BTC ETFs Approved: the Market Response and Trends

This blog post will cover:

- Summary

- The change in trading volumes

- Recent BTC performance according to the on-chain metrics

- The future of Bitcoin

Summary

- On January 10, the U.S. Securities and Exchange Commission (SEC) approved spot BTC ETFs, allowing 11 applicants to start trading. Surprisingly, the approval did not cause a significant surge in Bitcoin's price.

- Increased trading volumes were observed during the announcement and subsequent price movements.

- Market participants seem to be capitalizing on profits at current prices, considering the ETF approval as a "sell the news" event. Miners actively transferring BTC to exchanges and a multi-year record of inflows to Coinbase highlight profit realization.

- In the short term, a correction in BTC's price is possible. Support zones for correction are around $40K and $38K.

The approval of Bitcoin Exchange-Traded Funds (ETFs) has become a focal point of discussions and anticipation in 2023 within the cryptocurrency sphere. In our previous article, we explored the potential implications of BTC ETFs on asset performance and the broader crypto markets. Now, it is time to examine the initial outcomes post-approval and understand how this milestone is altering the landscape of the crypto industry.

On January 10, 2024, the SEC approved the launch of spot BTC ETFs and allowed all 11 applicants to start trading of their ETFs on NYSE, CBOE, and Nasdaq.

BTC ETF Applications © Bloomberg.com

The news, surprisingly, did not lead to a significant upswing in the price of Bitcoin. Following the announcement, the first cryptocurrency displayed some volatility but failed to show an immediate price surge. On the inaugural day of ETFs trading, the price exhibited a long squeeze, reaching a high of 48969, and subsequently embarked on a decline. As of mid-January, the price is down by approximately 12.7% from its recent local high.

BTC Performance after ETFs Approval © TradingView

In this article, we are diving deeper into what has been happening to BTC ever since the ETFs were approved to see what we can expect in the near future.

The change in trading volumes

We spotted increased trading volumes at the moment of announcement of ETFs, and then during the quick growth to $49K followed by price decline to $41.5K.

© TradingView

Subsequently, trading volumes reverted to their average levels, reflecting the cooling market sentiment and the typical decline in activity during weekends. Notably, the cumulative delta (daily) of BTC witnessed an increase after the approval of ETFs, reaching $217 million on January, 12 showing a strong sell pressure. This coincided with a period of price decline, indicating a correlation between the negative cumulative delta and the observed drop in BTC price during that specific timeframe.

