Crypto Market Overview: June 2024

This blog post will cover:

- BTC and Altcoins Performance in June

- Key Market Statistics

- The end of the retrodrops era?

- Conclusion

The first month of summer 2024 confirmed the phrase “Sell in May and go away” as BTC price dropped below $60K and altcoins market experiencing a deep correction. Crypto market still tries to find new narratives that fuel the growth of crypto assets and reaffirm investor’s belief in the bull market continuation in 2024. However, investors sentiment in June was primarily pessimistic amid the BTC and altcoins price decline and disappointing new token launches from established players in the crypto industry.

Token airdrops from zkSync (ZK) and LayerZero (ZERO) provoked a heated discussions about the future of airdrops meta and “retrodrops” farming as the results for many users were frustrating combined with weak performance of tokens after listing.

In our June market recap we will explore the most important narratives, data and news that shaped the crypto landscape last month and will have a long-lasting effect on the future of the industry.

BTC and Altcoins Performance in June

In June, BTC's price dropped by 7%, falling below the key support zone near $60K and triggering massive liquidations of leveraged long positions. The decline occurred amid negative news, notably the announcement from Mt. Gox about the distribution of $9B worth of BTC and Bitcoin Cash to its clients starting in early July. However, BTC successfully bounced back from the $60K support zone, reflecting traders' and investors' confidence in the asset's upside potential.

