What’s Next for the Crypto Industry?

This blog post will cover:

- Current market sentiment

- Key drivers for the market growth

- Obstacles to pay attention to

- Conclusion

Summer 2024 turns out to be a disappointing time for the crypto community. After a strong start to the year and BTC's all-time high in March, the market faced a deep correction, with altcoin prices also dropping significantly. The launch of long-awaited projects like zkSync (ZK), LayerZero (ZRO), and Blast (BLAST) failed to add optimism, instead sparking criticism over their airdrop distribution and listings. The current market situation is characterized by one simple abbreviation: FUD. Many in the crypto community are unsure how to navigate the current market without incurring losses. But is the situation truly that dire? Let’s dive deeper into the current landscape and analyze potential drivers and obstacles for crypto market growth in the upcoming months.

Current market sentiment

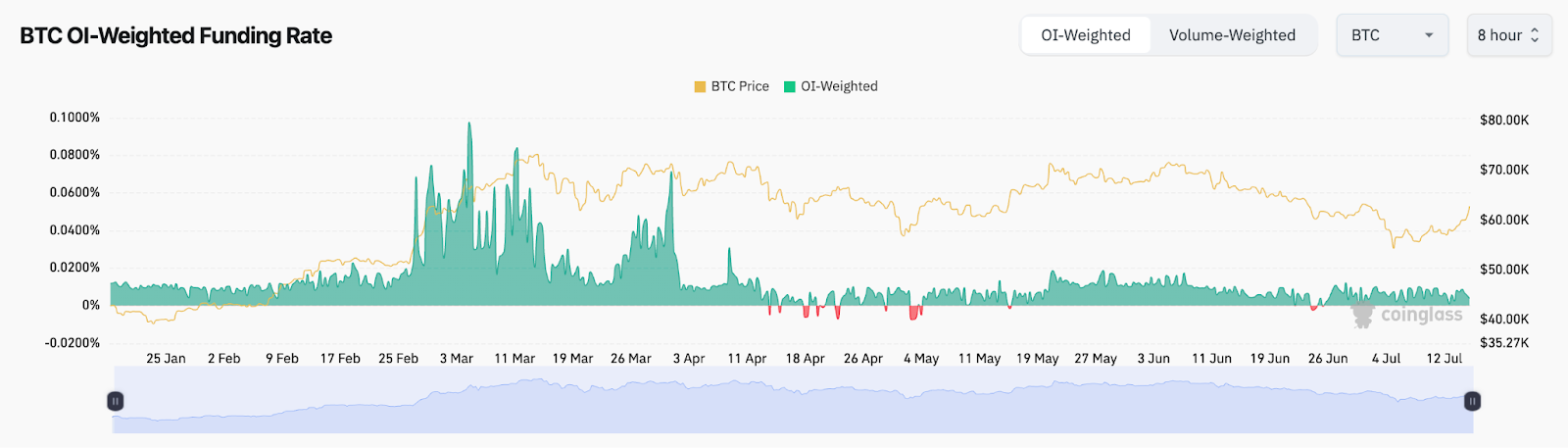

The July correction was accompanied by a lot of FUD and overall sentiment in the crypto market fell sharply. The main drivers for FUD were concerns about big selling pressure from the German government selling its Bitcoins and Mt.Gox compensation plans. BTC dropped below $54K marking the deepest correction in 2024. Funding rates are also at the lowest level in 2024 demonstrating that there is not much optimism among market participants right now.

BTC OI-Weighted Funding Rate. Source: CoinGlass.

Last correction ended up the longest growth cycle for BTC without a correction >25%. In other words, it is obvious that the market should face such a correction to cool down, deleverage long positions and prepare for the next upside movement. Following July's price decline BTC corrected by 27.5% from its ATH. During the previous bull runs the market also faced corrections by 25-50%, however they did not question the further growth of BTC and altcoins.

Key drivers for the market growth

Now let’s take a look at the main drivers for crypto market growth in the upcoming months.