BTC Delta (Daily). © CryptoVizor

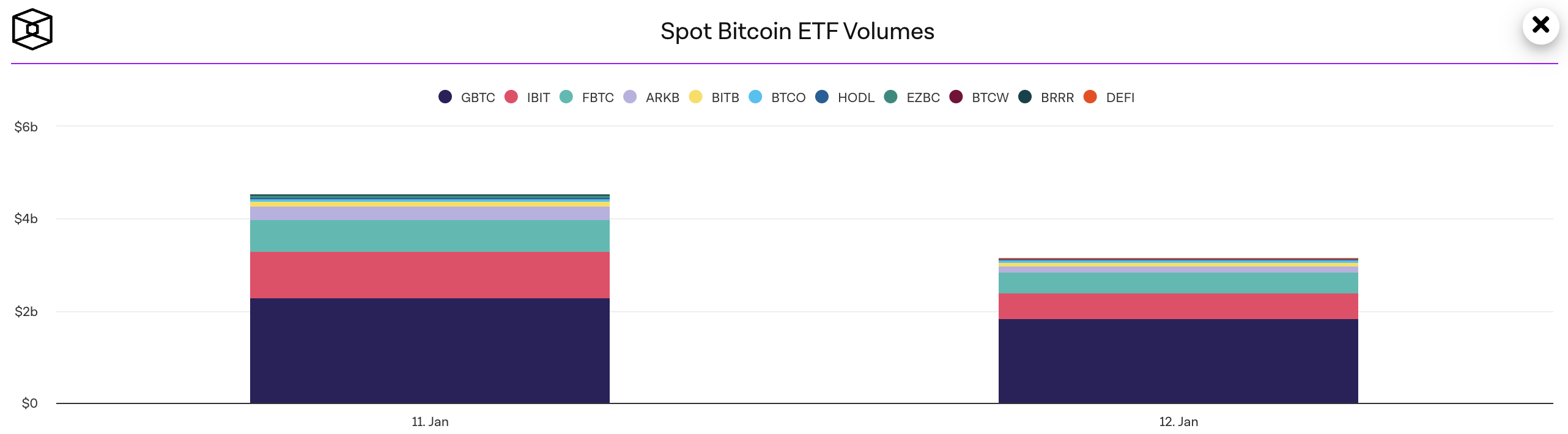

Within two days of trading, Bitcoin ETFs collectively reached a cumulative trading volume of $7 billion. Grayscale emerged as the frontrunner in this space, followed by BlackRock and Fidelity. Anticipating the inclusion of BTC in the portfolios of more retail investors and the support for ETFs trading on platforms like Gobingood, it is plausible to expect a further uptick in trading volumes in the foreseeable future.

Spot Bitcoin ETF Volumes. © The Block

The approval of BTC ETFs triggered heightened market volatility and increased trading volumes, leading to the first cryptocurrency dropping below $42,000. Despite these immediate effects, it is premature to conduct a comprehensive analysis of the full impact of BTC ETFs on the market, as we are still in the early stages of this unfolding narrative.

