Crypto Neobanking: Future of Worldwide Payments

This blog post will cover:

- Neobank Features

- Disadvantages

- Conclusion

The collapse of crypto-friendly banks Silvergate and Signature in the spring of 2023 shook the financial world. However, even before the main market players went bankrupt, crypto companies started to face banking problems - for instance, servicing their accounts and accessing the cryptofiat gateway.

The issue of banking for crypto companies remains difficult to this day. This is due to the fact that the cryptocurrency industry is saturated with fraud and many banks simply do not want to take risks and work with blockchain service providers.

However, crypto companies still need banks. Without banks, they have a hard time integrating fiat payments. At a simple level, for individuals, banks are necessary for paying salaries and maintaining accounts, paying for services both online and offline.

Although cryptocurrencies were originally created to bypass banks as intermediaries, with the growth of the regulated crypto industry, traditional banks and their solutions are becoming necessary. Therefore, so-called crypto neobanks are entering the market, which have successfully integrated cryptocurrencies into their ecosystem and received the necessary licenses to operate on the global market (mainly the EU).

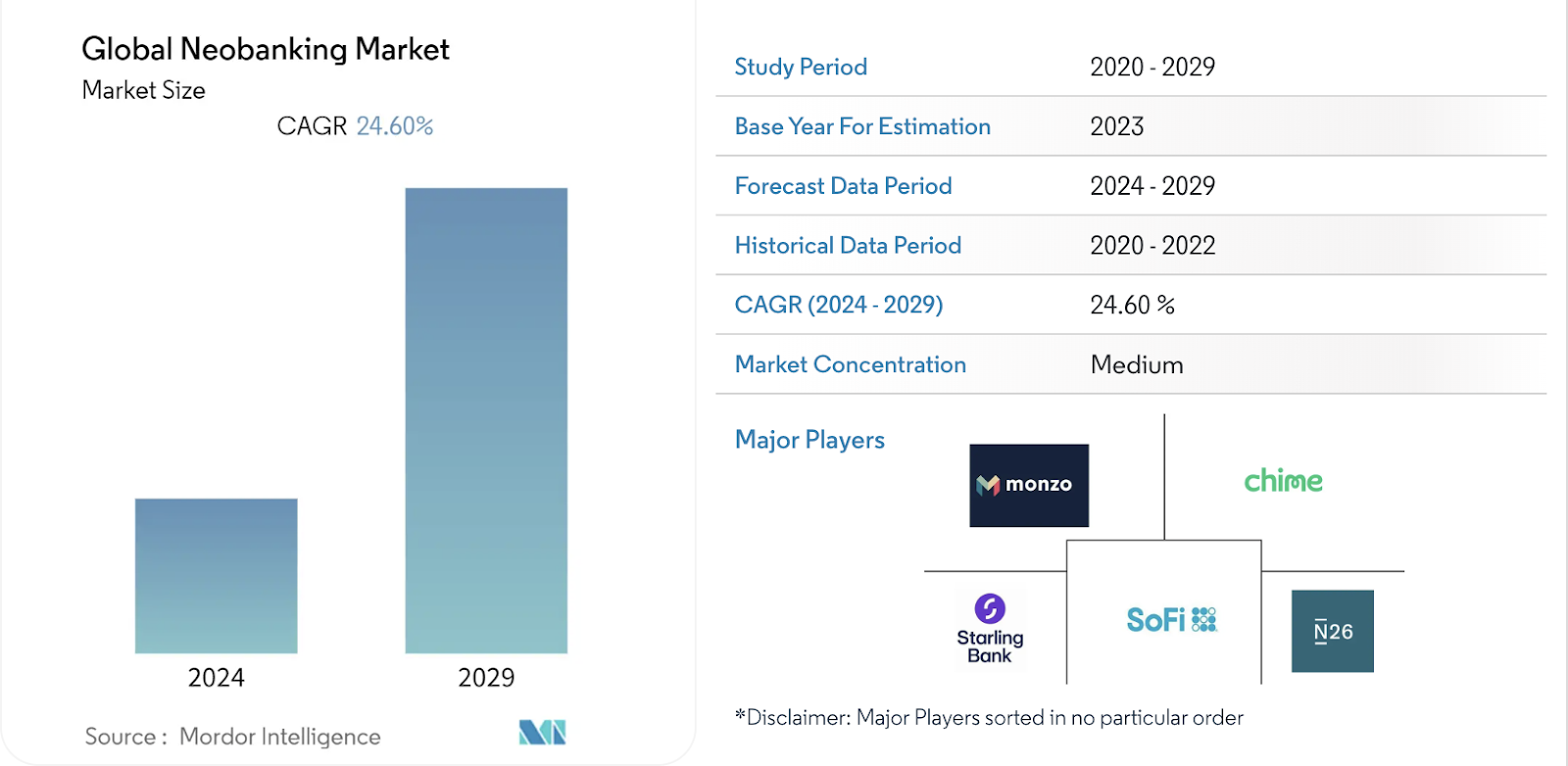