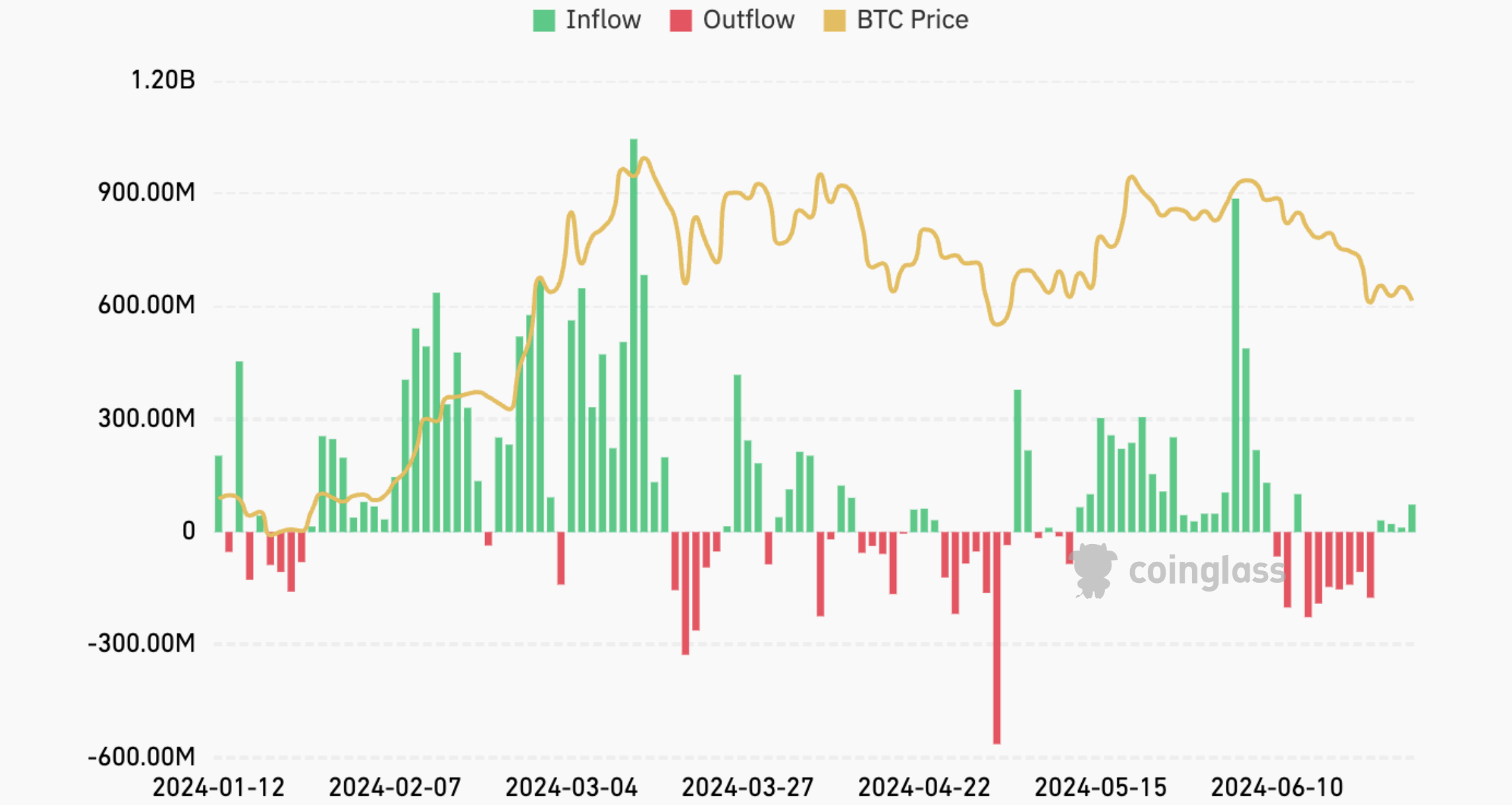

BTC ETFs experienced mixed performance in June, with several days of USD outflows, the largest being $226M on June 13. However, the final week of June saw a resurgence of positive inflows into ETFs, coinciding with the recovery of BTC price.

BTC Price and ETFs net Inflow (USD). Source: CoinGlass

The altcoin market reacted negatively to BTC's price decline in June. Among the top 10 crypto assets by market capitalization, Dogecoin (DOGE) fell by 21.9%, Solana (SOL) by 11.6%, and Ethereum (ETH) by 8.6%. The only asset from the top-10 showing positive dynamics was Toncoin (TON) with 20.4% gain amid the increasing adoption of the Ton blockchain and its collaboration with Telegram-based crypto projects.

