Crypto Market Overview: July 2024

This blog post will cover:

- Market Performance

- Ethereum ETFs Launched

- Trading Volumes

- State of Layer 1 and Layer 2

- State of DeFi

- Conclusion

July was another controversial month for the crypto industry. On the one hand, the market saw a deep correction in Bitcoin (BTC) and altcoin prices. BTC experienced its steepest correction of the year, dropping below $54K, driven by FUD around BTC sales by the German government and the commencement of Mt.Gox compensation distribution. On the other hand, Ethereum (ETH) exchange-traded funds (ETFs) were launched, providing a positive note for the market.

Despite the recent downturn, there are several reasons to remain optimistic about the crypto market's future in the coming months. Potential rate cuts in the fall, endorsement of the crypto industry by Donald Trump, and discussions about new crypto ETFs could all drive market recovery and growth.

The SimpleSwap team has prepared a July market recap, highlighting the most important trends, news, and data from the month.

Market Performance

Bitcoin saw the deepest correction since the beginning of the year in July. BTC price dropped below $54K and traded below 200D EMA for the first time since October 2023. July correction ended the 427 days long uptrend without a correction >25%. Correction was primarily driven by BTC sales from the German government that distributed BTC worth $3.5B to several exchanges and the start of compensations distribution from Mt.Gox worth $9.4B. By the end of July Mt.Gox had distributed nearly half of the reserves ($4B) to its creditors creating an extra selling pressure on BTC. However, it seems that the market is absorbing this pressure pretty well as BTC quickly bounced back from the $53-$54K zone and currently hovers near $66K. Another positive fact is the inflows to the BTC ETFs that remained mostly positive in July. Total net value of BTC ETFs is around $58.5B by the end of July.

