Crypto in 2025: Predictions, Trends, and Transformations

This blog post will cover:

- Key Crypto Market Events in 2024

- Bitcoin (BTC) Price Prediction & Forecast 2025

- Ethereum (ETH) Price Prediction & Forecast 2025

- Artificial Intelligence and Crypto in 2025

- Asset Tokenization in 2025

- Meme Coins Prediction & Forecast 2025

- Conclusion

The year 2024 marked a turning point for the cryptocurrency market. The approval of a spot Bitcoin ETF in January ushered in a new era of institutional investments, while the third halving in April reinforced its upward trend. BTC dominated the market, not only reaching two all-time highs but also surpassing the critical $100,000 psychological threshold for the first time. By the end of December 2024, it had firmly held its position around this milestone, affirming its strength as the leading asset in the crypto market.

However, 2024 wasn’t just the year of Bitcoin’s growth. Layer 2 solutions like zkSync and StarkNet gave Ethereum (ETH) a significant boost, enhancing the network's scalability. Meanwhile, meme coins captured public attention again, symbolizing the speculative potential of the crypto market.

Global economic instability also played a significant role. The Federal Reserve's interest rate cuts increased the appeal of cryptocurrencies as alternative investment tools. A key event was Donald Trump’s victory in the U.S. presidential election, sparking a market rally. Investor optimism was fueled by Trump’s promises during the Bitcoin 2024 conference to create favorable conditions for the crypto industry.

Looking back, 2024 laid the groundwork for transformative changes that could fully manifest in 2025. Bold regulatory steps, technological advancements, and a shifting economic landscape create both opportunities and risks for the cryptocurrency market. This forecast aims to glimpse into what 2025 could bring for the crypto industry. But first, it’s crucial to recap the key events of 2024.

Key Crypto Market Events in 2024

January 10: Bitcoin ETF approval

The approval of the first spot Bitcoin ETF was a landmark moment for the market. At the time of launch, Bitcoin was trading around $46,000. This decision opened the doors for institutional investors, significantly increasing liquidity and interest in the asset.

March 14: new Bitcoin All-Time High

Just two months after the ETF launch, Bitcoin reached $73,777, setting a new record and reflecting heightened interest from major investors.

April 20: Bitcoin’s third halving

For the first time in history, Bitcoin set new all-time highs even before halving. The reduction in mining rewards, a key event for Bitcoin, continued to shape its long-term price dynamics.

July 22: Ethereum ETF approval

The SEC approved the first spot Ethereum ETF, marking another step toward institutionalizing the crypto market. This development boosted interest in ETH and created new opportunities for attracting capital from institutional investors.

September 17: Fed rate cut

The U.S. Federal Reserve reduced the base interest rate by 50 basis points to a range of 4.75%-5.0%. This marked the first rate cut since 2020, bolstering investor confidence in cryptocurrencies as income-generating assets in a low-interest environment.

November 5: Bitcoin’s post-election rally

Donald Trump’s victory in the U.S. presidential election spurred another market surge. Bitcoin reached $76,400, fueled by Trump’s promises to foster a crypto-friendly environment.

November 7: one more Fed rate cut

The Federal Reserve cut rates again by 0.25%, further enhancing the attractiveness of cryptocurrencies as an alternative investment in the face of declining returns from traditional instruments.

December 5: Bitcoin breaks $100,000

In early December, Bitcoin surpassed the psychological $100,000 level, reaching a peak of $104,088, further solidifying its strength amid growing institutional interest.

December 18: another Fed rate cut

The Federal Reserve reduced the interest rate by 0.25% as anticipated. However, the regulator also announced plans to slow the pace of future rate cuts, citing the need to manage inflation risks and maintain macroeconomic stability.

Bitcoin (BTC) Price Prediction & Forecast 2025

Building on 2024’s momentum, 2025 is poised to bring significant changes and potential growth for Bitcoin. Donald Trump’s presidency plays a critical role here, as his administration has expressed intentions to establish BTC as a reserve asset for the U.S. and foster a crypto-friendly regulatory environment.

Trump’s inauguration on January 20, 2025, could act as a catalyst for increased Bitcoin demand if these initiatives come true. Additionally, favorable economic conditions, including continued rate cuts by the Federal Reserve, are expected to support the growth of high-yield and alternative assets, including cryptocurrencies.