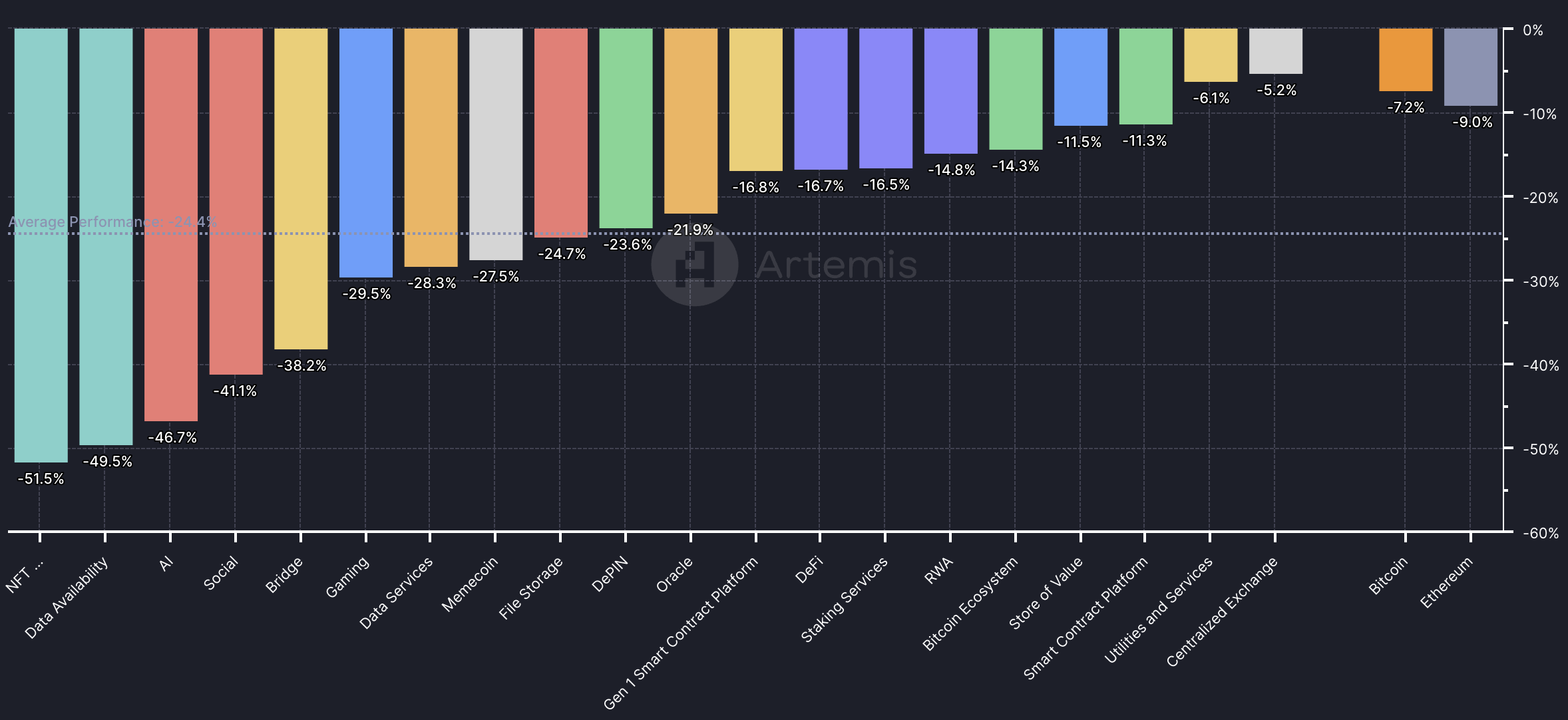

Overall, the total altcoins market cap decreased by 13.2%, dropping from $1.21T to $1.05T in June. The average fully diluted market cap (FDMC) change across all asset categories was -24.4% in June, with NFT-related projects performing the worst with a 51.5% decline, followed by data availability services (-49.5%) and AI services (-46.9%).

FDMC Monthly Change among Top Crypto Sectors. Source: Artemis

Key Market Statistics

Now let’s dive into the main crypto market stats of June.