BTC Price and ETFs Weekly Total Net Inflow. Source: SoSoValue

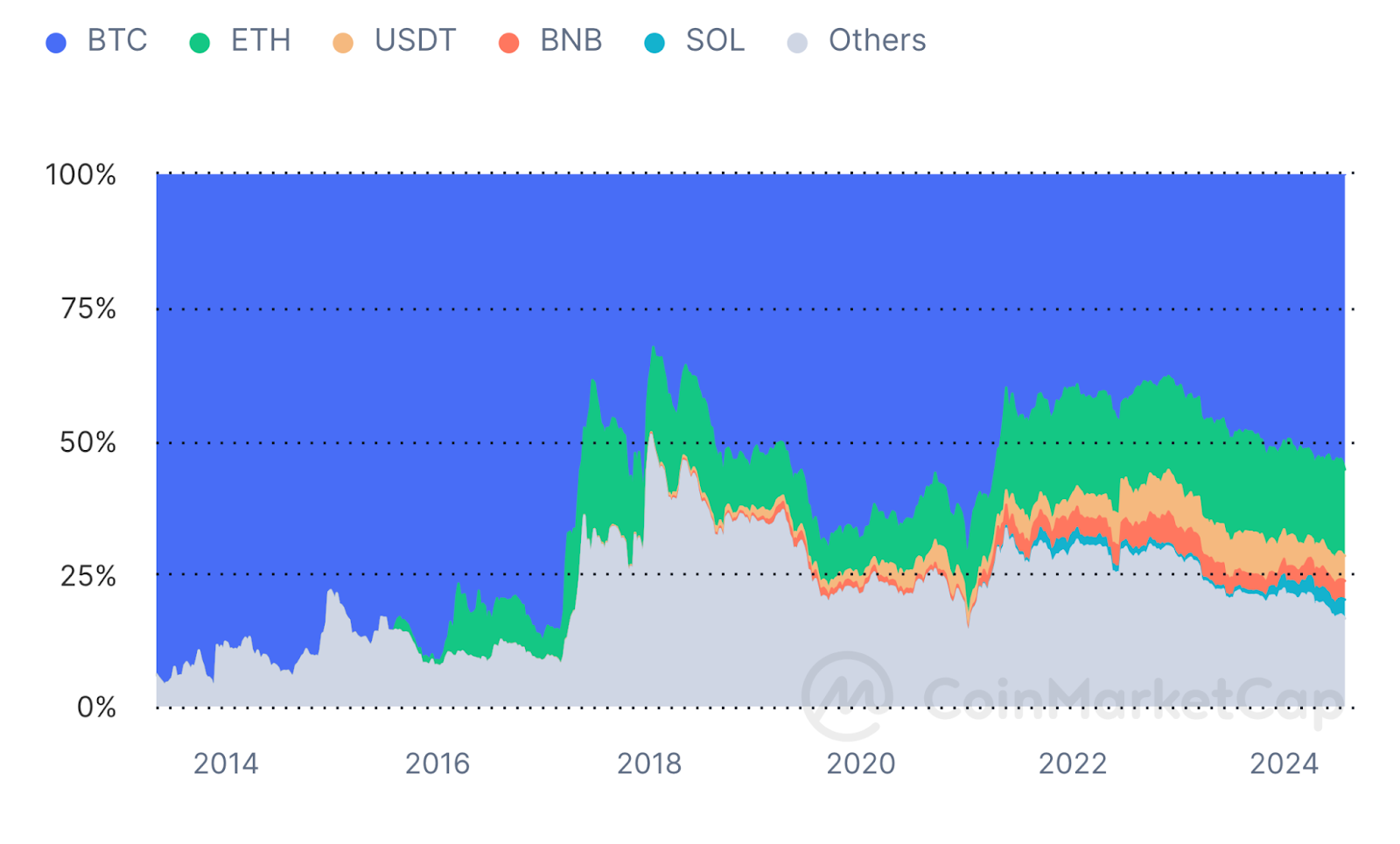

Altcoins suffered from the BTC correction and demonstrated a double digit price decrease in July. Altcoin market is experiencing huge problems as the majority of tokens do not show positive dynamics in the last months. One of the reasons for poor altcoins performance is high BTC dominance that rose above 55% in July, first time since April 2021. Decreasing BTC dominance and shift of liquidity from “major assets” to altcoins are the key factors that will trigger the highly anticipated altcoins season.

BTC and Altcoins Dominance. Source: CoinMarketCap

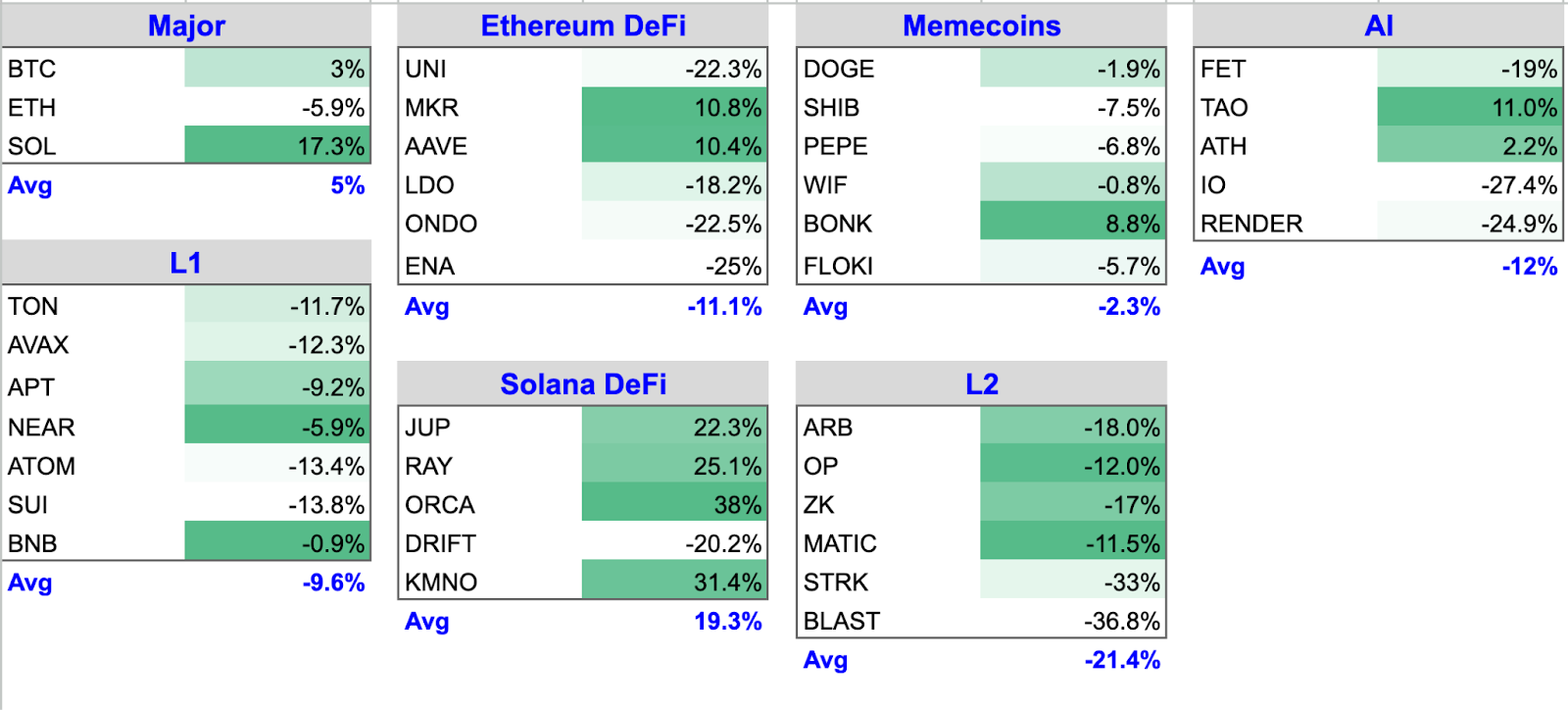

Overall, Solana (SOL) and Solana-based DeFi protocols performed best in July. Solana experienced +17.3% growth while average performance of top Solana DeFi protocols was +19.3%. Decentralized exchange Orca (ORCA) and lending protocol Kamino (KMNO) showed the highest growth amid the ongoing memecoin season, high interest in trading memes on DEXs and inflow of liquidity into the Solana ecosystem.

L2 tokens performed worst in July with average result -21.4%. Blast (BLAST) dropped by -36.8% just a month after its launch. Leading L2 projects such as Arbitrum (ARB) and Optimism (OP) also decreased amid huge selling pressure from token unlocks in July.

Major cryptocurrencies have outperformed the market again. Bitcoin, Ethereum, and Solana showed an average +5% monthly return. However, much of this growth is attributed solely to the SOL performance.

