Crypto Coins to Buy Now: 2024 - 2025 - 2026 Update

This blog post will cover:

- Introduction

- What are Cryptocurrencies

- Crypto Market Backdrop 2024–2026

- Methodology

- Coin Deep Dives by Theme

- Portfolio Construction for 2025–2026

- Round-Up

- FAQs

Introduction

Crypto has moved from a niche hobby to a global market with trillions in value, and the 2024–2026 window looks especially busy. Many newcomers open their first exchange account and immediately wonder “what are the best crypto to invest in?” or “what cryptocurrency should I buy?”, especially after big headlines. The fourth Bitcoin halving in April 2024 cut new BTC issuance from 6.25 to 3.125 BTC per block, tightening long-term supply.

In the same year, US regulators approved spot Bitcoin exchange-traded products, opening a route for crypto investors to gain exposure through regular brokerage accounts instead of direct self-custody. That mix of structural supply changes and easier access sits in the background of every “what's the best crypto to buy right now” conversation.

This guide is written for readers who know the crypto meaning at a basic level but still feel early in their journey. It looks at crypto coins to buy now and beyond in a practical way, grouped by themes and risk tiers, rather than giving one rigid answer to what is the best coin to invest in.

Disclaimer: This is educational content only, nothing in this article is financial advice in any form. Crypto markets are volatile and speculative. Always do your own research (DYOR), consider risk tolerance and time horizon, and never invest money that you can’t afford to lose.

What are Cryptocurrencies

At the simplest level, cryptocurrencies are digital assets that live on public networks and are secured by cryptography. They exist as entries in a shared database called a blockchain, where every transaction is recorded and checked by many independent nodes. This design removes the need for a central operator and lets users transact peer to peer.

That is the short blockchain explanation. Each block bundles transactions, and the network reaches agreement on which blocks are valid through consensus rules. The result is a ledger that is hard to tamper with and easy to audit. For investors asking “which cryptocurrency to invest in” or “what cryptocurrency to invest in”, this structure supports use cases such as borderless payments, permissionless finance, and programmable money.

Bitcoin was the first cryptocurrency and still dominates by market value and brand recognition. Its success inspired thousands of other projects that experiment with faster confirmation times, different security models, and smart contracts that can run code as part of a transaction. Any cryptocurrency that is not Bitcoin falls into the “altcoin” category, and many “top cryptocurrencies to buy” lists now include both BTC and major altcoins.

Crypto Market Backdrop 2024–2026

Before looking at individual coins to buy now, it helps to sketch the backdrop.On the macro side, interest rates and liquidity still shape risk appetite. Crypto tends to react to shifts in dollar strength, growth expectations, and equity sentiment. Analysts also watch how much capital flows into spot Bitcoin ETFs, since those products now hold tens of billions in assets and have turned BTC into a regular portfolio line for many institutions.

The regulatory picture is changing too. The approval of spot Bitcoin ETPs in January 2024 (and later rule changes that streamline the launch of new commodity-based crypto ETFs) made it easier to offer diversified or theme-based funds. Some issuers now track baskets that mix Bitcoin, Ether, and other majors, which many people view as top cryptocurrencies to invest in, and more tokens may meet listing standards as futures markets mature. That tends to widen the audience for large, liquid networks.

Inside crypto, the next two years revolve around scaling and new use cases. Rollups and modular data availability networks lower costs for transactions. Tokenization of real-world assets (RWAs) channels on-chain demand toward Treasuries, bonds, and funds.

Consumer onboarding continues through Telegram mini apps, gaming on platforms like Immutable and Polygon, and mobile-first wallets. Together, those forces create many potential paths, without guaranteeing smooth price action or a simple answer to what is the best crypto to invest in right now.

Methodology

With so many narratives in play, a clear crypto research framework matters more than a quick top 5 crypto coins list. This guide looks at token fundamentals first. That means asking whether the product has real users and product-market fit, checking revenues or protocol fees, and tracking active addresses or wallets over time. Networks with growing on-chain activity and repeat usage tend to have more staying power and often qualify as good crypto to invest in.

