LTC Halving From 2011 to Today: Tracing the Full Litecoin Halving History

This blog post will cover:

- Introduction

- Litecoin Halving Basics

- Litecoin Halving vs. Bitcoin Halving: Key Differences

- Litecoin Halving History (2011–2023)

- The Next Litecoin Halving

- Impact of Litecoin Halving

- Why Swap LTC with SimpleSwap

- Round-Up

- FAQ

Introduction

Litecoin has been around long enough to build its own story, not just live in Bitcoin’s shadow. One of the key threads running through that story is Litecoin halving – a recurring event that quietly reshapes LTC supply and often shakes up market expectations at the same time.

Every few years, the amount of new LTC created with each block is cut in half. That simple rule does quite a lot. It slows inflation, affects miner revenue, and feeds long-term narratives about scarcity. For long-term holders, halvings help define the rhythm of accumulation and conviction. For active traders, they often become focal points for speculation, volatility spikes, and shifting liquidity.

Litecoin halving history stretches from its early years in 2015, through a more public Litecoin halving 2019 event, up to the 2023 one that played out under the spotlight of a more mature crypto market. Across those cycles, LTC has shown familiar patterns at times (pre-halving rallies, post-event cool-downs) but never in exactly the same way. As of now, next Litecoin halving is projected to occur in late July/early August 2027.

Research on halving events across proof-of-work coins links these mechanics to lower new supply and higher scarcity, though market outcomes remain highly path dependent.

Understanding LTC halving does not only help you read historical charts. It also gives context for the next scheduled reduction in 2027, and for how LTC might behave when supply growth slows again.

The “When is Litecoin Halving?” question is just a small part of what this article is about. And before we walk through past cycles and future scenarios, it makes sense to look at the basics.

LTC Halving Dates | Block Height | LTC Mining Reward Reduction | LTC Price at Date of Halving | |

Prehalving Period | October 13, 2011 | 0 | 50 LTC | / |

First Halving | August 25, 2015 | 840,000 | 50 LTC → 25 LTC | $3.05 |

Second Halving | August 5, 20129 | 1,680,000 | 25 LTC → 12.5 LTC | $104.72 |

Third Halving | August 2, 2023 | 2,520,000 | 12.5 LTC → 6.25 LTC | $93 |

Fourth Halving | August 7, 2027* | 3,360,000 | 6.25 LTC → 3.125 LTC | / |

*A projected date

Disclaimer: This is educational content, not financial advice. Crypto markets are volatile and speculative. Always do your own research (DYOR), consider risk tolerance and time horizon, and never invest money that you can’t afford to lose.

Litecoin Halving Basics

Before diving into LTC halving dates history and looking at the Litecoin halving chart, let’s ground the idea itself. Then we can layer on what it means for scarcity, miners, and investors.

What Is Halving?

In the Litecoin network, new coins enter circulation as rewards paid to miners who add blocks to the blockchain. When the coin launched in 2011, each block came with a reward of 50 LTC. The protocol includes a rule that after every 840,000 blocks, that reward is cut in half.

You can imagine the block reward as a tap filling a bathtub. Every halving closes the tap a bit more. Water still flows, just at a slower rate. Over time the bathtub (total supply) approaches a fixed level.

Bitcoin uses the same basic idea, though with slightly different parameters. Its reward halves every 210,000 blocks, block times average ten minutes, and the total supply tops out at nearly 21 million BTC. Litecoin’s code keeps the same logic but adjusts it for faster blocks, a different mining algorithm, and a higher maximum supply of 84 million coins.

Why Does Halving Matter?

Halving matters because it touches three core areas at once.

First, inflation. Before each halving, a fixed number of coins enter circulation every 2.5 minutes. After the event, that number instantly drops by half. Daily issuance moves from roughly 7,200 LTC to around 3,600 LTC across a single epoch change, then halves again in the next cycle. This steadily lowers Litecoin’s inflation rate and supports a long-term scarcity narrative.

Second, miners. Block rewards are a key part of miner income. When rewards are cut in half, mining revenue falls unless offset by a higher LTC price, cheaper electricity, or more efficient hardware. Studies and market analyses point out that some miners leave after halvings, hash rate can wobble in the short term, and the network then rebalances as difficulty and miner composition adjust.

