How The Tezos Price Was Changing

This blog post will cover:

- 2017

- 2018

- 2019

- 2020

In this article we are going to track the Tezos coin price changes over the years. The idea of the Tezos (XTZ) project was established in 2014. The platform sets itself up as an alternative to the Ethereum network protocol for secure smart contracts, which can avoid the technological problems that Bitcoin and Ethereum had. The authors are Kathleen and Arthur Breitman, they own the company DLS, which is directly involved in programming.

The Swiss investment fund Thezos Foundation, led by Johann Gevers, is also relevant to the project. The technical innovation of the project was important for the blockchain market. For Tezos, a newly developed Michelson language was used. It was applied for a complete official verification of the server. During the Tezos ICO in 2017, the coin raised a record $232 million. But since the organizers did not provide financial limits, there were too many people who bought XTZ coins, which subsequently caused significant harm to the project. The platform was launching for a very long time and investors began to file lawsuits and demand a refund. And only 12 months after the ICO the beta version of the Tezos network was released. In addition, US regulators in the course of the proceedings ordered the identification of investors. This situation made Tezos to split into 2 networks - Tezos and a hard fork nTezos. Some people believe that it destroyed the original idea. Investors had to choose: to remain in the Tezos chain, but to show their personal data not only to the platform, but also to the regulators, or to prefer nTezos to be anonymous.

2017

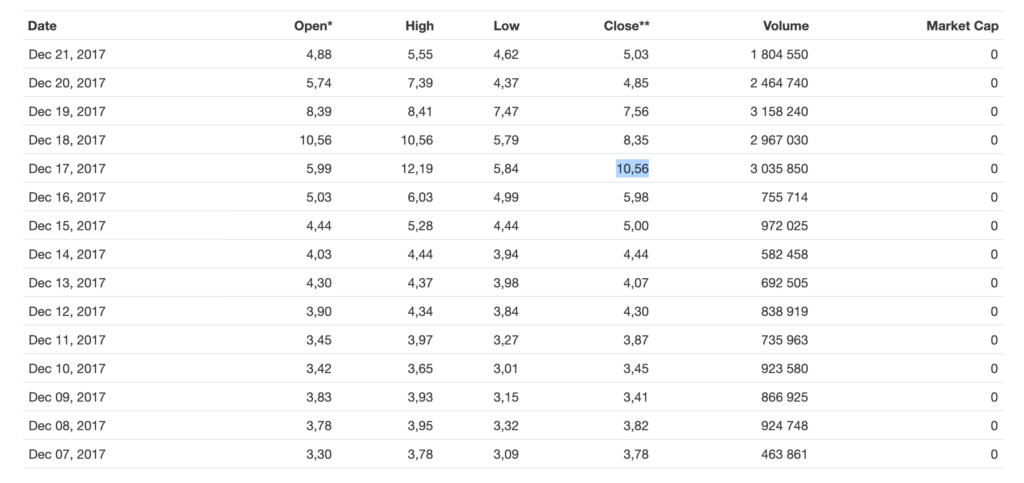

After the ICO completion, the XTZ coin appeared on Coinmarketcap on October 2, 2017. According to the website, the price of Tezos that day was $1.66. The fate of the coin in 2017 was rather complicated because of the litigation. It all started with the fact that the co-founders of Tezos, spouses Arthur and Kathleen Breitman, sought to oust Johann Gevers from the post of president of a non-profit organization that controls the investments collected during the crowdsale. The news of internal disagreements in the project led to the collapse of almost 60% of Tezos futures on BitMEX, the cost of Tezos on HitBTC fell by more than 30%. The next stage was a class action lawsuit from Tezos investors due to the fact that the project was clearly lingering in development and did not meet the expectations of investors. Project managers were accused of selling unregistered securities, fraud in the offer and sale of securities, misleading advertising, unfair competition and fictitious obligations. Amid the litigation news, the XTZ price increased and reached $10.56 on December 17, 2017 according to CoinMarketCap.

