Uniswap Smart Contracts Portfolio

Key Insights

- Balanced core holdings of BTC, ETH, and stablecoins provide stability while MATIC adds exposure to scaling solutions.

- Allocating WBTC to AAVE optimizes capital efficiency via collateralization and discounted asset acquisition.

- Pooling assets on Uniswap including MATIC/USDC diversifies holdings while generating trading fees.

Investment management is a key aspect of achieving financial stability. In this article we look into a methodology that combines portfolios with innovative approaches to maximizing fund potential, using Uniswap pools and the concept of smart contracts.

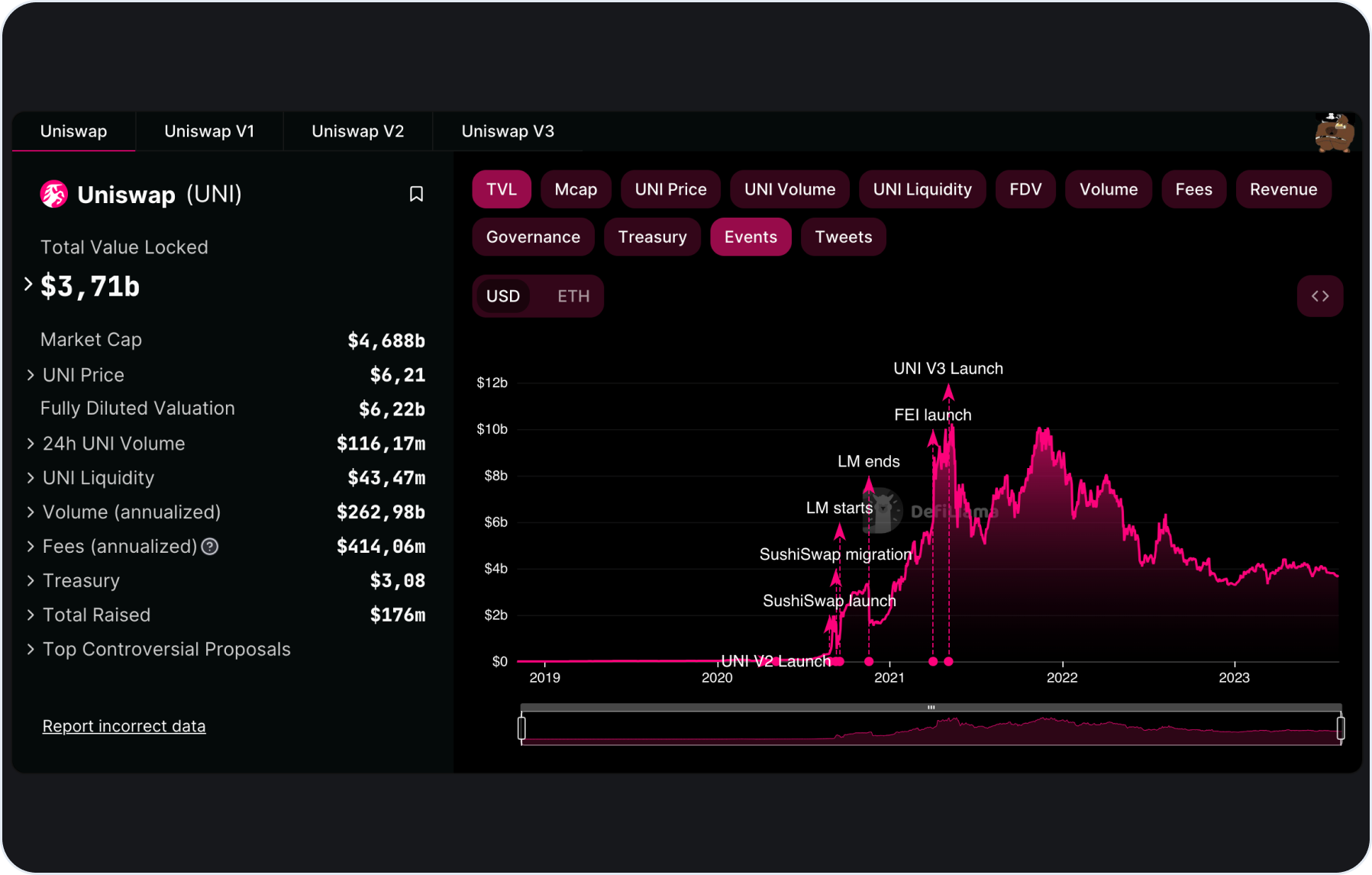

What Is Uniswap

Uniswap is a DEX that makes it easier for users to provide liquidity. Uniswap v2 lets users exchange any ERC-20 tokens with each other. As more and more people are looking for decentralized trading platforms, UNI is a great way to get involved in this growing sector.

