ATOM Technical Analysis

Key Insights

- Following an extensive consolidation period and a recent bearish phase, ATOM has demonstrated a notable recovery, suggesting a potential shift in market sentiment and establishing new trading patterns.

- The asset's price behavior at critical resistance levels, particularly around the $9.40 mark, serves as a crucial indicator for future price movement potential, with multiple significant resistance zones ahead that could influence its trajectory.

- The recent upward momentum, supported by increased trading volumes and broader market optimism, has positioned ATOM for potential long-term growth targets, though success will depend on its ability to overcome established resistance barriers.

As of writing, ATOM ranks 45th on CoinMarketCap with a market cap of $3.62B.

ATOM Tech Analysis

On the weekly timeframe, ATOM is showing the first signs of recovery after a prolonged bearish trend.

Since the launch of trading in 2019, the asset has shown significant growth, starting at $1.06 and reaching an all-time high of $44.70 in January 2022 amidst a bull market.

However, after reaching ATH, the asset faced a sharp decline, falling 85% in price already by June. The price fell to $6.00, where strong support was found. For almost two years (from June 2022 to May 2024), ATOM traded in the $6.00-$15.00 range, which became an accumulation zone.

After that, in May 2024, ATOM broke through the lower boundary of the range, dropping to the $3.78 level, where it ended the downward movement and began to recover.

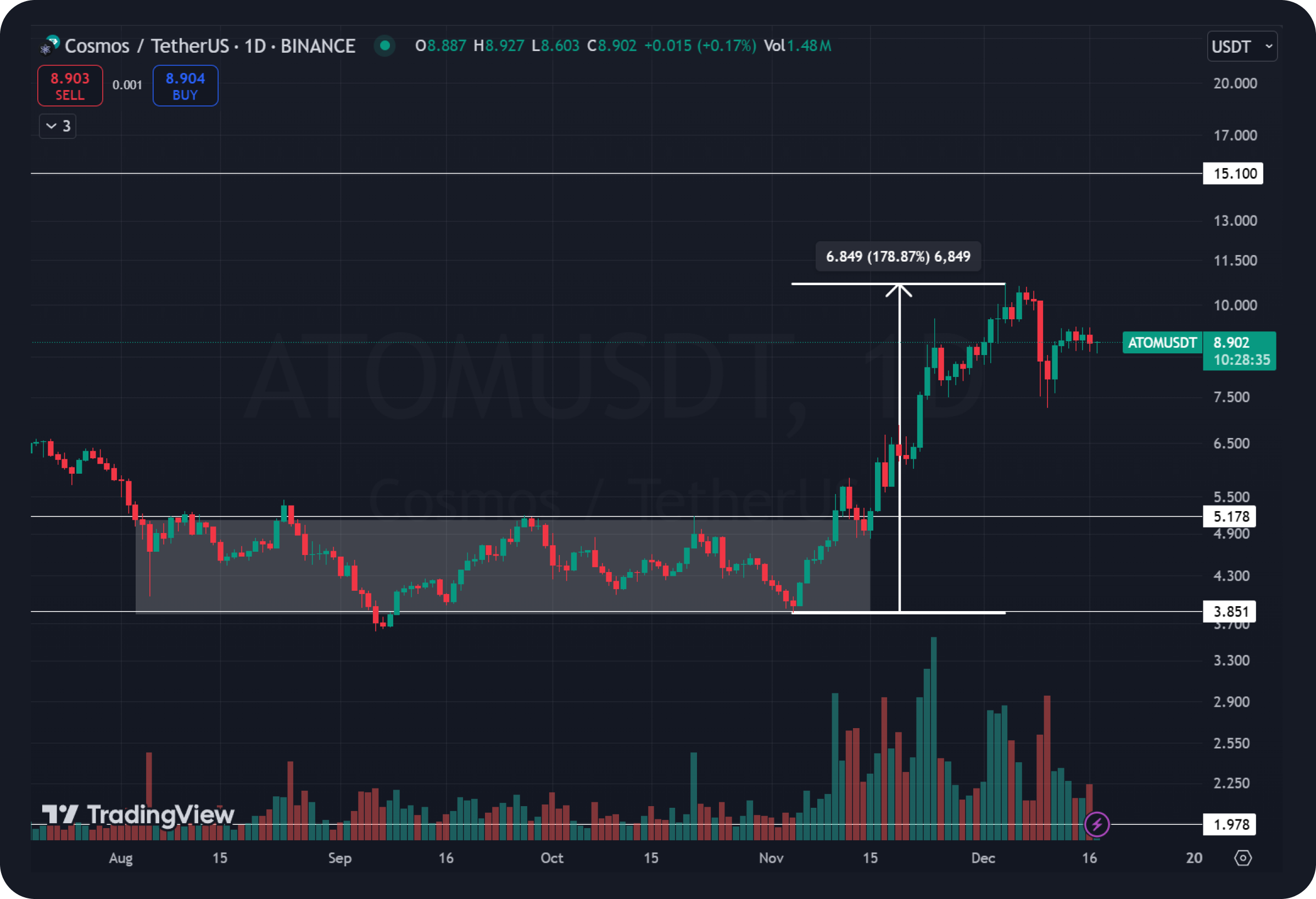

After breaking the lower boundary of the previous accumulation zone ATOM started trading in a new, narrower rangewith the upper boundary of $5.17 and the lower boundary of $3.80. The Cosmos asset spent several months in this range and in November of this year promptly came out of the accumulation, showing a strong uptrend.

The impulsive growth was accompanied by a general bullish rally in November, caused by positive news after the US elections.

The breakout of the range was accompanied by increased volumes, which confirms the veracity of the move. Over the course of the month, the asset rose 178%, from $3.82 to $10.67. This dynamics emphasizes the strength of the asset and the validity of the previous accumulation zone, which makes it attractive for market participants in the medium term.

ATOM Price Prediction

Despite the confident upward trend on the daily timeframe, it is premature to speak about medium-term growth.

ATOM price reached an important weekly resistance level POC, which is located at $9.40. At this level the upward movement slowed down and the price moved into local consolidation.

The $9.40 level plays a key role as it is in the center of the accumulation zone that has been forming for almost two years. The stock will need time to overcome this resistance, which will be an important indicator of the strength of the bullish trend.

Taking into account the general positive market dynamics, it can be assumed that ATOM will continue its upward movement. After overcoming the POC level ($9.40), the asset will head to the upper boundary of the accumulation zone, which is at $15.

If the asset manages to break through this level, the next key target will be the $26-$31 zone. This area can act as a strong resistance zone, and it is unlikely to be passed quickly. Traders should be especially careful here, as local pullbacks and consolidation are possible.

In case of confident overcoming of the $26-$31 zone and consolidation above these levels, ATOM is likely to head towards the renewal of its historic high ($44.70). Reaching this mark will open the way to the price discovery phase, where new historical tops will be formed.

Users can get ATOM and any other cryptocurrency for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.