2018

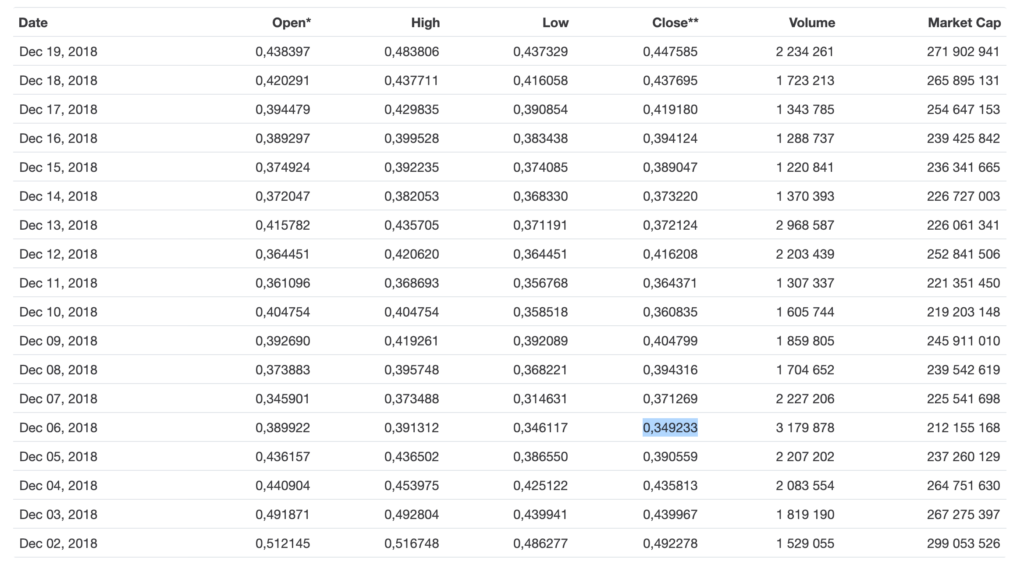

In January 2018, the price of XTZ fluctuated at the level of $4-6. On January 30, Tezos Foundation Depositary President, Johann Gevers, announced that he would quit his post after Tezos startup problems were resolved, but a few days later the message was deleted. On February 22, the Breitmans announced on Twitter that Johan Gevers stepped down as a president of the Tezos Foundation. This news caused a slight increase in the price of XTZ.On July 1, Tezos finally announced the launch of a beta platform. But the beta version had several nuances, for example, the network was not ready for large transactions. As a result, there was a significant reduction in the price of Tezos crypto in mid-2018. And even the end of the beta test could not affect the price for the better. Since the end of September, the price of XTZ coins has been steadily falling. On December 6, the historical minimum price of XTZ $0.349233 (according to the CMC historical data) was registered.

According to DigitalCoinPrice, the maximum Tezos price predicted for 2018 was $4.77, but unfortunately, quarrels within the project and the belated beta version led to the collapse of the XTZ price in 2018.

2019

2019 was the year of the Tezos rize. In January, the famous hardware wallet Ledger nano S added the XTZ coin to the list of supported cryptocurrencies.