Recent BTC performance according to the on-chain metrics

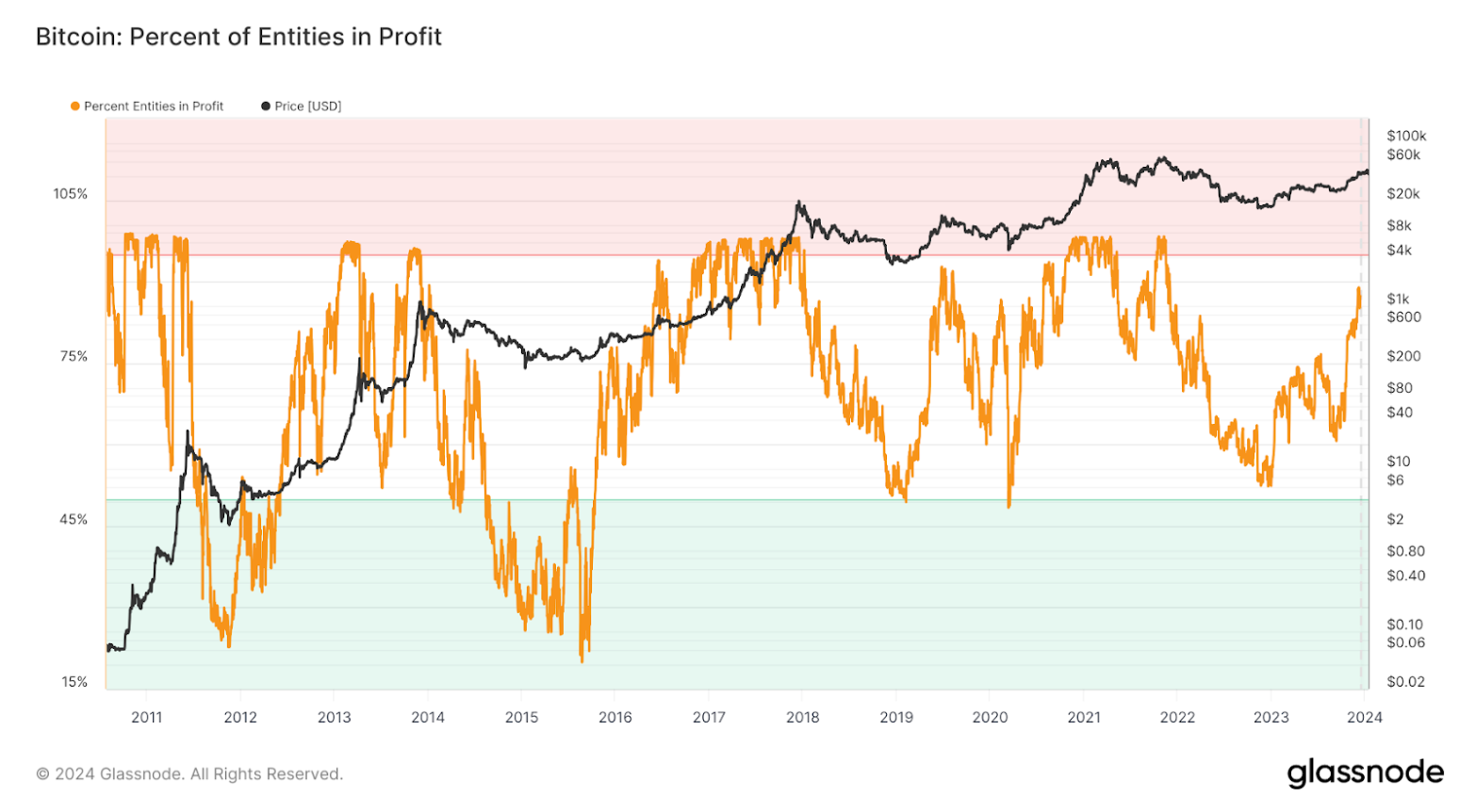

On-chain analytics is a crucial tool to understand the recent performance of BTC. With the current BTC price, it is noteworthy that almost 87% of entities holding BTC are in profit. This implies that these entities have the opportunity to sell their assets at a profit at the present moment.