The second pillar focuses on builders and token economics. Developer activity, ecosystem grants, and the quality of core clients reveal how much energy sits behind a project. Token design then adds another layer – what gives the token demand, which sinks or fees remove supply, how emissions and unlocks unfold, and whether treasuries are managed with long-term survival in mind. Rollup sequencer revenue, RWA fee income, and DEX swap fees are all examples of potential cash-flow sources.

Governance, liquidity, and exchange coverage form the third pillar. Decentralized decision-making can protect a project from single-team risk, although concentration in a few wallets can still be an issue. Deep liquidity on major exchanges and on-chain venues usually means tighter spreads and easier rebalancing. Shallow liquidity often pushes a token into the Speculative bucket by default.

The sections below use this framework to look at themes (scaling, AI, DeFi, consumer apps) then zoom in on coins that many investors discuss as hot crypto to buy for 2024–2026. Nothing here is a full due-diligence package. Think of it as a starting map, not a destination.

Coin Deep Dives by Theme

Crypto moves in clusters. Scaling plays often move together, then AI and DePIN have their own rhythm, and DeFi or gaming tokens can follow separate cycles. Grouping coins by theme helps readers understand how different picks interact inside a portfolio and gives context when evaluating the best coins to invest in 2024 versus longer-term holds.

Scaling and Infrastructure: ARB, OP, TIA, LINK, ZK

Scaling and infrastructure sound abstract until you look at a live network handling real users and real fees.

Arbitrum (ARB)