Trading Volumes

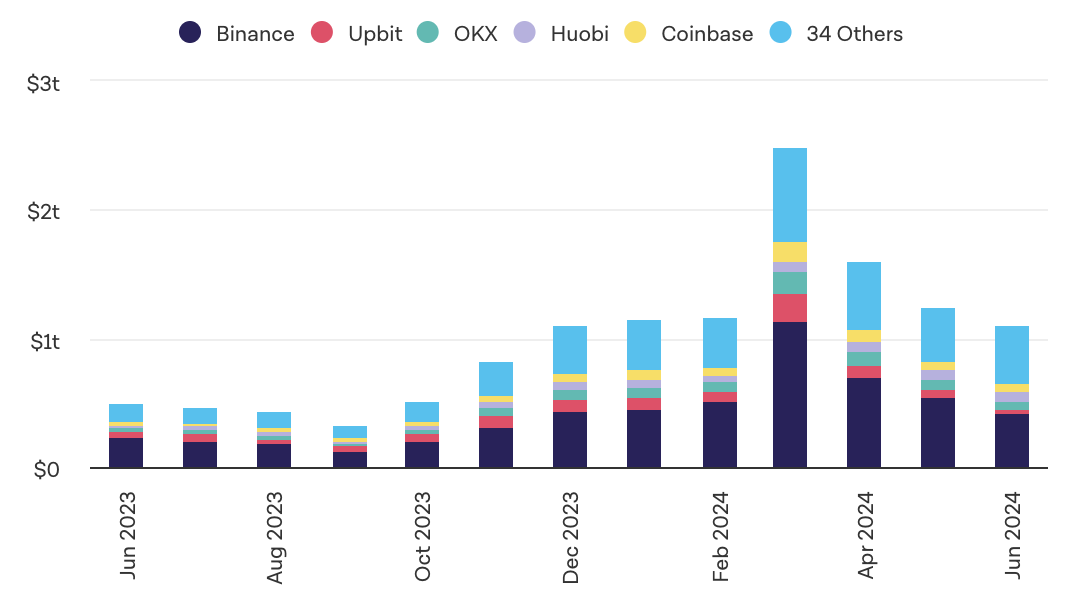

Following the correction in BTC and altcoins, trading volumes on centralized exchanges experienced a third consecutive monthly decline in June, dropping by 10.5% from $1.24T to $1.1T.

CEX Trading Volumes. Source: The Block

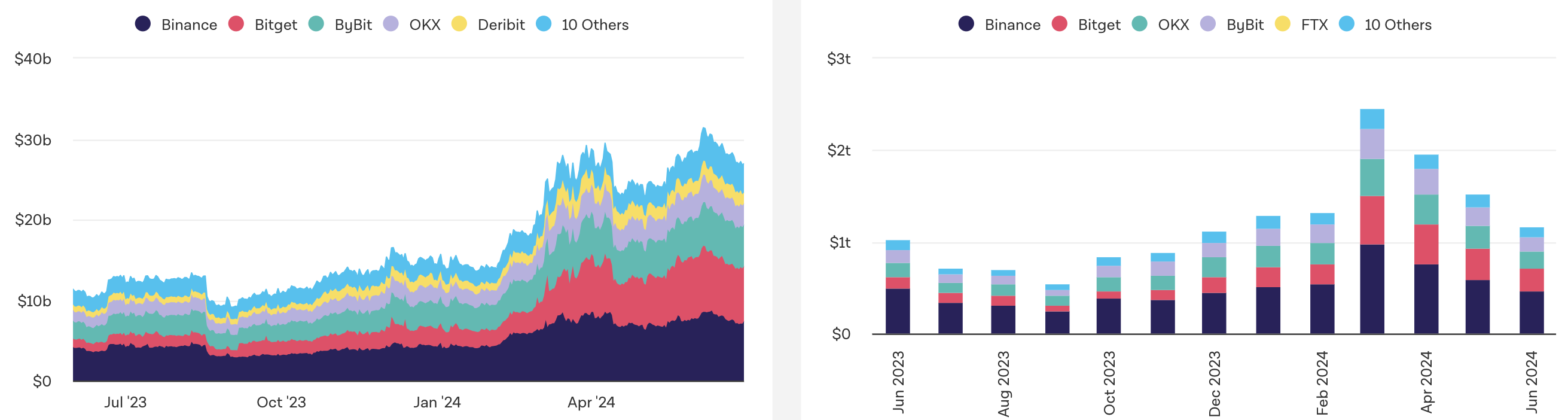

BTC futures trading volume decreased by 24.2% in June, reflecting slowing trading activity from both institutional and retail investors. Summer typically features lower trading activity compared to other seasons, and this historical pattern was confirmed in June. However, open interest in Bitcoin futures only decreased by 4.3% last month, demonstrating sustained interest in trading the first cryptocurrency.