© Glassnode

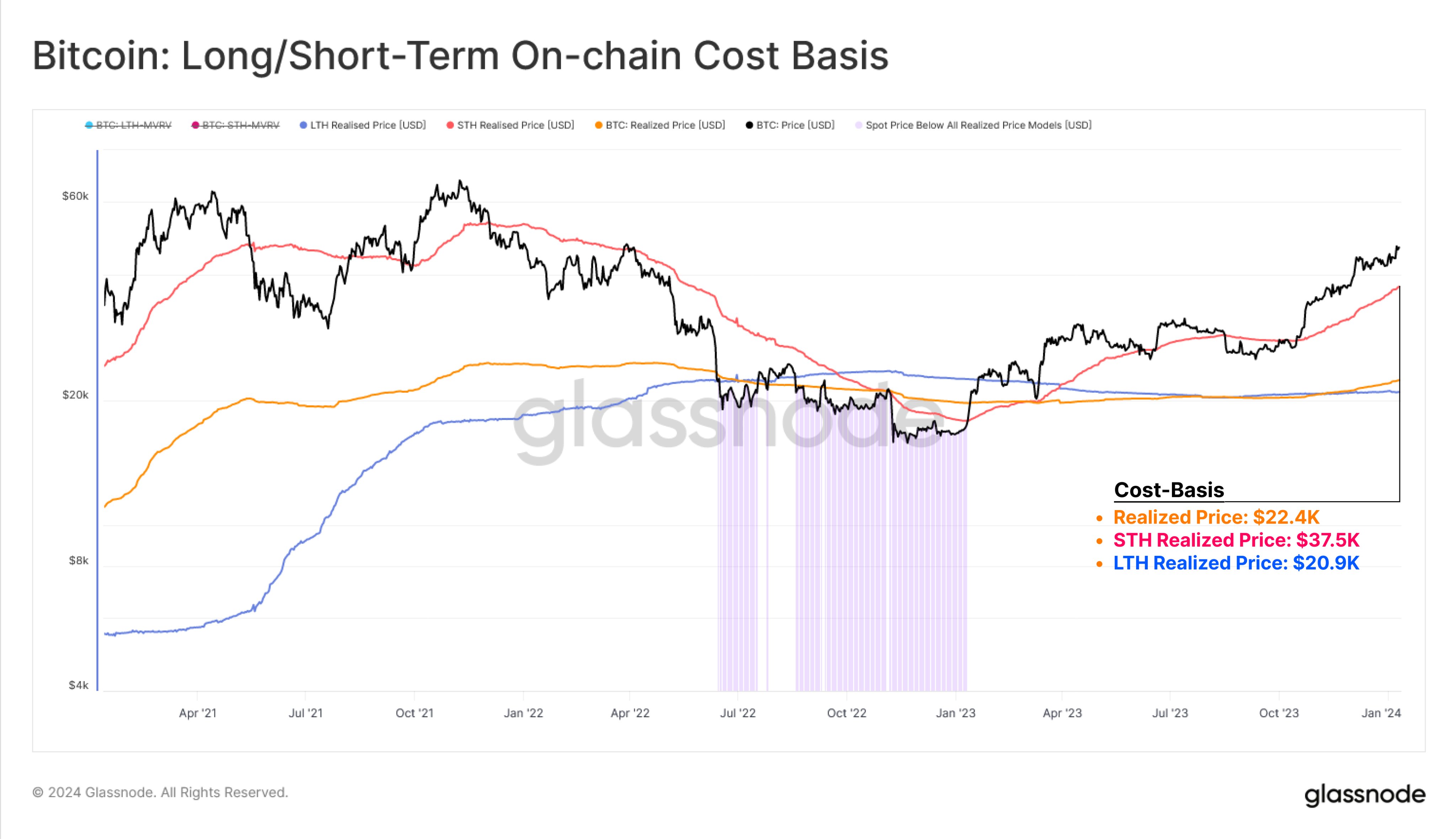

The realized price for short-term holders is reported at $37.5K, whereas long-term holders have a realized price of $20.9K. These levels can be indicative of potential support levels for the BTC price.