Let’s look at some numbers. According to Statista, the transaction volume in the neobank market will reach $6.37 trillion by the end of 2024. The global neobanking market, according to Mordor Intelligence, will register a compound annual growth rate (CAGR) of 24.60% during the forecast period until 2029.

The average transaction value per user in the neobank market will be $21.11k by the end of 2024. The number of users is expected to reach 386.3 million by 2028, and user penetration will reach 4.82% by the end of 2028.

Crypto-friendly neobanks bridge the gap between the traditional banking sector and the world of cryptocurrencies, providing customers with a safe and convenient platform for buying, selling and storing various types of crypto assets.

Neobank Features

Let's consider the main features of crypto neobanks and how they can bypass traditional financial institutions in popularity:

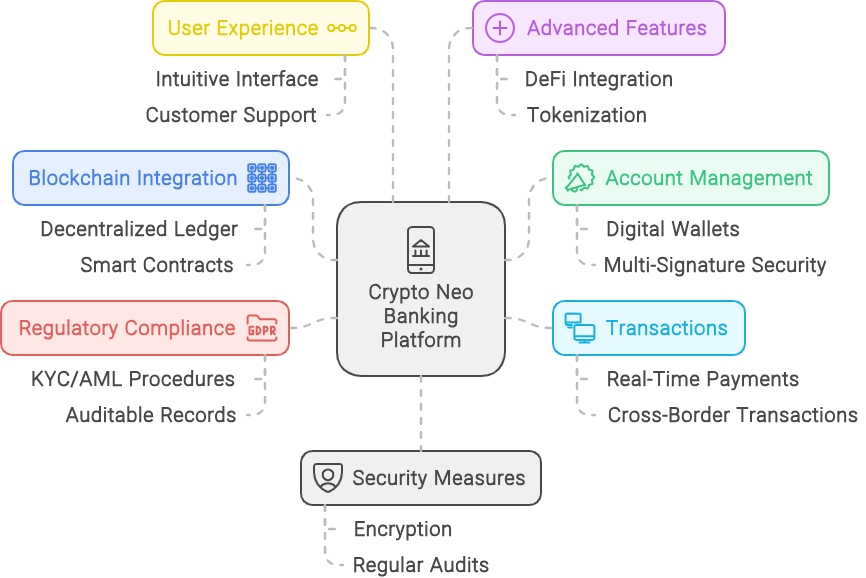

Crypto neobanks are based on a blockchain network that records and verifies all transactions on a decentralized ledger. Smart contracts automate processes such as fund transfers, loan approvals, and interest calculations, reducing the need for intermediaries and additional staff.

Users manage their assets through digital wallets integrated into the neobank platform. These wallets support both major cryptocurrencies (Bitcoin, Ethereum, Litecoin) and traditional fiat currencies (EURO, USD, CHF).

All payments are made in real time - unlike traditional banking systems, which can have delays and high fees, blockchain transactions are very fast and involve minimal fees. Large sums of money can be sent across borders without delays.

