Leveraged Lending DeFi Strategy

Key Insights

- Leveraged lending allows traders to maximize profits by using crypto assets as collateral to borrow extra capital and open leveraged positions.

- By maintaining a loan-to-value ratio and repaying borrowed stablecoins from DeFi lending protocols, traders can increase their overall contribution and achieve amplified returns.

- Following the steps of depositing collateral, borrowing, and repaying leveraged loans enables traders to calculate a leveraged annual percentage yield for their DeFi strategies that significantly exceeds regular deposit APY.

Leveraged lending is an effective strategy widely used in decentralized finance and the crypto space to maximize the profits using assets.

What is Leveraged Lending

In DeFi, leveraged lending involves using crypto assets as collateral to borrow stablecoins or another crypto.

By depositing crypto tokens in a smart contract, traders can take out leveraged loans in various digital assets up to a certain percentage of the collateral amount. For example, depositing $1000 in Ethereum can allow for a crypto loan of $500 in stablecoins DAI. This capital can then be used to open leveraged positions aiming to earn higher yields through DeFi strategies like yield farming.

If the value of deposited collateral drops due to market volatility, the positions face liquidation to maintain the loan's safety. However, the leverage also multiplies any gains, so profits can outpace losses when markets move in the trader's favor. Carefully managing liquidation levels mitigates risks.

For DeFi users, leveraged lending provides accessibility to leverage without centralized intermediaries. Traders profit from premium interest on loans while lenders earn stable rates of return. By automating the process through code, leveraged positions can be maintained cost-effectively at any time.

Deposit Collateral in DeFi strategies

Deposit a certain amount of your assets into a selected lending protocol, which we'll call Deposit.

Suppose you put $3,000 into the Deposit section. The pool provides an attractive Annual Percentage Yield (APY) of 15%, including a 5% base income from your deposit and a 10% reward.

In lending protocols and DeFi, Rewards are additional earnings users receive for participating in the system. They usually come from various sources.

Crypto Lending Rewards

- Protocol Tokens

Some lending protocols issue their tokens as an additional reward, representing a stake in the protocol or providing governance rights.

- Liquidity and Staking

Some protocols incentivize participants for providing liquidity or staking tokens, rewarding them with additional tokens for engaging in these activities.

Besides, blockchains may provide rewards for using a lending protocol on their network. In the context of lending protocols and DeFi, these rewards may include cryptocurrencies distributed to participants as a thank-you for active participation and interaction with the protocol on a specific blockchain network.

Thus, Rewards in lending protocols serve as a mechanism to stimulate user participation and generate additional income for their contribution to the system.

Borrowing Against Collateral

After depositing collateral into Deposit, you have the option to borrow a portion of the funds using the maximum available Loan-to-value ratio. In this example, the LTV is 80%, which allows you to borrow $2,400 from your Deposit investment.

Now, the loan's APY is -8%, meaning you are obligated to pay 8% interest on the borrowed amount. However, you also earn a 12% APY as a reward for taking out the leveraged loan.

Thus, the net effect is a 4% APY on the loan (12% - 8%).

Repayment of the Leveraged Loan Amount

Next, you repay the borrowed $2,400 back into Deposit, further increasing your overall contribution to the pool.

Total Contribution: $3,000 (initial deposit) + $2,400 (borrowed amount) = $5,400

The main advantage of leveraged lending is that it allows you to significantly increase your profits compared to a regular deposit. In this example, your leveraged position in Deposit leads to a higher APY.

Your APY for providing assets is 15%, and you provided assets 1.8 times more than your initial deposit. Meanwhile, your APY for the loan is 4%, as explained earlier.

How to Calculate Leveraged APY

Below is a leveraged APY formula.

(APY for providing assets * Total Contribution) + (APY for the loan * Total Borrowed Amount)

Leveraged APY = (15% * 1.8) + (4% * 2.4) = 27% + 9.6% = 36.6%

Thus, by following these steps and maintaining leverage, you can achieve a 36.6% APY on your assets, which is twice the APY for providing assets at 15%. You can continue to increase leverage by repeating these steps, further enhancing your profits. Feel free to get the desired crypto assets on SimpleSwap.

Base % + METIS Reward Tokens Protocols

Below are some examples of lending protocols that can be used in the Leveraged Lending strategy.

