Dencun Upgrade Impact on L2 Chains and Ethereum

This blog post will cover:

- Dencun Impact on L2 Chains

- Dencun Effect on Ethereum

- Conclusion

The Dencun upgrade marks an important milestone for the Eth blockchain, representing the most important improvement since its shift to a PoS consensus algorithm in September 2022. With Deneb-Cancun, or Dencun, the primary goal was to address the pressing issue of high transaction fees on the Ethereum L2 solutions. By targeting gas fees on Ethereum L2 chains, Dencun aimed to enhance the overall user experience within the Ethereum ecosystem. In this article, we delve deeper into the impact of Dencun on the L2 landscape and explore the initial outcomes of its implementation.

Dencun Impact on L2 Chains

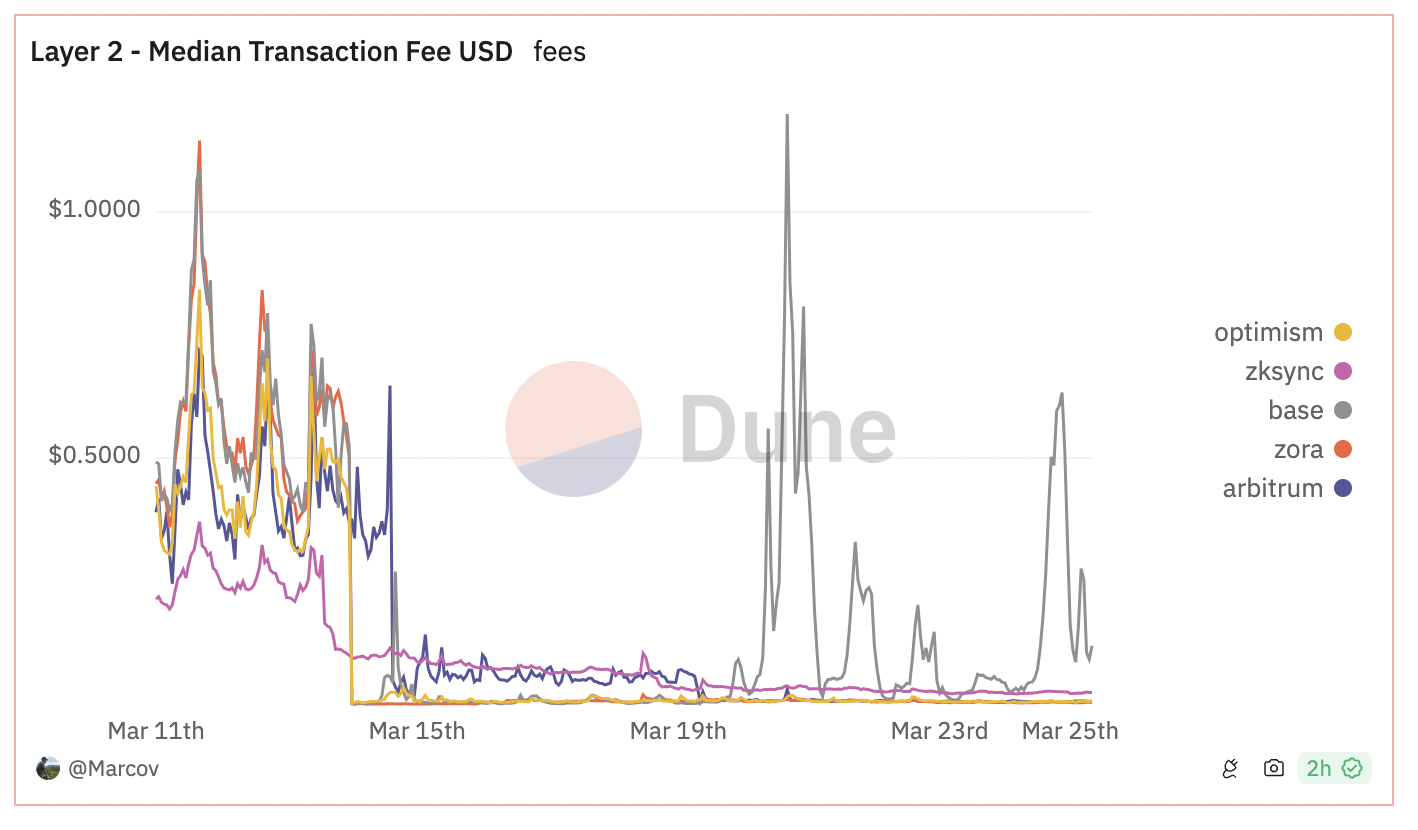

Although Dencun has not affected the persistently high gas fees on Ethereum's mainnet, it has notably boosted the performance of L2 chains, which are the primary beneficiaries of this upgrade. On-chain data indicates a substantial decrease in transaction fees across the popular L2 chains following the implementation of Dencun.