Third, markets. Lower new supply creates the potential for supply shocks if demand stays steady or grows. Historical data shows that traders often price in these expectations early, with enthusiasm building in the months before a halving and mixed performance after the event itself.

Litecoin Halving vs. Bitcoin Halving: Key Differences

Litecoin is often described as “silver” to Bitcoin’s “gold”. The comparison is not just poetic. It reflects real design choices in speed, supply, and use case. Halving events are where those choices show up clearly.

The table below sets out the main differences between Litecoin and Bitcoin halvings. These parameters come from each project’s own documentation and widely cited educational material.

Feature | Bitcoin | Litecoin |

Consensus algorithm | Proof of Work using SHA-256 | Proof of Work using Scrypt |

Target block time | ~10 minutes | ~2.5 minutes |

Max supply | 21 million BTC | 84 million LTC |

Halving interval (blocks) | Every 210,000 blocks | Every 840,000 blocks |

Typical time between halvings | Around 4 years | Around 4 years |

Recent halving and reward | April 2024 – reward cut from 6.25 BTC to 3.125 BTC | August 2023 – reward cut from 12.5 LTC to 6.25 LTC |

Next expected halving | Around 2028 | Around mid to late 2027 |

Common narrative | Long-term store of value and macro hedge | Faster, lower-fee payments and “digital silver” complement to BTC |

Same halving rhythm in years, different feel in practice. Bitcoin halves fewer coins per block but starts from a lower total supply and slower issuance. Halving Bitcoin often anchors broad crypto market expectations, whereas halving Litecoin tends to create more focused waves of interest within its own community and among traders who watch it as a “beta” play to BTC.

Litecoin Halving History (2011–2023)

