Polymarket Explained

This blog post will cover:

- How Polymarket Works

- Dispute Resolution Mechanism

- Technological Foundation and Security

- Enforcing Transparency and Trust with Smart Contracts

- Platform Growth on Polymarket

- Conclusion

Polymarket is the world’s largest decentralized prediction platform, running on the Polygon blockchain. It provides users with a unique opportunity to earn from their knowledge by betting on a variety of future events. Research shows that prediction markets often prove more accurate than expert opinions, as they aggregate news, surveys, and expert views to create a unified probability assessment of an event.

In this article, we will have a look at what this platform is and what role blockchain technologies play in it.

On Polymarket, users purchase shares representing different events’ outcomes, covering topics like elections, sports, various debates, etc. For example, they can bet on who will win the U.S. elections, whether TikTok will be banned in a specific country, or who will win a rugby or football tournament.

Users cannot directly create their own markets but may suggest ideas for new markets. When selecting markets to list, Polymarket considers factors such as:

Demand for trading on the market;

Social or newsworthy value of knowing the market-generated probability;

Clarity of the market resolution;

Availability of a reliable source to resolve the market, and others.

How Polymarket Works

Shares are priced between $0.00 and $1.00 in USDC, with each outcome pair (e.g., "Yes" and "No") fully backed by this amount. Users can trade shares until the market closes, allowing them to secure profit if the probability shifts in their favor. Upon market resolution (e.g., after an election), shares for the correct outcome are valued at $1.00, while incorrect outcomes are valued at $0.00.

For example, we will have a look at the most popular Polymarket market at the moment of writing this article, the U.S. presidential election. Let’s say one is betting $100 that Kamala Harris wins.

Her chances were estimated at 36%, so each share for her victory costs $0.36. If she wins, each $0.36 share will pay out at $1.00.

Post-election note: this time once more, Polymarket predictions were much closer to reality than polls, having correctly predicted the outcome of Trump winning. But the calculations stand, so let’s still see what could have happened with Harris winning.

Profit calculation formula looks like this: 1 / Probability×Amount Staked

In our example, this translates to 1/0.36×100 =$277,8.

A successful bet could thus yield $2.78 for every dollar spent, with a profit of $1.78. If she loses, the investment is forfeited.

Users may choose to close their positions before the event resolves. For instance, if the odds shift to 50% (an even chance for both Harris and Trump), shares can be sold early at $0.50 each. Buying at $0.36 and selling at $0.50 yields a profit of $0.14 per share.

The share price reflects the current event probability: if "Yes" shares are priced at $0.36, it indicates a 36% likelihood. Unlike traditional sportsbooks, users don’t bet against the platform itself: every Polymarket trade involves another user as a counterparty.

Dispute Resolution Mechanism

If an outcome on Polymarket becomes uncertain, the Market Integrity Committee steps in. This special group reviews the event, checks sources, and makes a decision to determine the outcome. The process includes:

Consulting official sources and third-party data for objective evaluation;

Making decisions public, so users can review the logic and rationale;

Finalizing the outcome and closing the market.

This mechanism is essential for maintaining user trust in the platform's fairness, preventing subjective or random errors, and ensuring independence and accuracy.

Technological Foundation and Security

Polymarket uses the Polygon blockchain to manage transactions and bets.

The Polygon blockchain is a scalable and resilient platform for building and deploying decentralized applications (DApps) and blockchain services.

Polymarket is built on Polygon to enhance scalability and minimize transaction fees. Polygon supported 37.6 transactions per second on average with a median gas price of 60.44 Gwei (< $0.01) at the moment of writing. These characteristics are crucial for prediction markets, where users may frequently buy and sell shares before the event resolves, requiring fast transaction processing.

Platforms like Polymarket rely on system trust and operational transparency. Decentralization allows the platform to function without the interference from centralized intermediaries like banks, essential for fair and censorship-resistant trading.