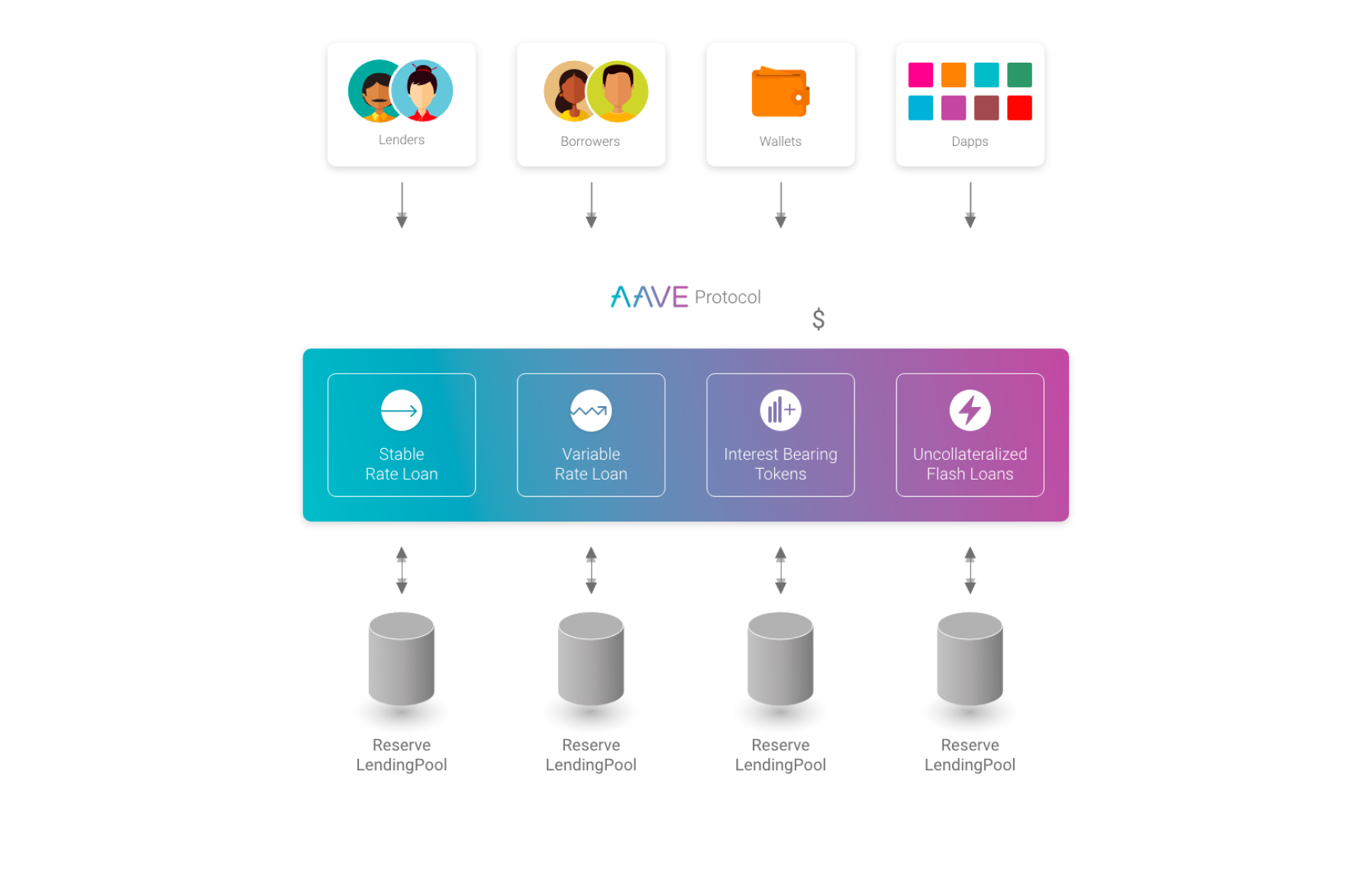

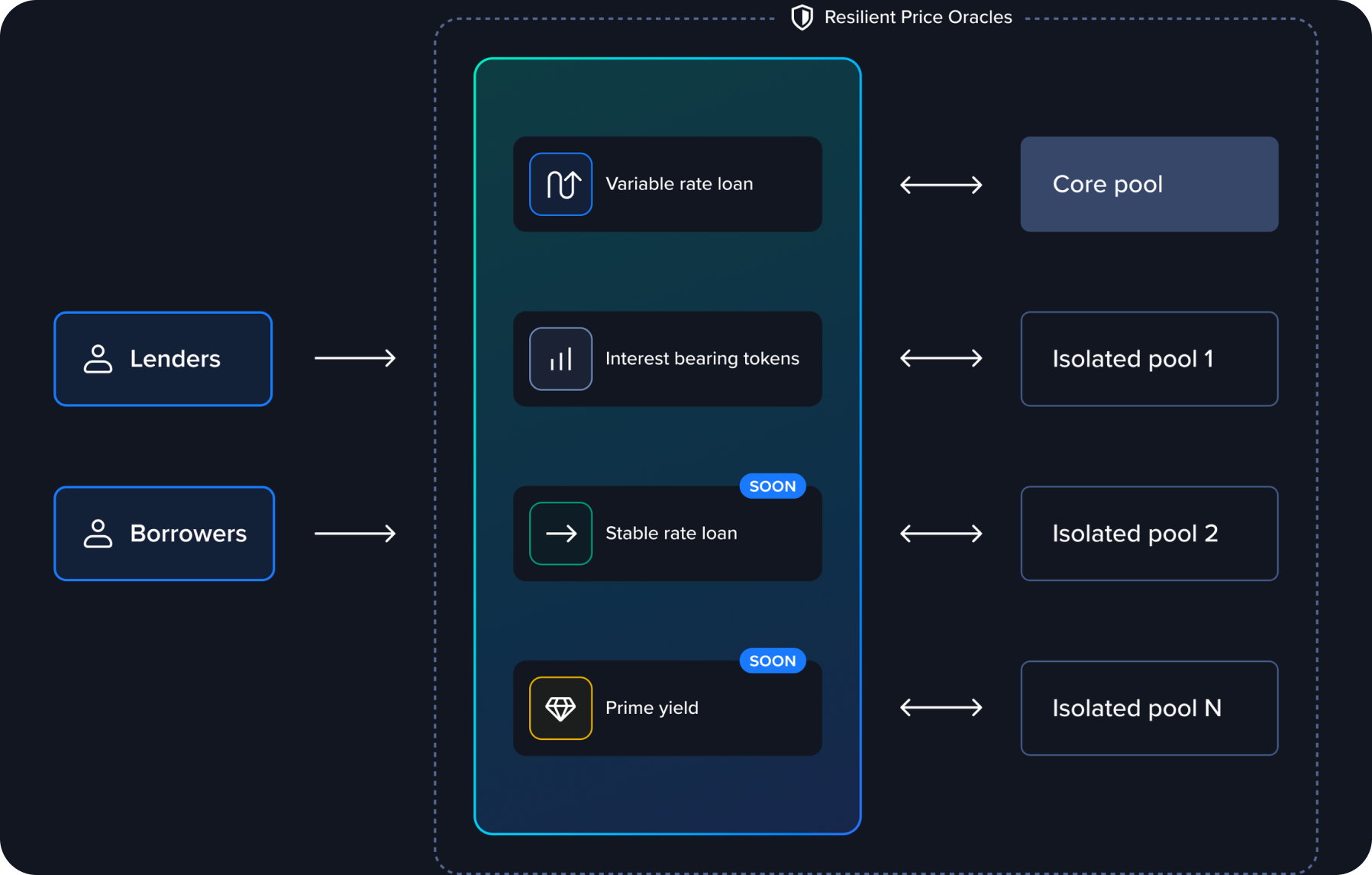

- Aave

The Aave protocol is an Ethereum-based lending protocol that provides liquidity and borrowing facilities for various cryptocurrencies. Users can use their assets as collateral and earn interest.

What is Aave crypto? Aave cryptocurrency refers to the LEND token, which is used for governance, staking rewards, and payment of platform fees on the Aave protocol. The LEND token allows users to participate in the Aave system by voting on proposals and earning additional rewards.

Aave allows users to borrow against their cryptocurrency holdings without having to liquidate them. The Aave protocol also enables flash loans, which are uncollateralized loans that must be repaid within the same blockchain transaction.

Aave applies variable interest rates using a supply and demand algorithmic model. Aave uses a native LEND token for governance, staking rewards, and payment of platform fees.

- Venus

Venus is a lending protocol on the Binance Smart Chain that allows users to provide liquidity and earn interest for using their assets. The protocol has its native Venus crypto, but users can earn yield by supplying BEP2, BEP8, and BEP20 tokens into Venus liquidity pools. The Venus protocol also supports lending with collateral and additional options for leverage.

The interest rates for lending and borrowing are determined algorithmically by the Venus protocol based on supply and demand. Users can access leveraged yield farming opportunities by borrowing assets to increase their positions in Venus liquidity pools.