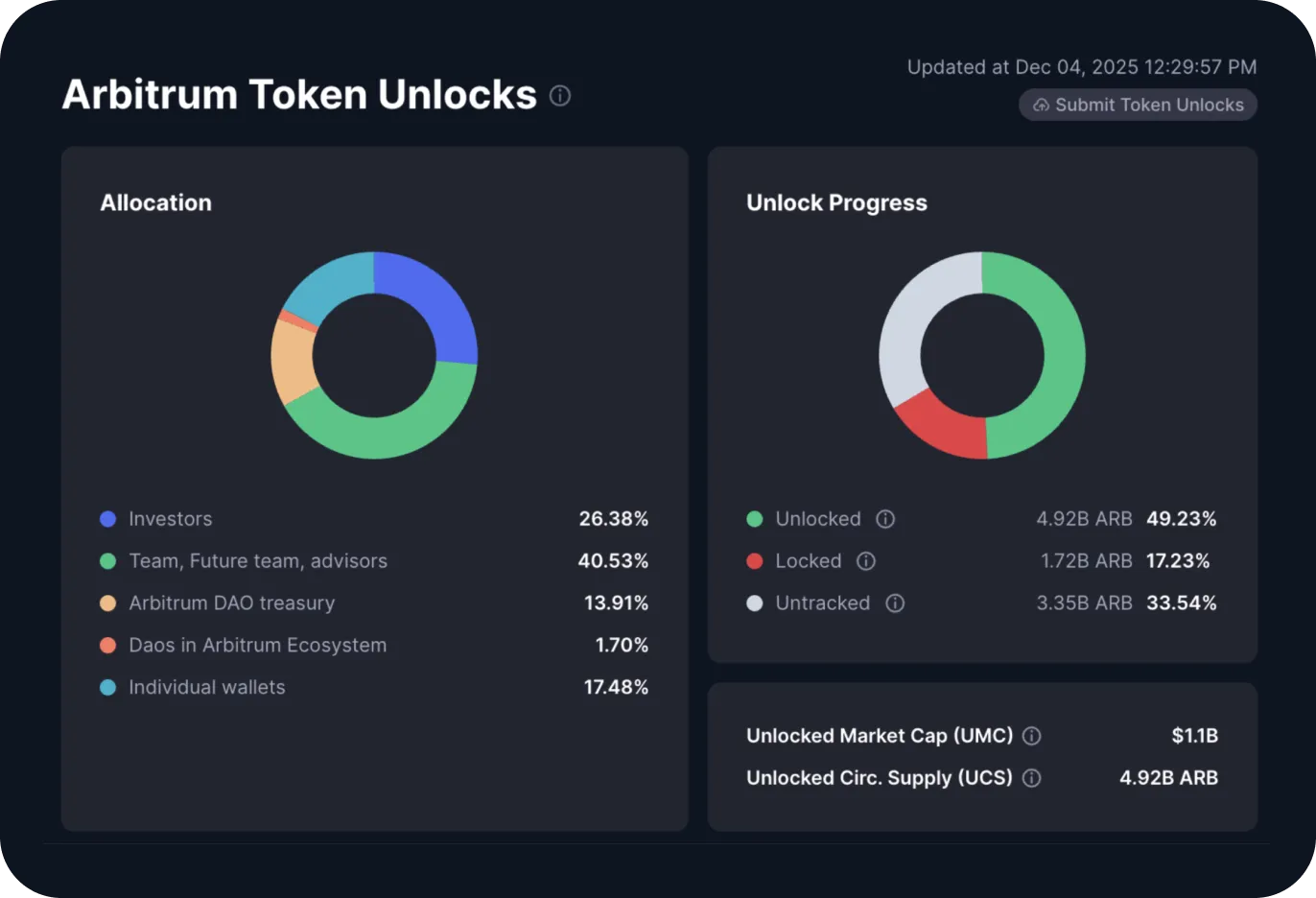

Arbitrum is a leading Ethereum rollup that batches transactions off-chain, then posts data back to Ethereum for security. Research from Nansen and others shows Arbitrum near the top of the Layer 2 pack by daily transactions, total value locked, and sequencer revenue.

Fees from that sequencer form a core source of value for the ecosystem. Grants and incentive programs from one of crypto’s largest DAOs aim to attract apps across DeFi, gaming, and social use cases.

Source: https://coinmarketcap.com/

Key risks sit around token unlocks, active DAO spending, and competition from other rollups and alternative L1s. ARB usually fits the Growth tier, since the network has strong traction but still faces intense rivalry.