BTC Futures Volume and Open Interest. Source: The Block

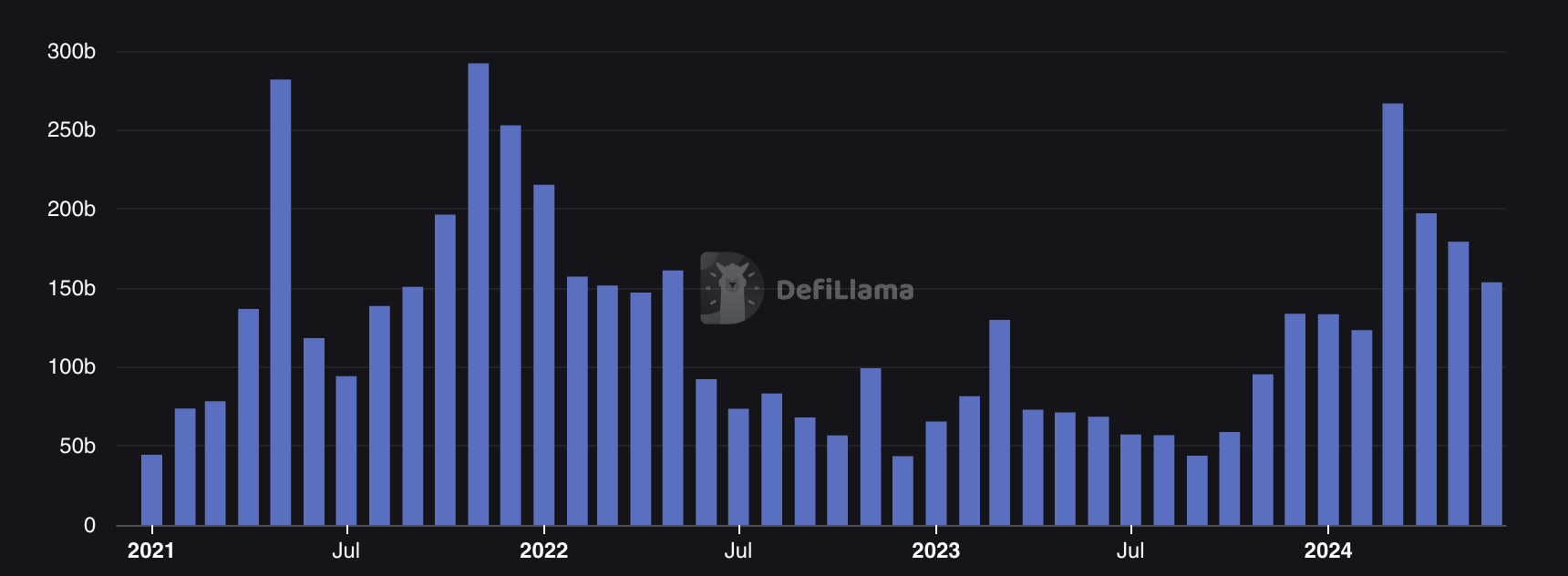

After reaching multi-year highs in March, trading volume on decentralized exchanges has also shown negative dynamics for three consecutive months. In June, DEX trading volume dropped by 17%, falling from $179B to $153B.