In 2024, Bitcoin ETFs brought over $117 billion into the market. This trend is likely to accelerate in 2025 as more investors look to diversify portfolios using ETFs as an entry point to cryptocurrency exposure.

Source: Coinglass

With supportive macroeconomic policies, potential government integration of Bitcoin in the U.S., and increasing capital flows through ETFs.

Ethereum (ETH) Price Prediction & Forecast 2025

In 2024, several significant Layer 2 solutions for the Ethereum network were introduced, such as zkSync (ZK), StarkNet (STRK), and Scroll (SCR), alongside with already popular platforms like Optimism (OP) and Arbitrum (ARB). These solutions greatly expand Ethereum’s capabilities, allowing the network to process more transactions, improving speed, and reducing transaction costs. As a result, the Ethereum ecosystem continues to develop, boosting interest in DeFi and other Ethereum-based blockchain applications. You can find a detailed description of L2 solutions, their architecture, and features in this article.

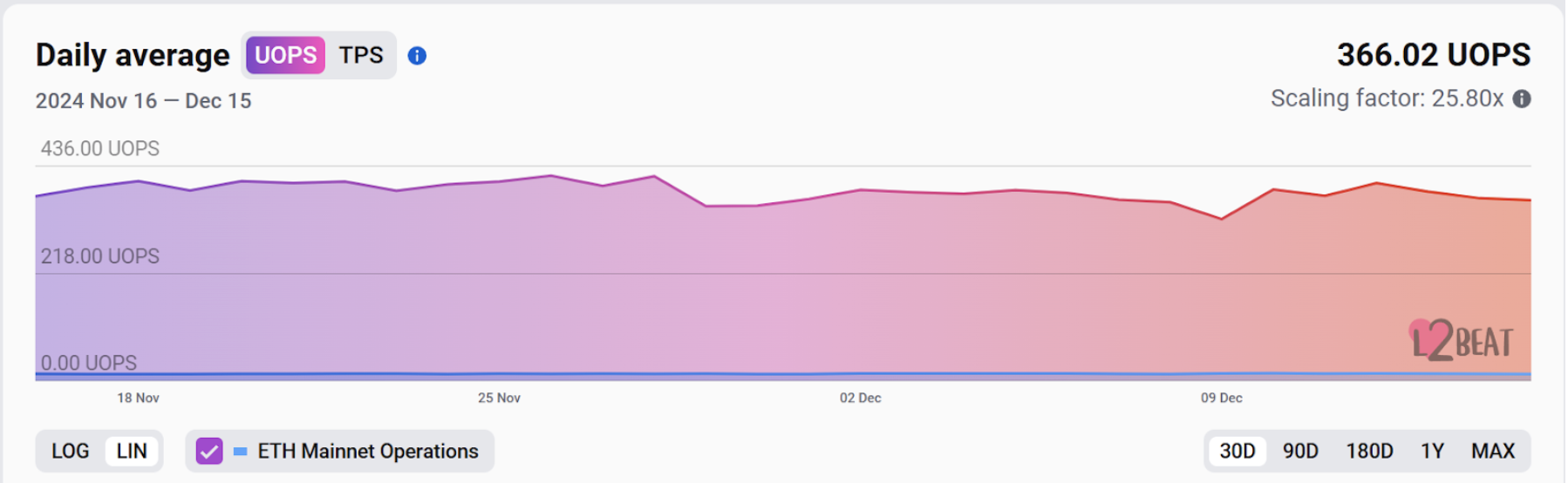

From November 16 to December 15, 2024, L2 solutions demonstrated 366.02 UOPS, with a Scaling factor of 25.80x. This means that the performance of Layer 2 solutions significantly surpasses the performance of the Ethereum mainnet, offering enhanced scalability and significantly increased throughput. Such a high Scaling factor confirms the growing popularity of L2 solutions, which are becoming essential tools for scaling and improving transaction speeds within the Ethereum ecosystem.

Source: L2BIT

In 2025, we can expect even tighter integration of L2 solutions with the Ethereum mainnet, as Vitalik Buterin previously mentioned in his articles. He emphasized the importance of L2 solutions and the need to improve network scalability for its continued growth.

Based on fundamental indicators, it can be predicted that the value of ETH and L2 tokens will rise in 2025. You can also explore articles featuring technical analyses of ETH and various L2 projects from our experts.