Source: https://coinmarketcap.com/

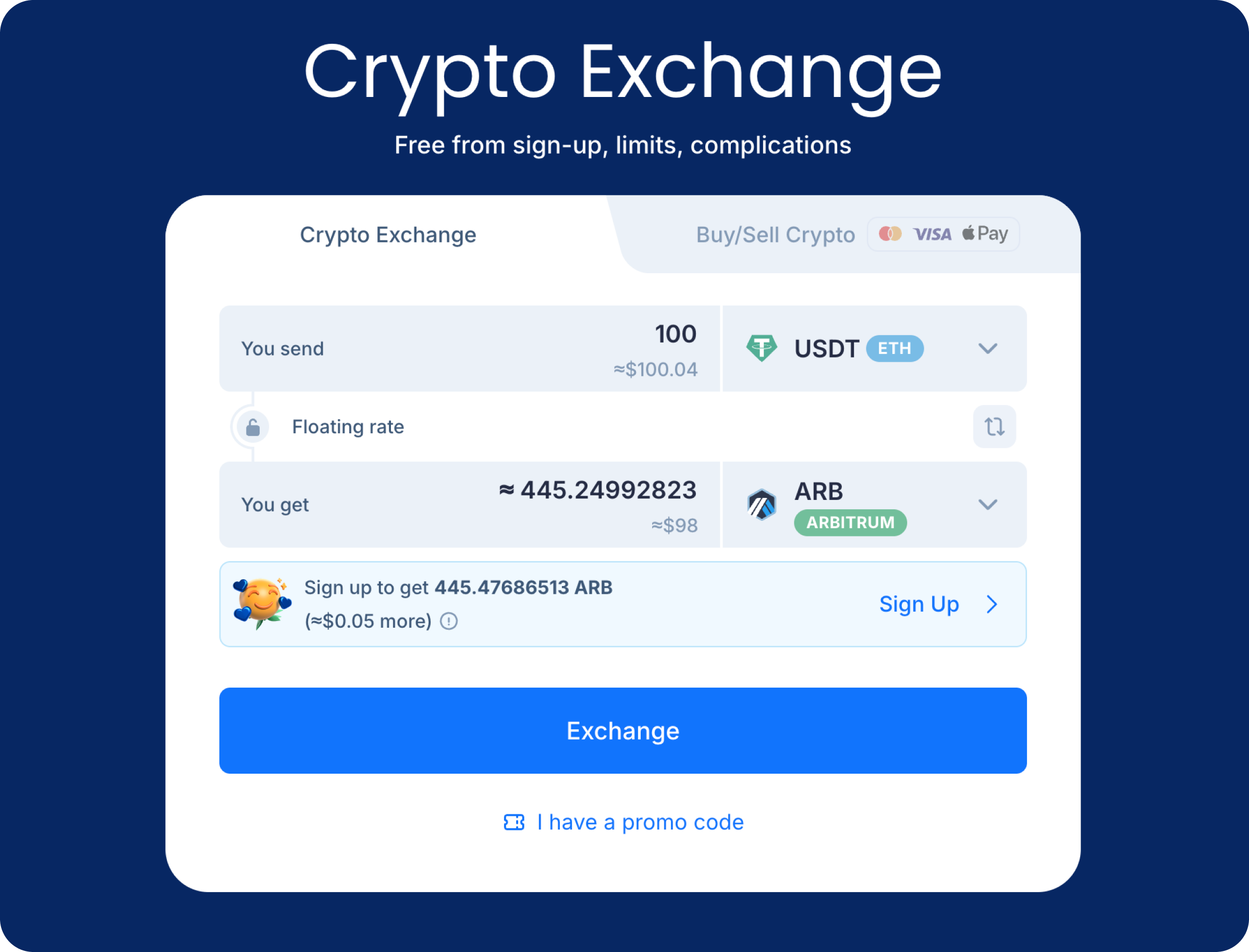

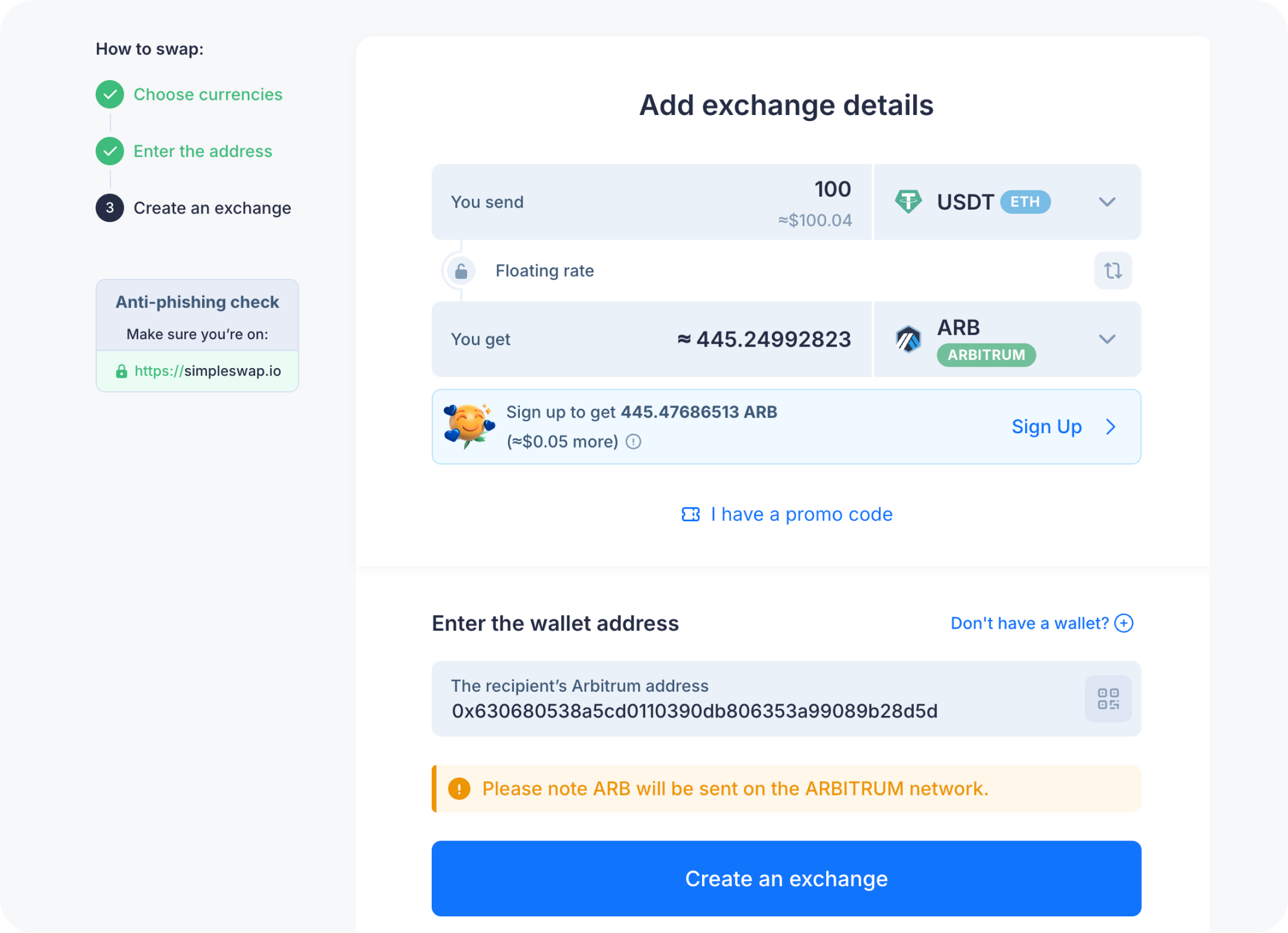

ARB is available for purchase or exchange on SimpleSwap, just as nearly 1,500 other cryptocurrencies. The process is fairly straightforward:

1. Open SimpleSwap and choose Crypto Exchange.

2. In You Send, pick your coin (for example, USDT). In You Get, select ARB, or any other coin of your choosing.

*The ARB wallet address on the picture is provided for example purposes only, it is not a real address.

3. Click Exchange, paste your receiving address (so funds land where you’ll use them).

4. Confirm the rate and send your deposit.

5. Receive ARB – typically within minutes – no registration required.

Users can also buy cryptocurrencies on SimpleSwap with fiat using debit or credit cards.

Optimism (OP)

Optimism builds an “OP Stack” for creating many chains that share common infrastructure. The Superchain vision links these chains together with shared governance, security assumptions, and bridging. Big partners building on the stack range from Coinbase’s Base chain to various gaming and DeFi projects, which positions OP as a kind of coordination layer.

The investment idea rests on broad OP Stack adoption and value that flows back to the token through governance and future network economics. Risks include heavy token emissions, ongoing grant programs, and policy decisions that may favor ecosystem growth over short-term holders. OP often sits in the Growth bucket.

Celestia (TIA)

Celestia is a modular data availability (DA) network. Instead of handling smart contract execution, it focuses on ordering and storing transaction data for rollups that post “blobs” to the base chain. Rollup teams pay for “blobspace” in TIA, so demand could rise if many chains choose Celestia as their DA layer. The project already integrates across multiple rollup stacks, tapping the broader modular thesis.

