Crypto In Mexico

This blog post will cover:

- The history of crypto in Mexico

- Cryptocurrencies’ legal status

- Conclusion

For a very long time already Mexico has suffered from a high inflation rate. Combined with anti-money laundering laws it made Mexican citizens distrustful of the banking system, thus more than 50% of people do not have any bank accounts and use mostly cash. The interesting thing is that it is not just individuals. Companies in this country prefer to pay salaries in cash too. One of the reasons for this is unbelievably high-interest rates. For example, the annual credit card interest rate may go higher than 67%. However, people still need to transfer money abroad to their relatives and make online purchases. As an alternative, there are several digital payment systems that do not require bank accounts and do not take high fees. But they are also limited.

Undoubtedly, this background led to an increase of interest in cryptocurrencies as an alternative to extremely expensive banking services and existing bounds for internal digital payment systems.

The history of crypto in Mexico

The history of crypto in Mexico started in 2014 when the first Bitcoin exchange was launched by Bitso. Thanks to gamers who paid for some services in Bitcoin, the exchange had an opportunity to grow.

Since 2018 Mexico has shown an increased interest in cryptocurrencies, which seems to be a forced measure and is connected to the imperfect banking system. Because of the fact that the Mexican government is trying to reduce criminal activities and prevent money laundering, bank transfers are too expensive for ordinary people. Undoubtedly, the necessity to make cross-border transactions remained. Consequently, people started looking for another way.

Why did it all start in 2018? It was the year when the new fintech laws were implemented. This law obliged any company that held deposits for users to register as a financial institution. The registration procedure costs $35,000 and more, which led to a significant shortening of the number of registered companies. Thus a lot of services, including PayPal, refused to hold deposits anymore making it even more difficult for citizens to operate their funds. However, Bitso, a crypto exchange, managed to become one of the registered companies.

Since the implementation of new laws, cryptocurrencies have received fresh interest, and crypto exchanges now promise easier and cheaper transactions than banks.

It is not just about interest rates. Opening a bank account requires a lot of formalities, such as reporting personal income information. Especially, it concerns foreign currency accounts, which is one of the most essential services. Crypto provides a solution for this. People can have stablecoins that are not subject to taxation and do not require any special documents.

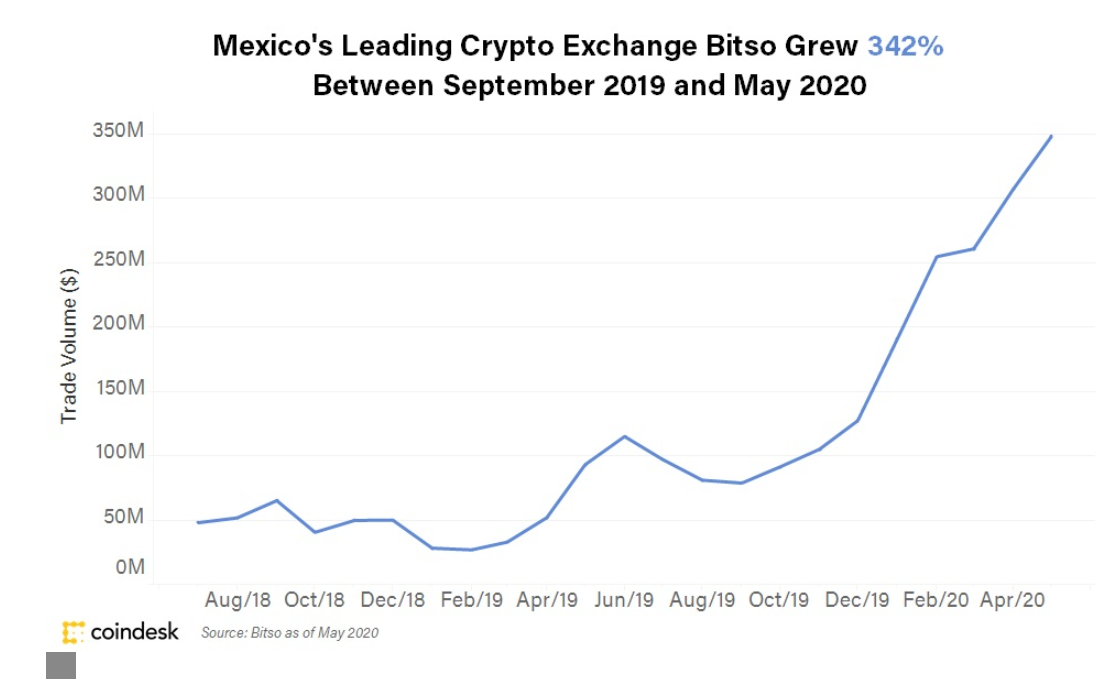

According to Coindesk from September 2019 to March 2020 the trading volume of Bitso grew by 342%.

Cryptocurrencies’ legal status

The first law that regulates cryptocurrency in Mexico was issued in March, 2018. It is known as Mexico’s Law to Regulate Financial Technology Companies. This law has a definition of ‘virtual assets’ that states that “virtual assets are representations of value electronically registered and utilized by the public as a means of payment for all types of legal transactions, which may only be transferred electronically”.

Later the Mexican government added an extension to this law that obliged financial institutions that provide services associated with virtual assets to report transactions that exceed certain amounts.

Under the current law all the financial institutions dealing with virtual assets have to get a registration. Mexico’s Central Bank is responsible for giving authorization to companies for operating with virtual assets. It also provides the understanding of all connected to this type of assets.

Companies that receive the right to provide virtual assets services are to inform their clients about the following:

- Any virtual assets are not legal currencies in the country of Mexico.

- No type of virtual assets is backed by the government of Mexico.

- The value of such assets can be extremely volatile and thus include some risks.

- The risk of fraud is high in the realm of virtual assets.

The current law also states that issuance and collection of stablecoins is the same as a collection of resources, which at the moment is restricted to financial institutions.

The law also describes two types of financial technology institutions:

- Electronic payment funds institutions or wallets.Issue and operate electronic money for payment or transfer funds

- Collective financing institutions.Facilitate communication between applicants and investors.

Since the issuance of the law, only one significant extension was added. In 2021 it was stated that virtual assets are not legal tender in the country and cannot be used as currencies.

There are a lot of aspects that were not covered in the text of the law. For example, there are no rules that regulate mining, holding declarations, or border restrictions.

Conclusion

As it can be seen, the interest in cryptocurrencies in Mexico comes from the incapacity of the local financial system to provide accessible services for the citizens in terms of high inflation and an urgent need to make international payments.

Since the regulations are not clear about a lot of points, people use cryptocurrencies following the rule that what is not prohibited is allowed.

Even though this law may not provide a lot of information about the cryptocurrencies themselves, nonetheless, it sets a framework for the future extensions of the current law. Mexican crypto users may expect some changes in the future.