Crypto neobanks use KYC (know your customer) and AML (anti-money laundering) protocols to comply with the regulatory requirements of the countries where they provide their services.

Modern crypto neobanks offer advanced functionality for professional users - for example, DeFi sector services (lending and staking), as well as tokenization of assets and their ownership (for example, real estate or precious metals)

Crypto neobanks undergo regular security audits and use data encryption to protect against unauthorized access.

Neobanks have a user-friendly interface where users can view account balances, make transactions and access other banking services.

Why are crypto neobanks so popular?

Why are crypto neobanks so popular in the market now and are becoming a trend in the financial sector:

The growth of cryptocurrency adoption (the so-called mass adoption). The number of cryptocurrency users is growing rapidly, many are already investing in digital assets or using them for transactions or in everyday life to pay for their needs. This creates a huge flow of paying customers for neobanks and they have no choice but to integrate cryptocurrency into themselves.

Cons of working and the risk of freezing funds in traditional banks (think of China, when residents' accounts were simply blocked). There are high fees, stagnation in the adoption of new finances and outdated interfaces. All of those accustomed with cryptocurrencies are looking for an alternative to storing personal money and crypto neobanks are ideal for solving such problems. As a result, we have a universal solution for managing our finances in one application.

Expanded sources of income from crypto neobanks, including crypto-collateral loans, crypto accounts with interest accrual (staking) or cryptocurrency farming (where income can reach 50% or more per annum). And also such advantages of their solutions as convenient sign up process which takes only a few minutes, ease of exchanging cryptocurrency into fiat money and back within the application, referral programs for users (bring a friend and get rewards).

Disadvantages

However, it is worth noting that crypto neobanks have certain disadvantages and limitations:

Crypto neobanks are not protected from market volatility risks if they hold a significant portion of assets (deposits) in crypto assets without hedging capital (and insurance companies often refuse to work and insure crypto banks).

Limited functionality for professional users. For the most part, the basis of such banks is the exchange of assets and storage. In super modern ones - DEFI and tokenization.

No traditional banking services, such as IBAN or payment by account, no lending or savings account, no issuance of proof of income certificates.

How can ordinary users use all the advantages of crypto neobanks?

There is already a fairly large and progressive community of cryptocurrency users, which have replaced traditional finance almost completely. In the new view of modern society, finances must meet the following requirements:

These must be personal finances, savings that are reliably protected from any control and influence (for example, they cannot be blocked by the state or anyone)

They can simply be used to pay for goods and services anywhere in the world without additional difficulties and large commissions, they must be converted into any currency of any country

They must be invested in accessible high-yield instruments at any time and generate income

These three points determine the future of crypto neobanking for the needs of the modern community of crypto enthusiasts, growing at a rapid pace. It is under these criteria that crypto neobanks are now building their development, trying to meet the requirements of the state and remain attractive to users.

Let's consider the TOP3 most popular crypto neobanks with the best storage solutions, fast transfers, seamless payments for goods and services for users and combining both traditional fiat money and crypto assets. Each of them has distinctive features and will find its user.

Revolut

Revolut is a crypto-friendly, all-in-one neobank founded in the UK in 2015. The company offers a wide range of financial services, including current accounts, debit cards, currency exchange, cryptocurrency exchange, savings accounts, and insurance.

Revolut has gained acclaim from users for its low fees and optimal exchange rates, as well as its user-friendly mobile app. It now serves over 30 million active users and supports over 200 countries worldwide.

Revolut is the only neobank that allows users to buy, sell, and exchange cryptocurrencies (over 160) for over 30 fiat currencies directly in the app. This is true mass adoption.

