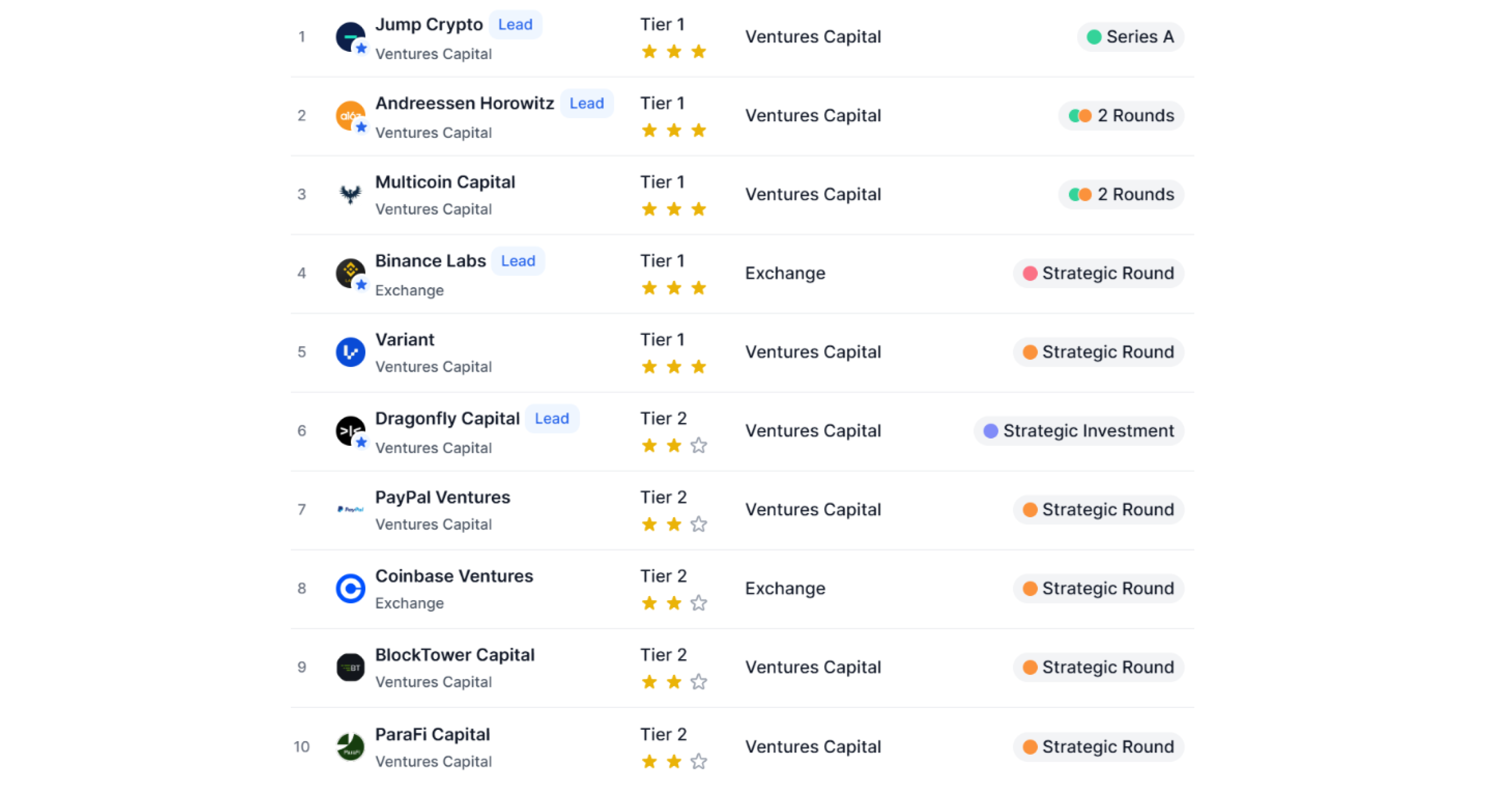

Investment in Aptos

The Aptos foundation has attracted significant investment, raising $350 million, reflecting high interest and confidence from major funds. Investors include Multicoin Capital, Jump Crypto, Andreessen Horowitz, and Binance Labs - funds known for selecting promising blockchain projects and technologies.

Aptos Coin (APT) Tokenomics

APT is an essential component of the Aptos ecosystem, supporting key functions within the network and offering potential as an investment asset. Its versatility supports both the technical and economic aspects of the Aptos ecosystem, incentivizing network participants and safeguarding the blockchain.

APT crypto is used to pay transaction fees, ensuring smooth network operations and incentivizing validators. It can also be staked, allowing holders to earn rewards for supporting the network, which contributes to blockchain decentralization.

Staking enhances network security, as a higher staked amount makes it harder for attackers to manipulate the consensus process.

Users can get APT (or any other cryptocurrency) for fiat or crypto on SimpleSwap.