Artificial Intelligence and Crypto in 2025

One of the most promising areas in 2025 will be the integration of artificial intelligence with cryptocurrency technologies. The incorporation of AI into blockchain systems will significantly improve operational efficiency and enhance user interaction with cryptocurrencies. The growth of AI agents is expected, capable of performing functions previously only possible for humans, such as managing crypto wallets, processing transactions, and executing complex operations in dApps.

A major event for the industry was the merger in March 2024 of Fetch.ai, SingularityNET, and Ocean Protocol, resulting in the creation of the largest alliance in the field of artificial superintelligence (ASI). The outcome was the creation of a unified ASI currency, which simplifies interaction within the ecosystem and accelerates the adoption of advanced technologies. In 2025, this alliance will likely drive the development of new solutions in artificial intelligence and decentralized data, making it a key area to watch.

One of the most promising applications of AI in cryptocurrencies will be the development of DePIN (Decentralized Physical Infrastructure Networks), built on physical devices such as sensors and cameras. This will enable the creation of more efficient and decentralized systems that directly interact with the real world, such as in energy, transportation, and logistics.

On the other hand, the use of AI in cryptocurrencies raises certain risks related to the potential autonomy of agents and their actions, which could be unethical or opaque. Therefore, the development of regulatory and technological frameworks will be crucial to ensure security and prevent abuse.

Asset Tokenization in 2025

Another important trend in 2025 will be the active development of asset tokenization. Tokenization technology allows various physical and financial assets, such as real estate, securities, artwork, and even biometric data, to be converted into digital tokens that can be used in blockchain applications.

Asset tokenization will make these assets accessible to a wider range of investors, enabling interaction with assets that were previously inaccessible due to high costs or limited markets. This will open up new opportunities for liquidity and attract more users to the crypto market. This is particularly important in sectors like real estate and art, where traditional investment methods can be complex and expensive.

Successful examples of tokenization can already be observed. For instance, tokens like PAX Gold and Tether Gold provide the opportunity to invest in physical gold in a digital format. This reduces storage and transfer costs, making gold accessible even to retail investors and simplifying its trade.

The use of tokenization combined with artificial intelligence can further enhance asset management efficiency and provide additional security for transactions. In the field of biometrics, tokenization will allow for the creation of unique digital identifiers that can be used for data protection and secure user identification in the digital space.

Thus, tokenization is opening new horizons for the digital economy, making previously inaccessible assets more liquid, accessible, and transparent for all market participants.

