Receiving Fixed Yield on Pendle

Key Insights

- There is a growing demand for investment products that allow crypto market participans to get fixed returns from the most popular crypto assets such as stablecoins, ETH and others.

- Pendle crypto platform is a pioneer in asset and yield management and asset returns in DeFi, offering users innovative mechanics for dealing with their assets

- The profitability of fixed yield crypto strategy depends on the current price of Principle Tokens and investors' expectations of the return of the underlying asset.

Obtaining fixed and predictable yield from DeFi strategies is a sought-after request from crypto market investors.

What Is Pendle

Pendle is essentially a derivative yield protocol, creating a market for yield in DeFi and allowing investors to develop advanced strategies to profit from DeFi assets.

Pendle crypto protocol is based on the concept of yield tokenization:

- Yield tokenization

Pendle wraps yield-bearing tokens into standardized yield tokens. SYs are wrapped underlying asset tokens that can be traded on the Pendle AMM (e.g., stETH is wrapped in SY-stETH). SY tokens are then split into a principal token (PT) and a yield token (YT).

Both tokens are traded as regular assets and can be used in a variety of strategies. The yield management process of separating yield into a separate token is called yield tokenization.

The process of yield tokenization on Pendle.

- Pendle AMM

Pendle AMM allows users to trade PT and YT tokens without restrictions, creating a liquid yield market and allowing investors to speculate on the returns of different assets.

Various yield strategies can be developed with Pendle, differing in risk and potential return from their implementation:

- Obtaining a fixed return (e.g. fixed return from stETH)

- Betting on future growth of the asset's return (e.g. buying YT stETH)

- Combining fixed returns and YT when providing liquidity to Pendle pools

Fixed Yield Strategy on Pendle

For the purposes of this article, we will focus on said strategy.

What are Principal Tokens

Principal tokens (PT) represent the bulk of the underlying yield-bearing asset when it is "wrapped" into a standardized yield token on Pendle.

PT tokens have a maturity date at which they can be exchanged for the underlying asset at a 1:1 ratio (e.g. one PT-stETH can be exchanged for 1 stETH at maturity). Since the PT token represents only the principal part of the underlying asset, while the yield is tokenized and represented by a separate token (YT), PT tokens are traded at a discount to the underlying asset.

The value of the PT token gradually increases and becomes equal to the value of the underlying asset at maturity of the PT token. This process creates a fixed guaranteed return that the owners of PT tokens receive when they hold them to maturity.

Principal tokens are analogous to time deposits or certificates of deposit in traditional finance, with the difference that PT tokens can be sold at any time before maturity.

Fixed Yield Crypto Strategy: Case Study

- Go go to the Pendle website and connect your wallet

Do that to start working with Pendle with purpuses of yield management.

At the moment Pendle works in Ethereum, Arbitrum, BNB Chain, Optimism and Mantle networks. This example of strategy implementation is given for the Ethereum network.