Median Transaction Fees on L2 Chains. Source

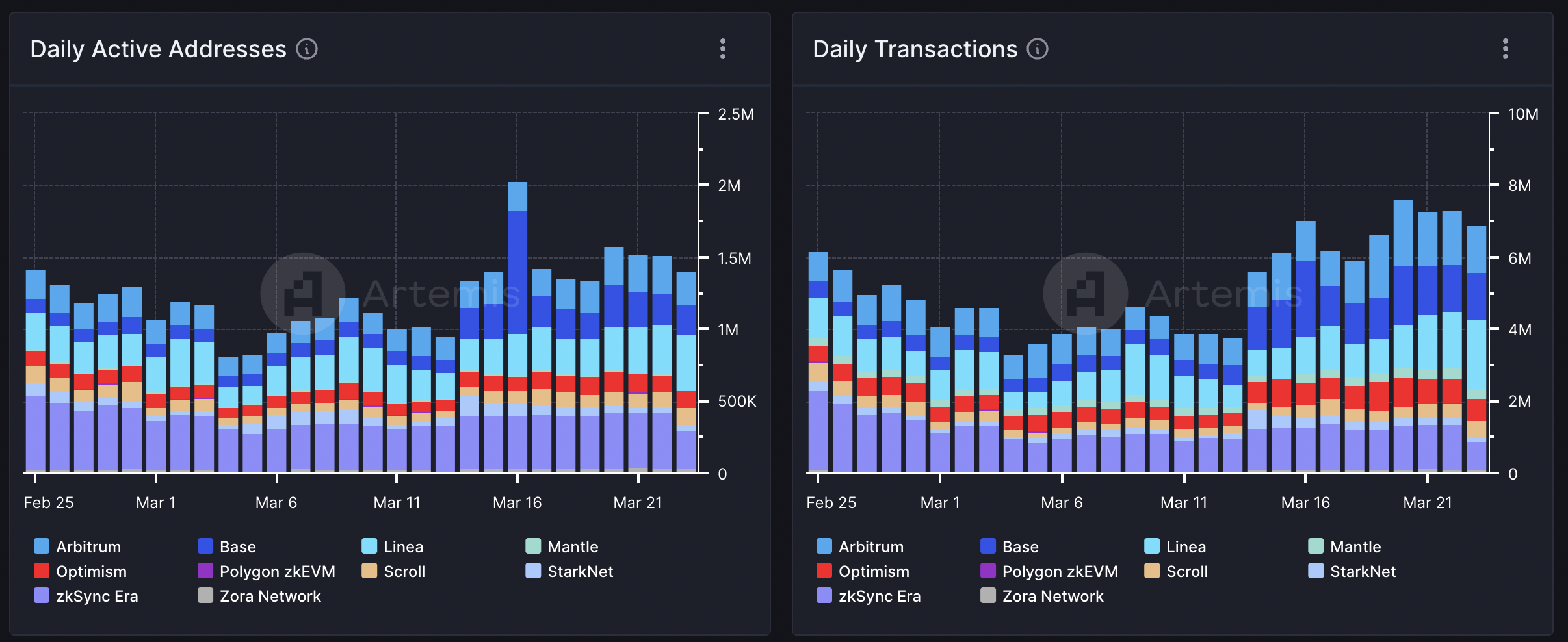

The decline in transaction fees might trigger a surge in activity on L2 chains as users become more engaged with Dapps and protocols built on these networks. This trend is already evident, with many of the top Layer 2 chains witnessing an uptick in on-chain activity since the introduction of Dencun. Since March 13, there has been a notable increase in both active addresses and everyday transactions across nearly all L2 platforms. More active use of L2 has a positive impact on Ethereum as it increases its overall throughput capacity without compromising security.

