What Is Dollar Cost Averaging (DCA): Strategy & Rules

Key Insights

- Dollar Cost Averaging involves regular fixed investments in an asset, irrespective of its current market price, aiming to mitigate the impact of price fluctuations and acquire assets at a stable average price.

- The example shows how to implement DCA strategy in the crypto market: consistent investment, budget allocation, market monitoring, and portfolio rebalancing.

- The article highlights the effectiveness of DCA meaning a long-term investment approach, showcasing significant portfolio growth over time, even during a volatile market.

The Dollar Cost Averaging definition is straightforward: it is an investment method in which an investor regularly purchases a specific amount of an asset, investing fixed sums over a defined period, regardless of the current market price of the asset. The main goal of Dollar Cost Averaging (DCA) is to smooth out the impact of price fluctuations and acquire assets at a more stable average price.

What is DCA in the crypto market? For illustrative purposes, say you decide to invest $1,000 in cryptocurrencies using this strategy. Let's familiarize ourselves with this example below.

How Dollar Cost Averaging Works

You conducted a market analysis and determined that Bitcoin (BTC) and Ethereum (ETH) appear to be the most promising. You decide to invest in them. You can get crypto assets to test this strategy on SimpleSwap.

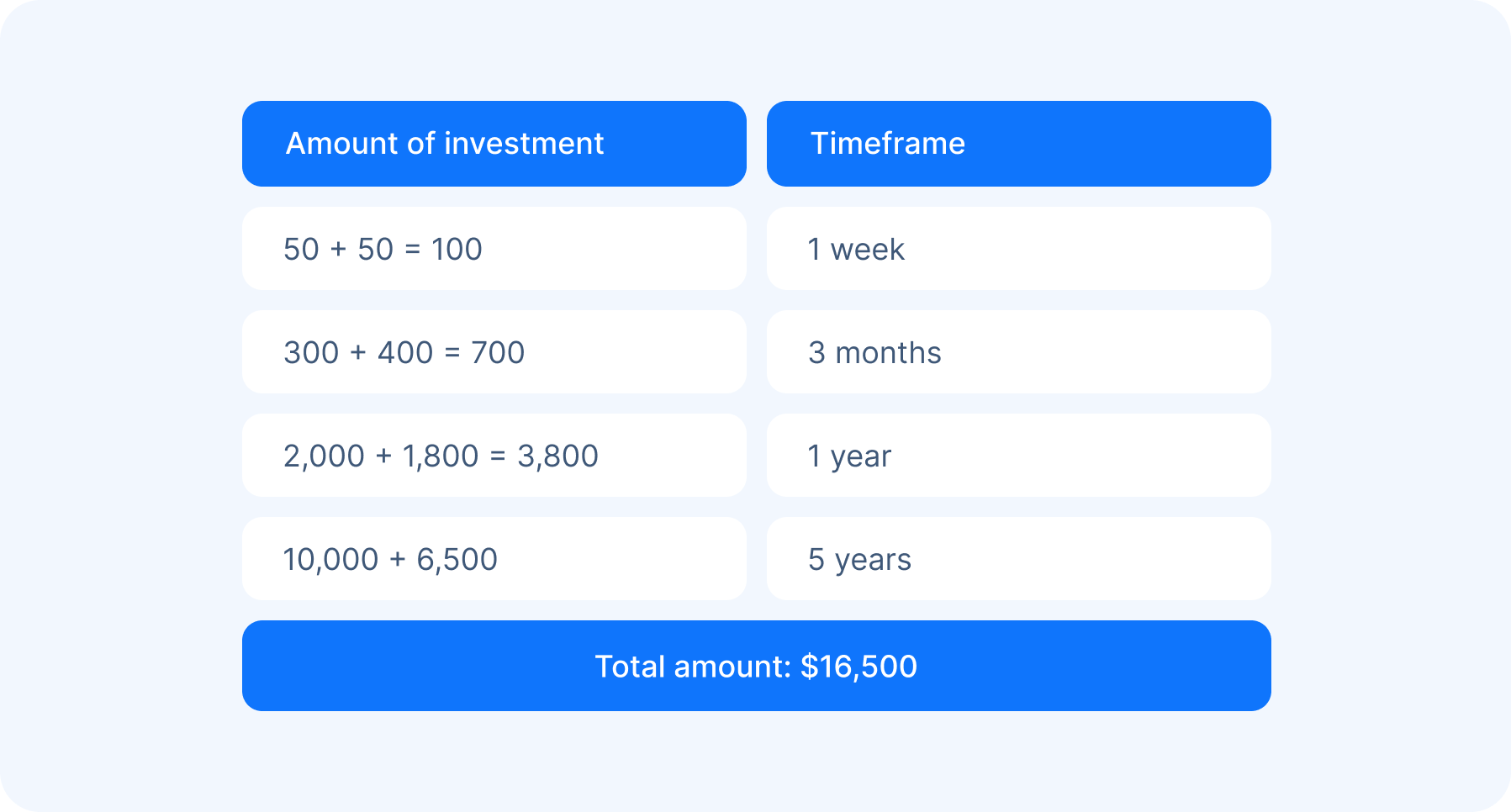

In the table below, 50 + 50 = 100 stands for $50/BTC + $50/ETH = $100 respectively. The amount in dollars is the equivalent of cryptocurrencies that are invested in.

- Setting the Budget

You set a budget of $1,000 that you are willing to invest over a certain period using a DCA crypto strategy.

- Purchase frequency

Invest this amount every week.

- Fixed amount

Invest $50 in BTC and $50 in ETH every week.

- Start of Investment

In the first week, buy $50 in BTC and $50 in ETH. In total, there are $100 in 2 cryptocurrencies in the portfolio.

- Market Monitoring

Regularly monitor the market and news about Bitcoin and Ethereum. Saym it's highly visible that the prices of both cryptocurrencies started to rise after a few weeks of DCA crypto investing.