Contrary to traditional betting platforms where users wager against the company, Polymarket fosters peer-to-peer transactions. This innovative approach not only eliminates the potential for the platform to manipulate odds in its favor but also promotes fairness among participants.

The decentralized nature of Polymarket ensures that every user action is meticulously logged on the blockchain, creating an unchangeable record that can be checked and validated at any time. This transparency gives users confidence, as they can rely on the fixed rules and rest assured that the market will not abruptly close due to arbitrary administrative decisions.

Enforcing Transparency and Trust with Smart Contracts

Polymarket relies on smart contracts to uphold security and transparency, as these automated agreements execute predetermined conditions without human intervention. In prediction markets, smart contracts guarantee that bet outcomes and payouts are processed automatically, leaving no room for manipulation or interference.

Key advantages of utilizing smart contracts in prediction markets include:

All bet placements, trades, and results are meticulously stored on the blockchain, ensuring complete transparency throughout the process;

Once a bet is placed and a market is established, the terms of the smart contract remain immutable, reducing the risk of fraudulent activities or retroactive changes to outcomes;

Upon event completion, the smart contract automatically distributes winnings according to the outcome, removing human error and ensuring timely, accurate payouts.

Platform Growth on Polymarket

Since its launch in 2020, Polymarket has shown steady growth, as evidenced by key metrics collected over time. Below are some statistics highlighting the platform's success:

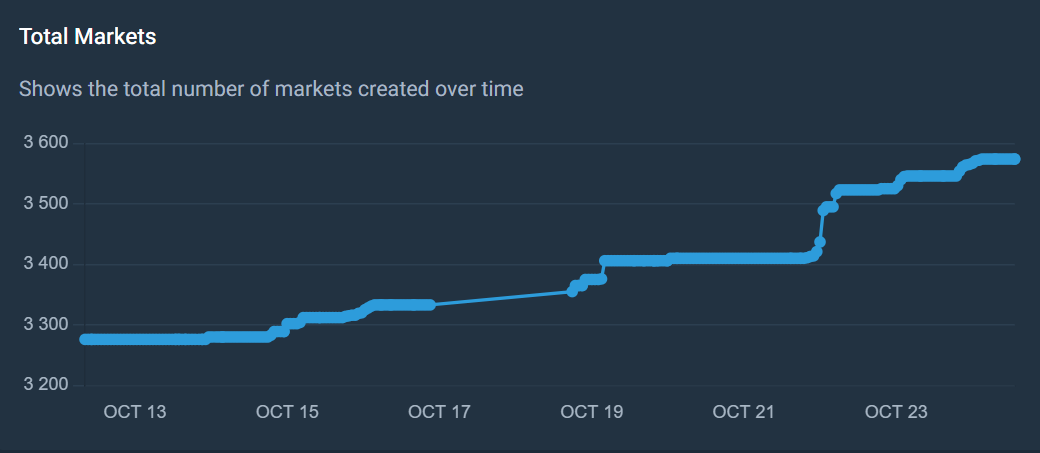

Total Markets: as of the end of October 2024, users have created over 3,600 markets on diverse topics, from political elections to cultural and sports events. This variety appeals to a broad audience with different interests.

Source: polymarket-tracker.com

Markets Volume Growth: Over its lifespan, Polymarket has seen total trading volume exceed $1.8 billion USD, reflecting substantial user engagement and trust.