Daily Active Addresses and Transactions on Popular L2. Source

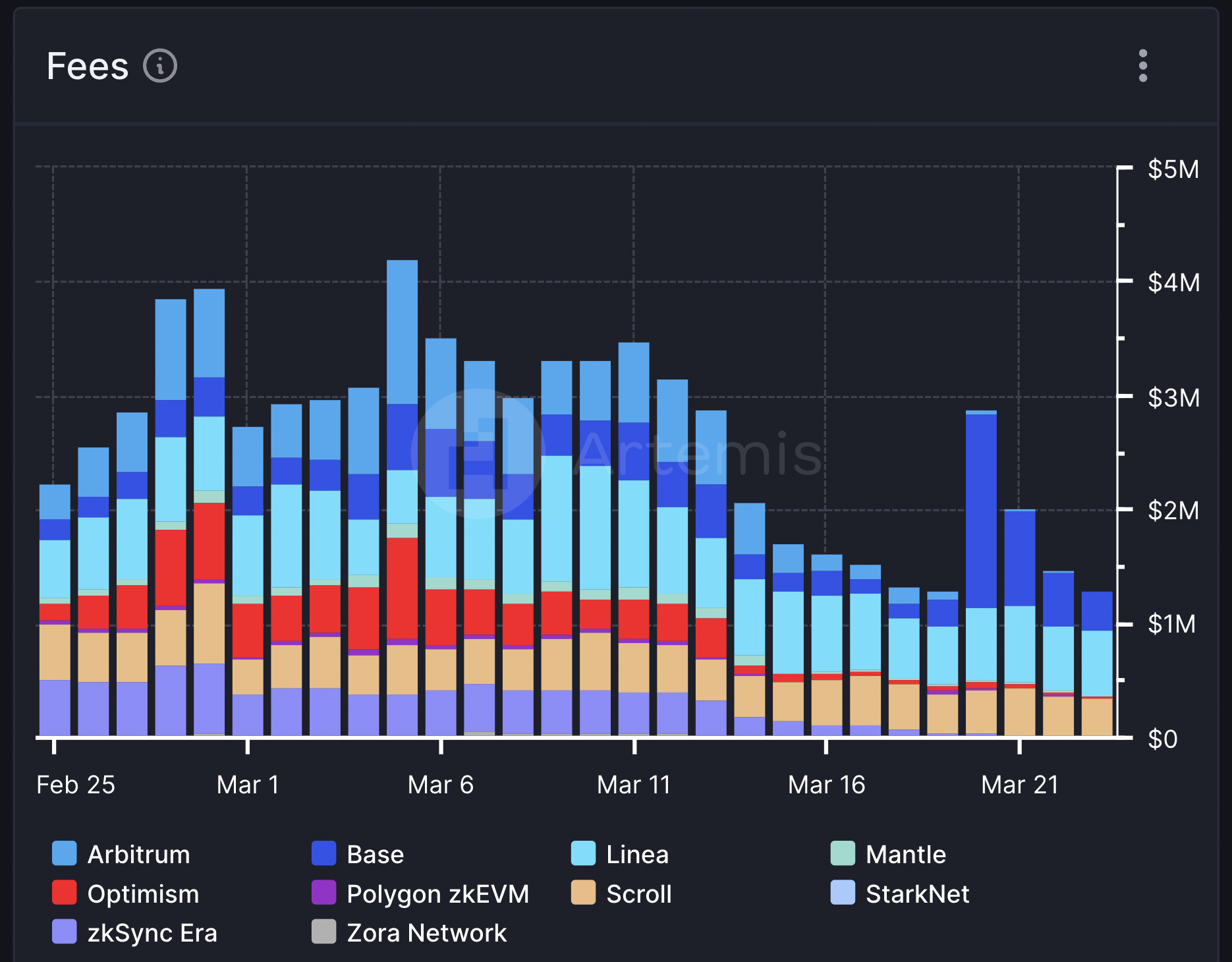

Reductions in fees have also resulted in the overall sum of fees paid by end-users of L2 chains.