© Glassnode

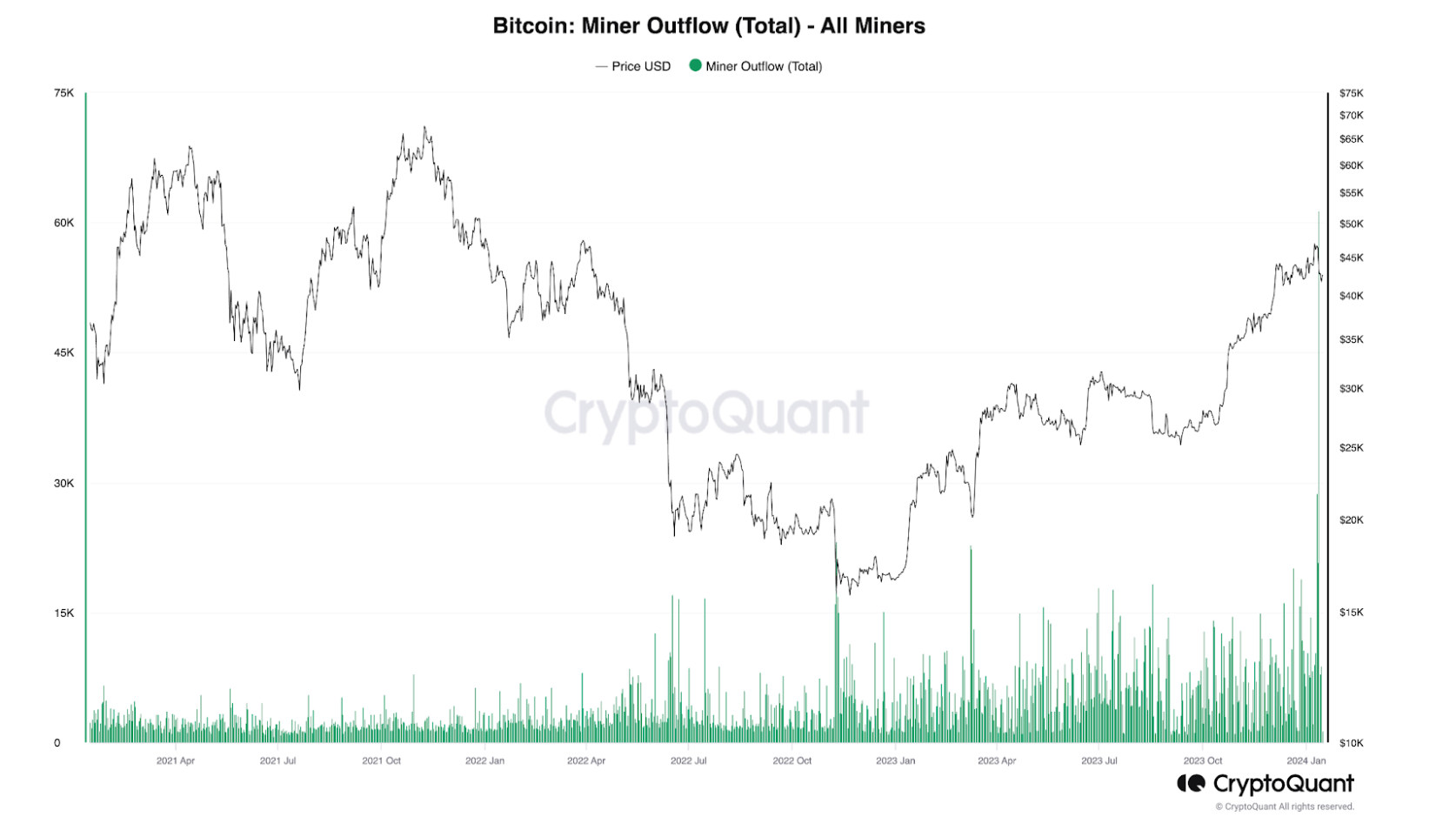

On-chain analysis also shows that BTC miners are actively transferring their BTC to exchanges, signaling they are going to realize profits at the current prices. On January 12, miners sent approximately 61,000 BTC to exchanges, marking a multi-year record.

