SEC Against Binance and Coinbase

This blog post will cover:

- Binance case. What happened?

- How did the situation affect BNB?

- Coinbase case. What happened?

- Conclusion

A little over a week ago, two of the crypto industry's biggest players, Binance and Coinbase, found themselves at the center of a legal storm as the US Securities and Exchange Commission unleashed its regulatory might. With accusations ranging from unregistered offerings to possible harm for investors, the SEC's charges against these prominent exchanges have shaken up the crypto community’s tranquility.

Today we’ll try to figure out what really happened and see how the firms’ representatives responded to SEC’s charges.

Binance case. What happened?

On June 5, the SEC filed a lawsuit against Binance and its founder, Changpeng Zhao. The regulator has brought forth thirteen charges, which include non-registered offerings and sales of BNB and BUSD, as well as the products — Simple Earn, BNB Vault, and staking.

The lawsuit also states that the exchange didn’t register its platform as an exchange, along with its American subsidiary, BAM. Zhao has been sued as a "controlling person."

Additionally, the SEC has classified the following assets as securities: SOL, ADA, MATIC, SAND, MANA etc. Check out the full list below:

SEC's press release says that Zhao and his company managed client assets, commingled and redirected them "at their discretion." According to the Commission, the top executive "secretly controlled" the US branch. Reuters had previously published a similar conclusion.

The regulator has demanded a permanent injunction against the exchange and its CEO, the disgorgement of unlawfully obtained profits with interest, and financial sanctions.

Additionally, as reported by The Block, the SEC has demanded the freezing of coins due to allegations against the executives and Zhao himself regarding the redirection of client funds into his own investment funds.

Reaction of Binance

Zhao commented on the news with a post containing the number "4". In his list, it signifies "ignore FUD and fake news".

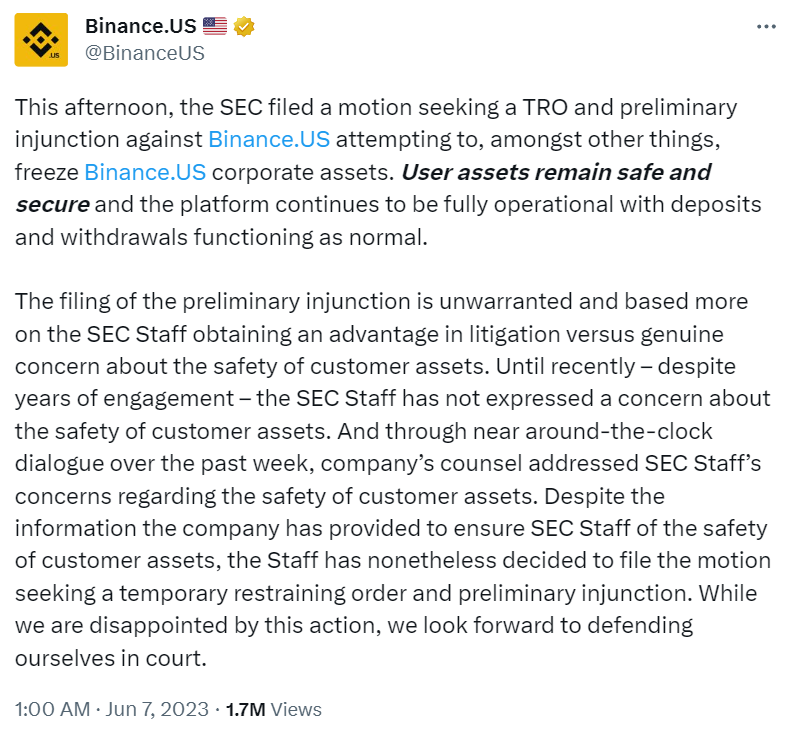

Talking about the demand to freeze the assets, the American division of the exchange released a statement on Twitter, referring to the actions of the agency as "unwarranted". Representatives of the platform assured that client funds are secure:

Later, Binance.US has challenged the SEC emergency motion to freeze the exchange's assets, calling it “draconian and unduly burdensome”. The company asserts that such a decision would effectively “put an end” to its operations, with the subsidiary trading platform, BAM, suffering the most significant impact.