The Uniswap exchange is a decentralized platform that uses automated liquidity pools instead of order books to make it easier for users to swap tokens directly.

The UNI token is a key part of the Uniswap ecosystem. It makes it easier to swap tokens without having to worry about trust, and it helps to boost liquidity for less popular ERC-20 tokens. Users also get to take part in the governance of the network and receive rewards with the UNI coin.

What Is a Smart Contract

A smart contract is basically an app (or program) that uses blockchain technology and gets added to a ledger. Otherwise, it's a virtual agreement that's backed by a set of rules. A computer program sets these rules. The code is replicated and executed by all the nodes in the network.

Diversified Crypto Portfolio Creation

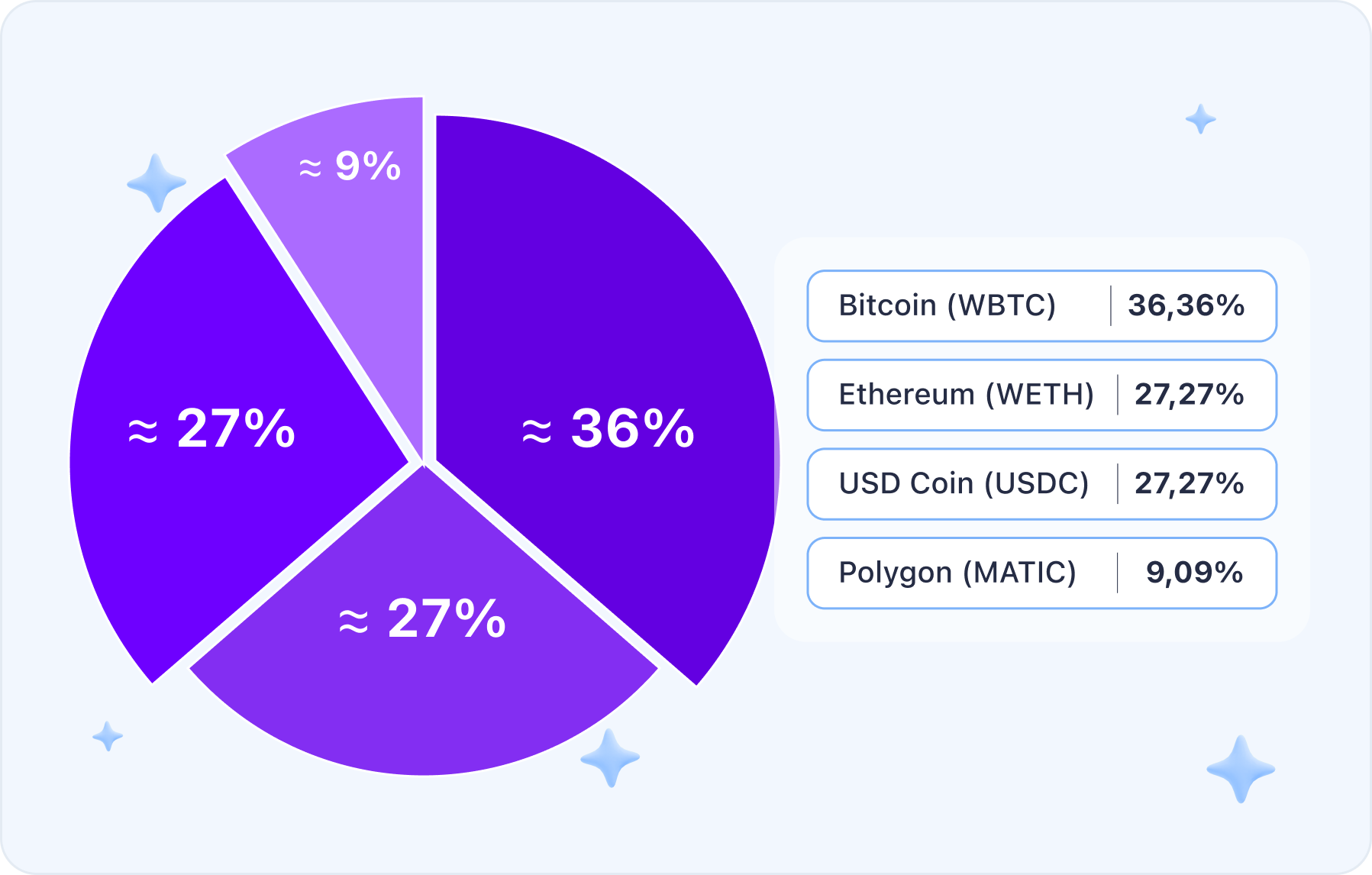

The first step of our approach involves providing a portfolio diversification by adding in it the core crypto assetsamounting to $1100.

Bitcoin is the first and most prominent cryptocurrency. It is a global standard of digital value and a symbol of resilience in the investment world. Bitcoin provides stability and reliability to investors. As the first decentralized digital currency, Bitcoin provides a reliable store of value and liquidity benchmark.

Bitcoin’s long history and proven security make it a reliable investment. The trading volume of BTC USDT shows that many market participants are interested in it. For those who don't know much about cryptocurrency, they might want to diversify the Bitcoin portfolio to reduce risk.

Ethereum is a platform for creating smart contracts and decentralized applications (DApps) that can be used to diversify your portfolio. The transition to Proof of Stake (PoS) in Ethereum 2.0 is expected to make things more efficient and scalable, which could help the DeFi ecosystem grow.

This cryptocurrency is also included in the portfolios of a diverse range of investors, with the objective of achieving stable, albeit not explosive, growth.

Ethereum is an integral part of the DeFi and innovative tech scene.

- USD Coin (USDC): $300 = 27.27%

