What is Crypto Top for 2025-2026? Best Coin to Invest in Long- and Short-Term

This blog post will cover:

- Introduction

- Crypto Investment Landscape 2025-2026

- Criteria for Selecting Top Coins

- Benefits of Short-Term Investment in Cryptocurrencies

- Benefits of Long-Term Investment in Cryptocurrencies

- Best Crypto to Invest in 2025–2026

- Best Long-Term Crypto Investments

- Best Short-Term Crypto Picks

- How to Invest in Cryptocurrency

- Actionable Strategies

- Round-Up

- FAQ

Introduction

The crypto market in late 2025 is huge and very noisy at the same time. For anyone typing “what is leading crypto?” or “what is crypto top?” into a search bar, the flood of numbers, narratives, and hot takes can feel overwhelming. Global crypto capitalization sits around 3.2 trillion dollars, after sharp swings that have moved hundreds of billions in a matter of days.

Around 559 million people now own some form of cryptocurrency, roughly one in ten adults on the planet, which shows how far the asset class has moved from a niche experiment to a mainstream talking point. Lists like “cryptocurrency top 5” or “top 5 cryptos” that dominate social feeds are one reflection of that shift.

At the same time, rules and technology are catching up. New laws such as the US GENIUS Act, the EU’s MiCA regime, and stablecoin rules in Hong Kong and Singapore give issuers and exchanges clearer guardrails, while decentralized finance, real-world asset tokenization, and AI-driven trading tools continue to grow.

For investors, that mix of maturity and experimentation means the next two years can bring large opportunities and equally real risks. Picking the best crypto coins to buy in 2025–2026 is less about guessing a single winner or chasing a supposed top crypto to buy today and more about understanding which coins have the depth to survive many cycles.

Disclaimer: This is educational content only, nothing in this article is financial advice in any form. Crypto markets are volatile and speculative. Always do your own research (DYOR), consider risk tolerance and time horizon, and never invest money that you can’t afford to lose.

Crypto Investment Landscape 2025-2026

Across the cryptocurrency market, a few forces stand out. Stablecoins hold roughly 300 billion dollars, with USDT and USDC near 185 and 75 billion dollars and dominating the sector. DeFi total value locked has climbed back above 160 billion dollars in 2025.

Tokenization of real-world assets has reached tens of billions, with forecasts in the trillions over the next decade. AI themes in trading tools and AI-linked tokens keep drawing speculative flows.

Pain points remain. Crypto still sees sharp volatility, illustrated by Bitcoin dropping from above 120,000 dollars to the low 80,000s and erasing more than a trillion in value at one stage. Some crypto investors focus on finding the best performing cryptocurrency in each cycle, but the bigger story is how assets behave through stress.

Regulation adds clarity and extra compliance duties, especially for stablecoins and KYC. Hacks, DeFi exploits, and smart-contract bugs persist, and researchers flag concentration among stablecoin issuers and DeFi risk metrics such as TVL. Adoption indexes still show strong usage in countries like India, Turkey, and the US, which supports the longer-term demand story even when prices shake traders’ confidence.

Criteria for Selecting Top Coins

Before answering questions like “what is the best cryptocurrency to buy right now?,” it helps to ground the process in a simple framework of some of the best practices. Think of it as a set of filters that an analyst can apply coin by coin instead of blindly following any “best crypto now” headline.

Fundamentals

To map out the tentative list of the best cryptocurrencies to invest the first look is often cast at the basic financial strength and transparency. Analysts tend to start with market cap, trading volume, and order-book depth, since high liquidity gives smoother entries and exits. They also check how supply works, including emissions, burn mechanisms, and any lock-up schedules.

Public audits, clear token distribution, and regular financial or reserve reports add another layer of comfort. Coins that pass this basic health check then move on to deeper research.

Utility and Adoption

Once basics check out, focus on real use. For blockchain platforms like Ethereum or Solana, track active addresses, fees, and DeFi or NFT activity – Ethereum still leads DeFi TVL above 160 billion dollars.