Crypto Market Performance in July. Source: SimpleSwap’s Team Calculations

Ethereum ETFs Launched

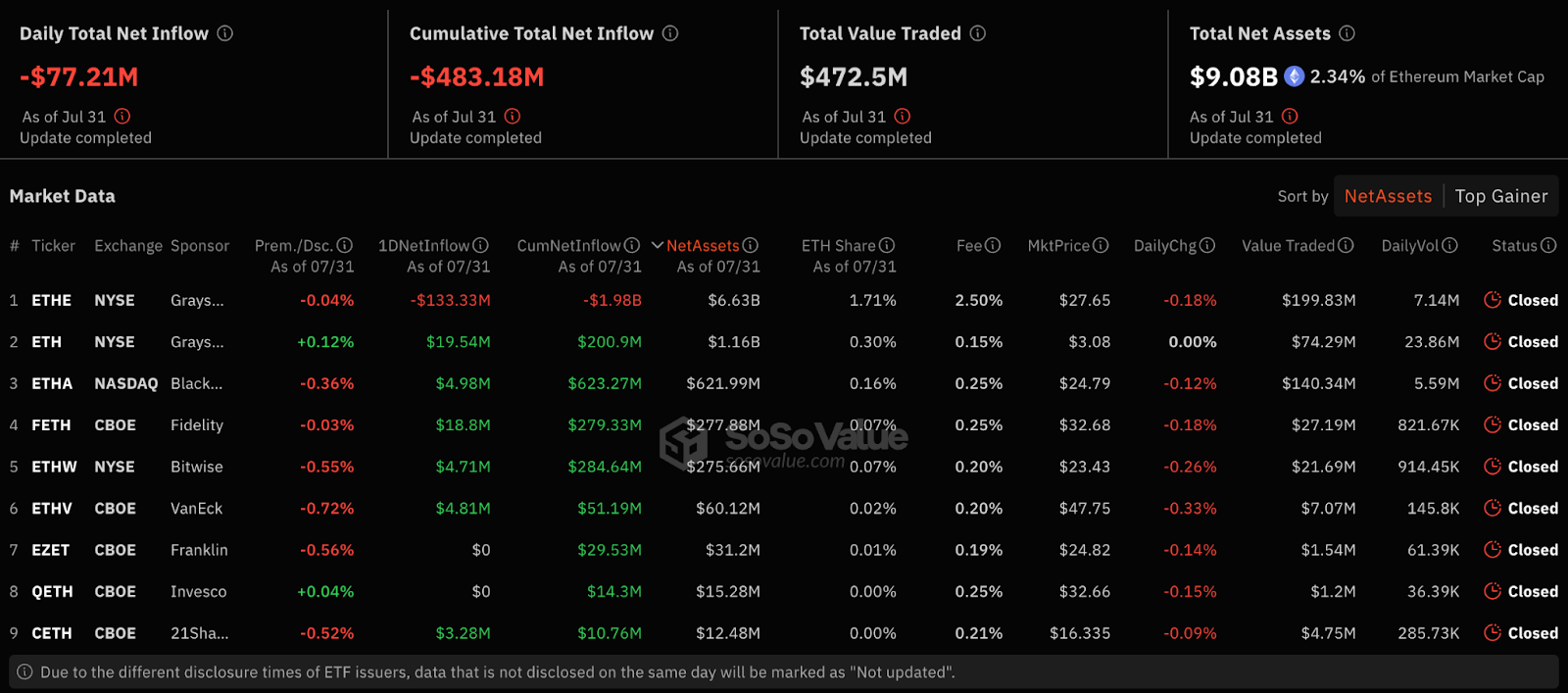

The launch of Ethereum ETFs became one of the loudest events of the last month. On July 23, 2024 spot ETH ETFs were opened for trading in the US. There are 9 ETF issuers now including Grayscale Ethereum Trust and Mini Trust. As of July 31, cumulative total new inflow to all ETFs was negative - $483M outflows. However, 8 of 9 funds show positive flows since launch and only Grayscale faces negative dynamics with $1.98B outflows.

Source: SoSoValue

Ethereum faced some selling pressure and closed a month with a 5.9% price decrease. This situation is reminiscent of January BTC moves when it corrected amid big outflows from Grayscale BTC ETF shortly after the ETFs launch. Now we may see the same situation when ETH will face short-term selling pressure, however it does not affect its long-term growth perspectives. Launch of ETFs is a strong growth driver for Ethereum and its ecosystem.

Trading Volumes

Trading volumes on both centralized and decentralized exchanges showed a slight growth in July after a 3 month consecutive decline. CEX trading volumes amounted to $1.12T - 1.82% growth compared to June. BTC futures trading volumes reached $2.02T marking a 32.8% monthly growth.