Fees Paid by End Users on L2 Chains. Source

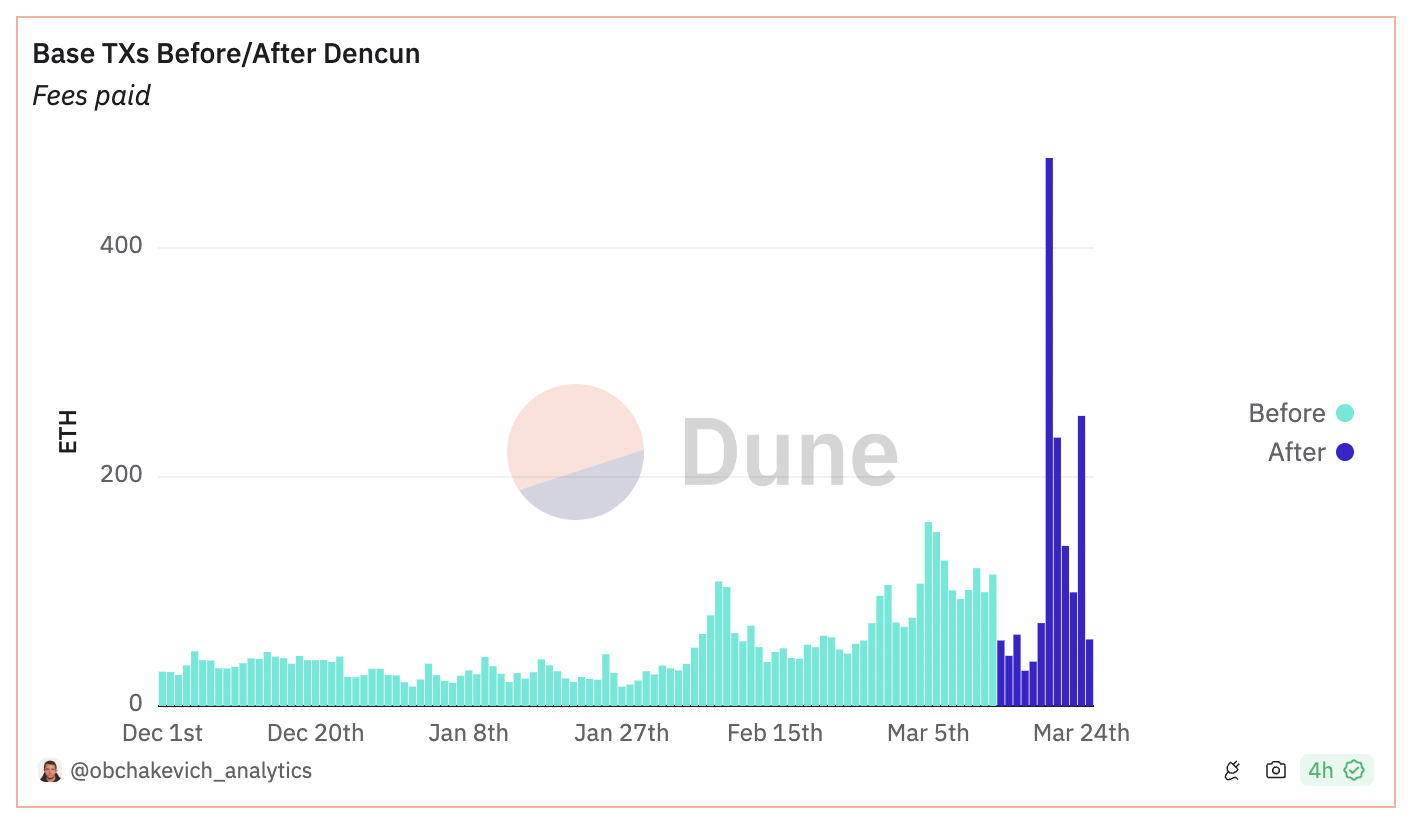

However, Base L2 showcases a notable uptick in paid fees amidst the heightened on-chain activity within the network. This surge is primarily fueled by activity related to memecoins. Notably, contracts associated with high-frequency trading of memecoins and Telegram trading bots utilized for memecoins trading emerge as the leading gas spenders on Base.

Fees Paid on Base. Source

Dencun Effect on Ethereum

Dencun's impact on Ethereum extends beyond just transaction fees; it also affects the platform's monetary policy via some changes in ETH staking:

- Perpetually Valid Signed Exits: This feature improves the user experience for delegated staking participants, such as those in liquid staking pools. With perpetually valid signed exits, participants can unilaterally exit their stake without waiting for validator operator approval.

- Increased Attestation Window: Dencun extends the time for voting on block correctness from 6.4 to 12.8 minutes by increasing the attestation window. This change can enhance the block confirmation process by allowing more attestations to be collected within a longer timeframe, potentially improving network security.

- Fixed Limit for New Validators: Dencun introduces a fixed limit of 8 new validators per ~6.4 minutes epoch. This limitation aims to control the growth of the validator set, preventing it from expanding too rapidly.