DEX Trading Volumes. Source: DefiLlama

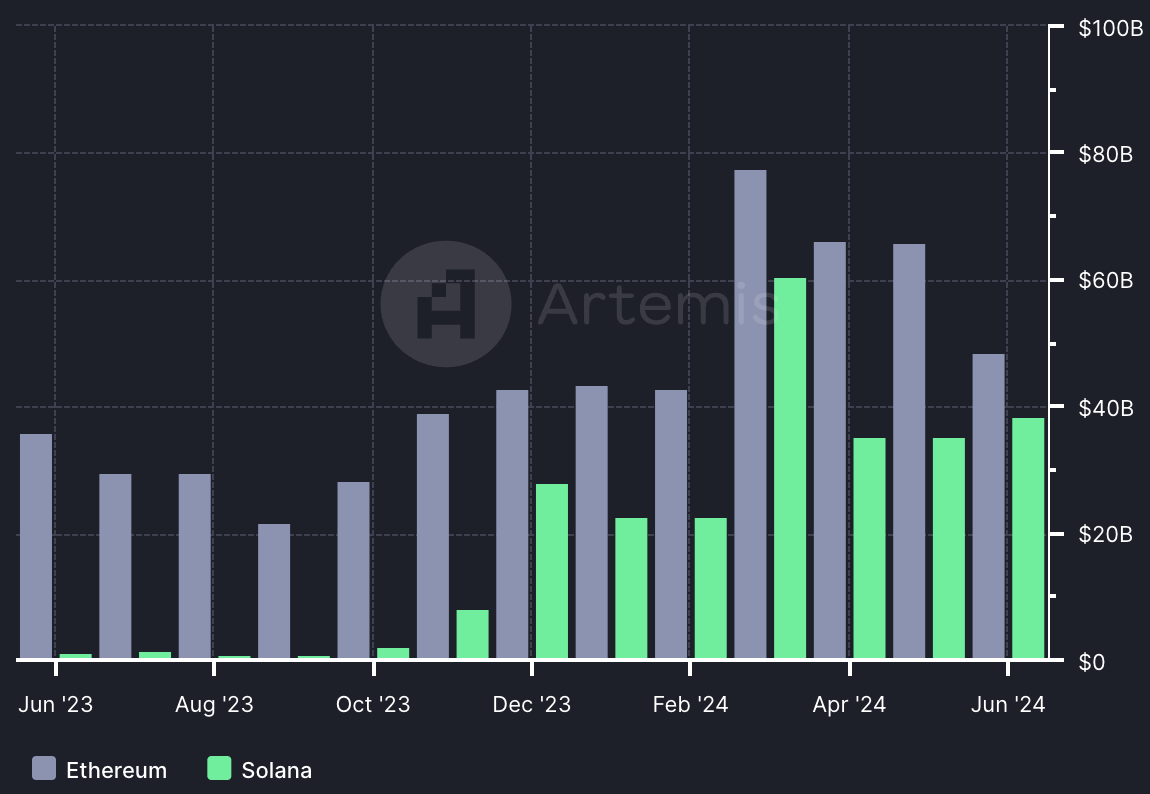

Ethereum and Solana are the most popular blockchains for DEX trades, with trading volumes of $48.7B and $38.4B, respectively. Notably, Solana’s share in DEX trading volumes surged from 1.6% in June 2023 to an impressive 25% in June 2024, reflecting the network's growth in user base and usage. Much of this growth can be attributed to the meme coin hype on Solana, with a record number of tokens launching on this blockchain and high interest in trading them on Solana-based DEXs.