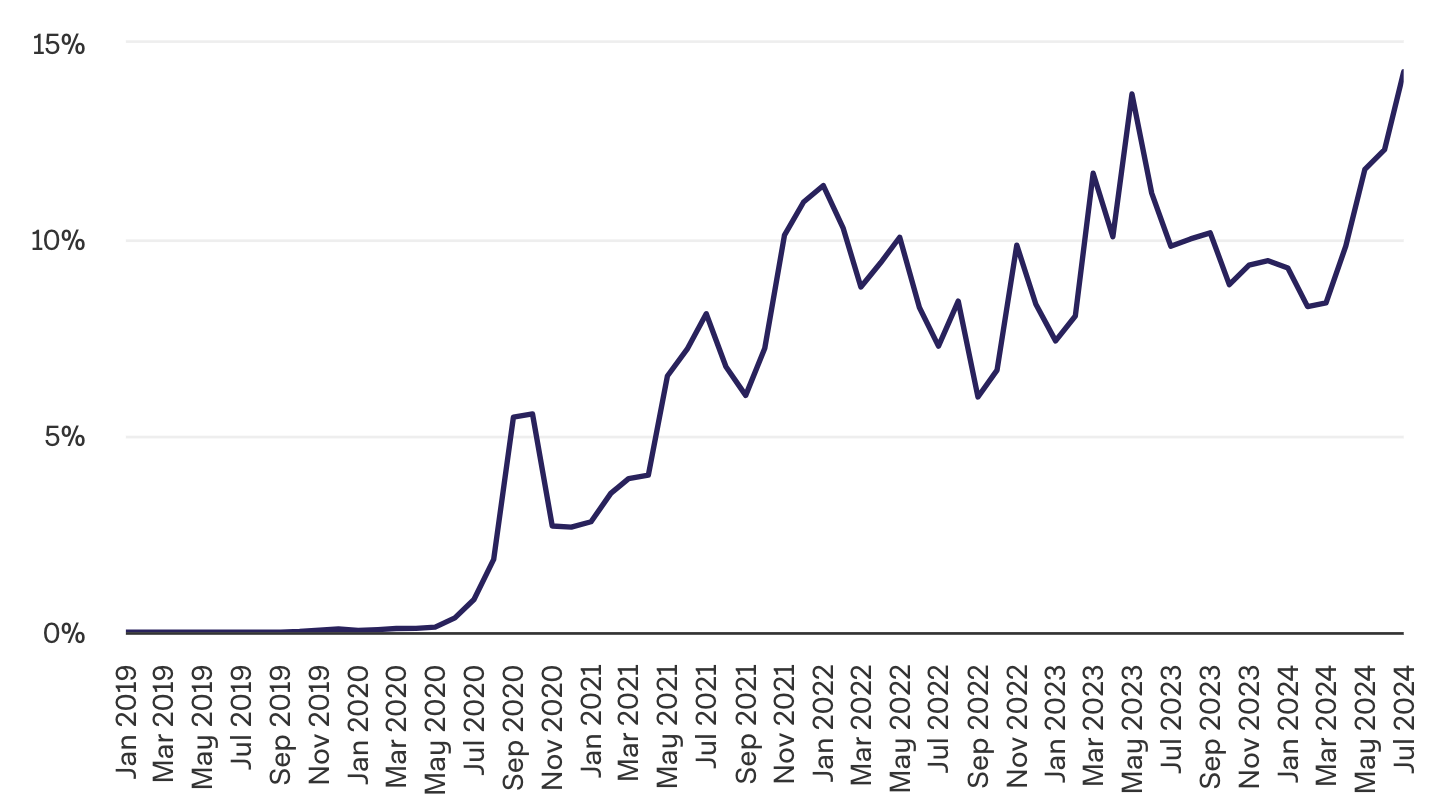

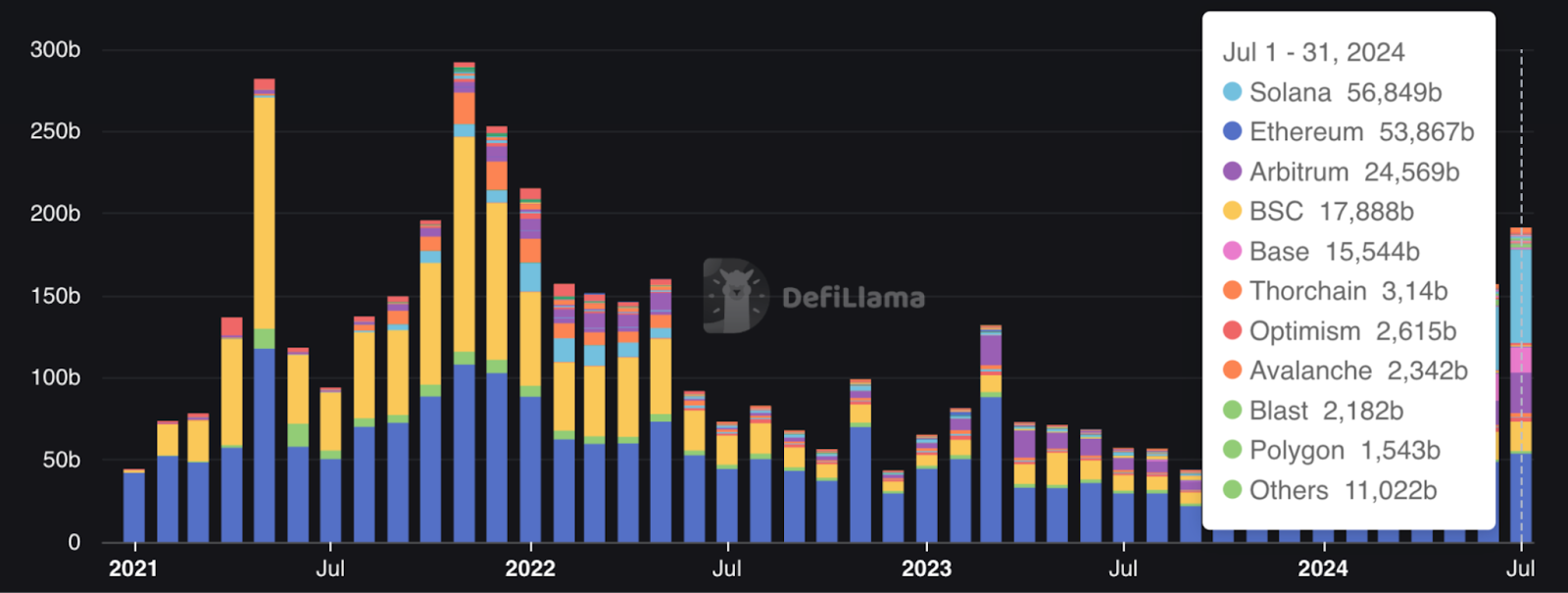

Following the trend of CEX, decentralized exchanges have also demonstrated a growth of trading volumes in July. Monthly DEX trading volume was $153.5B - 21.4% growth. Another important thing to note is the growing share of DEX to CEX trading volume. In July it reached the ATH high - 14.3% marking the growing popularity of DEX among traders. It also may be attributed to memecoin season and strong interest in trading memecoins on decentralized exchanges like Raydium.

DEX to CEX Trading Volume Ratio (%). Source: The Block