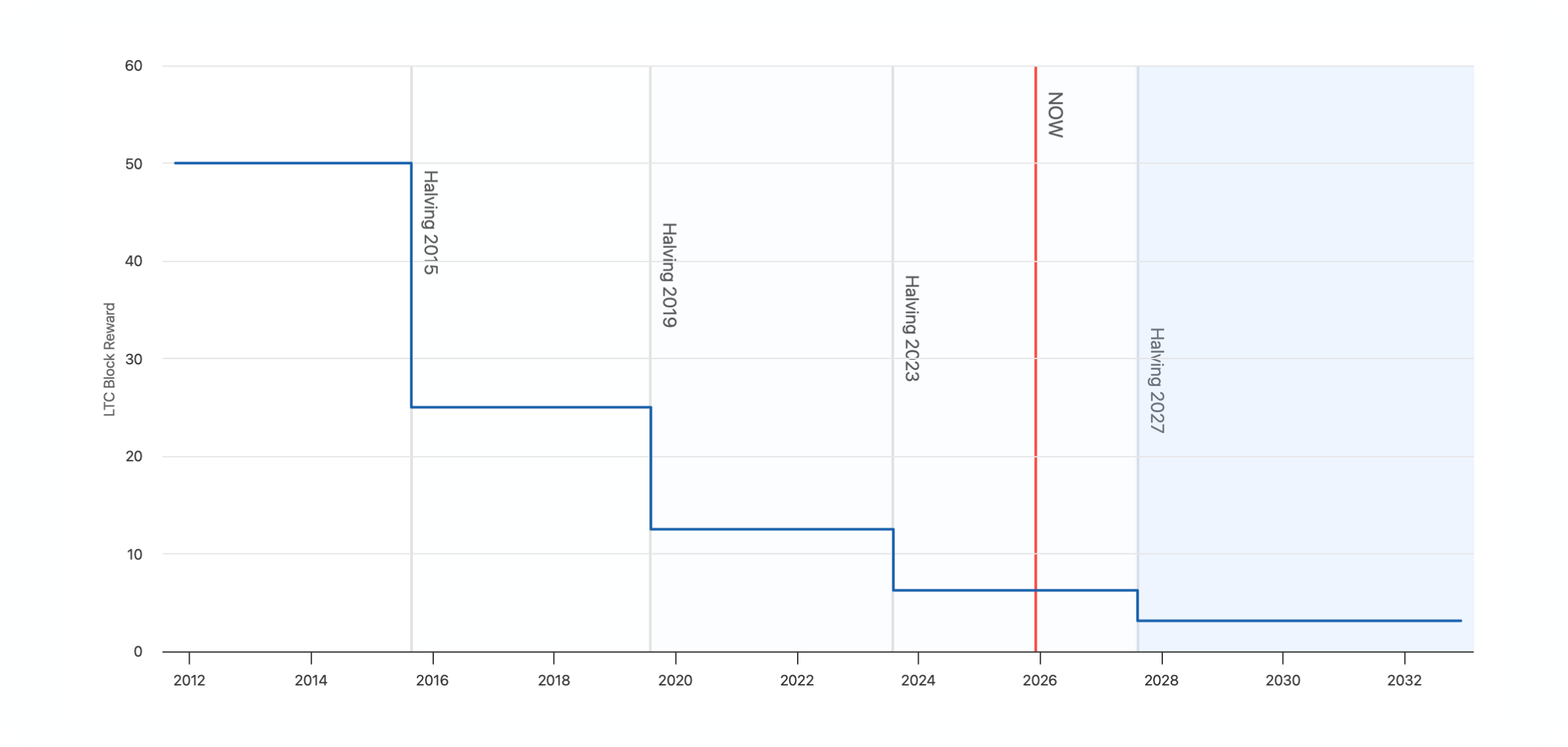

Litecoin’s history starts in 2011 as seen on the LTC halving chart below, but the real structural milestones for its supply came later. Each halving added another data point for analysts and another story for investors and miners.

LTC Halving Dates Chart

Litecoin halving chart. Source: LitecoinHalving

The 2015 Litecoin Halving Event

The first Litecoin halving arrived in August 2015, at block height 840,000. The block reward dropped from 50 LTC to 25 LTC, marking the first time the network slowed its issuance pace.

Back then, the crypto market was far smaller and less liquid. Litecoin’s price had already climbed sharply into early July, then pulled back in the weeks leading to the event. Research that revisits the period notes a familiar pattern even in this early cycle. Traders bid LTC up ahead of the halving, then sold into the news, leaving the price lower around the actual date.

Litecoin halving 2015. Source: CoinCodex

Media coverage was modest and mostly confined to niche crypto outlets and forums. For miners, the main question centered on whether reduced rewards would make Litecoin mining unprofitable. Historical hashrate data shows a dip around the event followed by recovery and long-term growth, which eased worries about network security.

The 2019 Halving

By the second Litecoin halving in August 2019, the environment had changed quite a bit. Crypto had already lived through the 2017 boom and 2018 crash. Litecoin itself was more widely listed, more followed, and more tied into Bitcoin’s broader cycles.

The 2019 halving took place at block 1,680,000 and cut the block reward from 25 LTC to 12.5 LTC. In the months beforehand, LTC rallied from low double-digit prices into triple digits during the first half of the year, then rolled over before the halving date. Analysts often describe this as a textbook “buy the rumor, sell the news” pattern.

Litecoin halving 2019. Source: CoinCodex

Price behavior after the event looked less exciting than some marketing narratives had suggested. Litecoin trended down for a while, echoing what had happened in 2015. Long-term charts show that the broader crypto cycle (including Bitcoin’s own path toward its 2020 halving) played a major role in where LTC settled.

The 2023 Litecoin Halving and Its Impact

The third Litecoin halving arrived on 2 August 2023, at block 2,520,000. Block rewards dropped again, this time from 12.5 LTC to 6.25 LTC.

By this stage, Litecoin was a veteran asset. Derivatives markets were more developed, and data providers tracked every twist in on-chain metrics. LTC once again showed strength in the lead-up, peaking about a month before the event.

After the halving, price slipped and even dropped sharply in the first days, with one report noting an 8 percent fall within hours.

Litecoin halving 2023. Source: CoinCodex

Commentary around this halving was more nuanced than in earlier cycles. Some analysts argued that reduced issuance matters mainly over long horizons, especially now that a large share of the 84 million LTC max supply has already been mined. Others pointed out that narrative and positioning still drive short-term moves.

The Next Litecoin Halving

The history is useful, yet most readers want to know what comes next. Litecoin’s code gives a clear schedule, even if the exact calendar date floats a bit.

When Is the Next Litecoin Halving?

Litecoin halvings occur every 840,000 blocks. With an average block time of about 2.5 minutes, that works out to roughly every four years, similar in calendar rhythm to Bitcoin.