Setting Up Monthly DCA Portfolio

After a few months, Ethereum has significantly increased in price, while Bitcoin remained stable. Here’s how the portfolio looks like now.

- BTC: $300 (increased by $150)

- ETH: $400 (increased by $200)

Rebalance the portfolio by selling $50 ETH and buying $50 BTC to restore balance.

- BTC: $350

- ETH: $350

Monitoring and Analyzing Results

Continue to monitor the market and invest $50 every week according to the DCA investing rules. Over time, the portfolio grows, and you achieve an average purchase price for Bitcoin and Ethereum, allowing to reduce risks in market volatility.

- Long-Term Perspective

Use the DCA crypto strategy as a tool for long-term investments. It's important to understand that the crypto market can be highly volatile, and price changes can be significant. However, by following your strategy, you are prepared for long-term investing despite fluctuations.

Annual DCA Strategy Results

After a year of DCA investing, your portfolio may look like this

- BTC: $2,000 (increased by $1,650)

- ETH: $1,800 (increased by $1,450)

The initial invested capital was $1,000, but thanks to the DCA strategy and the price growth of Bitcoin and Ethereum, the portfolio has increased to $3,800. We were able to smooth out price fluctuations and achieve a good profit.

After five years of DCA trading, the portfolio may continue to grow.

- BTC: $10,000 (increased by $9,650)

- ETH: $6,500 (increased by $6,000)

The portfolio, which started with $1,000, is now worth $16,500.

This is a good example of how the DCA strategy allows to accumulate assets over time, avoiding attempts to time the market's absolute low or high.

DCA Investment Opportunities

Using the DCA crypto strategy, especially during what seems to be a market bottom, can be an effective and safe way to invest.

It's important to remain disciplined, adhere to the established rules, and view investing as a long-term process to maximize the benefits of crypto market growth.

Users can get BTC and ETH on SimpleSwap, or exchange the coins of their choice to implement the DCA strategy.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.