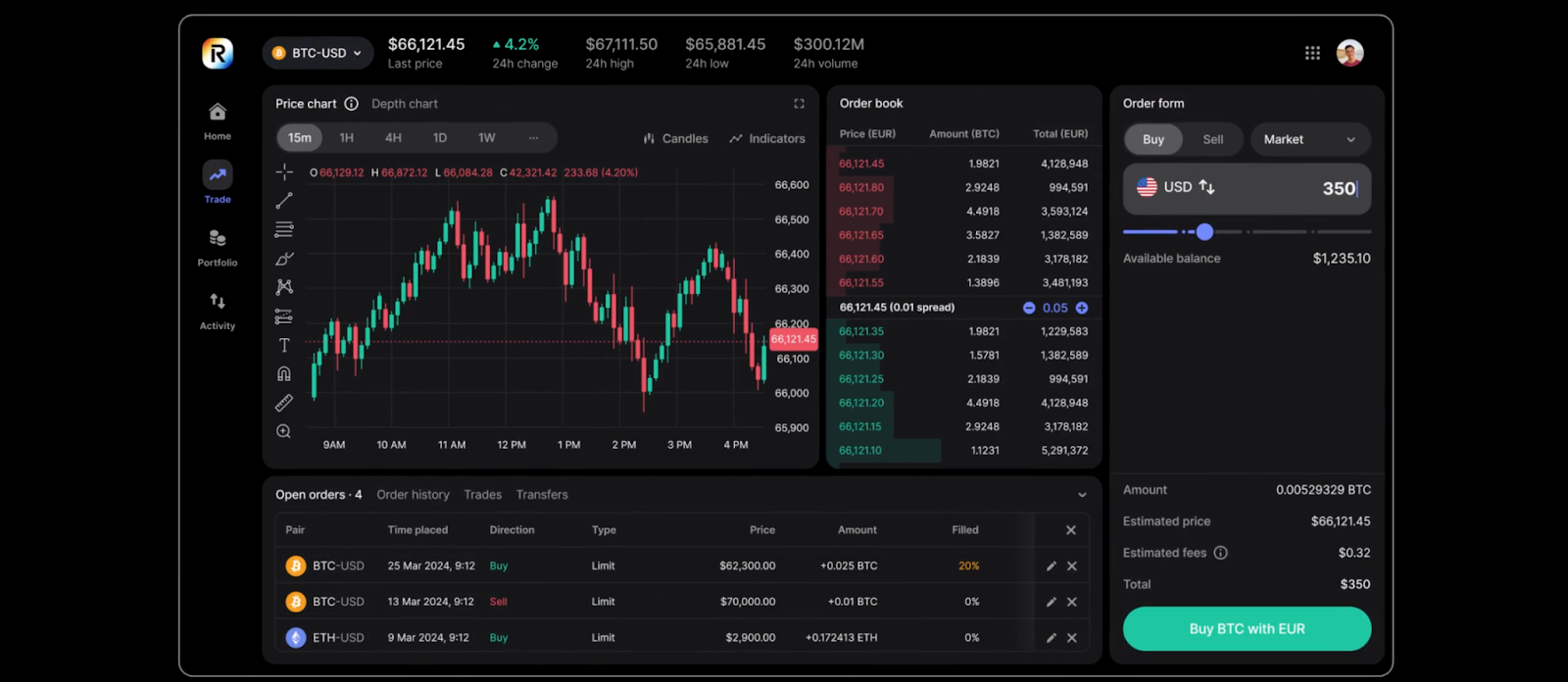

In March 2024, Revolut partnered with MetaMask to make it easier to buy cryptocurrency through its platform, and in early May 2024, the company launched Revolut X, a cryptocurrency trading platform aimed at professional traders (it offers over 100 tokens for trading, with fees similar to popular exchanges, and seamless integration with existing accounts).

Key benefits of Revolut:

The ability to provide app users with real-time notifications and balance and spending updates immediately after transactions.

Revolut offers a Learn and Earn section in the app, which allows users to earn cryptocurrency for completing lessons on certain tokens and passing a short test.

It enables users to open business accounts for businesses (already more than 550,000 unique users).

It opens up investment opportunities in the app, both cashback on purchases and an in-app crypto wallet with a yield of up to 4.75% per annum on savings

It gives the ability to instantly lock and unlock a card, set up location-based security and enable two-factor authentication

It offers a range of premium subscriptions that give additional features such as travel insurance, cashback and access to airport lounges.