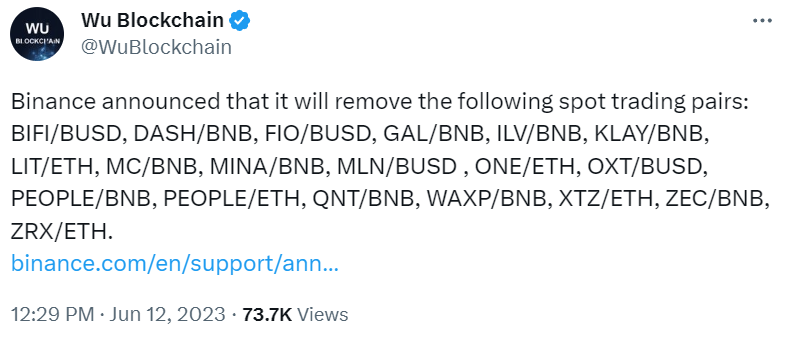

On June 12, Binance announced the delisting of several trading pairs involving BNB, BUSD, and ETH from June 14th:

The firm noted that users will still have an ability to trade the aforementioned coins in other available pairs. Some users have pointed out that the platform isn’t deleting the listed coins entirely but rather specific trading pairs. The extensive presence of BNB and BUSD trading instruments in the delisting list has led to an assumption that it may be related to the SEC lawsuit:

How did the situation affect BNB?

The situation mentioned above raises questions on the future of Binance Coin. SimpleSwap shares an answer of the crypto analyst below.

BNB price before lawsuits

Before the SEC lawsuit against Binance, the price of BNB demonstrated relatively stable growth. This indicated the popularity of BNB among traders and investors who considered it an attractive asset for investment. However, there was a risk that any legal issues related to Binance could negatively impact the price of BNB and cause concern among investors. For example, in February, the New York Department of Financial Services (NYDFS) banned the issuance of the Binance USD (BUSD) stablecoin following the SEC's announcement of a lawsuit against Paxos Trust, the company behind the Binance USD (BUSD) stablecoin. Such an event had a negative impact on the price of BNB as investors experienced fear and uncertainty, leading them to divest from the asset. This resulted in a decrease of over 20% from the price level of $336 to $267.

BNB price during proceedings

After the official announcement of the SEC lawsuit against Binance, the price of BNB decreased from around $313.6 to approximately $222. This reflects the panic and negative reaction of investors to the news of the legal issues faced by the exchange. The price decrease may be due to uncertainty regarding the outcome of the legal proceedings and potential consequences for Binance's operations. However, it is worth noting that after the price drop to $222, the decline in price halted.

Currently the asset is being traded in the price range of $222 - $250 with increased volumes, which may indicate a more rational assessment of the situation by the market and hope for a positive outcome. The recovery of price and stability within a specific price range may indicate that investors are approaching the situation more cautiously and analytically, awaiting further developments and the outcome of the legal proceedings.

However, this does not mean that risks and uncertainty have completely disappeared. It is important to understand that the outcome of the legal process and the actions of the SEC can continue to impact the future price of the BNB coin.

The possible future of BNB

Despite the current situation and the uncertainty associated with the SEC lawsuit against Binance, the future of the BNB coin still holds significant potential. One of the main strengths contributing to the stability and development of BNB is its active usage within the Binance ecosystem. Binance itself is a well-known and influential exchange in the crypto sphere, attracting numerous traders and investors.

Furthermore, Binance is actively expanding its services and geographical presence. This move can stimulate further demand for the BNB coin. The expansion of Binance's business opens up new opportunities and increases the attractiveness of the platform for users, which can have a positive impact on the price of BNB in the future.