On the risk side, alternative DA providers compete on cost and reliability, and valuations can swing as markets debate long-term adoption. TIA tends to sit at the edge of Growth and Speculative, depending on position size and time horizon.

Chainlink (LINK)

Chainlink started as an oracle network and has grown into critical infrastructure for DeFi, RWAs, and cross-chain messaging. Its Cross-Chain Interoperability Protocol (CCIP) lets projects move tokens and messages across dozens of public and private chains in a single integration. LINK secures these services through staking and rewards, and the network works closely with institutions exploring tokenized assets.

The upside case leans on growing adoption of CCIP and RWA feeds across banks, asset managers, and protocols. Risks include slower institutional timelines, evolving regulation, and competition from other oracle or bridging solutions. LINK often falls into the Core or Growth tier for many users, depending on portfolio style.

zkSync (ZK)

zkSync is a zk-rollup family for Ethereum. It uses zero-knowledge proofs to bundle transactions and post validity proofs back to Ethereum, targeting both low fees and high security. The project pushes “hyperchains” and aims to support consumer-friendly apps at scale. Developers like the Ethereum compatibility and growing tooling.

Concerns relate to competition from other zk rollups, questions around decentralization of sequencers, and the long-term economics of the token once fully live. That mix places ZK squarely in the Speculative camp for most portfolios.