Partnerships matter too: Chainlink oracles secure major DeFi value and support tokenization pilots. For payment coins like XRP and large stablecoins, judge remittance flows, merchant use, and settlements.

Studies such as TRM Labs show fiat-backed stablecoins now drive much on-chain volume.

Team, Community, Roadmap

Strong code alone is rarely enough. Investors often look for public, experienced teams with a clear development roadmap and regular progress updates.

Cardano’s weekly development reports or Solana’s roadmap for upgrades such as Firedancer give a good example of this kind of communication.

A healthy community shows up through GitHub commits, validator participation, governance votes, and social channels that focus on building rather than only hyping price targets.

Red flags include vague leadership, frequent leadership turnover, promises of guaranteed returns, or communities that focus only on “moon” narratives without discussing risks.

Benefits of Short-Term Investment in Cryptocurrencies

Short-term crypto investment, often seen as active trading, tries to use volatility instead of avoiding it. News, ETF flows, regulation, and protocol upgrades can move prices in minutes, opening room for swing and intraday trades.

Options and futures data show strong bursts of volatility in coins like Bitcoin and Ethereum, often higher than in many stocks, which can reward traders who plan entries and exits carefully.

Positions usually last hours or days, not years, so capital stays flexible and traders can move to the sidelines when markets feel stretched.

Benefits of Long-Term Investment in Cryptocurrencies

Long-term investing in crypto feels very different. The focus shifts from candles on a five-minute chart to multi-year trends in adoption and technology.

Long-term investment, often called “holding”, accepts market cycles. Bitcoin has seen drawdowns over 50 percent followed by new highs, including a 2025 slide from above 120,000 dollars to the low 80,000s and recovery toward 90,000.

Investors focus on halving cycles, adoption of crypto ETFs, and macro trends, treating long-term exposure as joining open financial infrastructure.

Best Crypto to Invest in 2025–2026

Before we break down each asset, it helps to view the group side by side. If you find yourself wondering what cryptos to buy now, this section reframes that question into understanding roles and risk rather than being hell-bent on making an ultimate single list of winners.

Top 10 Crypto Overview Table

The table below summarises rough categories, market cap tiers, and use cases. It is not a ranking, just a snapshot of where these coins sit in late 2025. This top cryptocurrencies list includes both BTC and altcoins (basically all coins that are not Bitcoin).

Coin | Category | Market Cap Tier | Typical Volatility | Primary Use Case | Suitability |

BTC | Store of value / payment | Mega cap | Medium | Macro asset, reserve asset | Long-Term |

ETH | Smart contract platform | Mega cap | Medium-high | DeFi, Web3, dApp settlement | Both |

USDT | Stablecoin (USD-pegged) | Mega cap | Low | Liquidity, hedging, trading pair | Short-Term |

USDC | Stablecoin (USD-pegged) | Large-mega cap | Low | Settlements, compliant liquidity | Short-Term |

BNB | Exchange / platform token | Large-mega cap | Medium-high | Fees, DeFi, staking on BNB Chain | Both |

XRP | Payment asset | Large-mega cap | Medium-high | Cross-border transfers, remittances | Both |

ADA | Smart contract platform | Large cap | Medium-high | Research-driven L1, DeFi, governance | Long-Term |

SOL | High-throughput L1 platform | Large cap | High | High-speed DeFi, NFTs, consumer apps | Both |

DOGE | Meme / payment asset | Large cap | High | Sentiment-driven trading, niche payments | Short-Term |

LINK | Oracle / infrastructure | Large cap | Medium-high | Data feeds, cross-chain and tokenization | Long-Term |

Bitcoin (BTC)

Bitcoin remains the reference asset for the entire sector. With a market cap near 1.85 trillion dollars and dominance close to 57 percent, BTC still behaves as the anchor of crypto pricing and a candidate for the best crypto currency to buy for investors who want a single, highly liquid macro asset.

Source: https://www.tradingview.com/

Many institutions that moved into digital assets in 2024–2025 did so through spot Bitcoin ETFs, treasury holdings, or structured products, which reinforces its “digital gold” narrative. Large on-chain liquidity and deep derivatives markets also draw short-term traders who look for volatility with tight spreads.

