Crypto in Austria

This blog post will cover:

- Legal status of crypto

- Crypto taxes

- Crypto usage in Austria

- Popular Austrian crypto firms

- The future of crypto in Austria

- Final thoughts

Austria is among the more progressive countries that have embraced various forms of digital assets. This article will look into the legality, tax situation, Austrian businesses that accept crypto payments, popular Austrian crypto and blockchain startups, and the future of crypto in the European country.

Legal status of crypto

The Austrian government has not yet passed any specific laws prohibiting the ownership, trading or use of cryptocurrencies. However, there are some legal frameworks and tax regulations that control the handling of cryptocurrencies.

The Austrian Financial Market Authority (FMA) has published guidelines to regulate trading in cryptocurrencies and protect consumers. It is recommended that individuals wishing to invest in or trade cryptocurrencies research current legal and tax requirements.

It is important to note that cryptocurrency regulation is subject to change and it is advisable to obtain current information from official sources or legal advisors in Austria.

Crypto taxes

All cryptocurrencies purchased before March 1, 2021 in Austria are considered “old assets”, which is why the old “taxation regulations” will continue to apply to these cryptocurrencies in the future. All cryptocurrencies purchased after February 28, 2021 (“new assets”), i.e. purchases within one year before the regulation came into force on March 1, 2022, and all future purchases, are subject to the new “taxation rules”.

New assets were still subject to the provisions of income from speculative transactions when sold (trades between cryptocurrencies, exchanged for fiat money and for goods/services) up to and including February 28, 2022, although these new acquisitions are by definition not exempt from sales tax. The resulting profits therefore generally had to be taxed at up to 55% until February 28, 2022.

Capital income and loss offsetting

Since March 1, 2022, profit from new assets from exchange for fiat (such as EUR or USD) and services or other values are subject to the special tax rate of 27.5%. Exchanges between cryptocurrencies of new assets have been irrelevant for tax purposes since March 1, 2022, although the historical acquisition costs always continue for ongoing exchange. This means that there is “only” a time delay in the taxation of hidden reserves, for example until the cryptocurrencies are sold for fiat currencies. This also applies to cryptocurrencies held as business assets.

As part of the Cryptocurrency Ordinance and the draft of the Tax Amendment Act 2023, the following changes in particular took effect on January 1, 2023:

- If there are several units of the same cryptocurrency in a securities account, but not all of them were purchased after February 28, 2021 (old assets), the taxpayer will be able to choose starting on January 1, 2023 which units of the cryptocurrency to sell first.

- If amounts of the same cryptocurrency were purchased in succession and kept in the same securities account, they must be valued at the moving average price. The moving average price applies to all income from realized increases in the value of cryptocurrencies after December 31, 2022. Therefore, a recalculation of the acquisition costs for all new assets took place on January 1, 2023.

Crypto usage in Austria

Some companies in Vienna, Lower and Upper Austria advertise that they accept Bitcoin as a means of payment. There is also the option to purchase so-called “paper coupons” in some locations, which can then be redeemed online as credit at Bitpanda. Here are some more examples of companies accepting cryptocurrency as a payment.

- You can pay in crypto for your hotel stay at kryptohotel.at. You need to notify them in advance by phone or email.

- 42Café in Vienna-Simmering and Delicious in Vienna accept Bitcoin and payment via the Bitcoin Lightning network in the restaurant and cafe.

- You can also pay in Bitcoin at the Labsalerie, Lindenhof, AlpenParks Hotel and Apartment in Hochkoenig, Bar and Restaurant Strandperle Seefeld in Tyrol, and Ara’s Bitcoin Taxi in Vienna.

- Klarkurs is another transport service that accepts payments in digital currency.