Solana surpassed Ethereum and became the leading blockchain by DEX trading volume in July for the first time in history. Trading volume on Solana-based DEX amounted to $56.8B vs $53.8B on Ethereum. Arbitrum took third place with $24.6B DEX volume.

DEX Volume by Chain. Source: DefiLlama

State of Layer 1 and Layer 2

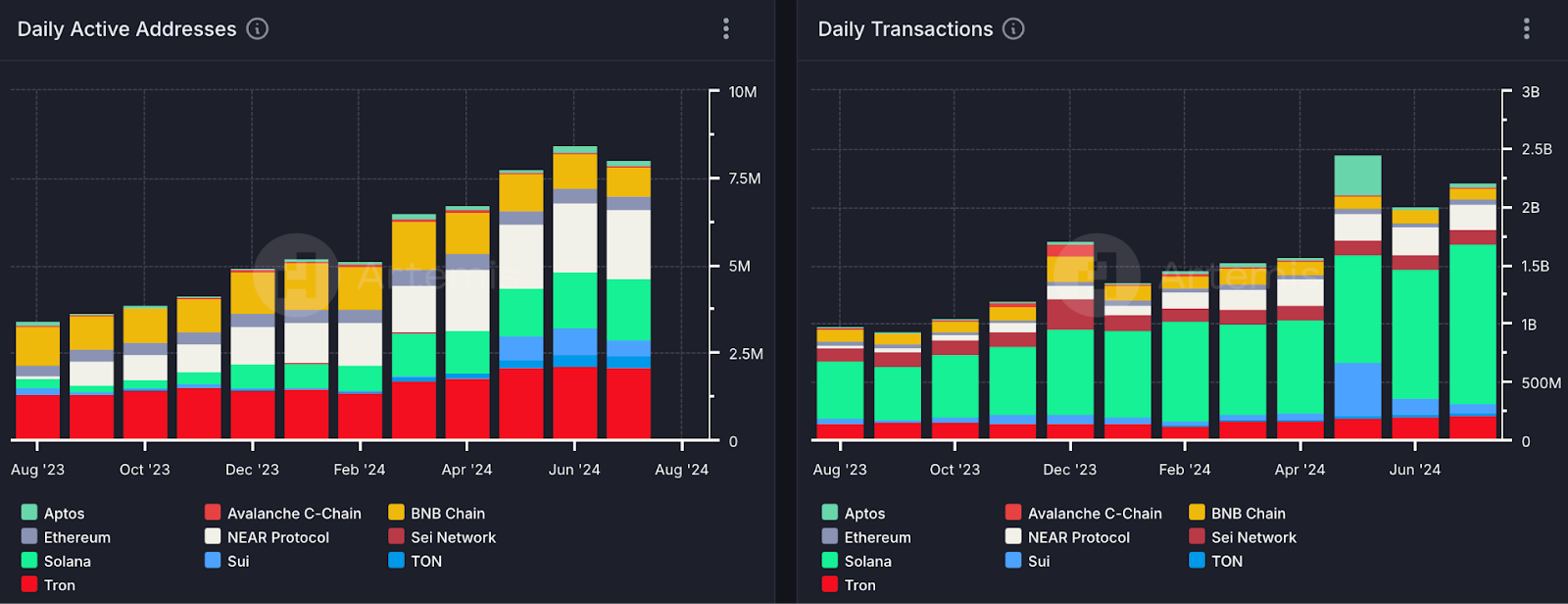

Active addresses on the leading L1 chains slightly decreased in July from 8.4M to 8M. Tron (TRX), Near (NEAR), and Solana (SOL) stay far from competitors in this metric. Tron and Near had near 2M active addresses last month and Solana accounted for 1.7M.

Solana also leads by daily transactions and processed 1.4B transactions in July. The nearest competitors, Near and Tron have only 218M and 212M respectively.