Ethereum (ETH)

Ethereum stands at the core of DeFi and Web3 activity. With a market cap around 370–390 billion dollars and a huge share of DeFi TVL, ETH acts both as the fuel and reserve asset for a wide range of protocols, from lending pools to NFT marketplaces.

Source: https://www.tradingview.com/

In 2025, upgrades continue to focus on scaling and fee relief, while rollups and Layer-2 networks push more transactions off the main chain. Many DeFi reports still describe Ethereum as the primary settlement layer for on-chain finance.

Tether (USDT)

USDT is the largest stablecoin by supply and a core trading pair across centralized and decentralized venues. Its market cap now sits near 185 billion dollars, making it a top-three asset by value. Traders use USDT to park funds between trades, hedge against sharp drawdowns, and move liquidity quickly across exchanges. Short-term crypto investment strategies often treat USDT as a base currency rather than a speculative bet.

Regulation of stablecoins is tightening, so any investor using USDT for capital preservation should stay alert to new disclosure rules, reserve audits, and jurisdiction-specific restrictions.

USD Coin (USDC)

USDC sits as the second-largest fiat-backed stablecoin, with a market cap in the mid-70 billion dollar range and strong use across DeFi and institutional products. It is often positioned as a more compliance-centric “digital dollar”, backed by regulated issuers with regular attestation reports. USDC plays a large role in settlements, cross-border payment pilots, and corporate treasury management on blockchain rails.

As with any stablecoin, there is still issuer risk and regulatory risk, yet many view USDC less as a vehicle for return and more as a short-term liquidity and settlement tool.