Thus, you can use Revolut in your everyday life, open accounts, pay for purchases and goods, transfer money to other countries, professionally trade cryptocurrencies and exchange them for fiat money. The only thing is to be careful with suspicious transfers (the company complies with the AML policy against money laundering).

Revolut will suit a wide range of users who want to be part of both the traditional financial market and the modern crypto financial world, open business accounts and securely store funds.

Wirex

Wirex is a crypto neobank that offers a wide range of cryptocurrency-related banking services. Unlike Revolut, it is aimed at more advanced crypto users and includes a cross-chain bridge for seamless token transfers between blockchains.

In addition, Wirex provides staking services and maintains a crypto wallet compatible with NFT assets. This also allows interaction with DeFi applications and enhances investment opportunities for users. Wirex, backed by Mastercard, allows you to pay for purchases with your card in 21 fiat currencies, thereby fulfilling the crypto neobank's main function as a crypto-fiat gateway for users.

Another special feature of Wirex is its unique ability to increase capital within the application, there is a Cryptoback program, where you get a cashback of up to 8% in WXT tokens (its own token) on your balance, as well as the ability to use an X-account, which gives you the opportunity to earn higher interest rates in the DEFI sector (16%+).

Key Features of Wirex:

Enables to fund your account via credit or debit card, or bank transfer (EU)

Allows you to buy, hold, and trade over 250 digital assets

Cashback up to 8% on each card transaction in WXT tokens

Variable annual percentage rate (AER) up to 16% on select currencies (crypto assets)

ATM withdrawals are limited to 250euro | $250 per day. Credit and debit card top-ups are max 8,000 euro | $10,000 per day.

There is also a maximum card balance of 16k euro | $20k.

Thus, Wirex is an advanced representative of crypto neobanks, which allows users to not only spend and store cryptocurrency, but also invest within the application.

Bybit Exchange

Bybit made it to our list for a reason, too. Despite being a popular platform for trading fiat and cryptocurrencies, it also has the advanced capabilities of a full-fledged crypto neobank, providing a bank card for paying for user purchases.

Registering with Bybit is quite simple, the whole process takes up to 30 minutes. Then, you can professionally manage your crypto assets, exchange them into fiat currencies, as well as order a Mastercard crypto card and spend crypto assets in any country in the world.

The card from Bybit provides the opportunity to receive cashback on all purchases and convert points into Euro or gifts - the platform provides the ability to pay for popular subscriptions such as Netflix, as well as exchange them for Apple equipment.

Key features of the Crypto Neobank solution from Bybit:

Possibility of professional management of crypto assets - spot trading, derivatives and margin trading

Enables to earn with a set of investment products with high profitability inside the application (Earn section).

ByBit card without special requirements for user criteria and with several card levels (VIP gradations).

Possibility to do without other banking solutions and exchange solutions, being inside one Bybit ecosystem.

Support and direct exchange of more than 1000 cryptocurrencies

And to experience exceptional convenience and all the benefits of exchanging cryptocurrencies (more than 1000), use https://simpleswap.io - a convenient crypto exchange service with low fees.

Thus, the Bybit solution is suitable for the most advanced cryptocurrency users who want to manage their assets and spend them in real life, while receiving cashback.

Conclusion

Crypto neobanks are quickly becoming the preferred choice for many customers looking for a modern banking experience and entering the era of new finance, preferring the freedom to move their personal finances and mastering new investment opportunities.

To choose the right solution for yourself, you need to consider your needs - do you just need to store and spend cryptocurrency on par with traditional fiat money, or do you want to exchange and manage your assets professionally and earn money on it. You need to compare the fees of each neobank and be sure of the security of the chosen solution. Then you can connect to the new financial system and be confident in your future.

Revolut, Wirex, Bybit are some of the few top players in the modern neobanking market that offer many advantages over traditional banks, such as low fees, high interest rates on deposits, a simple registration process, convenient spending of cryptocurrencies through Visa and Mastercard.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.