Active Addresses and Transactions on L1 Chains. Source: Artemis

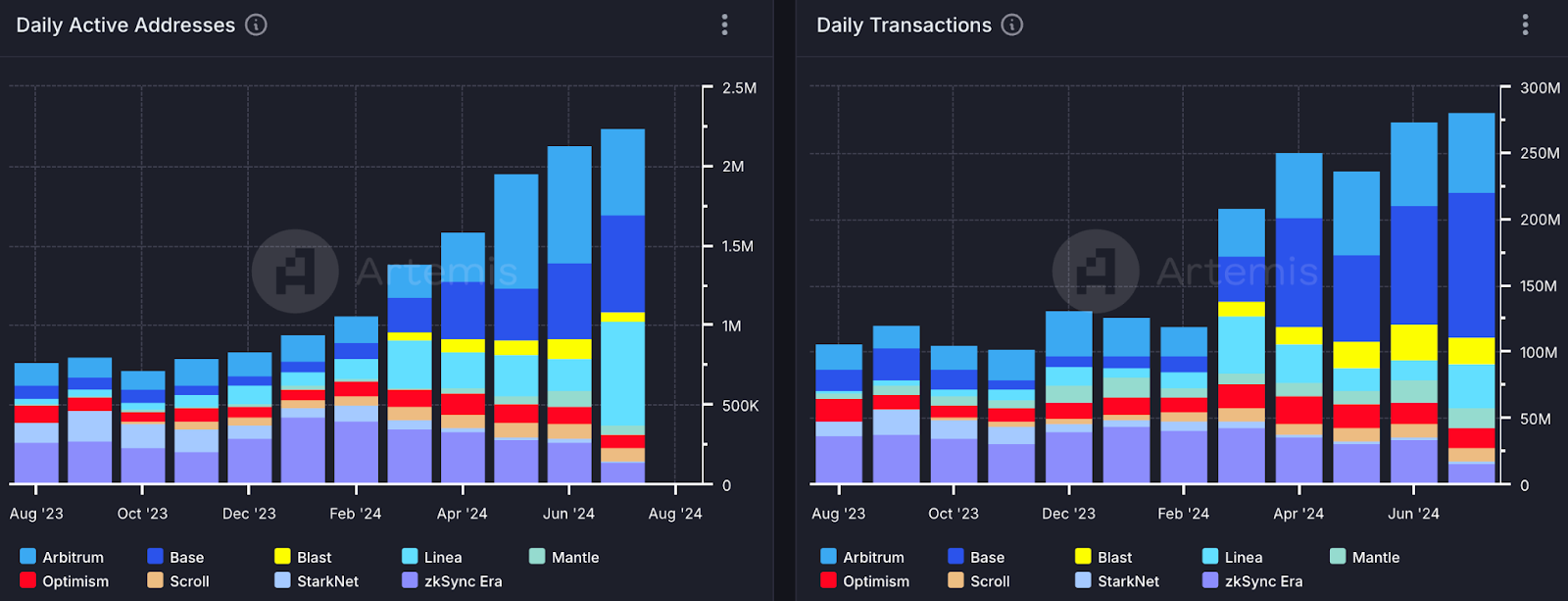

Linea became the leading L2 solution by active addresses in July (651K) amid the user inflow stimulated by “The Surge” incentivized program. Base and Arbitrum (ARB) follow the way with 610K and 545K monthly active addresses respectively.

Following the rising popularity of memecoins on Base, it became the most popular L2 by daily transaction last month accounting for 110M transactions - almost double the second place (59M for Arbitrum). Linea closed the top three with 32M monthly transactions.