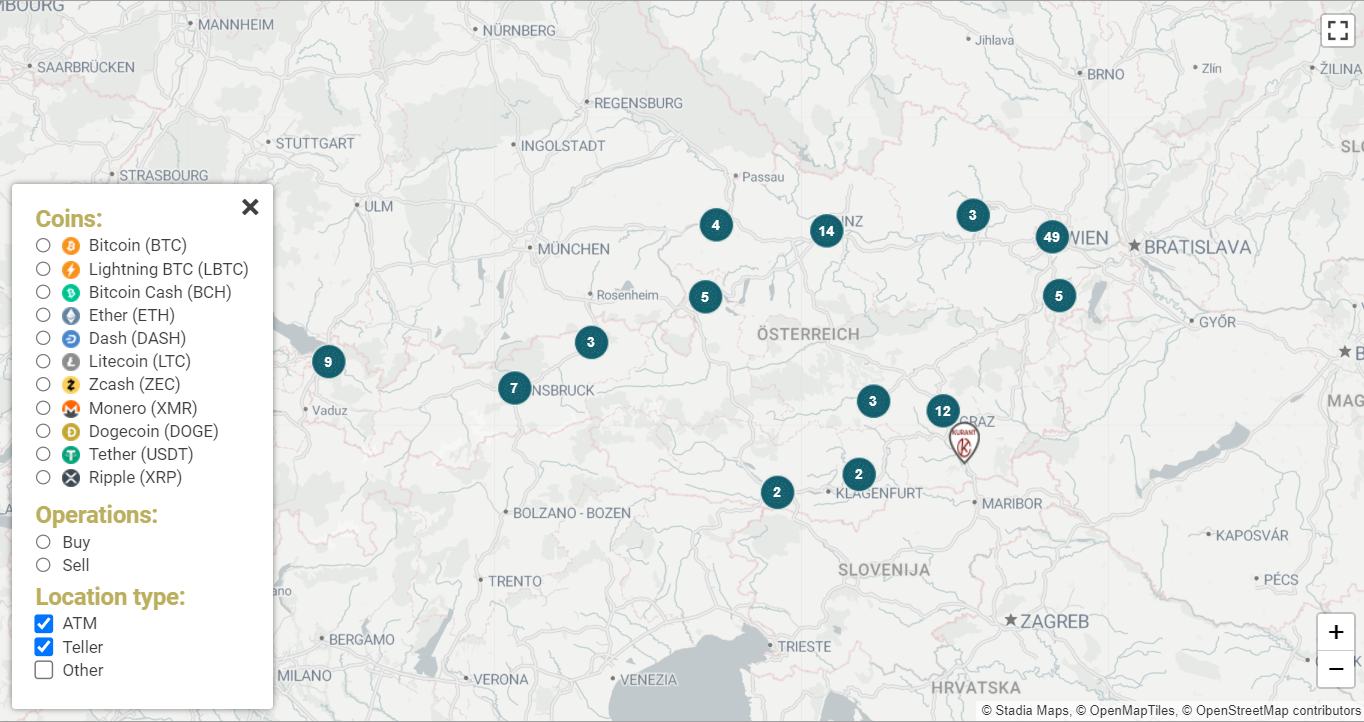

According to the Bitcoin ATMs map, Austria has 119 ATMs available. Here you can see the locations:

© Coin ATM Radar

Popular Austrian crypto firms

The cities of Graz, Vienna, and Innsbruck have been particularly active in promoting crypto and blockchain. It’s no wonder that the best-known Austrian crypto companies hail from these very cities.

This section presents several popular Austrian crypto companies.

Bitpanda

This firm is based in Vienna. It focuses on transactions in Bitcoin, Ethereum, XRP and more popular assets. Established almost a decade ago, it offers a completely automated platform. The buyer receives the digital assets right after getting payment confirmation.

Coinfinity

It is a Bitcoin and altcoin firm founded in Graz in 2014. It offers Bitcoin-based services and products and also launched the first Bitcoin ATMs in the country. The company provides consultations and facilitates Bitcoin payments to vendors.

Riddle and Code

This project focuses on the IoT. The Viennese blockchain firm sells hardware and software and works with businesses, institutions, and retail investors for applications in the fields of online fraud, product origin, identity theft, risk evaluation, cyber insurance, supply chains, and token investments.

Blocklancer

This Innsbruck-based job marketplace runs on the Ethereum Mainnet. It aims to offer a fully self-regulating platform to find work and complete tasks quickly and effectively. It achieves this by reducing fees and establishing a decentralized dispute resolution system.

Coin Factory

The final choice is a cryptocurrency mining company with data centers nationwide. It supports Bitcoin and many leading altcoins. It offers various mining packages with top-grade computing capacity, all of which are based on state-of-the-art mining hardware.

Customers can rent the packages for periods of up to four years. The dashboards display the daily mining yield of the asset being mined.

The future of crypto in Austria

While it’s impossible to make an exact prediction, the market can expect changes related to regulation, adoption and use, technological development, investments, and market growth.

Regulation of cryptocurrencies is a key factor. Austria could introduce more specific laws and regulations for dealing with cryptocurrencies in the future in order to stabilize and protect the market.

Adoption of cryptocurrencies could increase, both in everyday life and in the business sector. This could be done by introducing cryptocurrency payment options or integrating cryptocurrencies into existing financial systems.

Further developments in blockchain technology could enable new use cases for cryptocurrencies. Projects could emerge that solve problems or open up new markets.

Cryptocurrency investment interest and market growth could continue to rise as more and more people show interest in this space. The number of institutional investors in cryptocurrencies could increase.

Final thoughts

It is important to pay attention to developments in the global crypto community, as changes on an international level could also have an impact on the local market. Before investing in or trading cryptocurrencies, it is advisable to do your research and understand the potential risks.

If you want to learn about crypto regulation in other countries, check out our previous articles about Germany, United Kingdom, South Korea, Brazil, UAE, Australia, Nigeria, Mexico, India, Russia, Vietnam, USA, Switzerland, Portugal, Finland, Japan, Philippines, Iceland, Canada, Turkey and the Netherlands.