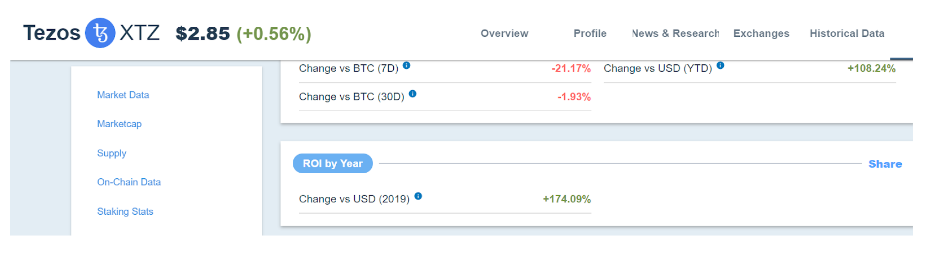

Digital asset management company “Elevated Returns” introduced a new real estate investment project for which Tezos tokenized objects worth $1 billion on the blockchain platform. Due to that news, the XTZ rate began to grow and already in March showed an increase of 40%. In March, the custodial division of the Coinbase cryptocurrency company announced the launch of a service that allowed users to get income from cryptocurrencies based on the Proof-of-Stake algorithm. The first supported PoS project was Tezos. The annual profitability of the tokens, according to Coinbase, should be about 6.6% (minus the company's commissions in the range of 20-25%). The news had a positive effect on the Tezos crypto price - a day after the announcement, the coin growth exceeded 16%. By the middle of the year, news came out that the Fifth largest Brazilian bank “BTG Pactual” and Dubai-based asset manager “Dalma Capital” would use the Tezos blockchain to conduct security token (STO) placements. In connection with this news, the XTZ price showed an increase of another 15%. Then the large cryptocurrency exchange Coinbase announced the listing of XTZ after which the Tezos crypto price went up rapidly, rising by Wednesday morning, July 31, by almost 30%. By the end of summer, according to the Messari service, since the beginning of the year, the XTZ coin has grown by 174.09%.

In November, Coinbase Cryptocurrency Exchange opened the possibility for U.S. customers to receive remuneration for Tezos stake. The price of the XTZ coin jumped by 53%, but subsequently fell by about 20%. This was followed by a lot of news about the support of various crypto exchanges and services (such as Binance and Kraken), which continued the significant growth of Tezos crypto by the end of 2019. This allowed XTZ to enter the top ten largest cryptocurrencies by market capitalization by the end of the year. According to Cryptoinfobase, the maximum XTZ price prediction at the end of 2019 was $1. With the help of hard work and big news, the coin managed to exceed this threshold with a maximum price of $1.78 per year.

2020

In 2020, XTZ continues to grow. Analysts believe that the reason for the growth of this altcoin is the trend of the bull market.

Crypto adopter and Twitter user @bitcoin_whales expressed his opinion on the future price of XTZ: "If you are wondering ...Once #Tezos breaks pass $ 2.60, it becomes pure price discovery. It will fly! It's a key #Fibonacci levelI expect this run to catch everyone by surprise & draw the whole #crypto space attention.BULLISH On $ XTZ"

Crypto trader Luke Martin is also among the supporters of a positive trend maintaining. He made a post on Twitter, in which he announced the transition to the long-term growth phase of Tezos against Bitcoin. The coin, according to his forecasts, may rise within the next few months by several tens of percent: “Never traded $XTZ before but now that it's back above the monthly it sure looks like it's continuing uptrend. At new ath dollar price. Expect it to carry the satoshi price.”

In 2020, the XTZ coin added about 100% in value (the price at 01/01/2020 was $1.35 and the price at 28/07/2020 was $2.83 according to the CMC historical data) and apparently, a positive trend will dominate in the near future. Among the altcoin growth factors, analysts highlight several important and positive events in the history of the development of the Tezos ecosystem. Firstly, the number of its participants increased sharply after the incorporation of the digital Transfer Agent Vertalo platform into its structure, as well as the integration of the tZero trading system. In addition, it recently became known that developers of services using the Ethereum network would be able to deploy their applications within the Tezos ecosystem. If the Tezos ecosystem maintains a positive development trend in 2020, this will give XTZ coin a chance not only to return to the top 10 cryptocurrencies in terms of market capitalization but also to take a place in the first top 5 cryptocurrencies.

If you want to become an XTZ owner, you are welcome to exchange these coins on SimpleSwap.

Thank you for your attention to this topic. SimpleSwap would like to remind you that this article has informational purposes only and does not provide advice on investment. All investments are your personal responsibility.