© CryptoQuant

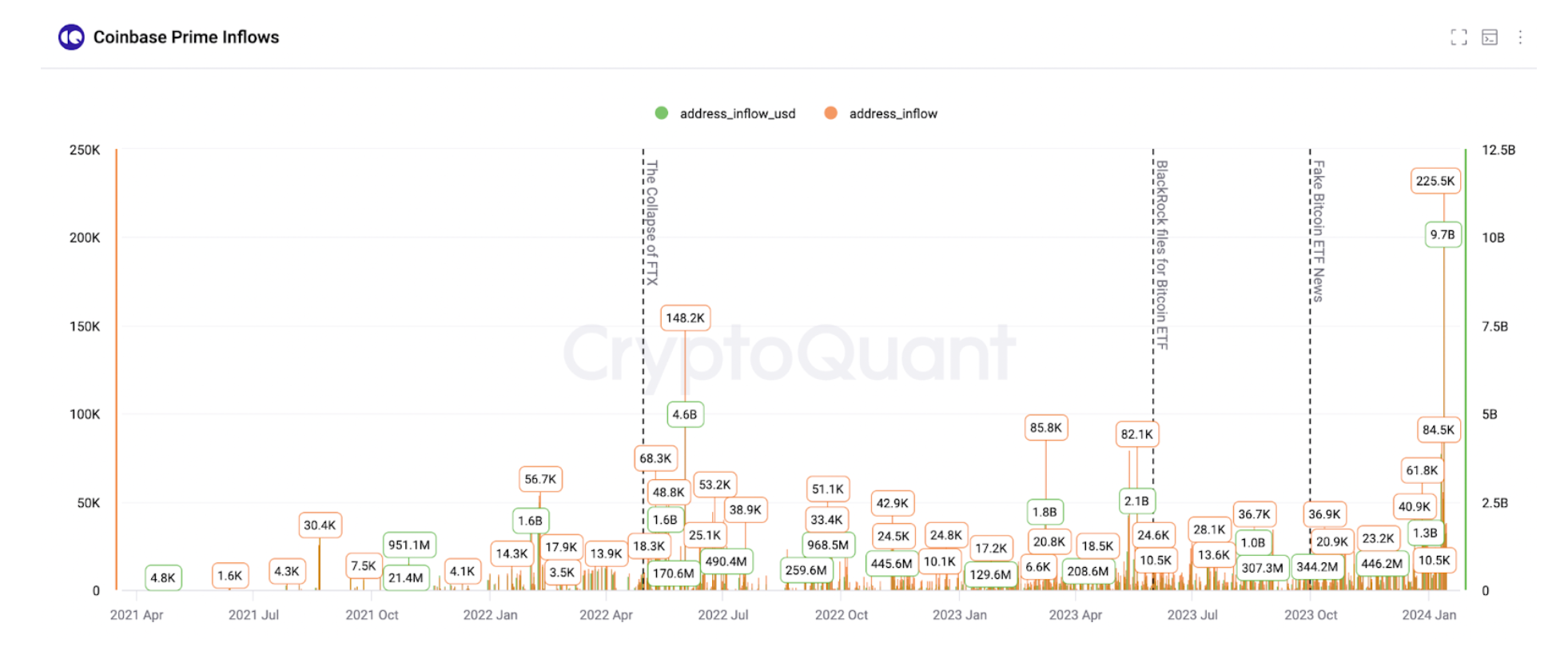

It is worth noting that Coinbase also saw a multi-year record of asset’s inflows on January 12, 2024, which amounted to $9.7B.

© CryptoQuant

On-chain data analysis indicates that some market participants have chosen to cash in on profits at the current prices, considering the approval of ETFs as a "sell the news" event. They assume that the current price already accounts for the impact of BTC ETFs, and they do not expect substantial growth in the near future.

