Liquid Restaking Protocols: the New DeFi Primitive

This blog post will cover:

- What is Ethereum Restaking?

- Liquid Restaking Projects Overview

- Limitations and Risks of LRT Protocols

Liquid restaking boom that happened in the crypto market in February 2024, marked a significant stride in the evolution of staked ETH within the DeFi landscape. In this article, we are going to discuss the transformative potential of Ethereum restaking, exploring how it optimizes capital efficiency, enhances security, and fosters a permissionless environment for innovation within the DeFi space.

What is Ethereum Restaking?

Ethereum restaking represents a groundbreaking advancement in DeFi, expanding the utility of staked ETH within the DeFi area. By enabling the reuse of Ethereum on the consensus layer, restaking introduces the concept of "pooled security." This innovative approach allows ETH to be staked and utilized to provide security for multiple projects simultaneously.

One of the key benefits of pooled security is the reduction of capital costs for stakers, as they can contribute their ETH to a common pool rather than staking individually for each project. This not only optimizes capital efficiency but also enhances trust in individual services and DApps by leveraging the collective security of ETH restakers.

Importantly, any service, regardless of its composition or EVM-compatibility, can tap into the pooled security provided by ETH restakers. This permissionless environment fosters innovation and free governance within the DeFi space.

Restaking mechanism offers several key advantages that contribute to the efficiency and security of the Ethereum and DeFi projects:

Maximum capital efficiency. Restaking allows ETH stakers to maximize their capital efficiency by earning staking rewards while also benefiting from utilization rewards. This means that ETH holders can earn rewards not only from staking their tokens but also from participating in the utilization of pooled security for various DApps and projects.

Pooled security for DApps. By pooling together the staked ETH of multiple participants, the restaking mechanism provides pooled security for DApps. This collective security, backed by Ethereum stakers, enhances the overall security and resilience of decentralized applications, making them more robust against potential attacks or vulnerabilities.

Boosted liquidity in DeFi. Restaking also contributes to increased liquidity in the DeFi space by enabling ETH stakers to participate in DeFi activities with their liquid restaking tokens.

Liquid Restaking Projects Overview

The pioneering project bringing the concept of ETH liquid restaking is EigenLayer. EigenLayer introduces a novel approach to enhancing the security of the Ethereum ecosystem by enabling consensus layer Ethereum (ETH) stakers to participate in validating various software modules built on top of Ethereum.

Here is how EigenLayer works:

Opting in. Stakers can choose to opt in to EigenLayer by granting the EigenLayer smart contracts permission to impose additional slashing conditions on their staked ETH. This allows them to extend the cryptoeconomic security of their ETH holdings beyond the traditional consensus layer.

Validation of modules. Once opted in, stakers can participate in validating a wide range of software modules that are built on top of the Ethereum ecosystem. These modules can include consensus protocols, data availability layers, virtual machines, keeper networks, oracle networks, bridges, threshold cryptography schemes, trusted execution environments, and more.

Aggregated security. Rather than fragmenting security across different modules, EigenLayer aggregates the security provided by ETH stakers across all supported modules. This means that stakers contribute to the security and integrity of multiple aspects of the Ethereum ecosystem simultaneously, enhancing overall resilience and robustness.