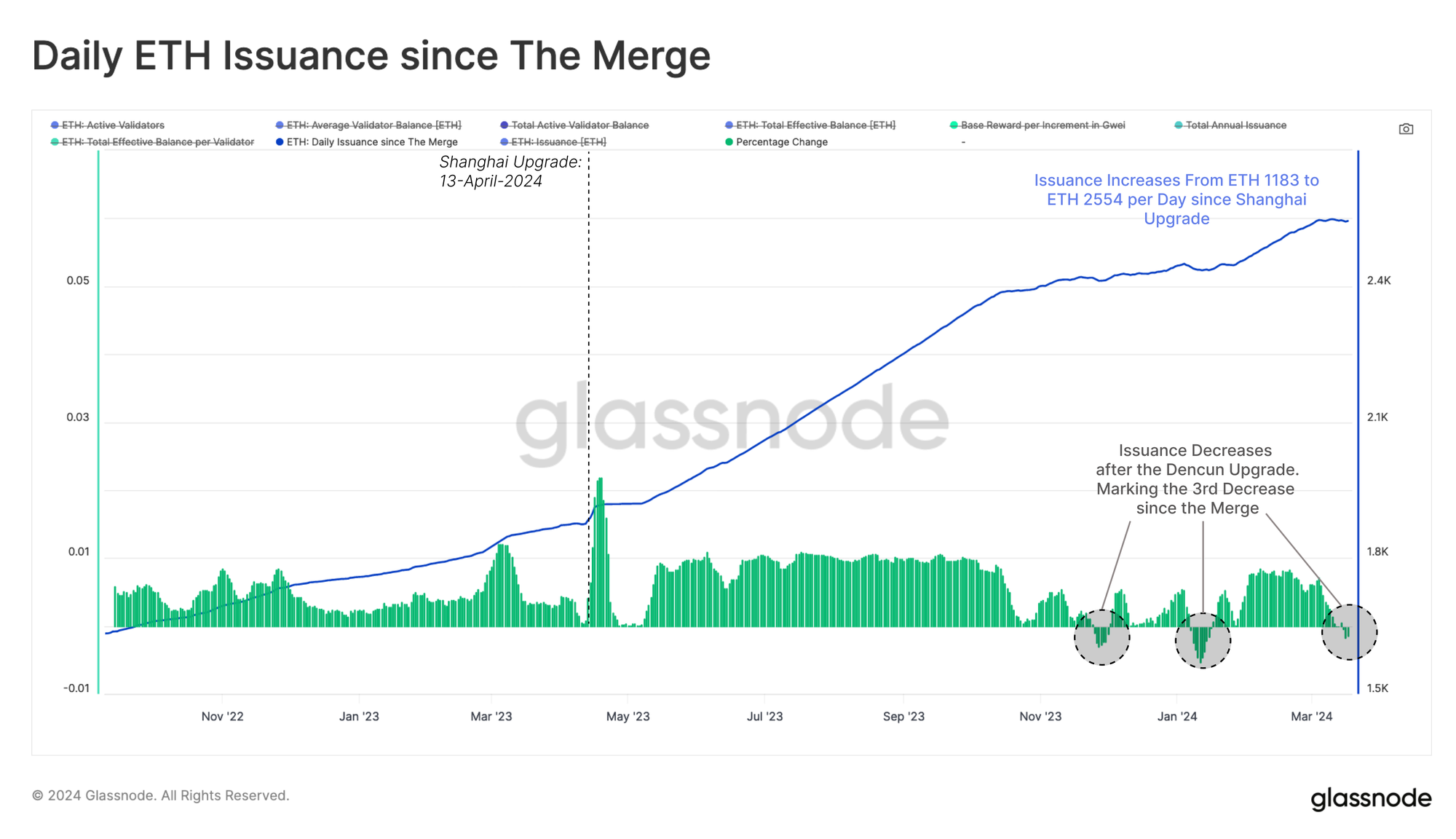

Indeed, these adjustments introduced by Dencun could influence Ethereum's monetary policy by potentially affecting the issuance rate. With the implementation of measures like the fixed limit for new validators, there's a possibility that fewer validators might join the staking pool over time.

The potential slowdown in Ethereum's issuance rate could have significant implications for its overall supply dynamics. As transaction fees continue to rise and potentially outpace the issuance of new ETH, Ethereum could transition towards a deflationary model. In a deflationary scenario, the total supply of Ethereum would gradually decrease over time as more ETH is burned through transaction fees than is newly issued. This could result in increased scarcity of ETH, potentially leading to upward pressure on its price.

Conclusion

Dencun stands out as Ethereum's most significant upgrade since its shift to Proof-of-Stake consensus in September 2022, notably enhancing user experience across layer 2 chains.

Following Dencun's implementation, prominent EVM Layer 2 platforms are witnessing a notable surge in on-chain activity alongside a decrease in transaction fees. This reduction in fees serves as an incentive for users to actively participate in protocols operating on layer 2 chains.

Dencun has also presented alterations to ETH staking and monetary policies, introducing new mechanics to the ETH staking and validation processes. These changes have the potential to alter the dynamics of ETH supply, potentially transitioning Ethereum towards a deflationary supply model.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.