Spot Ethereum ETFs

Launch of Ethereum (ETH) spot ETFs would be a strong growth driver for the crypto market. Given the success of BTC spot ETFs Ethereum has chances to follow the way and face the massive capital inflows into ETFs. Not only the launch of ETH ETFs attracts new capital to the industry but also emphasizes the growing importance of crypto assets and its positions as an reliable and regulated investment tool. According to the recent news, ETH spot ETFs are likely to be launched on July 23.

Regulatory Climate Improvement

Launch of spot ETFs is the first step to regulatory clarity for cryptocurrencies. Recently, the regulatory climate for the industry in many countries, first of all in the US, was not friendly. However, we see a positive shift in this field as more and more legislators and businessmen call for the adoption of crypto regulation in the US. Upcoming presidential elections also matter as Donald Trump currently is favorite in the presidential race. Trump promises to be a crypto-friendly president and improve the regulatory climate for crypto business and assets. Overall, Trump’s potential win is a positive factor for the crypto industry in the long term.

Potential Solana ETFs

VanEck has recently announced that they are preparing an application for a Solana ETF. While the chances of approval in the short term are minimal, it is worth keeping an eye on this development. ETFs could be a significant growth driver for Solana and its ecosystem and potentially paving the way for similar ETFs for other crypto assets.

Macroeconomic conditions

It appears that the interest rate hike cycle is over, and we might see the first rate cut this autumn. The latest macroeconomic data in the US is encouraging: GDP growth is slowing, the unemployment rate exceeds 4%, and core CPI is cooling down, currently near 3%. Given these factors, there is a strong possibility of a rate cut this autumn. Rate cuts traditionally have a positive impact on financial markets and the crypto industry in the mid and long term.

FTX Payout

FTX is set to distribute more than $14.5B as compensation to its users. While it is difficult to predict how people will use this money, there is potential for some to reinvest in the crypto market, creating extra buying pressure. This influx of funds could help offset the selling pressure anticipated from the Mt.Gox distribution.

Obstacles to pay attention to

There are also factors that potentially can hamper the growth of the crypto market and some altcoins.

Short-Term Selling Pressure

While the German government has cashed out with its Bitcoins, Mt.Gos just started to distribute compensations to its users in BTC. Potential selling pressure is more than $8B that can impact the market in the short term. However, it seems that market participants react more calmly to this possibility and the market has already “priced” this event.