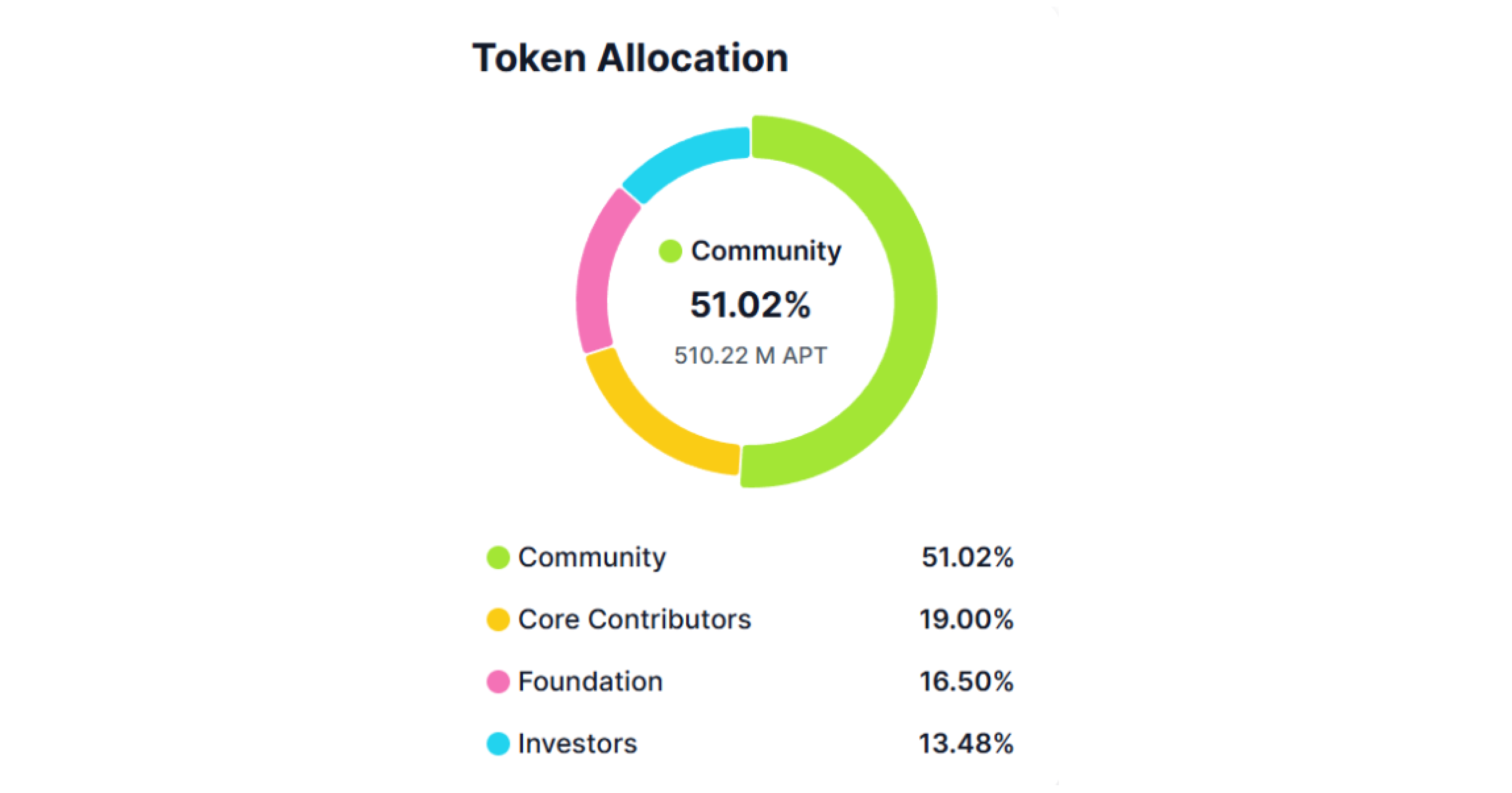

APT Tokens Strategic Distribution

APT tokens are strategically allocated to support Aptos ecosystem long-term development and meet the needs of various network participants:

- Community (51.02%)

Tokens distributed to foster and expand the Aptos ecosystem community through airdrops and other incentives, providing users and developers access to tokens for active platform participation.

- Core Contributors (19%)

Reserved for developers and key contributors building and maintaining Aptos technological infrastructure, attracting top talent.

- Foundation (16.5%)

Funds long-term initiatives and partnerships, driving innovation.

- Investors (13.48%)

Allocated to early investors, such as Multicoin Capital, Jump Crypto, Andreessen Horowitz, and Binance Labs, who provide strategic support and elevate project visibility.

Summary

Aptos ecosystem represents a promising blockchain project, combining innovative technology with a skilled team. Its unique architecture and Move programming language give Aptos the potential to achieve high performance and scalability, making it attractive to developers and users.

With a growing ecosystem and backing from major investors, Aptos has demonstrated both reliability and potential for future success.

Aptos could emerge as a major player in the blockchain space, particularly given the increasing demand for decentralized applications and solutions.

Considering current trends and continuous development, Aptos ecosystem is well-positioned to secure a prominent place among industry leaders, offering users not only high performance but also security - key factors that could lead to substantial achievements in the future.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.