However, legal proceedings and subsequent actions by the SEC have the potential to influence the long-term prospects of BNB. Regulators may introduce changes that affect Binance's operations or requirements for the use of the BNB coin. This creates uncertainty and risks for investors.

Coinbase case. What happened?

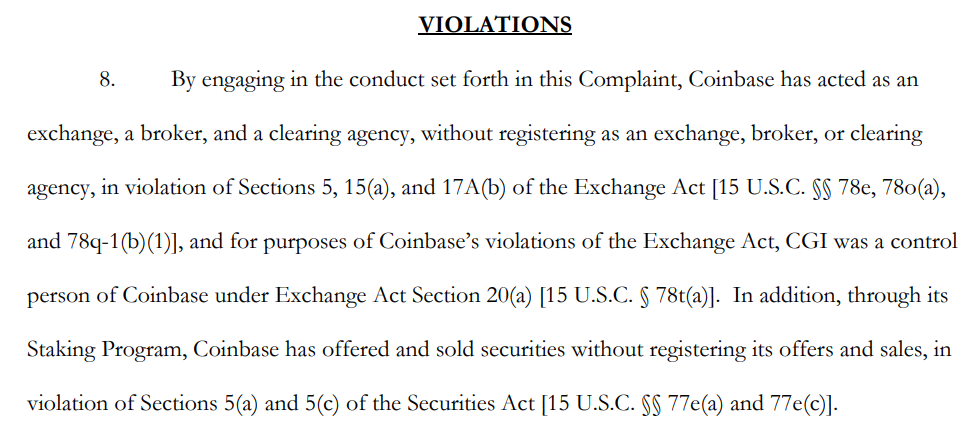

The similar situation continued when on June 6, the SEC filed a lawsuit against Coinbase. The Commission has also touched upon the staking program, Coinbase Earn.

The regulator claims that the company broke securities laws. Several crypto tickers on the exchange fall under this concept: SOL, ADA, MATIC, FIL, SAND and a couple of others.

The SEC said that Coinbase unlawfully combines three functions — acting as a broker, exchange, and clearing agency — which are typically separated in traditional markets.

SEC suggests that the absence of registration deprived the exchange’s customers of important safeguards, including regulatory oversight checks, documentation requirements, and conflict of interest prevention.

According to the lawsuit, Coinbase Global Inc., the holding company, is considered the controlling entity of the exchange and thus bears responsibility for certain violations committed by the company.

The complaint resulted in the shares of the crypto exchange plummeting by 19% within a few hours, dropping from $58 to $47. Most of the digital assets listed in the document also demonstrated negative dynamics.

Reaction of Coinbase

Coinbase CEO Brian Armstrong proclaimed that they intend to maintain their crypto staking program and operate it as usual. Armstrong emphasized that while the legal proceedings continue, the staking service will not be wound down. He also mentioned that the staking service contributes approximately 3% to Coinbase's overall net revenue.

In an interview with The Block, Coinbase's Chief Legal Officer, Paul Grewal, stated that the company has not made any decisions regarding the delisting of assets. He mentioned that the platform carefully analyzes and selects cryptocurrencies for listing and is confident in its choices.

Armstrong dismissed concerns about the financial stability of the company in the event of a mass withdrawal of assets by investors.

Conclusion

The outcome of these legal proceedings will have significant implications for the future of these platforms. As the cases unfold, it remains to be seen how the exchanges will address the allegations and whether they will lead to changes in their practices and compliance measures.

The SEC's actions highlight the increasing regulatory focus on the cryptocurrency market, underscoring the need for exchanges and market participants to navigate and adhere to evolving regulatory frameworks. Now we continue monitoring the situation on the charges. SimpleSwap will keep you updated about the impact of the legal proceedings.

If you enjoyed this article, you can read some of our previous ones, too: What SEC Is and How It Affects Crypto and Staking Crypto For Passive Income.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.