Source: polymarket-tracker.com

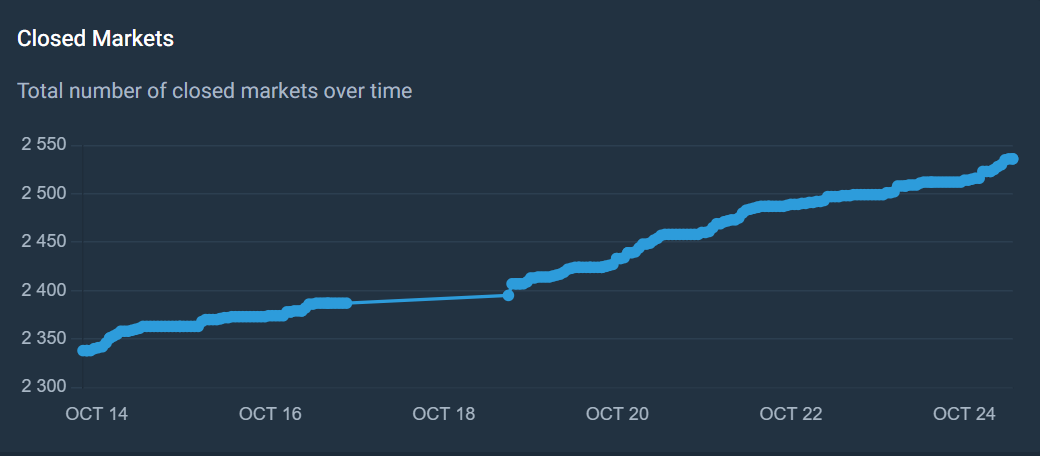

Closed Markets: Out of the 3,600 markets created, more than 2,550 have been resolved, showcasing the platform’s consistent operations and successful completion of numerous transactions.

Source: polymarket-tracker.com

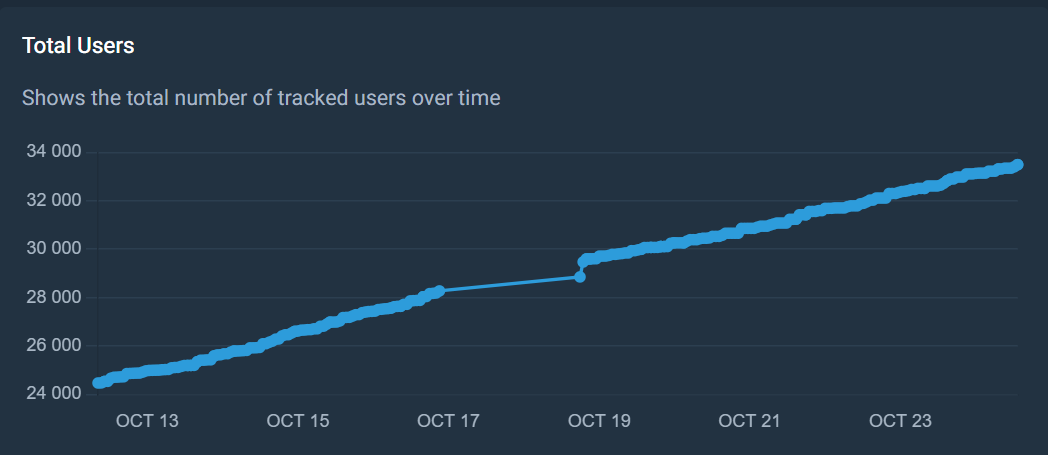

Total Users: Polymarket has attracted over 34,000 active users who have participated in creating and trading in markets, indicating growing interest in prediction markets as a method of investing and analyzing events.

Source: polymarket-tracker.com

This data underscores Polymarket’s popularity and its role as a major player in the prediction market space. These statistics demonstrate that decentralized prediction markets can thrive, combining high forecast accuracy and broad accessibility for users worldwide. In the long run, Polymarket may expand its influence and even become a factor in helping traditional finance instruments become more decentralized and transparent.

Conclusion

Polymarket is blending modern financial tools with advanced technology. Operating on the Polygon decentralized blockchain, the platform offers users a diverse range of prediction markets, from politics to sports. Prioritizing security, transparency, and independence from central control, Polymarket can be considered a reliable platform for making bets.

As Polymarket continues to expand, its performance metrics confirm the significant impact prediction markets will have on both traditional and decentralized finance.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.