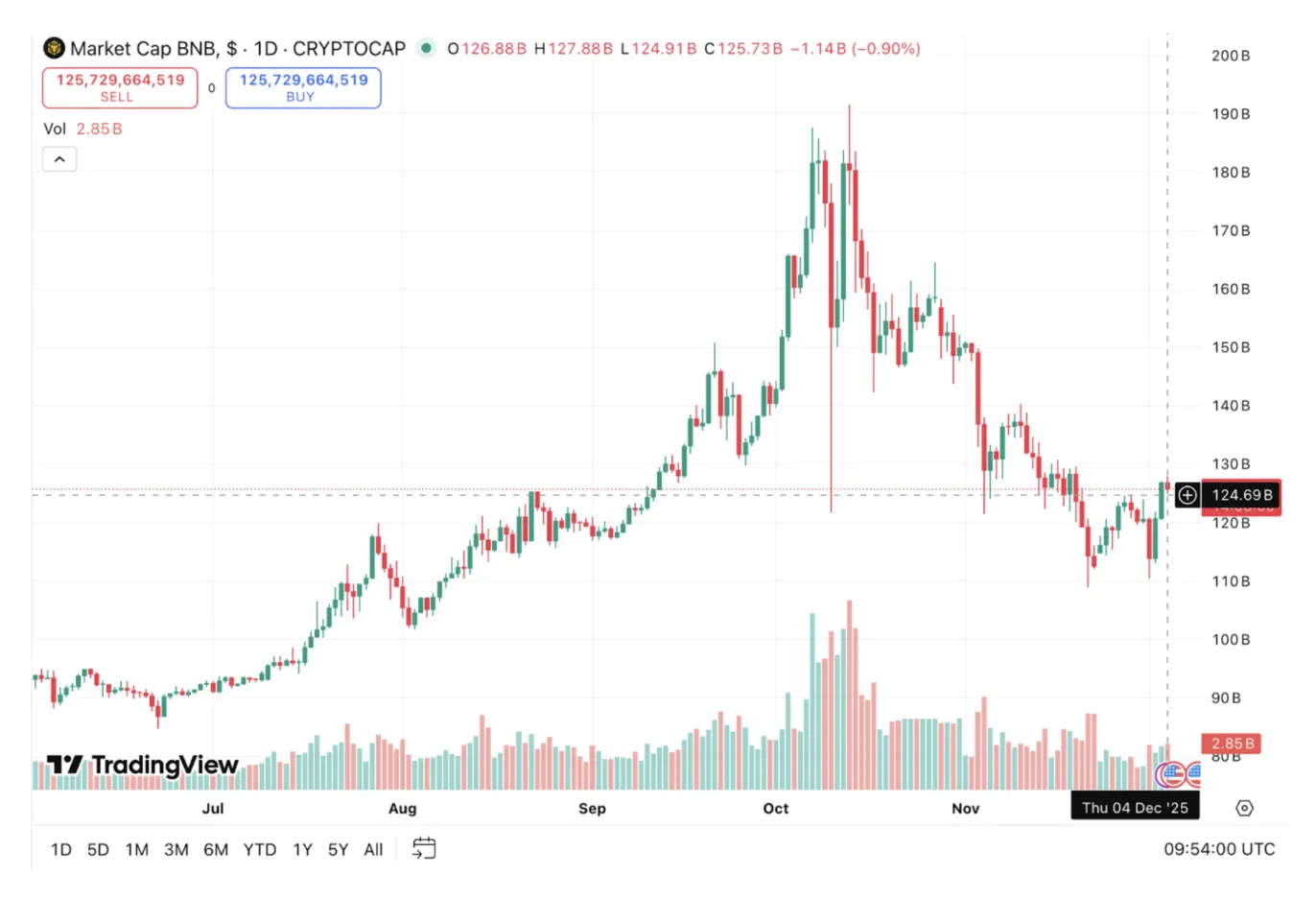

Binance Coin (BNB)

BNB serves as the primary token for the BNB Chain ecosystem. It grants trading fee discounts on the related exchange, pays gas on BNB Smart Chain, and supports staking and DeFi activity across a large set of protocols.

Source: https://www.tradingview.com/

The token reached new highs in 2025, helped by strong ecosystem revenue and a steady flow of new projects building on the BNB Chain.

XRP (XRP)

XRP focuses on fast, low-cost cross-border transfers and has long aimed to provide an alternative to legacy correspondent banking rails. Transaction confirmation times sit in the seconds range with relatively low fees, which keeps the asset in discussions about remittances and institutional settlement.

Source: https://www.tradingview.com/

Regulatory clarity in the US improved after court rulings in the Ripple vs SEC case, with markets expecting the remaining appeal process to end in 2025.

Cardano (ADA)

Cardano positions itself as a research-first smart contract platform. The project emphasizes peer-reviewed research, formal methods, and a structured roadmap. Weekly development updates in 2025 show more than two thousand active projects building on Cardano and rising on-chain metrics such as total transactions, native tokens, and governance participation.

Source: https://www.tradingview.com/

Smart contract usage through Plutus and newer languages like Aiken continues to expand, and DeFi plus NFT ecosystems on Cardano keep maturing.

Solana (SOL)

Solana aims for very high throughput and low fees, targeting consumer apps, DeFi, and high-frequency trading use cases. In 2025, Solana regained its spot among the top 10 coins by market cap, with the price hovering around the 140–200 dollar range and annual protocol revenue estimated in the billions.

Source: https://www.tradingview.com/

Developers continue to launch DeFi protocols, NFT collections, and gaming projects on Solana, helped by the chain’s speed. DeFi TVL data also show Solana among the leading chains by locked value.

Dogecoin (DOGE)

Dogecoin began as a meme and still leans heavily on its brand and community energy. Even so, by late 2025 DOGE holds a market capitalization near 24 billion dollars, sitting among the top ten crypto assets. Its price tends to move with social media sentiment, celebrity comments, and broad risk appetite, rather than detailed cash-flow models, just like many other meme coins.

Source: https://www.tradingview.com/

Some merchants accept Dogecoin for payments, including well-known brands for selected merchandise, which gives the coin a modest practical role as well.