Quick comparison: Scaling and infrastructure

Coin | Main role | Upside drivers | Key risks |

ARB | Ethereum rollup | High TVL, sequencer revenue, active DAO | Unlocks, L2 competition |

OP | OP Stack and Superchain hub | Partner chains, shared infra, ecosystem deals | Emissions, governance choices |

TIA | Modular DA for rollups | Rollup growth, blobspace demand | Strong competitors, valuation swings |

LINK | Oracles and CCIP | RWA and institutional integrations, DeFi reliance | Adoption speed, rival infra |

ZK | zk rollup scaling | zk tech adoption, consumer apps | Decentralization concerns, rivals |

AI and DePIN: RNDR, AKT

AI power and decentralized infrastructure touch both crypto and traditional tech. Two tokens often mentioned in “ai crypto” lists sit at the intersection of GPU demand and Web3 incentives.

Render (RNDR)

Render Network runs a peer-to-peer GPU marketplace where artists and creators send rendering jobs to node operators with spare GPUs. RNDR coordinates payments for this work and ties into creative tools for 3D graphics, AR, and more. As AI models grow more visual and compute heavy, many investors see overlap between classic rendering and inference workloads.

The thesis points toward growing demand for decentralized GPU power and tight integration with design pipelines. Risks range from volatile GPU pricing and cycles, to execution on Solana migration, to competition from centralized cloud providers or other DePIN networks. RNDR usually fits the Growth or Speculative tier, depending on conviction and time frame.

Akash Network (AKT)

Akash bills itself as a decentralized cloud marketplace. Providers list server capacity, including GPUs, and users bid for that capacity to run websites, AI models, or other workloads. The network aims for lower costs than big clouds, plus censorship resistance and flexible deployment. AKT secures the chain and connects incentives between providers and users.

Growth depends on developers trusting Akash for real workloads, particularly AI, and on the ecosystem offering friendly tooling. Risks include enterprise adoption speed, regulatory treatment for DePIN providers, and heavy competition from both centralized and decentralized rivals. AKT sits firmly in the Speculative bucket for most users, since outcomes depend on broad behavioral change in cloud buying.

Quick comparison: AI and DePIN

Coin | Focus | Upside drivers | Key risks |

RNDR | GPU rendering and media | Creative and AI workloads, strong brand story | GPU cycles, tech execution |

AKT | Decentralized cloud | AI and DePIN deployments, cost edge vs big clouds | Adoption pace, platform competition |

DeFi and RWA: ONDO, MKR, UNI

DeFi and real-world assets link crypto rails with yield and cryptocurrency market structure. The projects below show three different angles on this theme.

Ondo Finance (ONDO)

Ondo Finance focuses on tokenized Treasuries and other RWAs. Products such as OUSG and USDY give qualified users on-chain exposure to short-term US government debt and money market funds, with redemptions in stablecoins. Integrations with exchanges and L1 ecosystems spread those tokens across DeFi.

Source: https://coinmarketcap.com/

The upside case leans on more capital preferring tokenized T-bill rails over off-chain accounts, plus deeper use in lending markets. Main risks revolve around regulation in different regions, issuer and counterparty management, and the possibility that similar products crowd the niche. ONDO generally sits in the Growth tier.

Maker (MKR)

MakerDAO issues DAI, one of the oldest and most battle-tested decentralized stablecoins. MKR currency holders govern the system and absorb risk in extreme cases. The “Endgame” roadmap introduces a new stablecoin and governance token, plus a staged plan for rebranding, subDAOs, and a possible dedicated chain. Over the years, Maker has proven relatively resilient through market stress and has leaned more into RWAs such as Treasuries.

Growth potential comes from stablecoin demand, RWA yield, and effective execution of the Endgame phases. Risks include governance complexity, concentration of voting power, and interest-rate or credit shocks that affect collateral portfolios. Many investors treat MKR as a Growth or Core holding within DeFi.

Uniswap (UNI)

Uniswap remains one of the top DEXs by volume and liquidity. The UNI token governs protocol upgrades and treasury usage. Recent proposals discuss activating a “fee switch” that routes part of swap fees toward tokenholders, shifting the economics toward cash-flow sharing rather than pure governance.