The next Litecoin halving event will arrive at block height 3,360,000. Multiple trackers and educational sites place the estimated date in mid to late 2027. Some countdowns point toward late July, others lean toward dates in August, and at least one forecast has suggested early September.

Why the spread in estimates? Periods of higher hashrate can pull the date slightly forward. Slower block production can push it back. The protocol cares about block height, not a specific day on the calendar.

Looking at the pattern so far gives a rough guide:

First halving – August 2015 – 50 to 25 LTC

Second halving – August 2019 – 25 to 12.5 LTC

Third halving – August 2023 – 12.5 to 6.25 LTC

The next step in that sequence sits around 2027, and market participants are already watching block counters even if the exact day will only become clear closer to the time.

Price Prediction for Future Halving

Across previous LTC cycles, a few tendencies stand out in the data and commentary. The price often strengthens months before a halving as traders position around expected scarcity. Analysts have highlighted cases of several hundred percent gains from cycle lows into pre-halving peaks, followed by noticeable pullbacks once the event passes.

The 2023 halving continued that theme. LTC rallied earlier in the year, made local highs weeks before the date, then saw a quick drop around the event and choppy behavior afterward.

For the 2027 halving, several forces will interact:

Supply: New issuance will fall from 6.25 LTC per block to 3.125 LTC. That halves daily new supply again.

Demand: Adoption trends, payment usage, and investor interest will shape how meaningful that supply cut feels.

Macro and Bitcoin: Broader risk appetite, regulation, and Bitcoin’s own post-2028 cycle can amplify or mute Litecoin movements.

Market structure: Derivatives, liquidity on exchanges, and stablecoin volumes affect how quickly new information gets priced in.

Some observers expect a familiar “anticipation rally then cooling off” pattern. Others argue that as more of Litecoin’s supply is already in circulation, each new halving may have a softer effect on price. Both views rely on ranges and scenarios rather than precise targets, which is a healthy way to think about it.

Expected Changes in Block Rewards and Litecoin Issuance Rate

From a protocol point of view, the next halving makes a clean and predictable change.

Right now, miners receive 6.25 LTC per block. After block 3,360,000, that reward is expected to fall to 3.125 LTC. The historical progression looks like this in plain language:

Started at 50 LTC per block

Dropped to 25 LTC in 2015

Dropped to 12.5 LTC in 2019

Dropped to 6.25 LTC in 2023

Will drop to 3.125 LTC around 2027

Each step slows the rate at which new LTC enters circulation. A large majority of the eventual 84 million LTC supply has already been mined, and that share grows over time. That is why many long-term discussions focus less on “new” coins and more on holding, spending, liquidity, and fees as the network matures.

Impact of Litecoin Halving

Supply mechanics are only half the story. The other half lives in charts, mining dashboards, and portfolio decisions.

How Does Litecoin Halving Affect LTC Price?

Across the three halvings so far, Litecoin’s price has rarely moved in a straight line. Yet certain rhythms appear often enough to draw attention.

Historical reviews show that LTC tends to experience stronger performance in the months leading up to each halving, followed by mixed or weaker performance in the weeks and months after. Analysts often describe this as “buy the rumor, sell the news” behavior, where traders front-run the event and then lock in gains once the headline hits.

The key point is that halving changes the supply side in a clear way, but price only reacts strongly when demand and sentiment line up.

Halving can:

Increase attention and speculative volume in the run-up

Coincide with sharp short-term reversals around the date

Contribute to long-term scarcity that may support price over many years, alongside adoption and macro trends

What it does not provide is a guaranteed path or a fixed percentage gain for the next cycle.

How Does Litecoin Halving Affect Miners?

Miners feel the halving impact immediately. Revenue in newly minted coins falls by half from one block to the next.

Analyses of past halvings explain that this change can squeeze profitability, especially for miners running older hardware or facing high energy costs. Some miners shut down or switch to other coins when rewards drop. That outflow can reduce the network hashrate in the short term and slightly slow block production until difficulty adjusts.

Over multiple cycles, the pattern tends toward gradual professionalization. Less efficient operations exit, and those that remain push toward lower costs and more predictable cash flow. For network users, the important part is that hashrate and difficulty adapt, helping maintain security even as rewards step down.

How Does Litecoin Halving Affect Investors?