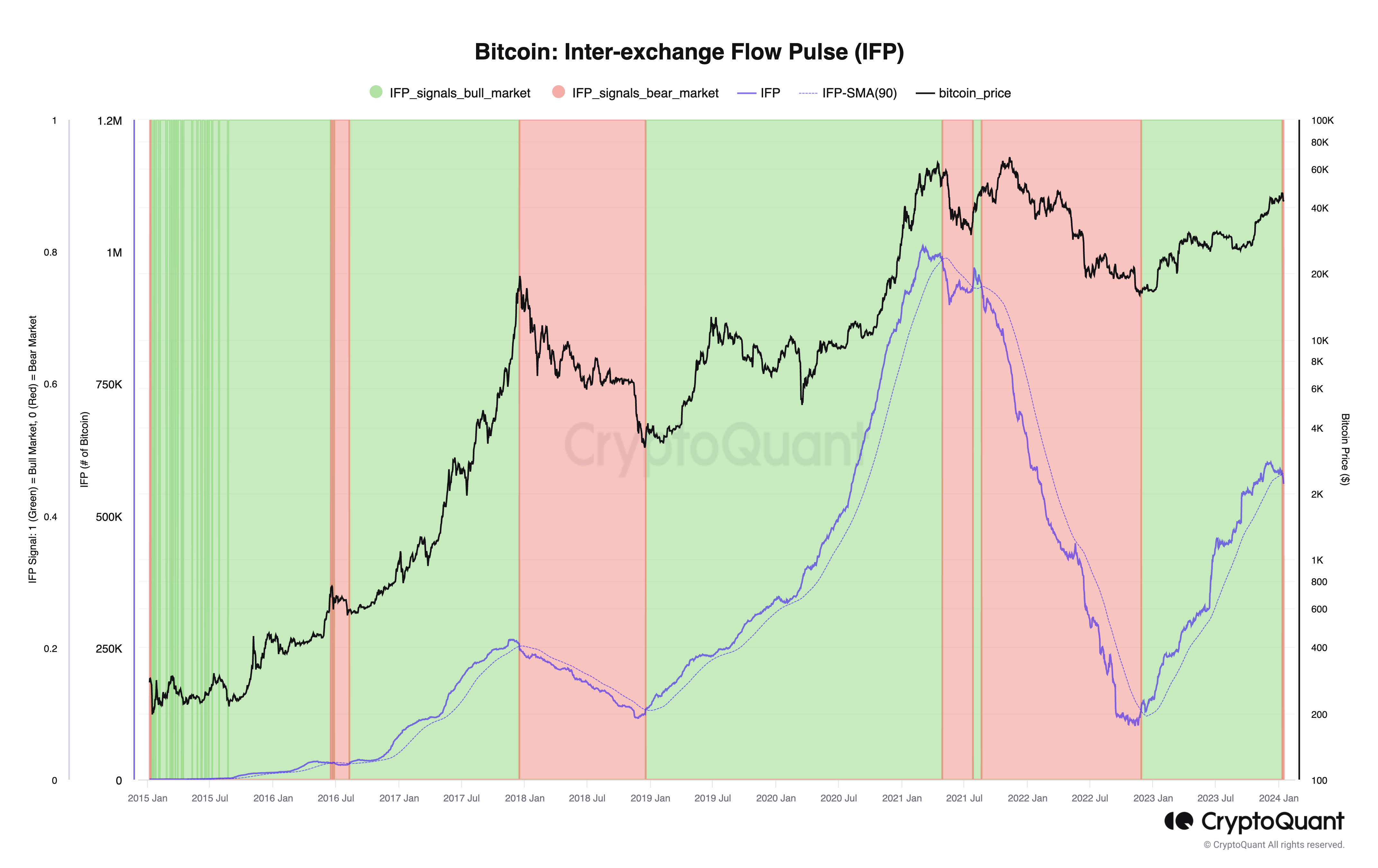

This line of thought finds support in another on-chain indicator, which tracks BTC flows between spot and derivatives exchanges. The direction of BTC flow — whether it is increasing or decreasing towards derivatives exchanges — can serve as an indication of a potential bull or bear market. Presently, there is a halt in the transfer of BTC to derivatives exchanges, suggesting that market participants have opted to de-leverage their positions and adopt a more conservative trading strategy. This change in BTC flows further underscores the cautious sentiment among participants in the market.

© CryptoQuant

The future of Bitcoin

The emerging reality in which BTC attains recognition as an established asset by traditional finance and financial regulators is poised to reshape the cryptocurrency landscape. There is evident substantial inflow of funds into BTC ETFs, marking the entrance of new investors who were previously unable to access the cryptocurrency market.