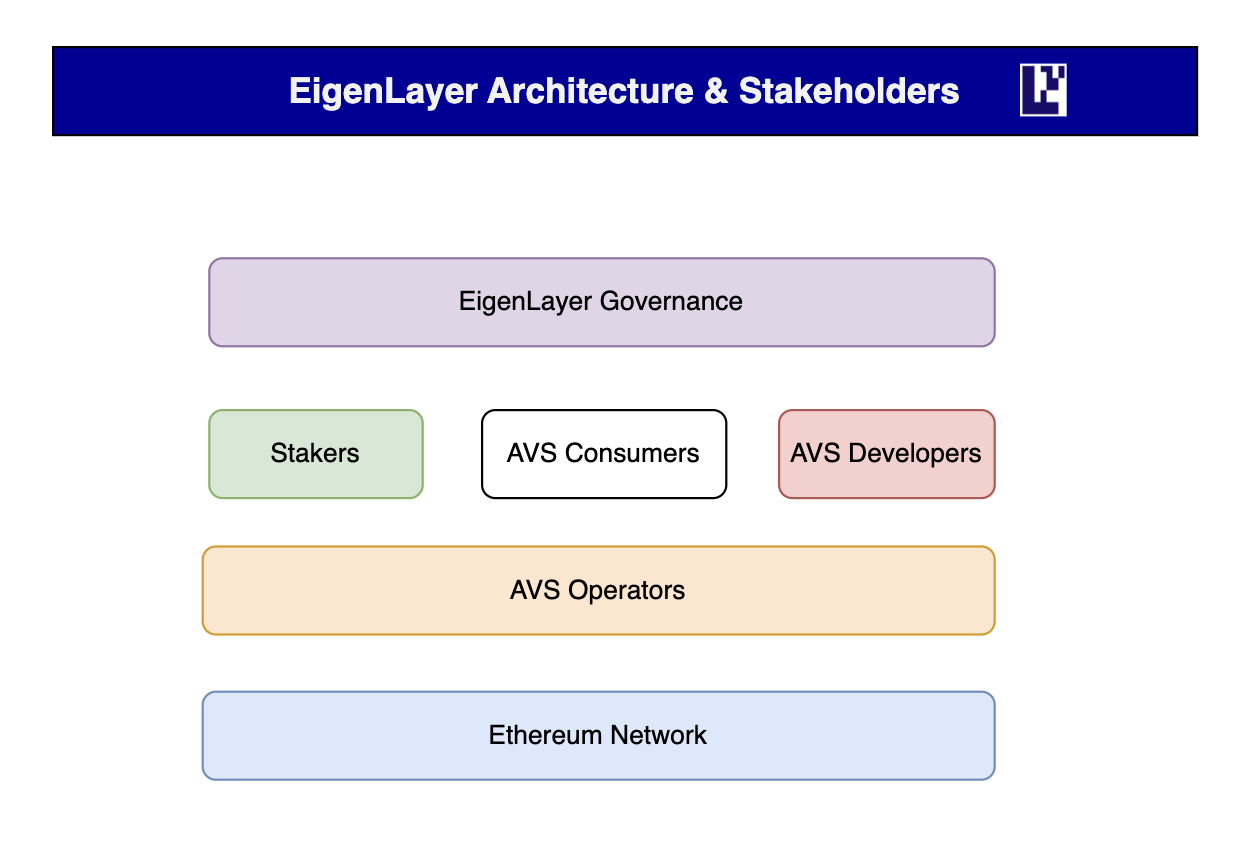

EigenLayer Architecture

EigenLayer became one of the most popular DeFi protocols in 2024 so far and now ranked 4th by total value locked among all DeFi projects with $7.65B TVL.

Top 10 DeFi Projects by TVL. Source: DefiLlama

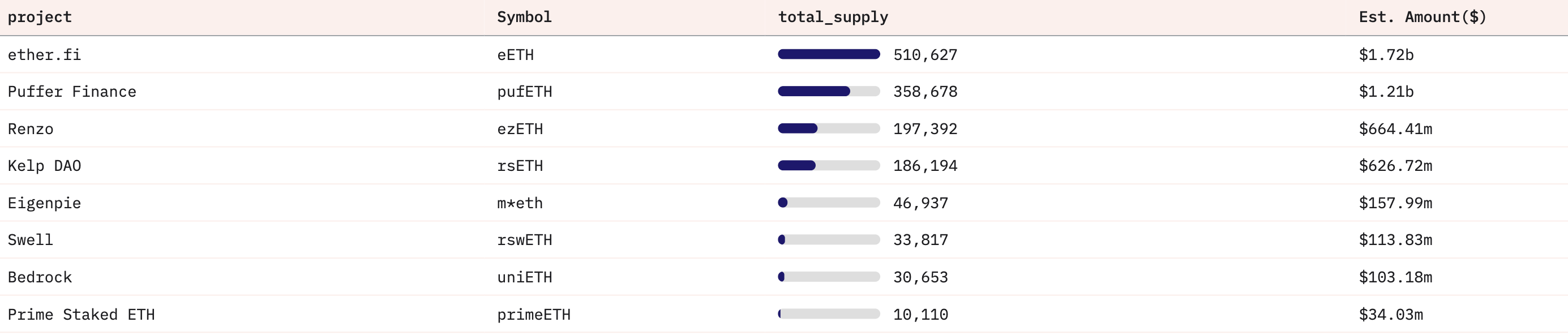

Popularity of ETH liquid restaking prompted other projects to build their services on top of the EigenLayer. They introduced their own liquid restaking tokens to be used for ETH staking and leveraged in EigenLayer infrastructure. Let's take a look at the leading liquid restaking tokens by TVL:

Top 8 ETH Restaking Protocols by Deposited Assets Value. Source: Dune.com

Liquid restaking protocols offer non-custodial solutions for liquid staking and restaking of ETH through transferable ERC-20 tokens like swETH, eETH, pufETH, and others. These tokens can be utilized across various DeFi applications, enhancing liquidity and capital efficiency in the DeFi ecosystem. LRT protocols provide users with:

- Higher yields. Enhanced rewards from ETH restaking and utilization in DeFi protocol.

- No minimum stake requirement. Participation in the validation process without needing to hold the standard 32 ETH.

- Fully self-custodial. Assets remain in the user's wallet, ensuring decentralization and privacy without the need to send ETH to a centralized entity.

Limitations and Risks of LRT Protocols

While liquid staking protocols offer compelling benefits, it is essential to acknowledge the associated risks. Unlike native ETH staking, where you directly stake ETH, using LRT protocols involves exchanging your ETH for LRT tokens pegged to ETH price.

However, there is no guarantee that the value of LRT tokens will always match native ETH. Risks include potential protocol hacks, scams, or other adverse events that could devalue LRT tokens, resulting in loss of invested ETH.

What is more, there are no mechanics to convert the LRT token back to ETH and holders can only swap LRT tokens for other assets (WETH, USDC, etc.) using DEX’s pools. In case of emergency, crypto investors might not be able to quickly withdraw their funds from LRT protocols that may lead to financial losses.

Finally, LRT protocols build on Ethereum blockchain and inherit all risks connected with Ethereum technology, such as bags, vulnerabilities, and penalties for node operators.

In conclusion, Ethereum restaking emerges as a game-changer, propelling the DeFi sector into a new era of efficiency and security. The liquid restaking mechanisms, as seen with projects like EigenLayer, have quickly become popular. However, it is crucial to navigate the landscape with a discerning eye, recognizing the potential risks associated with liquid restaking protocols.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.