Chainlink (LINK)

Chainlink provides decentralized oracle services, feeding off-chain data into smart contracts. Oracles supply prices, interest rates, weather data, and many other inputs that DeFi and tokenization protocols need. Chainlink now secures around 100 billion dollars in DeFi value and has helped process tens of trillions in on-chain transaction

Source: https://www.tradingview.com/

In 2025, its Cross-Chain Interoperability Protocol (CCIP) gains adoption among projects that want secure messaging and value transfer across chains, including liquid staking leaders such as Lido.

Best Long-Term Crypto Investments

The list below is not advice, but it reflects broad market themes visible in research reports and institutional flows.

Long-Term Leaders from the Top 10

For multi-year holding strategies, many investors start with Bitcoin and Ethereum, then add one or two smart contract platforms such as Cardano or Solana. Bitcoin often sits at the core as the oldest, most liquid asset, while Ethereum offers DeFi, NFT, and wider on-chain finance exposure.

BNB and XRP act as targeted bets on specific ecosystems, with BNB tied to BNB Chain activity and XRP linked to cross-border payment use.

Cardano and Solana add diversified Layer-1 exposure, one research-focused, the other high throughput and app-driven.

Chainlink often completes the group as the oracle and cross-chain layer connecting these networks and supporting tokenized real-world assets.

Building a Long-Term Basket from These Coins

A long-term basket built from these assets often follows a simple structure. Bitcoin and Ethereum sit at the core, holding the largest weights since they anchor market liquidity and dominate institutional products. Around that core, smaller slices of BNB, XRP, ADA, SOL, and LINK can spread exposure across exchange ecosystems, payment rails, smart contract platforms, and infrastructure.

Rather than fixating on exact percentages, many investors focus on ranges. For example, a conservative holder might keep most crypto exposure in BTC and ETH with modest allocations to one or two of the others, while a more growth-oriented profile may give more room to SOL, ADA, or LINK.

Best Short-Term Crypto Picks

Short-term traders look at the same list of coins and reach slightly different conclusions. They search for volatility, liquidity, frequent catalysts, and sometimes the hottest crypto right now narrative that dominates social channels for a few days at a time.

Short-Term Opportunities Within the Top 10

Among the top 10 coins, Solana, Dogecoin, ADA, XRP, and BNB often sit at the center of short-term strategies. Solana attracts active traders through busy on-chain activity, liquid perpetual futures, and upgrade news like Firedancer, which can trigger sharp rallies or pullbacks.

Dogecoin acts as a sentiment coin, with social media spikes and celebrity posts driving quick moves that short-term traders try to catch.

ADA and XRP often react to roadmap milestones, partnerships, and legal or ETF headlines, while BNB combines deep liquidity with strong derivatives markets for spot and futures mixes.

Many traders also keep USDT or USDC as a hedging leg, rotating from SOL or DOGE into a stablecoin pair during uncertain periods instead of jumping straight into another volatile asset.

Structuring Short-Term Trades with These Assets

Short-term trading works best with a written plan. Traders first choose setups they will focus on – breakouts above prior highs, pullbacks to moving averages, or reactions to events like rate decisions or network upgrades. They mark entries, exits, and a maximum loss per trade and per day before placing orders.

Risk control then comes down to small position sizes, stop-losses, profit targets, journaling results, and using alerts and portfolio tools to track funding, open interest, and large liquidations.

How to Invest in Cryptocurrency

Getting started with crypto does not need to feel overwhelming. Begin by choosing a style: long-term holding in coins like BTC and ETH, short-term active trading, or a mix with a long-term core and a smaller trading slice.

Then you could create a shortlist of large, established coins such as Bitcoin, Ethereum, major stablecoins, and a few leading platforms, instead of chasing every viral “cryptocoin to buy now” post.

Set a budget that fits your wider finances and use only money you can leave alone for a while. You might want to open an account on a reputable exchange, complete verification, and turn on strong security like two-factor authentication.

You may consider buying your starter coins, moving some to self-custody if that suits you, and reviewing your positions on a fixed schedule. Keep the focus on learning, consistent habits, and risk control instead of chasing every new token.

Actionable Strategies

This section stays high level and platform-agnostic, so you can adapt it to your own tools and preferences.