Investors experience halvings in different ways depending on their style and time horizon.

Long-term holders often treat halving as a structural milestone rather than a short-term trading signal. For them, reduced issuance supports a scarcity thesis over a decade-scale view, while short-term volatility becomes part of the cost of holding. Many choose to rebalance gradually or dollar-cost average around cycles rather than try to time the exact top or bottom.

Active traders focus more on the run-up and immediate aftermath. They track funding rates, derivatives positioning, funding spread between spot and futures, and cross-asset correlations with BTC and majors. Some specialize in trading “pre-halving narratives” and short-term reactions to the event itself, aware that both rallies and sharp reversals have occurred in past cycles.

Conservative allocators look at Litecoin halving through a portfolio lens. They may view LTC as one of several assets with programmed supply reductions and treat halving as a reminder to review exposure, risk limits, and diversification. For this group, risk management, position sizing, and an understanding of liquidity conditions around halving periods matter more than chasing short-term moves.

Across all profiles, one message repeats in research and educational content. Halving changes the math of new supply in a transparent way, but investment decisions still hinge on personal goals, risk tolerance, and broader market analysis, not on halving dates alone.

Why Swap LTC with SimpleSwap

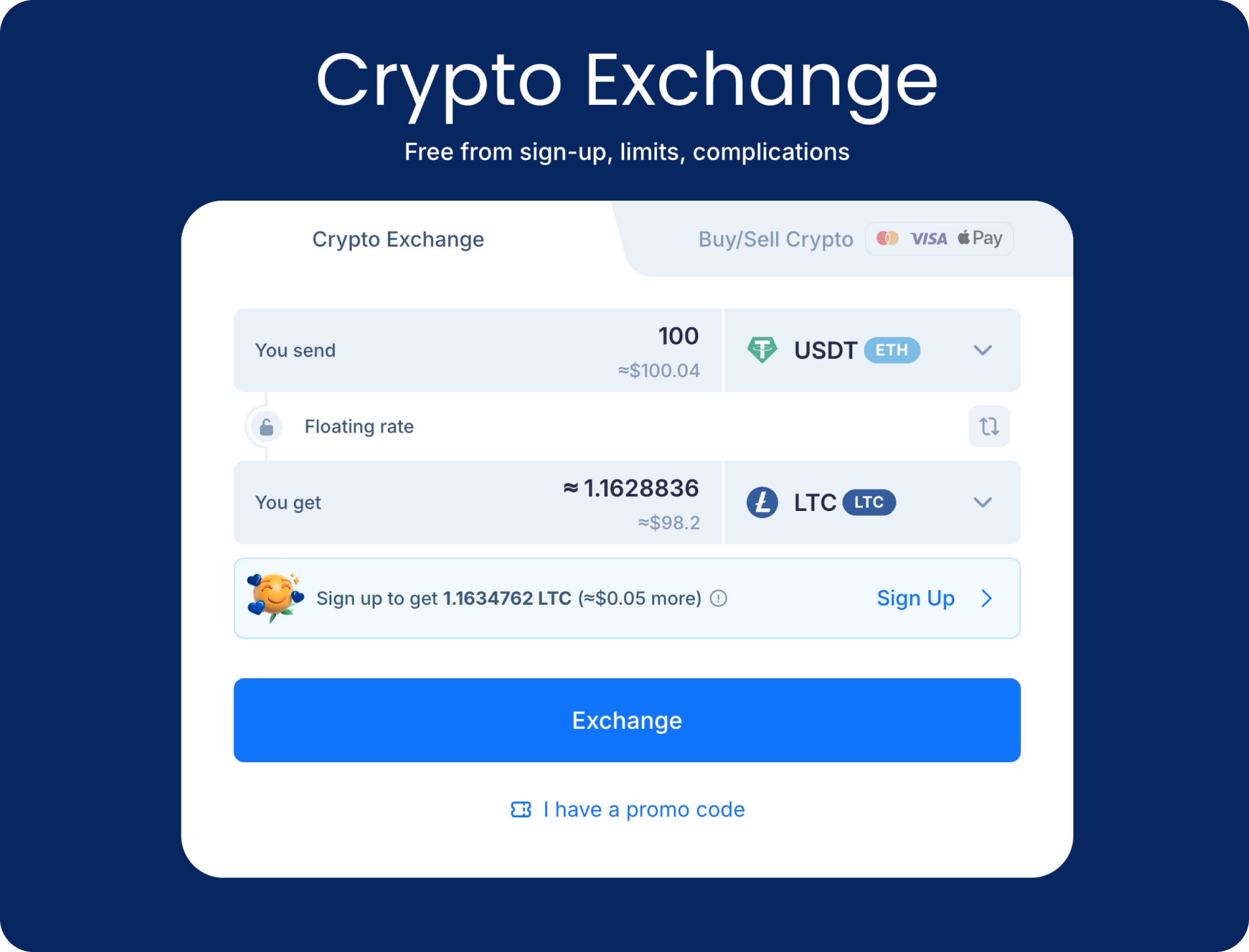

Understanding halving is one side of the story. Putting that knowledge to use often means moving between assets – for example, swapping LTC for USDT during a volatile phase or buying LTC with a bank card when you decide to build exposure. One of the options is using one of the exchange platforms, like SimpleSwap.