Ethereum vs Solana Dex Trading Volumes. Source: Artemis

On-chain Metrics

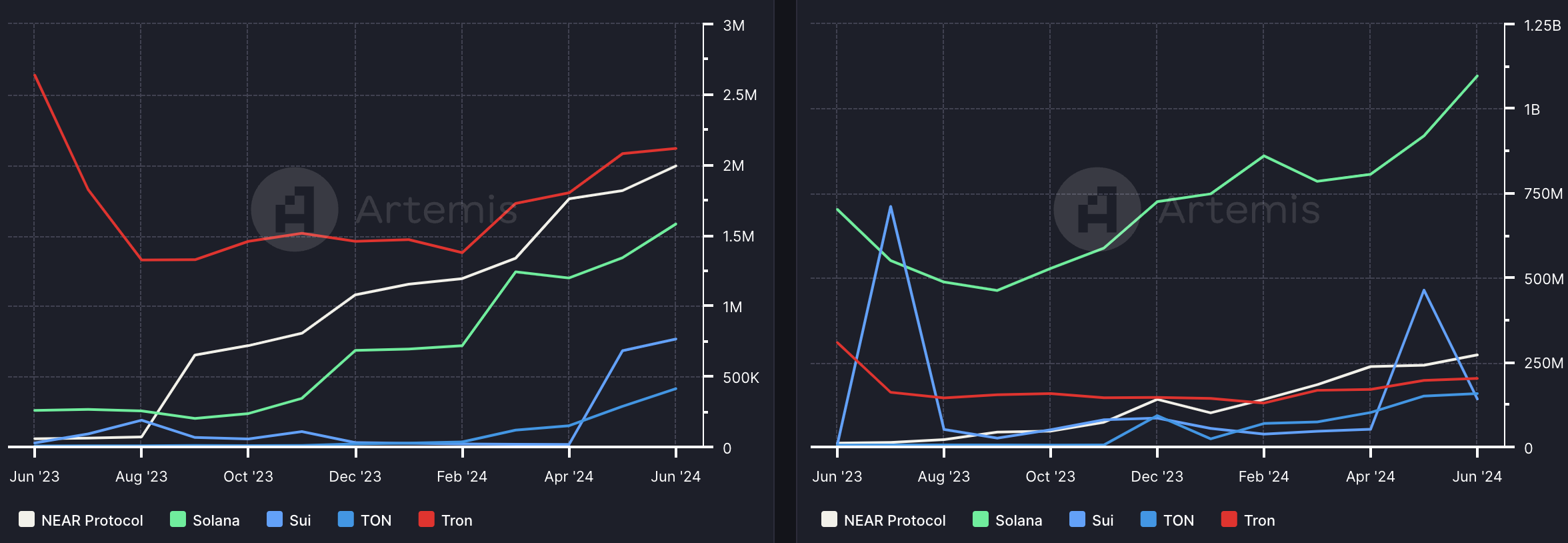

In June, Tron (TRX) maintained its leadership among Layer 1 (L1) blockchains by daily active addresses with 2.1M active addresses. Near (NEAR) and Solana (SOL) followed closely with 2M and 1.6M active addresses, respectively. BNB Chain (BNB) and Sui (SUI) rounded out the top 5 with 985K and 766K addresses.

Solana significantly outpaced its competitors in daily transactions, reaching 1.1B transactions in June. Near came in second with 272M transactions last month. Tron, Ton (TON), and Sui also ranked in the top 5 with 203M, 158M, and 142M transactions, respectively.

Top 5 L1 Blockchains by Active Addresses and Daily Transactions in June. Source: Artemis