Meme Coins Prediction & Forecast 2025

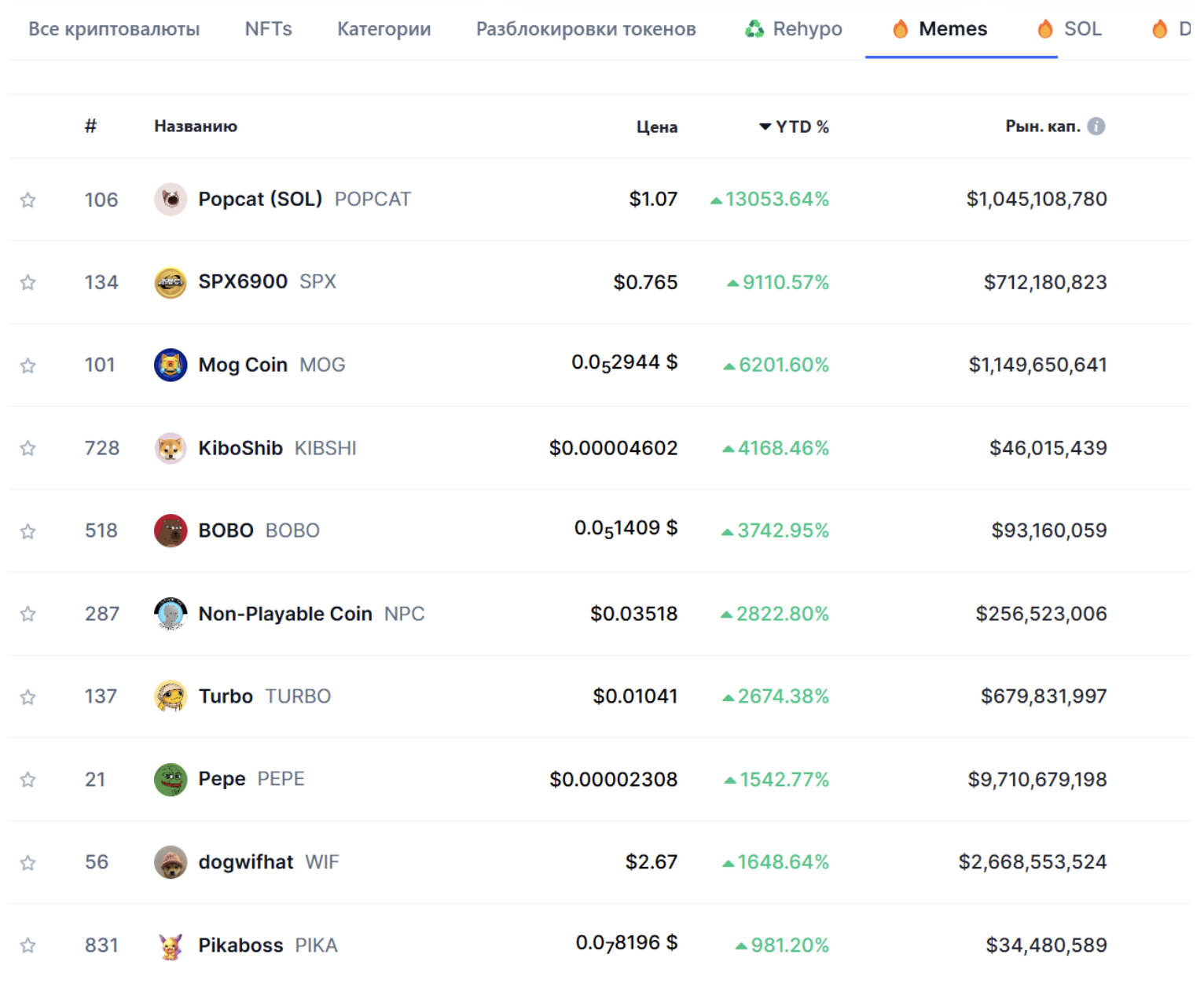

2024 has rightfully been the year of meme coins, surprising both the crypto community and a broader audience. The price dynamics of meme coins listed on CoinMarketCap have shown remarkable results. Among the top 10 meme coins that have seen growth since the beginning of the year, only the tenth did not manage to surpass the 1000% mark. These figures not only reflect the phenomenal growth of established favorites but also highlight the truly impressive achievements of new meme coins that have claimed their spots among the leaders.

Meme coins have gained mass attention due to their unpredictability, social activity, and the strong backing from the broader cryptocurrency community. The popularity of memes has evolved into a real movement, inspiring users and investors to search for new growth and speculation opportunities.

Source: CoinMarketCap

The outlook for meme coins in 2025 appears even more exciting. Interest in them continues to grow, fueled by active discussions on social media and forums, as well as immense support from users. A vibrant ecosystem surrounds meme coins, and it's expected that they will continue to deliver results that often defy the conventional logic of traditional investments.

Thus, while meme coins remain volatile and risky assets, their potential for rapid growth and popularity shows no sign of fading. 2025 is likely to see the continued popularity of this phenomenon.

Conclusion

The year 2025 holds significant potential for the expansive growth and further development of the cryptocurrency industry. Bitcoin, which gained a powerful boost in 2024 through institutional investments and political support, is poised to solidify its position as a global digital asset, breaking new price records. Political initiatives, particularly in the United States, are expected to play a pivotal role in shaping market trends.

Ethereum and Layer 2 solutions will continue to expand blockchain's capabilities, enhancing scalability and accessibility for users. Innovations in artificial intelligence, including the integration with DePIN and the creation of autonomous AI agents, are set to become key drivers for growth and capital influx.

The tokenization of real-world assets promises to bring traditional markets onto the blockchain, unlocking new liquidity sources and increasing operational transparency.

However, despite these optimistic prospects, the industry faces several challenges:

potential tightening of regulatory policies,

macroeconomic and geopolitical uncertainty,

risks associated with the adoption of AI technologies.

Sustaining market growth will require a balance between innovation and stability. The year 2025 might not only mark another phase of growth but also be a pivotal moment when cryptocurrencies and blockchain technologies firmly establish themselves in the global economy, transforming traditional financial and technological paradigms.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.