Upside scenarios involve sustained DEX dominance, a well-designed fee system, and deployment of Uniswap v4 with features that attract more liquidity and integrators. Risks cover regulatory pressure on DEX teams and front-ends, competition across chains, and the chance that a fee switch weakens liquidity if traders move elsewhere. UNI tends to sit in the Growth tier.

Quick comparison: DeFi and RWA

Coin | Role | Upside drivers | Key risks |

ONDO | Tokenized Treasuries and RWAs | RWA adoption, chain integrations | Regulation, issuer and counterparty risk |

MKR | Stablecoin and RWA bank | DAI and new stable growth, Endgame execution | Governance, collateral shocks |

UNI | Leading DEX governance | Fee switch, v4 upgrades, volume share | Regulatory pressure, LP behavior |

Consumer and Gaming: TON, IMX, NEAR

The next wave of users may not think of themselves as “crypto people” at all. They might just play games, chat in Telegram, or use simple apps that happen to run on chains like TON, Immutable, or NEAR. These networks often show up when people look beyond large caps and search for a new cryptocurrency to invest in within consumer and gaming niches.

Toncoin (TON)

TON is a high-speed layer-1 blockchain originally developed by the Telegram team, now run by an independent foundation. Toncoin powers payments, in-app economies, ads, and mini apps inside Telegram, which reaches hundreds of millions of users. A recent push makes TON the default infrastructure for Telegram mini apps, tightening the link between the messaging platform and the chain.

Source: https://coinmarketcap.com/

The story here is about distribution. If even a small slice of Telegram’s base uses TON-powered apps for payments, games, or digital goods, the network can grow fast. Risks include heavy dependence on a single platform, regulatory scrutiny around messaging and payments, and execution on scaling, security, and UX. TON usually sits in the Growth tier.

Immutable (IMX)

Immutable builds gaming infrastructure, including a zkEVM chain co-developed with Polygon and a large roster of Web3 games. The IMX token links to staking, governance, and various ecosystem incentives. Publishers gain tooling for NFTs, marketplaces, and onboarding, while players get self-custodial ownership of in-game items.

Upside depends on real game launches, especially AAA or large mid-core titles that can attract mainstream players. News around mobile, rewards programs, and partnerships with major studios keeps attention on the ecosystem. Risks involve game delays, player retention, and competition from other gaming chains. IMX tends to land between Growth and Speculative.

NEAR Protocol (NEAR)

NEAR aims for a user-friendly smart contract platform with account abstraction built into the protocol. Accounts can use human-readable names rather than long hex strings, which makes sending funds feel closer to sending an email. The chain also supports flexible recovery methods and tooling that targets both Web2 and Web3 developers.

That design helps lower friction for consumer apps, from wallets to games to social platforms. Risks involve intense competition for developers, the challenge of standing out among many L1s and L2s, and the need to keep security strong as convenience rises. NEAR often sits in the Growth tier, although more cautious readers might class it as Speculative in a Core-heavy portfolio.

Quick comparison: Consumer and gaming

Coin | Entry point | Upside drivers | Key risks |

TON | Telegram mini apps and payments | Huge messaging base, deep app integration | Platform dependence, regulation |

IMX | Web3 gaming infra | Game launches, publisher deals, zkEVM | Delays, player traction |

NEAR | User-friendly smart contract chain | Account abstraction, dev tools, UX focus | Competition for apps and builders |

Portfolio Construction for 2025–2026

Crypto portfolios often work best when they treat coins as parts of a structure rather than isolated bets. For 2025–2026, many investors lean on a “Core plus satellites” idea that mixes large assets with thematic plays at smaller weights.

Core Holdings: Bitcoin, Ethereum, Solana

In this guide, the Core tier centers on Bitcoin, Ethereum, and Solana. Bitcoin acts as a digital commodity and macro asset, shaped by the 2024 halving and ongoing ETF flows. Its role is often capital preservation within crypto rather than aggressive outperformance, although real results vary from cycle to cycle.

Ethereum underpins DeFi, NFTs, many L2s, and a growing RWA stack. Rollups and restaking experiments keep the ecosystem busy. Over 2024–2026, investors watch how much activity migrates to L2s, how protocol revenues evolve, and how governance steers upgrades.