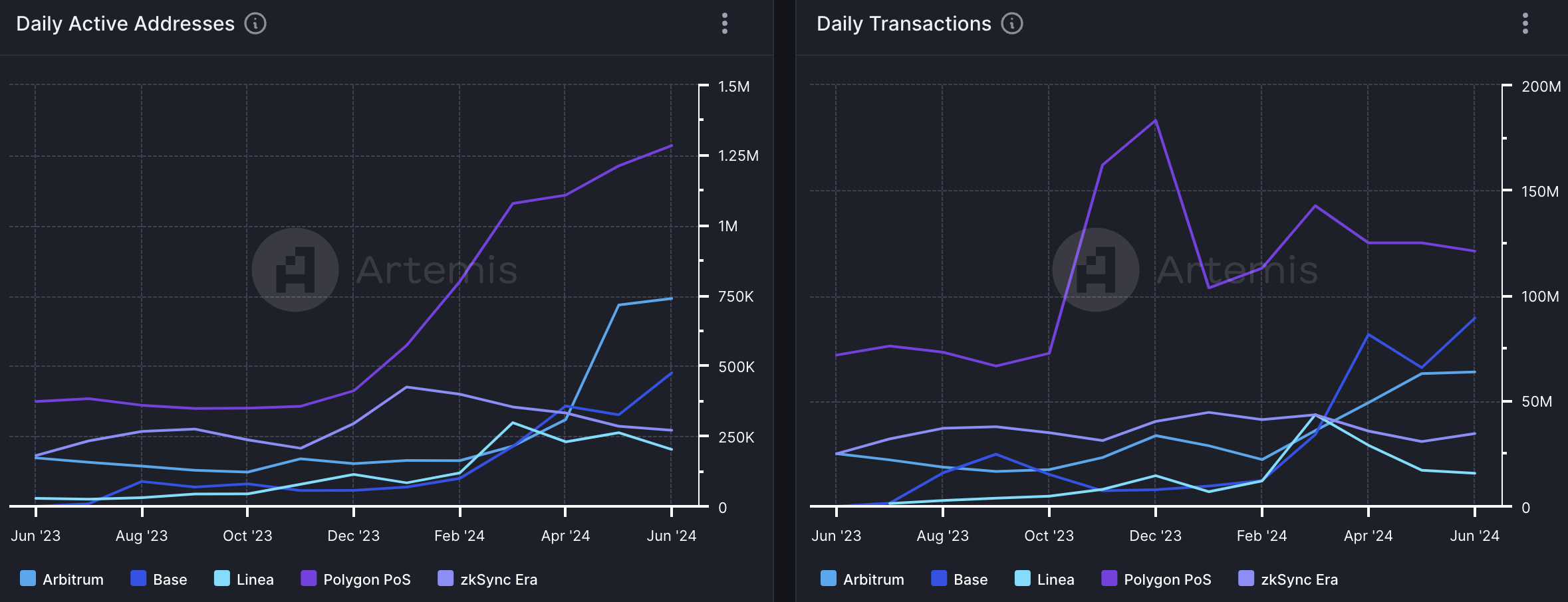

In June, Polygon PoS (MATIC) led among layer 2 solutions in both daily active addresses and daily transactions. Polygon faced 1.3M active addresses and 121M transactions during last month. Among the top 5 L2 solutions, Base is showing the highest growth rates since the beginning of the year, with active addresses growth by 733% and transactions increasing by an impressive 1012%. Base growth is attributed to its increasing popularity as a network for launching and trading memecoins.

Top 5 L2 Blockchains by Active Addresses and Daily Transactions in June. Source: Artemis

Total value locked in DeFi protocols reached its yearly high in early June and amounted to $226.8B. However, by the end of the month TVL dropped to $196.5B showing a 9.95% monthly decrease. Despite this, DeFi TVL demonstrates a solid growth in 2024 showing a 75% increase in June compared to the end of 2023. DeFi protocols are the key drivers of blockchain’s ecosystem’s growth and one of the main liquidity sources for them. Liquid staking, lending, and bridges were the top 3 DeFi sectors by TVL in June.

DeFi TVL Growth in 2024. Source: DefiLlama

The end of the retrodrops era?

June features the token launches of two highly anticipated projects: Ethereum Layer 2 solution zkSync (ZK) and the omnichain interoperability protocol LayerZero (ZRO). Alongside StarkNet (STRK), these three were dubbed the "big three" projects expected to provide huge retrodrops to their communities, following the case of Arbitrum (ARB) and Optimism (OP) with their generous token rewards to the community. However, airdrops from all three projects turned out to be disappointing for the majority of users. The projects failed to establish clear and transparent criteria for airdrop eligibility, sybil account detection, and token allocation to different user categories. Consequently, the crypto community was disillusioned and criticized the project teams for incompetence and greed.

The disappointing token airdrops were followed by weak performance after listing. zkSync (ZK) dropped by 43% in June, reflecting the lack of interest from the community and investors to buy the token at current prices. LayerZero (ZRO) also closed the month with a 19.6% price decrease.

ZK Token Performance in June. Source: CryptoRank

Such performance of the top projects backed by the leading investment funds sparked heated discussions about the future of airdrops and drop hunting prospects. Opinions varied, but it is clear that the crypto market is evolving, highlighting a strong need for new models of token launches and distributions that align the interests of projects, investors, and the community. It now seems that the era of "life-changing" airdrops and retrodrops from Tier 1 projects may be over. However, the future will reveal how these dynamics will evolve.

Conclusion

June proved to be a challenging month for the crypto industry, marked by declines in crypto asset prices and disappointing launches of new projects. The overall sentiment suggests a lack of optimism and growth drivers to sustain the bullish trajectory seen earlier in 2024. As July begins, there is hope that the potential approval of ETH spot ETFs could bring positivity to the market. It remains to be seen whether this will be sufficient to stimulate growth of crypto assets or it will be another month of uncertainty and fear for the crypto community.

Missed our previous Crypto Market Overview? Make sure to check it out now!

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.