Building a Crypto Portfolio

A crypto portfolio usually starts with your risk profile. A conservative approach keeps crypto as a small share of net worth, focused on BTC, ETH, and maybe a regulated stablecoin.

A balanced profile still uses BTC and ETH as the core and adds smaller slices of BNB, XRP, ADA, SOL, or LINK. Higher-risk setups tilt more toward growth platforms and infrastructure but still keep some Bitcoin.

A simple core – satellite layout helps. The core holds long-term BTC and ETH. Satellites carry smaller, active positions in SOL, ADA, BNB, XRP, LINK, or even DOGE. Diversify across store-of-value, smart contract, infrastructure, and stablecoin roles, then rebalance back to target ranges as winners run.

Buying coins for your possible portfolio can be accomplished in a straight-forward manner on a non-custodial exchange platform SimpleSwap. The available coins can be bought for crypto or fiat money. If anything goes against your expectations, the 24/7 support team is there to aid. Moreover, on the coins’ pages you can monitor what’s going on with the coins at the moment and retrospectively.

Risk Management in a Volatile World

Crypto’s volatility makes risk management crucial, as major and smaller coins can swing 10–20 percent in a week. Key habits help: use only money you can spare after bills, cap crypto as a share of total assets, avoid big single-coin bets, and set a maximum loss for each trade with matching position size.

Stop-losses, alerts, education on scams and protocol failures, reputable platforms, strong security, and clear tax records all lower stress when markets lurch.

Round-Up

Crypto in 2025–2026 sits at an interesting phase. The market is large, with trillions of dollars in value, hundreds of billions in DeFi TVL, and hundreds of millions of users. Regulation is firmer than in previous cycles, especially around stablecoins, even as new products and narratives appear every month.

That mix creates a field where both long-term builders and short-term speculators can operate, yet it also calls for more structure from anyone putting real capital at risk.

For investors, the key is not going for a single “best coin” or every “crypto buy now” call but building a clear plan. Long-term holders might anchor on BTC and ETH, then add a small mix of BNB, XRP, ADA, SOL, LINK, and carefully chosen stablecoins. Short-term traders might focus on more volatile names such as SOL and DOGE while keeping stablecoins ready for hedging.

Every approach benefits from basic due diligence, a written strategy, and risk controls that feel boring during bull markets yet protective during sharp drawdowns. Educational resources, market reports, and community channels can support that process, so users learn over time rather than treating crypto as a one-off bet.

FAQ

Which Coin is Best for Long-Term Investment?

Many analysts highlight Bitcoin, Ethereum, and Solana as leading long-term candidates, each for different reasons.

What is the Safest Cryptocurrency for Short-Term Investment?

“Safer” in short-term trading usually refers to lower volatility, strong liquidity, and tight spreads rather than a guarantee against loss. Large-cap coins such as BTC and ETH, plus major stablecoins like USDT and USDC, often sit in this bucket.

How to Choose the Best Coin to Invest in?

The earlier criteria apply here: fundamentals such as market cap and liquidity, utility and adoption metrics, team quality and transparency, and clear, realistic roadmaps. On top of that, you factor in personal risk tolerance and time horizon.

What are the Biggest Risks in Crypto Investing Now?

Major risks include volatility, sudden regulatory changes, technical failures, and outright scams. Recent months have shown crashes where over a trillion dollars in value vanished in a short time, often linked to leverage and DeFi exploits. Phishing, fake token launches, and misleading marketing remain common.

Is It Too Late to Start Investing in Crypto?

Entering in 2025–2026 can still make sense for disciplined investors who commit to research, thoughtful position sizing, and a long-term view. The key lies less in timing the perfect bottom and more in building habits that can survive several market cycles.

What Crypto Trends Should I Watch for in 2026?

AI-related tokens and tooling continue to attract attention, especially where they link to real usage. Layer-2 scaling on Ethereum and cross-chain solutions such as Chainlink CCIP aim to cut costs and connect ecosystems. Stablecoins, backed by new regulations, are likely to deepen their role in payments and DeFi.