Solana rounds out the trio as a high-throughput monolithic chain with strong traction in trading, payments, memecoins, and some consumer apps. Its position in “best long-term crypto” discussions rests on performance, developer energy, and ecosystem depth.

Together, BTC, ETH, and SOL often cover 40–70 percent of a crypto portfolio, depending on risk tolerance and time horizon. Higher-risk profiles tilt toward the upper end for SOL and lower for BTC, while conservative profiles tilt the other way.

Portfolio Tactics

Beyond the core, the Growth tier might hold 20–40 percent of the portfolio. This bucket includes many of the tokens discussed above – ARB and OP for scaling, LINK and TIA for infra, ONDO or MKR for RWA and DeFi, plus selective exposure to TON, IMX, or NEAR.

Speculative holdings then fill the remaining 5–20 percent, spread across higher-risk AI and DePIN bets like RNDR and AKT, or early-stage rollups such as ZK.

Dollar-cost averaging (DCA) helps smooth entry points. One simple pattern is monthly or biweekly buys into Core and Growth tiers, topped up with occasional entries into Speculative positions during drawdowns. Quarterly rebalancing keeps weights in line – trimming winners that grew too large and adding to areas that fell below target ranges, always within personal risk limits.

Spot investors who dislike forced selling often use mental or written “risk bands” instead of strict stop losses. For example, they might cap Speculative exposure at 10 percent and pause new buys when that band is hit. Many also keep a stablecoin buffer or fiat “dry powder” to deploy when volatility spikes, while remaining ready for long stretches where prices move sideways.

For those thinking of creating or expanding their crypto portfolio, SimpleSwap offers a vast variety of coins to buy for crypto or fiat.

Round-Up

This 2024–2026 update pulls together many strands. It explains what cryptocurrencies and altcoins are, lays out a framework for token fundamentals, and groups widely discussed candidates for best crypto to buy now into themes and risk tiers. The mix covers scaling and infrastructure, AI and DePIN, DeFi and RWAs, plus consumer and gaming networks that may pull in the next wave of users.

The SimpleSwap blog encourages readers to treat this as a living guide rather than a fixed prescription. Allocations can be revisited every quarter, risk tiers can shift as projects execute or stumble, and new signals can join the watchlist as tools evolve.

Anyone considering crypto coins to buy 2025 or 2026 should do their own research, cast a clear view on budget and time horizon, and have an honest sense of risk comfort. Nothing here replaces independent advice from licensed professionals.

FAQs

What is a Cryptocurrency?

A cryptocurrency is a type of digital money that runs on a blockchain – a shared ledger maintained by many independent nodes rather than a single bank or company. Transactions are protected by cryptography, recorded in blocks, and linked together so past history is hard to change.

What Crypto Should I Consider Buying Now?

This guide does not give personal investment advice, yet it does outline themes and example projects for readers exploring crypto to buy now. The main section on Coin Deep Dives by Theme covers scaling picks such as ARB and OP, AI and DePIN plays like RNDR and AKT, DeFi and RWA options such as ONDO, MKR, and UNI, plus consumer tokens like TON, IMX, and NEAR.

Which Cryptocurrency will Boom in the Future?

No one can say in advance which coin will “boom” in a specific year. The best future cryptocurrency stories usually combine several traits – real adoption, clear technology advantages, sound token economics, and a supportive macro backdrop. Some investors start by looking at themes such as scaling, AI, RWAs, and consumer apps, then pick tokens within each group that show rising usage and strong developer interest.

What is the Most Important Crypto?

Bitcoin is still the most important crypto asset by market capitalization and narrative weight. It introduced the idea of trust-minimized, scarce digital money and continues to anchor many portfolios and ETFs. Ethereum plays a different but crucial role as the base layer for DeFi, NFTs, and many rollups.

How to Choose a Crypto to Buy?

A simple framework for how to choose crypto starts with use case and risk tolerance. First, ask what the token actually does (Payments, scaling, DeFi, AI, gaming) and whether you believe that use case matters in the long run. Next, check fundamentals such as team track record, developer and user activity, liquidity on major venues, and how the token captures value. Then decide which risk tier it belongs in (Core, Growth, or Speculative) and how that fits your budget.