Active Addresses and Transactions on L2 Chains. Source: Artemis

State of DeFi

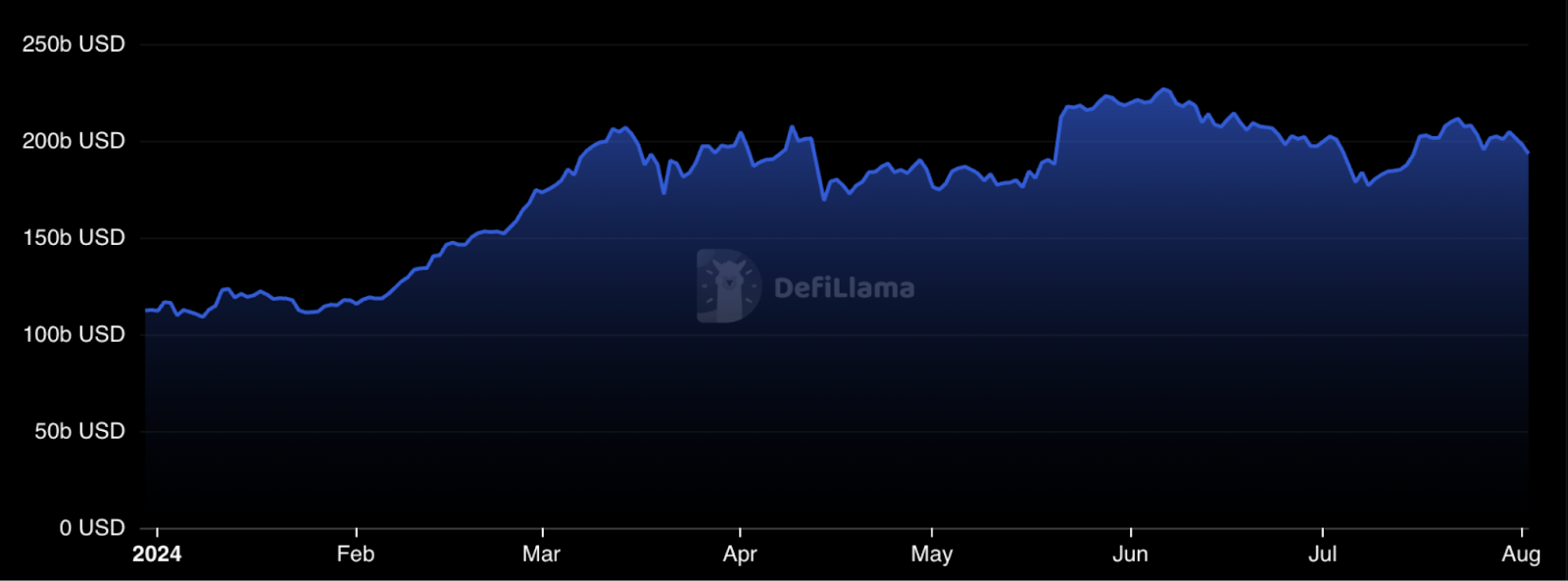

Total value locked (TVL) in DeFi protocols slightly increased in July from $197B to $201B.

DeFi Total Value Locked. Source: DefiLlama

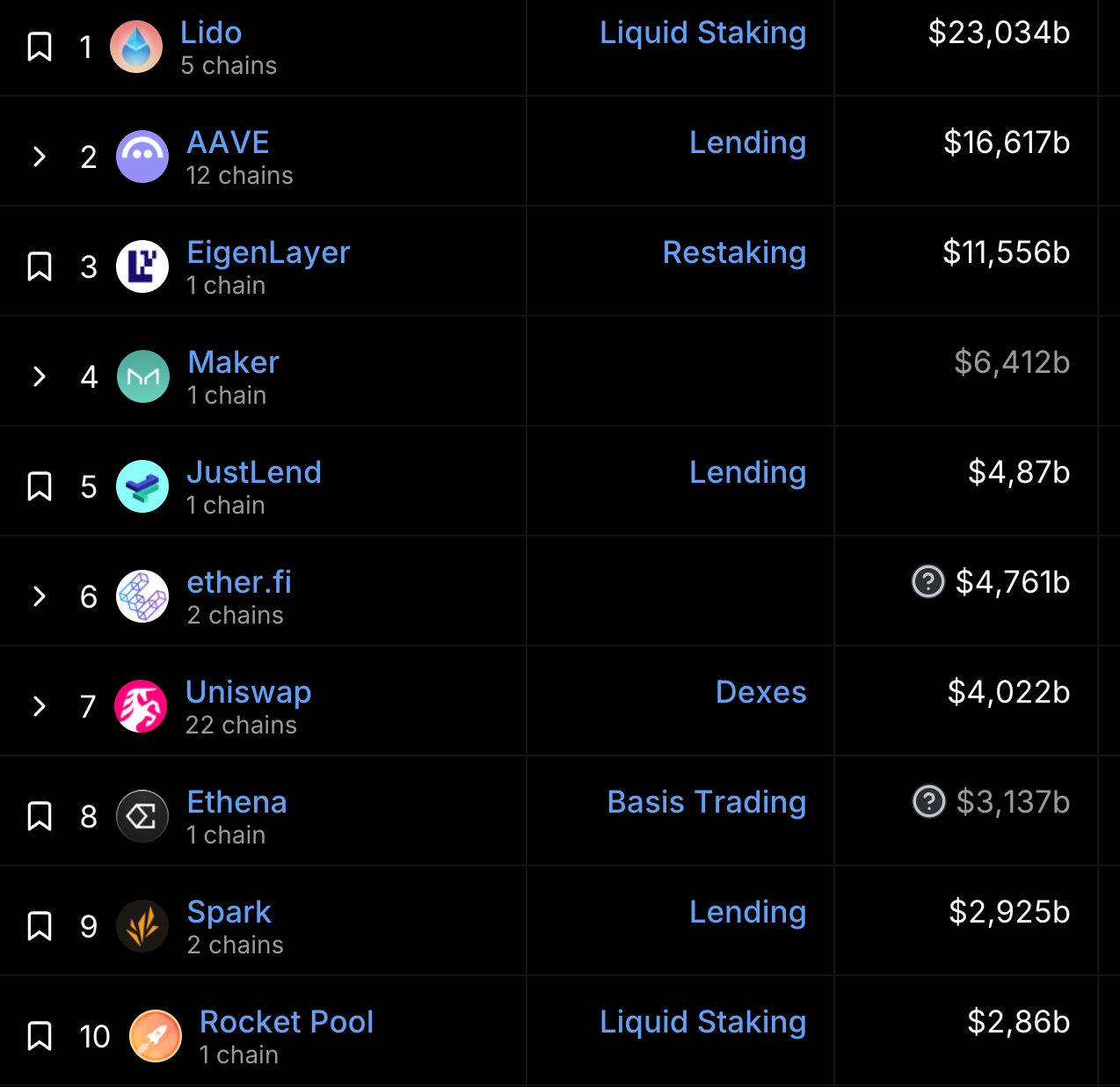

In July, liquid staking, lending protocols, and bridges were the leading categories by TVL. Lido Finance (LIDO) led the space with $23B in TVL, followed by AAVE (AAVE) and EigenLayer. Notably, Ethena (ENA), the issuer of the synthetic dollar stablecoin USDe, climbed into the top 10 DeFi projects by TVL in July.