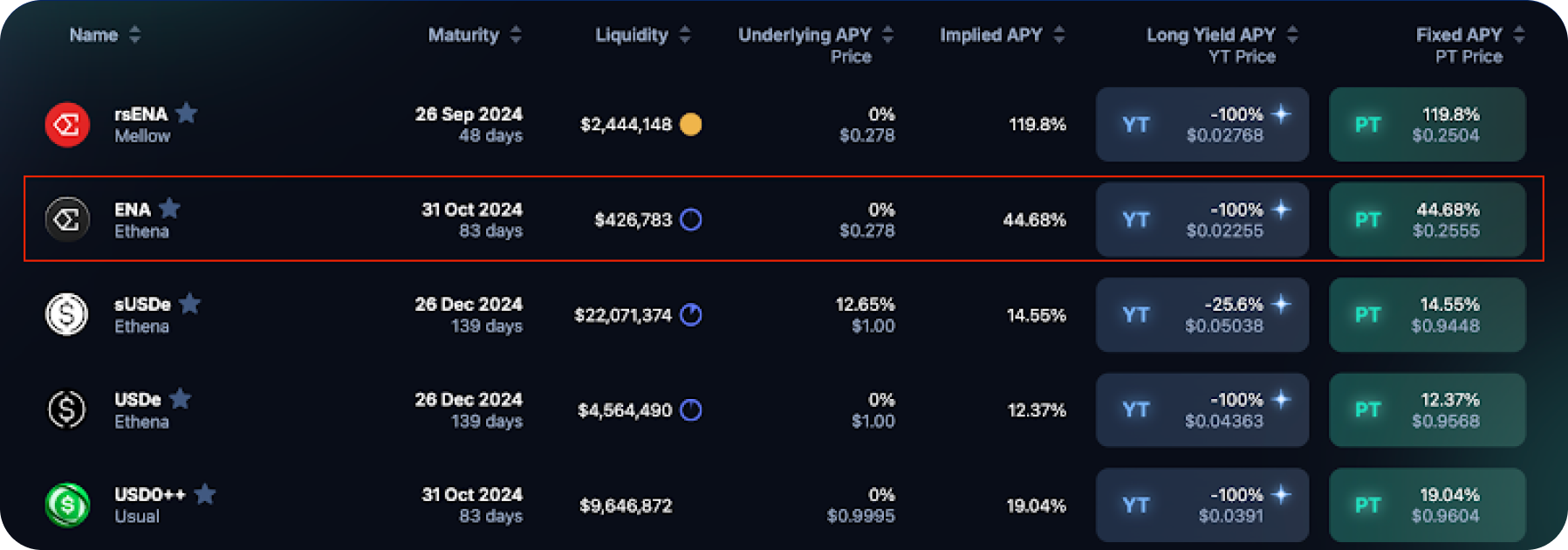

- Study the assets that are represented in the protocol

To do this, go to the Markets section, where a list of assets available for investment is provided.

- For example, buy the ENA token PT

The ENA token from the Ethena protocol offers a fixed APY of 44.68% with a maturity date of October 31, 2024. This means that if you buy the ENA token PT, you will get a guaranteed return of 44.68% APY if we hold the token PT until maturity.

- Calculate the return on the strategy of buying and holding PT-ENA to maturity

As a basis for calculations we will take the starting capital of $10,000 and the current price of ENA $0.278.

- Buy ENA tokens on SimpleSwap with low commissions

For instance, you can buy ENA token for USDC or other assets in just a couple of clicks.

As can be seen from the calculations, the ROI of this crypto strategy for 83 days is 8.35% if the current price of the underlying asset (ENA) is maintained. If ENA grows by 10%, the ROI will be 9.22%.

To implement this crypto strategy, you need to buy PT-ENA on the corresponding page. You can use ENA token or stablecoins, e.g. USDC.

You can buy USDC and other assets safely and with low commissions on SimpleSwap. For example, you can buy USDC for ETH or other stablecoins.

Fixed Yield Strategy on Pendle: Details

- If the return of the underlying asset is less than the fixed return of the PT token (i.e. it is trading cheap), this crypto strategy will be profitable provided that the return of the underlying asset does not exceed the fixed return of the PT token in the future

- The above example of a strategy with the ENA token has a peculiarity. ENA is not a yield-bearing token, i.e. the APY of the underlying asset is zero in this case. This means that buying PT-ENA will be more profitable than holding ENA token on the wallet. This strategy is great for ENA holders who intend to hold the asset for a long time.

- PT tokens are not locked in until maturity, meaning you can sell them at any time at the current market price while keeping the profits made. This allows you to exit or change your strategies early when crypto market conditions are favorable.

- When you buy PT tokens, you will only receive a fixed guaranteed return from holding them, and you will not receive a return on the underlying yield-bearing token as you would if you simply held it in your wallet. Also, you will not receive any points or other incentives from the underlying asset if you buy PT.

Summary

Pendle offers a unique approach to DeFi by enabling yield tokenization and creating a market for yield-bearing assets.

Through Pendle AMM, users can trade principal tokens (PT) and yield tokens (YT), allowing for flexible strategies that range from fixed returns to speculative bets on future yield growth.

The Pendle crypto platform provides various opportunities for yield management, including the ability to secure guaranteed yields through PT tokens.

Pendle’s innovative strategies, particularly in providing fixed returns and liquidity flexibility, make it a powerful tool for those looking to maximize their DeFi investments.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.