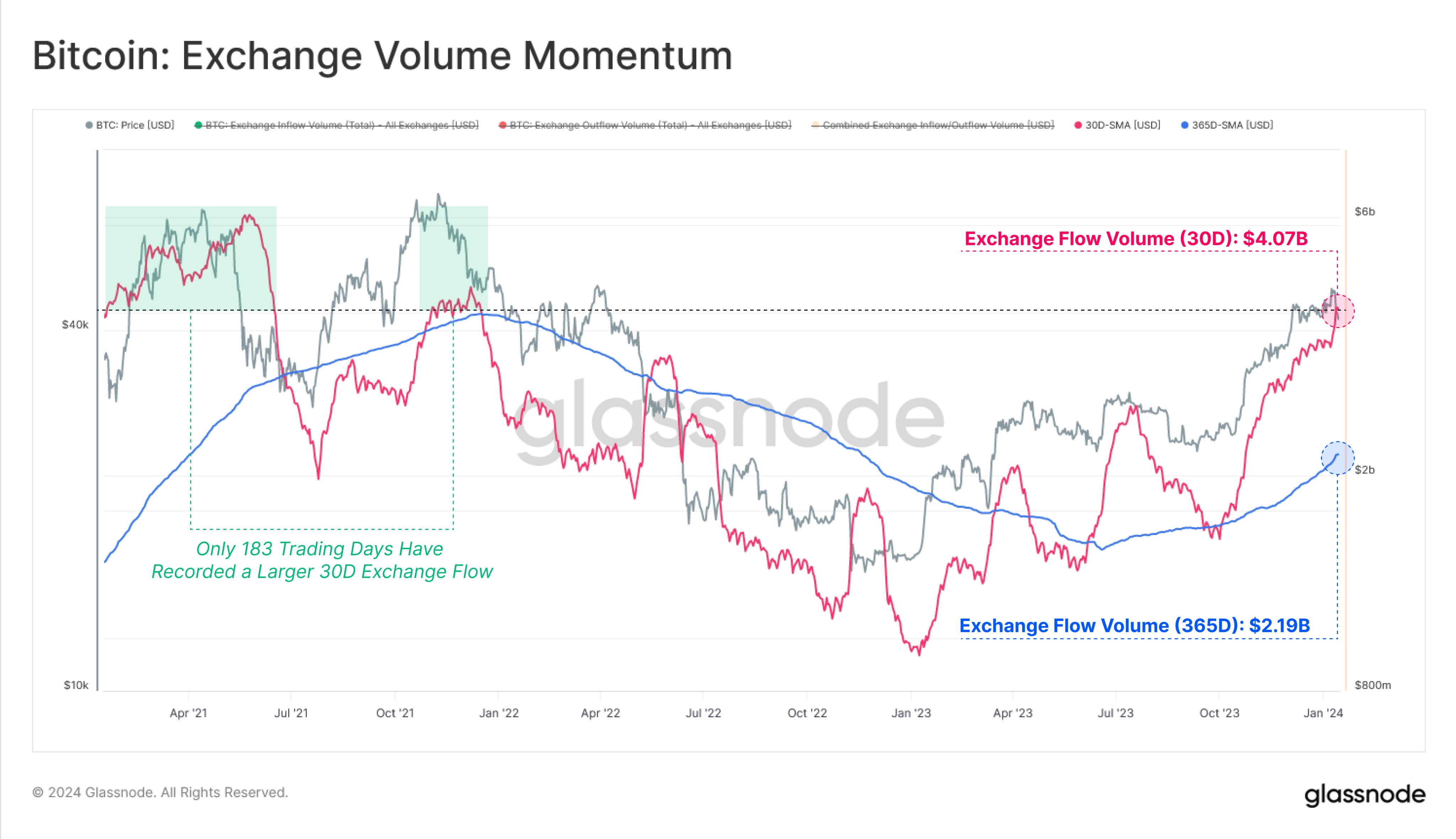

This heightened interest spans both institutional and retail investors, demonstrating a growing appetite for digital assets. Metrics such as open interest on Chicago Mercantile Exchange have surpassed those on leading cryptocurrency exchanges, indicating considerable interest in the asset. Moreover, the rising flow of exchange transactions on the Bitcoin network reaching $4.07B underscores the increasing activity among investors.

© Glassnode

In the long term, Bitcoin (BTC) has a significant upward potential, driven by factors such as the advent of ETFs, the halving event, and the potential tightening of financial policies in the United States. These elements contribute to a bullish sentiment not only for BTC but also for other crypto assets.

However, in the short term, we may witness a price correction of the first cryptocurrency as market participants take profits. This phase offers an opportunity for BTC to transition from short-term holders, who might be engaging in "sell the news" behavior, to long-term investors. Potential support zones for BTC correction in the immediate future could be around $40K and $38K. During this period, it is crucial for investors to conduct their own analysis and avoid reacting emotionally to market fluctuations. Making informed decisions based on thorough research is essential in navigating the short-term volatility of the market.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.