USD Coin is a stablecoin pegged to the US dollar, which means it's a stable and liquid addition to a diversified portfolio. USDC is backed 1:1 by the US dollar. It's a tokenized US dollar, with the value of one USDC coin being as close to the value of one US dollar as possible.

USDC has a wide range of applications in the DeFi sector and can be easily converted into other assets.

- Polygon (MATIC): $100 = 9.09%

Polygon is built on the Ethereum blockchain and offers a variety of scaling protocols and layers to help reduce the load on the Ethereum mainnet and lower transaction fees.

Polygon provides developers with tools for creating custom multi-chain applications through its development toolkit (Polygon SDK), making the platform attractive to developers.

All of this enables the Polygon blockchain to build high-performance, scalable, and decentralized applications on Ethereum with minimal transaction costs.

Including an asset like Polygon allows participation in the emerging blockchain scalability sector.

WBTC on AAVE Allocation

Allocate $300 in Wrapped Bitcoin (WBTC) on the AAVE protocol. This enables us to utilize WBTC for additional operations such as collateral and asset acquisition at favorable prices.

Check out how to add liquidity to pools in AVAX Yield Farming and Uniswap Stablecoins Farming strategies.

Establish Uniswap pools for two active pairs with an equal balance for each asset, with the aim of maximizing returns from our acquired assets.

- WBTC/WETH = $100/$100

- USDC/WETH = $200/$200

Then create an additional Uniswap pool with MATIC and USDC assets, providing further diversification

- MATIC/USDC = $100/$100

Then create an additional Uniswap pool with MATIC and USDC assets, providing further diversification

- MATIC/USDC = $100/$100

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

Summary

The strategy in this article is built on meticulous asset balancing, maximizing opportunities, and diversification to achieve stability and long-term growth prospects.

The objective of this study is to establish Uniswap pools for two active pairs with an equal balance for each asset. The aim is to maximize returns from the acquired assets.

Our approach is a diversification strategy built upon careful market analysis and balanced asset weighting.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.