AVAX Crypto Yield Farming

Key Insights

- Deposit Avalanche crypto as collateral on AAVE to borrow USDC, using the loan to buy GLP on GMX to earn AVAX rewards.

- Depositing AVAX on AAVE earns interest while borrowing USDC accrues a small fee, providing additional AVAX bonuses.

- Once GLP is purchased on GMX, it auto-stakes to generate high AVAX yields through GMX's yield farming.

This yield farming strategy is used for accumulating the AVAX crypto. The AAVE deposit and USDC borrowing to buy and further stake GLP for AVAX yield generate additional profit by farming crypto. Yield farming isn't implemented by a lot of users but is definitely a very lucrative strategy.

What is Yield Farming

Crypto yield farming stands as a decentralized finance strategy, offering users a pathway to passive income by contributing liquidity to decentralized platforms.

Users commit their crypto to liquidity pools, gaining corresponding liquidity provider tokens (or LP tokens), which are then staked in yield farming protocols. In return, users reap rewards, often in the form of additional crypto tokens.

Nevertheless, participants of DeFi yield farming must navigate inherent risks like smart contract vulnerabilities and market unpredictability, underscoring the critical need for research and careful engagement.

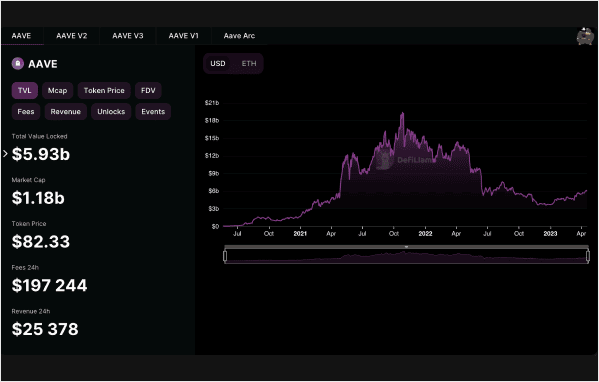

AAVE is one of the most popular and successful projects powered by Ethereum Smart Contracts and is a beneficial tool for DeFi yield farming.

This platform allows users to earn income on their crypto assets and/or receive loans secured by these assets.

AAVE users can earn interest by depositing their assets in liquidity pools or get loans using their funds as collateral. Various cryptocurrencies, including ETH, BTC, USDC, DAI are accepted as collateral.

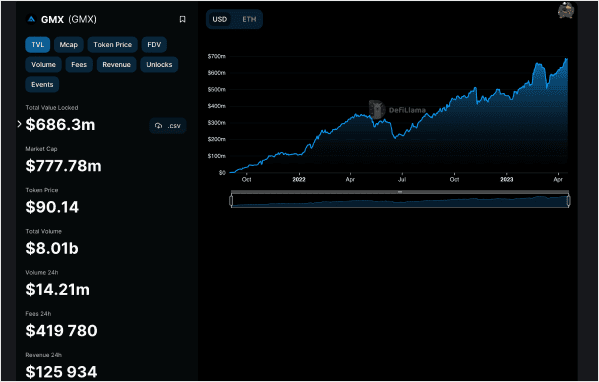

GMX is a decentralized exchange with low commissions and user-friendly interface; it allows you to trade derivatives such as futures.

How to Do Yield Farming with AVAX

- Create and top up your AVAX wallet

Create an AVAX wallet of your choice (Metamask, Trust Wallet, etc.) to hold your AVAX tokens. Top it up on SimpleSwap that allows cross-chain exchanges.

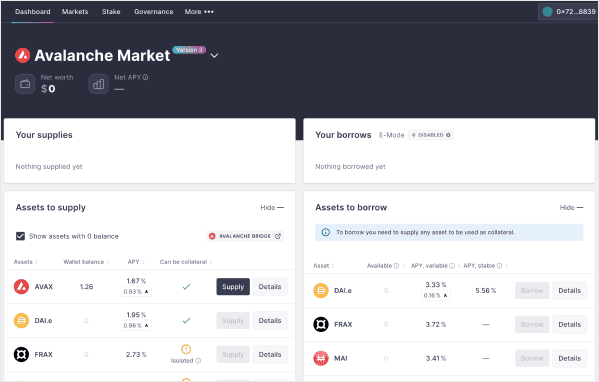

- Borrow USDC on AAVE

To do this, you need to pledge assets to AAVE as a collateral (in our case, it is AVAX, as we accumulate it).

By mortgaging AVAX crypto we get a yield of 1.67% + a bonus of 0.93%. When borrowing USDC, we pay 2.88% per annum and receive an additional 0.22% bonus in Avalanche crypto, which is AVAX.

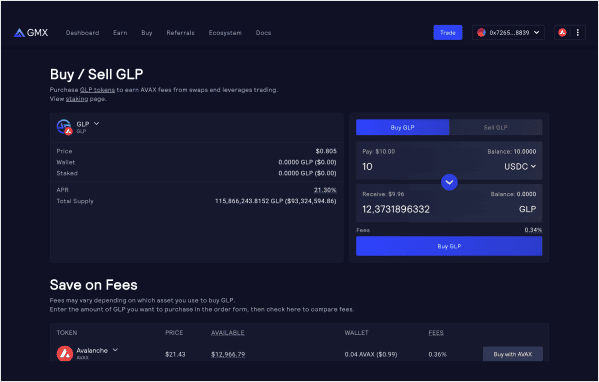

- Buy GLP on GMX

After you borrow USDC on AAVE, you need to use your USDC to buy GLP on GMX. Go to the Earn section and click Buy GLP.

- Stake GLP for AVAX yield

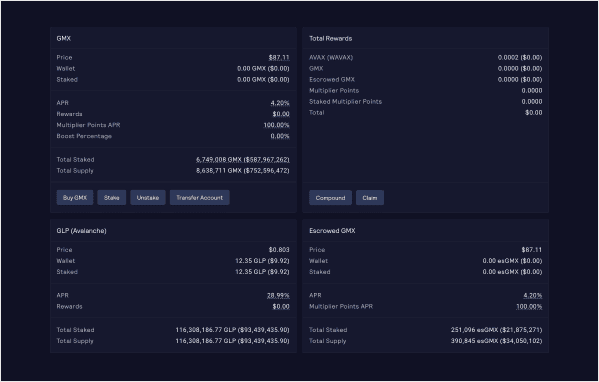

Once you have GLP tokens, they will be automatically staked. You can check this in the Earn section.

AVAX yield farming, encompassing AAVE deposits, USDC borrowing, and GLP staking, offers a significant annual return of 28.99% in AVAX.

Yet, participants must navigate the inherent risks of DeFi, emphasizing the importance of prudent decision-making in this potentially rewarding strategy.

Note that interest rates are subject to change based on market conditions.

Users can get all coins mentioned in this article on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.