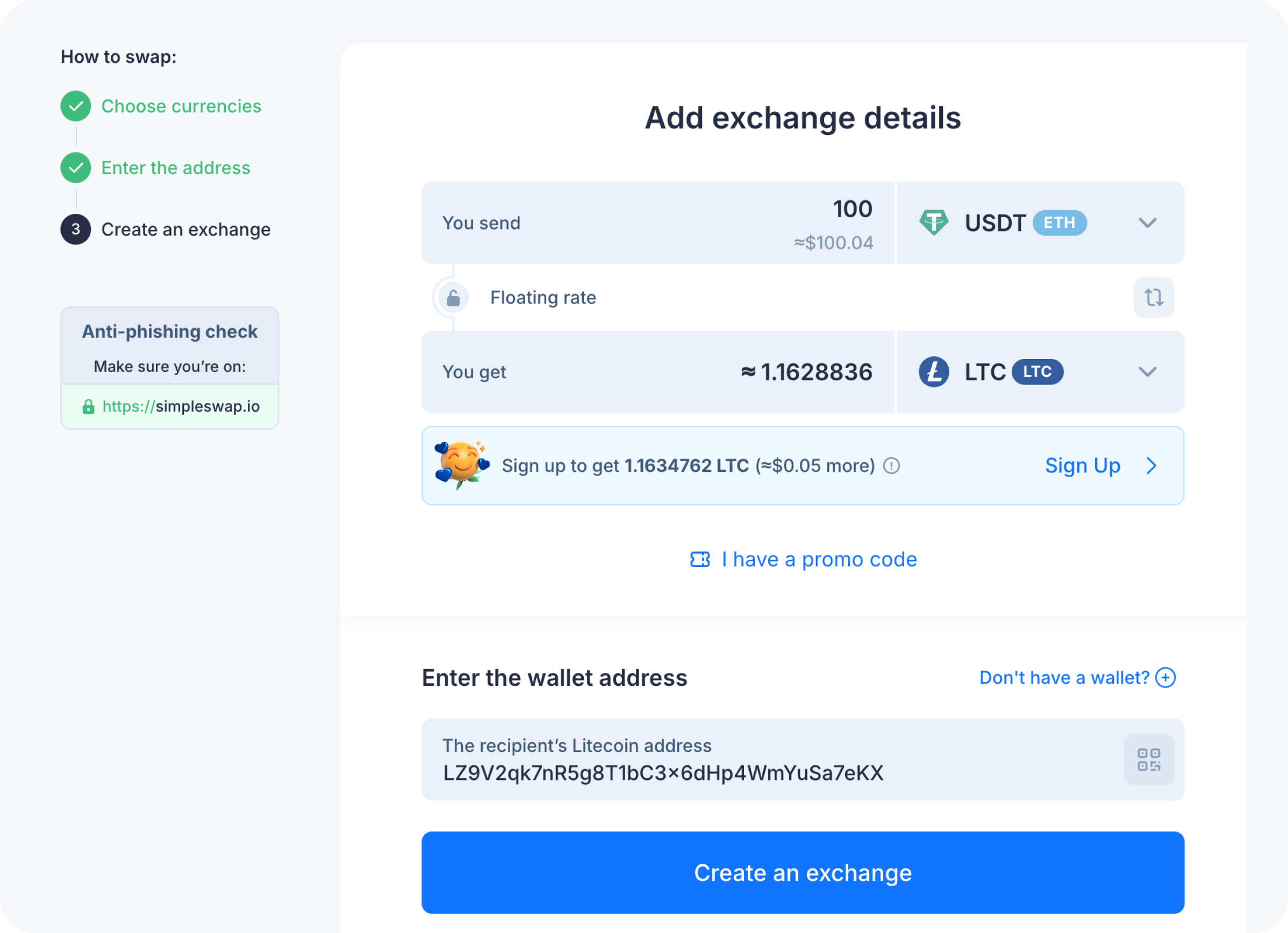

A typical path to swap into Litecoin using USDT or fiat on a non-custodial swap service looks like this:

1. Open SimpleSwap and choose Crypto Exchange.

2. In You Send, pick your coin (for example, USDT). In You Get, select LTC, or any other coin of your choosing.

*The LTC wallet address on the picture is provided for example purposes only, it is not a real address.

3. Click Exchange, paste your receiving address (so funds land where you’ll use them).

4. Confirm the rate and send your deposit.

5. Receive LTC – typically within minutes – no registration required.

If you plan to adjust your LTC exposure around halving cycles, the SimpleSwap path can make rebalancing or opportunistic buys more practical.

Round-Up

Litecoin halving sits at the center of LTC’s long-term design. Every 840,000 blocks, the reward that miners receive drops, daily issuance slows, and a new chapter in Litecoin’s monetary story begins. From the first event in 2015 through the events in 2019 and 2023, markets have repeatedly treated these dates as important, yet not all-powerful, catalysts.

For holders, halvings frame multi-year cycles of scarcity and sentiment. For miners, they force regular rethinks of business models, hardware, and energy costs. For traders, they offer windows of heightened attention and, often, volatility spikes that reward preparation more than guesswork.

The next Litecoin halving in 2027 will continue that pattern. It will not rewrite the rules overnight, yet it will shape LTC’s inflation path and narrative for another four-year stretch.

By understanding how past halvings played out and how the protocol works, you put yourself in a stronger position to read coming cycles, whether you stick with LTC for the long run or move in and out through services such as SimpleSwap.

FAQ

What Is Litecoin Halving?

It is a programmed event where the reward paid to miners for each new block is cut in half. It happens every 840,000 blocks and slows the rate at which new LTC enters circulation, helping to create long-term scarcity within the 84 million maximum supply.

What Triggers a Litecoin Halving?