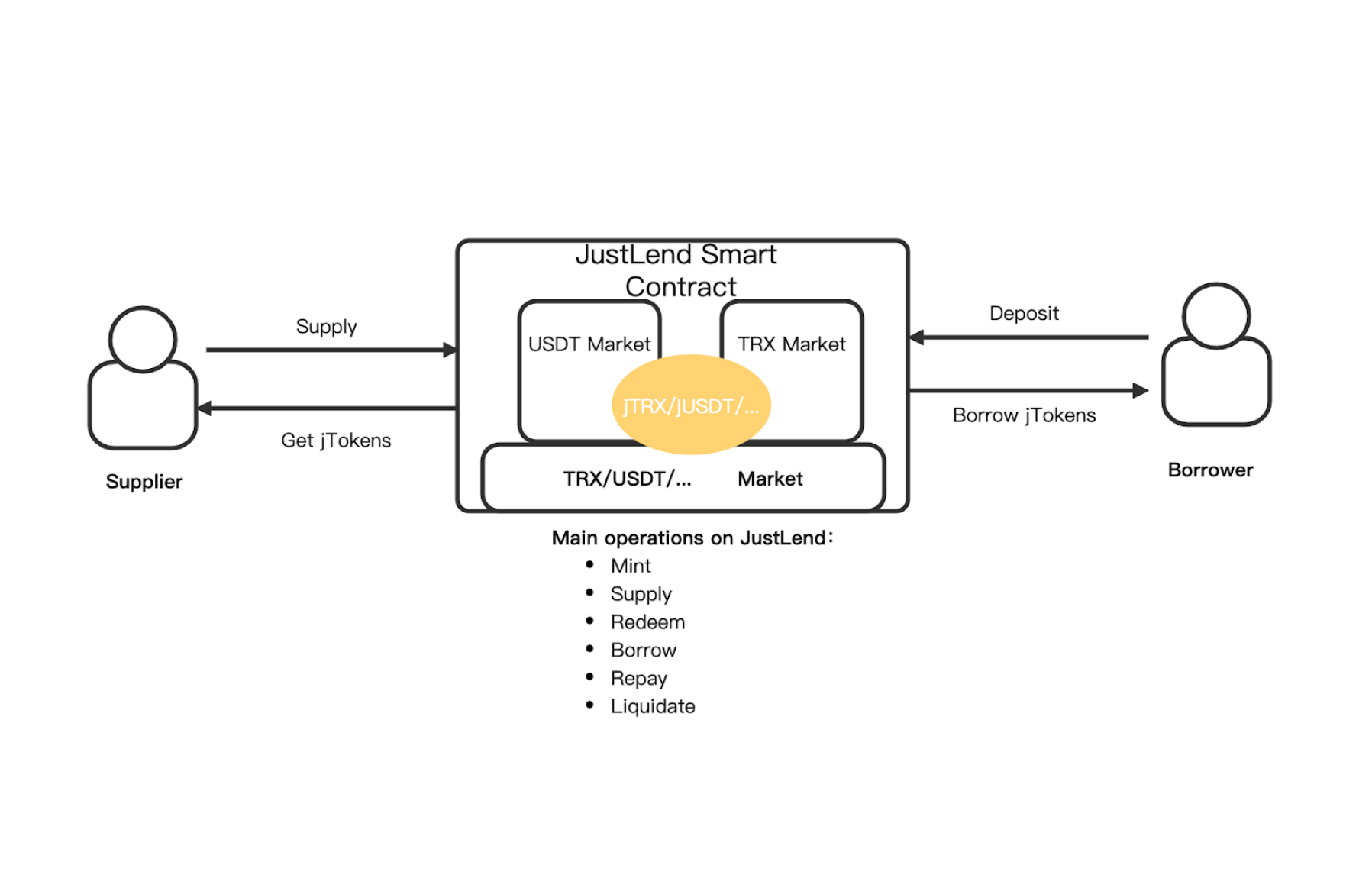

- JustLend

JustLend is a lending protocol offering users the ability to provide liquidity, collateralized lending, and additional leverage options.

Borrowers can obtain loans by putting up TRX, JST, or other TRC20 tokens as collateral. JustLend introduces credit delegation, allowing any TRON user to delegate their credit limit to a borrower and earn fees on interest payments.

The protocol also features fast settlement times and low fees compared to Ethereum-based lending platforms.

Users can get desired crypto assets on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.