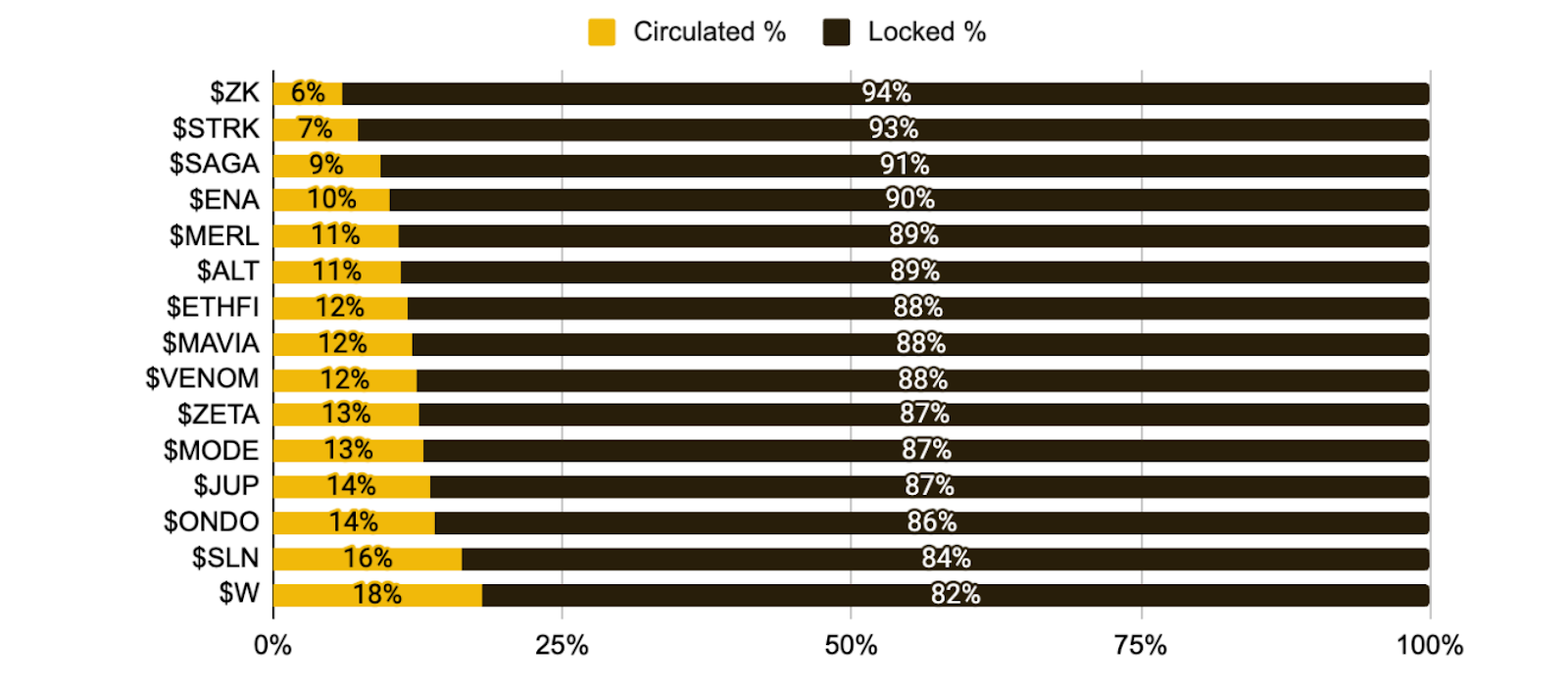

Token Unlocks Selling Pressure

According to Binance Labs report, nearly $155B worth of tokens will be unlocked between 2024-2030. It creates a constant selling pressure for many altcoins, especially those with low market cap/fully diluted valuation ratio. Some major projects currently have 6-20% tokens circulating with >80% of supply locked for early investors, team, and others. Such token distribution mechanics may hamper the token price growth in the future as the market will have to mitigate the huge selling pressure from upcoming unlocks.

Recently Launched Tokens with Low Circulating Supply. Source: Binance Research

Structural Changes on the Market

The crypto industry is rapidly evolving, with cryptocurrencies now recognized as an established asset class by leading investment banks and funds. Consequently, it becomes very difficult for projects to perform well without a strong product-market fit, traction, and community support. In a future altcoin season (if it occurs), we might not witness the broad growth of all sectors and tokens regardless of their market position and product. Instead, growth may be concentrated in specific sectors like AI, RWA, liquid restaking, etc, with projects in these areas demonstrating solid price growth. Meanwhile, the upside potential for other sectors and altcoins may be more moderate. Given these dynamics, it has become increasingly challenging to create an altcoin portfolio that will significantly outperform the market.

Black Swan Events

We should bear in mind unpredicted events that can dramatically alter the market landscape. The collapse of Terra, bankruptcy of FTX, and the COVID-19 pandemic are recent examples of such events. Given the current high political uncertainty and volatile macroeconomic conditions, the possibility of a "black swan" event in the financial and crypto markets is ever-present.

Conclusion

Despite the current pessimism in the crypto market, the growth drivers seem to outweigh the negative factors for the industry in the coming months. The recent correction might have a positive effect, paving the way for healthier future growth. Summer is typically more quite season for financial and crypto markets, so we should patiently wait and prepare for potential growth in the autumn. Remember to DYOR and make investment decisions only if you fully understand all associated risks.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.