A Litecoin halving is triggered automatically by the blockchain protocol once the total number of mined blocks reaches the next halving height. Every 840,000 blocks, the code reduces the block reward by 50 percent. This change happens without human intervention and directly affects how much new LTC miners earn and how much new supply reaches the market.

Does Litecoin Halving Affect LTC Price?

Many traders watch halving closely and expect upward pressure over time, since new supply falls. Historical data shows that Litecoin often rallies in the months before halvings, then faces mixed or weaker performance afterward, with outcomes heavily shaped by broader market conditions and Bitcoin trends. There is no guarantee that a future halving will push LTC price in a specific direction.

Why is Litecoin Halving Important?

Halving reduces block rewards, which directly cuts miner income in LTC terms. That change can push miners to upgrade hardware, seek cheaper energy, or exit if operations no longer make sense. Over time, competition among miners and ongoing difficulty adjustments support network security by keeping hashrate aligned with economic incentives. Once nearly all LTC is mined, block rewards will be tiny and miners will rely more on transaction fees, so halving events help guide the network toward that future state.

When is the Next Litecoin Halving?

The next Litecoin halving is projected for mid to late 2027 at block height 3,360,000. Estimates from halving trackers currently cluster around late July and August, with a few outliers pointing to early September. The reward is expected to drop from 6.25 LTC to 3.125 LTC per block at that point. Exact timing can shift because block times vary around the 2.5-minute target.

When Will Litecoin Halving Stop?

Litecoin halvings will continue far into the future, each event making the block reward smaller as the network moves toward its 84 million LTC supply cap. Eventually, the reward will become so tiny that it is effectively negligible, and miner income will come mainly from transaction fees rather than new coins. Current projections place that endpoint around the next century, similar in spirit to Bitcoin’s gradual path toward its own terminal supply.