Top-10 DeFi Projects by TVL. Source: DefiLlama

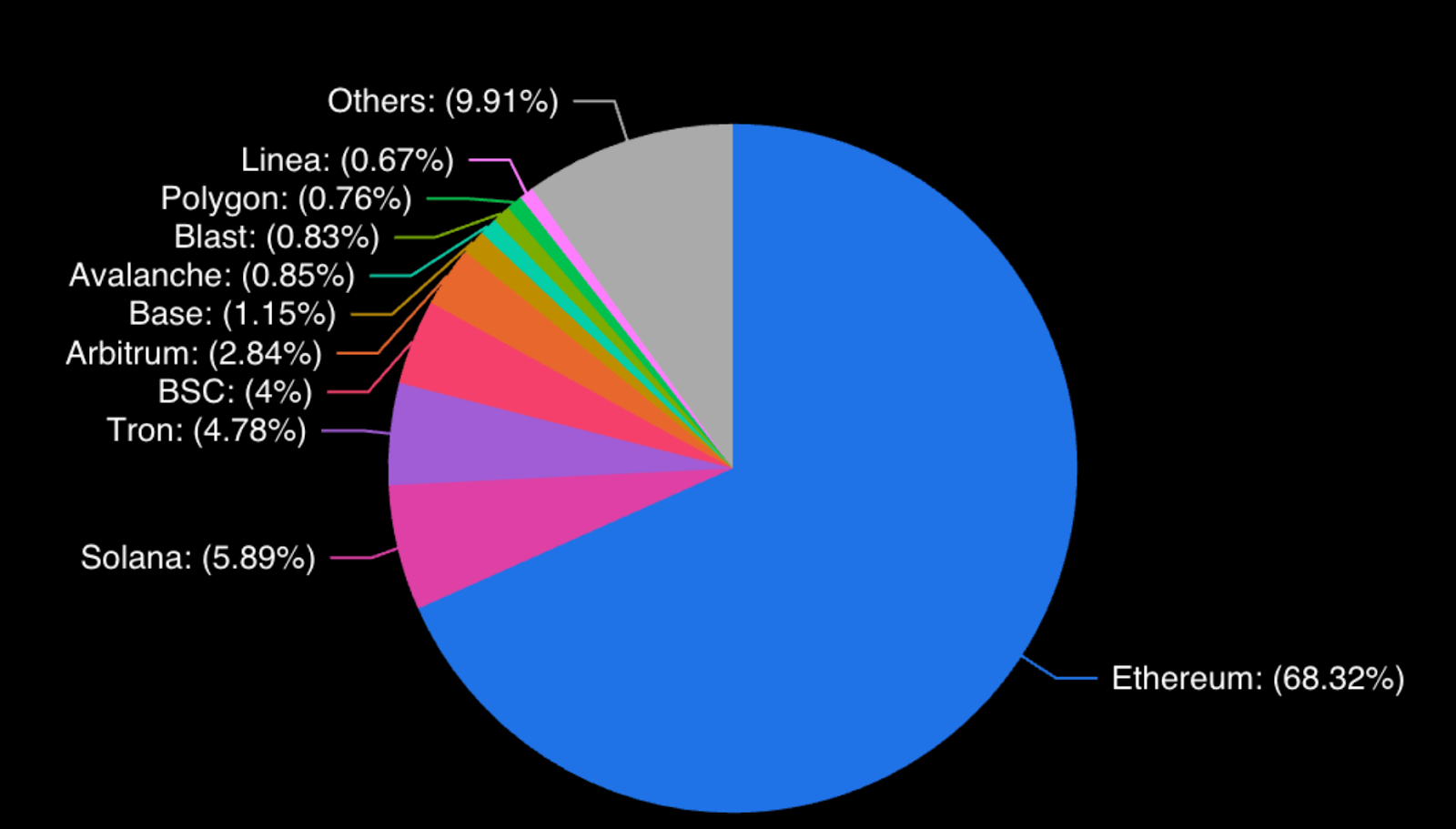

Ethereum remains the dominant chain in terms of total value locked with over $100B in locked assets last month. Solana holds the second position, followed by Tron, BNB Chain, and Arbitrum. Notably, the new Ethereum L2 solutions, Blast and Linea, have now entered the top 10 chains by TVL.

Top 10 Blockchains by TVL Share. Source: DefiLlama

Conclusion

July was a mixed month for the crypto market, marked by a BTC price rebound, increasing trading volumes, and the launch of Ethereum spot ETFs in the US. Conversely, the altcoin market continues to struggle, with some tokens hitting multi-month lows and showing no signs of recovery. High BTC dominance contributes to the poor performance of altcoins.

August is traditionally a weak month for Bitcoin, and it remains to be seen if this trend will hold true this year. Numerous news and events have the potential to reshape the crypto market landscape in the coming month.

In case you have missed our previous monthly market overview, here it is:

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.